Professional Documents

Culture Documents

Defined Benefit Pension Reporting - Chapter 19 - Assignment Set

Defined Benefit Pension Reporting - Chapter 19 - Assignment Set

Uploaded by

NicoleOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Defined Benefit Pension Reporting - Chapter 19 - Assignment Set

Defined Benefit Pension Reporting - Chapter 19 - Assignment Set

Uploaded by

NicoleCopyright:

Available Formats

Defined Benefit Pension Reporting – Chapter 19 – Assignment Set

British Properties Limited (BPL) has an employer funded defined benefit pension plan and

has adopted the provisions of IFRS 19 permitting immediate recognition of pension plan

contract changes and performance.

The following data is gathered for the year ended December 31, 2013. In this and all

models studied at this introductory level, assume the current service cost, benefits paid and

plan funding occur at the end of the period. In reality, all of these would be averaged during

the period and the resulting expected asset return and interest cost would be calculated

accordingly.

Rate provided by the Actuary in deriving the Benefit Obligation and provided by Fund

Manager in providing the expected return on Plan Assets...........4.0%

Defined Benefit Obligation:

Balance at January 1, 2013........................$11,275,000

Current service cost................................... 400,000

Additional spousal survival benefits,

effective, Jan.1, 2013...... 100,000

Actuarial revision to obligation arising

from slower than projected employee

turnover (fewer people quitting).................. 140,000

Plan Assets:

Balance at January 1, 2013.........................$9,062,500

Actual return on plan assets, net expenses.... 425,000

Funding to the plan, at year end................. 575,000

Benefits paid............................................. 300,000

Required:

1. Prepare the pension expense and funding entries for 2013. Show all supporting

calculations. Assume BPL reports pension expense relating to normal net income as

one line item. Round amounts to the nearest dollar; no cents.

2. What would be reported on the Statement of Financial Position at December 31,

2013 in respect of the pension? How would it be classified, described and note

referenced?

Page 1 of 3 – Fall, 2014 Key

Defined Benefit Pension Reporting – Chapter 19 – Assignment Set

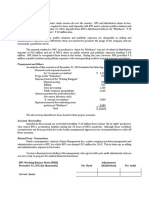

Items Experience Annual Cash Accrued Defined Plan Assets

Gains/Loss Pension pension Benefit

OCI Expense liability/ Obligation

asset

Balance, Jan 1 2,212,500c1 11,275,000c 9,062,500d

Service cost 400,000d 400,000c

Plan enhance 100,000d 100,000c

Interest2 455,000d 455,000c

Expected rtn.3 362,500c 362,500d

Gain4 62,500c 62,500d

Loss 140,000d 140,000c

Funding 575,000c 575,000d

Benefits paid 306, 250d 306,250c

Totals 77,500d 592,500d 575,000c 12,070,000c 9,772,500d

New balance 2,307,5005

Required #1:

Journal entry work up Pension Plan Positions

c = credit

d = debit

1

calculated; difference between plan assets and obligation

2

($11,275,000 + $100,000) x 4% = $455,000

3

$9,062,500 x 4.0% = $362,500

4

$425,000 - $362,500 = $62,500

5

$2,212,500 + $592,500 + $77,500 - $575,000 = $2,307,500

Entry:

Dr. Pension expense................................$592,500 (to normal income)

Cr. Other Comprehensive income (loss)........$77,500 (non-recyclable)

Cr. Accrued pension liability..................................$670,000

Dr. Accrued pension liability...........$575,000

Cr. Cash.....................................................$575,000 (transferred to the pension plan)

Required #2:

The balance sheet would report, as a non-current liability an account described, variously,

as Accrued Benefit Liability (Note X)..................$2,307,500

Note X would describe the pension plan and indicate the balances of the Defined Benefit

Obligation and Plan Assets. The net of the two balances is called the funded status.

Page 2 of 3 – Fall, 2014 Key

Defined Benefit Pension Reporting – Chapter 19 – Assignment Set

Shoppers Drug Mart: Provide note references where applicable.

What is the Deferred benefit liability (same as Accrued Pension Liability) for Shoppers at the

end of 2011 that is included as part of long term liabilities and what are the balances in

pension obligation and plan assets that comprise the net balance?

