Professional Documents

Culture Documents

Pushpa Form15g

Pushpa Form15g

Uploaded by

immanuel alfredOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pushpa Form15g

Pushpa Form15g

Uploaded by

immanuel alfredCopyright:

Available Formats

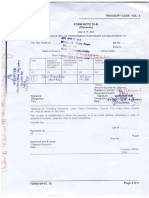

"rORM NO, 15G

[See section 197A(1), 197A(1A) and rute 29cl

Declaration undersection 1974{1)and sectio. 197A(1A)ofthe lncome-tax Act, 1961to

be made by an individuator a pe6on (not being a company oriirm).taiming

cenain receipts without deduction oft.x.

1. Name of Assessee {Dedaranr)

2. PAN of theassessee l-:lw PPA 4ITI -

3 Assessment Yei,

PusHFA {for wh'ct oectararror li b.,,e^"d.)142D / 2 |

4. Flat/Door/Blo.k No. 5. Name of Premises

eoTTu -Eeu T,l F)).r-.r.- Ha45 Z Assessed in whach Ward/Circte

8. Road/Street/Lrne 10. ao Code(under whom -lleiiEEiili

uftnl i<uL3,\) P.O- FDor{eoR, a,€a code

time)

lAorvp.lRanpe codc lao N0

11. Town/City/Disrrict 12. state k=itSAL-.A, -

]r-oz-t1\teeG.- 13. PtN

15. Email

&3sA-4.

16. Telepqone No. {w rh 5l D Code) ano MoDi e No

14. Last Assessment Year in which

7. Present Ward/Circle

errr|l2aT

18. Residential Status (within the

19 Name of Susiness/Occupation

meaninB ofSedior 6 of the tncome Tax

hORl-rl\gn'/ Act,1961)

20. PresentAO Code (ilnotL6?--

21,JUrisdictionalchiefcommi.'lone'ortncome@

lncome-tax earlier)

a."" coae ho ryp. fau.g;i;;-Fai;

fiom ihe rources nenrioned betow:

DNrdend from shares referred to in Schedute I trl

tnteresron securities refetred to in Schedule l E

tnteresr on sums referred to in Schedute Ir E

Income form units referred to in Schedute tV E

norawarrererr.d ro rn sect on aL)cca la, f.or NaflonalsavhEs s.t'e.e -G.eol*,

ir wh ch n.ome mentioned n c olumn 22 isto be inctuded

sirreo,,.v E

. oAt 6Al

24. Details of investments in resp€ct ofwhich the dectaration is being made:

5CHEDUIE.I

which stand in the name ofthe declarant and

Oate(s)on which the shares w€re acquired by the

SCHEDULE.I

oate{s)on which the securiries were

SCHEDULE III

Name and address of the

person to whom the sums are Oate on which the sums Period ror which sums werc

given on inrerest given on interest

SCHEDULE IV

{Detaik ofthe murualfund units hetd in the name of and benefic,ally owned by him)

SCHEOULE.V

of the withdrawalmade from Nationa

pa.trcutarso.theposiof trc"***r**-,r,"*-*l*l*Z Date on which fhe account

15 ma,nlrr,eo ano tne.ccoLnt nJmoer / was opened(ddlmm/yyyy)

n

Printed from www_incometaxindia.gov.;n

Page 1 of 2

/

**Sisnature of the Declarant

Declaration/ve.if ication

"Vw"....-REflPi-...do hereby declare that to the best of'my/our knowledse and belief what ,s stated above is corre.t, complete and is truly stated. *l/We

declare that the incomes referred to in thisform are not inciudible ir thetotalincone of any other person u/s 50to 54 ofthe lncome tar Act,1961 *l/we further,

oe.rare Ihar rhe rav 'on my/our esnm.ted roral rrcome. rrn.ome/rn.ore\ .etered to rn Col-m. 2r above, compJlFd rn d.cordrncF wiln the orov \,ons

'ncl-drnE

o' the lncome-ra, Acr. 1s6r, ro, rhe prev,ou. yea. en","e 1t.q3..?f.e#r ,o ,'," ,,.",,-"n' y"", 2-+f.*.J., tr u" "i, . riw".rro. o"ciare rhi- 'mv/oJ,

11ncome/ir comes ,efe, ed ro

"^

cotumr 7, 'o. rhe p,evrous year enoins onzclr{/2u,"'e*nr r" rt'" ,s r"ufl"nr't"",2+.2a./2.,1j1, not exceed lre ma,,mun

'n

amount whlch is not charEeableto income'tax.

