Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

72 viewsFunctions of Federal Board of Revenue

Functions of Federal Board of Revenue

Uploaded by

Rai Saif SiddiqThe document outlines the functions of the Federal Board of Revenue (FBR) related to litigation and legal matters. Key functions include approving appeals to higher courts, assigning court cases, monitoring legal advisors and advocates, and coordinating with field offices on legal matters. The FBR is also responsible for maintaining lists of pending court cases and coordinating with relevant government bodies on legal and parliamentary issues.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Local Self Government in PakistanDocument2 pagesLocal Self Government in Pakistanazqan100% (1)

- Gul Ahmed Textiles: Term ProjectDocument28 pagesGul Ahmed Textiles: Term Projectstreetfighter283No ratings yet

- Spilker TaxIndivBusEnt2019 WMDocument1,276 pagesSpilker TaxIndivBusEnt2019 WMablay logeneNo ratings yet

- Innovative Panaceas For Pakistan's Corruption Ills by M. Tariq WaseemDocument64 pagesInnovative Panaceas For Pakistan's Corruption Ills by M. Tariq WaseemAbu AbdullahNo ratings yet

- Contextualsing Extremism in Pakistan - CSS Online AcademyDocument4 pagesContextualsing Extremism in Pakistan - CSS Online AcademyTanveer EhmadNo ratings yet

- Informal Economy of PakistanDocument4 pagesInformal Economy of PakistanrokhanariazNo ratings yet

- JWT Pol ScienceDocument279 pagesJWT Pol ScienceGulali KàkârNo ratings yet

- Judicial Activism Is The Natural Corollary of Poor Governance in PakistanDocument3 pagesJudicial Activism Is The Natural Corollary of Poor Governance in PakistanSohail NasirNo ratings yet

- Essays 2015Document70 pagesEssays 2015abidnazir89877No ratings yet

- State Council of ChinaDocument2 pagesState Council of ChinaManjira Kar0% (1)

- Noori Anwar AliDocument109 pagesNoori Anwar AliCOLUMEAUNo ratings yet

- IB-492 Aman Haralalka 22IB408-Anshdha JainDocument18 pagesIB-492 Aman Haralalka 22IB408-Anshdha JainFIT-NESS BLENDERNo ratings yet

- Q 10 Feminist Movements in Pakistan (PR)Document8 pagesQ 10 Feminist Movements in Pakistan (PR)Hassan Khan100% (1)

- Autonomy Vs Integration Debate in Gender StudiesDocument4 pagesAutonomy Vs Integration Debate in Gender StudiesSheeba HabNo ratings yet

- The State Bank of Pakistan and Its FunctionsDocument4 pagesThe State Bank of Pakistan and Its Functionszaka586No ratings yet

- AJK Interim Constitution Act 1974 by Asif RajaDocument51 pagesAJK Interim Constitution Act 1974 by Asif RajaAsif Masood RajaNo ratings yet

- Job Description of Assistant CommissionerDocument3 pagesJob Description of Assistant CommissionerAgha Zeeshan Khan SoomroNo ratings yet

- Silent Features of IranDocument3 pagesSilent Features of Iranoxford- iansNo ratings yet

- Good Governance - Outline - CSS ForumsDocument2 pagesGood Governance - Outline - CSS ForumsAzeem ChaudharyNo ratings yet

- Juvenile Delinquency in PakDocument17 pagesJuvenile Delinquency in Pakwdhgwhjbdje100% (1)

- Assistant Registrar CooperativeDocument1 pageAssistant Registrar CooperativeAli Raza KaisraniNo ratings yet

- Islamiat Notes by Ayesha Younas RevisedDocument68 pagesIslamiat Notes by Ayesha Younas RevisedHumaNo ratings yet

- ICEP CSS - PMS Dawn+ 29 June, 2020 by M.Usman and Rabia Kalhoro PDFDocument17 pagesICEP CSS - PMS Dawn+ 29 June, 2020 by M.Usman and Rabia Kalhoro PDFBiYa ɱɥğȟål100% (2)

- The Creation of New Provinces in PakistanDocument2 pagesThe Creation of New Provinces in PakistanHasan TanveerNo ratings yet

