Professional Documents

Culture Documents

Certaingovernmentpaymentspua 1099g Josephcheeseborough 654202101300243

Certaingovernmentpaymentspua 1099g Josephcheeseborough 654202101300243

Uploaded by

Joseph CheeseboroughOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certaingovernmentpaymentspua 1099g Josephcheeseborough 654202101300243

Certaingovernmentpaymentspua 1099g Josephcheeseborough 654202101300243

Uploaded by

Joseph CheeseboroughCopyright:

Available Formats

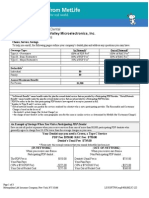

CERTAIN GOVERNMENT PAYMENTS

PUA-1099G

Claimant:

Date Mailed: 2/1/2021 JOSEPH CHEESEBOROUGH

Joseph Cheeseborough Claimant ID:

1733 S 23rd St 820663

Philadelphia, PA 19145-1910

STATEMENT FOR RECIPIENTS OF

PANDEMIC UNEMPLOYMENT ASSISTANCE (PUA) PAYMENTS

PUA-1099G

Payer: This form shows the total PUA paid to you by the Department of Labor &

COMMONWEALTH OF PENNSYLVANIA Industry in the tax year indicated, and the amount of federal income tax

withheld (if you requested tax withholding). This is important tax

DEPARTMENT OF LABOR & INDUSTRY information and is being furnished to the Internal Revenue Service

OFFICE OF UC BENEFITS POLICY (IRS). If you are required to file a return, a negligence penalty or other

651 BOAS STREET sanction may be imposed on you if this income is taxable and the IRS

determines that it has not been reported. For income tax purposes,

HARRISBURG, PA 17121-0750 unemployment compensation benefits are reported in the calendar year

888-313-7284 in which they are paid, regardless of when the claim for benefits was

filed.

OMB NO. 1545-0120 FEDERAL ID NO. 23-6003107

THIS IS NOT A BILL - DO NOT DESTROY - KEEP WITH YOUR TAX RECORDS

SOCIAL SECURITY NO. TOTAL PAYMENT TAX WITHHELD TAX YEAR Dear Recipient: YOU MAY BE ELIGIBLE FOR THE

EARNED INCOME CREDIT, which is a federal benefit

for both married and single parents who worked either

***-**-2517 19605.00 1980.00 2020 full or part time during all of or part of the year and

earned less than the federal qualifying amount. If you

RECIPIENT'S name, address, zip code are eligible, you will either owe less taxes or qualify for a

larger tax refund. To file for the Earned Income Credit,

fill out and attach "Schedule EIC" to your federal income

CHEESEBOROUGH JOSEPH tax return. For more information, call the IRS toll free at

800-829-1040 or visit www.irs.gov.

1733 S 23RD ST

Philadelphia PA, 19145-1910 NOTE: If you were overpaid benefits, and repaid the

amount, it is still included in the "TOTAL PAYMENT." If

the repayment was made in the same year as the

overpayment, make the necessary adjustment and

notation on your Tax Form 1040 or 1040A. Your

cancelled check or copy of money order may be used

as your proof for adjustments claimed.

PUA-1099G

Auxiliary aids and services are available upon request to individuals with disabilities.

Equal Opportunity Employer/Program

1 of 1 FE139B69-18C4-448A-8BF4-6A41DC4C0E9F 10426998

You might also like

- Judiciary Newsletter - Issue 1 - March 2024Document16 pagesJudiciary Newsletter - Issue 1 - March 2024L'express MauriceNo ratings yet

- Lepsl 590 Executing and Monitoring Your BudgetDocument9 pagesLepsl 590 Executing and Monitoring Your Budgetapi-462898831100% (1)

- Paula Atkins 17881 Thelma Ave Apt A Jupiter, FL 33458 Claimant ID: 226330Document2 pagesPaula Atkins 17881 Thelma Ave Apt A Jupiter, FL 33458 Claimant ID: 226330Natural Beauty LaserNo ratings yet

- Metlife - Dental Ppo 12 15Document3 pagesMetlife - Dental Ppo 12 15api-252555369No ratings yet

- CertainGovernmentPayments1099G JamesSmith-654202001310815Document4 pagesCertainGovernmentPayments1099G JamesSmith-654202001310815ireaditallNo ratings yet

- Statement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GDocument1 pageStatement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GClifton WilsonNo ratings yet

- CertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245Document1 pageCertainGovernmentPaymentsPUA 1099G CharrisePhelps 654202101193245c phelpsNo ratings yet

