Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

43 viewsSun Life e Brochure Flexi Bahagia en

Sun Life e Brochure Flexi Bahagia en

Uploaded by

cerywidjajaThis document summarizes an insurance product called Asuransi X-Tra Flexi Bahagia offered by Sun Life Financial Indonesia for CIMB Niaga bank customers. It provides compensation for daily hospital care, death benefits from accidents, and no-claim bonuses. The product has monthly premiums from Rp173,000-Rp326,000 depending on age. Benefits include daily inpatient compensation of Rp400,000-Rp800,000 and death payouts up to Rp400 million. General exclusions include war, suicide, dangerous work, and substance abuse. Customers can file claims by obtaining and submitting forms with required documents to Sun Life.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Health Insurance Ebook PDFDocument29 pagesHealth Insurance Ebook PDFPrashant Pote100% (1)

- INSURANCEDocument28 pagesINSURANCEcharuNo ratings yet

- Banking and InsuranceDocument20 pagesBanking and Insurancebeena antuNo ratings yet

- Distribution Channel of SBI Life Insurance - S&DDocument14 pagesDistribution Channel of SBI Life Insurance - S&DNaina BakshiNo ratings yet

- Summer Internship Project Report On Marketing ResearchDocument27 pagesSummer Internship Project Report On Marketing Researchharasankhbutru71% (14)

- Summer Training Project On BIRLA SUNLIFEDocument109 pagesSummer Training Project On BIRLA SUNLIFEsidharthllb90% (51)

- Health Insurance Ebook PDFDocument29 pagesHealth Insurance Ebook PDFIvan Grgić100% (1)

- Insurance Company AnalysisDocument13 pagesInsurance Company AnalysisAyon ImtiazNo ratings yet

- Iicci PruDocument60 pagesIicci PruCA Manoj GuptaNo ratings yet

- ICICI Pru IProtect Smart Illustrated BrochureDocument56 pagesICICI Pru IProtect Smart Illustrated Brochuresoubhadra nagNo ratings yet

- Term Plan ChecklistDocument1 pageTerm Plan ChecklistKumardasNsNo ratings yet

- ICICI Pru Iprotect Smart Illustrated Brochure PDFDocument60 pagesICICI Pru Iprotect Smart Illustrated Brochure PDFDhrubajyoti DattaNo ratings yet

- Corporate Chanakya Successful Management The Chanakya WaysDocument60 pagesCorporate Chanakya Successful Management The Chanakya WaysRaza OshimNo ratings yet

- Bajaj Allianz InsuranceDocument19 pagesBajaj Allianz Insurancesamy7541No ratings yet

- HealthDocument68 pagesHealthKvvPrasadNo ratings yet

- Introduction of Bank: BanksDocument45 pagesIntroduction of Bank: BanksKunal NagNo ratings yet

- Bajaj Allianz Life Insurance Company Ltd.Document13 pagesBajaj Allianz Life Insurance Company Ltd.rajvi shahNo ratings yet

- Consumer BehaviourDocument10 pagesConsumer BehaviourAishwarya GharmalkarNo ratings yet

- Myprotector: Choose Only What You NeedDocument12 pagesMyprotector: Choose Only What You NeedlydiaNo ratings yet

- Life Insurance Handbook (English)Document12 pagesLife Insurance Handbook (English)Satyam MittalNo ratings yet

- Reliance Life InsuranceDocument71 pagesReliance Life Insurancemanav_3No ratings yet

- Life InsuranceDocument26 pagesLife Insurancevivek kant100% (1)

- Product Diversification of LicDocument17 pagesProduct Diversification of LicSasi KumarNo ratings yet

- Project Report ON: University of MumbaiDocument55 pagesProject Report ON: University of MumbaiNayak SandeshNo ratings yet

- Internship Report FinalDocument40 pagesInternship Report FinalNeha GaiNo ratings yet

- Life Insurance HandbookDocument21 pagesLife Insurance HandbookSourabh KulkarniNo ratings yet

- Assignment-1 - Rohin - JainDocument15 pagesAssignment-1 - Rohin - JainFuryNo ratings yet

- Handbook On InsuranceDocument20 pagesHandbook On InsuranceSri Muslihah BakhtiarNo ratings yet

- Mission and VissionDocument11 pagesMission and VissionPradeep Kumar V PradiNo ratings yet

- SBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness TooDocument2 pagesSBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness ToobpshuNo ratings yet

- Summer PROJECT Report: Bajaj AllianzDocument54 pagesSummer PROJECT Report: Bajaj AllianzChirag Mittal50% (2)

- Share ICICI PrudentialsDocument63 pagesShare ICICI PrudentialsMadhushreeNo ratings yet

- Akshat Insurance & Risk MGMT CIA 1Document27 pagesAkshat Insurance & Risk MGMT CIA 1Mohammad HaiderNo ratings yet

- DOODHWAALADocument5 pagesDOODHWAALAShubham SardaNo ratings yet

- Icici Prud.Document82 pagesIcici Prud.Rachit JoshiNo ratings yet

- Bajaj AllianzDocument5 pagesBajaj AllianzMilin NagarNo ratings yet

- Private Insurance CompaniesDocument11 pagesPrivate Insurance CompaniesclytemnestraNo ratings yet

- Need For Life InsuranceDocument9 pagesNeed For Life InsuranceDeepak NayakNo ratings yet

- Life Insurance in India - 4Document7 pagesLife Insurance in India - 4Himansu S MNo ratings yet

- Health InsuranceDocument11 pagesHealth InsurancedishaNo ratings yet

- A Comparative Analysis of ULIP Plans of Bajaj Allianz Life Insurance With Mutual FundsDocument91 pagesA Comparative Analysis of ULIP Plans of Bajaj Allianz Life Insurance With Mutual FundshasanNo ratings yet

- About Insurance Policy: How To Buy Insurance Policies?Document7 pagesAbout Insurance Policy: How To Buy Insurance Policies?shivmech12No ratings yet

- Suleman Lic (Repaired)Document99 pagesSuleman Lic (Repaired)Saniya VpNo ratings yet

- SIP Presentation - Abhiram Molugu (025002)Document18 pagesSIP Presentation - Abhiram Molugu (025002)ABHIRAM MOLUGUNo ratings yet

- Life Insurance ProjectDocument11 pagesLife Insurance ProjectDarshana MathurNo ratings yet

- MBA ProjectDocument58 pagesMBA ProjectdhanushNo ratings yet

- Objective of The Project: Lic V/S Icici Prudential Life InsuranceDocument52 pagesObjective of The Project: Lic V/S Icici Prudential Life InsuranceRitika_swift13No ratings yet

- IPru Sarv Jana Suraksha BrochureDocument6 pagesIPru Sarv Jana Suraksha BrochureyesindiacanngoNo ratings yet

- Presentation: State Life Insurance Corporation of PakistanDocument16 pagesPresentation: State Life Insurance Corporation of PakistanAlee HulioNo ratings yet

- Q1. What Is InsuranceDocument5 pagesQ1. What Is InsuranceDebasis NayakNo ratings yet

- RLMMP - BrochureDocument7 pagesRLMMP - BrochureAnjesh KumarNo ratings yet

- Dissertation On Life InsuranceDocument6 pagesDissertation On Life InsuranceHelpWithYourPaperLittleRock100% (1)

- Basics of InsuranceDocument28 pagesBasics of InsuranceSwethaNo ratings yet

- Group Assignment G-12Document25 pagesGroup Assignment G-12sauravNo ratings yet

- Health Insurance Company 1Document19 pagesHealth Insurance Company 1ankitsapkale12No ratings yet

- Indian Insurance SectorDocument59 pagesIndian Insurance Sectorsidhu008100% (2)

- Executive SummaryDocument56 pagesExecutive Summaryshwetachalke21No ratings yet

- Insurance 2Document2 pagesInsurance 2father strechNo ratings yet

- pdf24 MergedDocument43 pagespdf24 MergedJoel WilliamNo ratings yet

- Exit Interview ReportDocument84 pagesExit Interview Reportshonimoni100% (4)

- ABNL Annual Report-2014-15 PDFDocument275 pagesABNL Annual Report-2014-15 PDFdeeptiNo ratings yet

- Name Risk Profile Preference of Stocks Preferred Sector Selection ParameterDocument7 pagesName Risk Profile Preference of Stocks Preferred Sector Selection ParameterMaithili SUBRAMANIANNo ratings yet

- Sun Life Financial ServicesDocument4 pagesSun Life Financial ServicesMelissa FabillarNo ratings yet

