Professional Documents

Culture Documents

Business and Transfer Taxation Gross Estate (Students' Handouts)

Business and Transfer Taxation Gross Estate (Students' Handouts)

Uploaded by

Angelica Jem Ballesterol CarandangCopyright:

Available Formats

You might also like

- Supply Chain Management - Tata MotorDocument30 pagesSupply Chain Management - Tata MotorGajanan87% (15)

- Estate Tax Post Quiz Answer KeyDocument8 pagesEstate Tax Post Quiz Answer KeyMichael AquinoNo ratings yet

- Demolition Planning PDFDocument12 pagesDemolition Planning PDFimanbilly67% (3)

- Acco 20173 Quiz 1Document7 pagesAcco 20173 Quiz 1Lyra EscosioNo ratings yet

- Quiz 1 - Estate TaxDocument7 pagesQuiz 1 - Estate TaxKevin James Sedurifa Oledan100% (4)

- HO4 Pre TestDocument4 pagesHO4 Pre TestJason Saberon Quiño0% (2)

- Free Range Chicken and Eggs Production Business PlanDocument4 pagesFree Range Chicken and Eggs Production Business PlanKassimGundah0% (2)

- Niche Cheat Sheet PDFDocument24 pagesNiche Cheat Sheet PDFCristina Alina LupuNo ratings yet

- Gross EstateDocument13 pagesGross EstateLadybellereyann A TeguihanonNo ratings yet

- M3 - Gross Estate - Common Rules Students'Document43 pagesM3 - Gross Estate - Common Rules Students'micaella pasionNo ratings yet

- Estate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaDocument38 pagesEstate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaRaymundo Eirah100% (1)

- Exercise No. 1-Estate TaxationDocument4 pagesExercise No. 1-Estate TaxationRed Velvet100% (1)

- Sample Problem For Gross EstateDocument5 pagesSample Problem For Gross EstateChristineNo ratings yet

- FA AnswersDocument12 pagesFA AnswersErica XaoNo ratings yet

- Chapter 23 QUESTIONS ANSWERSDocument18 pagesChapter 23 QUESTIONS ANSWERSDizon Ropalito P.No ratings yet

- Property Location Within Abroa D Within Outside Withi N Outside Real Properties X X Personal Properties Tangible X X Intangible X X XDocument4 pagesProperty Location Within Abroa D Within Outside Withi N Outside Real Properties X X Personal Properties Tangible X X Intangible X X XMarie Tes LocsinNo ratings yet

- ProblemsDocument12 pagesProblemsJohn Carlo J. DominoNo ratings yet

- Module 11 - ExercisesDocument8 pagesModule 11 - ExercisesDolliejane MercadoNo ratings yet

- Deductions From Gross EstateDocument34 pagesDeductions From Gross Estatesmosaldana.cvtNo ratings yet

- TX2 101Document3 pagesTX2 101Pau SantosNo ratings yet

- Estate Tax (Exercises)Document3 pagesEstate Tax (Exercises)dimpy dNo ratings yet

- Exercise-2-Estate-Tax QDocument2 pagesExercise-2-Estate-Tax QJaypee Verzo SaltaNo ratings yet

- Quiz On Estate TaxDocument4 pagesQuiz On Estate TaxRenz CastroNo ratings yet

- Quiz 2 Tax 2 Answer KeyDocument10 pagesQuiz 2 Tax 2 Answer KeyJamaica DavidNo ratings yet

- Estate Tax HW8Document12 pagesEstate Tax HW8ALYZA ANGELA ORNEDONo ratings yet

- Concept Map: Estate Tax: Summary of Rules On Gross EstateDocument22 pagesConcept Map: Estate Tax: Summary of Rules On Gross EstateEDELYN PoblacionNo ratings yet

- Gross Estate of A Married DecedentDocument5 pagesGross Estate of A Married DecedentKarl Wilson GonzalesNo ratings yet

- Estate Ni JonaDocument2 pagesEstate Ni Jonalov3m350% (2)

- Tax Without ChoicesDocument6 pagesTax Without ChoicesEdwinJugadoNo ratings yet

- Cagayan State University Aparri, Cagayan: Preliminary Examination - Transfer and Business Tax IDocument3 pagesCagayan State University Aparri, Cagayan: Preliminary Examination - Transfer and Business Tax IJenelyn BeltranNo ratings yet

