Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

22 viewsShivani Mohan Assistant Professor of Economics CNLU, Patna

Shivani Mohan Assistant Professor of Economics CNLU, Patna

Uploaded by

Antra AzadThis document discusses fiscal policy and its objectives, tools, and effects. It begins by explaining that fiscal policy aims to stabilize the economy through government spending and taxation. It then covers the following key points:

1) Expansionary fiscal policy involves increasing spending or decreasing taxes to stimulate aggregate demand during recessions.

2) Contractionary fiscal policy involves decreasing spending or increasing taxes to reduce aggregate demand and control inflation.

3) Taxes are an important fiscal policy tool that can influence income distribution, efficiency, and economic growth. Direct taxes include income tax while indirect taxes are levied on spending.

4) Fiscal policy faces challenges from implementation lags and may be undermined by "crow

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Economics Today 18th Edition Roger LeRoy Miller Solutions Manual DownloadDocument17 pagesEconomics Today 18th Edition Roger LeRoy Miller Solutions Manual DownloadJeremy Jackson100% (26)

- Fiscalpolicyppt 100129081312 Phpapp02Document23 pagesFiscalpolicyppt 100129081312 Phpapp02Vishal GoyalNo ratings yet

- Discretionary Fiscal Policy Refers To The Deliberate Manipulation of TaxesDocument4 pagesDiscretionary Fiscal Policy Refers To The Deliberate Manipulation of TaxesKeanu Menil MoldezNo ratings yet

- Macro Economic Policy InstrumentsDocument11 pagesMacro Economic Policy InstrumentsThankachan CJNo ratings yet

- Fiscal Policy of PakistanDocument15 pagesFiscal Policy of PakistanAXAD BhattiNo ratings yet

- Fiscal PolicyDocument7 pagesFiscal Policyndagarachel015No ratings yet

- Fiscal PolicyDocument34 pagesFiscal PolicyReymar Lorente Uy100% (1)

- Expansionary (Or Loose) Fiscal PolicyDocument4 pagesExpansionary (Or Loose) Fiscal PolicyFaisal HameedNo ratings yet

- Faculty of Commerce Department of Finance Group2 Student Name Student NumberDocument9 pagesFaculty of Commerce Department of Finance Group2 Student Name Student NumberRumbidzai KambaNo ratings yet

- Types & CritisismDocument4 pagesTypes & Critisismsgaurav_sonar1488No ratings yet

- Fiscal PolicyDocument30 pagesFiscal PolicySumana ChatterjeeNo ratings yet

- ANSWERS-WPS OfficeDocument5 pagesANSWERS-WPS OfficeisifumwiduNo ratings yet

- Macroeconomics CIA 3 2nd SemesterDocument33 pagesMacroeconomics CIA 3 2nd SemesterMeghansh AgarwalNo ratings yet

- Fiscal PolicyDocument6 pagesFiscal Policynarayan100% (2)

- Fiscal Policy MeaningDocument27 pagesFiscal Policy MeaningVikash SinghNo ratings yet

- What Is Fiscal Policy and Its Role in Economic GrowthDocument4 pagesWhat Is Fiscal Policy and Its Role in Economic GrowthsmartysusNo ratings yet

- Fiscal PolicyDocument19 pagesFiscal Policysoodaryan220No ratings yet

- Fiscal PolicyDocument12 pagesFiscal PolicyPule JackobNo ratings yet

- Ec MacrobudgetfpDocument3 pagesEc MacrobudgetfpNicholas TehNo ratings yet

- Fiscal PolicyDocument22 pagesFiscal Policydestinyebeku01No ratings yet

- Eep ProjectDocument13 pagesEep ProjectAnuradha SharmaNo ratings yet

- Fiscal PolicyDocument20 pagesFiscal PolicyPranav VaidNo ratings yet

- Fiscal PolicyDocument6 pagesFiscal Policynoor fatimaNo ratings yet

- What Is Fiscal Policy?Document10 pagesWhat Is Fiscal Policy?Samad Raza KhanNo ratings yet

- 5 Debates Over Macroeconomic PolicyDocument15 pages5 Debates Over Macroeconomic PolicyCarlNo ratings yet

- EssayDocument5 pagesEssayJim_Tsao_4234No ratings yet

- IB Economics SL12 - Demand-Side and Supply-Side PoliciesDocument11 pagesIB Economics SL12 - Demand-Side and Supply-Side PoliciesTerran100% (9)

- Macroecon Act 1Document3 pagesMacroecon Act 1Yzzabel Denise L. TolentinoNo ratings yet

- Fiscal and Monetary PolicyDocument16 pagesFiscal and Monetary PolicyBezalel OLUSHAKINNo ratings yet

- Fiscal PolicyDocument21 pagesFiscal PolicyHeoHamHốNo ratings yet

- Fiscal Policy DefinitionsDocument4 pagesFiscal Policy Definitionsreda_sayedsNo ratings yet

- AS Ch5 (Autosaved) (1) (Autosaved)Document108 pagesAS Ch5 (Autosaved) (1) (Autosaved)Wu JingbiaoNo ratings yet

- SolutionsManual Ch30Document16 pagesSolutionsManual Ch30Thiba SathivelNo ratings yet

- General Lecture 6Document13 pagesGeneral Lecture 6Shantie PittNo ratings yet

- Government Macroeconomic Policy ObjectivesDocument13 pagesGovernment Macroeconomic Policy ObjectivesalphaNo ratings yet

