Professional Documents

Culture Documents

Preferred Stock Issuing Price 120 Face Value 100 Preferred Dividend 13% Floatation Cost 4

Preferred Stock Issuing Price 120 Face Value 100 Preferred Dividend 13% Floatation Cost 4

Uploaded by

Fatima Sabir0 ratings0% found this document useful (0 votes)

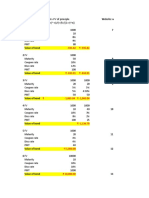

7 views1 pageThe document provides financial information to calculate the weighted average cost of capital (WACC) for an investment portfolio consisting of equity, preferred stock, and bonds. It lists the face value, time to maturity, coupon rate, and current price of a bond, as well as the issuing price, face value, dividend rate, and floatation costs of a preferred stock. It also provides the target weights, tax rate, risk free rate, beta, market return, and equity premium to calculate WACC.

Original Description:

investment portfolio management

Original Title

WACC Practice (1)

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides financial information to calculate the weighted average cost of capital (WACC) for an investment portfolio consisting of equity, preferred stock, and bonds. It lists the face value, time to maturity, coupon rate, and current price of a bond, as well as the issuing price, face value, dividend rate, and floatation costs of a preferred stock. It also provides the target weights, tax rate, risk free rate, beta, market return, and equity premium to calculate WACC.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views1 pagePreferred Stock Issuing Price 120 Face Value 100 Preferred Dividend 13% Floatation Cost 4

Preferred Stock Issuing Price 120 Face Value 100 Preferred Dividend 13% Floatation Cost 4

Uploaded by

Fatima SabirThe document provides financial information to calculate the weighted average cost of capital (WACC) for an investment portfolio consisting of equity, preferred stock, and bonds. It lists the face value, time to maturity, coupon rate, and current price of a bond, as well as the issuing price, face value, dividend rate, and floatation costs of a preferred stock. It also provides the target weights, tax rate, risk free rate, beta, market return, and equity premium to calculate WACC.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 1

Face Value of Bond 1000 Target Weights

Time to maturity 10 Years Equity 60%

Coupon Rate 12% Preferred Stock 25%

Current Price 990

Tax Rate 25%

Preferred Stock Issuing price 120 What is WACC?

Face Value 100

Preferred Dividend 13%

Floatation Cost 4

Last Year common dividend 17

Growth expected Growth 1st year 5%

2 to 4 year 4%

5 onward 3.50%

current Stock Price 110

Risk Free Rate 5%

Beta 1.7

Market Return 14%

Equity Premium on Debt 7%

You might also like

- Submarine Sandwich ModelDocument3 pagesSubmarine Sandwich ModelAliza RizviNo ratings yet

- Cost of Capital NumericalsDocument9 pagesCost of Capital Numericalsckcnathan001No ratings yet

- P07A - Cost of CapitalDocument3 pagesP07A - Cost of CapitalL1588AshishNo ratings yet

- Finance CalculationsDocument3 pagesFinance CalculationsDaniel ZentaoNo ratings yet

- FIN 550 Chapter 14Document29 pagesFIN 550 Chapter 14Kesarapu Venkata ApparaoNo ratings yet

- Par Value Coupon Interest N Avrage Discount Flotation Cost TaxDocument13 pagesPar Value Coupon Interest N Avrage Discount Flotation Cost TaxGhina NabilaNo ratings yet

- Value of Bond (% of Par Value) : 7.34% 105.17 105.17 UndervaluedDocument5 pagesValue of Bond (% of Par Value) : 7.34% 105.17 105.17 UndervaluedJAYRAJ AGRAWALNo ratings yet

- Alternative A Alternative B Alternative CDocument9 pagesAlternative A Alternative B Alternative CMohitNo ratings yet

- 3 Stage Growth ModelDocument2 pages3 Stage Growth Modeljanhabi.s25No ratings yet

