Professional Documents

Culture Documents

Richmond Americas Alliance MarketBeat Retail Q22021 FINAL

Richmond Americas Alliance MarketBeat Retail Q22021 FINAL

Uploaded by

Kevin ParkerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Richmond Americas Alliance MarketBeat Retail Q22021 FINAL

Richmond Americas Alliance MarketBeat Retail Q22021 FINAL

Uploaded by

Kevin ParkerCopyright:

Available Formats

M A R K E T B E AT

RICHMOND, VA

Retail Q2 2021

YoY 12-Mo. ECONOMIC OVERVIEW: Signs of Recovery

Chg Forecast

Employment growth has remained steady through the second quarter of 2021. The unemployment rate dropped from 5.8% in Q1

$69,300 to 4.4% in Q2 - its lowest since a pandemic high of 11.4%. Employment marketplace, ZipRecruiter, quotes over 50,000 jobs

available in Greater Richmond, 20,000 more jobs than the reported number of unemployed persons. The talent pool of employees

Median HH Income in Richmond has caught the attention of corporations that continue to make investments in Richmond, including: Carvana, which

announced a $25M inspection facility that will create 400 new jobs; and Amazon which is hiring 1,000 individuals to staff a new

0.4% distribution center.

Population Growth

SUPPLY AND DEMAND: Positive Absorption Returns

5.0% Retail was hit particularly hard because of the mandated closures due to COVID-19, but the lifting of restrictions in Q2 has led to a

significantly more stabilized market. Absorption for the quarter was net positive 31,000 square feet (sf) continuing a 12-month trend

Unemployment Rate

of positive absorption amounting to 393,000 sf. Richmond continues to post historically below average vacancy and signs of a

Source: BLS (Economic Indicators are resurging need are evident in several high-profile lease deals: Burke’s Outlet took over more than 27,000 sf at 203 N Washington

representative of specific county or MSA.) Hwy, Aaron’s will be moving into 17,650 sf on Southpark Blvd, and CVS inked a deal for 20 years on Weir Rd for $22.50 per square

foot (psf).

U.S.ECONOMIC INDICATORS

Q2 2021 PRICING: Low-Risk Investing

YoY 12-Mo. The second quarter of retail sales saw limited availability and low vacancies driving high prices. Sale price per square foot was at a

Chg Forecast recorded high of $153 and overall volume was consistent with ten-year averages. The pandemic has highlighted the value of lower

13.2% risk essential item focused retail single tenant net-leased properties or grocery anchored shopping centers. Walmart anchored

Hancock village sold for $11.1 million and CVS at 12410 W Broad St closed at $4.92 million.

GDP Growth

16.6%

Consumer Spending

Growth

31.0% RENT / VACANCY RATE AVAILABILITY BY PRODUCT TYPE

Retail Sales Growth 62%

$18 6%

Neighborhood & Community

$16 Strip

Source: BEA, Census Bureau

$14 5% Mall

Power

$12

13% 17%

$10 4% 8%

2015 2016 2017 2018 2019 2020 2021 YTD

Neighborhood & Strip Mall Power

Asking Rent, $ PSF Overall Vacancy Rate Community

full service asking

M A R K E T B E AT

RICHMOND, VA

Retail Q2 2021

OVERALL UNDER OVERALL

TOTAL OVERALL CURRENT NET OVERALL YTD NET DELIVERIES YTD

SUBMARKET INVENTORY (SF) VACANCY CONSTR AVERAGE

BLDGS ABSORTPTION (SF) ABSORPTION (SF) (SF)

