Professional Documents

Culture Documents

Assessed Coursework 2 - S2 2020 Update

Assessed Coursework 2 - S2 2020 Update

Uploaded by

Armaghan Ali MalikCopyright:

Available Formats

You might also like

- Bangalore University Fee ReceiptDocument2 pagesBangalore University Fee Receiptpunithrgowda22No ratings yet

- On January 1Document4 pagesOn January 1Kryzzel Anne JonNo ratings yet

- Latihan Soal Cash FlowDocument2 pagesLatihan Soal Cash FlowRuth AngeliaNo ratings yet

- HVAC Technical SpecificationDocument97 pagesHVAC Technical SpecificationMuhammedShafi100% (1)

- Cashflow Practice Solution-AdditionalDocument5 pagesCashflow Practice Solution-AdditionalNadjah JNo ratings yet

- AsasassaDocument3 pagesAsasassaIden PratamaNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Llagas 01 Laboratory Exercise 1Document5 pagesLlagas 01 Laboratory Exercise 1Angela Fye LlagasNo ratings yet

- Chapter 6 - Consolidated Financial Statements (Part 3)Document41 pagesChapter 6 - Consolidated Financial Statements (Part 3)Rena Jocelle NalzaroNo ratings yet

- Q3 NNF LimitedDocument2 pagesQ3 NNF Limitedamosmalusi5No ratings yet

- Financial Accounting Class Activity Fall 6 2021 Statement of Cash FlowsDocument4 pagesFinancial Accounting Class Activity Fall 6 2021 Statement of Cash FlowsRajay BramwellNo ratings yet

- Cada IntmgtAcctg3Exer1Document7 pagesCada IntmgtAcctg3Exer1KrishNo ratings yet

- 2 Corporate LiquidationDocument5 pages2 Corporate LiquidationSamantha0% (1)

- Lan Services Incorporated Income Statement For The Year Ended December 31,2020Document5 pagesLan Services Incorporated Income Statement For The Year Ended December 31,2020Jasmine ActaNo ratings yet

- Revision Questions - CH 17 - SolutionsDocument4 pagesRevision Questions - CH 17 - SolutionsMinh ThưNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- FA3 - GA1 - Group 3Document13 pagesFA3 - GA1 - Group 305 - Trần Mai AnhNo ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- Capital Reorganization QuestionsDocument20 pagesCapital Reorganization QuestionsProf. OBESENo ratings yet

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Question 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireDocument5 pagesQuestion 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireLaud ListowellNo ratings yet

- MSC F & A Test One SolutionDocument7 pagesMSC F & A Test One Solutionsebastian mlingwaNo ratings yet

- Janjua CompanyDocument3 pagesJanjua CompanySyed Muhammad Ali OmerNo ratings yet

- Alkaline Comp. Multi Step QuestionDocument2 pagesAlkaline Comp. Multi Step QuestionhotfujNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- E5 8, E5 11, P5 3, P5 6Document12 pagesE5 8, E5 11, P5 3, P5 6CellinejosephineNo ratings yet

- KUIS AKM 1 kp CDocument4 pagesKUIS AKM 1 kp Cs130321047No ratings yet

- Business Combi PDF FreeDocument13 pagesBusiness Combi PDF FreeEricka RedoñaNo ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Chapter 21 - QB - Q1 - SolutionDocument4 pagesChapter 21 - QB - Q1 - SolutionRichard SibekoNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Bheverlynn Corporation Data SetDocument2 pagesBheverlynn Corporation Data SetDaisy Macuroy PurcaNo ratings yet

- CashFlowStatement AssignmentDocument15 pagesCashFlowStatement AssignmentAnanta Vishain0% (1)

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- Solutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)Document36 pagesSolutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)sunnyauliaNo ratings yet

- 16 B 3 Supplemental - Problems - and - Solutions - CH - 1Document6 pages16 B 3 Supplemental - Problems - and - Solutions - CH - 1minajovanovicNo ratings yet

