Professional Documents

Culture Documents

Audit Quizzer (Cash) - 05

Audit Quizzer (Cash) - 05

Uploaded by

Ivy BautistaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Quizzer (Cash) - 05

Audit Quizzer (Cash) - 05

Uploaded by

Ivy BautistaCopyright:

Available Formats

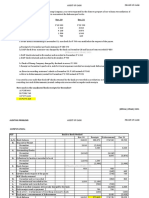

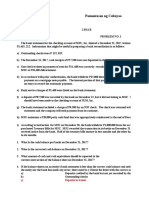

AUDIT OF CASH

In your audit of the cash account of Mandy Company, you were requested by the client to

prepare a four-column reconciliation of receipts, disbursements, and balances to

reconstruct the balances per books.

Nov. 30 Dec. 31

a. Balances per bank P 15 500 P 20 930

b. Deposits in transit 2 310 3 450

c. Outstanding checks 4 260 3 870

d. Bank collections not in books 1 500 1 900

e. Bank charges not in books 950 640

f. Of the checks outstanding on December 31, one check for P 700 was certified at the

request of the payee.

g. Receipts for December per bank statement: P 280 370

h. DAIF check from customer was charged by the bank on December 28 and has not been

recorded: P 850

i. DAIF check returned in November and recorded in December: P 1 150

j. DAIF check returned and recorded in December, P 900

k. Check of Mandy Company charged by the bank in error, P 2 350

l. Receipt on December 6 paid out in cash for travel expenses recorded as receipts and

disbursements per books, P 750

m. Error in recording customer's check on December 20, P 165 instead of P 365

n. Error in disbursements journal for December, P 3 250 instead of P 325

You noted in your audit that the DAIF checks returned by the bank are recorded as a

reduction on the cash receipts journal instead of recording it at cash disbursements

journal; redeposits are recorded as regular cash receipts.

How much is the unadjusted cash balance as of December 31?

A. P 19, 175

B. P 20, 025

C. P 20, 390

D. P 20, 190

AUDIT | jipb162021

You might also like

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Accounting10 (Reviewer)Document5 pagesAccounting10 (Reviewer)Erika Panit ReyesNo ratings yet

- Auditing and Assurance Principles Pre TestDocument9 pagesAuditing and Assurance Principles Pre TestKryzzel Anne JonNo ratings yet

- MOD 03 - Bank ReconDocument3 pagesMOD 03 - Bank ReconIrish VargasNo ratings yet

- Auditing Quiz Audit of CashDocument4 pagesAuditing Quiz Audit of CashLoveli Breindaelyn Rivera0% (2)

- Cash and Cash Equivalent QuizesDocument4 pagesCash and Cash Equivalent QuizesGIRL100% (1)

- Assignment No. 1 Audit of CashDocument5 pagesAssignment No. 1 Audit of CashMa Tiffany Gura RobleNo ratings yet

- Audit of CashDocument3 pagesAudit of CashCleopha Mae Torres100% (3)

- Quizzer Cash - Solution Printed KoDocument119 pagesQuizzer Cash - Solution Printed Kogoerginamarquez80% (10)

- All About CASHDocument18 pagesAll About CASHAshley Levy San Pedro100% (1)

- CM 03 Bank ReconciliationDocument7 pagesCM 03 Bank ReconciliationDanicaEsponilla67% (3)

- Audit Prob Q6 Proof of Cash 2021Document9 pagesAudit Prob Q6 Proof of Cash 2021Ivy BautistaNo ratings yet

- Auditing Problems: Jipbautista16 - Cpar - 2021Document2 pagesAuditing Problems: Jipbautista16 - Cpar - 2021Ivy BautistaNo ratings yet

- PAULA GOZUN - Activity 2 Accounting For Cash-receivables-InventoriesDocument9 pagesPAULA GOZUN - Activity 2 Accounting For Cash-receivables-InventoriesPaupauNo ratings yet

- AP - Cash and Cash EquivalentsDocument11 pagesAP - Cash and Cash EquivalentsErnest Andales88% (8)

- Accounting For Cash-receivables-InventoriesDocument12 pagesAccounting For Cash-receivables-InventoriesPaupau100% (1)

- Ap-5907 CashDocument11 pagesAp-5907 CashSaoxalo ONo ratings yet

- Prelim-Pr 2a14fb4488c3b5b235Document11 pagesPrelim-Pr 2a14fb4488c3b5b235Romina LopezNo ratings yet

