Professional Documents

Culture Documents

Singer LTD Solution

Singer LTD Solution

Uploaded by

Waseim khan Barik zaiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Singer LTD Solution

Singer LTD Solution

Uploaded by

Waseim khan Barik zaiCopyright:

Available Formats

Answer

Debit Credit

i) Materials 35,600.00

Account payable 35,600.00

ii) Work in process 25,250.00

Factory overhead 1,300.00

Materials 26,550.00

iii) Work in process 200.00

Materials 200.00

iv) Accounts payable…… 225.00

Materials 225.00

v) Materials 1,215.00

Work in process 1,090.00

Factory overhead controls. 125.00

vi) Payroll 77,670.00

Accrued payroll 72,054.00

Withheld tax payable….. 5,616.00

vii) Work in process 66,870.00

Factory overhead control 10,800.00

Payroll 77,670.00

viii) Factory overhead control 1,550.00

Accumulated depreciation:

Buildings 750.00

Machinery….. 800.00

ix) Factory overhead control 1,600.00

Property taxes payable.. 750.00

Prepaid insurance…. 850.00

x) Work in process 22,680.00

Applied factory overhead 22,680.00

xi) Applied factory overhead 22,680.00

Cost of goods sold 636.80

Factory overhead control 23,316.80

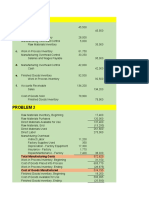

xii) Finished goods 122,020.00

Work in process 1 22,020.00

xiii) Cost of goods sold 108,300.00

Finished goods 108,300.00

Account Receivable 159,750.00

Sales 159,750.00

*Alternate solution for(m):

Work in process….. 22,680.00

Factory overhead control 22,680.00

**Alternate solution for(n):

Cost of goods sold…. 636.80

Factory overhead control 636.80

*Alternate solution for(c): Debit factory overhead control if defects are not the fault of a

particular job.

You might also like

- Job CostingDocument35 pagesJob Costingjpg17100% (2)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Premium Receipt - 008927742 - 131423Document2 pagesPremium Receipt - 008927742 - 131423Vignesh MahadevanNo ratings yet

- Macomb County Investigation Summary - RedactedDocument9 pagesMacomb County Investigation Summary - RedactedWXYZ-TV Channel 7 DetroitNo ratings yet

- Banitog - Chapter 6 (Problem 1)Document3 pagesBanitog - Chapter 6 (Problem 1)MyunimintNo ratings yet

- RT#3 CAF-9 AA - SolutionDocument3 pagesRT#3 CAF-9 AA - SolutionWaseim khan Barik zaiNo ratings yet

- Jawaban CH 3 (2) Problem 3-43 AKB ASLABDocument5 pagesJawaban CH 3 (2) Problem 3-43 AKB ASLABRantiyaniNo ratings yet

- Job Order Costing: Illustrative ProblemsDocument30 pagesJob Order Costing: Illustrative ProblemsPatrick LanceNo ratings yet

- End Answers Chapter 2,3,4,7-1 Managerial Accounting Hilton PlattDocument14 pagesEnd Answers Chapter 2,3,4,7-1 Managerial Accounting Hilton PlattShivani TannuNo ratings yet

- Chapter 6 Cost Accounting Problem 1-3Document6 pagesChapter 6 Cost Accounting Problem 1-3Baby MushroomNo ratings yet

- Solution To Quiz 2Document4 pagesSolution To Quiz 2GianJoshuaDayritNo ratings yet

- Tugas Managerial AccountinDocument3 pagesTugas Managerial Accountinlaurentinus fikaNo ratings yet

- Quiz 2Document4 pagesQuiz 2Nicole Kyle AsisNo ratings yet

- A2 - Cost Sheet - Crisp Revision SessionsDocument20 pagesA2 - Cost Sheet - Crisp Revision Sessionsshilpasolanki246No ratings yet