- Quiz 02 Subsequent To Acquisition DateDocument1 pageQuiz 02 Subsequent To Acquisition DateErjohn PapaNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- IFRS 3 Practical CasesDocument8 pagesIFRS 3 Practical CasesScribdTranslationsNo ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Chapter 4 - AssigmentDocument2 pagesChapter 4 - AssigmentKryzzel Anne JonNo ratings yet

- Description Income Expenses Assets LiabilitiesDocument12 pagesDescription Income Expenses Assets LiabilitiesNipuna Perera100% (1)

- Cash Flow Ex - 230721 - 002228Document7 pagesCash Flow Ex - 230721 - 002228Mohamed TahaNo ratings yet

- Exercise 17.11 SolutionDocument3 pagesExercise 17.11 Solutionraphaelrachel100% (1)

- Intacc 3 Fs ProblemsDocument25 pagesIntacc 3 Fs ProblemsUn knownNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument5 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- Financial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsDocument5 pagesFinancial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsUrvashi BaralNo ratings yet

- Cash Flow ProblemsDocument9 pagesCash Flow ProblemsSharu BsNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Westmont PLCDocument5 pagesWestmont PLCmutuamutisya306No ratings yet

- Adelaide - TaggedDocument2 pagesAdelaide - TaggedudhaymiscworkNo ratings yet

- Assignment 3Document3 pagesAssignment 3zhoudong910105No ratings yet

- Latihan Soal KelompokDocument3 pagesLatihan Soal KelompokPutri RahmawatiNo ratings yet

- Final Activity 3 QuestionDocument2 pagesFinal Activity 3 QuestionSze ChristienyNo ratings yet

- Acounting Revision QuestionsDocument10 pagesAcounting Revision QuestionsJoseph KabiruNo ratings yet

- Assets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Document2 pagesAssets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Usama RajaNo ratings yet

- Liabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsDocument3 pagesLiabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsAmit GodaraNo ratings yet

- Template and solution to Exercise 27.17 27.18Document12 pagesTemplate and solution to Exercise 27.17 27.18joehe2625No ratings yet

- Synge Company IntroductionDocument11 pagesSynge Company IntroductionChanez KNo ratings yet

- Module 1 Introduction To Engineering EconomicsDocument48 pagesModule 1 Introduction To Engineering EconomicsCol. Jerome Carlo Magmanlac, ACPNo ratings yet

- Retail Marketing DissertationDocument7 pagesRetail Marketing DissertationHowToFindSomeoneToWriteMyPaperSingapore100% (1)

- 280 11 001 UK Air Separation Plants Large Scale ExperienceDocument2 pages280 11 001 UK Air Separation Plants Large Scale ExperienceBRYAN CCOLQQUENo ratings yet

- Process Control Narratives: NEORSD Design StandardDocument1 pageProcess Control Narratives: NEORSD Design StandardRaviNo ratings yet

- Comparative Analysis of Promotion Strategies in THDocument16 pagesComparative Analysis of Promotion Strategies in THmanish yadavNo ratings yet

- Ombudsman Office Order No. 05-15, (January 24, 2005)Document4 pagesOmbudsman Office Order No. 05-15, (January 24, 2005)Alyssa Marie MartinezNo ratings yet

- Akuntansi Sektor Publik Ipsas Dan SapDocument107 pagesAkuntansi Sektor Publik Ipsas Dan SapVincenttio le Cloud100% (1)

- 2021 KBCM SaaS SurveyDocument71 pages2021 KBCM SaaS SurveyAdriaan StormeNo ratings yet

- Energizing Indonesia's Growth: Annual ReportDocument166 pagesEnergizing Indonesia's Growth: Annual ReportDevin SantosoNo ratings yet

- PDF 20230403 120901 0000Document12 pagesPDF 20230403 120901 0000Tirta syah putra AlamNo ratings yet

- Marketing of It Products by Zameer Bandh.....Document50 pagesMarketing of It Products by Zameer Bandh.....zameer_suoNo ratings yet

- Design Thinking Lab ExperimentsDocument25 pagesDesign Thinking Lab Experimentssrinivas gangishettiNo ratings yet

