Professional Documents

Culture Documents

1 Annual Tanglaw Cup Case Study Competition

1 Annual Tanglaw Cup Case Study Competition

Uploaded by

Dominic Dela VegaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 Annual Tanglaw Cup Case Study Competition

1 Annual Tanglaw Cup Case Study Competition

Uploaded by

Dominic Dela VegaCopyright:

Available Formats

1st ANNUAL TANGLAW CUP

Case Study Competition

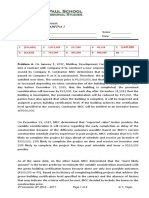

You are the manager responsible for the annual audit of GALYON Corp (GC) for the year

ending 31 December 2021. GC is a listed company and is engaged in the business of

construction, renting and selling of apartments and office buildings to individuals,

businesses and government departments.

Extracts from GC’s draft Profit and Loss Account are as follows:

2021 2020

Revenue 1,520,000.00 1,883,000.00

Operating Expenses 1,165,000.00 1,470,000.00

Operating Profit 355,000.00 413,000.00

225,000

Financial Charges 190,000.00 ?

Before Tax Profit ? 165,000 188,000.00

During the planning stage, the audit team has presented the following points for your

consideration:

i. On 31 January 2022 tenancy agreements of office buildings rented to municipal

corporations in 15 small cities in the province of Sindh, are expiring. The

concerned departments have informed GC that they would not renew the

agreements. These properties are also held as security with the company’s

bankers. Disclosure

Provision not contingent liability. Recognize as Expense

In August 2021, an apartment block which was completed and sold in 2017 was severely

damaged in an earthquake. The residents have filed a claim for damages against GC

amounting to Php400,000. The company denies any liability in this regard. However, to

maintain its goodwill GC has agreed to compensate the residents by making a payment of

Php100,000 in four quarterly instalments and accordingly this amount has been provided in

the accounts. The residents have rejected the offer and filed a suit against the company.

ii. During the year, construction equipment costing Php300,000 was acquired on lease. The

lease rentals were allocated to the contracts on the basis of time utilized. Lease rentals

pertaining to idle time were charged to financial expenses. Insert under Operating Expenses

iii. During the year GC sold a two-story office building to ANN Limited. According to the

contract of sale, GC is entitled to construct further offices on the third and fourth floors.

Required:

1. Audit Plan Considerations

2. Audit Procedures to Consider

3. Identify the audit risks that exist in the above scenarios and describe the manner in

which you would address those risks.

Revenue: two-story

Construct: to enter as long term CIP in case company entered as Revenue already

You might also like

- iQMS IT QuizzDocument2 pagesiQMS IT QuizzGopakumar K86% (7)

- Afar Construction Contracts PDFDocument10 pagesAfar Construction Contracts PDFArah Opalec0% (1)

- Angkas PresentationDocument10 pagesAngkas PresentationDominic Dela Vega100% (1)

- AFAR Self Test - 9002Document7 pagesAFAR Self Test - 9002Jennifer RueloNo ratings yet

- Syllabus - INTAUD1 - Audting Theory and Practice - T3 - 2021Document9 pagesSyllabus - INTAUD1 - Audting Theory and Practice - T3 - 2021Dominic Dela VegaNo ratings yet

- Quiz Long Term ContractsDocument7 pagesQuiz Long Term ContractsDeanna GicaleNo ratings yet

- ASSIGNMENT in Financial Accounting For QS ProjectsDocument9 pagesASSIGNMENT in Financial Accounting For QS ProjectsFahmy KfNo ratings yet

- Long-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Document5 pagesLong-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Divine Cuasay100% (1)

- Long Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF FreeDocument5 pagesLong Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF FreeMichael Brian TorresNo ratings yet

- Long-Term Construction Contracts (Pfrs 15) : Start of DiscussionDocument3 pagesLong-Term Construction Contracts (Pfrs 15) : Start of DiscussionErica DaprosaNo ratings yet