- Enhancement Estate Tax2Document35 pagesEnhancement Estate Tax2Kathleen Tabasa ManuelNo ratings yet

- Gross Estate QuizDocument29 pagesGross Estate QuizGanie Mar R. BiasonNo ratings yet

- Concept of Succession and Estate Tax and Gross Estate Common Rules & Special Rules (Married Decedents)Document12 pagesConcept of Succession and Estate Tax and Gross Estate Common Rules & Special Rules (Married Decedents)Hazel Jane Esclamada100% (1)

- Transfer Tax QuizDocument3 pagesTransfer Tax QuizMary Grace SalcedoNo ratings yet

- Tax Lecture Estate Tax Part 2Document7 pagesTax Lecture Estate Tax Part 2Kathreen Aya ExcondeNo ratings yet

- ACAE 18 - Deduction From Gross EstateDocument4 pagesACAE 18 - Deduction From Gross Estatechen dalitNo ratings yet

- Chapter 3 Gross EstateDocument4 pagesChapter 3 Gross EstatePJ PoliranNo ratings yet

- Gross Estate of Married DecedentDocument10 pagesGross Estate of Married Decedentbeverlyrtan85% (13)

- Gross EstateDocument30 pagesGross EstatesbadocenaNo ratings yet

- Exercise 2 Estate Tax pt1.5Document4 pagesExercise 2 Estate Tax pt1.5Maristella GatonNo ratings yet

- Exercise 2 Estate Tax pt1.5Document4 pagesExercise 2 Estate Tax pt1.5Angelica Nicole TamayoNo ratings yet

- Exercise 2 Estate Tax Pt1.5Document4 pagesExercise 2 Estate Tax Pt1.5Angelica Nicole TamayoNo ratings yet

- 16Document11 pages16Sheie WiseNo ratings yet

- Estate Tax Practice Set With AnswersDocument6 pagesEstate Tax Practice Set With AnswersXin ZhaoNo ratings yet

- Tax 2Document6 pagesTax 2Zerjo CantalejoNo ratings yet

- Transfer Tax Prelim ExamDocument4 pagesTransfer Tax Prelim ExamSalma AbdullahNo ratings yet

- BUSTAXDocument3 pagesBUSTAXMyrna MirandaNo ratings yet

- Gross Estate of Married DecedentsDocument16 pagesGross Estate of Married Decedentsある種の ジャマンドロンNo ratings yet

- Problems 1Document11 pagesProblems 1Kenneth Bryan Tegerero Tegio100% (1)

- Exercises On Estate Tax Additional ProblemsDocument8 pagesExercises On Estate Tax Additional ProblemsMidas Troy VictorNo ratings yet

- Exercise-2-Estate-Tax QDocument2 pagesExercise-2-Estate-Tax Qrick owensNo ratings yet

- Exercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationDocument14 pagesExercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationSheie WiseNo ratings yet

- Tax 2 4Document9 pagesTax 2 4amlecdeyojNo ratings yet

- Transfer & Business TaxDocument5 pagesTransfer & Business TaxAlif FabianNo ratings yet

- Property Regime For Married IndividualsDocument35 pagesProperty Regime For Married IndividualsbetariceNo ratings yet

- Composition of The Gross Estate of A DecedentDocument16 pagesComposition of The Gross Estate of A DecedentBill BreisNo ratings yet

- BT Quiz 2Document5 pagesBT Quiz 2Lou Anthony A. Calibo0% (1)

- Tax - 001Document3 pagesTax - 001HURLY BALANCAR0% (1)

- Gross Estate 1Document12 pagesGross Estate 1Maja SantosNo ratings yet

- Illustrations PDFDocument3 pagesIllustrations PDFCharrey Leigh FormaranNo ratings yet

- De La Salle University-Dasmarinas College of Business Administration and Accountancy Accountancy DepartmentDocument2 pagesDe La Salle University-Dasmarinas College of Business Administration and Accountancy Accountancy DepartmentGurong MNo ratings yet

- Acp and CPG QuizDocument6 pagesAcp and CPG QuizCarina Mae Valdez Valencia0% (1)

