Professional Documents

Culture Documents

Simplified, Fast and Intelligent Automated Trading : Studio

Simplified, Fast and Intelligent Automated Trading : Studio

Uploaded by

msu chennaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Simplified, Fast and Intelligent Automated Trading : Studio

Simplified, Fast and Intelligent Automated Trading : Studio

Uploaded by

msu chennaiCopyright:

Available Formats

AlgoStudio™

Simplified, fast and intelligent

automated trading…

AlgoStudio™ is an event-driven, ultra low-latency,

scalable and high-frequency algorithmic trading

platform that facilitates automated trading with

increase in profitability and competitive advantage.

Using AlgoStudio, trading organizations can identify

favourable market conditions in multiple markets and

simultaneously execute complex strategies to capture

short-lived trading opportunities at reduced risk and

operational cost.

Reference Data Real Time Market Data

Markets

Trades and Quotes

News Feeds etc.

Exchanges

OMS

Adapter  ECNs

Strategy Interface

Standard Algorithms (NeatXS*)

Direct Market

(VWAP, TWAP, Arbitrage…)

Access

Event

Adapter

Processing Brokers

Proprietary Algorithms

Adapter

Equities, Options,

Futures, Foreign

@ Customizer : Monitor Control Exchange Etc.

* AlgoStudio supports algorithmic trading on Indian exchanges powered by the NeatXS server.

FIRST FUTURES Global expertise

S O F T W A R E Indian reach

Product Summary

Build and quickly deploy latency-sensitive, complex trading strategies

Dynamic adjustment of strategy parameters to adapt to the changing market conditions

Supports multiple asset classes and is broker neutral

Event-driven and multi-threaded processing to support faster decisions on trade opportunities

Comprehensive risk management to provide secured trading environment

Pre-packaged strategies to perform arbitrage, volume based trading and market making

Analyses transaction costs and slippage

Supports strategy-readable live news feeds for algorithmic trading and risk management

Accepts algorithmic instructions and trading parameters via a FIX engine

Deployable at co-location in proximity of matching engine of the exchange

Other Features

Uses an event-driven architecture for ultra low-latency processing of event data streams

Component-based technology to plug adapters, strategies and other plug-ins

Provides a rich Application Programming Interface (API) for development and deployment of

complex trading strategies

Leverages the Microsoft®.NET® supported programming languages to develop strategies

Reusable strategy components and algorithmic logic

Provides real-time market data feed processing, automated execution management, order state

handling and smart order routing

Real-time reporting of open orders, order state changes, trade confirmations and position statistics

for further trading analysis

Access to historical and reference data for trading

Flexibility to trade on different markets simultaneously using the same strategy with a market

neutral strategy concept of Abstract Market Variables (AMV).

Monitor the strategy run statistics and simultaneously refer the market depth, touchline, OHLC and

other market information

Graphical presentation of position and tick data movement

Provides a fast data storage/retrieval of intraday time series data to facilitate an intraday analysis

of a market

Times and sales information for timely updates on trades at specific prices and volumes

Market watch to view latest market information

Maintains separate logs for the application tasks and the strategy-specific alerts

NSE.IT Limited

Trade Globe,

Andheri Kurla Road,

Andheri (East),

Mumbai 400059, India

First Futures Software

508 South Tower,

Sacred World,

Wanowrie,

First Futures Software (FFS) and NSE.IT have a comprehensive experience in providing seamless and Pune 411040, India

reliable electronic trading solutions. Our premier professional services offer consultation in transforming

your algorithmic trading ideas into reality.

Email:

marketing@nseit.co.in

info@firstfutures.com

www.nseit.com © 2010 NSE.IT Limited and First Futures Software Engineering Pvt. Ltd. All rights reserved.

www.firstfutures.com

You might also like

- Case Study Safety and Health AwarenessDocument103 pagesCase Study Safety and Health AwarenessNadyra Sebangga100% (3)

- Algorithmic Trading PDFDocument21 pagesAlgorithmic Trading PDFARSHAD100% (1)

- APPIA - FIX EngineDocument2 pagesAPPIA - FIX EngineNYSE TechnologiesNo ratings yet

- FIXATDL Intro and Tutorial 01092008Document23 pagesFIXATDL Intro and Tutorial 01092008Gunjan GandhiNo ratings yet

- Uml Diagrams of Hospital ManagmentsDocument34 pagesUml Diagrams of Hospital Managmentsshakir54491% (68)

- Important Principles of Labor LawDocument14 pagesImportant Principles of Labor LawPal Wa100% (2)

- Design Your Trading Strategies : Optimize, Analyze and Go LiveDocument2 pagesDesign Your Trading Strategies : Optimize, Analyze and Go Livemsu chennaiNo ratings yet