- Saroj Eng WorksDocument1 pageSaroj Eng WorksVidya SinghNo ratings yet

- Mba Summer 2019Document2 pagesMba Summer 2019Deepak SolankiNo ratings yet

- Fo Unit1&2 Notes BSC Hha 4TH SemDocument24 pagesFo Unit1&2 Notes BSC Hha 4TH Semnishadsushant40No ratings yet

- Adobe Scan 17 Apr 2023Document5 pagesAdobe Scan 17 Apr 2023Bijoy DuttaNo ratings yet

- (Palgrave Macmillan Studies in Banking and Financial Institutions) Alexandros-Andreas Kyrtsis (eds.) - Financial Markets and Organizational Technologies_ System Architectures, Practices and Risks in tDocument264 pages(Palgrave Macmillan Studies in Banking and Financial Institutions) Alexandros-Andreas Kyrtsis (eds.) - Financial Markets and Organizational Technologies_ System Architectures, Practices and Risks in trachid maghniwiNo ratings yet

- Sajid Ali CVDocument2 pagesSajid Ali CVMisbhasaeedaNo ratings yet

- Law of Contract II-1Document53 pagesLaw of Contract II-1Lusekero MwangondeNo ratings yet

- Rhina Calimlim Worksheet and Fin StatementsDocument11 pagesRhina Calimlim Worksheet and Fin StatementsDianna Rose MenorNo ratings yet

- Product Foundations - Telecommunications Service Operations Management - Companion GuideDocument36 pagesProduct Foundations - Telecommunications Service Operations Management - Companion GuideluisisidoroNo ratings yet

- Insulator and Conductor Fittings For Overhead Power Lines - : Part 1: Performance and General RequirementsDocument26 pagesInsulator and Conductor Fittings For Overhead Power Lines - : Part 1: Performance and General RequirementsMohamed Ahmed Afifi100% (1)

- Sy Suan V Regalla (1956)Document2 pagesSy Suan V Regalla (1956)Hyuga Neji50% (2)

- Big BasketDocument6 pagesBig BasketSujith Kumar100% (2)

- CFC Reform Story 11 Improving Internet Access in The Philippines PDFDocument9 pagesCFC Reform Story 11 Improving Internet Access in The Philippines PDFKarla Streegan Cruz100% (1)

- Nicolas-Joseph Cugnot de Rivas EngineDocument36 pagesNicolas-Joseph Cugnot de Rivas Enginesuhil bNo ratings yet

- Compro Saj 2023 - 22052023Document58 pagesCompro Saj 2023 - 22052023Ahmad FauziNo ratings yet

Assessed Coursework 2 - S2 2020 Update

Assessed Coursework 2 - S2 2020 Update

Uploaded by

Armaghan Ali MalikOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assessed Coursework 2 - S2 2020 Update

Assessed Coursework 2 - S2 2020 Update

Uploaded by

Armaghan Ali MalikCopyright:

Available Formats

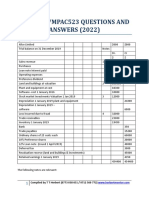

MASTER OF ACCOUNTING

(Professional)

ACCG8126 CORPORATE ACCOUNTING

Assessed Coursework 2

Due date: 11 September (5pm) submitted on ilearn

Marks and percentages: This assessed coursework will be marked out of 20 marks and

contributes towards 5% to your assessment.

Submitted document format: pdf file to be uploaded

On 1 July 2017 Salah Ltd acquired 100% of the share capital (cum div.) of Robertson Ltd for

$440,000. At that date, the relevant balances in the records of Robertson Ltd were:

$

Share capital 300,000

General reserve 15,000

Retained earnings 70,000

Dividend payable 6,000

At the date of acquisition all assets and liabilities of Robertson Ltd were recorded in the

accounting records at amounts equal to their fair values with the exception of the following

assets:

Carrying amount Fair value

$ $

Inventory 11,000 16,000

Equipment 39,000 55,000

Land 50,000 60,000

All inventory on hand at acquisition date was sold by 30 June 2018. Robertson Ltd revalued

the land to fair value immediately after the acquisition in its accounting records. The cost of

the equipment was $52,000 and had a further five (5) year life as at the date of acquisition.