- HO.11 - Introduction To Transfer TaxationDocument1 pageHO.11 - Introduction To Transfer TaxationAngelica Jem Ballesterol CarandangNo ratings yet

- HO.16 - Taxation RemediesDocument2 pagesHO.16 - Taxation RemediesAngelica Jem Ballesterol CarandangNo ratings yet

- HO.14 - Deductions From Gross Estate and Estate Tax PayableDocument3 pagesHO.14 - Deductions From Gross Estate and Estate Tax PayableAngelica Jem Ballesterol CarandangNo ratings yet

- HO.15 - Donation and Donors TaxationDocument3 pagesHO.15 - Donation and Donors TaxationAngelica Jem Ballesterol CarandangNo ratings yet

- Business and Transfer Taxation Business Taxation - VAT (Students' Handouts)Document1 pageBusiness and Transfer Taxation Business Taxation - VAT (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- Business and Transfer Taxation Business Taxation - VAT (Students' Handouts)Document1 pageBusiness and Transfer Taxation Business Taxation - VAT (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- Business and Transfer Taxation Business Taxation (Students' Handouts)Document2 pagesBusiness and Transfer Taxation Business Taxation (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- Business and Transfer Taxation Business Taxation (Students' Handouts)Document2 pagesBusiness and Transfer Taxation Business Taxation (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- 114 Pitney Bowes Model M Postage MeterDocument7 pages114 Pitney Bowes Model M Postage Meterinbox9999No ratings yet

- Introducing The Australian Defence Consultancy Group (ADCG) Defence Industry Security Program (DISP) CapabilityDocument3 pagesIntroducing The Australian Defence Consultancy Group (ADCG) Defence Industry Security Program (DISP) CapabilityKarthik KumarNo ratings yet

- Form E: Asean-China Free Trade Area Preferential Tariff Certificate of Origin (Combined Declaration and Certificate)Document1 pageForm E: Asean-China Free Trade Area Preferential Tariff Certificate of Origin (Combined Declaration and Certificate)saipul anwarNo ratings yet

- Ideal+Solution+ +DA+Case+Study+PPT+1Document10 pagesIdeal+Solution+ +DA+Case+Study+PPT+1Abha JainNo ratings yet

- Removing Barriers in The Value Chain - Mashreq Construction Report 9 1Document28 pagesRemoving Barriers in The Value Chain - Mashreq Construction Report 9 1Ihab RamlawiNo ratings yet

- YgnDocument215 pagesYgntalhakaplan76No ratings yet

- Branch AccountingDocument7 pagesBranch AccountingAmit KumarNo ratings yet

- Product Knowledge Training: For Administrative Staff PT Upking Steel IndonesiaDocument14 pagesProduct Knowledge Training: For Administrative Staff PT Upking Steel IndonesiaReynando NovebriansyahNo ratings yet

- Post Project Review TemplateDocument10 pagesPost Project Review TemplatehymerchmidtNo ratings yet

- Concept of Human Resource Management: Presented By: Rupesh NyaupaneDocument26 pagesConcept of Human Resource Management: Presented By: Rupesh NyaupaneEng MatanaNo ratings yet

- CONCEPTUAL FRAMEWORK - Recognition and MeasurementDocument5 pagesCONCEPTUAL FRAMEWORK - Recognition and MeasurementAllaine ElfaNo ratings yet

- SIr Ayaz LecturesDocument2 pagesSIr Ayaz LecturesMuhammad EjazNo ratings yet

- EngineeringEconomicsCeng5191 ByMeleseMengistuDocument299 pagesEngineeringEconomicsCeng5191 ByMeleseMengistuakewak arguNo ratings yet

- FATF Annual Report 2022 2023.pdf - CoredownloadDocument60 pagesFATF Annual Report 2022 2023.pdf - CoredownloadmagnetmarxNo ratings yet

- Cmacgm Inmaa Deham ST 20221027 Qspot2248388Document2 pagesCmacgm Inmaa Deham ST 20221027 Qspot2248388Vivek SinghNo ratings yet

- Depends InsuranceDocument3 pagesDepends Insurancevasuakm8No ratings yet

- Alyssa JonesDocument7 pagesAlyssa Jonesapi-454019927No ratings yet

- ICICI Prudential Life Insurance CompanyDocument21 pagesICICI Prudential Life Insurance CompanySayantan ChoudhuryNo ratings yet

