Professional Documents

Culture Documents

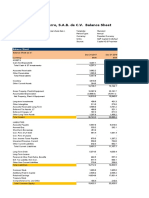

CapitaLand Limited SGX C31 Financials Income Statement

CapitaLand Limited SGX C31 Financials Income Statement

Uploaded by

Elvin TanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CapitaLand Limited SGX C31 Financials Income Statement

CapitaLand Limited SGX C31 Financials Income Statement

Uploaded by

Elvin TanCopyright:

Available Formats

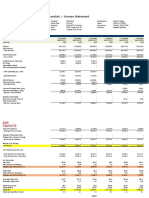

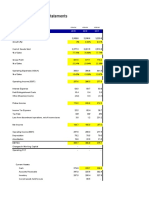

CapitaLand Limited (SGX:C31) > Financials > Income Statement

In Millions of the reported currency, except per share items. Template: Real Estate Restatement: Latest Filings

Period Type: Annual Order: Latest on Right

Currency: Reported Currency Conversion: Historical

Units: S&P Capital IQ (Defaul Decimals: Capital IQ (Default)

Source: Capital IQ & Proprieta

Income Statement

Restated Press Release

For the Fiscal Period Ending 12 months 12 months 12 months 12 months

Dec-31-2017 Dec-31-2018 Dec-31-2019 Dec-31-2020

Currency SGD SGD SGD SGD

Rental Revenue 4,618.2 5,602.4 6,234.8 6,532.6

Tenant Reimbursements - - - -

Other Revenue - - - -

Total Revenue 4,618.2 5,602.4 6,234.8 6,532.6

Property Exp. 2,594.1 2,913.0 3,235.0 3,613.3

Selling General & Admin Exp. 423.0 450.7 565.2 605.4

Depreciation & Amort. - - - -

Amort. of Goodwill and Intangibles - - - -

Other Operating Exp. 12.0 (13.6) (108.8) 2,134.1

Total Operating Exp. 3,029.1 3,350.1 3,691.4 6,352.8

Operating Income 1,589.1 2,252.3 2,543.4 179.8

Interest Expense, Total (437.8) (616.8) (830.4) (913.1)

Interest and Invest. Income 68.1 97.6 108.0 -

Net Interest Exp. (369.7) (519.2) (722.3) (913.1)

Income/(Loss) from Affiliates 882.3 959.4 988.8 51.7

Currency Exchange Gains (Loss) 7.9 (9.0) (38.2) -

Other Non-Operating Inc. (Exp.) (48.9) (19.7) (8.8) -

EBT Excl. Unusual Items 2,060.8 2,663.8 2,762.8 (681.7)

Total Merger & Rel. Restruct. Charges - - (43.5) -

Impairment of Goodwill 26.9 - - -

Gain (Loss) on Sale of Invest. 6.3 (1.6) 17.5 -

Gain (Loss) On Sale Of Assets 257.6 120.9 125.4 -

Asset Writedown 305.1 676.1 1,147.7 -

Other Unusual Items 158.8 49.3 218.5 -

EBT Incl. Unusual Items 2,815.5 3,508.5 4,228.5 (681.7)

Income Tax Expense 469.0 658.7 814.8 953.5

Earnings from Cont. Ops. 2,346.6 2,849.8 3,413.6 (1,635.1)

Earnings of Discontinued Ops. - - - -

Extraord. Item & Account. Change - - - -

Net Income to Company 2,346.6 2,849.8 3,413.6 (1,635.1)

Minority Int. in Earnings (777.0) (1,087.3) (1,277.7) 60.9

Net Income 1,569.6 1,762.5 2,135.9 (1,574.3)

Pref. Dividends and Other Adj. - - - -

NI to Common Incl Extra Items 1,569.6 1,762.5 2,135.9 (1,574.3)

NI to Common Excl. Extra Items 1,569.6 1,762.5 2,135.9 (1,574.3)

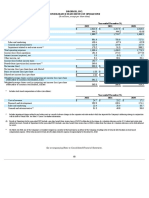

Per Share Items

Basic EPS 0.37 0.42 0.46 NA

Basic EPS Excl. Extra Items 0.37 0.42 0.46 NA

Weighted Avg. Basic Shares Out. 4,245.6 4,191.3 4,607.8 NA

Diluted EPS 0.34 0.39 0.44 NA

Diluted EPS Excl. Extra Items 0.34 0.39 0.44 NA

Weighted Avg. Diluted Shares Out. 4,742.1 4,705.6 5,004.1 NA

Normalized Basic EPS 0.12 0.14 0.1 NA

Normalized Diluted EPS 0.11 0.12 0.09 NA

Dividends per Share 0.12 0.12 0.12 0.09

Payout Ratio % 27.1% 28.6% 23.5% NM

Shares per Depository Receipt 2.0 2.0 2.0 2.0

Supplemental Items

FFO NA NA NA NA

EBITDA 1,665.4 2,326.8 2,642.1 359.5

EBITA 1,596.1 2,263.5 2,561.8 202.7

EBIT 1,589.1 2,252.3 2,543.4 179.8

EBITDAR 1,795.2 2,544.9 2,895.4 NA

Effective Tax Rate % 16.7% 18.8% 19.3% NM

Total Current Taxes 273.8 393.6 437.0 -

Total Deferred Taxes 24.0 11.8 77.0 -

Normalized Net Income 510.9 577.6 449.0 (365.2)