- Ac Cost AccDocument4 pagesAc Cost AccAngelica Vera L. GuevaraNo ratings yet

- Cost Accounting AssignmentDocument6 pagesCost Accounting AssignmentCharles BarcelaNo ratings yet

- 1 637681001255067638 767649Document5 pages1 637681001255067638 767649MUHAMMAD KASHIF RAHEEMNo ratings yet

- Jawaban Perhitungan Dan Akumulasi BiayaDocument7 pagesJawaban Perhitungan Dan Akumulasi BiayaEka OematanNo ratings yet

- Activity 4 Cost Accounting Answer KeyDocument6 pagesActivity 4 Cost Accounting Answer KeyJamesNo ratings yet

- AC 212 Test 1 SolutionDocument4 pagesAC 212 Test 1 SolutionJoyce PamendaNo ratings yet

- CostDocument3 pagesCostKyle Vincent SaballaNo ratings yet

- CHAPTER 3.costdocxDocument5 pagesCHAPTER 3.costdocxJapPy QuilasNo ratings yet

- DG8C3UQW6Document16 pagesDG8C3UQW6gumbanaleahfateNo ratings yet

- P1-1 P1-2 Jaja Bearings Company PPG CompanyDocument4 pagesP1-1 P1-2 Jaja Bearings Company PPG CompanyPrincesipieNo ratings yet

- UntitledDocument4 pagesUntitledJomar PenaNo ratings yet

- Cost AcctngDocument3 pagesCost AcctngairaguevarraNo ratings yet

- Elyssa Reahna E. Veloz - Tla3.2Document8 pagesElyssa Reahna E. Veloz - Tla3.2jyendrinaNo ratings yet

- Job Order CostingDocument6 pagesJob Order CostingTrixie DacanayNo ratings yet

- Popquizch4Au11 182nlk8Document3 pagesPopquizch4Au11 182nlk8PrincessNo ratings yet

- Ca - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursDocument7 pagesCa - Intermediate Group I - Paper 3 Cost & Management Accouting Series - 1 (May 2022) Batch:B-R-B Date: 24.01.2022 Maximum Marks: 100 Time - 3 HoursPROFESSIONAL WORK ROHITNo ratings yet

- Acco 3520 Tarea 2.2 Conjunto ADocument3 pagesAcco 3520 Tarea 2.2 Conjunto ANEISHA CASTELLANOSNo ratings yet

- Latihan Soal AMLDocument3 pagesLatihan Soal AMLSaskia ArumNo ratings yet

- PT HIGH TECH GADGET (LAPORAN KEUANGAN) - Dikonversi-Diedit PDFDocument1 pagePT HIGH TECH GADGET (LAPORAN KEUANGAN) - Dikonversi-Diedit PDFBulan julpi suwellyNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Job Order Costing Work Sheet - Answered REALDocument16 pagesJob Order Costing Work Sheet - Answered REALEllah MaeNo ratings yet

- 06 Cost Accounting System FTDocument18 pages06 Cost Accounting System FTnsm2zmvnbbNo ratings yet

- Budgetedmanufacturing Overhead Budgeted Machine Hours: Problem 3-43Document3 pagesBudgetedmanufacturing Overhead Budgeted Machine Hours: Problem 3-43Yanwar A MerhanNo ratings yet

- Baya - Exercise 4 Job Order Costing, Accounting For MaterialDocument12 pagesBaya - Exercise 4 Job Order Costing, Accounting For MaterialAngelica BayaNo ratings yet

- Chapter 3 Cost AccountingDocument2 pagesChapter 3 Cost AccountingJacob DiazNo ratings yet

- Cost Accounting Smart WorkDocument25 pagesCost Accounting Smart WorkmaacmampadNo ratings yet