- Doctors Note Policy 1Document1 pageDoctors Note Policy 1api-368387391No ratings yet

- Notice 10379458091 PDFDocument9 pagesNotice 10379458091 PDFRenee VasquezNo ratings yet

- Cash FlowDocument1 pageCash Flowpawan_019No ratings yet

- Claim Form: Li Shiran SL 07 13 1990 Li Shiran SL 1848 Mount Albert Rd. L0G 1V0 416 274 3390Document2 pagesClaim Form: Li Shiran SL 07 13 1990 Li Shiran SL 1848 Mount Albert Rd. L0G 1V0 416 274 3390Steve LiNo ratings yet

- Borrower Information: Disclosure Statement William D. Ford Federal Direct Loan ProgramDocument3 pagesBorrower Information: Disclosure Statement William D. Ford Federal Direct Loan ProgramNathan BurrisNo ratings yet

- Report CardDocument1 pageReport Cardapi-358301100No ratings yet

- Web Payment InvoiceDocument2 pagesWeb Payment Invoicemiranda criggerNo ratings yet

- Name: in This Lesson, You Will Learn To:: Resources QuestionsDocument2 pagesName: in This Lesson, You Will Learn To:: Resources QuestionsemscnpckNo ratings yet

- 2020 Form 5498 IRA Contribution Information: Upendra Eduru 24032 Audubon Trail DR ALDIE VA 20105-5917Document2 pages2020 Form 5498 IRA Contribution Information: Upendra Eduru 24032 Audubon Trail DR ALDIE VA 20105-5917BindhuNo ratings yet

- 2019-2020 Full PPO 0 Deductible SBC PDFDocument9 pages2019-2020 Full PPO 0 Deductible SBC PDFrgbrbNo ratings yet

- Low Income Home Energy Assistance Program (LIHEAP) : Application For Financial Help To Heat or Cool Your HomeDocument6 pagesLow Income Home Energy Assistance Program (LIHEAP) : Application For Financial Help To Heat or Cool Your HomeJessiCaddell-HunsuckerNo ratings yet

- Earnings StatementDocument1 pageEarnings Statementkrmita OrtizNo ratings yet

- Changed Circumstance Detail Form: Melissa Marie JonesDocument11 pagesChanged Circumstance Detail Form: Melissa Marie JonesMelissa JonesNo ratings yet

- Aetna 1850 HD PlanDocument10 pagesAetna 1850 HD PlanNaveen ChintamaniNo ratings yet

- SANDOVAL 8030228962 Loan EstimateDocument3 pagesSANDOVAL 8030228962 Loan EstimateRic PerezNo ratings yet

- Healthcare - Gov/sbc-Glossary: Important Questions Answers Why This MattersDocument10 pagesHealthcare - Gov/sbc-Glossary: Important Questions Answers Why This MattersQFQEWFWQEFwqNo ratings yet

- Non Negotiable - This Is Not A Check - Non NegotiableDocument1 pageNon Negotiable - This Is Not A Check - Non NegotiableWILLIE WRIGHTNo ratings yet

- ShowDocument2 pagesShowBrianna Jean-BaptisteNo ratings yet

- 5.tax Interview Questions Virtual Interview FiverrDocument4 pages5.tax Interview Questions Virtual Interview Fiverrfrantzloppe05No ratings yet

- Application To Rent or Lease (Fillable)Document2 pagesApplication To Rent or Lease (Fillable)Victorino ValdezNo ratings yet

- 8850 Wotc Tax FormDocument2 pages8850 Wotc Tax Formapi-127186411No ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09Braeylnn bookerNo ratings yet

- Description Rate Hours Earnings Year To Date Taxes Current Year To DateDocument1 pageDescription Rate Hours Earnings Year To Date Taxes Current Year To DateCody BryantNo ratings yet

- Monetary Determination Pandemic Unemployment Assistance: Michael L PresleyDocument3 pagesMonetary Determination Pandemic Unemployment Assistance: Michael L PresleyDylan VanslochterenNo ratings yet

- 2019-H-294-01023 Acosta Bridge Decorative Lighting Permit - RedactedDocument28 pages2019-H-294-01023 Acosta Bridge Decorative Lighting Permit - RedactedAnne SchindlerNo ratings yet

- 12 08 88 Explanation of Benefits LetterDocument1 page12 08 88 Explanation of Benefits LetterOKTeaPartyPACNo ratings yet