RATE (SF) ASKING RENT

Broad St. Corridor 272 4,848,303 3.5% 27,584 22,669 0 0 $17.34

Colonial Heights 219 3,267,127 7.6% 17,368 -31,107 0 0 $17.14

Downtown 454 3,132,096 4.2% 12,014 32,432 0 0 $17.66

East End 509 4,548,479 4.2% 21,697 34,270 15,300 20,975 $16.19

Far West End North 32 318,473 4.6% -1,500 -4,601 0 0 $31.29

Far West End South 87 1,284,579 5.7% -3,843 6,957 2,150 0 $15.05

Goochland 67 475,435 0.0% - 0 0 40,400 $12.97

Hopewell 169 1,295,009 7.4% 10,747 13,869 0 0 $9.80

I-95 Ashland/NW 213 2,057,238 3.4% 3,695 -10,116 0 4,050 $14.64

I-95 Chamberlayne/NE 114 1,158,254 2.3% 5,966 30,002 36,000 0 $16.38

Jeff Davis Corridor 526 3,076,015 7.0% -3,602 16,188 0 17,448 $15.75

Laburnum/Rte 360 462 2,877,073 6.7% -19,900 -20,783 0 9,180 $13.01

Louisa County 82 893,349 2.2% -3,800 3,990 0 0 $15.98

Mechanicsville 220 2,861,815 4.4% -21,566 -7,005 0 0 $9.38

Midlothian E/Hull St 579 7,185,989 4.6% -1,827 8,368 0 0 $12.71

Midlothian Village 135 1,811,418 4.7% 15,110 23,240 22,270 0 $25.97

Midlothian West 300 6,832,526 5.2% 26,092 -10,793 0 0 $17.28

Near West End 665 3,862,483 3.3% -10,565 -25,552 0 0 $18.93

New Kent County 63 591,802 0.9% 3,200 5,450 0 0 $17.61

Petersburg 403 3,035,072 6.7% -27,627 -25,561 0 0 $10.87

Powhatan 83 797,893 1.2% 1,830 830 0 0 $18.04

Prince George 69 1,050,689 3.5% 6,222 6,222 0 0 $11.09

Regency 121 2,756,345 10.6% 13,592 36,823 0 0 $17.99

Short Pump 145 4,772,799 6.7% -3,216 -4,828 0 0 $18.49

South Chesterfield 350 4,074,505 4.0% 2,969 106,239 71,422 0 $14.61

Staples Mill / Parham 356 5,347,781 6.9% -4,978 -37,975 2,560 7,225 $19.12

Swift Creek 186 3,817,141 5.0% -43,363 -44,763 3,000 0 $21.56

Willow Lawn 302 3,072,945 2.5% 8,980 17,339 2,250 0 $25.29

RICHMOND, VA TOTALS 7,183 81,102,633 4.60% 31,279 141,804 154,952 99,278 $16.86

*Rental rates reflect NNN asking $psf/year. Renewals included in leasing statistics

KEY LEASE TRANSACTIONS Q2 2021 CAMERON WILLIAMS

PROPERTY SUBMARKET TENANT SF TYPE Research Manager

203-259 N Washington Hwy I-95 Ashland/NW Burke’s Outlet 27,476 New +1 804 697 3560 / cameron.williams@thalhimer.com

3041-3135 Mechanicsville Tpke Laburnum/Rte 360 Hair Palace 23,000 New thalhimer.com

820-830 Southpark Blvd Colonial Heights Aaron’s 17,650 New A CUSHMAN & WAKEFIELD RESEARCH PUBLICATION

Cushman & Wakefield (NYSE: CWK) is a leading global real estate

services firm that delivers exceptional value for real estate occupiers

and owners. Cushman & Wakefield is among the largest real estate

KEY SALES TRANSACTIONS Q2 2021 services firms with approximately 50,000 employees in 400 offices

PROPERTY SUBMARKET SELLER / BUYER SF PRICE / $PSF and 60 countries. In 2020, the firm had revenue of $7.8 billion across

core services of property, facilities and project management, leasing,

4703-4715 Nine Mile Rd Laburnum/Rte 360 East End Resources Gp LLC / MacKenzie Commercial 100,000 $4.4M / $44

capital markets, valuation and other services.

Hancock Village Swift Creek EDCO, LLC / Equity Management Group 61,500 $11.1M / $180

©2021 Cushman & Wakefield. All rights reserved. The information

9850 W Broad St Broad St Corridor Weinstein Properties / The Penn Group of Companies 29,831 $6.3M / $210 contained within this report is gathered from multiple sources believed

to be reliable. The information may contain errors or omissions and is

Bowles Farm Plaza Mechanicsville Meyer Goergen & Marrs / New Generation Mgmt LLC 28,170 $4.4M / $158 presented without any warranty or representations as to its accuracy.