- SDFFDocument10 pagesSDFFNidhi AshokNo ratings yet

- 01 - M&A Conference - 2023 Year of The DealDocument25 pages01 - M&A Conference - 2023 Year of The Dealjm petitNo ratings yet

- Sensitivity Analysis BondsDocument5 pagesSensitivity Analysis BondsZhenyi ZhuNo ratings yet

- Vaibhav - Mojidra - Tanla Platforms DCF ValuationDocument93 pagesVaibhav - Mojidra - Tanla Platforms DCF Valuation71 Vaibhav MojidraNo ratings yet

- 7excels On Solved ProblemsDocument2 pages7excels On Solved ProblemsPranoy SarkarNo ratings yet

- Bond ValuationDocument4 pagesBond ValuationPragathi SundarNo ratings yet

- Cost of CapitalDocument11 pagesCost of CapitalSakshi BaiwalNo ratings yet

- IPM - 2023 - Au - T1 - W5 - Trần Trà MyDocument7 pagesIPM - 2023 - Au - T1 - W5 - Trần Trà MyTrần Trà MyNo ratings yet

- AccretionDilution AnalysisDocument14 pagesAccretionDilution AnalysisJayash KaushalNo ratings yet

- Set 3Document1 pageSet 3aneeshaNo ratings yet

- Fima FinalsDocument37 pagesFima FinalsKatrina PaquizNo ratings yet

- Bonds: Formulas & ExamplesDocument12 pagesBonds: Formulas & ExamplesAayush sunejaNo ratings yet

- Date Interest Paymentinterest Expense AmortizationDocument8 pagesDate Interest Paymentinterest Expense Amortizationnerica931No ratings yet

- Time Value of Money: Professor XXX Course Name/numberDocument34 pagesTime Value of Money: Professor XXX Course Name/numbersumuewuNo ratings yet

- BKB - WACC Past ExamDocument4 pagesBKB - WACC Past ExamReever RiverNo ratings yet

- Lý Vũ Hoàng - Cheapter 9Document7 pagesLý Vũ Hoàng - Cheapter 9Hoàng LýNo ratings yet

- Fima FinalsDocument15 pagesFima FinalsKatrina PaquizNo ratings yet

- #13WACCDocument10 pages#13WACCMarieNo ratings yet

- Individual Assignment Financial ManagementDocument17 pagesIndividual Assignment Financial ManagementUtheu Budhi Susetyo100% (1)

- Homework For 9 October - Nino KvaratskheliaDocument8 pagesHomework For 9 October - Nino KvaratskheliaKvaratskhelia NinoNo ratings yet

- Cost of Capitalfinal1Document30 pagesCost of Capitalfinal1samNo ratings yet

- Mayes 8e CH11 SolutionsDocument22 pagesMayes 8e CH11 SolutionsRamez AhmedNo ratings yet

- Session 7Document13 pagesSession 7spamxacc7No ratings yet

- Historical Growth: The Following Will Be Inputs For The Calculation of Fundamental GrowthDocument6 pagesHistorical Growth: The Following Will Be Inputs For The Calculation of Fundamental GrowthAnonymous rOv67RNo ratings yet

- Workshop 9: YTM Bond Price 2% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00%Document5 pagesWorkshop 9: YTM Bond Price 2% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00%rameenNo ratings yet

- Managerial Economics 3rd Assignment Bratu Carina Maria EXCELDocument11 pagesManagerial Economics 3rd Assignment Bratu Carina Maria EXCELCarina MariaNo ratings yet

- Finance Management HW Week 4Document7 pagesFinance Management HW Week 4arwa_mukadam03100% (1)

- Long Term Debt: New Common Stock New DebtDocument4 pagesLong Term Debt: New Common Stock New DebtPutri AndiniNo ratings yet

- The Debt Trade-Off HPDocument3 pagesThe Debt Trade-Off HP/jncjdncjdnNo ratings yet