- Ap02 Error Corrections and Accounting ChangesDocument2 pagesAp02 Error Corrections and Accounting ChangesJean Fajardo BadilloNo ratings yet

- Assumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceDocument4 pagesAssumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceAireyNo ratings yet

- LTCC Pas11Document1 pageLTCC Pas11Anna CharlotteNo ratings yet

- 71484bos57500 p5Document30 pages71484bos57500 p5KingNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- CA Inter Adv Accounts Suggested Answer May 2022Document30 pagesCA Inter Adv Accounts Suggested Answer May 2022BILLU-YTNo ratings yet

- CAF 5 FAR2 Spring 2022Document7 pagesCAF 5 FAR2 Spring 2022Ushna RajputNo ratings yet

- 04 Construction ContractsDocument3 pages04 Construction ContractsJoshua HonraNo ratings yet

- Module 14 Jun 2022questionDocument10 pagesModule 14 Jun 2022questionLove YanNo ratings yet

- Problems - Construction ContractDocument2 pagesProblems - Construction ContractAbby Gail TiongsonNo ratings yet

- Quiz No. 2Document3 pagesQuiz No. 2abbyNo ratings yet

- 02 FAR02 Accounting-for-ReceivablesDocument3 pages02 FAR02 Accounting-for-ReceivablesBea GarciaNo ratings yet

- AUDIT & ASSURANCE - ND-2022 - QuestionDocument7 pagesAUDIT & ASSURANCE - ND-2022 - QuestionTamzid Ahmed AnikNo ratings yet

- FAR MA-2023 QuestionDocument4 pagesFAR MA-2023 QuestionMd HasanNo ratings yet

- Cuac208 Tests and AssignmentsDocument8 pagesCuac208 Tests and AssignmentsInnocent GwangwaraNo ratings yet

- MTP 3 14 Questions 1680520270Document7 pagesMTP 3 14 Questions 1680520270Umar MalikNo ratings yet

- Actual Estimated Contract Percent Project No. Cost Total Cost Price CompleteDocument10 pagesActual Estimated Contract Percent Project No. Cost Total Cost Price CompleteRalph Renz CastilloNo ratings yet

- Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingDocument75 pagesTest Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- Afar 3Document7 pagesAfar 3Diana Faye CaduadaNo ratings yet

- Final Exam in Advanced Financial Accounting IDocument6 pagesFinal Exam in Advanced Financial Accounting IYander Marl BautistaNo ratings yet

- TAX PLANNING & COMPLIANCE - MA-2022 - QuestionDocument6 pagesTAX PLANNING & COMPLIANCE - MA-2022 - QuestionsajedulNo ratings yet

- Construction ContractsDocument4 pagesConstruction ContractsAnjelica MarcoNo ratings yet

- BF 220 Test One PracticeDocument2 pagesBF 220 Test One PracticePrince Daniels TutorNo ratings yet

- Acctg For Special Transaction - 3rd Lesson PDFDocument9 pagesAcctg For Special Transaction - 3rd Lesson PDFDebbie Grace Latiban LinazaNo ratings yet

- Long Term Construction Contract AssignmentDocument2 pagesLong Term Construction Contract Assignmentcali cdNo ratings yet

- Audit & Assurance - Ja-2023 - QuestionDocument5 pagesAudit & Assurance - Ja-2023 - QuestionMd Jakaria Md JakariaNo ratings yet

- Acctg 205B Prelim ExamDocument1 pageAcctg 205B Prelim ExamBella AyabNo ratings yet

- (EN) Problem Mojakoe AK1Document11 pages(EN) Problem Mojakoe AK1gebbyNo ratings yet

- Construction ContractttttDocument6 pagesConstruction ContractttttMARTINEZ, EmilynNo ratings yet

- ACP323 Audit of Iib and Ppe ReviewerDocument4 pagesACP323 Audit of Iib and Ppe ReviewerFRAULIEN GLINKA FANUGAONo ratings yet