Robertson Ltd disclosed a contingent liability in relation to a court case, which could

potentially result in the company paying damages to a contractor. Salah Ltd calculated the

fair value of this liability to be $14,000 at acquisition date. On 1 April 2020 Salah Ltd

reassessed the fair value of the liability to be $6,000 as the chances of winning the case had

improved, no amount has been paid.

Additional information:

a) During the year ending 30 June 2019, Robertson Ltd sold inventory to Salah Ltd for

$18,000. The cost of inventory to Robertson Ltd was $11,000. 70% of this inventory was

sold by Salah Ltd to external parties by 30 June 2019. The balance of the inventory was

sold to external entities in November 2019 for $9,000.

b) During the year ending 30 June 2020, Robertson Ltd purchased inventory from Salah Ltd

for $21,000, with Salah Ltd recording a before-tax profit of $8,000. By 30 June 2020,

Robertson sold a quarter of this inventory to external entities.

c) On 1 January 2019, Robertson Ltd sold an item of equipment to Salah Ltd for $40,000.

The original cost of the equipment to Robertson Ltd was $52,000 and had a carrying

amount at the time of sale of $31,000. The equipment is depreciated at 20% p.a.

straight-line.

d) All transfers from retained earnings to the general reserve by Salah Ltd and Robertson

Ltd were from post-acquisition earnings.

e) On realisation of the business combination valuation reserve, a transfer is made to

retained earnings on consolidation.

ACCG8126 s1 2020 Assessed coursework 2 Page 2

f) The tax rate is 30%.

ACCG8126 s1 2020 Assessed coursework 2 Page 3

The financial statements of the two companies at 30 June 2020 are as follows:

Salah Robertson

$ $

Revenues 840 000 520 000

Expenses (630 000) (400 000)

Net profit before tax 210 000 120 000

Income tax expense (72 000) (43 000)

Net profit after tax 138 000 77 000

Retained earnings 1 July 2019 190 000 140 000

328 000 217 000

Dividend declared (65 000) (22 000)

Transfer to general reserve (18 000) (14 000)

Retained earnings 30 June 2020 245 000 181 000

Share capital 610 000 300 000

General reserve 51 000 62 000

Asset revaluation reserve 12 000 7 000

Accounts payable 43 000 15 000

Advance from Salah Ltd – 75 000

Other liabilities 36 000 31 000

TOTAL EQUITY AND LIABILITIES 997 000 671 000

Cash 180 000 160 000

Accounts receivable 32 000 58 000

Prepayment 26 000 29 000

Inventory 99 000 100 000

Advance to Robertson Ltd 75 000 –

Investment in Robertson Ltd 434 000 –

Non-current assets 151 000 324 000

TOTAL ASSETS 997 000 671 000

Required:

Prepare the consolidation journal entries for the Salah Ltd group for the year ended 30 June

2020. (20 marks)

ACCG8126 s1 2020 Assessed coursework 2 Page 4

Acquisition Analysis

At 01 July 2017:

Net fair value of assets and liabilties of Robertson Ltd

= $ 300,000 + 15,000 + 70,000 (equity)

+ 5,000 x 0.7 (Inventory)

+ 16,000 x 0.7 (Equipment)

+ 10,000 x 0.7 (Land)

- 14,000 x 0.7 (Contingent Liability)

= $ 396,900

Consideration transferred = $ 434,000

Goodwill = $ 37,100

BCVR Journal Entries

Account DR CR

Goodwill 37,100

BCVR 37,100

Accumulated Depreciation 19,000

Equipment 3,000

Deferred tax liability 4,800

BCVR 11,200

Depreciation expense 3,200

Retained earnings 6,400

Accumulated depreciation 9,600

Land 10,000

Deferred tax liability 3,000

BCVR 7,000

Deferred tax liability 4,200

Income tax expense 1,367

Retained Earning 2,700

Income tax expense 4,200

Transferred from BCVR 9,800

Legal claim 6,000

Gain 8,000

No entry for inventory

Pre-Acquisition Journal Entries

ACCG8126 s1 2020 Assessed coursework 2 Page 5

Account DR CR

Share capital 300,000

General reserve 15,000

Retained earning 70,000

BCVR 55,000

Investment in Robertson Ltd 440,000

Retained earnings 3,500

BCVR 3,500

Inventory (5,000*0.7)