Interest Capitalized 67.1 64.5 87.4 NA

Interest on Long Term Debt 261.6 335.0 380.3 NA

Filing Date Mar-17-2019 Apr-05-2020 Apr-05-2020 Feb-23-2021

Restatement Type RS NC O P

Calculation Type REP REP REP REP

Supplemental Operating Expense Items

General and Administrative Exp. 409.6 438.0 559.3 605.4

Net Rental Exp. 129.8 218.1 253.4 NA

Imputed Oper. Lease Interest Exp. 28.1 51.7 66.7 -

Imputed Oper. Lease Depreciation 101.8 166.4 186.7 -

Stock-Based Comp., Unallocated 55.3 50.4 66.7 36.8

Stock-Based Comp., Total 55.3 50.4 66.7 36.8

Note: For multiple class companies, per share items are primary class equivalent, and for foreign companies listed as primary ADRs, per share items are ADR-equivalent.

You might also like

- Introduction To Managerial EconomicsDocument48 pagesIntroduction To Managerial EconomicsSajid RehmanNo ratings yet

- Homework Chapter 4Document17 pagesHomework Chapter 4Trung Kiên Nguyễn100% (1)

- Go Digit General Insurance Limited Financials Income StatementDocument3 pagesGo Digit General Insurance Limited Financials Income StatementShuchita AgarwalNo ratings yet

- Pidilite Industries Limited BSE 500331 Financials Income StatementDocument4 pagesPidilite Industries Limited BSE 500331 Financials Income StatementRehan TyagiNo ratings yet

- P-H-O-E-N-I-X Petroleum Philippines, Inc. (PSE:PNX) Financials Income StatementDocument12 pagesP-H-O-E-N-I-X Petroleum Philippines, Inc. (PSE:PNX) Financials Income StatementDave Emmanuel SadunanNo ratings yet

- Grupo Lala S A B de C V BMV LALA B Financials Cash FlowDocument4 pagesGrupo Lala S A B de C V BMV LALA B Financials Cash FlowElda AlemanNo ratings yet

- PI Industries Limited BSE 523642 Financials Income StatementDocument4 pagesPI Industries Limited BSE 523642 Financials Income StatementRehan TyagiNo ratings yet

- Cash Flow Analysis Col Pal 13-07-2023Document17 pagesCash Flow Analysis Col Pal 13-07-2023RohitNo ratings yet

- Cashflow Statement PSODocument4 pagesCashflow Statement PSOMaaz HanifNo ratings yet

- Tarea Razones RentabilidadDocument12 pagesTarea Razones RentabilidadEmilio BazaNo ratings yet

- 2018-Annual-Report Selected PagesDocument11 pages2018-Annual-Report Selected PagesLuis David BriceñoNo ratings yet

- 2021AnnualReport FINAL 39 43Document5 pages2021AnnualReport FINAL 39 43Wilson BastidasNo ratings yet

- Target FinancalDocument4 pagesTarget Financalnguyenchi1310No ratings yet

- PN Industry Performance As of The Quarter Ending December 31Document3 pagesPN Industry Performance As of The Quarter Ending December 31antonette mendozaNo ratings yet

- 12 Coca-Cola Item8Document62 pages12 Coca-Cola Item8prabhat127No ratings yet

- Nyse Ryn 2022Document170 pagesNyse Ryn 2022Boban CelebicNo ratings yet

- Trent LTD - 2023.06.03Document34 pagesTrent LTD - 2023.06.03pulkitnarang1606No ratings yet

- Hong Fok Corporation Limited: Revenue (Note 1)Document10 pagesHong Fok Corporation Limited: Revenue (Note 1)Theng RogerNo ratings yet

- Trent LTD - 2023.07.01Document34 pagesTrent LTD - 2023.07.01pulkitnarang1606No ratings yet

- ABC Cement FM (Final)Document24 pagesABC Cement FM (Final)Muhammad Ismail (Father Name:Abdul Rahman)No ratings yet

- Ai CF 14-15Document1 pageAi CF 14-15subhash dalviNo ratings yet

- Flujo de Caja AaplDocument9 pagesFlujo de Caja AaplPablo Alejandro JaldinNo ratings yet