- 12.7 Paper 1 Demand Side PoliciesDocument4 pages12.7 Paper 1 Demand Side PoliciesSambhavi ThakurNo ratings yet

- Fical Policy Assignment Final DraftDocument12 pagesFical Policy Assignment Final DraftHamlity SaintataNo ratings yet

- Fiscal Policy of IndiaDocument18 pagesFiscal Policy of IndiaRahulNo ratings yet

- Fiscal PolicyDocument11 pagesFiscal PolicyVenkata RamanaNo ratings yet

- Fiscal PolicyDocument6 pagesFiscal Policyapi-3695543100% (1)

- Fiscal PolicyDocument21 pagesFiscal PolicyDilpreet Singh MendirattaNo ratings yet

- Demand-Side Policies FiscalDocument20 pagesDemand-Side Policies Fiscalmaieva.diopyNo ratings yet

- Topic 8 Fiscal Policy, The Deficit, and Debt - JBNDocument24 pagesTopic 8 Fiscal Policy, The Deficit, and Debt - JBNleimarNo ratings yet

- Fiscal Policy Refers To The Use of Government Spending and Tax Policies ToDocument5 pagesFiscal Policy Refers To The Use of Government Spending and Tax Policies ToSaclao John Mark GalangNo ratings yet

- Fiscal PolicyDocument20 pagesFiscal PolicyZəfər CabbarovNo ratings yet

- Fiscal Policy of The Philippine GovernmentDocument55 pagesFiscal Policy of The Philippine GovernmentJervin Paul ManzanoNo ratings yet

- Demand Side PolicyDocument15 pagesDemand Side PolicyAnkit Shukla100% (1)

- MEBD - Fiscal PolicyDocument26 pagesMEBD - Fiscal PolicyCharles RussellNo ratings yet

- Session 4 Fiscal PolicyDocument13 pagesSession 4 Fiscal PolicyThouseef AhmedNo ratings yet

- Macroeconomics - Fiscal PolicyDocument29 pagesMacroeconomics - Fiscal PolicydahliagingerNo ratings yet

- (Semi-Finals) Fiscal PolicyDocument3 pages(Semi-Finals) Fiscal PolicyJUDE VINCENT MACALOSNo ratings yet

- What Is Fiscal Policy?: Economic Conditions MacroeconomicDocument7 pagesWhat Is Fiscal Policy?: Economic Conditions Macroeconomicziashahid54545No ratings yet

- Fiscal Policy NotesDocument5 pagesFiscal Policy NotesJaydenausNo ratings yet

- Macroeconomic Policies: Introduction To Economics Government Revenue & Expenditure: The Fiscal SystemDocument3 pagesMacroeconomic Policies: Introduction To Economics Government Revenue & Expenditure: The Fiscal SystemShahzaib EhsanNo ratings yet

- Five Debates Over Macroeconomic PolicyDocument4 pagesFive Debates Over Macroeconomic PolicyPatel ChiragNo ratings yet

- Business Economics: Business Strategy & Competitive AdvantageFrom EverandBusiness Economics: Business Strategy & Competitive AdvantageNo ratings yet

- Fundamentals of Business Economics Study Resource: CIMA Study ResourcesFrom EverandFundamentals of Business Economics Study Resource: CIMA Study ResourcesNo ratings yet

- Bail Application - Group7-1Document5 pagesBail Application - Group7-1Antra AzadNo ratings yet

- Chargesheet - Group7-1Document4 pagesChargesheet - Group7-1Antra AzadNo ratings yet

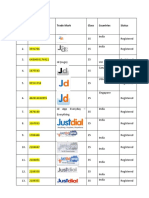

- REgistrationsDocument6 pagesREgistrationsAntra AzadNo ratings yet

- 2017 Chattishgarh Judiciary Prelims Paper PDFDocument54 pages2017 Chattishgarh Judiciary Prelims Paper PDFAntra AzadNo ratings yet

- Nagmani SLPDocument168 pagesNagmani SLPAntra AzadNo ratings yet

- Introduction Material 1Document18 pagesIntroduction Material 1Antra AzadNo ratings yet

- Freshers BudgetDocument1 pageFreshers BudgetAntra AzadNo ratings yet

- Bench CompositionDocument1 pageBench CompositionAntra AzadNo ratings yet

- Shivcon Estate PVT LTDDocument16 pagesShivcon Estate PVT LTDAntra AzadNo ratings yet

- Freshers DateDocument1 pageFreshers DateAntra AzadNo ratings yet

- UNDERTAKING For PlacementDocument1 pageUNDERTAKING For PlacementAntra AzadNo ratings yet

- Exhibit IDocument455 pagesExhibit IAntra AzadNo ratings yet

- 1 - Media Law Paper 1 - 1Document246 pages1 - Media Law Paper 1 - 1Antra Azad100% (1)

- The Commercial Courts Act, 2015Document28 pagesThe Commercial Courts Act, 2015Antra AzadNo ratings yet

- ListsDocument1 pageListsAntra AzadNo ratings yet

- DocumentDocument2 pagesDocumentAntra AzadNo ratings yet

- DJS New SyllabusDocument2 pagesDJS New SyllabusAntra AzadNo ratings yet

- Cailnmcc 2 1Document21 pagesCailnmcc 2 1Antra AzadNo ratings yet

- Primary Market - Concept, Functions Etc.Document3 pagesPrimary Market - Concept, Functions Etc.Antra AzadNo ratings yet