- Aditya Birla Money Mart LTD.: Wealth Management DivisionDocument25 pagesAditya Birla Money Mart LTD.: Wealth Management DivisionAbhijeet PatilNo ratings yet

- Value Research 1Document4,781 pagesValue Research 1akshNo ratings yet

- 3c ReportDocument16 pages3c Reportkeerthi kumariNo ratings yet

- Recruitment of AdvisiorDocument66 pagesRecruitment of AdvisiorSamuel DavisNo ratings yet

- Portfolio DocumentDocument544 pagesPortfolio DocumenttestNo ratings yet

- Aditya Birla Mutual Funds SIDocument14 pagesAditya Birla Mutual Funds SIABHISHEK SINGHNo ratings yet

- Equity Research in Banking Sector - Public Sector BanksDocument37 pagesEquity Research in Banking Sector - Public Sector Banksjayesh singhNo ratings yet

- Birla Sun Life InsuranceDocument59 pagesBirla Sun Life Insurancemillionaire karanNo ratings yet

- Birla Policy Surrender Form - January 2024Document2 pagesBirla Policy Surrender Form - January 2024rishsomzavNo ratings yet

- New Summer Training Project ReportDocument62 pagesNew Summer Training Project ReportSagar Bhardwaj100% (1)

- Cept University (Fianance & Admin)Document9 pagesCept University (Fianance & Admin)Sharad SorathiyaNo ratings yet

- Group 4 .XLSX - Sheet2Document1 pageGroup 4 .XLSX - Sheet2Maithili SUBRAMANIANNo ratings yet

- Mutual Funds in IndiaDocument8 pagesMutual Funds in IndiaSimardeep SinghNo ratings yet

- LUCAS FME111 InsuranceRiskMngmtDocument6 pagesLUCAS FME111 InsuranceRiskMngmtJohnVerjoGeronimoNo ratings yet

- Client: Robeco: August 2007Document8 pagesClient: Robeco: August 2007Shadab KhanNo ratings yet

- Sun Life e Brochure Flexi Bahagia enDocument1 pageSun Life e Brochure Flexi Bahagia encerywidjajaNo ratings yet

- Ty - Bcom (Banking and Insurance)Document36 pagesTy - Bcom (Banking and Insurance)BHAVESHNo ratings yet

- Group No 7 Aditya BirlaDocument14 pagesGroup No 7 Aditya Birlapushkar upadhyeNo ratings yet

- Equity Research Report - Tushar Soni (NU)Document47 pagesEquity Research Report - Tushar Soni (NU)tusharNo ratings yet

- Aditya Birla Sun Life AMC LTD.: Issue DetailsDocument6 pagesAditya Birla Sun Life AMC LTD.: Issue Detailsjitendra76No ratings yet

- Nagindas Khandwala CollegeDocument50 pagesNagindas Khandwala CollegeRitika_swift13No ratings yet

- Active Inactive DataDocument889 pagesActive Inactive Datapallavi chaddhaNo ratings yet

- 2013715173232IM - Pantloon - 15 July 2013 - FINALDocument184 pages2013715173232IM - Pantloon - 15 July 2013 - FINALdeeptiNo ratings yet

- Summer Intern ReportDocument32 pagesSummer Intern ReportPradeep Dashora100% (1)

- Cfo GM & Manager ClientDocument36 pagesCfo GM & Manager ClientMitul RawatNo ratings yet

Sun Life e Brochure Flexi Bahagia en

Sun Life e Brochure Flexi Bahagia en

Uploaded by

cerywidjaja0 ratings0% found this document useful (0 votes)

43 views1 pageThis document summarizes an insurance product called Asuransi X-Tra Flexi Bahagia offered by Sun Life Financial Indonesia for CIMB Niaga bank customers. It provides compensation for daily hospital care, death benefits from accidents, and no-claim bonuses. The product has monthly premiums from Rp173,000-Rp326,000 depending on age. Benefits include daily inpatient compensation of Rp400,000-Rp800,000 and death payouts up to Rp400 million. General exclusions include war, suicide, dangerous work, and substance abuse. Customers can file claims by obtaining and submitting forms with required documents to Sun Life.

