Professional Documents

Culture Documents

ABBOTT INDIA LTD - ICICI Direct - Co Update - 190521 - Sales Recovery in The Offing

ABBOTT INDIA LTD - ICICI Direct - Co Update - 190521 - Sales Recovery in The Offing

Uploaded by

Shanti RanganCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Sample Compromise AgreementDocument3 pagesSample Compromise AgreementHazel Ninolas100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

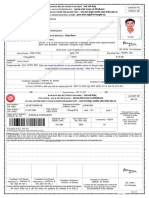

- RRB Call Letter SampleDocument2 pagesRRB Call Letter SampleChiranjeevi KindinlaNo ratings yet

- Major Constitutional Amendments PPT PresentationDocument28 pagesMajor Constitutional Amendments PPT Presentationpcdon0% (2)

- Petition For ReissuanceDocument6 pagesPetition For Reissuanceasdfg100% (7)

- Tax Invoice: Home Carpets & Furnishing Invoice 109 17/04/2022Document1 pageTax Invoice: Home Carpets & Furnishing Invoice 109 17/04/2022Sivaprakasam ThamizharasanNo ratings yet

- English 9 Module 1 Activity 1Document1 pageEnglish 9 Module 1 Activity 1Rowell Digal BainNo ratings yet

- Ye Dharmā HetuprabhavaDocument3 pagesYe Dharmā HetuprabhavaProkhor PetrovNo ratings yet

- Tafseer Mariful Quran Sura 109 Al Kafirun English Translation PDFDocument6 pagesTafseer Mariful Quran Sura 109 Al Kafirun English Translation PDFamaanking8bpNo ratings yet

- HDFC Life InsuranceDocument1 pageHDFC Life InsuranceSureshKarnanNo ratings yet

- Milanowski, Todd v. SpeedplayDocument6 pagesMilanowski, Todd v. SpeedplayPriorSmartNo ratings yet

- Disturbing Sun by Richardson, Robert S. (Robert Shirley), 1902-1981Document16 pagesDisturbing Sun by Richardson, Robert S. (Robert Shirley), 1902-1981Gutenberg.orgNo ratings yet

- RA 8799 - Securities Regulation CodeDocument38 pagesRA 8799 - Securities Regulation CodeJacinto Jr Jamero100% (1)

- Liham - Pahintulot: Republic of The Philippines Department of Education Schools Division of PalawanDocument12 pagesLiham - Pahintulot: Republic of The Philippines Department of Education Schools Division of PalawanMarbert GarganzaNo ratings yet

- Rabusa 2005Document8 pagesRabusa 2005Desiree GuaschNo ratings yet

- GO Price - escalation.GO - Ms.124.2007Document3 pagesGO Price - escalation.GO - Ms.124.2007hussainNo ratings yet

- En Banc: (G.R. No. 116418. March 7, 1995.)Document2 pagesEn Banc: (G.R. No. 116418. March 7, 1995.)Luna BaciNo ratings yet

- Apple: December 11-12-2016:itpm Senior Trading Mentor Raj Malhotra Interview On Why Traders FailDocument3 pagesApple: December 11-12-2016:itpm Senior Trading Mentor Raj Malhotra Interview On Why Traders FaildenisNo ratings yet

- Legal Aspects of Sale LeaseDocument12 pagesLegal Aspects of Sale LeaseJoshua Ardie MesinaNo ratings yet

- Thayer US-Burma Policy ChangeDocument2 pagesThayer US-Burma Policy ChangeCarlyle Alan ThayerNo ratings yet

- Sui Sells Presses at December 31 2011 Sui S Inventory AmountedDocument1 pageSui Sells Presses at December 31 2011 Sui S Inventory AmountedAmit PandeyNo ratings yet

- Salun-At vs. EspejoDocument2 pagesSalun-At vs. EspejoBelen Aliten Sta MariaNo ratings yet

- Student Visa For Studies in Spain (For More Than 180 Days) : Embajada de España Islamabad PakistánDocument3 pagesStudent Visa For Studies in Spain (For More Than 180 Days) : Embajada de España Islamabad PakistánabdulbaseerNo ratings yet

