Professional Documents

Culture Documents

Se The Following Information For The Next Two Questions

Se The Following Information For The Next Two Questions

Uploaded by

Unknown 01Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Se The Following Information For The Next Two Questions

Se The Following Information For The Next Two Questions

Uploaded by

Unknown 01Copyright:

Available Formats

se the following information for the next two questions

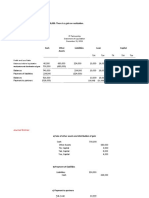

The following balances as at October 31, 2016 for the Partnership of FFF were as follows:

Cash 80,000

Fair, Loan 24,000

Non-cash assets 640,000

Liabilities 24,000

Fare, Loan 36,000

Fare, Capital 168,000

Fair, Capital 156,000

Faire, Capital 360,000

Fare has decided to retire from the partnership on October 31. Partners agreed to

adjust the non -cash assets to their fair values of P784,000. The estimated profit

on October 31 is P160,000. Fare will be paid P276,800 for her partnership interest

exclusive of her loan which is to be paid in full. Their profit and loss ratio is 3:4:3

to FFF respectively.

1. What will be the balance of Fair capital account after the retirement of Fare?

2. Assuming the amount paid to Fare is inclusive of his loan, what is the

capital account of Faire after the retirement of Fare?

Rico, Sean and Tim are partners sharing profits in the ratio of 3:2:1 respectively.Capital

accounts are P250,000, P150,000 and P100,000 on December 31, 2015 when Tim decides to

withdraw. It is agreed to pay P150,000 for Tim’s investment. Profits after the withdrawal of

Tim are to be shared equally. What is the entry required to record the withdrawal of Tim

under the bonus method?

You might also like

- Quiz Liquidation and DissolutionDocument30 pagesQuiz Liquidation and DissolutionIan RanilopaNo ratings yet

- BusCom AssetAcquisitionDocument5 pagesBusCom AssetAcquisitionDanna Claire0% (1)

- Midterm Partnership Liquidation AssignmentDocument6 pagesMidterm Partnership Liquidation AssignmentLee Suarez0% (1)

- The Old Partners Get The Bonus and Contribute The GoodwillDocument7 pagesThe Old Partners Get The Bonus and Contribute The GoodwillMaria Beatriz Munda0% (1)

- Closing Entries - Branchbooks: (Branch Books) Home OfficeDocument2 pagesClosing Entries - Branchbooks: (Branch Books) Home OfficeUnknown 01No ratings yet

- Afar - Tutorial - QuestionsDocument5 pagesAfar - Tutorial - QuestionsRalph Anthony MakinanoNo ratings yet

- St. Marry Inter CollegeDocument15 pagesSt. Marry Inter CollegeSTAR PRINTINGNo ratings yet

- St. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingDocument3 pagesSt. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingGennelyn Grace Peñaredondo100% (1)

- 3 AdmissionDocument14 pages3 AdmissionAman KakkarNo ratings yet

- Rev 1 - Prelim Examination - From Partnership Formation To Joint ArrangemeDocument6 pagesRev 1 - Prelim Examination - From Partnership Formation To Joint ArrangemeCM Lance100% (2)

- Competency Appraisal UM Digos (PARTNERSHIP)Document10 pagesCompetency Appraisal UM Digos (PARTNERSHIP)Diana Faye CaduadaNo ratings yet

- 0 - AFAR.002 Partnership Dissolution and Liquidation - 2106158851 PDFDocument9 pages0 - AFAR.002 Partnership Dissolution and Liquidation - 2106158851 PDFIan RanilopaNo ratings yet

- Adg8kk1) r8 Fq7''uDocument6 pagesAdg8kk1) r8 Fq7''uThe makas AbababaNo ratings yet

- Partnership - ExercisesDocument6 pagesPartnership - ExercisesCARPIO, JIANE KYLE M.No ratings yet