- Autonomy Vs Integration Debate in Gender Studies PDFDocument4 pagesAutonomy Vs Integration Debate in Gender Studies PDFShumaila KhanNo ratings yet

- National IntegrationDocument2 pagesNational IntegrationSamina HaiderNo ratings yet

- CPEC CssDocument14 pagesCPEC CssWarda KhanNo ratings yet

- Topic Number 9 - Organization of Provincial and Local GovernmentDocument6 pagesTopic Number 9 - Organization of Provincial and Local GovernmentalikhanNo ratings yet

- 4.1 Judicial Activism in PakistanDocument5 pages4.1 Judicial Activism in PakistanArbaz KhanNo ratings yet

- What Type of Pakistan Do We NeedDocument12 pagesWhat Type of Pakistan Do We NeedmtalhanazarNo ratings yet

- M. Aslam Ch.Document655 pagesM. Aslam Ch.Ali IrtazaNo ratings yet

- Public Administration For Competitive ExamsDocument10 pagesPublic Administration For Competitive ExamsMubashir AhmadNo ratings yet

- PMS KP Past PapersDocument260 pagesPMS KP Past PapersSheraz AliNo ratings yet

- Women StudiesDocument8 pagesWomen StudiesEbaraNo ratings yet

- Civil Service of Pakistan - Protection & ReformDocument21 pagesCivil Service of Pakistan - Protection & Reformhamzashafqaat100% (1)

- Gender Studies - The CSS PointDocument2 pagesGender Studies - The CSS PointCH M AhmedNo ratings yet

- Business Administration Css NotesDocument14 pagesBusiness Administration Css NotesAnwar Khan100% (1)

- Lecture Foreign Policy of Pakistan and Its ChallengesDocument8 pagesLecture Foreign Policy of Pakistan and Its Challengesmuhammad bilal ahmedNo ratings yet

- Social Issues of Pakistan: Dated: 23 April 2019Document23 pagesSocial Issues of Pakistan: Dated: 23 April 2019Muhammad Ahmed SaleemNo ratings yet

- Syllabus of CSS PapersDocument15 pagesSyllabus of CSS PapersNida GondalNo ratings yet

- Center-Province RelationsDocument4 pagesCenter-Province RelationsAmmar HashmiNo ratings yet

- History of SOcial COnstructionismDocument6 pagesHistory of SOcial COnstructionismZarnish HussainNo ratings yet

- Centre Province Relations Pakistan 1973Document27 pagesCentre Province Relations Pakistan 1973Ehtasham KhanNo ratings yet

- IMF vs. WTO vs. World Bank - What's The Difference - Notes For CSS, PMSDocument5 pagesIMF vs. WTO vs. World Bank - What's The Difference - Notes For CSS, PMSTalbia SyedNo ratings yet

- Lecture 22 Structure of Federal GovtDocument33 pagesLecture 22 Structure of Federal GovtalikhanNo ratings yet

- Essay On Human Trafficking in PakistanDocument5 pagesEssay On Human Trafficking in PakistanAlina ChNo ratings yet

- Efficiency VS ResponsivenessDocument1 pageEfficiency VS ResponsivenessMa YaNo ratings yet

- Mukhtar MaiDocument36 pagesMukhtar MaimahNo ratings yet

- 10 Essay OutlineDocument57 pages10 Essay OutlinemubasharNo ratings yet

- Crisis of Good Governance in Pakistan Causes Impacts and RemediesDocument5 pagesCrisis of Good Governance in Pakistan Causes Impacts and RemediesRabia TufailNo ratings yet

- SBOTS 18th Batch 10 Sep 12Document2 pagesSBOTS 18th Batch 10 Sep 12Mian AttaNo ratings yet

- National Accountability BureauDocument21 pagesNational Accountability BureauAhmad JuttNo ratings yet

- New Warfronts Lie in Economic ZonesDocument11 pagesNew Warfronts Lie in Economic ZonesMuhammad USman BUzdarNo ratings yet

- Committee System in Parliament of PakistanDocument10 pagesCommittee System in Parliament of PakistanMarviSirmed100% (1)