Original Description:

Sun life

Original Title

Sun Life e Brochure Flexi Bahagia En

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes an insurance product called Asuransi X-Tra Flexi Bahagia offered by Sun Life Financial Indonesia for CIMB Niaga bank customers. It provides compensation for daily hospital care, death benefits from accidents, and no-claim bonuses. The product has monthly premiums from Rp173,000-Rp326,000 depending on age. Benefits include daily inpatient compensation of Rp400,000-Rp800,000 and death payouts up to Rp400 million. General exclusions include war, suicide, dangerous work, and substance abuse. Customers can file claims by obtaining and submitting forms with required documents to Sun Life.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

43 views1 pageSun Life e Brochure Flexi Bahagia en

Sun Life e Brochure Flexi Bahagia en

Uploaded by

cerywidjajaThis document summarizes an insurance product called Asuransi X-Tra Flexi Bahagia offered by Sun Life Financial Indonesia for CIMB Niaga bank customers. It provides compensation for daily hospital care, death benefits from accidents, and no-claim bonuses. The product has monthly premiums from Rp173,000-Rp326,000 depending on age. Benefits include daily inpatient compensation of Rp400,000-Rp800,000 and death payouts up to Rp400 million. General exclusions include war, suicide, dangerous work, and substance abuse. Customers can file claims by obtaining and submitting forms with required documents to Sun Life.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Most people have not considered the importance of

having health insurance protection. Nevertheless,

based on a survey taken by Towers-Watson Global

Medical on 2014, medical expenses in Indonesia have

witnessed increases of approximately 11% - 15% per

year. Imagine, what if something bad happened to you

when you don’t have any preparation yet. You will

Asuransi jeopardize your family’s life because of the high

medical expense.

X-Tra Flexi PProtect your health by choosing the best health

Bahagia insurance product. Sun Life Financial Indonesia

presents Asuransi X-Tra Flexi Bahagia for CIMB

Niaga clients. Besides medical expenses benefit, this

The right protection from Exclusive for

insurance product also gives no claim bonus and

CIMB Clicks

various health risks Customers death by accident benefit.

Benefits: Important Notes

• Compensation for daily care at the hospital • Asuransi X-Tra Flexi Bahagia is an insurance product of PT Sun Life

• Death by accident benefit Financial Indonesia that has been approved and recorded in the

• No claim bonus Financial Service Authority.

• PT Bank CIMB Niaga Tbk is not responsible for the risks that arise

from insurance products, including but not limited to the payment

Terms & conditions of claims to the customers and this product is not covered by the

• Entrance Age: government’s guarantee program.

• Children: 6 – 17 years • The offer of the product and the use of PT Bank CIMB Niaga Tbk’s

• Adult: 18 – 55 years logo are based on the approval of PT Bank CIMB Niaga Tbk and as

• Currency: IDR the realization of marketing cooperation in the business model of

• Policy period: Insurance period up to 65 years old. product distribution between PT Bank CIMB Niaga Tbk and PT Sun

• Premium payment frequency: monthly Life Financial Indonesia.

• Premium payment period: based on insurance period and annually • PT Sun Life Financial Indonesia is registered with and overseen by

updated up to 65 years the FSA.

• This document is not an insurance policy. This information is

prepared and made as concisely as possible by Sun Life Financial

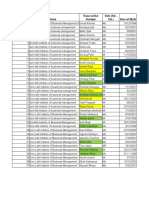

Premium

Indonesia to provide an overview of the various insurance benefits

PLAN A PLAN B and terms of ownership of this insurance to product’s purchaser.

Monthly Premium The full terms can be read in the Policy.

Age 6-40 Rp173.000 Rp240.000

Age 41-50 Rp189.000 Rp264.000

Age 51-55 Rp232.000 Rp326.000 About Sun Life Financial

Benefit

Sun Life Financial is a leading international financial services organiza-

Daily Inpatient Rp400.000/day Rp800.000/day

tion providing a diverse range of insurance, wealth and asset manage-

Dies due to accident Rp200.000.000 Rp400.000.000 ment solutions to individuals and corporate clients. We operate in a

No Claim Bonus 25% of Premium 25% of Premium number of markets worldwide, including Canada, the United States,

(paid every 3 years) paid paid the United Kingdom, Ireland, Hong Kong, the Philippines, Japan,

Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia and

Bermuda.