- CH 12Document19 pagesCH 12Vandana GuptaNo ratings yet

- Quickbooks ProjectDocument15 pagesQuickbooks ProjectALEJANDRE, Chris Shaira M.No ratings yet

- Source: The International Business, New Realities (Cavusgil, Et Al., 2017)Document6 pagesSource: The International Business, New Realities (Cavusgil, Et Al., 2017)Abdul SattarNo ratings yet

- B.N.Rathi Securities Limited: Board of DirectorsDocument48 pagesB.N.Rathi Securities Limited: Board of DirectorsSudha GurazadaNo ratings yet

- Bank of The Philippine Islands vs. de Reny Fabric Industries, Inc., 35 SCRA 253 (1970)Document2 pagesBank of The Philippine Islands vs. de Reny Fabric Industries, Inc., 35 SCRA 253 (1970)Robinson MojicaNo ratings yet

- Macroeconomic - UlangkajiDocument12 pagesMacroeconomic - UlangkajiAnanthi BaluNo ratings yet

- University of Calcutta: Application Form For Under Graduate ExaminationsDocument1 pageUniversity of Calcutta: Application Form For Under Graduate ExaminationsBishal BhandariNo ratings yet

- BS - Performance Evaluation Ratios .ppt.3Document65 pagesBS - Performance Evaluation Ratios .ppt.3SM IrfanNo ratings yet

Business and Transfer Taxation Gross Estate (Students' Handouts)

Business and Transfer Taxation Gross Estate (Students' Handouts)

Uploaded by

Angelica Jem Ballesterol CarandangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business and Transfer Taxation Gross Estate (Students' Handouts)

Business and Transfer Taxation Gross Estate (Students' Handouts)

Uploaded by

Angelica Jem Ballesterol CarandangCopyright:

Available Formats

BUSINESS AND TRANSFER TAXATION

Gross Estate (Students’ Handouts)

GROSS ESTATE

-consists of all tangible or intangible, real or personal properties, of the decedent wherever situated at

the point of death

Illustration

A decedent died leaving the following property:

Location

Philippines Abroad Total

Real property P2,000,000 P3,000,000 P5,000,000

Tangible personal property 1,000,000 500,000 1,500,000

Intangible personal property 800,000 1,200,000 2,000,000

Total P3,800,000 P4,700,000 P8,500,000

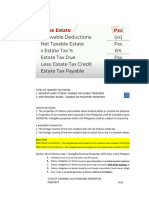

The Gross Estate Formula

Inventory of properties at the point of death P xxx

Less: Exempt transfers

Properties not owned P xxx

Properties owned but excluded by law xxx xxx

Inventory of taxable present properties xxx

Add: Taxable transfers xxx

Gross Estate P xxx

Transfer of Properties Not Owned by the Decedent

1. Merger of the usufruct in the owner of the naked title

2. The transmission or delivery of the inheritance or legacy by the fiduciary heir or legatee to the

fideicommissary

3. The transmission from the first heir, legatee, or done in favor of another beneficiary, in

accordance with the desire of the predecessor

4. Proceeds of irrevocable life insurance policy payable to beneficiary other than the estate,

administrator or executor

5. Properties held in trust by the decedent

6. Separate properties of the surviving spouse of the decedent

7. Transfer by way of bona fide sales

Legal Exclusions

1. Proceeds of group insurance taken out by a company for its employees

2. Proceeds of GSIS policy or benefits from GSIS

3. Accruals from SSS

4. United States Veterans Administration (USVA) benefits – RA136

5. War damage payments

6. All bequests, devises, legacies or transfers to social welfare, cultural and charitable institution,

no part of net income of which inures to the benefit of any individual; provided, however, that

not more than 30% of the said bequests, devises, legacies or transfers shall be used by such

institutions for administration purposes

7. Acquisitions and or transfers expressly declared as non-taxable by law

Taxable Transfers

1. Transfer in contemplation of death

2. Revocable transfers, including conditional transfers

3. Property passing under general power of appointment

Composition of Gross Estate

1. Properties, movable or immovable, tangible or intangible

2. Decedent’s interest on properties

3. Proceeds of life insurance

a. Designated as revocable to any heir

b. Regardless of designation, if the beneficiary is the estate, administrator or executor

4. Taxable transfers

Valuation of the Gross Estate

Properties subject to estate tax shall be appraised at their fair value at the point of death.

