Professional Documents

Culture Documents

April 2021: Restaurant Performance Index Rose 1.2% in April Restaurant Performance Index

April 2021: Restaurant Performance Index Rose 1.2% in April Restaurant Performance Index

Uploaded by

Jesse ManekOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

April 2021: Restaurant Performance Index Rose 1.2% in April Restaurant Performance Index

April 2021: Restaurant Performance Index Rose 1.2% in April Restaurant Performance Index

Uploaded by

Jesse ManekCopyright:

Available Formats

April 2021

Restaurant Performance Index Rose 1.2% Restaurant Performance Index

in April 107

Bolstered by favorable comparisons for the current 106

situation indicators, the National Restaurant Association’s

105

Restaurant Performance Index (RPI) registered a healthy

increase in April. The RPI – a monthly composite index that 104

tracks the health of the U.S. restaurant industry – stood at 103

106.3 in April, up 1.2% from a level of 105.1 in March. 102

101

The recent surge in the RPI largely reflects the sales and

customer traffic levels compared to the most challenging 100

months of the pandemic, and is not a direct indication of 99

the current health of the restaurant industry. Still, the

98

positive trajectory in the forward-looking indicators points

toward improving business conditions in the months ahead. 97

96

The RPI is constructed so that the health of the restaurant 95

industry is measured in relation to a neutral level of 100.

94

Index values above 100 indicate that key industry indicators 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21

are in a period of expansion, while index values below 100

represent a period of contraction. The Restaurant Source: NRA; Values Greater than 100 = Expansion; Values Less than 100 = Contraction

Performance Index consists of two components – the

Current Situation Index and the Expectations Index.

Current Situation & Expectations Indices

Current Situation Index Increased 2.2% in April to a 107

Level of 106.7; Expectations Index Edged Up 0.2%

106

to a Level of 105.9

105

The Current Situation Index, which measures current trends 104

in four industry indicators (same-store sales, traffic, labor 103

and capital expenditures), stood at 106.7 in April – up 2.2% 102

from a level of 104.4 in March. The vast majority of 101

restaurant operators reported higher sales and customer 100

traffic compared to April 2020 – the worst month of the

99

pandemic. However, overall industry sales remain below

98

pre-pandemic levels.

97

96

The Expectations Index, which measures restaurant

95

operators’ six-month outlook for four industry indicators

94

(same-store sales, employees, capital expenditures and

93

business conditions), stood at 105.9 – up 0.2% from the

92

previous month. Restaurant operators are generally 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21

optimistic about sales and the economy in the coming

months, and their plans for capital expenditures rose to a Current Situation Index Expectations Index

record high. Source: NRA; Values Greater than 100 = Expansion; Values Less than 100 = Contraction

National Restaurant Association | Restaurant Performance Index | April 2021 Page 1

More Than Nine in Ten Operators Reported Higher Restaurant Operators’ Reporting of Same-Store

Same-Store Sales and Customer Traffic in April Sales versus Same Month in Previous Year

100%

The vast majority of restaurant operators reported higher 94%

same-store sales in April, as comparisons were up against 80%

78% 77% 77%

the dampened April 2020 readings. Ninety-four percent of 80%

70%

restaurant operators reported a same-store sales increase 64%

60% 61%

between April 2020 and April 2021, while only 3% reported 60%

a sales decline.

40%

32%

While 100% of fullservice operators reported higher same- 30% 29%

store sales in April, it wasn’t unanimous in the limited- 21% 19% 17% 18%

20%

service segment. One in 10 limited-service operators said 12%

their sales were lower in April 2021 than they were in April 3%

2020. 0%

Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21

Higher Same-Store Sales Lower Same-Store Sales

Ninety-three percent of restaurant operators said their

Source: National Restaurant Association, Restaurant Industry Tracking Survey

customer traffic increased between April 2020 and April

2021, while only 3% reported a traffic decline.