- AlgoTrading ReviewDocument10 pagesAlgoTrading ReviewNitin MongaNo ratings yet

- Algorithmic Trading Solutions: PE Cial EP OR TDocument15 pagesAlgorithmic Trading Solutions: PE Cial EP OR Taba3abaNo ratings yet

- Algorithmic Trading Bot: Medha Mathur, Satyam Mhadalekar, Sahil Mhatre, Vanita ManeDocument9 pagesAlgorithmic Trading Bot: Medha Mathur, Satyam Mhadalekar, Sahil Mhatre, Vanita ManeTasty Feasty By PremiNo ratings yet

- Shree Edited Gaurav 1 BlackbookDocument52 pagesShree Edited Gaurav 1 BlackbookATHARVA KNo ratings yet

- Algorithm Trading in Indian Financial MarketsDocument3 pagesAlgorithm Trading in Indian Financial MarketswakhanNo ratings yet

- Powering Your Success, Your Way.: Business Solutions Built For YouDocument8 pagesPowering Your Success, Your Way.: Business Solutions Built For YouNYSE TechnologiesNo ratings yet

- Topic: Algo Trading Concepts, Trends and The Regulatory Environment in IndiaDocument12 pagesTopic: Algo Trading Concepts, Trends and The Regulatory Environment in IndiaAryan MaheshwariNo ratings yet

- MBA Analytics For Finance 13Document10 pagesMBA Analytics For Finance 13JOJONo ratings yet

- Algo TradingDocument128 pagesAlgo TradingdishaNo ratings yet

- Machine Learning Algorithms For Stock Market PredictionDocument7 pagesMachine Learning Algorithms For Stock Market PredictionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Blue & Dark Modern Cryptocurrency Presentation TemplateDocument11 pagesBlue & Dark Modern Cryptocurrency Presentation TemplateharshNo ratings yet

- Targit Corporate PresentationDocument27 pagesTargit Corporate PresentationsowmikchakravertyNo ratings yet

- Stock Trading AssistantDocument6 pagesStock Trading Assistantyash.makwana.aiNo ratings yet

- Algo Trading - Group 8Document10 pagesAlgo Trading - Group 8harshNo ratings yet

- REDI Platform OverviewDocument1 pageREDI Platform OverviewtuhinaNo ratings yet

- HTTPS://WWW - Cryptoalertscam.com/instant Max Ai ReviewDocument10 pagesHTTPS://WWW - Cryptoalertscam.com/instant Max Ai Reviewlockie-fergusonNo ratings yet

- Cisco Trading FabricDocument1 pageCisco Trading FabrickkkkhineNo ratings yet

- INTRODUCTIONDocument10 pagesINTRODUCTIONharshNo ratings yet

- Financial Domain: Technology inDocument18 pagesFinancial Domain: Technology inRonitsinghthakur SinghNo ratings yet

- Xopenhub Technology OfferDocument19 pagesXopenhub Technology OfferFebrian RamadaniNo ratings yet

- E TerramarketmanagerDocument2 pagesE TerramarketmanagerEbrahim ArzaniNo ratings yet

- Protrader Presentation WebDocument30 pagesProtrader Presentation WebraviNo ratings yet

- TESADocument4 pagesTESAAhsan DidarNo ratings yet

- MTR BrochureDocument16 pagesMTR BrochureSudhakarNo ratings yet

- SuperTrade Product SheetDocument2 pagesSuperTrade Product SheetNYSE TechnologiesNo ratings yet

- Vijit Survey PaperDocument6 pagesVijit Survey PaperHimanshu GaurNo ratings yet

- WWW Mt4greylabel Com Meta-Trader-5Document9 pagesWWW Mt4greylabel Com Meta-Trader-5Mt4 Grey LabelNo ratings yet

- Ankush KattarmalDocument2 pagesAnkush KattarmalD CNo ratings yet

- Algo Trading Intro 2013 Steinki Session 8 PDFDocument21 pagesAlgo Trading Intro 2013 Steinki Session 8 PDFProfitiserNo ratings yet

- Getting Started With R TraderDocument38 pagesGetting Started With R TraderNem ProdutorNo ratings yet

- Strata The Open Source Java Library For Market Risk Stephen ColebourneDocument64 pagesStrata The Open Source Java Library For Market Risk Stephen ColebournesudotesterNo ratings yet

- Rev 20 e 05Document7 pagesRev 20 e 05rrrNo ratings yet

- A Survey On Computer Automated Trading in Indian Stock MarketsDocument10 pagesA Survey On Computer Automated Trading in Indian Stock MarketsTJPRC PublicationsNo ratings yet

- EzeSoft EMS Overview A4Document3 pagesEzeSoft EMS Overview A4Huang FerryNo ratings yet

