Professional Documents

Culture Documents

009QA

009QA

Uploaded by

mjmariaantonyrajCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

009QA

009QA

Uploaded by

mjmariaantonyrajCopyright:

Available Formats

Stocks & Commodities V.

22:1 (44): Q&A by Don Bright

Q&A

SINCE YOU ASKED

Confused about some aspect of trading? Professional trader Don Bright of Bright

Trading (www.stocktrading.com), an equity trading corporation, answers a few of

your questions. To submit a question, post your question to our website at http://

Message-Boards.Traders.com. Answers will be posted there, and selected questions

will appear in a future issue of S&C.

FOLLOWUP: ECONOMIC POLICIES Chicago Mercantile Exchange (CME), Don Bright of Bright Trading

Thank you very much for the useful and Eurex. Regards — Gerry Quick

information in your December 2003 Okay, I’m going to pass the ball a bit

column! I now have another question: here, and suggest that you check out the derlying. These contracts expire every

do the general economic policies of a three websites: www.eurexchange.com, three months starting in the March quar-

country have an impact on the variation www.cme.com, and www.cbot.com. terly cycle. (See the current listings at

of the value of stocks ? — Satinka Xo They all have excellent access to rules www.cme.com.) ETFs trade just like

Absolutely! As we grow into a true and regulations. The CME even has a stocks, and you can buy and hold them

global economy, we must always con- phone number to call for help. if you wish, or trade them intraday. The

sider such things as currency exchange I spoke directly with the CME help futures contracts that use the ETF as the

rates, import and export policies, price desk, and they were kind enough to call underlying trade just like other futures

controls, and of course, the labor mar- me back to explain the following: The and convert into cash value upon expi-

kets. If products are taxed too heavily, emini quotes show only depth and ration. The value of the Nasdaq 100

or their import/export duties favor one breadth (the order price and size), not upon expiration will be the conversion

company’s product line over another, the type, nor who or where the order cash price.

this could have a significant effect on came from. They do not distinguish

the company’s expansion, thereby af- between stop orders and any other type ENVELOPING

fecting its growth. of order. In your experience with intraday envel-

You might want to research recent I don’t think you’ll have too much oping (not on the opening), shouldn’t

legislation about the steel industry; some trouble with stop orders on any elec- we be enveloping only when the markets

call the policies “protectionism,” while tronic exchange. The breadth and depth get quiet and illiquid (generally during

others praise the policy as good for of the markets should more than com- the 11:00 am to 2:00 pm “New York

America (this is not a political forum, so pensate for any possibility of shenani- Lunch”?) Is it true that we should gen-

I’ll let you decide how you feel when gans by other traders or exchange mem- erally not have envelopes in when the

you do the research). Don’t forget about bers. We prefer not to use stop orders markets are moving? Does this also

the Federal Open Market Committee for any equity trading, but find that they hold true for the pair trading strategy

(FOMC), as well as the Federal Reserve can be used in futures trading. (yes when quiet, no when moving?)

Board and its influence on interest rates. Thanks for the help — Guy Truicko

The rates have more effect on some CONTRACTS AND EXPIRATION First off, we are not suggesting too

stocks (such as financials) than others, The March 2003 issue of S&C has an much in the way of simple pair trading

but nevertheless affect the overall in- article on the QQQ by Misha Sarkovich. these days (at least not in the same

vesting atmosphere. Good luck, and keep On page 28, item 8, Misha writes: “The context as in the past). We focus much

up your interest. QQQ contracts do not expire.” Please more on crutch pair trading versus cor-

help! I do not understand; I thought all relation modeling. Our pairs specialists

BIG BOYS contracts expire. Thank you — Bill are constantly modifying their approach

If I enter an order, do the big boys know The QQQs (the ticker symbol for the to this tactic.

it is a stop or just a new position? Can Nasdaq 100 Trust) is an exchange-traded As far as enveloping goes, yes, we

they try to hit my stop to knock me out? fund (ETF) that trades on the American want to focus on making nickels and

I am talking about the electronic futures Stock Exchange (AMEX) and is also dimes during the slower part of the day.

at the Chicago Board of Trade (CBOT), listed on the New York Stock Exchange It’s not so much a matter of busy versus

(NYSE). It trades like slow (time of day), but more a matter of

a stock on other ECNs. trending versus channeling. During the

The breadth and depth of the markets Perhaps you may be NYSE “lunch break,” we can certainly

should more than compensate for any thinking of the ND, keep tight envelopes and do well.

possibility of shenanigans by other which is the futures

contract that uses the S&C

traders or exchange members. Nasdaq 100 as the un-

Copyright (c) Technical Analysis Inc.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Radio Feature ScriptDocument3 pagesRadio Feature ScriptGauri GargNo ratings yet

- Sami Abusaad Trend Analysis PDF EbookDocument18 pagesSami Abusaad Trend Analysis PDF EbookWuU234550% (2)

- Explosive Move Predictor: Conditions For An EMP DayDocument2 pagesExplosive Move Predictor: Conditions For An EMP DayMazid Khan100% (1)

- Etching Chains: Could This Be The Mother of All Tech-Nical Stock Screens?Document2 pagesEtching Chains: Could This Be The Mother of All Tech-Nical Stock Screens?mjmariaantonyrajNo ratings yet