- CP Irmo 12042022 220720 125318Document138 pagesCP Irmo 12042022 220720 125318Antra AzadNo ratings yet

- Project ListDocument10 pagesProject ListAntra AzadNo ratings yet

- Project List of Cyber LawDocument4 pagesProject List of Cyber LawAntra AzadNo ratings yet

- Deelip Singh v. State of Bihar, (2005)Document20 pagesDeelip Singh v. State of Bihar, (2005)Antra AzadNo ratings yet

- Statement of JurisdictionDocument5 pagesStatement of JurisdictionAntra AzadNo ratings yet

- Contract Act"), On One Hand, A Contract Can Be Validly Terminated by Giving LegitimateDocument5 pagesContract Act"), On One Hand, A Contract Can Be Validly Terminated by Giving LegitimateAntra Azad100% (1)

- Alakh Alok Srivastava v. Union of India, (2018) 17 SCC 291Document9 pagesAlakh Alok Srivastava v. Union of India, (2018) 17 SCC 291Antra AzadNo ratings yet

- Yedla Srinivasa Rao v. State of A.P., (2006) 11 SCCDocument10 pagesYedla Srinivasa Rao v. State of A.P., (2006) 11 SCCAntra AzadNo ratings yet

- Deepak Gulati v. State of Haryana, (2013) 7 SCC 675Document10 pagesDeepak Gulati v. State of Haryana, (2013) 7 SCC 675Antra AzadNo ratings yet

- Institution Letter Head: Form: INT-02/17Document1 pageInstitution Letter Head: Form: INT-02/17Antra AzadNo ratings yet

- Customer Name Masked Card NumberDocument68 pagesCustomer Name Masked Card NumberAntra AzadNo ratings yet

- Final Webinar Presentation - IRRBBDocument43 pagesFinal Webinar Presentation - IRRBBRAHUL YADAVNo ratings yet

- Hull-White ModelDocument5 pagesHull-White Modeljackie555No ratings yet

- Macroeconomics Australia 7th Edition Mctaggart Solutions ManualDocument17 pagesMacroeconomics Australia 7th Edition Mctaggart Solutions Manualdencuongpow5100% (24)

- Reviewer in Theory of Accounts Multiple ChoiceDocument17 pagesReviewer in Theory of Accounts Multiple ChoiceDaniella Mae ElipNo ratings yet

- MyLoanCare Personal Loan Comparison HDFC Bank Axis BankDocument1 pageMyLoanCare Personal Loan Comparison HDFC Bank Axis BankAakash JhaNo ratings yet

- Tutorial 2 Chapter 5 With AnswersDocument9 pagesTutorial 2 Chapter 5 With AnswersNoor TaherNo ratings yet

- Iapm Iim Jammu #4Document64 pagesIapm Iim Jammu #4Daksh KhullarNo ratings yet

- Practice Questions On Time Value of MoneyDocument7 pagesPractice Questions On Time Value of MoneyShashank shekhar ShuklaNo ratings yet

- GenMath Q2 W 1 825 PagesDocument25 pagesGenMath Q2 W 1 825 PagesMarylyn MirandaNo ratings yet

- Chapter 11Document20 pagesChapter 11Mahra AlMazroueiNo ratings yet

- Literature Review On Auto LoanDocument6 pagesLiterature Review On Auto Loansvgkjqbnd100% (1)

- ScriptDocument5 pagesScriptFredmark EvangelistaNo ratings yet

- Current Liabilities - PROBLEMSDocument11 pagesCurrent Liabilities - PROBLEMSIra Grace De Castro100% (2)

- Derivatives Markets 3rd Edition McDonald Test Bank DownloadDocument5 pagesDerivatives Markets 3rd Edition McDonald Test Bank DownloadBarbara Sosa100% (28)

- Ch24 - Measuring The Cost of LivingDocument39 pagesCh24 - Measuring The Cost of LivingKhánh HiềnNo ratings yet

- Midterm RevisionDocument2 pagesMidterm Revisionhoantkss181354No ratings yet

- M3.2 Security ValuationDocument26 pagesM3.2 Security ValuationVan AnhNo ratings yet

- PRELIMQUIZ2Document2 pagesPRELIMQUIZ2Mathew EstradaNo ratings yet

- Financial Markets in IndiaDocument9 pagesFinancial Markets in IndiatheOnuMonu GamerNo ratings yet

- Chapter - 10 - Fixed Income Securities - GitmanDocument39 pagesChapter - 10 - Fixed Income Securities - GitmanJessica Charoline PangkeyNo ratings yet

- All Question PapersDocument16 pagesAll Question PapersSwastika MohapatraNo ratings yet

- Tg26 Mat 152 Lesson Exam Pg3Document6 pagesTg26 Mat 152 Lesson Exam Pg3ECE CAPILINo ratings yet

- The Cost of Capital: Answers To End-Of-Chapter QuestionsDocument21 pagesThe Cost of Capital: Answers To End-Of-Chapter QuestionsMiftahul FirdausNo ratings yet

- (Lecture 8 & 9) - Cost of CapitalDocument22 pages(Lecture 8 & 9) - Cost of CapitalAjay Kumar TakiarNo ratings yet