Refer note # 21: The Deferred benefit liability is $38,104 comprised of (000):

Pension obligation.....................($146,720)

Plan assets.............................. $108,616

($38,104)

Page 3 of 3 – Fall, 2014 Key

You might also like

- E5-11 (Statement of Financial Position Preparation) Presented Below Is TheDocument7 pagesE5-11 (Statement of Financial Position Preparation) Presented Below Is Thedebora yosika100% (1)

- Solution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDocument9 pagesSolution Manual For Fundamental Financial Accounting Concepts 7th Edition by EdmondsDiane Jones100% (28)

- MKT 3, Marketing in Travel and TourismDocument22 pagesMKT 3, Marketing in Travel and TourismDP100% (4)

- OCR GCSE 9-1 Business: My Revision GuideDocument113 pagesOCR GCSE 9-1 Business: My Revision GuideAnya Johal100% (1)

- Chapter 16 Sol 2020 WKDocument53 pagesChapter 16 Sol 2020 WKVu Khanh LeNo ratings yet

- Intermediate Accounting 2 and 3 FinalDocument67 pagesIntermediate Accounting 2 and 3 FinalNah HamzaNo ratings yet

- ACCT3302 Financial Statement Analysis Tutorial 2: Accrual Accounting and Income DeterminationDocument3 pagesACCT3302 Financial Statement Analysis Tutorial 2: Accrual Accounting and Income DeterminationDylan AdrianNo ratings yet

- Finman ProblemDocument16 pagesFinman ProblemKatrizia FauniNo ratings yet

- PA-1 Adjusments and Worksheet (Problems)Document5 pagesPA-1 Adjusments and Worksheet (Problems)Safira ChairunnisaNo ratings yet

- Test Bank MGMT 126Document8 pagesTest Bank MGMT 126najihachangminNo ratings yet

- FMGT4110 - Assignment - Chapter 19 - Pension Reporting: Defined Benefit Obligation DataDocument2 pagesFMGT4110 - Assignment - Chapter 19 - Pension Reporting: Defined Benefit Obligation DataNicoleNo ratings yet

- Chapter 19Document41 pagesChapter 19Tati AnaNo ratings yet

- Tugas Penyelesaian 14 AIK - 0119101024 - Muhamad Adam Palmaleo - Kelas BDocument23 pagesTugas Penyelesaian 14 AIK - 0119101024 - Muhamad Adam Palmaleo - Kelas BAdam PalmaleoNo ratings yet

- TM 5 AKM 3 Ananda Dika M. 164Document4 pagesTM 5 AKM 3 Ananda Dika M. 164Bam BamNo ratings yet

- Intermediate Accounting ExamDocument6 pagesIntermediate Accounting ExamPISONANTA KRISETIANo ratings yet

- Practice Solution 1Document8 pagesPractice Solution 1Luigi NocitaNo ratings yet

- Jawaban LatihanDocument13 pagesJawaban Latihanpurna.irawanNo ratings yet

- Auxtero - Assignment No. 2 - Pension AccountingDocument3 pagesAuxtero - Assignment No. 2 - Pension AccountingCunanan, Malakhai JeuNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- The Chapel 2019 - 2020 Audited Financial StatementDocument21 pagesThe Chapel 2019 - 2020 Audited Financial StatementTodd WilhelmNo ratings yet

- Brunswick County Feasibility Report-2nd Draft 9-16-19Document48 pagesBrunswick County Feasibility Report-2nd Draft 9-16-19Johanna Ferebee StillNo ratings yet

- Financial Statement Analysis: Income Statement Balance Sheet Statement of Cash Flows Free Cash Flow Performance MeasuresDocument44 pagesFinancial Statement Analysis: Income Statement Balance Sheet Statement of Cash Flows Free Cash Flow Performance Measuressincere sincereNo ratings yet

- Working Capital and Current Assets Management: Answers To Warm-Up ExercisesDocument13 pagesWorking Capital and Current Assets Management: Answers To Warm-Up ExercisesNorman DelirioNo ratings yet

- Working Capital and Current Assets Manag PDFDocument13 pagesWorking Capital and Current Assets Manag PDFNorman DelirioNo ratings yet

- Assignment No. 2 - Pension - Cunanan & ManlangitDocument3 pagesAssignment No. 2 - Pension - Cunanan & ManlangitCunanan, Malakhai JeuNo ratings yet

- FAR570 GROUP PROJECT KedahDocument12 pagesFAR570 GROUP PROJECT KedahAmmarNo ratings yet

- Topic - Accumulated Profits (Losses)Document3 pagesTopic - Accumulated Profits (Losses)Kaye ArsadNo ratings yet

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocument12 pagesSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionChristine Jean MajestradoNo ratings yet

- Chapter 1Document12 pagesChapter 1Kyllar HizonNo ratings yet

- Chapter 19 SolutionsDocument34 pagesChapter 19 SolutionsRachel Rajanayagam100% (1)