General Exclusion

a. War Our ambition is to be one of the best insurance and asset manage-

b. Suicide, and/or hurt themselves in any way ment companies in the world by helping our clients achieve lifetime

c. Carrying out dangerous and high-risk work financial security and live healthier lives.

d. Nuclear contamination, radiation or chemical warfare As of December 31, 2017, Sun Life Financial had total assets under

e. Use of Alcohol and / or drug abuse management of $944 billion. Sun Life Financial Inc. trades on the

f. Pregnancy, including childbirth, miscarriage, abortion, infertility and all Toronto (TSX), New York (NYSE) and Philippine (PSE) stock exchanges

the complications that occur because of it. under the ticker symbol SLF.

g. Unlawful acts or acts of crime or the criminal trial that directly or

indirectly by the policy owner, insured and / or Beneficiary under this

Policy. About Sun Life Financial Indonesia

Since 1995, PT Sun Life Financial Indonesia (Sun Life) has provided

clients with a comprehensive range of protection and wealth

How to File Your Claim management products, including life insurance, education insurance,

Fill and submit health insurance, and retirement plans. At Sun Life, our Purpose is

Obtain claim the form clear: to help our clients achieve lifetime financial security and live

form at the altogether with Claim is

processed healthier lives.

client service required

center office document

by Sun Life Every year, we have experienced significant growth in the markets we

operate in. We continuously improve our products and services to

meet the needs of our clients. Our advisors and employees have

worked tirelessly to gain the trust of our clients and we continue to

expand our business through agency (conventional and shariah) and

partnership distribution. Today we provide innovative products to our

clients through a network of 130 conventional and 58 shariah

marketing offices in 56 cities across Indonesia.

Life’s brighter under the sun PT Sun Life Financial Indonesia terdaftar dan diawasi oleh Otoritas Jasa Keuangan (OJK)

You might also like

- Health Insurance Ebook PDFDocument29 pagesHealth Insurance Ebook PDFPrashant Pote100% (1)

- INSURANCEDocument28 pagesINSURANCEcharuNo ratings yet

- Banking and InsuranceDocument20 pagesBanking and Insurancebeena antuNo ratings yet

- Distribution Channel of SBI Life Insurance - S&DDocument14 pagesDistribution Channel of SBI Life Insurance - S&DNaina BakshiNo ratings yet

- Summer Internship Project Report On Marketing ResearchDocument27 pagesSummer Internship Project Report On Marketing Researchharasankhbutru71% (14)

- Summer Training Project On BIRLA SUNLIFEDocument109 pagesSummer Training Project On BIRLA SUNLIFEsidharthllb90% (51)

- Health Insurance Ebook PDFDocument29 pagesHealth Insurance Ebook PDFIvan Grgić100% (1)

- Insurance Company AnalysisDocument13 pagesInsurance Company AnalysisAyon ImtiazNo ratings yet

- Iicci PruDocument60 pagesIicci PruCA Manoj GuptaNo ratings yet

- ICICI Pru IProtect Smart Illustrated BrochureDocument56 pagesICICI Pru IProtect Smart Illustrated Brochuresoubhadra nagNo ratings yet

- Term Plan ChecklistDocument1 pageTerm Plan ChecklistKumardasNsNo ratings yet

- ICICI Pru Iprotect Smart Illustrated Brochure PDFDocument60 pagesICICI Pru Iprotect Smart Illustrated Brochure PDFDhrubajyoti DattaNo ratings yet

- Corporate Chanakya Successful Management The Chanakya WaysDocument60 pagesCorporate Chanakya Successful Management The Chanakya WaysRaza OshimNo ratings yet

- Bajaj Allianz InsuranceDocument19 pagesBajaj Allianz Insurancesamy7541No ratings yet

- HealthDocument68 pagesHealthKvvPrasadNo ratings yet

- Introduction of Bank: BanksDocument45 pagesIntroduction of Bank: BanksKunal NagNo ratings yet

- Bajaj Allianz Life Insurance Company Ltd.Document13 pagesBajaj Allianz Life Insurance Company Ltd.rajvi shahNo ratings yet

- Consumer BehaviourDocument10 pagesConsumer BehaviourAishwarya GharmalkarNo ratings yet

- Myprotector: Choose Only What You NeedDocument12 pagesMyprotector: Choose Only What You NeedlydiaNo ratings yet

- Life Insurance Handbook (English)Document12 pagesLife Insurance Handbook (English)Satyam MittalNo ratings yet