- MBA (Sem 4) Theory Examination 2019-20 Financial Derivatives Multiple Choice QuestionsDocument17 pagesMBA (Sem 4) Theory Examination 2019-20 Financial Derivatives Multiple Choice QuestionsRiya Kaushik67% (3)

- Economics Project: Role of Rbi in Control of CreditDocument35 pagesEconomics Project: Role of Rbi in Control of CreditDhairya Tamta79% (19)

- Chapter 2-Part 2Document13 pagesChapter 2-Part 2Puji dyukeNo ratings yet

- Camels RatingDocument30 pagesCamels RatingAbhishek BarmanNo ratings yet

- Ia 1 Setc Finalexam No AnswerDocument10 pagesIa 1 Setc Finalexam No Answerjulia4razo100% (1)

- 2021 WHLP Week 1 2 Business FInance 2nd QuarterDocument4 pages2021 WHLP Week 1 2 Business FInance 2nd QuarterHa Jin KimNo ratings yet

Shivani Mohan Assistant Professor of Economics CNLU, Patna

Shivani Mohan Assistant Professor of Economics CNLU, Patna

Uploaded by

Antra Azad0 ratings0% found this document useful (0 votes)

22 views23 pagesThis document discusses fiscal policy and its objectives, tools, and effects. It begins by explaining that fiscal policy aims to stabilize the economy through government spending and taxation. It then covers the following key points:

1) Expansionary fiscal policy involves increasing spending or decreasing taxes to stimulate aggregate demand during recessions.

2) Contractionary fiscal policy involves decreasing spending or increasing taxes to reduce aggregate demand and control inflation.

3) Taxes are an important fiscal policy tool that can influence income distribution, efficiency, and economic growth. Direct taxes include income tax while indirect taxes are levied on spending.

4) Fiscal policy faces challenges from implementation lags and may be undermined by "crow

Original Description:

Original Title

fiscal policy

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses fiscal policy and its objectives, tools, and effects. It begins by explaining that fiscal policy aims to stabilize the economy through government spending and taxation. It then covers the following key points:

1) Expansionary fiscal policy involves increasing spending or decreasing taxes to stimulate aggregate demand during recessions.

2) Contractionary fiscal policy involves decreasing spending or increasing taxes to reduce aggregate demand and control inflation.

3) Taxes are an important fiscal policy tool that can influence income distribution, efficiency, and economic growth. Direct taxes include income tax while indirect taxes are levied on spending.

4) Fiscal policy faces challenges from implementation lags and may be undermined by "crow

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

22 views23 pagesShivani Mohan Assistant Professor of Economics CNLU, Patna

Shivani Mohan Assistant Professor of Economics CNLU, Patna

Uploaded by

Antra AzadThis document discusses fiscal policy and its objectives, tools, and effects. It begins by explaining that fiscal policy aims to stabilize the economy through government spending and taxation. It then covers the following key points:

1) Expansionary fiscal policy involves increasing spending or decreasing taxes to stimulate aggregate demand during recessions.

2) Contractionary fiscal policy involves decreasing spending or increasing taxes to reduce aggregate demand and control inflation.

3) Taxes are an important fiscal policy tool that can influence income distribution, efficiency, and economic growth. Direct taxes include income tax while indirect taxes are levied on spending.

4) Fiscal policy faces challenges from implementation lags and may be undermined by "crow

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 23

Shivani Mohan

Assistant Professor of Economics

CNLU, Patna

INTRODUCTION

One major function of the government is to stabilize

the economy (prevent unemployment or inflation)

Stabilization can be achieved in part by manipulating

the public budget-government spending and tax

collections-to increase output and employment or to

reduce inflation.

Objectives of Fiscal Policy

Full employment

Equitable distribution of income and wealth

Price Stability

Economic stabilization

Economic Growth

Optimum allocation of resources

FISCAL POLICY AND THE AD/AS

MODEL

A. Discretionary fiscal

B. Simplifying assumptions:

1. Assume initial government purchases don’t

depress or stimulate private spending.

2. Assume fiscal policy affects only the demand, not

supply, side of the economy.

FISCAL POLICY CHOICES

1. Expansionary fiscal policy: used to combat a

recession.

2. Contractionary fiscal policy: used to combat

demand-pull inflation, due to excess spending.

EXPANSIONARY FISCAL POLICY

Expansionary Policy needed:

a. An increase in government spending, which shifts AD to

the right by more than the change in G, due to the

multiplier.

b. A decrease in taxes (raises income, and consumption

rises by MPC times the change in income). AD shifts to the

right by a multiple of the change in consumption.

c. A combination of increased G spending and reduced

taxes.

d. If the budget was initially balanced, expansionary fiscal

policy creates a budget deficit.

CONTRACTIONARY FISCAL POLICY

Contractionary Policy needed:

a. A decrease in G spending shifts AD back left, once the

multiplier process is complete. Here price level returns to

its pre-inflationary level, but GDP remains at full-

employment level.

b. An increase in taxes will reduce income, and then

consumption at first by the MPC times the decrease in

income, and then the multiplier process leads AD to shift

leftward still further.

c. A combined G spending decrease and tax increase could

have the same effect with the right combination.

d. If the budget was initially balanced, a contractionary

fiscal policy creates a budget surplus.

