Professional Documents

Culture Documents

Comparative Statement of Profit and Loss

Comparative Statement of Profit and Loss

Uploaded by

Anindya Batabyal0 ratings0% found this document useful (0 votes)

114 views2 pagesThe document compares the profit and loss statement of Ultratech Cement for the years ending 2020 and 2021. It shows that total revenue increased 5.19% to Rs. 43,465 in 2021 from Rs. 40,759 in 2020. Expenses increased slightly by 0.28% while profit before tax grew substantially by 38.10% to Rs. 9,464 in 2021 from Rs. 6,853 in 2020. Despite higher taxes, profit after tax decreased only slightly by 2.55% to Rs. 6,911 in 2021 from Rs. 7,092 in 2020.

Original Description:

COMPARATIVE STATEMENT OF PROFIT AND LOSS

Original Title

COMPARATIVE STATEMENT OF PROFIT AND LOSS

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document compares the profit and loss statement of Ultratech Cement for the years ending 2020 and 2021. It shows that total revenue increased 5.19% to Rs. 43,465 in 2021 from Rs. 40,759 in 2020. Expenses increased slightly by 0.28% while profit before tax grew substantially by 38.10% to Rs. 9,464 in 2021 from Rs. 6,853 in 2020. Despite higher taxes, profit after tax decreased only slightly by 2.55% to Rs. 6,911 in 2021 from Rs. 7,092 in 2020.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

114 views2 pagesComparative Statement of Profit and Loss

Comparative Statement of Profit and Loss

Uploaded by

Anindya BatabyalThe document compares the profit and loss statement of Ultratech Cement for the years ending 2020 and 2021. It shows that total revenue increased 5.19% to Rs. 43,465 in 2021 from Rs. 40,759 in 2020. Expenses increased slightly by 0.28% while profit before tax grew substantially by 38.10% to Rs. 9,464 in 2021 from Rs. 6,853 in 2020. Despite higher taxes, profit after tax decreased only slightly by 2.55% to Rs. 6,911 in 2021 from Rs. 7,092 in 2020.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

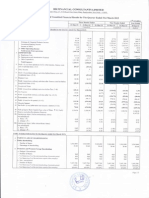

COMPARATIVE STATEMENT OF PROFIT AND LOSS

OF ULTRATECH CEMENT FOR THE YEARS ENDED 2020 & 2021

Particulars Note no. 31-03-2021 31-03-2020 Absolute % increase/

change decrease

1 Revenue from operations 42,677 40,033 2644 6.60%

2 Add: other income 788 726 62 8.54%

3 Total Revenue 43465 40759 2706 5.19%

4 Less: Expenses

Cost of materials consumed 5175 4960 215 4.33%

Changes in inventories 426 (362) 788 217.68 %

Employee benefit expenses 2181 2336 (155) -6.63%

Finance costs 1259 1704 (445) -26.11%

Depreciation & amortisation 2434 2454 (20) -0.81%

Other expenses 22526 22814 (288) -1.26%

Total Expenses 34001 33906 95 0.28%

5 Profit before tax 9464 6853 2611 38.10%

6 Less: Tax

Current Tax 1415 915 500 54.64%

Deferred Tax 1138 (1154) 2472 214.21%

7 Profit after tax 6911 7092 (181) -2.55%

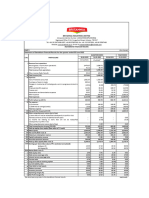

COMMON SIZE STATEMENT OF PROFIT AND LOSSOF ULTRATECH CEMENT

FOR THE YEAR ENDED 2020 & 2021

Particulars Note no. Absolute amounts % Of revenue from

operations

31.03.2021 31.03.2020 31.03.2021 31.03.2020

1 Revenue from 42,677 40,033 100% 100%

operations

2 Add: other income 788 726 1.85% 1.81%

3 Total Revenue 43465 40759 101.84% 101.81%

4 Less: Expenses

Cost of materials 5175 4960 12.12% 12.38%

consumed

Changes in inventories 426 (362) 1% -0.9%

Employee benefit 2181 2336 5.11% 5.83%

expenses

Finance costs 1259 1704 2.95% 4.26%

Depreciation & 2434 2454 5.70% 6.12%

amortisation

Other expenses 22526 22814 52.78% 56.98%

Total Expenses 34001 33906 79.67% 84.69%

5 Profit before tax 9464 6853 22.17% 17.11%

6 Less: Tax

Current Tax 1415 915 3.31% 2.28%

Deferred Tax 1138 (1154) 2.66% -2.88%

7 Profit after tax 6911 7092 16.19% 17.71%

You might also like

- Anderson Tax SaleDocument1 pageAnderson Tax SaleSarah Nelson0% (3)