- Single Entry BookkeepingDocument12 pagesSingle Entry BookkeepingJason Cabrera100% (1)

- Champaran SatyagrahaDocument3 pagesChamparan SatyagrahakumardeyapurbaNo ratings yet

- People Vs TudtudDocument2 pagesPeople Vs TudtudjayNo ratings yet

- New SN of Polling Station Locality Building in Which It Will Be Polling Areas Wheather For All Voters or Men Only or Women OnlyDocument51 pagesNew SN of Polling Station Locality Building in Which It Will Be Polling Areas Wheather For All Voters or Men Only or Women OnlyJugal HarkutNo ratings yet

- Ndian Apital Arket: 25-1 Excel Books Business Environment Suresh BediDocument12 pagesNdian Apital Arket: 25-1 Excel Books Business Environment Suresh BediSebin ThomasNo ratings yet

- Changing Seats Re-Domiciliation To Curaçao FinalDocument2 pagesChanging Seats Re-Domiciliation To Curaçao FinalRicardo NavaNo ratings yet

- Dr. Bacchiocchi, The Sabbath, and The Writings of Paul - Kerry WynneDocument19 pagesDr. Bacchiocchi, The Sabbath, and The Writings of Paul - Kerry WynneRubem_CLNo ratings yet

- ANSYS Inc. Known Issues and LimitationsDocument34 pagesANSYS Inc. Known Issues and LimitationsV CafNo ratings yet

ABBOTT INDIA LTD - ICICI Direct - Co Update - 190521 - Sales Recovery in The Offing

ABBOTT INDIA LTD - ICICI Direct - Co Update - 190521 - Sales Recovery in The Offing

Uploaded by

Shanti RanganOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ABBOTT INDIA LTD - ICICI Direct - Co Update - 190521 - Sales Recovery in The Offing

ABBOTT INDIA LTD - ICICI Direct - Co Update - 190521 - Sales Recovery in The Offing

Uploaded by

Shanti RanganCopyright:

Available Formats

Abbott India (ABBIND)

CMP: | 16041 Target: | 19235 (20%) Target Period: 12 months BUY

May 19, 2021

Sales recovery in the offing...

While Q4FY21 results are not strictly comparable on a YoY basis due to

pandemic related challenges in the base year, FY21 revenues grew 5.3%

Company Update

YoY to | 4310 crore likely moderated by the decline in 'Duphaston' Particulars

(gynaecology) sales alongside demand slowdown in some other therapies Particular Amount

amid the pandemic. EBITDA margins expanded 290 bps YoY to 21.4% with Market Capitalisation | 34087 crore

an overall better operational performance. EBITDA for the fiscal grew Debt (FY21) | 0 crore

21.8% YoY to | 922 crore. PAT was up 16.5% YoY to | 691 crore in line Cash (FY21) | 2409 crore

with operational performance and lower other income. | 31678 crore

EV

52 week H/L 17800/13970

“Power brands” continue to grow ahead of industry growth Equity capital | 21.3 crore

Abbott India is one of the fastest growing listed MNC pharma companies. It Face value | 10

has outperformed the industry on a consistent basis in women’s health, GI, Price Performance

metabolic, pain, CNS among others. The company’s top five brands

including (Duphaston– gynaecological, Thyronorm– thyroid, Udiliv, 20000 14000

Duphalac– both GI and Vertin- CNS) together posted revenue CAGR of 12000

15000

~13% in March 2017-21 (MAT basis). Thus, revenue growth has been 10000

driven by top brands (power brands). Additionally, continuous new 8000

10000

launches and line extension in existing and new segments is also driving 6000

growth. We expect future launches of new products from key divisions, 5000 4000

2000

along with brand extensions and access to innovative molecules from

0 0

ICICI Securities – Retail Equity Research

global parent to drive growth.

May-18

Nov-18

May-19

Nov-19

May-20

Nov-20

May-21

Margin improvement with better return ratios

EBITDA margins have recovered from lows of 11.8% in FY14 [due to Abbott India(L.H.S) NSE500 (R.H.S)

inclusion of one its top brand (Thyronorm) under price control] to 21.4% in

FY21. Core margins of the company could have been even better after Key risks to our call

excluding marketing margins (related to Novo Nordisk diabetic portfolio).