Taxation

Taxation represents the revenue side of the budget

and is regarded as a very important instrument for

the public sector not only for raising income, but

also for achieving some socio-economic objectives,

such as reduction in income inequalities,

correction of external diseconomies, and

restriction of production of some regrettable

necessities

Taxation

Public sector economics lays more emphasis on

some specific issues, such as taxation and income

distribution, taxation and efficiency, taxation and

work efforts, problems of optimal taxation, and

some other related issues like tax evasion and tax

avoidance.

Direct and Indirect Taxes

Direct taxation is levied on income, wealth and profit.

Direct taxes include income tax, inheritance tax, and

corporation tax.

Indirect taxes are taxes on spending – such as excise

duties on fuel, cigarettes and alcohol and Value Added

Tax (VAT) on many different goods and services

Types of Taxes

With a progressive tax, the marginal rate of tax rises

as income rises. i.e. as people earn more income, the

rate of tax on each extra income goes up. This causes a

rise in the average rate of tax

With a proportional tax, the marginal rate of tax is

constant

With a regressive tax, the rate of tax falls as incomes

rise – i.e. the average rate of tax is lower for people of

higher incomes

LAFFER CURVE PRINCIPLE

Taxes and Aggregate Demand

Changes in tax rates and tax allowances can have a direct

and indirect effect on the level of aggregate demand

Government spending can be

used to manage the level and

growth of AD to meet

macroeconomic policy

objectives such as low inflation

and higher levels of employment

When private sector demand for

goods and services is low, the

government needs to find a

compensating source of demand

to rebalance the economy – and

the solution comes from the

government in the form of

higher borrowing or less saving.

The case for budget deficit

reduction

High debt threatens stability and recovery

Government wants credibility in financial markets

Higher future taxes will squeeze the private sector

Inequitable to leave future generations with debt

Doubts about effectiveness of stimulus policies

FINANCING DEFICITS

The method used to finance deficits or dispose of surpluses

influences fiscal policy:

A. Financing deficits can be done 2 ways:

1. Borrowing: (“crowding out” effect) The government

competes with private borrowers for funds, and could drive up

interest rates; the government may “crowd out” private

borrowing, and this offsets the government expansion.

2. Money Creation: When the Federal Reserve loans

directly to the government by buying bonds, the expansionary

effect is greater since private investors are not buying bonds.

(Monetarists argue that this is monetary, not fiscal, policy that

is having the expansionary effect in this situation).

PUBLIC DEBT

DISPOSING OF SURPLUSES

B. Disposing of surpluses can be done in 2 ways:

1. Debt reduction is good, but may cause interest rates

to fall and stimulate spending, which could then be

inflationary.

2. Impounding or letting the surplus funds remain

idle would have greater anti-inflationary impact. The

government holds surplus tax revenues which keeps

these funds from being spent.

BUILT-IN STABILITY

Built-in stability arises because net taxes (taxes minus

transfers and subsidies) change with GDP. Remember that

taxes reduce incomes, and therefore, spending. It is

desirable for spending to rise when the economy is

slumping and to fall when the economy is becoming

inflationary.

1. Taxes automatically rise with GDP because incomes rise

and tax revenues fall when GDP falls.

2. Transfers and subsidies rise when GDP falls; when these

government payments (welfare, unemployment, etc.)

rise, net tax revenues fall along with GDP.

BUILT-IN STABILITY

The size of automatic stability depends on

responsiveness of changes in taxes to changes in GDP:

The more progressive the tax system, the greater the

economy’s built-in stability.

1. Marginal tax rates on personal income can be

changed, such as in 1993, when it was increased from

31% to 39.6% to prevent demand-pull inflation.

2. Automatic stability reduces instability, but does not

correct this economic instability.

PROBLEMS, CRITICISMS, AND

COMPLICATIONS

A. Problems of timing

1. Recognition lag is the elapsed time between the

beginning of recession or inflation and awareness of

the occurrence.

2. Administrative lag is the difficulty in changing policy

once the problem has been recognized.

3. Operational lag is the time elapsed between change in

policy and its impact on the economy.

PROBLEMS, CRITICISMS, AND

COMPLICATIONS

B. Political considerations: Government has other goals

besides economic stability, and these may conflict with

stabilization policy.

1. A political business cycle may destabilize the economy:

Election years have been characterized by more

expansionary policies regardless of economic conditions.

2. State and local finance policies may offset federal

stabilization policies. They are often pro cyclical,

because balanced-budget requirements cause states and

local governments to raise taxes in a recession or cut

spending, making the recession possibly worse. In an

inflationary period, they may increase spending or cut

taxes as their budgets head for surplus.

PROBLEMS, CRITICISMS, AND

COMPLICATIONS

3. The “crowding-out” effect may be caused by fiscal policy.

a. “crowding-out” may occur with government deficit

spending. It may increase the interest rate and reduce

private spending which weakens or cancels the stimulus of

fiscal policy.

b. Some economists argue that little crowding out will

occur during a recession.

c. Economists agree that government deficits should not

occur at Full-Employment. It is also argued that monetary

authorities could counteract the crowding-out by

increasing the money supply to accommodate fiscal policy.

FISCAL POLICY IN AN OPEN

ECONOMY

A. Shocks or changes from abroad will cause changes in

net exports which can shift aggregate demand

leftward or rightward.

B. The net export effect reduces the effectiveness of

fiscal policy by offsetting its effects. For example:

1. Expansionary fiscal policy may increase domestic

interest rates, which can cause the dollar to

appreciate and exports to decline.

2. Contractionary fiscal policy may reduce domestic

interest rates, which would cause the dollar to

depreciate, and net exports to increase.