- Rate Analysis HUme PipesDocument13 pagesRate Analysis HUme PipesRamesh86% (14)

- Comparison of The Gift of India and John BrownDocument11 pagesComparison of The Gift of India and John BrownAnindya Batabyal75% (12)

- Comparison of The Gift of India and John BrownDocument11 pagesComparison of The Gift of India and John BrownAnindya Batabyal75% (12)

- Comparison of The Gift of India and John BrownDocument11 pagesComparison of The Gift of India and John BrownAnindya Batabyal75% (12)

- Coca-Cola Common Size Financials - Balance SheetDocument1 pageCoca-Cola Common Size Financials - Balance Sheetapi-584364787No ratings yet

- Vertical and Horizontal Analysis of OGDCLDocument7 pagesVertical and Horizontal Analysis of OGDCLMuhammad Tayyab JavaidNo ratings yet

- StatCon Case Digests PDFDocument19 pagesStatCon Case Digests PDFallen joyce malazarte100% (5)

- CH 07Document16 pagesCH 07cushin2009100% (1)

- Financial Management 2 - BirminghamDocument21 pagesFinancial Management 2 - BirminghamsimuragejayanNo ratings yet

- FeasibilityDocument28 pagesFeasibilityKhim CalusinNo ratings yet

- Titan Shoppers Stop Ratio Analysis - 2014Document25 pagesTitan Shoppers Stop Ratio Analysis - 2014Jigyasu PritNo ratings yet

- Raymond Limited Financial StatementsDocument85 pagesRaymond Limited Financial StatementsVinay KukrejaNo ratings yet

- Karnataka Bank Results Sep12Document6 pagesKarnataka Bank Results Sep12Naveen SkNo ratings yet

- Montefiore Health System Q3 2019 Financial StatementsDocument25 pagesMontefiore Health System Q3 2019 Financial StatementsJonathan LaMantiaNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Consolidated Balance Sheet of Steel Authority of India (In Rs. Crores) Mar-17 Mar-16 Mar-15 Equity and Liabilities Shareholder'S FundDocument4 pagesConsolidated Balance Sheet of Steel Authority of India (In Rs. Crores) Mar-17 Mar-16 Mar-15 Equity and Liabilities Shareholder'S FundPuneet GeraNo ratings yet

- Income: For The Year Ended March 31, 2020Document3 pagesIncome: For The Year Ended March 31, 2020Vaibhav BorateNo ratings yet

- Raymond P&LDocument2 pagesRaymond P&LSJNo ratings yet

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderNo ratings yet

- Statement of Assets and Liabilities - H1 2018-19 8Document1 pageStatement of Assets and Liabilities - H1 2018-19 8saichakrapani3807No ratings yet

- Annual-Report-FML-30-June-2020 Vol 1Document1 pageAnnual-Report-FML-30-June-2020 Vol 1Bluish FlameNo ratings yet

- I. Assets: 2018 2019Document7 pagesI. Assets: 2018 2019Kean DeeNo ratings yet

- 3 MDocument11 pages3 MDENNIS DEPITA MORONNo ratings yet

- P&L Consolidated - Aegis LogisticsDocument4 pagesP&L Consolidated - Aegis LogisticsNitish BawejaNo ratings yet

- Maruti Suzuki India: PrintDocument2 pagesMaruti Suzuki India: PrintSoumya KhatuaNo ratings yet

- Balance Sheet As at March 31, 2020: Property, Plant and EquipmentDocument8 pagesBalance Sheet As at March 31, 2020: Property, Plant and Equipmentishwaryaishu0708No ratings yet

- SIB Result Q1 2024 FinalDocument24 pagesSIB Result Q1 2024 Finalseeme55runNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results Q1 August 2018Document13 pagesFinancial Results Q1 August 2018shakeelahmadjsrNo ratings yet

- Profit Loss Account TemplateDocument4 pagesProfit Loss Account TemplatesnehaNo ratings yet