Apart from this, erstwhile tax amendments have had the effect of reducing Higher than expected competition

its tax rate from 36% in FY19 to 25-26% from FY20 onwards. Continued panning in domestic power brands

new product launches, volume led growth in Abbott India’s top brands and Addition of any product to NLEM list

intermittent price hikes in its portfolio provide comfort on overall financials.

The company has also declared a | 275 dividend (final: | 120 + special:

| 155) per share for FY21.

Valuation & Outlook Research Analyst

Siddhant Khandekar

Covid-19 related disturbances notwithstanding, companies from the siddhant.khandekar@icicisecurities.com

pharma MNC staple like Abbott continue to generate investor’s interest

with robust and sustainable business model backed by stable growth, Mitesh Shah, CFA

mitesh.sha@icicisecurities.com

debt-free b/s, favourable market dynamics with doctor prescription

stickiness and lower perceived risk factors. We continue to believe in Sudarshan Agarwal

Abbott’s strong growth track in power brands and capability in new sudarshan.agarwal@icicisecurities.com

launches on a fairly consistent basis (+100 launches in the last 10 years).

We maintain BUY and arrive at a target price of | 19235 (vs. earlier | 19065)

based on 40x FY23E EPS of | 480.9.

Key Financial Summary

FY20 FY21 FY22E FY23E CAGR FY21-23E (%)

Revenues 4093.1 4310.0 4922.7 5513.5 13.1

EBITDA 756.4 921.5 1078.8 1254.0 16.7

EBITDA margins (%) 18.5 21.4 21.9 22.7

Net Profit 592.9 690.7 878.2 1021.9 21.6

EPS (|) 279.0 325.0 413.3 480.9

PE (x) 57.5 49.4 38.8 33.4

RoCE (%) 30.7 33.8 38.7 36.6

ROE 24.4 26.5 30.3 28.4

Source: ICICI Direct Research; Company

Company Update | Abbott India ICICI Direct Research

Exhibit 1: Power brands

BRAND Therapy FY17 FY18 FY19 FY20 FY21 CAGR FY17-21

THYRONORM HORMONES 194.0 260.8 342.2 352.9 359.6 16.7

UDILIV GASTRO INTESTINAL 161.2 197.3 252.3 286.2 309.9 17.8

DUPHASTON GYNAECOLOGICAL 210.6 262.0 358.9 380.5 273.9 6.8

VERTIN NEURO / CNS 135.5 149.8 166.5 179.8 204.0 10.8

DUPHALAC GASTRO INTESTINAL 122.8 132.4 154.9 171.1 185.7 10.9

Top 5 824.2 1002.3 1274.9 1370.4 1333.2 12.8

Source: AIOCD; Company; MAT based value in | crore

ICICI Securities | Retail Research 2

Company Update | Abbott India ICICI Direct Research

Financial Summary

Exhibit 2: Profit & Loss (| crore) Exhibit 3: Cash Flow Statement (| crore)

Year-end March FY20 FY21 FY22E FY23E Year-end March FY20 FY21 FY22E FY23E

Total Operating Income 4,093.1 4,310.0 4,922.7 5,513.5 Profit/(Loss) after taxation 573.5 690.5 878.2 1,021.9

Growth (%) 11.3 5.3 14.2 12.0 Add: Depreciation & Amortization 59.6 58.1 62.2 66.3

Raw Material Expenses 2,315.7 2,390.9 2,668.2 2,942.7 Net Increase in Current Assets 84.0 -113.7 -227.9 -157.4

Gross Profit 1,777.5 1,919.1 2,254.5 2,570.7 Net Increase in Current Liabilities -14.2 125.0 152.1 136.1

Gross Profit Margins (%) 43.4 44.5 45.8 46.6 Others -76.8 -33.1 18.3 18.3

Employee Expenses 476.1 492.6 560.3 627.6 CF from Operating activities 626.1 726.7 882.9 1,085.2

Other Expenditure 544.9 505.0 615.3 689.2

Total Operating Expenditure 3,336.7 3,388.6 3,843.9 4,259.5 (Purchase)/Sale of Fixed Assets -15.6 -23.2 -30.0 -30.0