THANK YOU

You might also like

- Economics Today 18th Edition Roger LeRoy Miller Solutions Manual DownloadDocument17 pagesEconomics Today 18th Edition Roger LeRoy Miller Solutions Manual DownloadJeremy Jackson100% (26)

- Fiscalpolicyppt 100129081312 Phpapp02Document23 pagesFiscalpolicyppt 100129081312 Phpapp02Vishal GoyalNo ratings yet

- Discretionary Fiscal Policy Refers To The Deliberate Manipulation of TaxesDocument4 pagesDiscretionary Fiscal Policy Refers To The Deliberate Manipulation of TaxesKeanu Menil MoldezNo ratings yet

- Macro Economic Policy InstrumentsDocument11 pagesMacro Economic Policy InstrumentsThankachan CJNo ratings yet

- Fiscal Policy of PakistanDocument15 pagesFiscal Policy of PakistanAXAD BhattiNo ratings yet

- Fiscal PolicyDocument7 pagesFiscal Policyndagarachel015No ratings yet

- Fiscal PolicyDocument34 pagesFiscal PolicyReymar Lorente Uy100% (1)

- Expansionary (Or Loose) Fiscal PolicyDocument4 pagesExpansionary (Or Loose) Fiscal PolicyFaisal HameedNo ratings yet

- Faculty of Commerce Department of Finance Group2 Student Name Student NumberDocument9 pagesFaculty of Commerce Department of Finance Group2 Student Name Student NumberRumbidzai KambaNo ratings yet

- Types & CritisismDocument4 pagesTypes & Critisismsgaurav_sonar1488No ratings yet

- Fiscal PolicyDocument30 pagesFiscal PolicySumana ChatterjeeNo ratings yet

- ANSWERS-WPS OfficeDocument5 pagesANSWERS-WPS OfficeisifumwiduNo ratings yet

- Macroeconomics CIA 3 2nd SemesterDocument33 pagesMacroeconomics CIA 3 2nd SemesterMeghansh AgarwalNo ratings yet

- Fiscal PolicyDocument6 pagesFiscal Policynarayan100% (2)

- Fiscal Policy MeaningDocument27 pagesFiscal Policy MeaningVikash SinghNo ratings yet

- What Is Fiscal Policy and Its Role in Economic GrowthDocument4 pagesWhat Is Fiscal Policy and Its Role in Economic GrowthsmartysusNo ratings yet

- Fiscal PolicyDocument19 pagesFiscal Policysoodaryan220No ratings yet

- Fiscal PolicyDocument12 pagesFiscal PolicyPule JackobNo ratings yet

- Ec MacrobudgetfpDocument3 pagesEc MacrobudgetfpNicholas TehNo ratings yet

- Fiscal PolicyDocument22 pagesFiscal Policydestinyebeku01No ratings yet

- Eep ProjectDocument13 pagesEep ProjectAnuradha SharmaNo ratings yet

- Fiscal PolicyDocument20 pagesFiscal PolicyPranav VaidNo ratings yet

- Fiscal PolicyDocument6 pagesFiscal Policynoor fatimaNo ratings yet

- What Is Fiscal Policy?Document10 pagesWhat Is Fiscal Policy?Samad Raza KhanNo ratings yet

- 5 Debates Over Macroeconomic PolicyDocument15 pages5 Debates Over Macroeconomic PolicyCarlNo ratings yet

- EssayDocument5 pagesEssayJim_Tsao_4234No ratings yet

- IB Economics SL12 - Demand-Side and Supply-Side PoliciesDocument11 pagesIB Economics SL12 - Demand-Side and Supply-Side PoliciesTerran100% (9)

- Macroecon Act 1Document3 pagesMacroecon Act 1Yzzabel Denise L. TolentinoNo ratings yet

- Fiscal and Monetary PolicyDocument16 pagesFiscal and Monetary PolicyBezalel OLUSHAKINNo ratings yet

- Fiscal PolicyDocument21 pagesFiscal PolicyHeoHamHốNo ratings yet

- Fiscal Policy DefinitionsDocument4 pagesFiscal Policy Definitionsreda_sayedsNo ratings yet

- AS Ch5 (Autosaved) (1) (Autosaved)Document108 pagesAS Ch5 (Autosaved) (1) (Autosaved)Wu JingbiaoNo ratings yet

- SolutionsManual Ch30Document16 pagesSolutionsManual Ch30Thiba SathivelNo ratings yet

- General Lecture 6Document13 pagesGeneral Lecture 6Shantie PittNo ratings yet

- Government Macroeconomic Policy ObjectivesDocument13 pagesGovernment Macroeconomic Policy ObjectivesalphaNo ratings yet

- 12.7 Paper 1 Demand Side PoliciesDocument4 pages12.7 Paper 1 Demand Side PoliciesSambhavi ThakurNo ratings yet

- Fical Policy Assignment Final DraftDocument12 pagesFical Policy Assignment Final DraftHamlity SaintataNo ratings yet

- Fiscal Policy of IndiaDocument18 pagesFiscal Policy of IndiaRahulNo ratings yet

- Fiscal PolicyDocument11 pagesFiscal PolicyVenkata RamanaNo ratings yet

- Fiscal PolicyDocument6 pagesFiscal Policyapi-3695543100% (1)

- Fiscal PolicyDocument21 pagesFiscal PolicyDilpreet Singh MendirattaNo ratings yet