Restaurant Operators’ Outlook for Sales Volume in

Sixty-one percent of restaurant operators said they made a Six Months versus Same Period in Previous Year

capital expenditure for equipment, expansion or 100%

remodeling during the last three months. This represented

79%

the third consecutive monthly increase, and marked the 78%

75%

highest level since February 2020. 70%

54%

Restaurant Operators Are Optimistic about 50%

49%

44% 45% 43%

Business Conditions in the Months Ahead 40%

36% 36%

30% 32%

Restaurant operators are solidly optimistic about sales 28%

23%

25%

growth in the months ahead, though that sentiment 15%

continues to be qualified by the fact that the year-ago 5%

3%

comparisons are pandemic levels that were dampened for 0%

most restaurants. Seventy-nine percent of restaurant Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21

operators expect their sales volume in six months to be Higher Sales in Six Months Lower Sales in Six Months

higher than it was during the same period in the previous Source: National Restaurant Association, Restaurant Industry Tracking Survey

year, compared to 78% last month. Only 3% of operators

expect their sales in six months to be lower than it was

during the same period in the previous year, down slightly Restaurant Operators’ Outlook for General

Economic Conditions in Six Months

from 5% last month.

75%

70% 69%

Restaurant operators continue to have a positive outlook 64%

60%

for the overall economy, though optimism was down 56%

52%

slightly from the March and April surveys. Sixty-four percent

50%

of restaurant operators said they expect economic

38%

conditions will improve in six months, down from 69% who 36%

33%

reported similarly last month. Eleven percent of operators

22% 24% 22% 24%

think economic conditions will worsen in six months, up 25%

18%

from 5% last month. 13%

11%

6% 5%

Seventy-four percent of restaurant operators plan to make

0%

a capital expenditure for equipment, expansion or Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21

remodeling in the next six months. That was up from 64%

Better Conditions in Six Months Worse Conditions in Six Months

last month, and represented the highest reading in the

nearly 20-year history of the monthly tracking survey. Source: National Restaurant Association, Restaurant Industry Tracking Survey

National Restaurant Association | Restaurant Performance Index | April 2021 Page 2

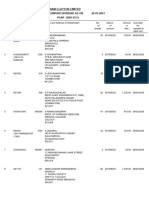

National Restaurant Association Restaurant Performance Index and Its Components

Apr-21

December January February March April over

2020 2021 2021 2021 2021 Mar-21

Restaurant Performance Index 98.6 99.1 100.1 105.1 106.3 1.2%

Current Situation Index 94.9 96.0 95.4 104.4 106.7 2.2%

Current Situation Indicators:

Same-Store Sales 93.8 96.4 94.1 106.5 109.2 2.5%

Customer Traffic 91.7 93.9 92.8 106.0 109.0 2.9%

Labor 93.6 94.7 94.9 103.4 106.4 2.9%

Capital Expenditures 100.3 99.0 99.9 101.6 102.3 0.6%

Expectations Index 102.4 102.2 104.8 105.7 105.9 0.2%

Expectations Indicators:

Same-Store Sales 102.6 102.6 105.5 107.3 107.6 0.3%

Staffing 102.5 101.7 104.5 106.6 105.9 -0.6%

Capital Expenditures 100.3 100.1 102.8 102.7 104.9 2.1%

Business Conditions 104.1 104.2 106.3 106.4 105.3 -1.0%

Note: For each of the Indices and Indicators, a value above 100 signals a period of expansion while a value below 100 signals a period of contraction.

Definitions

The National Restaurant Association’s Restaurant Performance Index is a statistical barometer that measures the overall health of the U.S.

Restaurant Industry. This monthly composite index is based on the responses to the National Restaurant Association’s monthly Restaurant

Industry Tracking Survey, which is fielded among restaurant operators nationwide on a variety of indicators including sales, traffic, labor and

capital expenditures. The Restaurant Performance Index is composed of two equally-weighted components: the Current Situation Index and

the Expectations Index. For each of the Indices and Indicators, a value above 100 signals a period of expansion while a value below 100 signals

a period of contraction. The distance from 100 signifies the magnitude of the expansion or contraction.

The Current Situation Index is a composite index based on four ‘recent-period’ restaurant industry indicators:

Same-Store Sales: Compares same-store sales volume in the reference month versus the same month in the previous year

Customer Traffic: Compares customer traffic in the reference month versus the same month in the previous year

Labor: Compares the number of employees and the average employee hours in the reference month versus the same month

in the previous year

Capital Expenditures: Measures capital expenditure activity during the three most recent months

The Expectations Index is a composite index based on four ‘forward-looking’ restaurant industry indicators:

Same-Store Sales: Restaurant operators’ outlook for same-store sales in six months, compared to the same period in the

previous year

Staffing: Restaurant operators’ expectations for their number of employees in six months, compared to the same period in

the previous year

Capital Expenditures: Restaurant operators’ capital expenditure plans during the next six months

Business Conditions: Restaurant operators’ outlook for general business conditions during the next six months

For a complete analysis of the National Restaurant Association’s Restaurant Industry Tracking Survey including data broken out by industry

segment, as well as a host of other economic indicators that impact the restaurant industry, log on to Restaurant TrendMapper at

www.restaurant.org/trendmapper (subscription required).

