Professional Documents

Culture Documents

Activity-3 WongCarmela

Activity-3 WongCarmela

Uploaded by

Carmela WongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity-3 WongCarmela

Activity-3 WongCarmela

Uploaded by

Carmela WongCopyright:

Available Formats

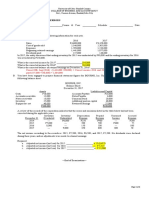

Carmela Jia Ming A.

Wong

BS Accountancy

1. Due to growing financial difficulties, F Bank was unable to finish construction of its 21-

storey building on a prime lot located in Makati City. Thus, the Bangko Sentral ordered the

closure of F Bank and, consequently, placed it under receivership. In a bid to save the bank’s

property investment, the President of F Bank entered into a financing agreement with a group of

investors for the completion of the construction of the 21- storey building in exchange for a ten-

year lease and the exclusive option to purchase the building. Is the act of the President valid?

Why or why not? (5 points)

(Answer 1) No, the bank president’s act is not valid. He had no authority to enter into the

financing agreement. Z Bank was ordered closed and placed under receivership. Control over the

properties of Z Bank passed to the receiver. The appointment of a receiver operates to suspend

the authority of the bank and its officers over the bank’s assets and properties.

2.When MANILA Bank folded up due to insolvency, Bong had the following separate deposits

in his name: P200,000 in savings deposit; P250,000 in time deposit; P50,000 in current account;

P1 million in a trust account and P3 million in money market placement. Under the Philippine

Deposit Insurance Corporation Act, how much could Bong recover? Explain and cite the

applicable legal provision. (5 points)

(Answer 2) Bong can recover the amount of P500,000, as the total of his savings deposit, time

deposit and current account. As amended he trust account and the money market placements are

not included in the insured deposit by Republic Act No.3591 under Section 4, the trust account

and the money market placements are not included in the insured deposits.

You might also like

- Carmela Jiaming A. Wong Bs-AccountancyDocument2 pagesCarmela Jiaming A. Wong Bs-AccountancyCarmela WongNo ratings yet

- Carmela Jiaming A. Wong Bs-AccountancyDocument2 pagesCarmela Jiaming A. Wong Bs-AccountancyCarmela WongNo ratings yet

- Sa1 Wong Section7Document2 pagesSa1 Wong Section7Carmela WongNo ratings yet

- La Consolacion College - Manila Auditing Problem Final Quiz # 1Document6 pagesLa Consolacion College - Manila Auditing Problem Final Quiz # 1NJ SyNo ratings yet

- Problem 2Document1 pageProblem 2LouisAnthonyHabaradasCantillonNo ratings yet

- 2019 PFRS Pas PicDocument4 pages2019 PFRS Pas PicAron Vicente100% (1)

- Level Up-Cost Accounting Reviewer PDFDocument14 pagesLevel Up-Cost Accounting Reviewer PDFazithethirdNo ratings yet

- MissionVision - Emperador BrandyDocument3 pagesMissionVision - Emperador BrandyBianca GoNo ratings yet

- Acc204 Quiz 2Document2 pagesAcc204 Quiz 2Judy Ann ImusNo ratings yet

- Sanicomodule 2Document11 pagesSanicomodule 2Luigi Enderez BalucanNo ratings yet

- Central Bank Vs CA 139 SCRA 46 (1985)Document1 pageCentral Bank Vs CA 139 SCRA 46 (1985)Benitez GheroldNo ratings yet

- 1st Long Exam New Central Bank Act QnADocument5 pages1st Long Exam New Central Bank Act QnAAldrin100% (1)

- Top Competitors of BDODocument2 pagesTop Competitors of BDORozen Anne PolonioNo ratings yet

- An Update On The Philippine Banking Industry Group7Document9 pagesAn Update On The Philippine Banking Industry Group7Queen TwoNo ratings yet

- Prelim Advac Set ADocument3 pagesPrelim Advac Set ANah HamzaNo ratings yet

- ACC117-CON09 Module 3 ExamDocument16 pagesACC117-CON09 Module 3 ExamMarlon LadesmaNo ratings yet

- Chapter 04 GG BalladaDocument4 pagesChapter 04 GG BalladaRichie RayNo ratings yet

- Final Output BMDocument4 pagesFinal Output BMJenny BagonNo ratings yet

- 2Document17 pages2shaniaNo ratings yet

- SAMCIS AE 322 COURSE GUIDE v2Document6 pagesSAMCIS AE 322 COURSE GUIDE v2Fernando III PerezNo ratings yet

- Budgeting Multiple ChoiceDocument2 pagesBudgeting Multiple ChoiceRachel Mae FajardoNo ratings yet

- Financial Accounting Valix Summary 1 7Document12 pagesFinancial Accounting Valix Summary 1 7notsogoodNo ratings yet

- MGMT 134 CA KeyDocument4 pagesMGMT 134 CA KeyAnand KL100% (1)

- QUIZDocument21 pagesQUIZSol Andallo100% (1)

- The Purpose of Money MarketDocument3 pagesThe Purpose of Money MarketAbu Sofiyyah Ibn Zuhri100% (2)

- Auditing ProblemsDocument4 pagesAuditing ProblemsCristineJoyceMalubayIINo ratings yet