You might also like

- Business Dealings in Emerging Economies, Non-Contractual Relations, and Recourse To Law - An AnalysisDocument12 pagesBusiness Dealings in Emerging Economies, Non-Contractual Relations, and Recourse To Law - An AnalysisAnish GuptaNo ratings yet

- Hành VI Người Tiêu Dùng Nông Thôn Việt Nam MMA - Coc CocDocument29 pagesHành VI Người Tiêu Dùng Nông Thôn Việt Nam MMA - Coc CocNguyễn MyNo ratings yet

- Monopoly ProjectDocument13 pagesMonopoly Projectapi-311197959No ratings yet

- Why Everybody Trades: Comparative AdvantageDocument17 pagesWhy Everybody Trades: Comparative Advantagebk gautamNo ratings yet

- Charlottesville 2024 Q1 Retail Market ReportDocument1 pageCharlottesville 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Roanoke Americas Alliance MarketBeat Retail Q32020 PDFDocument1 pageRoanoke Americas Alliance MarketBeat Retail Q32020 PDFKevin ParkerNo ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q12022Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q12022Kevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Retail Q1 2024Document3 pagesRichmond Americas Alliance MarketBeat Retail Q1 2024Kevin ParkerNo ratings yet

- Fredericksburg Americas Alliance MarketBeat Retail Q12020 PDFDocument2 pagesFredericksburg Americas Alliance MarketBeat Retail Q12020 PDFKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Retail Market ReportDocument3 pagesFredericksburg 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Fredericksburg Americas Alliance MarketBeat Retail Q32021 FINALDocument2 pagesFredericksburg Americas Alliance MarketBeat Retail Q32021 FINALKevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Office Q1 2024Document3 pagesRichmond Americas Alliance MarketBeat Office Q1 2024Kevin ParkerNo ratings yet

- Greenville Americas Alliance MarketBeat Industrial Q22020 PDFDocument2 pagesGreenville Americas Alliance MarketBeat Industrial Q22020 PDFKevin ParkerNo ratings yet

- Roanoke 2024 Q1 Retail Market ReportDocument1 pageRoanoke 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Industrial Q22021 (Final)Document2 pagesRichmond Americas Alliance MarketBeat Industrial Q22021 (Final)Kevin ParkerNo ratings yet

- Hampton Roads Americas Alliance MarketBeat Industrial Q2 2020Document2 pagesHampton Roads Americas Alliance MarketBeat Industrial Q2 2020Kevin ParkerNo ratings yet

- Dallas/Fort Worth: Office Q4 2020Document4 pagesDallas/Fort Worth: Office Q4 2020David ThomasNo ratings yet

- Richmond Americas Alliance MarketBeat Office Q12022Document2 pagesRichmond Americas Alliance MarketBeat Office Q12022Kevin ParkerNo ratings yet

- Greenville Americas Alliance MarketBeat Industrial Q42020Document2 pagesGreenville Americas Alliance MarketBeat Industrial Q42020Kevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Office Q32021Document2 pagesRichmond Americas Alliance MarketBeat Office Q32021Kevin ParkerNo ratings yet

- Student Dashboard TemplateDocument5 pagesStudent Dashboard Templateapi-456173788No ratings yet

- Roanoke Americas Alliance MarketBeat Office Q32020 PDFDocument1 pageRoanoke Americas Alliance MarketBeat Office Q32020 PDFKevin ParkerNo ratings yet

- Hampton Roads 2024 Q1 Office Market ReportDocument3 pagesHampton Roads 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Fredericksburg Americas Alliance MarketBeat Industrial Q12020 PDFDocument2 pagesFredericksburg Americas Alliance MarketBeat Industrial Q12020 PDFKevin ParkerNo ratings yet

- Q1 FY20 InfographicDocument1 pageQ1 FY20 Infographicabhishek kumarNo ratings yet

- Mexico City: Industrial Q4 2019Document2 pagesMexico City: Industrial Q4 2019PepitofanNo ratings yet

- Greenville Americas Alliance MarketBeat Office Q32018Document1 pageGreenville Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- (BOC) PickarooDocument19 pages(BOC) PickarooalfhyoNo ratings yet

- 4Q21 Philadelphia Office Market ReportDocument6 pages4Q21 Philadelphia Office Market ReportKevin ParkerNo ratings yet

- HDFC Sept 20 Key FinancialDocument1 pageHDFC Sept 20 Key FinancialAnya ThakurNo ratings yet

- Roanoke Americas Alliance MarketBeat Industrial Q1 2021Document1 pageRoanoke Americas Alliance MarketBeat Industrial Q1 2021Kevin ParkerNo ratings yet

- Charleston Americas Alliance MarketBeat Industrial Q2 2020Document2 pagesCharleston Americas Alliance MarketBeat Industrial Q2 2020Kevin ParkerNo ratings yet

