Professional Documents

Culture Documents

Dec 20 Invoice

Dec 20 Invoice

Uploaded by

bharauthero barautOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dec 20 Invoice

Dec 20 Invoice

Uploaded by

bharauthero barautCopyright:

Available Formats

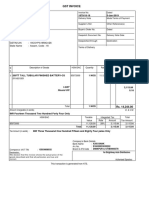

Tax In

Debit Note

[See Rule 1 under Tax Invoice

Tax Invoice, Credit and Debit Note Rules]

Details of Dealer

ORIGINAL FOR RECIPIENT

Name : M/S BHARAT AUTO AGENCY DUPLICATE

Dealer

Dealer FOR

PanNo.

Pan Number Dealer

: : AHEPM5664M

:

Pan Number

Address : DELHI SHARANPUR ROADNR TEHSIL BARANT UTTAR PRADESH

Address :

DateNumber

Pan : :

State : UTTAR PRADESH

Hero Ref Number

No. : :

GSTIN/Unique ID : 09AHEPM5664M1ZQ Inv Serial

Hero Ref

Ref NumberNumber : 10056/Dec/20

Details of Recipient

Name : Hero FinCorp Limited Invoice Number : 10056/2020-21/09

34,Community Centre,Basant Lok,Vasant

Address : Invoice Date : 03/03/2021

Vihar,Delhi-110057

State : Delhi

State Code : 07

GSTIN/Unique ID : 07AAACH0157J1ZS Pan Number

Recipient

Recipient Pan : : AAACH0157J

Number

Pan No. :

Place of supply : Delhi

Name of State : Delhi

CGSTCGST SGST/UTGST

SGST/UTGST IGST

IGST CESS

CESS

Sr.No.

Sr.No. Description

Descriptionofof Services

HSN

SAC Total Total

HSN Taxable

Discount

Discount Taxable Value

HSN

Services Value Rate Rate

Amt Amt

Rate Rate Amt Rate

Amt AmtRateRate Amt Amt

Rate Amt

TW Loan

sourcing 998399 448236.0 379861.0 - - - - 18.0 68375.0

Total Total 379861.0 - - 68375.0

Total

Total Invoice

Invoice Value

Value (In figure)

(In figure) 448236.0

Total Invoice Value (In Words)

Total Invoice Value (In Words) Four Hundred Forty-Eight Thousand Two Hundred Thirty-Six

Amount of Tax subject to Reverse Charges

Amount of Tax subject to Reverse Charges NO No

E.&.O.E

Designation / Status

Electronic Reference Number Name of the Signatory

Signature

Note : For the services provided by individual direct selling agent (other than a body corporate,

For the servicesprovidedby individualdirectsellingagent (other than a body corporate,

partnership or LLP firm) to banking company or NBFC are covered under reverse charge

partnershipor LLP firm) to bankingcompanyor NBFC are coveredunder reverse charge SATENDRA

Signature Digitally signed by

SATENDRA KUMAR

mechanism. GST is payable by recipient of services as same is covered under RCM as per

mechanism.GST is payable by recipientof servicesas same is coveredunder RCM as per

clause 11 of Notification no. 13/2017-Central Tax (Rate) dated 28th Jun 2017 as amended by

clause 11 of Notificationno.13/2017-Central Tax (Rate) dated 28th Jun 2017 as amended by KUMAR MALIK

notification no.15/2018- Central Tax (Rate) dated 26th July 2018. Date: 2021.06.24

notificationno.15/2018- Central Tax (Rate) dated 26th July 2018.

MALIK 11:24:36 +05'30'

You might also like

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)mskhandelwal33% (3)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)PrithviNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Deepanjay PaulNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Poola RangaduNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)KamakshiNo ratings yet

- Invoice 11Document1 pageInvoice 11c8ny2rzwskNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Ananya singhNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)rupeshNo ratings yet

- oneplus7tDocument1 pageoneplus7t0ankitsrivastavaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Rishi SacharNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)mamillapalli sri harshaNo ratings yet

- Nadim Khan Up16ak9563Document1 pageNadim Khan Up16ak9563Sandeep KumarNo ratings yet

- Invoice 4Document1 pageInvoice 4Pallab DasNo ratings yet

- InvoiceDocument1 pageInvoicemurali.5482No ratings yet

- InvoiceDocument1 pageInvoiceBhaskar KumarNo ratings yet

- Sto Deccan Sale - 2 PDFDocument1 pageSto Deccan Sale - 2 PDFvicky gadekarNo ratings yet