National Restaurant Association | Restaurant Performance Index | April 2021 Page 3

You might also like

- PDF Telecommunications Law and Regulation Ian Walden Editor Ebook Full ChapterDocument53 pagesPDF Telecommunications Law and Regulation Ian Walden Editor Ebook Full Chapternoelle.mcveigh210100% (1)

- Laurs & BridzDocument4 pagesLaurs & Bridzrichie rich100% (2)

- Jiu-Jitsu University Ribeiro, Saulo, Howell, Kevin 9780981504438 Amazon - Com BooksDocument8 pagesJiu-Jitsu University Ribeiro, Saulo, Howell, Kevin 9780981504438 Amazon - Com BooksJesse ManekNo ratings yet

- India Prowessdx Data Dictionary PDFDocument5,841 pagesIndia Prowessdx Data Dictionary PDFRiturajPaulNo ratings yet

- 2024 State of Restaurants ReportDocument62 pages2024 State of Restaurants ReportHector RiveraNo ratings yet

- October 2017 Retail Sales PublicationDocument4 pagesOctober 2017 Retail Sales PublicationBernewsAdminNo ratings yet

- Bigdata 2Document8 pagesBigdata 2Nguyễn Phương TrangNo ratings yet

- 3-March 2020 Retail Sales PublicationDocument4 pages3-March 2020 Retail Sales PublicationAnonymous UpWci5No ratings yet

- Benchmark+Report+ +02+november+2021 CanxchangeDocument27 pagesBenchmark+Report+ +02+november+2021 CanxchangepatonopeNo ratings yet

- Inisiatif Vol 2 No 1 Januari 2023 Hal 343-361Document19 pagesInisiatif Vol 2 No 1 Januari 2023 Hal 343-361Lasagna OoooNo ratings yet

- Accounting Ratios UsedDocument4 pagesAccounting Ratios UsedS.A.KarzaviNo ratings yet

- NegotiatedDocument19 pagesNegotiatedTerry FurtadoNo ratings yet

- MBA 511 ShawonDocument25 pagesMBA 511 ShawonMD. JULFIKER HASANNo ratings yet

- 1 January 2018 Retail Sales PublicationDocument4 pages1 January 2018 Retail Sales PublicationBernewsAdminNo ratings yet

- Consumer Price Index - Apr 20Document5 pagesConsumer Price Index - Apr 20BernewsAdminNo ratings yet

- Beverage & Food Assignment One.Document10 pagesBeverage & Food Assignment One.Kirimi FionaNo ratings yet

- Financial DepartmentDocument27 pagesFinancial DepartmentPiyu VyasNo ratings yet

- Uganda Revenue Authority 9 Months Revenue Performance Report For The Period (July 2016 - March 2017) .Document14 pagesUganda Revenue Authority 9 Months Revenue Performance Report For The Period (July 2016 - March 2017) .URAuganda100% (2)

- Sales KPIDocument11 pagesSales KPIVictor DharmawanNo ratings yet

- September 2017 Retail Sales PublicationDocument4 pagesSeptember 2017 Retail Sales PublicationBernewsAdminNo ratings yet

- Consumer Price Index - Feb 2020Document4 pagesConsumer Price Index - Feb 2020BernewsAdminNo ratings yet

- Ibn Sina Project 22Document18 pagesIbn Sina Project 22Amr ElghazalyNo ratings yet

- Q2 2021 Financial Statements AWFSDocument44 pagesQ2 2021 Financial Statements AWFSHakeshi ScarletNo ratings yet

- 1-January 2020 Retail Sales PublicationDocument4 pages1-January 2020 Retail Sales PublicationBernewsAdminNo ratings yet

- Business Perception 2021 Q2 en & ArDocument16 pagesBusiness Perception 2021 Q2 en & ArPuneet MehtaNo ratings yet

- 4-April 2018 Retail Sales PublicationDocument4 pages4-April 2018 Retail Sales PublicationBernewsAdminNo ratings yet

- KF Vs Kalbe Syndicate Group 4 - FixDocument15 pagesKF Vs Kalbe Syndicate Group 4 - FixFadhila Nurfida HanifNo ratings yet