- Demand-Side Policies FiscalDocument20 pagesDemand-Side Policies Fiscalmaieva.diopyNo ratings yet

- Topic 8 Fiscal Policy, The Deficit, and Debt - JBNDocument24 pagesTopic 8 Fiscal Policy, The Deficit, and Debt - JBNleimarNo ratings yet

- Fiscal Policy Refers To The Use of Government Spending and Tax Policies ToDocument5 pagesFiscal Policy Refers To The Use of Government Spending and Tax Policies ToSaclao John Mark GalangNo ratings yet

- Fiscal PolicyDocument20 pagesFiscal PolicyZəfər CabbarovNo ratings yet

- Fiscal Policy of The Philippine GovernmentDocument55 pagesFiscal Policy of The Philippine GovernmentJervin Paul ManzanoNo ratings yet

- Demand Side PolicyDocument15 pagesDemand Side PolicyAnkit Shukla100% (1)

- MEBD - Fiscal PolicyDocument26 pagesMEBD - Fiscal PolicyCharles RussellNo ratings yet

- Session 4 Fiscal PolicyDocument13 pagesSession 4 Fiscal PolicyThouseef AhmedNo ratings yet

- Macroeconomics - Fiscal PolicyDocument29 pagesMacroeconomics - Fiscal PolicydahliagingerNo ratings yet

- (Semi-Finals) Fiscal PolicyDocument3 pages(Semi-Finals) Fiscal PolicyJUDE VINCENT MACALOSNo ratings yet

- What Is Fiscal Policy?: Economic Conditions MacroeconomicDocument7 pagesWhat Is Fiscal Policy?: Economic Conditions Macroeconomicziashahid54545No ratings yet

- Fiscal Policy NotesDocument5 pagesFiscal Policy NotesJaydenausNo ratings yet

- Macroeconomic Policies: Introduction To Economics Government Revenue & Expenditure: The Fiscal SystemDocument3 pagesMacroeconomic Policies: Introduction To Economics Government Revenue & Expenditure: The Fiscal SystemShahzaib EhsanNo ratings yet

- Five Debates Over Macroeconomic PolicyDocument4 pagesFive Debates Over Macroeconomic PolicyPatel ChiragNo ratings yet

- Business Economics: Business Strategy & Competitive AdvantageFrom EverandBusiness Economics: Business Strategy & Competitive AdvantageNo ratings yet

- Fundamentals of Business Economics Study Resource: CIMA Study ResourcesFrom EverandFundamentals of Business Economics Study Resource: CIMA Study ResourcesNo ratings yet

- Bail Application - Group7-1Document5 pagesBail Application - Group7-1Antra AzadNo ratings yet

- Chargesheet - Group7-1Document4 pagesChargesheet - Group7-1Antra AzadNo ratings yet

- REgistrationsDocument6 pagesREgistrationsAntra AzadNo ratings yet

- 2017 Chattishgarh Judiciary Prelims Paper PDFDocument54 pages2017 Chattishgarh Judiciary Prelims Paper PDFAntra AzadNo ratings yet

- Nagmani SLPDocument168 pagesNagmani SLPAntra AzadNo ratings yet

- Introduction Material 1Document18 pagesIntroduction Material 1Antra AzadNo ratings yet

- Freshers BudgetDocument1 pageFreshers BudgetAntra AzadNo ratings yet

- Bench CompositionDocument1 pageBench CompositionAntra AzadNo ratings yet

- Shivcon Estate PVT LTDDocument16 pagesShivcon Estate PVT LTDAntra AzadNo ratings yet

- Freshers DateDocument1 pageFreshers DateAntra AzadNo ratings yet

- UNDERTAKING For PlacementDocument1 pageUNDERTAKING For PlacementAntra AzadNo ratings yet

- Exhibit IDocument455 pagesExhibit IAntra AzadNo ratings yet

- 1 - Media Law Paper 1 - 1Document246 pages1 - Media Law Paper 1 - 1Antra Azad100% (1)

- The Commercial Courts Act, 2015Document28 pagesThe Commercial Courts Act, 2015Antra AzadNo ratings yet

- ListsDocument1 pageListsAntra AzadNo ratings yet

- DocumentDocument2 pagesDocumentAntra AzadNo ratings yet

- DJS New SyllabusDocument2 pagesDJS New SyllabusAntra AzadNo ratings yet

- Cailnmcc 2 1Document21 pagesCailnmcc 2 1Antra AzadNo ratings yet

- Primary Market - Concept, Functions Etc.Document3 pagesPrimary Market - Concept, Functions Etc.Antra AzadNo ratings yet

- CP Irmo 12042022 220720 125318Document138 pagesCP Irmo 12042022 220720 125318Antra AzadNo ratings yet

- Project ListDocument10 pagesProject ListAntra AzadNo ratings yet

- Project List of Cyber LawDocument4 pagesProject List of Cyber LawAntra AzadNo ratings yet

- Deelip Singh v. State of Bihar, (2005)Document20 pagesDeelip Singh v. State of Bihar, (2005)Antra AzadNo ratings yet

- Statement of JurisdictionDocument5 pagesStatement of JurisdictionAntra AzadNo ratings yet

- Contract Act"), On One Hand, A Contract Can Be Validly Terminated by Giving LegitimateDocument5 pagesContract Act"), On One Hand, A Contract Can Be Validly Terminated by Giving LegitimateAntra Azad100% (1)