- Axis Detailed Report - May 2020 PDFDocument118 pagesAxis Detailed Report - May 2020 PDFRohan AdlakhaNo ratings yet

- 2021 Assessment Summary Report - Final - April 21, 2021Document19 pages2021 Assessment Summary Report - Final - April 21, 2021Duluth News TribuneNo ratings yet

- Day InDocument148 pagesDay IntechnosharukhNo ratings yet

- Greenville Americas Alliance MarketBeat Industrial Q22017Document2 pagesGreenville Americas Alliance MarketBeat Industrial Q22017Anonymous Feglbx5No ratings yet

- Richmond Americas Alliance MarketBeat Industrial Q1 2024Document3 pagesRichmond Americas Alliance MarketBeat Industrial Q1 2024Kevin ParkerNo ratings yet

- 4QFY16 Income Declines 21.1%: Share DataDocument5 pages4QFY16 Income Declines 21.1%: Share DataJajahinaNo ratings yet

- Latam Investment Banking Review q1 2021Document18 pagesLatam Investment Banking Review q1 2021Fernando Cano WongNo ratings yet

- Phoenix Americas MarketBeat Multifamily Q2 2023Document4 pagesPhoenix Americas MarketBeat Multifamily Q2 2023redcorolla95573No ratings yet

- Charleston Americas Alliance MarketBeat Industrial Q3 2020Document2 pagesCharleston Americas Alliance MarketBeat Industrial Q3 2020Kevin ParkerNo ratings yet

- Việt Nam: Rural ReportDocument29 pagesViệt Nam: Rural ReportHiếu ĐinhNo ratings yet

- Reducing FV Estimate On A More Conservative Outlook: Bloomberry Resorts CorporationDocument10 pagesReducing FV Estimate On A More Conservative Outlook: Bloomberry Resorts CorporationJajahinaNo ratings yet

- HCMC Brief 2019h2eDocument7 pagesHCMC Brief 2019h2eBui Duc TrungNo ratings yet

- 2018 Q4 Jakarta Retail Market Report ColliersDocument10 pages2018 Q4 Jakarta Retail Market Report ColliersNovia PutriNo ratings yet

- Should We Worry About American Debt?: Part V: Economics GroupDocument6 pagesShould We Worry About American Debt?: Part V: Economics GroupPhileas FoggNo ratings yet

- Economic Impact of Tourism in Greater Palm Springs 2023 CLIENT FINALDocument15 pagesEconomic Impact of Tourism in Greater Palm Springs 2023 CLIENT FINALJEAN MICHEL ALONZEAUNo ratings yet

- Hospitality Industry Canada March 2022Document49 pagesHospitality Industry Canada March 2022NormelNo ratings yet

- Greenville Americas Alliance MarketBeat Office Q12018Document1 pageGreenville Americas Alliance MarketBeat Office Q12018Anonymous Feglbx5No ratings yet

- 4Q21 Greater Philadelphia Industrial MarketDocument5 pages4Q21 Greater Philadelphia Industrial MarketKevin ParkerNo ratings yet

- US Industrial MarketBeat Q2 2020 PDFDocument7 pagesUS Industrial MarketBeat Q2 2020 PDFRN7 BackupNo ratings yet

- VIETNAM Residential Market Q2 2019Document39 pagesVIETNAM Residential Market Q2 2019Huỳnh VõNo ratings yet

- India Ahmedabad Industrial H1 2020Document2 pagesIndia Ahmedabad Industrial H1 2020Shivam SharmaNo ratings yet

- Beijing: Capital Markets Q2 2020Document2 pagesBeijing: Capital Markets Q2 2020Trang PhanNo ratings yet

- Tussell - 2022 Year in Review - 2023-01-09Document7 pagesTussell - 2022 Year in Review - 2023-01-09james.dickson72No ratings yet

- Fredericksburg 2024 Q1 Industrial Market ReportDocument3 pagesFredericksburg 2024 Q1 Industrial Market ReportKevin ParkerNo ratings yet

- MID-YEAR 2021 Riaa Revenue Statistics: Joshua P. Friedlander Senior Vice President, Research and Economics, RIAADocument3 pagesMID-YEAR 2021 Riaa Revenue Statistics: Joshua P. Friedlander Senior Vice President, Research and Economics, RIAAAnn ZhouNo ratings yet