- Consumer Price Index - June 20Document5 pagesConsumer Price Index - June 20BernewsAdminNo ratings yet

- Manufacturing and Trade Inventories and Sales, May 2018Document4 pagesManufacturing and Trade Inventories and Sales, May 2018aria woohooNo ratings yet

- R365 State of The Restaurant Industry 2024Document12 pagesR365 State of The Restaurant Industry 2024Hector RiveraNo ratings yet

- Consumer Price Index - Jan 17Document4 pagesConsumer Price Index - Jan 17BernewsAdminNo ratings yet

- Pharmaceuticals Domestic Formulations Sector Secular Growth StoriesDocument92 pagesPharmaceuticals Domestic Formulations Sector Secular Growth StoriesSaurabh PrasadNo ratings yet

- 4-April 2020 Retail Sales PublicationDocument5 pages4-April 2020 Retail Sales PublicationBernewsAdminNo ratings yet

- SERR JubilantFoodWorksDocument25 pagesSERR JubilantFoodWorksRonakk MoondraNo ratings yet

- Manufacturing and Trade Inventories and Sales, September 2018Document4 pagesManufacturing and Trade Inventories and Sales, September 2018koloNo ratings yet

- Consumer Price Index - Aug 21Document4 pagesConsumer Price Index - Aug 21Anonymous UpWci5No ratings yet

- Customer Service Supervisor KPIsDocument14 pagesCustomer Service Supervisor KPIslennsjNo ratings yet

- Bos 0719Document2 pagesBos 0719Valter SilveiraNo ratings yet

- ACSI Restaurant Report 2018Document9 pagesACSI Restaurant Report 2018KierstenNo ratings yet

- Consumer Price Index - Mar 2020Document4 pagesConsumer Price Index - Mar 2020BernewsAdminNo ratings yet

- FMCG Monitor 2024 Q1Document16 pagesFMCG Monitor 2024 Q1Muhammad HarlandNo ratings yet

- Building On Our Global Expertise: FormulationsDocument4 pagesBuilding On Our Global Expertise: FormulationsSrinivasNo ratings yet

- Financial Statement Analysis of BATADocument21 pagesFinancial Statement Analysis of BATAArefin FerdousNo ratings yet

- 3) Financial and Operational Performance Analysis 2018-2021Document33 pages3) Financial and Operational Performance Analysis 2018-2021Tomas LeonardelliNo ratings yet

- In The Partial Fulfillment of The Requirements For The SubjectDocument11 pagesIn The Partial Fulfillment of The Requirements For The SubjectAnuradhaNo ratings yet

- ESMS 2019 04 SurveyDocument5 pagesESMS 2019 04 SurveyValter SilveiraNo ratings yet

- Consumer Price Index - May 18Document4 pagesConsumer Price Index - May 18BernewsAdminNo ratings yet

- 5-May 2020 Retail Sales PublicationDocument5 pages5-May 2020 Retail Sales PublicationAnonymous UpWci5No ratings yet

- 2018 January NAB Monthly Business SurveyDocument9 pages2018 January NAB Monthly Business SurveyAnonymous j5sBJA9No ratings yet

- Deliverable 5 - Trend Analysis & PresentationDocument6 pagesDeliverable 5 - Trend Analysis & PresentationRamizNo ratings yet

- July 2022 CPI ReportDocument5 pagesJuly 2022 CPI ReportBernewsAdminNo ratings yet

- EL Estee Lauder 2018Document15 pagesEL Estee Lauder 2018Ala Baster100% (1)

- NIAKPI2013 Medical Record DepartmentDocument3 pagesNIAKPI2013 Medical Record DepartmentHasni OmarNo ratings yet

- Financial Management Project: Presented byDocument16 pagesFinancial Management Project: Presented byAsif KhanNo ratings yet

- Myanmar: Monitoring The Impacts of COVID-19 in MyanmarDocument8 pagesMyanmar: Monitoring The Impacts of COVID-19 in MyanmarJohn Dave PunoNo ratings yet

- RatioanalyasisDocument20 pagesRatioanalyasiscknowledge10No ratings yet

- 3-March 2018 Retail Sales PublicationDocument4 pages3-March 2018 Retail Sales PublicationBernewsAdminNo ratings yet

- Nestle India: Project RURBAN To Support Strong Growth Inflationary Clouds RemainDocument11 pagesNestle India: Project RURBAN To Support Strong Growth Inflationary Clouds Remainkrishna_buntyNo ratings yet