- 助教課講義 Ch.4Document12 pages助教課講義 Ch.45213adamNo ratings yet

- Preparing Financial Statements: Key Terms and Concepts To KnowDocument27 pagesPreparing Financial Statements: Key Terms and Concepts To KnowTrisha Monique VillaNo ratings yet

- Preparing Financial Statements: Key Terms and Concepts To KnowDocument27 pagesPreparing Financial Statements: Key Terms and Concepts To KnowMohammed AkramNo ratings yet

- Casa de DisenoDocument8 pagesCasa de DisenoMarilou Broñosa-PepañoNo ratings yet

- MT Test Review-Taxation 1-Win 2024Document4 pagesMT Test Review-Taxation 1-Win 2024Mariola AlkuNo ratings yet

- Chapter 4 Question Review 11th EdDocument9 pagesChapter 4 Question Review 11th EdEmiraslan MhrrovNo ratings yet

- Problem 1: True or False: Selected ExplanationDocument5 pagesProblem 1: True or False: Selected ExplanationJannelle SalacNo ratings yet

- Final Financial Statements AIF - 10.30.2020Document19 pagesFinal Financial Statements AIF - 10.30.2020prescongoa.ikigaiNo ratings yet

- Jawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document22 pagesJawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Module 1, Chapter 1 Handout Introduction To Financial StatementsDocument5 pagesModule 1, Chapter 1 Handout Introduction To Financial StatementssdfsdfuignbcbbdfbNo ratings yet

- Accountancy FinancialDocument9 pagesAccountancy Financialverma.vineet.officialNo ratings yet

- Chapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Document6 pagesChapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Minh HuyyNo ratings yet

- PA T22WSB 3 Group Assignment 1Document4 pagesPA T22WSB 3 Group Assignment 1Pham Minh Thu NguyenNo ratings yet

- Assignment Financial Management: Student Id Unit CodeDocument7 pagesAssignment Financial Management: Student Id Unit CodeAdrian ContilloNo ratings yet

- Acp - Acc417 Case Study 1Document6 pagesAcp - Acc417 Case Study 1Faker MejiaNo ratings yet

- Nama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityDocument10 pagesNama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityAliea YenemiaNo ratings yet

- MOJAKOE AK1 UTS 2012 GasalDocument15 pagesMOJAKOE AK1 UTS 2012 GasalVincenttio le CloudNo ratings yet

- Government Grant ActivitiesDocument5 pagesGovernment Grant Activitiesjoong wanNo ratings yet

- Module A (June 2013) - AnswerDocument16 pagesModule A (June 2013) - Answer徐滢No ratings yet

- Notes IAS 19 EMPLOYEE BENEFITSDocument13 pagesNotes IAS 19 EMPLOYEE BENEFITSCunanan, Malakhai JeuNo ratings yet

- Exercise No 1 (CGS CGM) - P SDocument11 pagesExercise No 1 (CGS CGM) - P SArun kumarNo ratings yet

- Group AssignmentDocument4 pagesGroup Assignmentmichaelbarbosa0265No ratings yet

- Complete Cycle Servicing Graded ActivityDocument13 pagesComplete Cycle Servicing Graded ActivityZPadsNo ratings yet

- (Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearDocument3 pages(Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearFlorencia IrenaNo ratings yet

- Psa Financial Reporting AssignmentDocument8 pagesPsa Financial Reporting AssignmentNyara MakurumidzeNo ratings yet

- Capital Expenditures BudgetDocument4 pagesCapital Expenditures BudgetDawit AmahaNo ratings yet

- What A ProblemDocument4 pagesWhat A ProblemEleazar SalazarNo ratings yet

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- ACCT 2500 Test 2 Format, Instructions and ReviewDocument17 pagesACCT 2500 Test 2 Format, Instructions and Reviewyahye ahmedNo ratings yet

- Events After The Reporting PeriodDocument5 pagesEvents After The Reporting PeriodIohc NedmiNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- FMGT4110 - Assignment - Chapter 19 - Pension Reporting: Defined Benefit Obligation DataDocument2 pagesFMGT4110 - Assignment - Chapter 19 - Pension Reporting: Defined Benefit Obligation DataNicoleNo ratings yet

- Busi370 Midterm Practice Summer2016Document12 pagesBusi370 Midterm Practice Summer2016NicoleNo ratings yet

- Notice Final ExamDocument9 pagesNotice Final ExamNicoleNo ratings yet

- Busi370 FinalExamStuff Summer2017Document11 pagesBusi370 FinalExamStuff Summer2017NicoleNo ratings yet