- InvoiceDocument1 pageInvoiceRPGERNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Shivani ThakurNo ratings yet

- Needle Cutter - InvoiceDocument1 pageNeedle Cutter - InvoiceArindam HaldarNo ratings yet

- Invoice - 2021-01-05T150255.950Document1 pageInvoice - 2021-01-05T150255.950mib_santoshNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Goutham PNo ratings yet

- Invoice Foe Mobile Oneplus UpDocument1 pageInvoice Foe Mobile Oneplus UpShantanu SinghNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Garvit ChaudharyNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)openchesichuduNo ratings yet

- invoiceDocument1 pageinvoicekigid55721No ratings yet

- 64442508318019502Document48 pages64442508318019502Prabhat SharmaNo ratings yet

- Invoice RHA PDFDocument1 pageInvoice RHA PDFPakoda SinghNo ratings yet

- InvoiceDocument1 pageInvoiceAmit KrNo ratings yet

- Iphone InvoiceDocument1 pageIphone InvoiceUniversity Of Science & Technology Meghalaya100% (1)

- InvoiceDocument1 pageInvoiceopenchesichuduNo ratings yet

- Book Invoice NavneetDocument1 pageBook Invoice Navneetsumanpal78No ratings yet

- Amaze HSRP FormDocument2 pagesAmaze HSRP FormZamirtalent TrNo ratings yet

- InvoiceDocument1 pageInvoicebishtayush390No ratings yet

- Lucky ScootyDocument1 pageLucky ScootyPramodKumarNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Amit SinghNo ratings yet

- InvoiceDocument1 pageInvoiceYashNo ratings yet

- Shivam MobileDocument1 pageShivam MobileShivam GuptaNo ratings yet

- Shivam MobileDocument1 pageShivam MobileShivam GuptaNo ratings yet

- Invoice Jio Book Notes Best CompressDocument1 pageInvoice Jio Book Notes Best CompresshdakNo ratings yet

- Indra BillDocument1 pageIndra Billarthagarwal09No ratings yet

- Print Invoice Old - PHP Invoice No S0FPTDI0MjUxMDc4NTY4Document2 pagesPrint Invoice Old - PHP Invoice No S0FPTDI0MjUxMDc4NTY4K M SNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Saurabh SumanNo ratings yet

- Samsung Soundbar InvoiceDocument1 pageSamsung Soundbar InvoiceJeevan NJNo ratings yet

- InvoiceDocument1 pageInvoicearyanaarya035No ratings yet

- InvoiceDocument1 pageInvoicediruNo ratings yet

- Document - 2021-09-02T113659.768Document1 pageDocument - 2021-09-02T113659.768Yellow MellowNo ratings yet

- 69858227840019598Document2 pages69858227840019598jeelp625No ratings yet

- Toner InnvoiceDocument1 pageToner Innvoicerajat vijali0% (1)

- InvoiceDocument1 pageInvoicedevanshupal0101No ratings yet

- 28 Oct - 406-1121117-5329126Document2 pages28 Oct - 406-1121117-53291261791No ratings yet

- invoiceDocument1 pageinvoicej24431477No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Tanish SharmaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Ranjith R (RS)No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)karthikyuvi12No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Abhisek KumarNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)srikanth2vangaraNo ratings yet

- GST Invoice: Circular Road, Dimapur Nagaland GSTIN/UIN: 13CHIPM1831L1ZC State Name: Nagaland, Code: 13Document1 pageGST Invoice: Circular Road, Dimapur Nagaland GSTIN/UIN: 13CHIPM1831L1ZC State Name: Nagaland, Code: 13Yogesh GuptaNo ratings yet

- InvoiceDocument1 pageInvoicePuneet AgrawalNo ratings yet

- Business Law Question BankDocument244 pagesBusiness Law Question BankArpit ChaurasiaNo ratings yet

- SBI Home Loan TMV BlackbookDocument106 pagesSBI Home Loan TMV Blackbookvishal birajdarNo ratings yet

- Department of Commerce: Aims & ObjectivesDocument3 pagesDepartment of Commerce: Aims & ObjectivesRekha BNo ratings yet