- Disso and LiquiDocument9 pagesDisso and LiquiDexell Mar MotasNo ratings yet

- Partnership Liquidation Part 1Document2 pagesPartnership Liquidation Part 1azzenethfaye.delacruz.mnlNo ratings yet

- FAR2 Ans QuizChap45Document6 pagesFAR2 Ans QuizChap45Kaira ArceñoNo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationMaria LopezNo ratings yet

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, Cabuyao, LagunaDocument8 pagesPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, Cabuyao, LagunaDan RyanNo ratings yet

- MOD 4 Partnership LiquidationDocument3 pagesMOD 4 Partnership LiquidationCharles GainNo ratings yet

- Quiz 5 Problems Second Semester AY2223 With AnswersDocument4 pagesQuiz 5 Problems Second Semester AY2223 With AnswersManzano, Carl Clinton Neil D.No ratings yet

- Case ADocument8 pagesCase AMary Ann LubaoNo ratings yet

- LiquidationDocument2 pagesLiquidationMikelle Justin RaizNo ratings yet

- Unit 4.2 Partnership LiquidationDocument2 pagesUnit 4.2 Partnership LiquidationBenjamine EscañoNo ratings yet

- 1st PREBOARD EXAMINATION - AFAR STUDENTS PDFDocument16 pages1st PREBOARD EXAMINATION - AFAR STUDENTS PDFAANo ratings yet

- A 4. LiquidationDocument3 pagesA 4. LiquidationAngela DucusinNo ratings yet

- Liquidation Sample ProblemsDocument1 pageLiquidation Sample ProblemsMarian B TersonaNo ratings yet

- Comprehensive Review QuestionsDocument5 pagesComprehensive Review QuestionsJane Ruby JennieferNo ratings yet

- Accountancy QP-Term II-Pre Board 1 - Class XIIDocument6 pagesAccountancy QP-Term II-Pre Board 1 - Class XIIRaunofficialNo ratings yet

- Assignment AnswerDocument2 pagesAssignment AnswerMims ChiiiNo ratings yet

- Lump Sum LiquidationDocument4 pagesLump Sum LiquidationKara Manansala LayuganNo ratings yet

- HO2 Partnership Dissolution and Liquidation RevisedDocument5 pagesHO2 Partnership Dissolution and Liquidation RevisedChristianAquinoNo ratings yet

- Accountancy Worksheets 4Document15 pagesAccountancy Worksheets 4devanshubhattacharya018No ratings yet

- Rapid Test Series 2021 (Accounting For Not For Profit Organizations, Partnership Firms)Document5 pagesRapid Test Series 2021 (Accounting For Not For Profit Organizations, Partnership Firms)Swami NarangNo ratings yet

- Admission WorksheetDocument9 pagesAdmission WorksheetShristi BishtNo ratings yet

- Partnership Dissolution and LiquidationDocument4 pagesPartnership Dissolution and Liquidationkat kaleNo ratings yet

- Ne ExamDocument5 pagesNe Examppmasojt2024No ratings yet

- Xii Acc Retirement WSDocument2 pagesXii Acc Retirement WSgowthampc1No ratings yet

- Use The Following Information To Answer The Question BelowDocument3 pagesUse The Following Information To Answer The Question BelowmarychanNo ratings yet

- Accountancy Previous QuestionsDocument4 pagesAccountancy Previous QuestionsmurthyNo ratings yet

- PARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalDocument4 pagesPARTNERSHIP DISSOLUTION For Quali Exam Reviewees FinalErica AbegoniaNo ratings yet

- Quiz 1 AFAR ReviewDocument7 pagesQuiz 1 AFAR ReviewPrankyJellyNo ratings yet

- CAPE U1 Partnership Revaluation QuestionsDocument6 pagesCAPE U1 Partnership Revaluation QuestionsNadine DavidsonNo ratings yet

- P6 June 2023 SY23Document5 pagesP6 June 2023 SY23Shivam GuptaNo ratings yet

- Far - SfeDocument6 pagesFar - SfeAdrian ManongdoNo ratings yet

- 2nd Quiz Midterm Acctg12Document3 pages2nd Quiz Midterm Acctg12Erma Caseñas50% (2)

- CBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot QuestionsDocument6 pagesCBSE Class 12 Accountancy Accounting For Partnership Firms Sure Shot Questionsdakshrwt06No ratings yet

- ACCL02B - Partnership and Corporation Accounting Prelim Reviewer: ComputationsDocument9 pagesACCL02B - Partnership and Corporation Accounting Prelim Reviewer: ComputationsBaby BabeNo ratings yet

- Partnership Liquidation: Problem MDocument5 pagesPartnership Liquidation: Problem MJoeneil DamalerioNo ratings yet

- CONFRAS LiquidationDocument2 pagesCONFRAS LiquidationMaybelyn DagamiNo ratings yet

- Assets: Name: Date: Professor: Section: ScoreDocument2 pagesAssets: Name: Date: Professor: Section: ScoreAndrea Florence Guy VidalNo ratings yet

- 12 Revision p2Document2 pages12 Revision p2LexNo ratings yet

- Dissolution of Partnership FirmDocument5 pagesDissolution of Partnership FirmDark SoulNo ratings yet

- Questions - 16th November 2022Document3 pagesQuestions - 16th November 2022Pawan TalrejaNo ratings yet

- 1ST GRADING EXAM For StudentsDocument12 pages1ST GRADING EXAM For StudentsAndrea Florence Guy VidalNo ratings yet

- PT 06 (Partnership) (5 Dec)Document8 pagesPT 06 (Partnership) (5 Dec)Rajesh Kumar100% (2)

- Prequalifying ExaminationDocument6 pagesPrequalifying ExaminationVincent Villalino LabrintoNo ratings yet

- Saplor SYNTHESIS-PARTNERSHIPLUMPSUMDocument16 pagesSaplor SYNTHESIS-PARTNERSHIPLUMPSUMRhad EstoqueNo ratings yet

- Financial Instruments and Institutions: Accounting and Disclosure RulesFrom EverandFinancial Instruments and Institutions: Accounting and Disclosure RulesNo ratings yet

- Management Advisory Services: Costs and Cost ConceptsDocument45 pagesManagement Advisory Services: Costs and Cost ConceptsUnknown 01No ratings yet

- Act 6Document1 pageAct 6Unknown 01No ratings yet

- Acc 3Document1 pageAcc 3Unknown 01No ratings yet

- Acc 6Document1 pageAcc 6Unknown 01No ratings yet

- Use The Following Information For The Next Three QuestionsDocument1 pageUse The Following Information For The Next Three QuestionsUnknown 01No ratings yet

- Acc 4Document1 pageAcc 4Unknown 01No ratings yet

- Hope Company Adjusted Trial Balances December 31, 20XX: Home Office Branch (DR) (CR) (DR) (CR)Document1 pageHope Company Adjusted Trial Balances December 31, 20XX: Home Office Branch (DR) (CR) (DR) (CR)Unknown 01No ratings yet

- Acc 9Document1 pageAcc 9Unknown 01No ratings yet

- Home Office Branch (DR) (CR) (DR) (CR) : HE Corporation Adjusted Trial Balances December 31, 20XXDocument1 pageHome Office Branch (DR) (CR) (DR) (CR) : HE Corporation Adjusted Trial Balances December 31, 20XXUnknown 01No ratings yet

- HE Corporation Combined Statement Working Paper For The Year Ended December 31, 20XXDocument2 pagesHE Corporation Combined Statement Working Paper For The Year Ended December 31, 20XXUnknown 01No ratings yet

- Reconciliation of Reciprocalaccounts: Investment in Branch Account (Home Office Books)Document1 pageReconciliation of Reciprocalaccounts: Investment in Branch Account (Home Office Books)Unknown 010% (1)

- Aa 3Document4 pagesAa 3Unknown 01No ratings yet

- Principles of DesignDocument7 pagesPrinciples of DesignUnknown 01No ratings yet