- Reliance Life InsuranceDocument71 pagesReliance Life Insurancemanav_3No ratings yet

- Life InsuranceDocument26 pagesLife Insurancevivek kant100% (1)

- Product Diversification of LicDocument17 pagesProduct Diversification of LicSasi KumarNo ratings yet

- Project Report ON: University of MumbaiDocument55 pagesProject Report ON: University of MumbaiNayak SandeshNo ratings yet

- Internship Report FinalDocument40 pagesInternship Report FinalNeha GaiNo ratings yet

- Life Insurance HandbookDocument21 pagesLife Insurance HandbookSourabh KulkarniNo ratings yet

- Assignment-1 - Rohin - JainDocument15 pagesAssignment-1 - Rohin - JainFuryNo ratings yet

- Handbook On InsuranceDocument20 pagesHandbook On InsuranceSri Muslihah BakhtiarNo ratings yet

- Mission and VissionDocument11 pagesMission and VissionPradeep Kumar V PradiNo ratings yet

- SBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness TooDocument2 pagesSBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness ToobpshuNo ratings yet

- Summer PROJECT Report: Bajaj AllianzDocument54 pagesSummer PROJECT Report: Bajaj AllianzChirag Mittal50% (2)

- Share ICICI PrudentialsDocument63 pagesShare ICICI PrudentialsMadhushreeNo ratings yet

- Akshat Insurance & Risk MGMT CIA 1Document27 pagesAkshat Insurance & Risk MGMT CIA 1Mohammad HaiderNo ratings yet

- DOODHWAALADocument5 pagesDOODHWAALAShubham SardaNo ratings yet

- Icici Prud.Document82 pagesIcici Prud.Rachit JoshiNo ratings yet

- Bajaj AllianzDocument5 pagesBajaj AllianzMilin NagarNo ratings yet

- Private Insurance CompaniesDocument11 pagesPrivate Insurance CompaniesclytemnestraNo ratings yet

- Need For Life InsuranceDocument9 pagesNeed For Life InsuranceDeepak NayakNo ratings yet

- Life Insurance in India - 4Document7 pagesLife Insurance in India - 4Himansu S MNo ratings yet

- Health InsuranceDocument11 pagesHealth InsurancedishaNo ratings yet

- A Comparative Analysis of ULIP Plans of Bajaj Allianz Life Insurance With Mutual FundsDocument91 pagesA Comparative Analysis of ULIP Plans of Bajaj Allianz Life Insurance With Mutual FundshasanNo ratings yet

- About Insurance Policy: How To Buy Insurance Policies?Document7 pagesAbout Insurance Policy: How To Buy Insurance Policies?shivmech12No ratings yet

- Suleman Lic (Repaired)Document99 pagesSuleman Lic (Repaired)Saniya VpNo ratings yet

- SIP Presentation - Abhiram Molugu (025002)Document18 pagesSIP Presentation - Abhiram Molugu (025002)ABHIRAM MOLUGUNo ratings yet

- Life Insurance ProjectDocument11 pagesLife Insurance ProjectDarshana MathurNo ratings yet

- MBA ProjectDocument58 pagesMBA ProjectdhanushNo ratings yet

- Objective of The Project: Lic V/S Icici Prudential Life InsuranceDocument52 pagesObjective of The Project: Lic V/S Icici Prudential Life InsuranceRitika_swift13No ratings yet

- IPru Sarv Jana Suraksha BrochureDocument6 pagesIPru Sarv Jana Suraksha BrochureyesindiacanngoNo ratings yet

- Presentation: State Life Insurance Corporation of PakistanDocument16 pagesPresentation: State Life Insurance Corporation of PakistanAlee HulioNo ratings yet

- Q1. What Is InsuranceDocument5 pagesQ1. What Is InsuranceDebasis NayakNo ratings yet

- RLMMP - BrochureDocument7 pagesRLMMP - BrochureAnjesh KumarNo ratings yet

- Dissertation On Life InsuranceDocument6 pagesDissertation On Life InsuranceHelpWithYourPaperLittleRock100% (1)

- Basics of InsuranceDocument28 pagesBasics of InsuranceSwethaNo ratings yet

- Group Assignment G-12Document25 pagesGroup Assignment G-12sauravNo ratings yet

- Health Insurance Company 1Document19 pagesHealth Insurance Company 1ankitsapkale12No ratings yet