- Q2 Fy2011-12 PDFDocument2 pagesQ2 Fy2011-12 PDFTushar PatelNo ratings yet

- q2 2022 Financial ResultsDocument44 pagesq2 2022 Financial ResultsPalagummi YasaswiNo ratings yet

- P&LDocument2 pagesP&LShashank SidhantNo ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- Unaudited Standalone Financial Results 30 06 2022 7dcaac46eaDocument4 pagesUnaudited Standalone Financial Results 30 06 2022 7dcaac46eamobgamer677No ratings yet

- Common Size P&LDocument1 pageCommon Size P&Lyuvrajsoni17112001No ratings yet

- Balance Sheet RsDocument5 pagesBalance Sheet RsBinesh BashirNo ratings yet

- 23MB0026 FAR AssignmentDocument14 pages23MB0026 FAR Assignmenthimanshu011623No ratings yet

- Income Statements: Brown & Company PLCDocument5 pagesIncome Statements: Brown & Company PLCprabathdeeNo ratings yet

- Audited Financial Results For The Quarter and Year Ended March 31, 2023Document6 pagesAudited Financial Results For The Quarter and Year Ended March 31, 2023vikaspawar78No ratings yet

- First Quarter Ended March 31 2012Document24 pagesFirst Quarter Ended March 31 2012Wai HOngNo ratings yet

- Annexure 4116790Document31 pagesAnnexure 4116790ayesha ansariNo ratings yet

- 7-E Fin Statement 2022Document4 pages7-E Fin Statement 20222021892056No ratings yet

- Clarissa Computation StramaDocument29 pagesClarissa Computation StramaZejkeara ImperialNo ratings yet

- Lii Hen - Q1 (2017) 1Document15 pagesLii Hen - Q1 (2017) 1Jordan YiiNo ratings yet

- PROFIT & LOSS ACCOUNT Gross Premium Written Reinsurance Ceded NetDocument17 pagesPROFIT & LOSS ACCOUNT Gross Premium Written Reinsurance Ceded NetmissphNo ratings yet

- 4th Quarter Unaudited Report 2076-2077Document25 pages4th Quarter Unaudited Report 2076-2077Srijana DhunganaNo ratings yet

- P&L 2021 2Document2 pagesP&L 2021 267SYBMORE SHUBHAMNo ratings yet

- DHL Express India PVT LTD Industry:CouriersDocument3 pagesDHL Express India PVT LTD Industry:CouriersNitish BawejaNo ratings yet

- Ajay Britannia BsDocument5 pagesAjay Britannia BsKhushali PoddarNo ratings yet

- P&L DataDocument3 pagesP&L DataAbdelrahman AkeedNo ratings yet

- Quarter AnnualDocument8 pagesQuarter AnnualNeetu JainNo ratings yet

- RHB Group Soci SofpDocument3 pagesRHB Group Soci SofpAnis SuhailaNo ratings yet

- Financial Statements of BMW AgDocument52 pagesFinancial Statements of BMW AgSimranNo ratings yet

- Tata Steel Q1 FY15 16Document6 pagesTata Steel Q1 FY15 16mariyathai_1No ratings yet

- Balance Sheet: Share Capital and ReservesDocument42 pagesBalance Sheet: Share Capital and ReservesaaliaccaNo ratings yet

- Q1FY22Document8 pagesQ1FY22Anjalidevi TNo ratings yet

- Projected P&L and BSDocument9 pagesProjected P&L and BSbipin kumarNo ratings yet

- Profit and Loss ProjectionDocument1 pageProfit and Loss ProjectionAbel GetachewNo ratings yet

- FINANCIAL PERFORMANCE June302017Document9 pagesFINANCIAL PERFORMANCE June302017Reginald ValenciaNo ratings yet

- Opensys An20200518a2 1Document17 pagesOpensys An20200518a2 1Nor FarizalNo ratings yet

- Wema-Bank-Financial Statement-2020Document24 pagesWema-Bank-Financial Statement-2020john stonesNo ratings yet

- SECUREX (PVT.) Limited: Statement of Comprehensive Income For The Year Ended 29 February 2016 2016 Notes TakaDocument4 pagesSECUREX (PVT.) Limited: Statement of Comprehensive Income For The Year Ended 29 February 2016 2016 Notes TakaBiplob K. SannyasiNo ratings yet