BCVR 9,800

Transfer from BCVR 9,800

Lawsuit (14,000*0.7)

Retained earnings 7,000

Land 7,000

Land (10,000*0.7)

Intra-group Journal Entries

Account DR CR

Dividend Declared

Dividend payable 22,000

Dividend declared 22,000

Dividend revenue 22,000

Dividend receivable 22,000

Opening inventory (Robertson-Salah)

Retained earnings 3,430

Income tax expense 1,470

Cost of sales 4,900

Ending inventory (Salah- Robertson)

Sales 21,000

Cost of sales 15,000

Inventory 6,000

Deferred tax assets 1,800

Income tax expense 1,800

Non-current assets (Robertson-Salah)

Retained earning 6,300

ACCG8126 s1 2020 Assessed coursework 2 Page 6

Deferred tax assets 2,700

Equipment 12,000

Accumulated depreciation 21,000

Accumulated depreciation 2,700

Retained earnings 900

Depreciation expense 1,800

Retained earnings 270

Income tax expense 540

Deferred tax assets 810

Inter-company balances

Advance from Salah 75,000

Advance to Robertsons 75,000

ACCG8126 s1 2020 Assessed coursework 2 Page 7

You might also like

- Bangalore University Fee ReceiptDocument2 pagesBangalore University Fee Receiptpunithrgowda22No ratings yet

- On January 1Document4 pagesOn January 1Kryzzel Anne JonNo ratings yet

- Latihan Soal Cash FlowDocument2 pagesLatihan Soal Cash FlowRuth AngeliaNo ratings yet

- HVAC Technical SpecificationDocument97 pagesHVAC Technical SpecificationMuhammedShafi100% (1)

- Cashflow Practice Solution-AdditionalDocument5 pagesCashflow Practice Solution-AdditionalNadjah JNo ratings yet

- AsasassaDocument3 pagesAsasassaIden PratamaNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Llagas 01 Laboratory Exercise 1Document5 pagesLlagas 01 Laboratory Exercise 1Angela Fye LlagasNo ratings yet

- Chapter 6 - Consolidated Financial Statements (Part 3)Document41 pagesChapter 6 - Consolidated Financial Statements (Part 3)Rena Jocelle NalzaroNo ratings yet

- Q3 NNF LimitedDocument2 pagesQ3 NNF Limitedamosmalusi5No ratings yet

- Financial Accounting Class Activity Fall 6 2021 Statement of Cash FlowsDocument4 pagesFinancial Accounting Class Activity Fall 6 2021 Statement of Cash FlowsRajay BramwellNo ratings yet

- Cada IntmgtAcctg3Exer1Document7 pagesCada IntmgtAcctg3Exer1KrishNo ratings yet

- 2 Corporate LiquidationDocument5 pages2 Corporate LiquidationSamantha0% (1)

- Lan Services Incorporated Income Statement For The Year Ended December 31,2020Document5 pagesLan Services Incorporated Income Statement For The Year Ended December 31,2020Jasmine ActaNo ratings yet

- Revision Questions - CH 17 - SolutionsDocument4 pagesRevision Questions - CH 17 - SolutionsMinh ThưNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- FA3 - GA1 - Group 3Document13 pagesFA3 - GA1 - Group 305 - Trần Mai AnhNo ratings yet

- MPACC512 Advanced Fin Reporting Answer Bank 2022Document44 pagesMPACC512 Advanced Fin Reporting Answer Bank 2022Tawanda Tatenda HerbertNo ratings yet

- Capital Reorganization QuestionsDocument20 pagesCapital Reorganization QuestionsProf. OBESENo ratings yet

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Question 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireDocument5 pagesQuestion 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireLaud ListowellNo ratings yet

- MSC F & A Test One SolutionDocument7 pagesMSC F & A Test One Solutionsebastian mlingwaNo ratings yet

- Janjua CompanyDocument3 pagesJanjua CompanySyed Muhammad Ali OmerNo ratings yet