" ---;;;;;k*A; ;":i";;;-" -

to whom the declaratlon is

1. Name ofthe person responsible for paying ihe income refened to in Column 22 of Part I 2. PAN ofthe peBon indicated in Column 1of Part ll

4.TAN ofthe peEon indicated in Column 1of Pa.t ll

6. Te ephone No. (with ST0 Code)and Mobile No.

8. Oate on which Declaration is Furnished 9 Period in respe.tofwhichthe dividend has been 10. Amount of income paid 11. Dat. oh which the income

declaredorthe in.ome has been paid/credlred

12- Date ofdeclaration, distribution or payment ol divrdend/w,thd ra wa I u nder the 113.

Account Number of NationalSaving Scheme from which wirhdraw.lhrs

NationalSavin8s Scheme(dd/mm/ryyy) lbeen made

Forwardedtothe Chief

0ate:

SiEnature ofthe person responsible for

payingthe income referred to in

Column 22 of Part I

1. Th€ declaration should be furnished in duplicate.

2.

*Delete whichever is not applicable.

sDeclaration

3. can be furnished bv an ind ividual under section 197A(1i and a person {otherthan a company ora firm)under sectior 1974{1A).

**lndicate the capa.ityin which the declaration is furnished on behalf of a HUF, AOP, etc.

5. Before signing the de.larction/verificatlon , the de.larant should satisfy himselfthat the information furnished in this form is true, correct and complete in all

respects Any person ma king a fa lse statement in the declaratior shall be lb ble to prosecution under 277 of the lncome tax A.t, 1961 a nd on conviction be

punishable-

i) ln a case where tax sought to be evaded exceeds twenty-five lakh rupees, with rigorous im prisonment which shallnoi be less than 6 months but which

may exrend ro seven vea,s and wilr frre;

ii) ln any other case, with rlgorous imprisonment whl.h shall not be less than 3 months but which may extend to two years and with fine.

The person responsable for paying the incom€ referred to in column 22 of Part rshall not acceptthe declararon where the amountot income ofthe nature refered

to in sub section (1)or sub section (14)ofsection 1974 orthe affiretateofthe amounts ofsuch income credlted or paid or likelyto be credited or paid duringthe

previous year in which such income isto be included exceedsthe maximum amountwhach as not char8eable to tax.",

Printed from www.incometaxindia.gov.in Page 2 of 2

You might also like

- 3.all About CandlesticksDocument39 pages3.all About Candlestickstrisha chandroo100% (3)

- Dixon Inc: Case Study: I H R M Prof Bharat NadkarniDocument2 pagesDixon Inc: Case Study: I H R M Prof Bharat NadkarniAbhijeet ChavanNo ratings yet

- Ajay 15 GDocument1 pageAjay 15 Gsurendra singh kachhavaNo ratings yet

- FR', e /s /": Ea PP - NGDocument2 pagesFR', e /s /": Ea PP - NGZach EdwardsNo ratings yet

- F T I '"". U .: DisclosureDocument4 pagesF T I '"". U .: DisclosureZach EdwardsNo ratings yet

- Adobe Scan 4 Jan 2024Document2 pagesAdobe Scan 4 Jan 2024paplujiNo ratings yet

- R'A'8 (Iw : Jur - 7 T992Document3 pagesR'A'8 (Iw : Jur - 7 T992Zach EdwardsNo ratings yet

- Ajay15 GDocument1 pageAjay15 Gsurendra singh kachhavaNo ratings yet

- Disclosure PA: ? L - L o oDocument1 pageDisclosure PA: ? L - L o oZach EdwardsNo ratings yet