- Net Revenue $ 15,301 $ 16,883 $ 14,950 Operating Expenses: Consolidated Statement of OperationsDocument1 pageNet Revenue $ 15,301 $ 16,883 $ 14,950 Operating Expenses: Consolidated Statement of OperationsMaanvee JaiswalNo ratings yet

- Flujo de Caja NvtaDocument14 pagesFlujo de Caja NvtaPablo Alejandro JaldinNo ratings yet

- In Millions of Euros, Except For Per Share DataDocument33 pagesIn Millions of Euros, Except For Per Share DataGrace StylesNo ratings yet

- Financial Statements Kodak Q3 2022Document3 pagesFinancial Statements Kodak Q3 2022GARCÍA GUTIERREZ NOEMINo ratings yet

- Coca Cola 18.11.22Document99 pagesCoca Cola 18.11.22Arturo Del RealNo ratings yet

- Financial AnalysisDocument6 pagesFinancial AnalysisRinceNo ratings yet

- Документ Microsoft WordDocument2 pagesДокумент Microsoft WordZaknafein999No ratings yet

- Singtel 18 Financial Statements ExcerptsDocument4 pagesSingtel 18 Financial Statements ExcerptsAayush PrakashNo ratings yet

- Apple Valuation Exercise - AAPL Financials (Annual) July 31 2020Document44 pagesApple Valuation Exercise - AAPL Financials (Annual) July 31 2020/jncjdncjdnNo ratings yet

- Flujo de Caja BngoDocument15 pagesFlujo de Caja BngoPablo Alejandro JaldinNo ratings yet

- Cash Flow Statement ConsolidatedDocument2 pagesCash Flow Statement Consolidatedsamarth rajvaidNo ratings yet

- Cash Flow Statement: For The Year Ended December 31, 2015Document2 pagesCash Flow Statement: For The Year Ended December 31, 2015Sahrish KhanNo ratings yet

- CF Export 30 11 2023Document8 pagesCF Export 30 11 2023Sayantika MondalNo ratings yet

- Estadosfinancieros FerreycorpDocument2 pagesEstadosfinancieros Ferreycorpluxi0No ratings yet

- Q2 2023 Financial SchedulesDocument30 pagesQ2 2023 Financial SchedulesVinieboy De mepperNo ratings yet

- Consolidated Statement of Cash Flows: For The Year Ended March 31, 2018Document2 pagesConsolidated Statement of Cash Flows: For The Year Ended March 31, 2018amitNo ratings yet

- Income StatementDocument1 pageIncome StatementImran HusainiNo ratings yet

- Group AssignmentDocument4 pagesGroup Assignment1954032027cucNo ratings yet

- Actividad 3.1Document27 pagesActividad 3.1David RiosNo ratings yet

- Financial Section - Annual2019-08Document11 pagesFinancial Section - Annual2019-08AbhinavHarshalNo ratings yet

- Ceat LTD (CEAT IN) - As ReportedDocument24 pagesCeat LTD (CEAT IN) - As ReportedAman SareenNo ratings yet

- RBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddDocument3 pagesRBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddFuaad DodooNo ratings yet

- Case 9Document11 pagesCase 9Nguyễn Thanh PhongNo ratings yet

- Final Project Financial ManagementDocument10 pagesFinal Project Financial ManagementMaryam SaeedNo ratings yet

- Promit Singh Rathore - 20PGPM111Document14 pagesPromit Singh Rathore - 20PGPM111mahiyuvi mahiyuviNo ratings yet

- Condensed Consolidated Statements of Income: Weighted-Average Shares Outstanding (In Millions) 4,201 4,141 4,201 4,141Document10 pagesCondensed Consolidated Statements of Income: Weighted-Average Shares Outstanding (In Millions) 4,201 4,141 4,201 4,141Annemiek BlezerNo ratings yet

- Case Study Part 1 Financial AnalysisDocument4 pagesCase Study Part 1 Financial AnalysisNikola PavlovskaNo ratings yet

- q1 09 IOL Netcom ResultsDocument1 pageq1 09 IOL Netcom ResultsmixedbagNo ratings yet

- Dufry HY 2022 ReportDocument27 pagesDufry HY 2022 ReportHaden BraNo ratings yet

- FibDocument39 pagesFibHana MokhlessNo ratings yet

- RBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Document3 pagesRBGH Financials - 31 December 2021 - Colour - 21.02.2022 (3 Full Pages)Fuaad DodooNo ratings yet

- BookDocument4 pagesBookspj1962001No ratings yet

- GR-I-Crew-II-2018-Bajaj FinanceDocument51 pagesGR-I-Crew-II-2018-Bajaj FinanceMUKESH KUMARNo ratings yet

- First Quarter Financial Statement and Dividend AnnouncementDocument9 pagesFirst Quarter Financial Statement and Dividend Announcementkelvina_8No ratings yet