Based on R.B.Banggawan’s Business and Transfer Taxation (2019) Page 1 of 2

BUSINESS AND TRANSFER TAXATION

Gross Estate (Students’ Handouts)

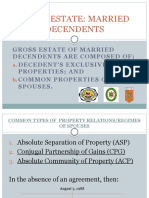

Gross Estate of Married Decedents

1. Decedent’s exclusive properties

2. Common properties of the spouses

PROPERTY RELATIONS BETWEEN SPOUSES

Common Types of Property Regimes

1. Absolute Separation of Property

2. Conjugal Partnership of Gains

Properties of spouse including fruits before marriage are their exclusive properties.

Exception to prospectivity: gratuitous acquisition during marriage

3. Absolute Community of Property

All properties will be common except:

a. Properties received by way of gratuitous title during marriage

b. Fruits of separate properties of the spouses

c. Properties for exclusive personal use of either spouses, except jewelry

d. Properties brought into the marriage by either spouse with a descendant by a prior

marriage

Illustration 1

Mr. A, a citizen resident, died leaving the following properties:

Cash proceeds of life insurance designated to

A brother as revocable beneficiary P 1,000,000

Building, properties held as usufructuary 4,000,000

Cash and cars, earned from building 2,400,000

Agricultural land 3,000,000

House and lot, from Mr. A’s industry 7,000,000

Benefits from GSIS 500,000

Total properties P17,900,000

Additional information:

1. The agricultural land was designated by Mr. A’s father in his will to be transferred to D, Mr. A’s

son, upon Mr. A’s death.

2. Mr. A made a revocable donation involving a residential lot to his brother, E. Mr. E paid P400,000

when the lot was worth P1,000,000. The lot was currently valued at P2,000,000 zonal value

upon Mr. A’s death.

Illustration 2

Mr. Crocs died. An inventory of the properties of Mr. and Mrs. Crocs were as follows:

Mr. Crocs Mrs. Crocs Total

Properties accruing before marriage:

Properties inherited before marriage P 200,000 P 100,000 P 300,000

Properties for exclusive personal use 50,000 60,000 110,000

Other properties brought into marriage 350,000 440,000 790,000

Properties accruing during marriage:

Properties inherited during marriage P 250,000 P 150,000 P 400,000

Properties as fruit of own labor 140,000 160,000 300,000

Properties accrued for exclusive use 30,000 40,000 70,000

Properties as fruit of common labor 250,000

Fruits of:

Properties inherited before marriage 100,000 50,000 150,000

Properties inherited during marriage 20,000 80,000 100,000

Properties acquired from own labor 20,000 40,000 60,000

Properties earned from common labor 50,000

Based on R.B.Banggawan’s Business and Transfer Taxation (2019) Page 2 of 2

You might also like

- Supply Chain Management - Tata MotorDocument30 pagesSupply Chain Management - Tata MotorGajanan87% (15)

- Estate Tax Post Quiz Answer KeyDocument8 pagesEstate Tax Post Quiz Answer KeyMichael AquinoNo ratings yet

- Demolition Planning PDFDocument12 pagesDemolition Planning PDFimanbilly67% (3)

- Acco 20173 Quiz 1Document7 pagesAcco 20173 Quiz 1Lyra EscosioNo ratings yet

- Quiz 1 - Estate TaxDocument7 pagesQuiz 1 - Estate TaxKevin James Sedurifa Oledan100% (4)

- HO4 Pre TestDocument4 pagesHO4 Pre TestJason Saberon Quiño0% (2)

- Free Range Chicken and Eggs Production Business PlanDocument4 pagesFree Range Chicken and Eggs Production Business PlanKassimGundah0% (2)

- Niche Cheat Sheet PDFDocument24 pagesNiche Cheat Sheet PDFCristina Alina LupuNo ratings yet

- Gross EstateDocument13 pagesGross EstateLadybellereyann A TeguihanonNo ratings yet

- M3 - Gross Estate - Common Rules Students'Document43 pagesM3 - Gross Estate - Common Rules Students'micaella pasionNo ratings yet