- TTFLR: Ia TTDocument2 pagesTTFLR: Ia TTSatendra TiwariNo ratings yet

- Lnlres: Do (/BRVL) L'!ilh V EctDocument1 pageLnlres: Do (/BRVL) L'!ilh V EctAshok BhatNo ratings yet

- 15H - WellDocument2 pages15H - WellRaju KambleNo ratings yet

- Income Tax Exemption 21Document7 pagesIncome Tax Exemption 21samNo ratings yet

- Mona Chirag DarjiDocument3 pagesMona Chirag Darjikirit patelNo ratings yet

- X NPW 116789489370Document4 pagesX NPW 116789489370Ravin JangraNo ratings yet

- 2009 10 9 - AmendedDocument2 pages2009 10 9 - AmendedZach EdwardsNo ratings yet

- RDSQ$X: Ii.t 2o FGGZDocument2 pagesRDSQ$X: Ii.t 2o FGGZZach EdwardsNo ratings yet

- Latest - Minimum Wages DelhiDocument2 pagesLatest - Minimum Wages DelhiDurgesh SharmaNo ratings yet

- 911 Taxpayer AssistanceDocument1 page911 Taxpayer Assistanceapi-3826089No ratings yet

- BMS34A00194Document3 pagesBMS34A00194Rohit Parmar (Computer Operator, Bangalore)No ratings yet

- M - TN Hezr 'T/M - Ilrclr7nqrl "FF - O,"",-Orr : DisclosureDocument2 pagesM - TN Hezr 'T/M - Ilrclr7nqrl "FF - O,"",-Orr : DisclosureZach EdwardsNo ratings yet

- Ve N R T (I"Dar LT H FL.R: Disclosure DR.2Document3 pagesVe N R T (I"Dar LT H FL.R: Disclosure DR.2Zach EdwardsNo ratings yet

- T' ,... Furl: TreasuryDocument2 pagesT' ,... Furl: TreasurySatendra TiwariNo ratings yet

- Alex Ghencea ApplicationDocument34 pagesAlex Ghencea Applicationanandanitha01No ratings yet

- ' - ,-E / /-Ta - O/: Disclosure Sumiiary Page DR-2Document1 page' - ,-E / /-Ta - O/: Disclosure Sumiiary Page DR-2Zach EdwardsNo ratings yet

- 2019 Labour Law PaperDocument1 page2019 Labour Law PaperParitosh MahalNo ratings yet

- Received L, lAY I I 1992: D.Isclosure Summaby PDocument5 pagesReceived L, lAY I I 1992: D.Isclosure Summaby PZach EdwardsNo ratings yet

- '$#F, ?+ L, T I' Eu Oi "TFF HFDocument1 page'$#F, ?+ L, T I' Eu Oi "TFF HFZach EdwardsNo ratings yet

- .Rrttu:) R Il-c.,podr1r,..Tsdro, !4n/.r.,a.. 0,,","ar." I. ' "Document6 pages.Rrttu:) R Il-c.,podr1r,..Tsdro, !4n/.r.,a.. 0,,","ar." I. ' "Praveen KumarNo ratings yet

- SPL - Jul 25-26, 2022 - RTDDocument1 pageSPL - Jul 25-26, 2022 - RTDS SenseNo ratings yet

- IN 1 Free Area Preferential Certifigate (Combined Declaration and Gertificate)Document1 pageIN 1 Free Area Preferential Certifigate (Combined Declaration and Gertificate)Deni anggalaNo ratings yet

- RajbhanDocument2 pagesRajbhanSatendra TiwariNo ratings yet

- Iiiiiiiiiiii, Iiiiiiiiiiiill: EiheiheiihhieeDocument220 pagesIiiiiiiiiiii, Iiiiiiiiiiiill: EiheiheiihhieejohndoesrNo ratings yet

- Ylrr: :",F R:: Na Ts and Repo, TS",R, Ffii T"T" 20t I Jan T 2 'TRDocument4 pagesYlrr: :",F R:: Na Ts and Repo, TS",R, Ffii T"T" 20t I Jan T 2 'TRZach EdwardsNo ratings yet