- Balance SheetDocument25 pagesBalance SheetImran AhmedNo ratings yet

- Narayana Hrudayalaya Limited NSEI NH Financials Balance SheetDocument2 pagesNarayana Hrudayalaya Limited NSEI NH Financials Balance Sheetakumar4uNo ratings yet

- PSO StatementDocument1 pagePSO StatementNaseeb Ullah TareenNo ratings yet

- Page 32 - P&L AnnexureDocument1 pagePage 32 - P&L AnnexureKelly GandhiNo ratings yet

- Tata Motors FY20-21 FY19-20 FY18-19: ExpenditureDocument6 pagesTata Motors FY20-21 FY19-20 FY18-19: ExpenditureJyothish JbNo ratings yet

- Isalvator by William SomersetDocument4 pagesIsalvator by William SomersetAnindya BatabyalNo ratings yet

- Commerce Addidas Swot AnalysisDocument10 pagesCommerce Addidas Swot AnalysisAnindya BatabyalNo ratings yet

- Excess Printing of MoneyDocument9 pagesExcess Printing of MoneyAnindya BatabyalNo ratings yet

- Demand and Law of DemandDocument19 pagesDemand and Law of DemandAnindya BatabyalNo ratings yet

- Lincoln Vs CA CIR DigestDocument1 pageLincoln Vs CA CIR DigestJay Ribs100% (1)

- Basics of Financial Management ExercisesDocument20 pagesBasics of Financial Management ExercisesWessel TraasNo ratings yet

- Tilson Short LLDocument40 pagesTilson Short LLCanadianValueNo ratings yet

- 1st Year Class - Depreciation - EditedDocument60 pages1st Year Class - Depreciation - EditedAnkit Patnaik67% (3)

- INB 301 AArongDocument14 pagesINB 301 AArongtasmihaNo ratings yet

- NotesDocument5 pagesNotesHadi Rizwan100% (3)

- Furniture Complete Report TDAPDocument22 pagesFurniture Complete Report TDAPMohammad SiddiquiNo ratings yet

- Inchausti v. CromwellDocument2 pagesInchausti v. CromwellGennard Michael Angelo AngelesNo ratings yet

- UntitledDocument25 pagesUntitledDiễm QuỳnhNo ratings yet

- Market FailureDocument42 pagesMarket FailureYacine100% (1)

- Revised IRR of RA 9295Document34 pagesRevised IRR of RA 9295danilo laraNo ratings yet

- Land Law SectionsDocument19 pagesLand Law SectionsRudraaksha SharmaNo ratings yet

- Rolling IndustriesDocument11 pagesRolling IndustriesPoen, Chris ChouNo ratings yet

- Tambunting Vs CIRDocument46 pagesTambunting Vs CIRCh YmnNo ratings yet

- Unit - 3 Tax PlanningDocument37 pagesUnit - 3 Tax PlanningYash JainNo ratings yet

- Bilateral Deed of Absolute Sale TemplateDocument2 pagesBilateral Deed of Absolute Sale Templatechuchoy888No ratings yet

- Monetary & Fiscal Policy in GeneralDocument129 pagesMonetary & Fiscal Policy in GeneralNishant Neogy100% (1)

- Jarrett - DRAFT Complaint 05-18-2021Document8 pagesJarrett - DRAFT Complaint 05-18-2021jeff_roberts881No ratings yet

- Tax ProbDocument3 pagesTax ProbJohn Paul Acebedo14% (7)

- Basic Customs Procedures, Including Trade Facilitation in BangladeshDocument29 pagesBasic Customs Procedures, Including Trade Facilitation in BangladeshArifur Rahman MunnaNo ratings yet

- 218, K-1, WAPDA TOWN, Lahore Wapda Town Muhammad Omar QureshiDocument4 pages218, K-1, WAPDA TOWN, Lahore Wapda Town Muhammad Omar QureshiIkramNo ratings yet

- Feu LQ #1 Answer Key Income Taxation Feu Makati Dec.4, 2012Document23 pagesFeu LQ #1 Answer Key Income Taxation Feu Makati Dec.4, 2012anggandakonohNo ratings yet

- Persia Revisited by Gordon, Thomas EdwardDocument77 pagesPersia Revisited by Gordon, Thomas EdwardGutenberg.orgNo ratings yet

- FABDocument3 pagesFABvinayaga fabricationNo ratings yet