- Estate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaDocument38 pagesEstate Tax: Gross Estate: Pamantasan NG Lungsod NG MuntinlupaRaymundo Eirah100% (1)

- Exercise No. 1-Estate TaxationDocument4 pagesExercise No. 1-Estate TaxationRed Velvet100% (1)

- Sample Problem For Gross EstateDocument5 pagesSample Problem For Gross EstateChristineNo ratings yet

- FA AnswersDocument12 pagesFA AnswersErica XaoNo ratings yet

- Chapter 23 QUESTIONS ANSWERSDocument18 pagesChapter 23 QUESTIONS ANSWERSDizon Ropalito P.No ratings yet

- Property Location Within Abroa D Within Outside Withi N Outside Real Properties X X Personal Properties Tangible X X Intangible X X XDocument4 pagesProperty Location Within Abroa D Within Outside Withi N Outside Real Properties X X Personal Properties Tangible X X Intangible X X XMarie Tes LocsinNo ratings yet

- ProblemsDocument12 pagesProblemsJohn Carlo J. DominoNo ratings yet

- Module 11 - ExercisesDocument8 pagesModule 11 - ExercisesDolliejane MercadoNo ratings yet

- Deductions From Gross EstateDocument34 pagesDeductions From Gross Estatesmosaldana.cvtNo ratings yet

- TX2 101Document3 pagesTX2 101Pau SantosNo ratings yet

- Estate Tax (Exercises)Document3 pagesEstate Tax (Exercises)dimpy dNo ratings yet

- Exercise-2-Estate-Tax QDocument2 pagesExercise-2-Estate-Tax QJaypee Verzo SaltaNo ratings yet

- Quiz On Estate TaxDocument4 pagesQuiz On Estate TaxRenz CastroNo ratings yet

- Quiz 2 Tax 2 Answer KeyDocument10 pagesQuiz 2 Tax 2 Answer KeyJamaica DavidNo ratings yet

- Estate Tax HW8Document12 pagesEstate Tax HW8ALYZA ANGELA ORNEDONo ratings yet

- Concept Map: Estate Tax: Summary of Rules On Gross EstateDocument22 pagesConcept Map: Estate Tax: Summary of Rules On Gross EstateEDELYN PoblacionNo ratings yet

- Gross Estate of A Married DecedentDocument5 pagesGross Estate of A Married DecedentKarl Wilson GonzalesNo ratings yet

- Estate Ni JonaDocument2 pagesEstate Ni Jonalov3m350% (2)

- Tax Without ChoicesDocument6 pagesTax Without ChoicesEdwinJugadoNo ratings yet

- Cagayan State University Aparri, Cagayan: Preliminary Examination - Transfer and Business Tax IDocument3 pagesCagayan State University Aparri, Cagayan: Preliminary Examination - Transfer and Business Tax IJenelyn BeltranNo ratings yet

- Enhancement Estate Tax2Document35 pagesEnhancement Estate Tax2Kathleen Tabasa ManuelNo ratings yet

- Gross Estate QuizDocument29 pagesGross Estate QuizGanie Mar R. BiasonNo ratings yet

- Concept of Succession and Estate Tax and Gross Estate Common Rules & Special Rules (Married Decedents)Document12 pagesConcept of Succession and Estate Tax and Gross Estate Common Rules & Special Rules (Married Decedents)Hazel Jane Esclamada100% (1)

- Transfer Tax QuizDocument3 pagesTransfer Tax QuizMary Grace SalcedoNo ratings yet

- Tax Lecture Estate Tax Part 2Document7 pagesTax Lecture Estate Tax Part 2Kathreen Aya ExcondeNo ratings yet

- ACAE 18 - Deduction From Gross EstateDocument4 pagesACAE 18 - Deduction From Gross Estatechen dalitNo ratings yet

- Chapter 3 Gross EstateDocument4 pagesChapter 3 Gross EstatePJ PoliranNo ratings yet

- Gross Estate of Married DecedentDocument10 pagesGross Estate of Married Decedentbeverlyrtan85% (13)

- Gross EstateDocument30 pagesGross EstatesbadocenaNo ratings yet

- Exercise 2 Estate Tax pt1.5Document4 pagesExercise 2 Estate Tax pt1.5Maristella GatonNo ratings yet