EBITDA 756.4 921.5 1,078.8 1,254.0 Investments -506.0 -135.1 0.0 0.0

Growth (%) 25.1 21.8 17.1 16.2 Others 625.3 225.0 -9.8 -8.5

Interest 8.5 18.3 18.3 18.3 CF from Investing activities 103.8 66.7 -39.8 -38.5

Depreciation 59.6 58.1 62.2 66.3

Other Income 114.4 80.9 175.7 196.8 (inc)/Dec in Loan 0.0 0.0 0.0 0.0

PBT before Exceptional Items 802.7 926.0 1,174.0 1,366.2 Dividend & Dividend tax -166.5 -531.2 -584.4 -318.7

Less: Exceptional Items 0.0 0.0 0.0 0.0 Other -50.3 -50.6 -18.3 -18.3

PBT after Exceptional Items 802.7 926.0 1,174.0 1,366.2 CF from Financing activities -216.8 -581.8 -602.6 -337.0

Total Tax 209.8 235.3 295.9 344.3

PAT before MI 592.9 690.7 878.2 1,021.9 Net Cash Flow 513.1 211.7 240.4 709.7

PAT 592.9 690.7 878.2 1,021.9 Cash and Cash Equivalent 1,684.3 2,197.4 2,409.0 2,649.5

Growth (%) 31.7 16.5 27.1 16.4 Cash 2,197.4 2,409.0 2,649.5 3,359.2

EPS (Adjusted) 279.0 325.0 413.3 480.9 Free Cash Flow 610.6 703.6 852.9 1,055.2

Source: ICICI Direct Research Source: ICICI Direct Research

Exhibit 4: Balance Sheet (| crore) Exhibit 5: Key Ratios (| crore)

Year-end March FY20 FY21 FY22E FY23E Year-end March FY20 FY21 FY22E FY23E

Per share data (|)

Equity Capital 21.3 21.3 21.3 21.3 Reported EPS 279.0 325.0 413.3 480.9

Reserve and Surplus 2,410.5 2,580.9 2,874.7 3,577.9 Cash EPS 5.7 77.4 292.6 337.1

Total Shareholders funds 2,431.7 2,602.2 2,896.0 3,599.2 BV per share 1,144.4 1,224.6 1,362.9 1,693.8

Total Debt 0.0 0.0 0.0 0.0 Cash per Share 1,034.1 1,133.7 1,246.8 1,580.8

Deferred Tax Liability 0.0 0.0 0.0 0.0 Dividend per share 301.4 275.0 150.0 175.0

Long-Term Provisions 84.8 89.8 98.7 108.6 Operating Ratios (%)

Lease Liability 139.2 117.7 105.9 95.3 Gross Profit Margins 43.4 44.5 45.8 46.6

Source of Funds 2,655.8 2,809.6 3,100.6 3,803.1 EBITDA margins 18.5 21.4 21.9 22.7

PAT Margins 14.5 16.0 17.8 18.5

Gross Block - Fixed Assets 387.4 426.5 456.5 486.5 Cash Conversion Cycle 16.7 17.4 21.8 21.8

Accumulated Depreciation 117.6 175.7 237.9 304.3 Asset Turnover 10.6 10.1 10.8 11.3

Net Block 269.8 250.8 218.6 182.2 EBITDA conversion Rate 82.8 78.9 81.8 86.5

Capital WIP 1.6 0.7 0.7 0.7 Return Ratios (%)

Fixed Assets 271.5 251.4 219.2 182.9 RoE 24.4 26.5 30.3 28.4

Investments 0.0 0.0 0.0 0.0 RoCE 30.7 33.8 38.7 36.6

Other Non Current Assets 70.7 70.5 77.5 85.3 RoIC 157.6 226.0 235.9 281.6

Inventory 527.2 717.6 812.0 909.5 Valuation Ratios (x)