- Brealey Fundamentals of Corporate Finance 10e Ch05 PPT 2022Document32 pagesBrealey Fundamentals of Corporate Finance 10e Ch05 PPT 2022farroohaahmedNo ratings yet

- Introduction To Financial Management lRuDDocument14 pagesIntroduction To Financial Management lRuDKinNo ratings yet

- AMH Co QuestionDocument3 pagesAMH Co QuestionOlivier MNo ratings yet

- Bond Valuation ExamplesDocument2 pagesBond Valuation ExamplesKaushik ChopraNo ratings yet

- WACC and Traditional AppoachDocument3 pagesWACC and Traditional AppoachAnuvratNo ratings yet

- HW 3Document24 pagesHW 3Matthew RyanNo ratings yet

- 543L7 2 (Wacc 2)Document9 pages543L7 2 (Wacc 2)Äyušheë TŸagïNo ratings yet

- Excel Model - LT LoanDocument6 pagesExcel Model - LT LoanMurtazaNadeemNo ratings yet

- Bond ValuationDocument17 pagesBond ValuationMatthew RyanNo ratings yet

- 2 DDMDocument5 pages2 DDMSilvani Margaretha SimangunsongNo ratings yet

- Bai Many AssetsDocument3 pagesBai Many AssetsGia Linh Nguyen HoangNo ratings yet

- Session-1 CF-2Document13 pagesSession-1 CF-2rajyalakshmiNo ratings yet

- FCFFSTDocument10 pagesFCFFSTapi-3701114No ratings yet

- DCF ModelDocument29 pagesDCF ModelPATMON100% (7)

- w6 - Cost of Capital - Capital StructureDocument3 pagesw6 - Cost of Capital - Capital StructureMooqyNo ratings yet

- Cash Flow StudentsDocument38 pagesCash Flow StudentsPreet KawediaNo ratings yet

- The Financial Environment:: Markets, Institutions, and Interest RatesDocument18 pagesThe Financial Environment:: Markets, Institutions, and Interest RatesMSA-ACCA100% (2)

- CH 4 - in ClassDocument3 pagesCH 4 - in ClassJOSEPH MICHAEL MCGUINNESSNo ratings yet

- Financial Crisis Inquiry Commission: Mike Mayo, CFADocument14 pagesFinancial Crisis Inquiry Commission: Mike Mayo, CFAosmar92387No ratings yet

- Data Structures: Dr. Seemab Latif Lecture 1-A Introduction To Programming (Conditional Statements and Loops)Document34 pagesData Structures: Dr. Seemab Latif Lecture 1-A Introduction To Programming (Conditional Statements and Loops)Fatima SabirNo ratings yet

- CFI MODA YogaStudio PyramidDocument2 pagesCFI MODA YogaStudio PyramidFatima Sabir100% (1)

- Data Structures: Dr. Seemab LatifDocument33 pagesData Structures: Dr. Seemab LatifFatima SabirNo ratings yet

- Dr. Seemab Latif Introduction To Data StructuresDocument17 pagesDr. Seemab Latif Introduction To Data StructuresFatima SabirNo ratings yet

- Data Structures: Dr. Seemab Latif StacksDocument23 pagesData Structures: Dr. Seemab Latif StacksFatima SabirNo ratings yet

- Data Structures: Dr. Seemab Latif Arrays and PointersDocument26 pagesData Structures: Dr. Seemab Latif Arrays and PointersFatima SabirNo ratings yet

- TRG Pael MLCF Lotchem FCCL PPL DGKC Ogdc Hubc UBL Efert Bafl PSO Searl NML FFC HBL Epcl MCB Mebl NBP Luck Engro ISL Atrl SNGP POL Bahl Mari MTLDocument17 pagesTRG Pael MLCF Lotchem FCCL PPL DGKC Ogdc Hubc UBL Efert Bafl PSO Searl NML FFC HBL Epcl MCB Mebl NBP Luck Engro ISL Atrl SNGP POL Bahl Mari MTLFatima SabirNo ratings yet