- Alabama Court Form - Answer To Landlord's Claim (Eviction)Document1 pageAlabama Court Form - Answer To Landlord's Claim (Eviction)ForeclosureGate.org LibraryNo ratings yet

- Insurance Dec Page-DummyDocument1 pageInsurance Dec Page-DummyAjha DortchNo ratings yet

- ResourceProxy PDFDocument3 pagesResourceProxy PDFGuerline PhilistinNo ratings yet

- Myrna Keith - Employer Package PDFDocument24 pagesMyrna Keith - Employer Package PDFJoey KeithNo ratings yet

- Documents Form Medical Claim Il PDFDocument4 pagesDocuments Form Medical Claim Il PDFAnonymous isUyKYK1zwNo ratings yet

- Edna M Guzman: 1570 Thousand Oaks DR APT 201 SAN ANTONIO, TX 78232-2395Document8 pagesEdna M Guzman: 1570 Thousand Oaks DR APT 201 SAN ANTONIO, TX 78232-2395Edna GuzmanNo ratings yet

- Form IL-941: 2020 Illinois Withholding Income Tax ReturnDocument2 pagesForm IL-941: 2020 Illinois Withholding Income Tax ReturnArnawama LegawaNo ratings yet

- Tax Return Enclosures List: FEDERAL T1 2009Document16 pagesTax Return Enclosures List: FEDERAL T1 2009Christine TemplemanNo ratings yet

- Pay SlipDocument1 pagePay Slipwilaiketngam15No ratings yet

- State of New Jersey Department of The Treasury Unclaimed Property Administration P. O. Box 214 Trenton, NJ 08625Document3 pagesState of New Jersey Department of The Treasury Unclaimed Property Administration P. O. Box 214 Trenton, NJ 08625Tommy GraceNo ratings yet

- Leave Certification Requirements: Page 1 of 14Document14 pagesLeave Certification Requirements: Page 1 of 14Anonymous zEf2TWiHgWNo ratings yet

- Healthcare - Gov/sbc-Glossary: Important Questions Answers Why This MattersDocument8 pagesHealthcare - Gov/sbc-Glossary: Important Questions Answers Why This Mattersapi-252555369No ratings yet

- Shared Temp ELA0Request For Transcript of Tax Ret B 2 11 OutputDocument1 pageShared Temp ELA0Request For Transcript of Tax Ret B 2 11 OutputBlessing Nel GuillaumeNo ratings yet

- In Jin Moon & Ben Lorentzen Son Auston Birth CertificateDocument1 pageIn Jin Moon & Ben Lorentzen Son Auston Birth CertificateHWDYKYMNo ratings yet

- 1481546265426Document3 pages1481546265426api-370784582No ratings yet

- QwertyDocument1 pageQwertyqwew1eNo ratings yet

- Summary of Account Activity Payment Information: Protecting What Matters MostDocument4 pagesSummary of Account Activity Payment Information: Protecting What Matters MostJames BergmanNo ratings yet

- Bank StatementDocument1 pageBank StatementNicholas BealNo ratings yet

- FD 941 Apr-Jun 2017 PDFDocument3 pagesFD 941 Apr-Jun 2017 PDFScott WinklerNo ratings yet

- Name of Local Body Issuing CertificateDocument1 pageName of Local Body Issuing CertificateMuhammad RaadNo ratings yet

- Statement Details: Your Account SummaryDocument3 pagesStatement Details: Your Account SummaryTJ JanssenNo ratings yet

- Personal Financial Statement 2637980Document3 pagesPersonal Financial Statement 2637980Alexander Weir-WitmerNo ratings yet

- MV 441 EdlDocument4 pagesMV 441 Edltuan nguyenNo ratings yet

- Instructions For Student: CorrectedDocument1 pageInstructions For Student: CorrectedBipal GoyalNo ratings yet

- VV Tinnie 4402 Umnga Crescent Langa Cape Town 7455: Contact CentreDocument3 pagesVV Tinnie 4402 Umnga Crescent Langa Cape Town 7455: Contact Centrebra9tee9tiniNo ratings yet

- Sample InsuranceDocument4 pagesSample InsuranceShashanth Kumar (CS - OMTP)No ratings yet

- Financial Information Form WordDocument1 pageFinancial Information Form WordAfshin SarbazNo ratings yet

- CertainGovernmentPaymentsPUA 1099G YamilkaRiveraSemidey 654202101305845Document1 pageCertainGovernmentPaymentsPUA 1099G YamilkaRiveraSemidey 654202101305845yamilkarivera71No ratings yet