- Chapter Wise QuestionsDocument2 pagesChapter Wise QuestionsHammad ZafarNo ratings yet

- Pakistan's National Culture Reflects Unity in Diversity. ElaborateDocument18 pagesPakistan's National Culture Reflects Unity in Diversity. ElaborateĀLįįHaiderPanhwerNo ratings yet

- 18th Amendment in Constitution of PakistanDocument3 pages18th Amendment in Constitution of PakistanMuhammad SubhaniNo ratings yet

- Does Foreign Aid Help To Achieve Economic Stability - Essay For CSSDocument7 pagesDoes Foreign Aid Help To Achieve Economic Stability - Essay For CSSIhsaan gulzarNo ratings yet

- Governance Indicators (GPP by Asad Ejaz Butt 4th Lecture) : Voice and AccountabilityDocument3 pagesGovernance Indicators (GPP by Asad Ejaz Butt 4th Lecture) : Voice and AccountabilityHafiz Farrukh IshaqNo ratings yet

- Sponsored By:: The Chanrobles GroupDocument9 pagesSponsored By:: The Chanrobles Groupbaby.torpee9117No ratings yet

- Power of The Commissioner To Interpret Tax Laws and To Decide Tax CasesDocument3 pagesPower of The Commissioner To Interpret Tax Laws and To Decide Tax CasesLovelyNo ratings yet

- Quotation: Customer Code: 10008260 Information VAT Number - 300055945410003Document1 pageQuotation: Customer Code: 10008260 Information VAT Number - 300055945410003Marcial MilitanteNo ratings yet

- Philatelic Terms 30 Newspaper StampsDocument2 pagesPhilatelic Terms 30 Newspaper Stampsself sayidNo ratings yet

- Certificate of Tax Exemption No. 005-19Document3 pagesCertificate of Tax Exemption No. 005-19Lheo KisimNo ratings yet

- CTA EB Case No. 250 and 255Document25 pagesCTA EB Case No. 250 and 255trina tsai100% (1)

- The Role of Multinational Corporation in The Global EconomnyDocument30 pagesThe Role of Multinational Corporation in The Global EconomnyJmNo ratings yet

- ROBIN Hood ExamDocument5 pagesROBIN Hood Examjoke_jansen_dulkNo ratings yet

- QTN - Nuricon - 24052022Document3 pagesQTN - Nuricon - 24052022AbuAbdullah KhanNo ratings yet

- Personify360 7.7.0 Release NotesDocument86 pagesPersonify360 7.7.0 Release NotesANIEFIOK UMOHNo ratings yet

- Southern Luzon Drug Corporation v. DSWD, Et. Al., G.R. No. 199669, April 25, 2017Document25 pagesSouthern Luzon Drug Corporation v. DSWD, Et. Al., G.R. No. 199669, April 25, 2017Charmaine GraceNo ratings yet

- PAS 41 AgricultureDocument2 pagesPAS 41 AgricultureErica UyNo ratings yet

- Ashiana Anmol Price List Phase-2 Wef 1st July 22Document4 pagesAshiana Anmol Price List Phase-2 Wef 1st July 22Vivek SharmaNo ratings yet

- CFPB v. Mackinnon, Et Al. 1:16-cv-00880-FPG-HKSDocument31 pagesCFPB v. Mackinnon, Et Al. 1:16-cv-00880-FPG-HKSPacer CasesNo ratings yet

- Package One - Lowering The Personal Income Tax - #TaxReformNowDocument4 pagesPackage One - Lowering The Personal Income Tax - #TaxReformNowJarwikNo ratings yet

- Financial AdministrationDocument322 pagesFinancial AdministrationAbhijit Jadhav91% (58)

- NAVA Vs CIRDocument1 pageNAVA Vs CIRJong CjaNo ratings yet

- CIR v. CTA and Smith Kline, G.R. No. L-54108, 1984Document4 pagesCIR v. CTA and Smith Kline, G.R. No. L-54108, 1984JMae MagatNo ratings yet

- Principles From Decisions of SC On Penalties and Select Issues Under Penal ProvisionsDocument51 pagesPrinciples From Decisions of SC On Penalties and Select Issues Under Penal ProvisionsSaikumar SawantNo ratings yet