- Remson Mark C. Macawile MCP Quiz Part 2: Transaction Account Title Debit CreditDocument2 pagesRemson Mark C. Macawile MCP Quiz Part 2: Transaction Account Title Debit CreditMarcus McWile MorningstarNo ratings yet

- Problem 1Document2 pagesProblem 1Von Andrei MedinaNo ratings yet

- Cebu Wine FactoryDocument5 pagesCebu Wine FactorySally Ubando Delos ReyesNo ratings yet

- AaaaDocument7 pagesAaaadiane camansagNo ratings yet

- BSMA 1A Quiz 3 Cost Accounting CycleDocument5 pagesBSMA 1A Quiz 3 Cost Accounting CycleMaeca Angela SerranoNo ratings yet

- Intro To SCM Cost Concepts Variable Costing QuizDocument58 pagesIntro To SCM Cost Concepts Variable Costing QuizRiza Zaira Esteban MateoNo ratings yet

- Cost Exercise For Chapter TwoDocument1 pageCost Exercise For Chapter TwonaaninigistNo ratings yet

- FIFODocument5 pagesFIFOYanna YahNo ratings yet

- Banitog, Brigitte C. BSA 211Document8 pagesBanitog, Brigitte C. BSA 211MyunimintNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingLhaizsa PalmagilNo ratings yet

- Toaz - Info Chapter 3 Cost Accounting and Control by de Leon 2019 PRDocument12 pagesToaz - Info Chapter 3 Cost Accounting and Control by de Leon 2019 PRMeg Lorenz DayonNo ratings yet

- Kunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34Document3 pagesKunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34RantiyaniNo ratings yet

- Problem 1:: Job Order CostingDocument4 pagesProblem 1:: Job Order CostingTrina Mae BarrogaNo ratings yet

- Job Order CostingDocument4 pagesJob Order CostingTrina Mae BarrogaNo ratings yet

- Cost Accounting WorksheetDocument2 pagesCost Accounting WorksheetLEON JOAQUIN VALDEZNo ratings yet

- Name: Pamulagan, Cherry Mae G Section: BSA 1-C Code: 3020Document5 pagesName: Pamulagan, Cherry Mae G Section: BSA 1-C Code: 3020Cherry MaeNo ratings yet

- To Record Raw Materials Purchased On AccountDocument4 pagesTo Record Raw Materials Purchased On AccountKathleen MercadoNo ratings yet

- Maria2 103130Document4 pagesMaria2 103130Clay MaaliwNo ratings yet

- WB Job OrderDocument30 pagesWB Job OrderSaleh AlizadeNo ratings yet

- Cost C. Test EM Question 03.03.2023 VI-1, VDI-1Document2 pagesCost C. Test EM Question 03.03.2023 VI-1, VDI-1harish jangidNo ratings yet

- Cost Sheet: (-) Sales of WastageDocument1 pageCost Sheet: (-) Sales of WastageAuras Raj PantaNo ratings yet

- Important Problems With SolutionsDocument5 pagesImportant Problems With SolutionsSahil KumarNo ratings yet

- Assignment 3 ManufacturingDocument5 pagesAssignment 3 Manufacturingandrei batoNo ratings yet

- RT#1 CAF-9 AA CH#1 - SolutionDocument2 pagesRT#1 CAF-9 AA CH#1 - SolutionWaseim khan Barik zaiNo ratings yet

- RT#2 CAF-9 AA - SolutionDocument4 pagesRT#2 CAF-9 AA - SolutionWaseim khan Barik zaiNo ratings yet

- RT#2 CAF-9 AA - Question PaperDocument3 pagesRT#2 CAF-9 AA - Question PaperWaseim khan Barik zaiNo ratings yet

- Production Double EntriesDocument8 pagesProduction Double EntriesWaseim khan Barik zaiNo ratings yet

- SC ExamplesDocument2 pagesSC ExamplesWaseim khan Barik zaiNo ratings yet

- Question No .1: The Professionals'Academy of Commerce Audit and AssuranceDocument2 pagesQuestion No .1: The Professionals'Academy of Commerce Audit and AssuranceWaseim khan Barik zaiNo ratings yet