- Documents (942,202212311058, F99NEE)Document2 pagesDocuments (942,202212311058, F99NEE)LertoraNo ratings yet

- Cases For Agency - Atty. Prime RamosDocument60 pagesCases For Agency - Atty. Prime RamosRoxanne PeñaNo ratings yet

- Danilo A. Aurelio v. Ida Ma. Corazon P. AurelioDocument2 pagesDanilo A. Aurelio v. Ida Ma. Corazon P. AurelioMinorka Sushmita Pataunia Santoluis100% (1)

- Membership of School Council: NotificationDocument4 pagesMembership of School Council: NotificationAasif NawazNo ratings yet

- People V CornelDocument1 pagePeople V CornelGeenea VidalNo ratings yet

- The Rights and Privileges of The Teachers inDocument24 pagesThe Rights and Privileges of The Teachers inErika Woon Soo100% (2)

- OfferDocument5 pagesOfferYong MgdnglNo ratings yet

- Abra Valley College, Inc. v. Aquino, 162 SCRA 106Document2 pagesAbra Valley College, Inc. v. Aquino, 162 SCRA 106MonikkaNo ratings yet

- Chhattisgarh Human Rights CommissionDocument30 pagesChhattisgarh Human Rights CommissionVikas SinghNo ratings yet

- Phillip M. Call v. United States, 338 F.2d 974, 1st Cir. (1964)Document6 pagesPhillip M. Call v. United States, 338 F.2d 974, 1st Cir. (1964)Scribd Government DocsNo ratings yet

- Foi 26868..Document3 pagesFoi 26868..Eliot GanoshiNo ratings yet

- Javed Anwar, A077 044 013 (BIA Dec. 30, 2013)Document12 pagesJaved Anwar, A077 044 013 (BIA Dec. 30, 2013)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Uptricks Services Private Limited: HR PoliciesDocument2 pagesUptricks Services Private Limited: HR PoliciesUpTricks Services Pvt. Ltd.No ratings yet

- Period 4 Jacksonian Era Video GuideDocument6 pagesPeriod 4 Jacksonian Era Video GuideTravis McDermottNo ratings yet

- Presidential Decree 1221Document8 pagesPresidential Decree 1221fire_ice888No ratings yet

- Journey Of: MR Pranab Mukherjee (President of India)Document18 pagesJourney Of: MR Pranab Mukherjee (President of India)Atul PandeyNo ratings yet

- VDA. DE NAZARENO vs. THE COURT OF APPEALSDocument1 pageVDA. DE NAZARENO vs. THE COURT OF APPEALSjed_sinda100% (1)

- Local Governance in IndiaDocument15 pagesLocal Governance in Indiaanshul chauhanNo ratings yet

- Philippine Electronics Code (Electronics and Communications Engineering Law of The Philippines)Document7 pagesPhilippine Electronics Code (Electronics and Communications Engineering Law of The Philippines)Rain Gallarda Diaz40% (5)

- SMCR013263 PDFDocument10 pagesSMCR013263 PDFthesacnewsNo ratings yet

- AP Comparative Government Mexico Summary (ROSKIN)Document2 pagesAP Comparative Government Mexico Summary (ROSKIN)Vlad BobrovnykNo ratings yet

- Trayon Kirby v. Officer Henderson, 4th Cir. (2011)Document2 pagesTrayon Kirby v. Officer Henderson, 4th Cir. (2011)Scribd Government DocsNo ratings yet

- Kossover Notice of Claim May 2020Document7 pagesKossover Notice of Claim May 2020Daily FreemanNo ratings yet

- Article 22 23 &24Document7 pagesArticle 22 23 &24ShreyaNo ratings yet

- CSMR Reg 350-3 Mems BadgeDocument16 pagesCSMR Reg 350-3 Mems Badgemailbocks96No ratings yet

- Appeal From MTC To RTC in Civil CasesDocument1 pageAppeal From MTC To RTC in Civil Casesroyax1100% (2)

- AIATSL Advertisement Security Agenfts 0416Document10 pagesAIATSL Advertisement Security Agenfts 0416Thangadurai GunaNo ratings yet

- 2023.03.31 - Letter Response From DA OfficeDocument6 pages2023.03.31 - Letter Response From DA OfficeWashington Examiner100% (2)

- Us V. Segundo Barias +: /juris/view/c9edDocument4 pagesUs V. Segundo Barias +: /juris/view/c9edNadzlah BandilaNo ratings yet