- Notice - Final ExamDocument13 pagesNotice - Final ExamNicoleNo ratings yet

- Busi370 Midterm Practice Summer2017Document12 pagesBusi370 Midterm Practice Summer2017NicoleNo ratings yet

- Busi370 Midterm Practice Fall2014Document11 pagesBusi370 Midterm Practice Fall2014NicoleNo ratings yet

- Busi370 Midterm Practice Summer2012Document11 pagesBusi370 Midterm Practice Summer2012NicoleNo ratings yet

- Introduction To Corporate Finance: Fourth EditionDocument39 pagesIntroduction To Corporate Finance: Fourth EditionNicoleNo ratings yet

- Solutions To Selected Textbook Problems - Pre-Midterm (3rd Ed)Document17 pagesSolutions To Selected Textbook Problems - Pre-Midterm (3rd Ed)NicoleNo ratings yet

- The Business Model of Flipkart: March 2018 December 2018 January 2019Document11 pagesThe Business Model of Flipkart: March 2018 December 2018 January 2019Suryateja ChallaNo ratings yet

- Zeeman's Family ExpansionDocument16 pagesZeeman's Family ExpansionColinNo ratings yet

- Midterm - Principles of MarketingDocument4 pagesMidterm - Principles of Marketingroselle nepomuceno100% (1)

- MCQs - 6Document10 pagesMCQs - 6gfxexpert36No ratings yet

- Tools and Techniques of Management AccountingDocument4 pagesTools and Techniques of Management Accountinggowtham100% (2)

- Managerial Economics in A Global Economy, 5th Edition by Dominick SalvatoreDocument21 pagesManagerial Economics in A Global Economy, 5th Edition by Dominick SalvatoreAR finance ID Ex BOGORNo ratings yet

- BP Case BPMDocument20 pagesBP Case BPMkiller drama100% (1)

- Sanjay Kanojiya-ElectricalDocument1 pageSanjay Kanojiya-ElectricalAMANNo ratings yet

- SEBI N FEMADocument28 pagesSEBI N FEMAD Attitude KidNo ratings yet

- Let's Talk Stocks! Student's VersionDocument6 pagesLet's Talk Stocks! Student's Versiongkjw897hr4No ratings yet

- STPR ReportDocument18 pagesSTPR ReportSiddhi SharmaNo ratings yet

- Multiple Choice - Problems Part 1: A. Percentage TaxDocument6 pagesMultiple Choice - Problems Part 1: A. Percentage TaxCJ TinNo ratings yet

- Characteristics of The TourismDocument4 pagesCharacteristics of The TourismRay KNo ratings yet

- Pink - Not Sure But Possible Answer Orange - Wrong Answer Note For Questions With Computations: Your Answer Should Be A Whole Number. Do Not UseDocument26 pagesPink - Not Sure But Possible Answer Orange - Wrong Answer Note For Questions With Computations: Your Answer Should Be A Whole Number. Do Not UseGene Albert LopezNo ratings yet

- KPMG Uae Banking Perspectives 2022Document37 pagesKPMG Uae Banking Perspectives 2022RayrayNo ratings yet

- Profit Maximization1Document14 pagesProfit Maximization1AYA707No ratings yet

- Cash Flow - The Coca-Cola Company (KO)Document1 pageCash Flow - The Coca-Cola Company (KO)vijayNo ratings yet

- Tax Case Digest 5Document11 pagesTax Case Digest 5Tammy YahNo ratings yet

- Mulugeta Final Proposal CommentedDocument33 pagesMulugeta Final Proposal Commentedpetolaw238No ratings yet

- Southwest Airlines Case Study AnswersDocument6 pagesSouthwest Airlines Case Study AnswersRamesh Mandava50% (4)

- John Ervin Bonilla Bsba Fm2B 1. Admission by Purchase of InterestDocument8 pagesJohn Ervin Bonilla Bsba Fm2B 1. Admission by Purchase of InterestJohn Ervin Bonilla100% (4)

- Chapter 3Document47 pagesChapter 3zeid100% (1)

- Creation of CreditDocument9 pagesCreation of CreditRashmi Ranjan PanigrahiNo ratings yet

- Pilipinas Shell Petroleum Corporation: SHLPHDocument17 pagesPilipinas Shell Petroleum Corporation: SHLPHIsis Normagne PascualNo ratings yet

- Ajay Khandelwal PDFDocument12 pagesAjay Khandelwal PDFAditya SinghNo ratings yet

- Ab 3Document2 pagesAb 3sanpoung809No ratings yet

- Quality Management - Ch.9 2Document15 pagesQuality Management - Ch.9 2manarNo ratings yet