- Indian Insurance SectorDocument59 pagesIndian Insurance Sectorsidhu008100% (2)

- Executive SummaryDocument56 pagesExecutive Summaryshwetachalke21No ratings yet

- Insurance 2Document2 pagesInsurance 2father strechNo ratings yet

- pdf24 MergedDocument43 pagespdf24 MergedJoel WilliamNo ratings yet

- Exit Interview ReportDocument84 pagesExit Interview Reportshonimoni100% (4)

- ABNL Annual Report-2014-15 PDFDocument275 pagesABNL Annual Report-2014-15 PDFdeeptiNo ratings yet

- Name Risk Profile Preference of Stocks Preferred Sector Selection ParameterDocument7 pagesName Risk Profile Preference of Stocks Preferred Sector Selection ParameterMaithili SUBRAMANIANNo ratings yet

- Sun Life Financial ServicesDocument4 pagesSun Life Financial ServicesMelissa FabillarNo ratings yet

- Aditya Birla Money Mart LTD.: Wealth Management DivisionDocument25 pagesAditya Birla Money Mart LTD.: Wealth Management DivisionAbhijeet PatilNo ratings yet

- Value Research 1Document4,781 pagesValue Research 1akshNo ratings yet

- 3c ReportDocument16 pages3c Reportkeerthi kumariNo ratings yet

- Recruitment of AdvisiorDocument66 pagesRecruitment of AdvisiorSamuel DavisNo ratings yet

- Portfolio DocumentDocument544 pagesPortfolio DocumenttestNo ratings yet

- Aditya Birla Mutual Funds SIDocument14 pagesAditya Birla Mutual Funds SIABHISHEK SINGHNo ratings yet

- Equity Research in Banking Sector - Public Sector BanksDocument37 pagesEquity Research in Banking Sector - Public Sector Banksjayesh singhNo ratings yet

- Birla Sun Life InsuranceDocument59 pagesBirla Sun Life Insurancemillionaire karanNo ratings yet

- Birla Policy Surrender Form - January 2024Document2 pagesBirla Policy Surrender Form - January 2024rishsomzavNo ratings yet

- New Summer Training Project ReportDocument62 pagesNew Summer Training Project ReportSagar Bhardwaj100% (1)

- Cept University (Fianance & Admin)Document9 pagesCept University (Fianance & Admin)Sharad SorathiyaNo ratings yet

- Group 4 .XLSX - Sheet2Document1 pageGroup 4 .XLSX - Sheet2Maithili SUBRAMANIANNo ratings yet

- Mutual Funds in IndiaDocument8 pagesMutual Funds in IndiaSimardeep SinghNo ratings yet

- LUCAS FME111 InsuranceRiskMngmtDocument6 pagesLUCAS FME111 InsuranceRiskMngmtJohnVerjoGeronimoNo ratings yet

- Client: Robeco: August 2007Document8 pagesClient: Robeco: August 2007Shadab KhanNo ratings yet

- Sun Life e Brochure Flexi Bahagia enDocument1 pageSun Life e Brochure Flexi Bahagia encerywidjajaNo ratings yet

- Ty - Bcom (Banking and Insurance)Document36 pagesTy - Bcom (Banking and Insurance)BHAVESHNo ratings yet

- Group No 7 Aditya BirlaDocument14 pagesGroup No 7 Aditya Birlapushkar upadhyeNo ratings yet

- Equity Research Report - Tushar Soni (NU)Document47 pagesEquity Research Report - Tushar Soni (NU)tusharNo ratings yet

- Aditya Birla Sun Life AMC LTD.: Issue DetailsDocument6 pagesAditya Birla Sun Life AMC LTD.: Issue Detailsjitendra76No ratings yet

- Nagindas Khandwala CollegeDocument50 pagesNagindas Khandwala CollegeRitika_swift13No ratings yet

- Active Inactive DataDocument889 pagesActive Inactive Datapallavi chaddhaNo ratings yet

- 2013715173232IM - Pantloon - 15 July 2013 - FINALDocument184 pages2013715173232IM - Pantloon - 15 July 2013 - FINALdeeptiNo ratings yet

- Summer Intern ReportDocument32 pagesSummer Intern ReportPradeep Dashora100% (1)

- Cfo GM & Manager ClientDocument36 pagesCfo GM & Manager ClientMitul RawatNo ratings yet