- Cpa Review School of The PhilippinesDocument12 pagesCpa Review School of The PhilippinesMike SerafinoNo ratings yet

- Cpar 2Document11 pagesCpar 2Ana MarieNo ratings yet

- Intermediate Acctg 1 - Cash11Document5 pagesIntermediate Acctg 1 - Cash11Rozen Orlina0% (1)

- Proof of Cash (Bank To Book Method)Document1 pageProof of Cash (Bank To Book Method)clothing shoptalkNo ratings yet

- Answer in Act. 2 For Cash-receivables-InventoriesDocument10 pagesAnswer in Act. 2 For Cash-receivables-InventoriesPaupauNo ratings yet

- Encode JobDocument12 pagesEncode JobRainNo ratings yet

- Ap-5907q Cash PDFDocument5 pagesAp-5907q Cash PDFnikkaaaNo ratings yet

- AUD02 - 05 Audit of Cash and Cash EquivalentsDocument3 pagesAUD02 - 05 Audit of Cash and Cash EquivalentsMark BajacanNo ratings yet

- Do The Drill Cash Intaud1Document3 pagesDo The Drill Cash Intaud1ダニエルNo ratings yet

- 3.3 - Bank Reconciliation and Proof of CashDocument5 pages3.3 - Bank Reconciliation and Proof of CashxxxNo ratings yet

- Auditing ExamDocument14 pagesAuditing ExamJericha GolezNo ratings yet

- Applied AuditingDocument18 pagesApplied Auditing4295.montesNo ratings yet

- Cash and Cash EquivalentsDocument50 pagesCash and Cash EquivalentsAnne EstrellaNo ratings yet

- Cce 5Document4 pagesCce 5Charish Jane Antonio CarreonNo ratings yet

- Cce ProblemDocument3 pagesCce ProblemCharish Jane Antonio CarreonNo ratings yet

- F CFAS-EXAM - Docx 143874436Document48 pagesF CFAS-EXAM - Docx 143874436Athena AthenaNo ratings yet

- 10.28.2017 MT (Audit of Receivables)Document7 pages10.28.2017 MT (Audit of Receivables)PatOcampo100% (1)

- Bank Recon ProblemsDocument5 pagesBank Recon ProblemsDivine MungcalNo ratings yet

- Audit of CashDocument9 pagesAudit of CashRizzel SubaNo ratings yet

- Cash For SeatworkDocument3 pagesCash For SeatworkMika MolinaNo ratings yet

- Cash & Cash Equivalent TheoryDocument17 pagesCash & Cash Equivalent Theoryjoneth.duenasNo ratings yet

- PROBLEM NO. 4 - Bank ReconciliationDocument2 pagesPROBLEM NO. 4 - Bank Reconciliationelsana philipNo ratings yet

- Audit of Cash LecturesDocument3 pagesAudit of Cash Lecturespekka172No ratings yet

- A) B) C) D) E) A) B) C) D) E) A) B) C) D) E) A) B) C) D) E)Document3 pagesA) B) C) D) E) A) B) C) D) E) A) B) C) D) E) A) B) C) D) E)Mharvie LorayaNo ratings yet

- Ap Tip Preweek 2017Document58 pagesAp Tip Preweek 2017Jay-L Tan100% (1)

- FAR2 BANK RECONCILIATION StudentDocument7 pagesFAR2 BANK RECONCILIATION StudentCHRISTIAN BETIANo ratings yet

- AP-5907 CashDocument12 pagesAP-5907 CashxxxxxxxxxNo ratings yet

- Auditing Problems: Audit of Cash and Cash Equivalents Problem No. 1Document21 pagesAuditing Problems: Audit of Cash and Cash Equivalents Problem No. 1ATLASNo ratings yet

- Audit Cash - Aud ProblemsDocument36 pagesAudit Cash - Aud ProblemsIvy BautistaNo ratings yet

- Partnership Liquidation: Answer: (D)Document2 pagesPartnership Liquidation: Answer: (D)Ivy BautistaNo ratings yet

- Partnership Liquidation: Assets Liabilities & EquityDocument2 pagesPartnership Liquidation: Assets Liabilities & EquityIvy BautistaNo ratings yet

- Audit Prob Q6 Proof of Cash 2021Document9 pagesAudit Prob Q6 Proof of Cash 2021Ivy BautistaNo ratings yet

- Auditing Problems: Jipbautista16 - Cpar - 2021Document2 pagesAuditing Problems: Jipbautista16 - Cpar - 2021Ivy BautistaNo ratings yet