- Exercise 2 Estate Tax pt1.5Document4 pagesExercise 2 Estate Tax pt1.5Angelica Nicole TamayoNo ratings yet

- Exercise 2 Estate Tax Pt1.5Document4 pagesExercise 2 Estate Tax Pt1.5Angelica Nicole TamayoNo ratings yet

- 16Document11 pages16Sheie WiseNo ratings yet

- Estate Tax Practice Set With AnswersDocument6 pagesEstate Tax Practice Set With AnswersXin ZhaoNo ratings yet

- Tax 2Document6 pagesTax 2Zerjo CantalejoNo ratings yet

- Transfer Tax Prelim ExamDocument4 pagesTransfer Tax Prelim ExamSalma AbdullahNo ratings yet

- BUSTAXDocument3 pagesBUSTAXMyrna MirandaNo ratings yet

- Gross Estate of Married DecedentsDocument16 pagesGross Estate of Married Decedentsある種の ジャマンドロンNo ratings yet

- Problems 1Document11 pagesProblems 1Kenneth Bryan Tegerero Tegio100% (1)

- Exercises On Estate Tax Additional ProblemsDocument8 pagesExercises On Estate Tax Additional ProblemsMidas Troy VictorNo ratings yet

- Exercise-2-Estate-Tax QDocument2 pagesExercise-2-Estate-Tax Qrick owensNo ratings yet

- Exercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationDocument14 pagesExercise 7-7. Multiple Choice Problem: Items 1 and 2 Are Based On The Following InformationSheie WiseNo ratings yet

- Tax 2 4Document9 pagesTax 2 4amlecdeyojNo ratings yet

- Transfer & Business TaxDocument5 pagesTransfer & Business TaxAlif FabianNo ratings yet

- Property Regime For Married IndividualsDocument35 pagesProperty Regime For Married IndividualsbetariceNo ratings yet

- Composition of The Gross Estate of A DecedentDocument16 pagesComposition of The Gross Estate of A DecedentBill BreisNo ratings yet

- BT Quiz 2Document5 pagesBT Quiz 2Lou Anthony A. Calibo0% (1)

- Tax - 001Document3 pagesTax - 001HURLY BALANCAR0% (1)

- Gross Estate 1Document12 pagesGross Estate 1Maja SantosNo ratings yet

- Illustrations PDFDocument3 pagesIllustrations PDFCharrey Leigh FormaranNo ratings yet

- De La Salle University-Dasmarinas College of Business Administration and Accountancy Accountancy DepartmentDocument2 pagesDe La Salle University-Dasmarinas College of Business Administration and Accountancy Accountancy DepartmentGurong MNo ratings yet

- Acp and CPG QuizDocument6 pagesAcp and CPG QuizCarina Mae Valdez Valencia0% (1)

- HO.11 - Introduction To Transfer TaxationDocument1 pageHO.11 - Introduction To Transfer TaxationAngelica Jem Ballesterol CarandangNo ratings yet

- HO.16 - Taxation RemediesDocument2 pagesHO.16 - Taxation RemediesAngelica Jem Ballesterol CarandangNo ratings yet

- HO.14 - Deductions From Gross Estate and Estate Tax PayableDocument3 pagesHO.14 - Deductions From Gross Estate and Estate Tax PayableAngelica Jem Ballesterol CarandangNo ratings yet

- HO.15 - Donation and Donors TaxationDocument3 pagesHO.15 - Donation and Donors TaxationAngelica Jem Ballesterol CarandangNo ratings yet

- Business and Transfer Taxation Business Taxation - VAT (Students' Handouts)Document1 pageBusiness and Transfer Taxation Business Taxation - VAT (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- Business and Transfer Taxation Business Taxation - VAT (Students' Handouts)Document1 pageBusiness and Transfer Taxation Business Taxation - VAT (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- Business and Transfer Taxation Business Taxation (Students' Handouts)Document2 pagesBusiness and Transfer Taxation Business Taxation (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- Business and Transfer Taxation Business Taxation (Students' Handouts)Document2 pagesBusiness and Transfer Taxation Business Taxation (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- 114 Pitney Bowes Model M Postage MeterDocument7 pages114 Pitney Bowes Model M Postage Meterinbox9999No ratings yet