- Internal Audit Practice and Financial Reporting Quality Perspective From Nigerian Quoted Foods and Beverages Firms PDFDocument19 pagesInternal Audit Practice and Financial Reporting Quality Perspective From Nigerian Quoted Foods and Beverages Firms PDFlumumba kuyelaNo ratings yet

- Gec 107 Module-1Document10 pagesGec 107 Module-1Stephan Joy VelezNo ratings yet

- NEI 06-14 QAPD TemplateDocument78 pagesNEI 06-14 QAPD TemplateRuslan SukovachNo ratings yet

- Reliance Bigflix Case study-BootStrapTodayDocument3 pagesReliance Bigflix Case study-BootStrapTodaybootstraptodayNo ratings yet

- Pre Class Notes and Assignment PDFDocument18 pagesPre Class Notes and Assignment PDFShah SujitNo ratings yet

- Medias Futuro NYTDocument14 pagesMedias Futuro NYTsanti barreiroNo ratings yet

- FM - Scheme of EvaluationDocument10 pagesFM - Scheme of EvaluationramanjaneyuluNo ratings yet

- GST Update 18.11.2017Document39 pagesGST Update 18.11.2017sridharanNo ratings yet

- Kolej Matrikulasi Kejuruteraan Kedah EB025 SEMESTER 2, SESSION 2022/2023 Assignment: Design Project (Key Chain)Document6 pagesKolej Matrikulasi Kejuruteraan Kedah EB025 SEMESTER 2, SESSION 2022/2023 Assignment: Design Project (Key Chain)VEENOM 0204No ratings yet

- G10X Quality Assurance Engineering - Basics of POS Testing (Autosaved)Document7 pagesG10X Quality Assurance Engineering - Basics of POS Testing (Autosaved)Milon MondalNo ratings yet

- Internship Report On National Bank of Pakistan L Branch Abbottabad (1907)Document71 pagesInternship Report On National Bank of Pakistan L Branch Abbottabad (1907)Faisal AwanNo ratings yet

- Introduction To Managment: Assignment#1Document5 pagesIntroduction To Managment: Assignment#1Hamza AyazNo ratings yet

- Case 12 HDT Truck CompanyDocument6 pagesCase 12 HDT Truck Companylasha badanashviliNo ratings yet

- MARE3Document42 pagesMARE3chuchu maneNo ratings yet

- GM1738NA Version 1.0 4-14-15Document37 pagesGM1738NA Version 1.0 4-14-15Maryana cNo ratings yet

- New IFC Discussion PaperDocument33 pagesNew IFC Discussion PaperCr CryptoNo ratings yet

- UNHRC - Study GuideDocument13 pagesUNHRC - Study Guideitsumar09No ratings yet

- Child Benefit Claim Form : Who Should Fill in This FormDocument9 pagesChild Benefit Claim Form : Who Should Fill in This Formஅருண் குமார் விNo ratings yet

- FSH 12 - Fisheries Laws, Policies and InstitutionDocument14 pagesFSH 12 - Fisheries Laws, Policies and InstitutionjofrenmorenoNo ratings yet

- Course ManualDocument5 pagesCourse ManualSoumya BhattacharjeeNo ratings yet

- EY Global Supply Chain Benchmarking Study For The Tire Industry Executive SummaryDocument8 pagesEY Global Supply Chain Benchmarking Study For The Tire Industry Executive SummaryAnonymous Rn5SFJW0No ratings yet

- EDU CAT EN ASM FF V5-6R2015 ToprintDocument301 pagesEDU CAT EN ASM FF V5-6R2015 ToprintBosse BoseNo ratings yet

- Receiving of Packaging Material SOPDocument4 pagesReceiving of Packaging Material SOPanoushia alvi100% (1)

- Cost Estimate: Project Name: Date: Month 1 2 3 4 5 6 WBS CategoriesDocument2 pagesCost Estimate: Project Name: Date: Month 1 2 3 4 5 6 WBS CategoriesRanda S JowaNo ratings yet

- Material Handling Control Procedure PDF FreeDocument9 pagesMaterial Handling Control Procedure PDF FreeAli KayaNo ratings yet

- Experience Economy - Pop CultureDocument13 pagesExperience Economy - Pop CultureJV RatmanNo ratings yet

- 22 - GAIL - GLENMARK - Final ReportDocument85 pages22 - GAIL - GLENMARK - Final ReportManas TiwariNo ratings yet