- Practice Exercise 1.1Document4 pagesPractice Exercise 1.1leshz zynNo ratings yet

- 9206 - Long-Term Construction Contracts - Test Bank & ReviewerDocument4 pages9206 - Long-Term Construction Contracts - Test Bank & ReviewerspaynanteNo ratings yet

- Ar21 22Document164 pagesAr21 22abdulraheem18822No ratings yet

- 1 2 3 4 5 6 7 8 MergedDocument78 pages1 2 3 4 5 6 7 8 MergedKartik GuptaNo ratings yet

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- Prelimx No AnswersDocument7 pagesPrelimx No Answerscarl fuerzasNo ratings yet

- Special Revenue Recognition Special Revenue RecognitionDocument4 pagesSpecial Revenue Recognition Special Revenue RecognitionCee Gee BeeNo ratings yet

- 2022 FIA132 Term Test 1 FinalDocument9 pages2022 FIA132 Term Test 1 FinalkaityNo ratings yet

- Fragment M 11Document7 pagesFragment M 11sm munNo ratings yet

- Darshini Mariappan Far 4Document10 pagesDarshini Mariappan Far 4darshini mariappanNo ratings yet

- CA Inter Adv Accounts RTP May22Document46 pagesCA Inter Adv Accounts RTP May22katheharsh183No ratings yet

- Toaz - Info Afar Reviewer PRDocument10 pagesToaz - Info Afar Reviewer PRLiliNo ratings yet

- Week 03 - Accounts ReceivablesDocument4 pagesWeek 03 - Accounts ReceivablesPj ManezNo ratings yet

- HW On ReceivablesDocument4 pagesHW On ReceivablesGian Carlo RamonesNo ratings yet

- May 2020 Error SHE Intangibles Liabilities LeasesDocument14 pagesMay 2020 Error SHE Intangibles Liabilities Leasesiraleigh17No ratings yet

- Final FAR-2 Mock Q. PaperDocument6 pagesFinal FAR-2 Mock Q. PaperAli OptimisticNo ratings yet

- PL FA&R Class SummaryDocument12 pagesPL FA&R Class SummaryRazib DasNo ratings yet

- CACC021 CF - Questions (2023)Document10 pagesCACC021 CF - Questions (2023)ShantellNo ratings yet

- HaloCrypto Cumulative Case Tutorial QuestionsDocument6 pagesHaloCrypto Cumulative Case Tutorial QuestionsLim ShawnNo ratings yet

- LTCC SeatworkDocument2 pagesLTCC SeatworkCaselyn Clyde UyNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Decis I On - .: PhilippineDocument15 pagesDecis I On - .: PhilippineDominic Dela VegaNo ratings yet

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- FIRST INTEGRATION EXAM - 3rd Term 20-21Document14 pagesFIRST INTEGRATION EXAM - 3rd Term 20-21Dominic Dela VegaNo ratings yet

- The Next President:: Alex Dominic ChuaDocument40 pagesThe Next President:: Alex Dominic ChuaDominic Dela VegaNo ratings yet

- Quotation: FOR SK350 EXCAVATOR (L-172) LAST ISSUE DATE:-30/07/2023 Req by Kelum/FathuDocument1 pageQuotation: FOR SK350 EXCAVATOR (L-172) LAST ISSUE DATE:-30/07/2023 Req by Kelum/FathuVimal RajNo ratings yet

- EnglishFile4e Upp-Int TG PCM Comm RevisionDocument1 pageEnglishFile4e Upp-Int TG PCM Comm RevisionletimanfrediNo ratings yet

- Central Bank and Its EvolutionDocument6 pagesCentral Bank and Its EvolutionSadia AshadNo ratings yet

- Adverse Claim CamposDocument3 pagesAdverse Claim CamposEdmundo ManlapaoNo ratings yet