- ExamplesDocument7 pagesExamplesWaseim khan Barik zaiNo ratings yet

- Question 2Document1 pageQuestion 2Waseim khan Barik zaiNo ratings yet

- Aluminium LTDDocument1 pageAluminium LTDWaseim khan Barik zaiNo ratings yet

- CVP of One Product of Many ProductsDocument1 pageCVP of One Product of Many ProductsWaseim khan Barik zaiNo ratings yet

- Cost of Opening WIP:: Other InformationDocument2 pagesCost of Opening WIP:: Other InformationWaseim khan Barik zaiNo ratings yet

- Short Term Decision Making - TestDocument2 pagesShort Term Decision Making - TestWaseim khan Barik zaiNo ratings yet

- R0019 M Waseem Khan - 158884 - 0Document2 pagesR0019 M Waseem Khan - 158884 - 0Waseim khan Barik zaiNo ratings yet

- Ifrs 9Document4 pagesIfrs 9Waseim khan Barik zaiNo ratings yet

- Test#7 Process CostingDocument1 pageTest#7 Process CostingWaseim khan Barik zaiNo ratings yet

- The Professionals' Academy of Commerce: Financial Accounting & Reporting-II IFRS-8Document1 pageThe Professionals' Academy of Commerce: Financial Accounting & Reporting-II IFRS-8Waseim khan Barik zaiNo ratings yet

- Grand Test - Question PaperDocument3 pagesGrand Test - Question PaperWaseim khan Barik zaiNo ratings yet

- CMAC Section A, B Mid-Term Q.PaperDocument5 pagesCMAC Section A, B Mid-Term Q.PaperWaseim khan Barik zaiNo ratings yet

- FAR-II Test IFRS-16 (AB)Document2 pagesFAR-II Test IFRS-16 (AB)Waseim khan Barik zaiNo ratings yet

- Financial Accounting & Reporting II: Certificatein Accountingand Finance Stage ExaminationsDocument3 pagesFinancial Accounting & Reporting II: Certificatein Accountingand Finance Stage ExaminationsWaseim khan Barik zaiNo ratings yet

- IFRS-9 SolutionDocument2 pagesIFRS-9 SolutionWaseim khan Barik zaiNo ratings yet

- IFRS-9 Financial InstrumentsDocument1 pageIFRS-9 Financial InstrumentsWaseim khan Barik zaiNo ratings yet

- KALPANAMEHTA Pages DYCDocument85 pagesKALPANAMEHTA Pages DYCMansi SinghNo ratings yet

- Taxation: Tata Consultancy Services vs. State of Andhra PradeshDocument11 pagesTaxation: Tata Consultancy Services vs. State of Andhra PradeshkartikNo ratings yet

- Balances Preference Dividend Liquidation Premium Balance To Common Outstanding Shares Book Value/ShareDocument4 pagesBalances Preference Dividend Liquidation Premium Balance To Common Outstanding Shares Book Value/ShareJhazreel BiasuraNo ratings yet

- Preamble To The Indian ConstitutionDocument5 pagesPreamble To The Indian ConstitutionVarun RathourNo ratings yet

- Accused Can't Be Indefinitely Kept in Jail For His Inability To Produce Registered Surety For Reasons Beyond His Control - SC (Read Order)Document4 pagesAccused Can't Be Indefinitely Kept in Jail For His Inability To Produce Registered Surety For Reasons Beyond His Control - SC (Read Order)HuzaifaNo ratings yet

- CMTA Super Section 800Document2 pagesCMTA Super Section 800Noel Christopher G. BellezaNo ratings yet

- Ejercicios Resueltos de Mecanica de SuelDocument129 pagesEjercicios Resueltos de Mecanica de SuelJhancarlos Canchanya JaureguiNo ratings yet