Debtors 317.9 250.2 369.5 413.8 P/E 57.5 49.4 38.8 33.4

Loans and Advances 6.1 5.0 5.4 6.0 EV / EBITDA 42.2 34.4 29.1 24.5

Other Current Assets 156.0 136.7 150.4 165.4 EV / Net Sales 7.8 7.3 6.4 5.6

Cash 2,197.4 2,409.0 2,649.5 3,359.2 Market Cap / Sales 8.3 7.9 6.9 6.2

Total Current Assets 3,204.6 3,518.5 3,986.8 4,853.9 Price to Book Value 14.0 13.1 11.8 9.5

Creditors 657.8 762.7 887.9 994.5 Solvency Ratios

Provisions 107.5 116.0 127.6 140.3 Debt / EBITDA 0.0 0.0 0.0 0.0

Other Current Liabilities 125.9 152.2 167.5 184.2 Debt / Equity 0.0 0.0 0.0 0.0

Total Current Liabilities 891.1 1,030.9 1,182.9 1,319.0 Current Ratio 1.1 1.1 1.1 1.1

Net Current Assets 2,313.5 2,487.7 2,803.9 3,534.9 Source: ICICI Direct Research

Application of Funds 2,655.7 2,809.6 3,100.6 3,803.1

Source: ICICI Direct Research

ICICI Securities | Retail Research 3

Company Update | Abbott India ICICI Direct Research

RATING RATIONALE

ICICI Direct endeavours to provide objective opinions and recommendations. ICICI Direct assigns ratings to its

stocks according to their notional target price vs. current market price and then categorises them as Buy, Hold,

Reduce and Sell. The performance horizon is two years unless specified and the notional target price is defined

as the analysts' valuation for a stock

Buy: >15%;

Hold: -5% to 15%;

Reduce: -5% to -15%;

Sell: <-15%

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities | Retail Research 4

Company Update | Abbott India ICICI Direct Research

ANALYST CERTIFICATION

I/We, Siddhant Khandekar, Inter CA, Mitesh Shah, (cleared all 3 levels of CFA), Sudarshan Agarwal, PGDM (Finance), Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views

expressed in this research report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific

recommendation(s) or view(s) in this report. It is also confirmed that above mentioned Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months and do

not serve as an officer, director or employee of the companies mentioned in the report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products.

ICICI Securities is Sebi registered stock broker, merchant banker, investment adviser, portfolio manager and Research Analyst. ICICI Securities is registered with Insurance Regulatory Development Authority of India Limited (IRDAI)

as a composite corporate agent and with PFRDA as a Point of Presence. ICICI Securities Limited Research Analyst SEBI Registration Number – INH000000990. ICICI Securities Limited SEBI Registration is INZ000183631 for stock

broker. ICICI Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance,

venture capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business

relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities and its analysts, persons reporting to analysts and their relatives are generally prohibited from maintaining a

financial interest in the securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions, trading volume etc as opposed to focusing on a company's fundamentals and, as

such, may not match with the recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical Research Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions expressed in this document may or

may not match or may be contrary with the views, estimates, rating, and target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected

recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would

endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI

Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in

circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information

herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the

customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal,

accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all

investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent

judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI

Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure

Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to

change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-

managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any compensation or other

benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts and their relatives have any material conflict of

interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication

of the research report.

Since associates of ICICI Securities and ICICI Securities as a entity are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject

company/companies mentioned in this report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or

use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale

in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

ICICI Securities | Retail Research 5

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Sample Compromise AgreementDocument3 pagesSample Compromise AgreementHazel Ninolas100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- RRB Call Letter SampleDocument2 pagesRRB Call Letter SampleChiranjeevi KindinlaNo ratings yet

- Major Constitutional Amendments PPT PresentationDocument28 pagesMajor Constitutional Amendments PPT Presentationpcdon0% (2)

- Petition For ReissuanceDocument6 pagesPetition For Reissuanceasdfg100% (7)

- Tax Invoice: Home Carpets & Furnishing Invoice 109 17/04/2022Document1 pageTax Invoice: Home Carpets & Furnishing Invoice 109 17/04/2022Sivaprakasam ThamizharasanNo ratings yet

- English 9 Module 1 Activity 1Document1 pageEnglish 9 Module 1 Activity 1Rowell Digal BainNo ratings yet

- Ye Dharmā HetuprabhavaDocument3 pagesYe Dharmā HetuprabhavaProkhor PetrovNo ratings yet