- L-MMJK-RHJK-13-0034 Date 03 May 13 - Self - Assessment NotificationDocument3 pagesL-MMJK-RHJK-13-0034 Date 03 May 13 - Self - Assessment NotificationAgung Tri SugihartoNo ratings yet

- Homework Monitoring SystemDocument6 pagesHomework Monitoring Systemafnangetppyqes100% (1)

- Introduction To Management Semester 2 2021 Case Study: Happy CoffeeDocument2 pagesIntroduction To Management Semester 2 2021 Case Study: Happy CoffeeNgoc NguyenNo ratings yet

- Journal - Vikri Alif PDocument14 pagesJournal - Vikri Alif PVikri AlifNo ratings yet

- Ways To Become Successful On UpworkDocument2 pagesWays To Become Successful On Upworkhely shahNo ratings yet

- Premium Woven Sand Control Screens For Oil and Gas ExplorationDocument16 pagesPremium Woven Sand Control Screens For Oil and Gas ExplorationDIEGO ALEJANDRO PARRA GARRIDO100% (1)

- Morgan 2009Document9 pagesMorgan 2009Atelier Adina ConstantinescuNo ratings yet

- Pre-Feasibility Study: Departmental StoreDocument21 pagesPre-Feasibility Study: Departmental StoreWaqarNo ratings yet

- Sustainable Design PrinciplesDocument15 pagesSustainable Design PrinciplesyaraNo ratings yet

- FRBM ActDocument8 pagesFRBM ActTanvi ShahNo ratings yet

- BA2088 - Lecture 7 Corporate Credit VI - Credit Facilities (Long-Term) & Programme Lending (SME) & Green FinanceDocument44 pagesBA2088 - Lecture 7 Corporate Credit VI - Credit Facilities (Long-Term) & Programme Lending (SME) & Green FinancekeuqNo ratings yet

- Sr. No. Paper Type Part Sem Paper Code Paper NameDocument7 pagesSr. No. Paper Type Part Sem Paper Code Paper Nameshiv mishraNo ratings yet

- Contract Acceptance LetterDocument4 pagesContract Acceptance LetterMoriah BolfordNo ratings yet

- Mohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingDocument7 pagesMohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingMohsin HassanNo ratings yet

- Math 10-3 Unit 1.4 Worksheet - Sales 2018-19 W - KEYDocument8 pagesMath 10-3 Unit 1.4 Worksheet - Sales 2018-19 W - KEYBob SmynameNo ratings yet

- Form G: Application For Admission/transfer To Graduate MembershipDocument4 pagesForm G: Application For Admission/transfer To Graduate MembershipcrayonleeNo ratings yet

- BEDocument14 pagesBENguyễn Phương UyênNo ratings yet

- RPT Sanction EPayment DetailsDocument4 pagesRPT Sanction EPayment DetailsTYCS35 SIDDHESH PENDURKARNo ratings yet

- Spic+Pinnacle English Short Version v6.2Document25 pagesSpic+Pinnacle English Short Version v6.2Best MedanNo ratings yet

- Are Audit Partners' Compensation and Audit Quality Related ToDocument25 pagesAre Audit Partners' Compensation and Audit Quality Related TobannourmeriemNo ratings yet

- FTI Tech Trends 2022 AIDocument73 pagesFTI Tech Trends 2022 AISabina vlaicuNo ratings yet

- Contemporary World - Activity 3Document3 pagesContemporary World - Activity 3Emily Despabiladeras Dulpina100% (2)

- VIFO To Tech in Asia CompetitionDocument14 pagesVIFO To Tech in Asia CompetitionVuong Viet LinhNo ratings yet

- Jurnal Vol 8 No 1 ZainiDocument8 pagesJurnal Vol 8 No 1 ZainiWahyu TriNo ratings yet

- CCH Tagetik Workforce Planning EN June 2020Document2 pagesCCH Tagetik Workforce Planning EN June 2020Hoanganh SetupNo ratings yet