- INCOME TAX TEST 2 100 MARKS With Answer by CA VIVEK GABADocument16 pagesINCOME TAX TEST 2 100 MARKS With Answer by CA VIVEK GABAAmiya Upadhyay100% (1)

- Exp Res PrasadDocument2 pagesExp Res PrasadVidhyaSagarNo ratings yet

- SL 3 Corporate TaxationDocument73 pagesSL 3 Corporate Taxationsanu sayedNo ratings yet

- Back Home: Wheel India SCM Solutions PVT LTD D-27, Okhla Phase-1 New Delhi-110020Document1 pageBack Home: Wheel India SCM Solutions PVT LTD D-27, Okhla Phase-1 New Delhi-110020Irfan ShaikhNo ratings yet

- 12 FSLCE Ex Report - EconomicsDocument26 pages12 FSLCE Ex Report - EconomicsZiyad Wazim AliNo ratings yet

- Assessment ProcessDocument2 pagesAssessment ProcessAltheaVergaraNo ratings yet

- Slump Sale and Related Income Tax ProvisionsDocument4 pagesSlump Sale and Related Income Tax ProvisionsMahaveer DhelariyaNo ratings yet

- 5 Lung CenterDocument11 pages5 Lung Centerpinkblush717No ratings yet

- Aloha TableService - Essentials - WorkbookDocument93 pagesAloha TableService - Essentials - WorkbookIgnatius Reilly50% (2)

- Ebook Issues in Economics Today 8E PDF Full Chapter PDFDocument67 pagesEbook Issues in Economics Today 8E PDF Full Chapter PDFolive.ploss151100% (38)

- Four Year Profit ProjectionDocument1 pageFour Year Profit ProjectionDebbieNo ratings yet

Functions of Federal Board of Revenue

Functions of Federal Board of Revenue

Uploaded by

Rai Saif Siddiq0 ratings0% found this document useful (0 votes)

72 views2 pagesThe document outlines the functions of the Federal Board of Revenue (FBR) related to litigation and legal matters. Key functions include approving appeals to higher courts, assigning court cases, monitoring legal advisors and advocates, and coordinating with field offices on legal matters. The FBR is also responsible for maintaining lists of pending court cases and coordinating with relevant government bodies on legal and parliamentary issues.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the functions of the Federal Board of Revenue (FBR) related to litigation and legal matters. Key functions include approving appeals to higher courts, assigning court cases, monitoring legal advisors and advocates, and coordinating with field offices on legal matters. The FBR is also responsible for maintaining lists of pending court cases and coordinating with relevant government bodies on legal and parliamentary issues.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

72 views2 pagesFunctions of Federal Board of Revenue

Functions of Federal Board of Revenue

Uploaded by

Rai Saif SiddiqThe document outlines the functions of the Federal Board of Revenue (FBR) related to litigation and legal matters. Key functions include approving appeals to higher courts, assigning court cases, monitoring legal advisors and advocates, and coordinating with field offices on legal matters. The FBR is also responsible for maintaining lists of pending court cases and coordinating with relevant government bodies on legal and parliamentary issues.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

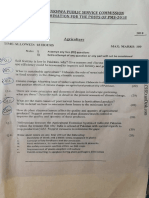

FEDERAL BOARD OF REVENUE

FUNCTIONS

Grant of approval for filing of appeals/references before High Courts and

CPLAs/Review before the Supreme Court and to pursue litigation in courts.

Assigning court cases, issuing Power of Attorney and monitoring

performance of Legal Advisors and Advocates on panel.

Making recommendations for appointment of Legal Advisors and placement

of advocates on panel of FBR.

Coordination with field offices to ensure filing of para-wise comments and

proper representation in each case sub-judice before the courts.

Coordination with field offices in respect of matters relating to the

appointment of Advocates, ASCs and AORs in court cases and fee matters of

such advocates.

Maintaining and updating the list of pending cases before the Supreme Court

and High Courts on the official website of FBR.

Coordination with field offices and FTO office to ensure submission of

reports to FTO, implementation of FTO recommendations, filing of

representation before the President and review before the FTO.