- Introducing The Australian Defence Consultancy Group (ADCG) Defence Industry Security Program (DISP) CapabilityDocument3 pagesIntroducing The Australian Defence Consultancy Group (ADCG) Defence Industry Security Program (DISP) CapabilityKarthik KumarNo ratings yet

- Form E: Asean-China Free Trade Area Preferential Tariff Certificate of Origin (Combined Declaration and Certificate)Document1 pageForm E: Asean-China Free Trade Area Preferential Tariff Certificate of Origin (Combined Declaration and Certificate)saipul anwarNo ratings yet

- Ideal+Solution+ +DA+Case+Study+PPT+1Document10 pagesIdeal+Solution+ +DA+Case+Study+PPT+1Abha JainNo ratings yet

- Removing Barriers in The Value Chain - Mashreq Construction Report 9 1Document28 pagesRemoving Barriers in The Value Chain - Mashreq Construction Report 9 1Ihab RamlawiNo ratings yet

- YgnDocument215 pagesYgntalhakaplan76No ratings yet

- Branch AccountingDocument7 pagesBranch AccountingAmit KumarNo ratings yet

- Product Knowledge Training: For Administrative Staff PT Upking Steel IndonesiaDocument14 pagesProduct Knowledge Training: For Administrative Staff PT Upking Steel IndonesiaReynando NovebriansyahNo ratings yet

- Post Project Review TemplateDocument10 pagesPost Project Review TemplatehymerchmidtNo ratings yet

- Concept of Human Resource Management: Presented By: Rupesh NyaupaneDocument26 pagesConcept of Human Resource Management: Presented By: Rupesh NyaupaneEng MatanaNo ratings yet

- CONCEPTUAL FRAMEWORK - Recognition and MeasurementDocument5 pagesCONCEPTUAL FRAMEWORK - Recognition and MeasurementAllaine ElfaNo ratings yet

- SIr Ayaz LecturesDocument2 pagesSIr Ayaz LecturesMuhammad EjazNo ratings yet

- EngineeringEconomicsCeng5191 ByMeleseMengistuDocument299 pagesEngineeringEconomicsCeng5191 ByMeleseMengistuakewak arguNo ratings yet

- FATF Annual Report 2022 2023.pdf - CoredownloadDocument60 pagesFATF Annual Report 2022 2023.pdf - CoredownloadmagnetmarxNo ratings yet

- Cmacgm Inmaa Deham ST 20221027 Qspot2248388Document2 pagesCmacgm Inmaa Deham ST 20221027 Qspot2248388Vivek SinghNo ratings yet

- Depends InsuranceDocument3 pagesDepends Insurancevasuakm8No ratings yet

- Alyssa JonesDocument7 pagesAlyssa Jonesapi-454019927No ratings yet

- ICICI Prudential Life Insurance CompanyDocument21 pagesICICI Prudential Life Insurance CompanySayantan ChoudhuryNo ratings yet

- CH 12Document19 pagesCH 12Vandana GuptaNo ratings yet

- Quickbooks ProjectDocument15 pagesQuickbooks ProjectALEJANDRE, Chris Shaira M.No ratings yet

- Source: The International Business, New Realities (Cavusgil, Et Al., 2017)Document6 pagesSource: The International Business, New Realities (Cavusgil, Et Al., 2017)Abdul SattarNo ratings yet

- B.N.Rathi Securities Limited: Board of DirectorsDocument48 pagesB.N.Rathi Securities Limited: Board of DirectorsSudha GurazadaNo ratings yet

- Bank of The Philippine Islands vs. de Reny Fabric Industries, Inc., 35 SCRA 253 (1970)Document2 pagesBank of The Philippine Islands vs. de Reny Fabric Industries, Inc., 35 SCRA 253 (1970)Robinson MojicaNo ratings yet

- Macroeconomic - UlangkajiDocument12 pagesMacroeconomic - UlangkajiAnanthi BaluNo ratings yet

- University of Calcutta: Application Form For Under Graduate ExaminationsDocument1 pageUniversity of Calcutta: Application Form For Under Graduate ExaminationsBishal BhandariNo ratings yet

- BS - Performance Evaluation Ratios .ppt.3Document65 pagesBS - Performance Evaluation Ratios .ppt.3SM IrfanNo ratings yet