- A Survey On Computer Automated Trading in Indian Stock MarketsDocument10 pagesA Survey On Computer Automated Trading in Indian Stock MarketsVamsi KrishnaNo ratings yet

- Treasury Brochure LatestDocument8 pagesTreasury Brochure Latestjalajsingh19877605No ratings yet

- Bestxek: HCL Product EngineeringDocument6 pagesBestxek: HCL Product Engineeringmsu chennaiNo ratings yet

- Seminar Report - Algorithmic TradingDocument32 pagesSeminar Report - Algorithmic TradingHarshal LolgeNo ratings yet

- Multi Asset Market Simulator January 2023Document2 pagesMulti Asset Market Simulator January 2023depotvtdNo ratings yet

- Machine Learning Classification of Price Extrema BDocument25 pagesMachine Learning Classification of Price Extrema BJialin XingNo ratings yet

- Algo-Trading Research PaperDocument20 pagesAlgo-Trading Research Papermartinrigan992No ratings yet

- StabilityDocument2 pagesStabilityAhmad MukarramNo ratings yet

- Lecture1 PDFDocument60 pagesLecture1 PDFron9123No ratings yet

- Improving Stock Trend Prediction Using LSTM Neural Network Trained On A Complex Trading StrategyDocument13 pagesImproving Stock Trend Prediction Using LSTM Neural Network Trained On A Complex Trading StrategyIJRASETPublicationsNo ratings yet

- An Automatic Stock Trading System Using Particle Swarm Optimization (2017)Document4 pagesAn Automatic Stock Trading System Using Particle Swarm Optimization (2017)Gonza NNo ratings yet

- MX.3 For FX Cash TradingDocument2 pagesMX.3 For FX Cash TradingSibashis Mishra100% (1)

- DartstockDocument5 pagesDartstockstrignentNo ratings yet

- Algo Traders Conference - MumbaiDocument282 pagesAlgo Traders Conference - MumbaiAshutosh GuptaNo ratings yet

- An Ensembling Architecture Incorporating Machine LDocument25 pagesAn Ensembling Architecture Incorporating Machine LLong Trần QuangNo ratings yet

- Efficiency of Algorithmic Trading in Modern MarketsDocument5 pagesEfficiency of Algorithmic Trading in Modern MarketsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- MIS 501 Assignment 1Document7 pagesMIS 501 Assignment 1Fakhrul IslamNo ratings yet

- SnapEx Deck V1.016964Document20 pagesSnapEx Deck V1.016964Trần Đỗ Trung MỹNo ratings yet

- Low Latency Library For HFT-Algo-Logic-4831a009Document8 pagesLow Latency Library For HFT-Algo-Logic-4831a009Bo FerrisNo ratings yet

- Trading Tactics in the Financial Market: Mathematical Methods to Improve PerformanceFrom EverandTrading Tactics in the Financial Market: Mathematical Methods to Improve PerformanceNo ratings yet

- LMESelect 9.4 FIX Specification v1.2Document112 pagesLMESelect 9.4 FIX Specification v1.2msu chennaiNo ratings yet

- Code Promotion ModelDocument13 pagesCode Promotion Modelmsu chennaiNo ratings yet

- White Paper Architects Guide To Implementing Event Driven ArchitectureDocument31 pagesWhite Paper Architects Guide To Implementing Event Driven Architecturemsu chennaiNo ratings yet

- Portfolio Builder User GuideDocument33 pagesPortfolio Builder User Guidemsu chennaiNo ratings yet

- Lifetime Support Middleware 069163Document70 pagesLifetime Support Middleware 069163msu chennaiNo ratings yet

- Design Your Trading Strategies : Optimize, Analyze and Go LiveDocument2 pagesDesign Your Trading Strategies : Optimize, Analyze and Go Livemsu chennaiNo ratings yet

- Endeavone EMS BrochureDocument13 pagesEndeavone EMS Brochuremsu chennaiNo ratings yet

- Big Data Open Source ToolsDocument1 pageBig Data Open Source Toolsmsu chennaiNo ratings yet

- Basket Orders: ExampleDocument3 pagesBasket Orders: Examplemsu chennaiNo ratings yet

- Latency Imperatives and ImplicationsDocument21 pagesLatency Imperatives and Implicationsmsu chennaiNo ratings yet

- Bestxek: HCL Product EngineeringDocument6 pagesBestxek: HCL Product Engineeringmsu chennaiNo ratings yet

- Arrows Merging Concept: This Is A Sample Text. You Can Edit Here. This Is A Sample Text. You Can Edit HereDocument6 pagesArrows Merging Concept: This Is A Sample Text. You Can Edit Here. This Is A Sample Text. You Can Edit Heremsu chennaiNo ratings yet