- Accounting Control Research TaskDocument12 pagesAccounting Control Research TaskAgamdeep SinghNo ratings yet

- India Delhi NCR Retail Q3 2021Document2 pagesIndia Delhi NCR Retail Q3 2021avinash sharmaNo ratings yet

- Financial Report Analysis: Mangalore Chemical & Fertilizers LTD and Madras Fertilizers LTDDocument10 pagesFinancial Report Analysis: Mangalore Chemical & Fertilizers LTD and Madras Fertilizers LTDRonit VermaNo ratings yet

- 10-October 2018 Retail Sales PublicationDocument4 pages10-October 2018 Retail Sales PublicationBernewsAdminNo ratings yet

- Alert: Developments in Preparation, Compilation, and Review Engagements, 2017/18From EverandAlert: Developments in Preparation, Compilation, and Review Engagements, 2017/18No ratings yet

- Vaccines Eligibility CheckerDocument1 pageVaccines Eligibility CheckerJesse ManekNo ratings yet

- Rip Van Wafels, Cookies Mini Dutch Caramel and Vanilla, 3.55 OunceDocument6 pagesRip Van Wafels, Cookies Mini Dutch Caramel and Vanilla, 3.55 OunceJesse ManekNo ratings yet

- Base Culture Keto Bread - Cinnamon Raisin, 100% Paleo, Gluten Free, Grain Free, Non-GMO, Dairy Free, Soy Free and Kosher - 16oz LoafDocument7 pagesBase Culture Keto Bread - Cinnamon Raisin, 100% Paleo, Gluten Free, Grain Free, Non-GMO, Dairy Free, Soy Free and Kosher - 16oz LoafJesse ManekNo ratings yet

- 365 by WFM, Cauliflower Riced Organic, 12 OunceDocument7 pages365 by WFM, Cauliflower Riced Organic, 12 OunceJesse ManekNo ratings yet

- Large Organic Hass AvocadoDocument7 pagesLarge Organic Hass AvocadoJesse ManekNo ratings yet

- Organic Hass Avocados, 4 CountDocument7 pagesOrganic Hass Avocados, 4 CountJesse ManekNo ratings yet

- Banana, 1 EachDocument6 pagesBanana, 1 EachJesse ManekNo ratings yet

- Base Culture Keto Bread - Cheese, 100% Paleo, Gluten Free, Grain Free, Non-GMO, Dairy Free, Soy Free and Kosher - 16oz LoafDocument7 pagesBase Culture Keto Bread - Cheese, 100% Paleo, Gluten Free, Grain Free, Non-GMO, Dairy Free, Soy Free and Kosher - 16oz LoafJesse ManekNo ratings yet

- Best Sellers Customer Service Prime New Releases Pharmacy Books Fashion Toys & GamesDocument8 pagesBest Sellers Customer Service Prime New Releases Pharmacy Books Fashion Toys & GamesJesse ManekNo ratings yet

- Whole Foods MarketDocument3 pagesWhole Foods MarketJesse ManekNo ratings yet

- Best Sellers Customer Service Prime New Releases Pharmacy Books Fashion Toys & GamesDocument8 pagesBest Sellers Customer Service Prime New Releases Pharmacy Books Fashion Toys & GamesJesse ManekNo ratings yet

- CDC Clear Communication Index: User GuideDocument36 pagesCDC Clear Communication Index: User GuideJesse ManekNo ratings yet

- 2020 CPA Zicklin IndexDocument57 pages2020 CPA Zicklin IndexJesse ManekNo ratings yet

- Brazilian Jiu Jitsu Black Belt Techniques at DuckDuckGoDocument3 pagesBrazilian Jiu Jitsu Black Belt Techniques at DuckDuckGoJesse ManekNo ratings yet

- Regnier JujitsuDocument66 pagesRegnier JujitsuJesse Manek100% (1)

- CCIHE2018 Research Activity Index MethodDocument1 pageCCIHE2018 Research Activity Index MethodJesse ManekNo ratings yet

- Flares and Hoof Wall Separation: MagnesiumDocument2 pagesFlares and Hoof Wall Separation: MagnesiumJesse ManekNo ratings yet

- Upper ExtremityDocument1 pageUpper ExtremityJesse ManekNo ratings yet

- Understanding Solar IndicesDocument3 pagesUnderstanding Solar IndicesJesse ManekNo ratings yet