- Ernesto Maceda Vs Energy Regulatory Board Et AlDocument6 pagesErnesto Maceda Vs Energy Regulatory Board Et AlShane FulguerasNo ratings yet

- Pil MCQDocument92 pagesPil MCQDiksha MundhraNo ratings yet

- AT2 Prelim Quizzes CompileDocument16 pagesAT2 Prelim Quizzes CompileHelen Faith EstanteNo ratings yet

- Subject: Issuance of Equivalence Certificate of MBA (3.5) To MBA/MS/M. PhillDocument1 pageSubject: Issuance of Equivalence Certificate of MBA (3.5) To MBA/MS/M. PhillAbdulBasitKhanSadozaiNo ratings yet

- Hari Nath Tilhari, J.: Equiv Alent Citation: Air1997Kant48, 1997 (1) Karlj665Document8 pagesHari Nath Tilhari, J.: Equiv Alent Citation: Air1997Kant48, 1997 (1) Karlj665bharat bhatNo ratings yet

- Jurisprudence (Personality)Document16 pagesJurisprudence (Personality)Madan JhaNo ratings yet

- Distinction Between Partnership and CorporationDocument2 pagesDistinction Between Partnership and CorporationIan Ray PaglinawanNo ratings yet

- Authorization Letter 2Document3 pagesAuthorization Letter 2Mercilita De Paz LeopardasNo ratings yet

- Ceklis Dok. Kontrak Yang Dibutuhkan Review 2021Document1 pageCeklis Dok. Kontrak Yang Dibutuhkan Review 2021kurvax konsultanNo ratings yet

- List of Multilateral Treaties Signed by NepalDocument25 pagesList of Multilateral Treaties Signed by NepalBalram ChaudharyNo ratings yet

- CPJ Loi Fiesta 2024 BrochureDocument36 pagesCPJ Loi Fiesta 2024 BrochureUtsav SinghNo ratings yet

- 43.aguilo v. SAndiganbayan 361 SCRA 556 PDFDocument14 pages43.aguilo v. SAndiganbayan 361 SCRA 556 PDFaspiringlawyer1234No ratings yet

- Riverhead Central School District /henriquez Agreement and ResignationDocument10 pagesRiverhead Central School District /henriquez Agreement and ResignationRiverheadLOCALNo ratings yet

- Check List ISO 31000Document14 pagesCheck List ISO 31000Mohammed alsalahiNo ratings yet

- Fire Engineering Report Rev 02 Prepared by Core Engineering Group Dated 9 June 2017Document31 pagesFire Engineering Report Rev 02 Prepared by Core Engineering Group Dated 9 June 2017Pablosky AlfaroskyNo ratings yet

- Assignment On Intellectual Property RightsDocument7 pagesAssignment On Intellectual Property RightsAbhishekNo ratings yet

- Topic 1 - Introduction Topic 1 - Student Kiểm toán căn abrnDocument14 pagesTopic 1 - Introduction Topic 1 - Student Kiểm toán căn abrnQUY VO TRONGNo ratings yet

- 100) Coastal Subic Bay Terminal, Inc. v. Department of Labor and Employment - Office of The Secretary, 537 Phil. 459 (2006)Document3 pages100) Coastal Subic Bay Terminal, Inc. v. Department of Labor and Employment - Office of The Secretary, 537 Phil. 459 (2006)Daniela SandraNo ratings yet

- President Aquino Reaction in SpeechDocument3 pagesPresident Aquino Reaction in SpeechDayana Mangorobong100% (4)

- Congress of TL - O L - Tltpptnos: Ppublic - IljtltpptnesDocument5 pagesCongress of TL - O L - Tltpptnos: Ppublic - IljtltpptnesWilvic Jan GacitaNo ratings yet

- Title 3ADocument44 pagesTitle 3ATynny Roo Beldua100% (1)