- Aai 2 Part 4 Psa 220 PSQCDocument92 pagesAai 2 Part 4 Psa 220 PSQCJewel MandayaNo ratings yet

- P1 AssessmentDocument26 pagesP1 AssessmentRay Jhon OrtizNo ratings yet

- p1 IaDocument1 pagep1 IaLeika Gay Soriano OlarteNo ratings yet

- Problems 3 PRELIM TASK FINALDocument4 pagesProblems 3 PRELIM TASK FINALJohn Francis RosasNo ratings yet

- Chapter 27 PFRS 6 EXPLORATION 0 EVALUATION OF MINERAL RESOURCESDocument8 pagesChapter 27 PFRS 6 EXPLORATION 0 EVALUATION OF MINERAL RESOURCESJoelyn Grace MontajesNo ratings yet

- Cash and Acrrual Basis QUIZDocument2 pagesCash and Acrrual Basis QUIZMarii M.100% (1)

- LEC104-C: Debt Restructuring Problem 1: Asset Swap (IFRS Vs US GAAP)Document1 pageLEC104-C: Debt Restructuring Problem 1: Asset Swap (IFRS Vs US GAAP)Miles SantosNo ratings yet

- Credit AbejarDocument2 pagesCredit AbejarGerwin AbejarNo ratings yet

- C18 - Defined Benefit Plan PDFDocument23 pagesC18 - Defined Benefit Plan PDFKristine Diane CABAnASNo ratings yet

- Assignment 02 Correction of Errors Answer KeyDocument1 pageAssignment 02 Correction of Errors Answer KeyDan Andrei BongoNo ratings yet

- 12Document6 pages12Mido MedNo ratings yet

- Case Digest: PartnershipDocument3 pagesCase Digest: PartnershipKsetsNo ratings yet

- The Expenditure Cycle Part 1: Purchases and Cash Disbursements ProceduresDocument26 pagesThe Expenditure Cycle Part 1: Purchases and Cash Disbursements ProceduresJNo ratings yet

- RFBT Q 1 2Document63 pagesRFBT Q 1 2Sean SanchezNo ratings yet

- Mancon Quiz 6Document45 pagesMancon Quiz 6Quendrick SurbanNo ratings yet

- SW - NpoDocument1 pageSW - NpoGwy HipolitoNo ratings yet

- Concept Map RCDocument2 pagesConcept Map RCkat kaleNo ratings yet

- Chapter 4 Price Other Consideration Panes Rosales Roson PDFDocument46 pagesChapter 4 Price Other Consideration Panes Rosales Roson PDFAngelNo ratings yet

- Drill Business CombinationDocument4 pagesDrill Business CombinationPrankyJellyNo ratings yet

- The Rise and Fall of Banco FilipinoDocument7 pagesThe Rise and Fall of Banco FilipinoJaypee JavierNo ratings yet

- Economic Development Midterm ExaminationDocument4 pagesEconomic Development Midterm ExaminationHannagay BatallonesNo ratings yet

- Chapter 23 28Document104 pagesChapter 23 28Xander Clock50% (2)

- Operation AuditingDocument3 pagesOperation AuditingRosette RevilalaNo ratings yet

- Activity 5Document8 pagesActivity 5Marielle UyNo ratings yet

- Qualifying ExamDocument60 pagesQualifying ExamMARK ANGELO PANGILINANNo ratings yet

- Inventory ShortageDocument1 pageInventory Shortagesharen jill monteroNo ratings yet

- Chapter 12 - Practice SetDocument2 pagesChapter 12 - Practice SetKrystal shaneNo ratings yet

- ADocument89 pagesAJohn Carlo O. BallaresNo ratings yet

- Ce P1 13-14Document16 pagesCe P1 13-14shudayeNo ratings yet

- Threats To Compliance With The Fundamental PrinciplesDocument5 pagesThreats To Compliance With The Fundamental PrinciplesAbigail SubaNo ratings yet

- SIM - RFLIB Week 1 To 3 PDFDocument17 pagesSIM - RFLIB Week 1 To 3 PDFJoshua MediloNo ratings yet

- Ch. 4: Financial Forecasting, Planning, and BudgetingDocument41 pagesCh. 4: Financial Forecasting, Planning, and BudgetingFahmia Winata8No ratings yet

- Chapter 3 - Gross Estate2013Document8 pagesChapter 3 - Gross Estate2013Marvin Celedio100% (8)

- Banking - Bar QuestionsDocument11 pagesBanking - Bar QuestionsGenelle Mae MadrigalNo ratings yet

- 11 Activity 3Document2 pages11 Activity 3jaehan834No ratings yet

- First Philippine International Bank V. Ca, 252 Scra 258 (1996)Document4 pagesFirst Philippine International Bank V. Ca, 252 Scra 258 (1996)Sheila Mae AramanNo ratings yet

- ART-APP-PPT-editedDocument12 pagesART-APP-PPT-editedCarmela WongNo ratings yet

- Carmela Jia Ming A. Wong Section 20Document2 pagesCarmela Jia Ming A. Wong Section 20Carmela WongNo ratings yet

- Activity E - Actual ICF ManualDocument1 pageActivity E - Actual ICF ManualCarmela WongNo ratings yet

- Wong CarmelaDocument1 pageWong CarmelaCarmela WongNo ratings yet