- Material Type Industry Sector Material Group Mtart MBRSH Matkl Matl - Type Ind - Sector Matl - GroupDocument25 pagesMaterial Type Industry Sector Material Group Mtart MBRSH Matkl Matl - Type Ind - Sector Matl - GroupHari Hara SuthanNo ratings yet

- Hadiza Bala Usman's Access Bank Account StatementDocument1 pageHadiza Bala Usman's Access Bank Account StatementSahara ReportersNo ratings yet

- Multiple Choice Questions: Share CapitaalDocument21 pagesMultiple Choice Questions: Share CapitaalYashik JindalNo ratings yet

- 9D Research GroupDocument8 pages9D Research Groupapi-291828723No ratings yet

- Sundaram Clayton (2021)Document90 pagesSundaram Clayton (2021)insaafduggal33No ratings yet

- Sol. Man. - Chapter 17 - Depletion of Mineral Resources - Ia Part 1BDocument3 pagesSol. Man. - Chapter 17 - Depletion of Mineral Resources - Ia Part 1BMahasia MANDIGANNo ratings yet

- BA2 Course NotesDocument230 pagesBA2 Course NotesОля Оляфка100% (1)

- Capital Account Management in IndiaDocument9 pagesCapital Account Management in IndiaSanjana KrishnakumarNo ratings yet

- Chapter 4 ECON 112Document11 pagesChapter 4 ECON 112dewetmonjaNo ratings yet

- Screenshot 2023-07-06 at 3.03.02 PMDocument8 pagesScreenshot 2023-07-06 at 3.03.02 PMShweta KothariNo ratings yet

- Ashok Indane Gas ServiceDocument37 pagesAshok Indane Gas ServiceJatin DuaNo ratings yet

- Notice Aspirateur Pour Bassin Ubbink VacuPro Cleaner MaxiDocument56 pagesNotice Aspirateur Pour Bassin Ubbink VacuPro Cleaner Maxi8bbr1dx9No ratings yet

- Husqvarna/Viking Angelica Sewing Machine Instruction ManualDocument42 pagesHusqvarna/Viking Angelica Sewing Machine Instruction ManualiliiexpugnansNo ratings yet

- Bayes and Minimax Solutions of Sequential Decision ProblemsDocument33 pagesBayes and Minimax Solutions of Sequential Decision ProblemsSrinivasaNo ratings yet

- DocxDocument16 pagesDocxLara FloresNo ratings yet

- Are Related-Party Sales Value-Adding or Value-Destroying? Evidence From ChinaDocument38 pagesAre Related-Party Sales Value-Adding or Value-Destroying? Evidence From Chinanovie endi nugrohoNo ratings yet

- Permaban Wave FAQs Issue 6 131119Document4 pagesPermaban Wave FAQs Issue 6 131119Inteligencia MercadoNo ratings yet

- InvoiceDocument1 pageInvoiceSoumyadeep DuttaNo ratings yet

- Pointy Hat - The JinxDocument11 pagesPointy Hat - The JinxMatias AravenaNo ratings yet

- RJ Mention Sample Script For RadioDocument2 pagesRJ Mention Sample Script For RadioJoel67% (3)

- Questions Q1: What Is The Difference Between Economics and Business Economics?Document96 pagesQuestions Q1: What Is The Difference Between Economics and Business Economics?sushainkapoor photoNo ratings yet

- Pune To Indore 1 JuneDocument1 pagePune To Indore 1 Junevikas pawaiyaNo ratings yet

- Al in Source Grade 12 For Abm OnlyDocument483 pagesAl in Source Grade 12 For Abm OnlyAxelle PorcelNo ratings yet

- Alifaldo Daffa Darmawan - 242221075 - Calculating NPV EtcDocument9 pagesAlifaldo Daffa Darmawan - 242221075 - Calculating NPV EtcFaldo DaffaNo ratings yet

- Hazop SaDocument1 pageHazop SaAndreia BrandaoNo ratings yet

- Billed To: International Package Services InvoiceDocument12 pagesBilled To: International Package Services InvoiceBingmondoy Feln Lily Canonigo0% (1)

- 1 Book Pricing Publishers Versus Authors Consider The ProblemDocument2 pages1 Book Pricing Publishers Versus Authors Consider The Problemtrilocksp SinghNo ratings yet

- Azoxystrobin 245 SCFormulationDocument2 pagesAzoxystrobin 245 SCFormulationAlfredo MéndezNo ratings yet