- Alkaline Comp. Multi Step QuestionDocument2 pagesAlkaline Comp. Multi Step QuestionhotfujNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- E5 8, E5 11, P5 3, P5 6Document12 pagesE5 8, E5 11, P5 3, P5 6CellinejosephineNo ratings yet

- KUIS AKM 1 kp CDocument4 pagesKUIS AKM 1 kp Cs130321047No ratings yet

- Business Combi PDF FreeDocument13 pagesBusiness Combi PDF FreeEricka RedoñaNo ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Chapter 21 - QB - Q1 - SolutionDocument4 pagesChapter 21 - QB - Q1 - SolutionRichard SibekoNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Bheverlynn Corporation Data SetDocument2 pagesBheverlynn Corporation Data SetDaisy Macuroy PurcaNo ratings yet

- CashFlowStatement AssignmentDocument15 pagesCashFlowStatement AssignmentAnanta Vishain0% (1)

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- Solutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)Document36 pagesSolutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)sunnyauliaNo ratings yet

- 16 B 3 Supplemental - Problems - and - Solutions - CH - 1Document6 pages16 B 3 Supplemental - Problems - and - Solutions - CH - 1minajovanovicNo ratings yet

- Quiz 02 Subsequent To Acquisition DateDocument1 pageQuiz 02 Subsequent To Acquisition DateErjohn PapaNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- IFRS 3 Practical CasesDocument8 pagesIFRS 3 Practical CasesScribdTranslationsNo ratings yet

- ACCT10002 Tutorial 9 ExercisesDocument6 pagesACCT10002 Tutorial 9 ExercisesJING NIENo ratings yet

- Chapter 4 - AssigmentDocument2 pagesChapter 4 - AssigmentKryzzel Anne JonNo ratings yet

- Description Income Expenses Assets LiabilitiesDocument12 pagesDescription Income Expenses Assets LiabilitiesNipuna Perera100% (1)

- Cash Flow Ex - 230721 - 002228Document7 pagesCash Flow Ex - 230721 - 002228Mohamed TahaNo ratings yet

- Exercise 17.11 SolutionDocument3 pagesExercise 17.11 Solutionraphaelrachel100% (1)

- Intacc 3 Fs ProblemsDocument25 pagesIntacc 3 Fs ProblemsUn knownNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument5 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Consolidated Financial Statement Practice 3-2Document2 pagesConsolidated Financial Statement Practice 3-2Winnie TanNo ratings yet

- Financial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsDocument5 pagesFinancial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsUrvashi BaralNo ratings yet

- Cash Flow ProblemsDocument9 pagesCash Flow ProblemsSharu BsNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Westmont PLCDocument5 pagesWestmont PLCmutuamutisya306No ratings yet

- Adelaide - TaggedDocument2 pagesAdelaide - TaggedudhaymiscworkNo ratings yet

- Assignment 3Document3 pagesAssignment 3zhoudong910105No ratings yet

- Latihan Soal KelompokDocument3 pagesLatihan Soal KelompokPutri RahmawatiNo ratings yet

- Final Activity 3 QuestionDocument2 pagesFinal Activity 3 QuestionSze ChristienyNo ratings yet

- Acounting Revision QuestionsDocument10 pagesAcounting Revision QuestionsJoseph KabiruNo ratings yet

- Assets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Document2 pagesAssets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Usama RajaNo ratings yet

- Liabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsDocument3 pagesLiabilities 31.03.20X1 Rs. 31.03.20X 2 Rs. Assets 31.03.20X 1 Rs. 31.03.20X2 RsAmit GodaraNo ratings yet

- Template and solution to Exercise 27.17 27.18Document12 pagesTemplate and solution to Exercise 27.17 27.18joehe2625No ratings yet

- Synge Company IntroductionDocument11 pagesSynge Company IntroductionChanez KNo ratings yet

- Module 1 Introduction To Engineering EconomicsDocument48 pagesModule 1 Introduction To Engineering EconomicsCol. Jerome Carlo Magmanlac, ACPNo ratings yet

- Retail Marketing DissertationDocument7 pagesRetail Marketing DissertationHowToFindSomeoneToWriteMyPaperSingapore100% (1)