- Tafseer Mariful Quran Sura 109 Al Kafirun English Translation PDFDocument6 pagesTafseer Mariful Quran Sura 109 Al Kafirun English Translation PDFamaanking8bpNo ratings yet

- HDFC Life InsuranceDocument1 pageHDFC Life InsuranceSureshKarnanNo ratings yet

- Milanowski, Todd v. SpeedplayDocument6 pagesMilanowski, Todd v. SpeedplayPriorSmartNo ratings yet

- Disturbing Sun by Richardson, Robert S. (Robert Shirley), 1902-1981Document16 pagesDisturbing Sun by Richardson, Robert S. (Robert Shirley), 1902-1981Gutenberg.orgNo ratings yet

- RA 8799 - Securities Regulation CodeDocument38 pagesRA 8799 - Securities Regulation CodeJacinto Jr Jamero100% (1)

- Liham - Pahintulot: Republic of The Philippines Department of Education Schools Division of PalawanDocument12 pagesLiham - Pahintulot: Republic of The Philippines Department of Education Schools Division of PalawanMarbert GarganzaNo ratings yet

- Rabusa 2005Document8 pagesRabusa 2005Desiree GuaschNo ratings yet

- GO Price - escalation.GO - Ms.124.2007Document3 pagesGO Price - escalation.GO - Ms.124.2007hussainNo ratings yet

- En Banc: (G.R. No. 116418. March 7, 1995.)Document2 pagesEn Banc: (G.R. No. 116418. March 7, 1995.)Luna BaciNo ratings yet

- Apple: December 11-12-2016:itpm Senior Trading Mentor Raj Malhotra Interview On Why Traders FailDocument3 pagesApple: December 11-12-2016:itpm Senior Trading Mentor Raj Malhotra Interview On Why Traders FaildenisNo ratings yet

- Legal Aspects of Sale LeaseDocument12 pagesLegal Aspects of Sale LeaseJoshua Ardie MesinaNo ratings yet

- Thayer US-Burma Policy ChangeDocument2 pagesThayer US-Burma Policy ChangeCarlyle Alan ThayerNo ratings yet

- Sui Sells Presses at December 31 2011 Sui S Inventory AmountedDocument1 pageSui Sells Presses at December 31 2011 Sui S Inventory AmountedAmit PandeyNo ratings yet

- Salun-At vs. EspejoDocument2 pagesSalun-At vs. EspejoBelen Aliten Sta MariaNo ratings yet

- Student Visa For Studies in Spain (For More Than 180 Days) : Embajada de España Islamabad PakistánDocument3 pagesStudent Visa For Studies in Spain (For More Than 180 Days) : Embajada de España Islamabad PakistánabdulbaseerNo ratings yet

- Single Entry BookkeepingDocument12 pagesSingle Entry BookkeepingJason Cabrera100% (1)

- Champaran SatyagrahaDocument3 pagesChamparan SatyagrahakumardeyapurbaNo ratings yet

- People Vs TudtudDocument2 pagesPeople Vs TudtudjayNo ratings yet

- New SN of Polling Station Locality Building in Which It Will Be Polling Areas Wheather For All Voters or Men Only or Women OnlyDocument51 pagesNew SN of Polling Station Locality Building in Which It Will Be Polling Areas Wheather For All Voters or Men Only or Women OnlyJugal HarkutNo ratings yet

- Ndian Apital Arket: 25-1 Excel Books Business Environment Suresh BediDocument12 pagesNdian Apital Arket: 25-1 Excel Books Business Environment Suresh BediSebin ThomasNo ratings yet

- Changing Seats Re-Domiciliation To Curaçao FinalDocument2 pagesChanging Seats Re-Domiciliation To Curaçao FinalRicardo NavaNo ratings yet

- Dr. Bacchiocchi, The Sabbath, and The Writings of Paul - Kerry WynneDocument19 pagesDr. Bacchiocchi, The Sabbath, and The Writings of Paul - Kerry WynneRubem_CLNo ratings yet

- ANSYS Inc. Known Issues and LimitationsDocument34 pagesANSYS Inc. Known Issues and LimitationsV CafNo ratings yet