- Canada Mortgage and Housing Corporation 2020 Rental Market ReportDocument165 pagesCanada Mortgage and Housing Corporation 2020 Rental Market ReportPeterborough ExaminerNo ratings yet

- ONE MAN ARMY - Fore School of ManagementDocument4 pagesONE MAN ARMY - Fore School of ManagementABHIRAM MOLUGUNo ratings yet

- Accenture-Supporting-Materials-Q4fy17Document10 pagesAccenture-Supporting-Materials-Q4fy17ankit.scsNo ratings yet

- 2.3 Jll-Vn-Hotel-Market-Snapshot-Hn-Dn-Hcmc-Sept-2019-EnDocument5 pages2.3 Jll-Vn-Hotel-Market-Snapshot-Hn-Dn-Hcmc-Sept-2019-EnjohnyNo ratings yet

- Q4 FY22 InfographicDocument1 pageQ4 FY22 InfographicawarialocksNo ratings yet

- Overcoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyFrom EverandOvercoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyNo ratings yet

- Analysis of House WRDA24 BillDocument5 pagesAnalysis of House WRDA24 BillKevin ParkerNo ratings yet

- Global Fraud Report 2024 AmericasDocument16 pagesGlobal Fraud Report 2024 AmericasKevin ParkerNo ratings yet

- Food Drink the Baltimore BannerDocument1 pageFood Drink the Baltimore BannerKevin ParkerNo ratings yet

- Cpu June 2024Document31 pagesCpu June 2024Kevin ParkerNo ratings yet

- P2024 SBB 20240506 Eng - 0Document2 pagesP2024 SBB 20240506 Eng - 0Kevin ParkerNo ratings yet

- Beach Management Analysis 2024Document29 pagesBeach Management Analysis 2024Kevin ParkerNo ratings yet

- Roanoke 2024 Q1 Office Market ReportDocument1 pageRoanoke 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Due Madri - Catering MenuDocument1 pageDue Madri - Catering MenuKevin ParkerNo ratings yet

- 2023 Healthy Harbor Report CardDocument9 pages2023 Healthy Harbor Report CardKevin ParkerNo ratings yet

- ERDC-CHL MP-24-3Document20 pagesERDC-CHL MP-24-3Kevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Retail Q1 2024Document3 pagesRichmond Americas Alliance MarketBeat Retail Q1 2024Kevin ParkerNo ratings yet

- Due Madri MenuDocument1 pageDue Madri MenuKevin ParkerNo ratings yet

- Roanoke 2024 Q1 Retail Market ReportDocument1 pageRoanoke 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Consumer Products Update - April 2024Document31 pagesConsumer Products Update - April 2024Kevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 FredericksburgDocument1 pageFive Fast Facts Q1 2024 FredericksburgKevin ParkerNo ratings yet

- Roanoke 2024 Q1 Industrial Market ReportDocument1 pageRoanoke 2024 Q1 Industrial Market ReportKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Retail Market ReportDocument3 pagesFredericksburg 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Hampton Roads 2024 Q1 Office Market ReportDocument3 pagesHampton Roads 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Industrial Market ReportDocument3 pagesFredericksburg 2024 Q1 Industrial Market ReportKevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 RichmondDocument1 pageFive Fast Facts Q1 2024 RichmondKevin ParkerNo ratings yet

- Charlottesville 2024 Q1 Office Market ReportDocument1 pageCharlottesville 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Charlottesville 2024 Q1 Retail Market ReportDocument1 pageCharlottesville 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- 2024 Q1 Industrial Houston Report ColliersDocument7 pages2024 Q1 Industrial Houston Report ColliersKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Office Market ReportDocument3 pagesFredericksburg 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 CharlottesvilleDocument1 pageFive Fast Facts Q1 2024 CharlottesvilleKevin ParkerNo ratings yet

- Canals 2024 UpdateDocument57 pagesCanals 2024 UpdateKevin ParkerNo ratings yet

- 2024 Real Estate Event InvitationDocument1 page2024 Real Estate Event InvitationKevin ParkerNo ratings yet

- LeadershipDocument4 pagesLeadershipKevin ParkerNo ratings yet

- Manufacturing Update - March 2024Document31 pagesManufacturing Update - March 2024Kevin ParkerNo ratings yet

- Linesight Construction Market Insights Americas - March 2024 1Document36 pagesLinesight Construction Market Insights Americas - March 2024 1Kevin ParkerNo ratings yet