- APN Partner Project Plan TemplateDocument8 pagesAPN Partner Project Plan Templatemsu chennaiNo ratings yet

- Chemical Reactions Equations Chapter-Wise Important Questions Class 10 Science - LearnCBSE - in PDFDocument23 pagesChemical Reactions Equations Chapter-Wise Important Questions Class 10 Science - LearnCBSE - in PDFmsu chennaiNo ratings yet

- Demat Account Literature ReviewDocument6 pagesDemat Account Literature Reviewc5hc4kgx100% (1)

- Form 8 Particulars of Alteration in The Stated Capital of A CompanyDocument1 pageForm 8 Particulars of Alteration in The Stated Capital of A CompanyKroos DominicNo ratings yet

- Course Title: Course Code: CSIT660 Credit Units: 3 Level: PGDocument4 pagesCourse Title: Course Code: CSIT660 Credit Units: 3 Level: PGAkash Singh RajputNo ratings yet

- Numericals On Capital Budgeting TechniquesDocument5 pagesNumericals On Capital Budgeting TechniquesKritikaNo ratings yet

- HBO Syllabus 1Document9 pagesHBO Syllabus 1Json FranciscoNo ratings yet

- 13 Ortega Vs CA, GR No. 109248, July 3, 1995 PDFDocument9 pages13 Ortega Vs CA, GR No. 109248, July 3, 1995 PDFMark Emmanuel LazatinNo ratings yet

- Shangri-La VS Developers Case DigestDocument2 pagesShangri-La VS Developers Case DigestCL GeduquioNo ratings yet

- MidtermExam VillanuevaDocument7 pagesMidtermExam VillanuevaJustine Sto. DomingoNo ratings yet

- Roles of SSI in EconomyDocument5 pagesRoles of SSI in EconomyMr JainNo ratings yet

- Chapter 1 Solution of RoboticsDocument4 pagesChapter 1 Solution of RoboticsEngr ShabirNo ratings yet

- Braun & Koddenbrock (Eds.) - Capital Claims. Power and Global Finance (2023)Document283 pagesBraun & Koddenbrock (Eds.) - Capital Claims. Power and Global Finance (2023)mrdesignNo ratings yet

- CivPro Atty. Custodio Case DigestsDocument12 pagesCivPro Atty. Custodio Case DigestsRachel CayangaoNo ratings yet

- What Is A Tangible Asset Comparison To Non-Tangible AssetsDocument7 pagesWhat Is A Tangible Asset Comparison To Non-Tangible AssetshieutlbkreportNo ratings yet

- Chapter-3 Electronic Data Interchange (EDI)Document23 pagesChapter-3 Electronic Data Interchange (EDI)Suman BhandariNo ratings yet

- Department of Education - Division of PalawanDocument27 pagesDepartment of Education - Division of PalawanJasmen Garnado EnojasNo ratings yet

- BanksDocument34 pagesBanksabhikaamNo ratings yet

- Load Chart Givaudan DG PDFDocument1 pageLoad Chart Givaudan DG PDFMuhammad Ghazaly HatalaNo ratings yet

- Unified GCI Form - V2021.0063.01 - Personal Financing - Tawarruq - App Form - V2021.0063.01-ENGDocument9 pagesUnified GCI Form - V2021.0063.01 - Personal Financing - Tawarruq - App Form - V2021.0063.01-ENGYue Wen TradingNo ratings yet

- Quote - Q2045201Document2 pagesQuote - Q2045201makhanyasibusisiwe7No ratings yet

- Empire Title Complaint 09-30-2010Document40 pagesEmpire Title Complaint 09-30-2010OAITANo ratings yet

- Cissp 2Document6 pagesCissp 2Ahmed FikreyNo ratings yet

- HEICO - WikipediaDocument10 pagesHEICO - WikipediaNUTHI SIVA SANTHANNo ratings yet

- Business Plan Presentation V4Document40 pagesBusiness Plan Presentation V4Shakil Jowad RahimNo ratings yet

- Factors Affecting Industrial RelationsDocument11 pagesFactors Affecting Industrial Relationsdeep_archesh88% (33)

- Sustainability 10 03791 v2Document15 pagesSustainability 10 03791 v2João Gabriel DuarteNo ratings yet

- 3.internal AuditingDocument38 pages3.internal AuditingyebegashetNo ratings yet

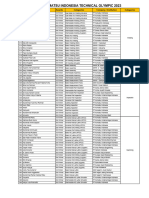

- 12th All Komatsu Indonesia Technical Olympic 2022 Official ResultDocument2 pages12th All Komatsu Indonesia Technical Olympic 2022 Official ResultMarchal KawengianNo ratings yet