- Alakh Alok Srivastava v. Union of India, (2018) 17 SCC 291Document9 pagesAlakh Alok Srivastava v. Union of India, (2018) 17 SCC 291Antra AzadNo ratings yet

- Yedla Srinivasa Rao v. State of A.P., (2006) 11 SCCDocument10 pagesYedla Srinivasa Rao v. State of A.P., (2006) 11 SCCAntra AzadNo ratings yet

- Deepak Gulati v. State of Haryana, (2013) 7 SCC 675Document10 pagesDeepak Gulati v. State of Haryana, (2013) 7 SCC 675Antra AzadNo ratings yet

- Institution Letter Head: Form: INT-02/17Document1 pageInstitution Letter Head: Form: INT-02/17Antra AzadNo ratings yet

- Customer Name Masked Card NumberDocument68 pagesCustomer Name Masked Card NumberAntra AzadNo ratings yet

- Final Webinar Presentation - IRRBBDocument43 pagesFinal Webinar Presentation - IRRBBRAHUL YADAVNo ratings yet

- Hull-White ModelDocument5 pagesHull-White Modeljackie555No ratings yet

- Macroeconomics Australia 7th Edition Mctaggart Solutions ManualDocument17 pagesMacroeconomics Australia 7th Edition Mctaggart Solutions Manualdencuongpow5100% (24)

- Reviewer in Theory of Accounts Multiple ChoiceDocument17 pagesReviewer in Theory of Accounts Multiple ChoiceDaniella Mae ElipNo ratings yet

- MyLoanCare Personal Loan Comparison HDFC Bank Axis BankDocument1 pageMyLoanCare Personal Loan Comparison HDFC Bank Axis BankAakash JhaNo ratings yet

- Tutorial 2 Chapter 5 With AnswersDocument9 pagesTutorial 2 Chapter 5 With AnswersNoor TaherNo ratings yet

- Iapm Iim Jammu #4Document64 pagesIapm Iim Jammu #4Daksh KhullarNo ratings yet

- Practice Questions On Time Value of MoneyDocument7 pagesPractice Questions On Time Value of MoneyShashank shekhar ShuklaNo ratings yet

- GenMath Q2 W 1 825 PagesDocument25 pagesGenMath Q2 W 1 825 PagesMarylyn MirandaNo ratings yet

- Chapter 11Document20 pagesChapter 11Mahra AlMazroueiNo ratings yet

- Literature Review On Auto LoanDocument6 pagesLiterature Review On Auto Loansvgkjqbnd100% (1)

- ScriptDocument5 pagesScriptFredmark EvangelistaNo ratings yet

- Current Liabilities - PROBLEMSDocument11 pagesCurrent Liabilities - PROBLEMSIra Grace De Castro100% (2)

- Derivatives Markets 3rd Edition McDonald Test Bank DownloadDocument5 pagesDerivatives Markets 3rd Edition McDonald Test Bank DownloadBarbara Sosa100% (28)

- Ch24 - Measuring The Cost of LivingDocument39 pagesCh24 - Measuring The Cost of LivingKhánh HiềnNo ratings yet

- Midterm RevisionDocument2 pagesMidterm Revisionhoantkss181354No ratings yet

- M3.2 Security ValuationDocument26 pagesM3.2 Security ValuationVan AnhNo ratings yet

- PRELIMQUIZ2Document2 pagesPRELIMQUIZ2Mathew EstradaNo ratings yet

- Financial Markets in IndiaDocument9 pagesFinancial Markets in IndiatheOnuMonu GamerNo ratings yet

- Chapter - 10 - Fixed Income Securities - GitmanDocument39 pagesChapter - 10 - Fixed Income Securities - GitmanJessica Charoline PangkeyNo ratings yet

- All Question PapersDocument16 pagesAll Question PapersSwastika MohapatraNo ratings yet

- Tg26 Mat 152 Lesson Exam Pg3Document6 pagesTg26 Mat 152 Lesson Exam Pg3ECE CAPILINo ratings yet

- The Cost of Capital: Answers To End-Of-Chapter QuestionsDocument21 pagesThe Cost of Capital: Answers To End-Of-Chapter QuestionsMiftahul FirdausNo ratings yet

- (Lecture 8 & 9) - Cost of CapitalDocument22 pages(Lecture 8 & 9) - Cost of CapitalAjay Kumar TakiarNo ratings yet

- MBA (Sem 4) Theory Examination 2019-20 Financial Derivatives Multiple Choice QuestionsDocument17 pagesMBA (Sem 4) Theory Examination 2019-20 Financial Derivatives Multiple Choice QuestionsRiya Kaushik67% (3)

- Economics Project: Role of Rbi in Control of CreditDocument35 pagesEconomics Project: Role of Rbi in Control of CreditDhairya Tamta79% (19)

- Chapter 2-Part 2Document13 pagesChapter 2-Part 2Puji dyukeNo ratings yet

- Camels RatingDocument30 pagesCamels RatingAbhishek BarmanNo ratings yet

- Ia 1 Setc Finalexam No AnswerDocument10 pagesIa 1 Setc Finalexam No Answerjulia4razo100% (1)

- 2021 WHLP Week 1 2 Business FInance 2nd QuarterDocument4 pages2021 WHLP Week 1 2 Business FInance 2nd QuarterHa Jin KimNo ratings yet