Coordination with Law Division and Attorney General of Pakistan.

Coordination in respect of matters relating to the National Assembly and

Senate Standing Committees on Revenue and Finance.

Coordination in respect of matters relating to Inter Provincial Coordination

Committee.

Condonation of time limitations on requests made by the CsIR (A) and

Collectors (A).

Monitoring of work of CsIR (A) and Collectors (A) and rationalization of work

load of appeals.

Any other assignment given by the Chairman.

CHART OF FUNCTIONS

To identify the Withholding Agents;

To facilitate issuance of NTN/FTN to unregistered Withholding Agents in

respective Regional Tax Office through Pakistan Revenue Automation Limited;

To assist FBR in developing an accounting policy for appropriation of the

deduction to the Regional Tax Offices / Large Taxpayers Unit having

jurisdiction over particular taxpayer(s);

To review and recommend suitable (automated) processes and filing structure

of withholding statements that is compatible with income tax environment;

To suggest to Federal Board of Revenue modification / amendments. Required

in the Withholding Tax Regime under the Income Tax Ordinance, 2001, to

make them responsive and in accordance with the universally acknowledged

principles of direct taxation and best practices.

To monitor the certificates of exemption from withholding taxes, issued by

concerned tax authorities, for their proper utilization by all concerned.

To adopt ways and means to educate and facilitate the prescribed persons

(Withholding agents)and other stakeholders in meeting their withholding tax

related obligations;

To collate information on withholding taxes withheld / collected and deposited

for various purposes, by identifying non-NTN holders for broadening of tax

base;

To perform any other work incidental or necessary to achieve the objectives of

the organization and discharge of above functions;

To perform such other functions as may be assigned by the Federal Board of

Revenue;

To check, supervise, ascertain, monitor, reconcile and properly enforce, in

whole of Pakistan, the Withholding regime and other relevant provisions of the

Income Tax Ordinance, 2001 and Sales Tax of 1990.

To adopt ways and means to monitor deduction, collection and payment of tax

collected / withheld to ensure their correctness as per law and timely deposit in

the Government treasury / State Bank of Pakistan / National Bank of Pakistan;

To control possible leakages of Withholding Taxes;

14. To investigate cases of non-deduction / short-deduction of Withholding

Taxes;

To enforce the prescribed statements in respect of taxes withheld and take

appropriate action under the law in the cases of defaulters;

To maintain proper record of Withholding Taxes and prescribed persons;

To verify and cross match the monthly statements of Withholding Taxes with

tax deposits / collection, returns / statements / book of accounts / declarations

and other information on taxpayers.

To get the orders passed under relevant provisions of the Income Tax

Ordinance, 2001, imposition of additional tax and penalty and to ensure the

recovery of tax not deducted / collected by the withholding agents.

You might also like

- Local Self Government in PakistanDocument2 pagesLocal Self Government in Pakistanazqan100% (1)

- Gul Ahmed Textiles: Term ProjectDocument28 pagesGul Ahmed Textiles: Term Projectstreetfighter283No ratings yet

- Spilker TaxIndivBusEnt2019 WMDocument1,276 pagesSpilker TaxIndivBusEnt2019 WMablay logeneNo ratings yet

- Innovative Panaceas For Pakistan's Corruption Ills by M. Tariq WaseemDocument64 pagesInnovative Panaceas For Pakistan's Corruption Ills by M. Tariq WaseemAbu AbdullahNo ratings yet

- Contextualsing Extremism in Pakistan - CSS Online AcademyDocument4 pagesContextualsing Extremism in Pakistan - CSS Online AcademyTanveer EhmadNo ratings yet

- Informal Economy of PakistanDocument4 pagesInformal Economy of PakistanrokhanariazNo ratings yet

- JWT Pol ScienceDocument279 pagesJWT Pol ScienceGulali KàkârNo ratings yet

- Judicial Activism Is The Natural Corollary of Poor Governance in PakistanDocument3 pagesJudicial Activism Is The Natural Corollary of Poor Governance in PakistanSohail NasirNo ratings yet