- 280 11 001 UK Air Separation Plants Large Scale ExperienceDocument2 pages280 11 001 UK Air Separation Plants Large Scale ExperienceBRYAN CCOLQQUENo ratings yet

- Process Control Narratives: NEORSD Design StandardDocument1 pageProcess Control Narratives: NEORSD Design StandardRaviNo ratings yet

- Comparative Analysis of Promotion Strategies in THDocument16 pagesComparative Analysis of Promotion Strategies in THmanish yadavNo ratings yet

- Ombudsman Office Order No. 05-15, (January 24, 2005)Document4 pagesOmbudsman Office Order No. 05-15, (January 24, 2005)Alyssa Marie MartinezNo ratings yet

- Akuntansi Sektor Publik Ipsas Dan SapDocument107 pagesAkuntansi Sektor Publik Ipsas Dan SapVincenttio le Cloud100% (1)

- 2021 KBCM SaaS SurveyDocument71 pages2021 KBCM SaaS SurveyAdriaan StormeNo ratings yet

- Energizing Indonesia's Growth: Annual ReportDocument166 pagesEnergizing Indonesia's Growth: Annual ReportDevin SantosoNo ratings yet

- PDF 20230403 120901 0000Document12 pagesPDF 20230403 120901 0000Tirta syah putra AlamNo ratings yet

- Marketing of It Products by Zameer Bandh.....Document50 pagesMarketing of It Products by Zameer Bandh.....zameer_suoNo ratings yet

- Design Thinking Lab ExperimentsDocument25 pagesDesign Thinking Lab Experimentssrinivas gangishettiNo ratings yet

- Saroj Eng WorksDocument1 pageSaroj Eng WorksVidya SinghNo ratings yet

- Mba Summer 2019Document2 pagesMba Summer 2019Deepak SolankiNo ratings yet

- Fo Unit1&2 Notes BSC Hha 4TH SemDocument24 pagesFo Unit1&2 Notes BSC Hha 4TH Semnishadsushant40No ratings yet

- Adobe Scan 17 Apr 2023Document5 pagesAdobe Scan 17 Apr 2023Bijoy DuttaNo ratings yet

- (Palgrave Macmillan Studies in Banking and Financial Institutions) Alexandros-Andreas Kyrtsis (eds.) - Financial Markets and Organizational Technologies_ System Architectures, Practices and Risks in tDocument264 pages(Palgrave Macmillan Studies in Banking and Financial Institutions) Alexandros-Andreas Kyrtsis (eds.) - Financial Markets and Organizational Technologies_ System Architectures, Practices and Risks in trachid maghniwiNo ratings yet

- Sajid Ali CVDocument2 pagesSajid Ali CVMisbhasaeedaNo ratings yet

- Law of Contract II-1Document53 pagesLaw of Contract II-1Lusekero MwangondeNo ratings yet

- Rhina Calimlim Worksheet and Fin StatementsDocument11 pagesRhina Calimlim Worksheet and Fin StatementsDianna Rose MenorNo ratings yet

- Product Foundations - Telecommunications Service Operations Management - Companion GuideDocument36 pagesProduct Foundations - Telecommunications Service Operations Management - Companion GuideluisisidoroNo ratings yet

- Insulator and Conductor Fittings For Overhead Power Lines - : Part 1: Performance and General RequirementsDocument26 pagesInsulator and Conductor Fittings For Overhead Power Lines - : Part 1: Performance and General RequirementsMohamed Ahmed Afifi100% (1)

- Sy Suan V Regalla (1956)Document2 pagesSy Suan V Regalla (1956)Hyuga Neji50% (2)

- Big BasketDocument6 pagesBig BasketSujith Kumar100% (2)

- CFC Reform Story 11 Improving Internet Access in The Philippines PDFDocument9 pagesCFC Reform Story 11 Improving Internet Access in The Philippines PDFKarla Streegan Cruz100% (1)

- Nicolas-Joseph Cugnot de Rivas EngineDocument36 pagesNicolas-Joseph Cugnot de Rivas Enginesuhil bNo ratings yet

- Compro Saj 2023 - 22052023Document58 pagesCompro Saj 2023 - 22052023Ahmad FauziNo ratings yet