- Circular Economy - Recycling Waste To WealthDocument64 pagesCircular Economy - Recycling Waste To Wealthvipul.gnu2602No ratings yet

- Guinea Tax 2Document6 pagesGuinea Tax 2Onur KopanNo ratings yet

- FlexoDocument5 pagesFlexolucky cultureNo ratings yet

- Developing A Brand NameDocument30 pagesDeveloping A Brand NameMagskie TVNo ratings yet

- Block 4Document84 pagesBlock 4Abhinav Ashok ChandelNo ratings yet

- Floyd Jacobs FileDocument23 pagesFloyd Jacobs Filethe kingfishNo ratings yet

- Cement Project Ch-1,2Document41 pagesCement Project Ch-1,2Krish DesaiNo ratings yet

- Cambridge IGCSE: ACCOUNTING 0452/21Document20 pagesCambridge IGCSE: ACCOUNTING 0452/21Valerine VictoriaNo ratings yet

- C Ward Level - ELU ReportDocument6 pagesC Ward Level - ELU ReportKaran TNo ratings yet

- Syllabus in Theory and Practice in Public AdministrationDocument6 pagesSyllabus in Theory and Practice in Public AdministrationLeah MorenoNo ratings yet

- The Nature of EnterpreneurshipDocument25 pagesThe Nature of EnterpreneurshipKoernia JabbarNo ratings yet

- PARTNERSHIPDocument153 pagesPARTNERSHIPJoen SinamagNo ratings yet

- Role of e Service Quality Brand Commitment and e WOM Trust On e WOM Intentions of MillennialsDocument22 pagesRole of e Service Quality Brand Commitment and e WOM Trust On e WOM Intentions of MillennialsCaptain SkyNo ratings yet

- Intermediate Macro Mankiw Ch13 20 Questions PDFDocument164 pagesIntermediate Macro Mankiw Ch13 20 Questions PDFYusuf Çubuk100% (1)

- Corporate Governance Semester 1 2022 2023 CityU 4stdDocument250 pagesCorporate Governance Semester 1 2022 2023 CityU 4stdNguyen KylieNo ratings yet

- Lab-Current LiabilitiesDocument5 pagesLab-Current LiabilitiesPatrick HarponNo ratings yet

- 05 Mar 2023 To 03 Jun 2023 FCMB StatementDocument2 pages05 Mar 2023 To 03 Jun 2023 FCMB StatementOlamilekan QuadriNo ratings yet

- Final ExamDocument7 pagesFinal ExamRuthchell CiriacoNo ratings yet

- ICAEW - Bus - Fin - Chapter 5 - StudentDocument123 pagesICAEW - Bus - Fin - Chapter 5 - StudentMai HuyenNo ratings yet

- Better Together Dorset HealthCares Five-Year StrategyDocument57 pagesBetter Together Dorset HealthCares Five-Year StrategyApopei Ana MariaNo ratings yet

- Innovative Access To HSBC's Unique Network of FX LiquidityDocument2 pagesInnovative Access To HSBC's Unique Network of FX LiquidityDev GogoiNo ratings yet

- PAS 19 Employee Benefits: Short-Term Employee Benefits Are Employee Benefits (Other Than Termination BenDocument5 pagesPAS 19 Employee Benefits: Short-Term Employee Benefits Are Employee Benefits (Other Than Termination BenKaila Clarisse CortezNo ratings yet

- InvoiceDocument2 pagesInvoiceSaravanan KNo ratings yet

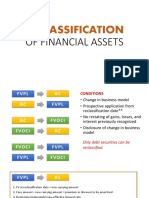

- Reclassification: of Financial AssetsDocument15 pagesReclassification: of Financial AssetsHazel Jane EsclamadaNo ratings yet

- MACROECONOMICS For PHD (Dynamic, International, Modern, Public Project)Document514 pagesMACROECONOMICS For PHD (Dynamic, International, Modern, Public Project)the.lord.of.twitter101No ratings yet

- Edexcel A-Level Economics Paper 3 2019Document36 pagesEdexcel A-Level Economics Paper 3 2019William BackNo ratings yet

- YL9000P Stellar Labs (MCM Electronics) Product Details: Part Number: Worldway Part: Category: Manufacturer: ApplicationsDocument3 pagesYL9000P Stellar Labs (MCM Electronics) Product Details: Part Number: Worldway Part: Category: Manufacturer: ApplicationsAbdallh MahmoudNo ratings yet