- Essays 2015Document70 pagesEssays 2015abidnazir89877No ratings yet

- State Council of ChinaDocument2 pagesState Council of ChinaManjira Kar0% (1)

- Noori Anwar AliDocument109 pagesNoori Anwar AliCOLUMEAUNo ratings yet

- IB-492 Aman Haralalka 22IB408-Anshdha JainDocument18 pagesIB-492 Aman Haralalka 22IB408-Anshdha JainFIT-NESS BLENDERNo ratings yet

- Q 10 Feminist Movements in Pakistan (PR)Document8 pagesQ 10 Feminist Movements in Pakistan (PR)Hassan Khan100% (1)

- Autonomy Vs Integration Debate in Gender StudiesDocument4 pagesAutonomy Vs Integration Debate in Gender StudiesSheeba HabNo ratings yet

- The State Bank of Pakistan and Its FunctionsDocument4 pagesThe State Bank of Pakistan and Its Functionszaka586No ratings yet

- AJK Interim Constitution Act 1974 by Asif RajaDocument51 pagesAJK Interim Constitution Act 1974 by Asif RajaAsif Masood RajaNo ratings yet

- Job Description of Assistant CommissionerDocument3 pagesJob Description of Assistant CommissionerAgha Zeeshan Khan SoomroNo ratings yet

- Silent Features of IranDocument3 pagesSilent Features of Iranoxford- iansNo ratings yet

- Good Governance - Outline - CSS ForumsDocument2 pagesGood Governance - Outline - CSS ForumsAzeem ChaudharyNo ratings yet

- Juvenile Delinquency in PakDocument17 pagesJuvenile Delinquency in Pakwdhgwhjbdje100% (1)

- Assistant Registrar CooperativeDocument1 pageAssistant Registrar CooperativeAli Raza KaisraniNo ratings yet

- Islamiat Notes by Ayesha Younas RevisedDocument68 pagesIslamiat Notes by Ayesha Younas RevisedHumaNo ratings yet

- ICEP CSS - PMS Dawn+ 29 June, 2020 by M.Usman and Rabia Kalhoro PDFDocument17 pagesICEP CSS - PMS Dawn+ 29 June, 2020 by M.Usman and Rabia Kalhoro PDFBiYa ɱɥğȟål100% (2)

- The Creation of New Provinces in PakistanDocument2 pagesThe Creation of New Provinces in PakistanHasan TanveerNo ratings yet

- Autonomy Vs Integration Debate in Gender Studies PDFDocument4 pagesAutonomy Vs Integration Debate in Gender Studies PDFShumaila KhanNo ratings yet

- National IntegrationDocument2 pagesNational IntegrationSamina HaiderNo ratings yet

- CPEC CssDocument14 pagesCPEC CssWarda KhanNo ratings yet

- Topic Number 9 - Organization of Provincial and Local GovernmentDocument6 pagesTopic Number 9 - Organization of Provincial and Local GovernmentalikhanNo ratings yet

- 4.1 Judicial Activism in PakistanDocument5 pages4.1 Judicial Activism in PakistanArbaz KhanNo ratings yet

- What Type of Pakistan Do We NeedDocument12 pagesWhat Type of Pakistan Do We NeedmtalhanazarNo ratings yet

- M. Aslam Ch.Document655 pagesM. Aslam Ch.Ali IrtazaNo ratings yet

- Public Administration For Competitive ExamsDocument10 pagesPublic Administration For Competitive ExamsMubashir AhmadNo ratings yet

- PMS KP Past PapersDocument260 pagesPMS KP Past PapersSheraz AliNo ratings yet

- Women StudiesDocument8 pagesWomen StudiesEbaraNo ratings yet

- Civil Service of Pakistan - Protection & ReformDocument21 pagesCivil Service of Pakistan - Protection & Reformhamzashafqaat100% (1)

- Gender Studies - The CSS PointDocument2 pagesGender Studies - The CSS PointCH M AhmedNo ratings yet

- Business Administration Css NotesDocument14 pagesBusiness Administration Css NotesAnwar Khan100% (1)

- Lecture Foreign Policy of Pakistan and Its ChallengesDocument8 pagesLecture Foreign Policy of Pakistan and Its Challengesmuhammad bilal ahmedNo ratings yet