- Apcs Cca Conduct Amendments InstructionsDocument269 pagesApcs Cca Conduct Amendments Instructionstomz555No ratings yet

- 323 To 325 - Da - BS Ii21022024192715Document6 pages323 To 325 - Da - BS Ii21022024192715Legal DepartmentNo ratings yet

- RE ffi.$VHD: Disclosure Suiuimary PAGDocument2 pagesRE ffi.$VHD: Disclosure Suiuimary PAGZach EdwardsNo ratings yet

- A Generalization of Snell's Law - Thesis - 20200708Document83 pagesA Generalization of Snell's Law - Thesis - 20200708arun rajaramNo ratings yet

- Indian Corporation Limited: ? Oass AstDocument2 pagesIndian Corporation Limited: ? Oass AstrockNo ratings yet

- RMC No 85-2018Document1 pageRMC No 85-2018Carlu YooNo ratings yet

- Receive: DisclosureDocument2 pagesReceive: DisclosureZach EdwardsNo ratings yet

- NCR No.-6Document7 pagesNCR No.-6Galsingh ChouhanNo ratings yet

- Eheeohohmhmhhe Eesheeohhhhmhe Mhhheemmemhe Mmohmeeeees MohhohmheeesheDocument190 pagesEheeohohmhmhhe Eesheeohhhhmhe Mhhheemmemhe Mmohmeeeees MohhohmheeesheJoseph JimmyNo ratings yet

- cs!E8$4E!M MI/.: C.TT - Cataot.vuveaDocument1 pagecs!E8$4E!M MI/.: C.TT - Cataot.vuveapawaryogeshNo ratings yet

- "Ffi I 'R".o ,: Disclosure SutuimaryDocument6 pages"Ffi I 'R".o ,: Disclosure SutuimaryZach EdwardsNo ratings yet

- AgeingDocument76 pagesAgeingbisuNo ratings yet

- Flurcdec3O Di, B: K7: Ul5, T'IDocument2 pagesFlurcdec3O Di, B: K7: Ul5, T'IZach EdwardsNo ratings yet

- Addres Candidate OU, A: R Va RADocument2 pagesAddres Candidate OU, A: R Va RAAnshul RathiNo ratings yet

- Affidavit 1699871483Document14 pagesAffidavit 1699871483namoyuviNo ratings yet

- United DC-6/7 Combined Flight ManualDocument578 pagesUnited DC-6/7 Combined Flight Manualsimonduder85No ratings yet

- Spaze Grand Central HRERADocument2 pagesSpaze Grand Central HRERAakash vermaNo ratings yet

- R.y:::::::y:y:'":::::ru T A'tut 2 S Ai I8:: DisclosureDocument3 pagesR.y:::::::y:y:'":::::ru T A'tut 2 S Ai I8:: DisclosureZach EdwardsNo ratings yet

- YUERS Itr2022Document18 pagesYUERS Itr2022CL-KAIZEN BOOKKEEPINGNo ratings yet

- Complition Certificat New2Document1 pageComplition Certificat New2Erin A. RobertNo ratings yet

- 2006-07-19 DR1Document1 page2006-07-19 DR1Zach EdwardsNo ratings yet

- Disclosure Summary Page: Late Filed Nports Era Subject To Possible Civil and Criminal Penalties. Following Sentence: Ga4'Document3 pagesDisclosure Summary Page: Late Filed Nports Era Subject To Possible Civil and Criminal Penalties. Following Sentence: Ga4'Zach EdwardsNo ratings yet

- l8 B L'V.L: Oul5./alDocument2 pagesl8 B L'V.L: Oul5./alSatendra TiwariNo ratings yet

- Errors and Accounting ChangesDocument8 pagesErrors and Accounting ChangesAndrew Benedict PardilloNo ratings yet

- 81&ii Ant, Nkfu: GRN S/tu/at UvDocument19 pages81&ii Ant, Nkfu: GRN S/tu/at UvZach EdwardsNo ratings yet

- Form 16 2017 of Prabhat RajDocument2 pagesForm 16 2017 of Prabhat RajDevendra singhNo ratings yet