- FY 2014 Consolidated Financial StatementsDocument99 pagesFY 2014 Consolidated Financial StatementsGrace StylesNo ratings yet

- Q2fy23 Investor SheetDocument13 pagesQ2fy23 Investor SheetHello Brother2No ratings yet

- Financial Statements-Kingsley AkinolaDocument4 pagesFinancial Statements-Kingsley AkinolaKingsley AkinolaNo ratings yet

- Securities Operations: A Guide to Trade and Position ManagementFrom EverandSecurities Operations: A Guide to Trade and Position ManagementRating: 4 out of 5 stars4/5 (3)

- Indemnity Bond PDFDocument3 pagesIndemnity Bond PDFPradeep RajNo ratings yet

- Advantages and Disadvantages of Sources of Finance For ExpansionDocument26 pagesAdvantages and Disadvantages of Sources of Finance For ExpansionKhushbu VarmaNo ratings yet

- Valenzuela Vs CA, December 22, 1998Document2 pagesValenzuela Vs CA, December 22, 1998Kim Arniño100% (1)

- Update Sheet For Upgrade Risk Mitigation Building-Bi-01409Document12 pagesUpdate Sheet For Upgrade Risk Mitigation Building-Bi-01409SARANGMUMBAINo ratings yet

- Predicting Flight Prices in India SectorsDocument16 pagesPredicting Flight Prices in India SectorsDeepak jaiswalNo ratings yet

- SAIKUMAR OBMMS Andhra Pradesh State OBMMS - CGGDocument3 pagesSAIKUMAR OBMMS Andhra Pradesh State OBMMS - CGGKarna Satish KumarNo ratings yet

- Torrent PharmaDocument212 pagesTorrent PharmaBharath NaniNo ratings yet

- Msci Japan IndexDocument3 pagesMsci Japan IndexSimonNo ratings yet

- BMBE Application FormDocument1 pageBMBE Application FormDoc AemiliusNo ratings yet

- Chapter 17Document24 pagesChapter 17Shiela MaeaNo ratings yet

- CPSPM 51119392 1715007813Document29 pagesCPSPM 51119392 1715007813Nittu SharmaNo ratings yet

- Berita Dan Politik: Forum Jual Beli Groupee Kaskusradio Sign inDocument2 pagesBerita Dan Politik: Forum Jual Beli Groupee Kaskusradio Sign inBob YuNo ratings yet

- 1 What Implications Do You Draw From The Graph ForDocument2 pages1 What Implications Do You Draw From The Graph ForAmit PandeyNo ratings yet

- Crossrail Project - The Evolution of An Innovation EcosystemDocument10 pagesCrossrail Project - The Evolution of An Innovation EcosystemjamotrNo ratings yet

- Abc 2Document2 pagesAbc 2nguyentuandangNo ratings yet

- 1.3.4 Sources of Business Finance-2Document31 pages1.3.4 Sources of Business Finance-2javier.mayor83No ratings yet

- India Is Largest Producer and Consumer in The World: Moot Proposition 3Document2 pagesIndia Is Largest Producer and Consumer in The World: Moot Proposition 3rishabh0% (1)

- Fs Idxhealth 2023 04Document3 pagesFs Idxhealth 2023 04Rahman AnshariNo ratings yet

- RHP of OPL Octo 27 2019 P 278Document278 pagesRHP of OPL Octo 27 2019 P 278Rumana SharifNo ratings yet

- Convention CentreDocument4 pagesConvention CentreMohd Amaan SheikhNo ratings yet

- Big Data Analytics - National Occupational Accident and Disease Statistics 2021Document9 pagesBig Data Analytics - National Occupational Accident and Disease Statistics 2021MuhamadSadiqNo ratings yet

- Potential Negative Effects in A Cashless Society 17pg.Document17 pagesPotential Negative Effects in A Cashless Society 17pg.mannysteveNo ratings yet

- Group 6 Report HandoutsDocument13 pagesGroup 6 Report HandoutsAlia Arnz-DragonNo ratings yet

- E Learning Toolkit: Summary Chapter 9Document3 pagesE Learning Toolkit: Summary Chapter 9Sarita MaliNo ratings yet

- Balabac Executive Summary 2022Document5 pagesBalabac Executive Summary 2022Gray XoxoNo ratings yet

- Total Economic Impact Asset Performance Management Power GenerationDocument34 pagesTotal Economic Impact Asset Performance Management Power GenerationSyed Asim Ur RahmanNo ratings yet

- TX Finland 2993 Scientific ResearchDocument314 pagesTX Finland 2993 Scientific ResearchivanarandiaNo ratings yet

- HTTP DR - FarkasszilveszterDocument40 pagesHTTP DR - FarkasszilveszterGud Man75% (4)