- Social Issues of Pakistan: Dated: 23 April 2019Document23 pagesSocial Issues of Pakistan: Dated: 23 April 2019Muhammad Ahmed SaleemNo ratings yet

- Syllabus of CSS PapersDocument15 pagesSyllabus of CSS PapersNida GondalNo ratings yet

- Center-Province RelationsDocument4 pagesCenter-Province RelationsAmmar HashmiNo ratings yet

- History of SOcial COnstructionismDocument6 pagesHistory of SOcial COnstructionismZarnish HussainNo ratings yet

- Centre Province Relations Pakistan 1973Document27 pagesCentre Province Relations Pakistan 1973Ehtasham KhanNo ratings yet

- IMF vs. WTO vs. World Bank - What's The Difference - Notes For CSS, PMSDocument5 pagesIMF vs. WTO vs. World Bank - What's The Difference - Notes For CSS, PMSTalbia SyedNo ratings yet

- Lecture 22 Structure of Federal GovtDocument33 pagesLecture 22 Structure of Federal GovtalikhanNo ratings yet

- Essay On Human Trafficking in PakistanDocument5 pagesEssay On Human Trafficking in PakistanAlina ChNo ratings yet

- Efficiency VS ResponsivenessDocument1 pageEfficiency VS ResponsivenessMa YaNo ratings yet

- Mukhtar MaiDocument36 pagesMukhtar MaimahNo ratings yet

- 10 Essay OutlineDocument57 pages10 Essay OutlinemubasharNo ratings yet

- Crisis of Good Governance in Pakistan Causes Impacts and RemediesDocument5 pagesCrisis of Good Governance in Pakistan Causes Impacts and RemediesRabia TufailNo ratings yet

- SBOTS 18th Batch 10 Sep 12Document2 pagesSBOTS 18th Batch 10 Sep 12Mian AttaNo ratings yet

- National Accountability BureauDocument21 pagesNational Accountability BureauAhmad JuttNo ratings yet

- New Warfronts Lie in Economic ZonesDocument11 pagesNew Warfronts Lie in Economic ZonesMuhammad USman BUzdarNo ratings yet

- Committee System in Parliament of PakistanDocument10 pagesCommittee System in Parliament of PakistanMarviSirmed100% (1)

- Chapter Wise QuestionsDocument2 pagesChapter Wise QuestionsHammad ZafarNo ratings yet

- Pakistan's National Culture Reflects Unity in Diversity. ElaborateDocument18 pagesPakistan's National Culture Reflects Unity in Diversity. ElaborateĀLįįHaiderPanhwerNo ratings yet

- 18th Amendment in Constitution of PakistanDocument3 pages18th Amendment in Constitution of PakistanMuhammad SubhaniNo ratings yet

- Does Foreign Aid Help To Achieve Economic Stability - Essay For CSSDocument7 pagesDoes Foreign Aid Help To Achieve Economic Stability - Essay For CSSIhsaan gulzarNo ratings yet

- Governance Indicators (GPP by Asad Ejaz Butt 4th Lecture) : Voice and AccountabilityDocument3 pagesGovernance Indicators (GPP by Asad Ejaz Butt 4th Lecture) : Voice and AccountabilityHafiz Farrukh IshaqNo ratings yet

- Sponsored By:: The Chanrobles GroupDocument9 pagesSponsored By:: The Chanrobles Groupbaby.torpee9117No ratings yet

- Power of The Commissioner To Interpret Tax Laws and To Decide Tax CasesDocument3 pagesPower of The Commissioner To Interpret Tax Laws and To Decide Tax CasesLovelyNo ratings yet

- Quotation: Customer Code: 10008260 Information VAT Number - 300055945410003Document1 pageQuotation: Customer Code: 10008260 Information VAT Number - 300055945410003Marcial MilitanteNo ratings yet

- Philatelic Terms 30 Newspaper StampsDocument2 pagesPhilatelic Terms 30 Newspaper Stampsself sayidNo ratings yet

- Certificate of Tax Exemption No. 005-19Document3 pagesCertificate of Tax Exemption No. 005-19Lheo KisimNo ratings yet