- 156 LetDocument3 pages156 LetmjmariaantonyrajNo ratings yet

- HurstCycles MINICourseDocument15 pagesHurstCycles MINICoursemjmariaantonyraj100% (3)

- 150PRDocument2 pages150PRmjmariaantonyrajNo ratings yet

- The Relative Volatility IndexDocument4 pagesThe Relative Volatility IndexmjmariaantonyrajNo ratings yet

- The Visibility Graph: A New Method For Estimating The Hurst Exponent of Fractional Brownian MotionDocument5 pagesThe Visibility Graph: A New Method For Estimating The Hurst Exponent of Fractional Brownian MotionmjmariaantonyrajNo ratings yet

- Xplore Our Ptions: Got A Question About Options?Document1 pageXplore Our Ptions: Got A Question About Options?mjmariaantonyrajNo ratings yet

- Anatomy of A Candlestick: Take A Closer Look at This Strong Reversal PatternDocument2 pagesAnatomy of A Candlestick: Take A Closer Look at This Strong Reversal PatternmjmariaantonyrajNo ratings yet

- Pening Osition: The Traders' MagazineDocument1 pagePening Osition: The Traders' MagazinemjmariaantonyrajNo ratings yet

- Prayer: Writ Petition Filed Under Article 226 of The Constitution of IndiaDocument5 pagesPrayer: Writ Petition Filed Under Article 226 of The Constitution of IndiamjmariaantonyrajNo ratings yet

- 2nd Place Live Trading June 09 ChallengeDocument12 pages2nd Place Live Trading June 09 ChallengemjmariaantonyrajNo ratings yet

- Application Economics of Public PolicyDocument13 pagesApplication Economics of Public Policyfilipa barbosaNo ratings yet

- The Ludhiana Stock Exchange Limited Was Established in 1981Document10 pagesThe Ludhiana Stock Exchange Limited Was Established in 1981PREET10No ratings yet

- June 2011Document64 pagesJune 2011alypatyNo ratings yet

- An Update - Old Bridge CapitalDocument3 pagesAn Update - Old Bridge CapitalAshwin HasyagarNo ratings yet

- CHAPTER 2 - Financial MarketDocument16 pagesCHAPTER 2 - Financial MarketHirai GaryNo ratings yet

- Bio Oil Tebu 24 Jan 2022Document13 pagesBio Oil Tebu 24 Jan 2022Haniif PrasetyawanNo ratings yet

- Ecn 232Document158 pagesEcn 232adeniyimustapha46No ratings yet

- The 5 Hour MillionaireDocument33 pagesThe 5 Hour Millionairehello_ayanNo ratings yet

- Types of Elasticity of DemandDocument6 pagesTypes of Elasticity of DemandVijeta ShuklaNo ratings yet

- Causes of Downward Sloping Demand CurveDocument2 pagesCauses of Downward Sloping Demand CurveGkgolam KibriaNo ratings yet

- The Price SystemDocument18 pagesThe Price SystemCommerce LineNo ratings yet

- 3 M's of ManagementDocument1 page3 M's of ManagementLuna CassiopeiaNo ratings yet

- CH 4 Indiv and Market Demand s1Document50 pagesCH 4 Indiv and Market Demand s1Jhon Boyke SiahaanNo ratings yet

- Slave Trade and World EconomyDocument5 pagesSlave Trade and World EconomySarah AkkaouiNo ratings yet

- Forex Basic and Advanced NotesDocument8 pagesForex Basic and Advanced Notespivoc46821No ratings yet

- (Hoff) Novel Ways of Implementing Carry Alpha in CommoditiesDocument13 pages(Hoff) Novel Ways of Implementing Carry Alpha in CommoditiesrlindseyNo ratings yet

- Oriental Despotism in Ancient IndiaDocument4 pagesOriental Despotism in Ancient IndiamishikaNo ratings yet

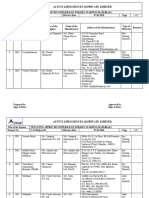

- Tentative Approved Supplier List For All Raw MaterialsDocument5 pagesTentative Approved Supplier List For All Raw Materialsqa ativzNo ratings yet

- Gartman LetterDocument8 pagesGartman Letterjwink444No ratings yet

- Market EquilibriumDocument8 pagesMarket EquilibriumParth SharmaNo ratings yet

- Margin Requirements Across Equity-Related InstrumentsDocument21 pagesMargin Requirements Across Equity-Related InstrumentsAbdEssamad RbahNo ratings yet

- Weighted Index Numbers Are Also of Two TypesDocument4 pagesWeighted Index Numbers Are Also of Two TypesSumit BainNo ratings yet

- VSA in 10 LessonsDocument72 pagesVSA in 10 Lessonsstowfank80% (5)

- 7th Answer PDFDocument11 pages7th Answer PDFprajapati kumar paswanNo ratings yet

- Week 4-Module in EconomicsDocument20 pagesWeek 4-Module in EconomicsTommy Montero88% (8)

- Foreign Exchange MarketDocument10 pagesForeign Exchange MarketBeverly Claire Lescano-MacagalingNo ratings yet

- Board Question Paper - July 2023 - 64d0d24ee7f31Document3 pagesBoard Question Paper - July 2023 - 64d0d24ee7f31Sadab raeenNo ratings yet