- 2009 05 28 - DR 2Document2 pages2009 05 28 - DR 2Zach EdwardsNo ratings yet

- MBFM4003Document3 pagesMBFM4003PreethiNo ratings yet

- Audit of Biological AssetsDocument5 pagesAudit of Biological AssetsTrisha Mae RodillasNo ratings yet

- Timber Business Plan PDFDocument16 pagesTimber Business Plan PDFGift MesaNo ratings yet

- IOC Schedule 2019Document3 pagesIOC Schedule 2019Soumil KuraniNo ratings yet

- Cityfheps Verification of Eligibility: 1. Referral SourceDocument2 pagesCityfheps Verification of Eligibility: 1. Referral SourceAbc FghNo ratings yet

- Cost-Benefit Analysis For Investment DecisionsDocument39 pagesCost-Benefit Analysis For Investment DecisionsshackeristNo ratings yet

- UBL Internship ReportDocument58 pagesUBL Internship Reportbbaahmad89100% (1)

- Economics CcacaatutorialDocument16 pagesEconomics CcacaatutorialMohd ZulhafiziNo ratings yet

- IFSCA Grade A Officer 2022 Phase 1 Paper 2 Previous Year PaperDocument20 pagesIFSCA Grade A Officer 2022 Phase 1 Paper 2 Previous Year PaperSwayamNo ratings yet

- Teaching PowerPoint Slides - Chapter 4Document23 pagesTeaching PowerPoint Slides - Chapter 4Suziraha DzulkepliNo ratings yet

- Risk Identification TableDocument18 pagesRisk Identification TableHANIS AQILAH SALIMNo ratings yet

- The IMF (International Monetary Fund)Document3 pagesThe IMF (International Monetary Fund)ssssNo ratings yet

- Cash Book WorksheetDocument4 pagesCash Book Worksheetanastasiarobinson21000No ratings yet

- KT Giua Ky K Năng T NG H P 5Document3 pagesKT Giua Ky K Năng T NG H P 5huynhtrongtuan1998No ratings yet

- RptSaleInvoiceByBundelDetails - 2022-03-28T223440.333Document1 pageRptSaleInvoiceByBundelDetails - 2022-03-28T223440.333Mahdi omerNo ratings yet

- Econ 211 Chapter 3 Test BankDocument55 pagesEcon 211 Chapter 3 Test Bankanthony gebrayelNo ratings yet

- 39 Trading RulesDocument2 pages39 Trading RulesZulfiqar AliNo ratings yet

- Surbana Jurong, SingaporeDocument3 pagesSurbana Jurong, SingaporeKS LeeNo ratings yet

- Nautical Tourism in EuropeDocument6 pagesNautical Tourism in EuropeEdward ShaneNo ratings yet

- 1Document8 pages1Absolute ZeroNo ratings yet

- Sluice Gate NRS 4 To 8 IN DRAWINGDocument1 pageSluice Gate NRS 4 To 8 IN DRAWINGRoberto RosasNo ratings yet

- Chess School 1a Manual of Chess Combinations IvashchenkoDocument146 pagesChess School 1a Manual of Chess Combinations IvashchenkoBence CsizmadiaNo ratings yet

- America 1919-1941 RevisionDocument22 pagesAmerica 1919-1941 RevisionalbaNo ratings yet

- Monthly Billing ReportDocument2,293 pagesMonthly Billing ReportBalaNo ratings yet

- Economics - Schools of ThoughtDocument4 pagesEconomics - Schools of ThoughtQasid AbbasNo ratings yet

- Fin550 SipraDocument6 pagesFin550 Sipramadhu sudhanNo ratings yet

- Notice To Members Continuing Professional Education (CPE) TrainingDocument3 pagesNotice To Members Continuing Professional Education (CPE) TrainingMonkey.D. LuffyNo ratings yet

- Simple Rules To Trade Using 5 EMA (LOW-HIGH)Document9 pagesSimple Rules To Trade Using 5 EMA (LOW-HIGH)JoTraderNo ratings yet