- CTA EB Case No. 250 and 255Document25 pagesCTA EB Case No. 250 and 255trina tsai100% (1)

- The Role of Multinational Corporation in The Global EconomnyDocument30 pagesThe Role of Multinational Corporation in The Global EconomnyJmNo ratings yet

- ROBIN Hood ExamDocument5 pagesROBIN Hood Examjoke_jansen_dulkNo ratings yet

- QTN - Nuricon - 24052022Document3 pagesQTN - Nuricon - 24052022AbuAbdullah KhanNo ratings yet

- Personify360 7.7.0 Release NotesDocument86 pagesPersonify360 7.7.0 Release NotesANIEFIOK UMOHNo ratings yet

- Southern Luzon Drug Corporation v. DSWD, Et. Al., G.R. No. 199669, April 25, 2017Document25 pagesSouthern Luzon Drug Corporation v. DSWD, Et. Al., G.R. No. 199669, April 25, 2017Charmaine GraceNo ratings yet

- PAS 41 AgricultureDocument2 pagesPAS 41 AgricultureErica UyNo ratings yet

- Ashiana Anmol Price List Phase-2 Wef 1st July 22Document4 pagesAshiana Anmol Price List Phase-2 Wef 1st July 22Vivek SharmaNo ratings yet

- CFPB v. Mackinnon, Et Al. 1:16-cv-00880-FPG-HKSDocument31 pagesCFPB v. Mackinnon, Et Al. 1:16-cv-00880-FPG-HKSPacer CasesNo ratings yet

- Package One - Lowering The Personal Income Tax - #TaxReformNowDocument4 pagesPackage One - Lowering The Personal Income Tax - #TaxReformNowJarwikNo ratings yet

- Financial AdministrationDocument322 pagesFinancial AdministrationAbhijit Jadhav91% (58)

- NAVA Vs CIRDocument1 pageNAVA Vs CIRJong CjaNo ratings yet

- CIR v. CTA and Smith Kline, G.R. No. L-54108, 1984Document4 pagesCIR v. CTA and Smith Kline, G.R. No. L-54108, 1984JMae MagatNo ratings yet

- Principles From Decisions of SC On Penalties and Select Issues Under Penal ProvisionsDocument51 pagesPrinciples From Decisions of SC On Penalties and Select Issues Under Penal ProvisionsSaikumar SawantNo ratings yet

- INCOME TAX TEST 2 100 MARKS With Answer by CA VIVEK GABADocument16 pagesINCOME TAX TEST 2 100 MARKS With Answer by CA VIVEK GABAAmiya Upadhyay100% (1)

- Exp Res PrasadDocument2 pagesExp Res PrasadVidhyaSagarNo ratings yet

- SL 3 Corporate TaxationDocument73 pagesSL 3 Corporate Taxationsanu sayedNo ratings yet

- Back Home: Wheel India SCM Solutions PVT LTD D-27, Okhla Phase-1 New Delhi-110020Document1 pageBack Home: Wheel India SCM Solutions PVT LTD D-27, Okhla Phase-1 New Delhi-110020Irfan ShaikhNo ratings yet

- 12 FSLCE Ex Report - EconomicsDocument26 pages12 FSLCE Ex Report - EconomicsZiyad Wazim AliNo ratings yet

- Assessment ProcessDocument2 pagesAssessment ProcessAltheaVergaraNo ratings yet

- Slump Sale and Related Income Tax ProvisionsDocument4 pagesSlump Sale and Related Income Tax ProvisionsMahaveer DhelariyaNo ratings yet

- 5 Lung CenterDocument11 pages5 Lung Centerpinkblush717No ratings yet

- Aloha TableService - Essentials - WorkbookDocument93 pagesAloha TableService - Essentials - WorkbookIgnatius Reilly50% (2)

- Ebook Issues in Economics Today 8E PDF Full Chapter PDFDocument67 pagesEbook Issues in Economics Today 8E PDF Full Chapter PDFolive.ploss151100% (38)

- Four Year Profit ProjectionDocument1 pageFour Year Profit ProjectionDebbieNo ratings yet