Professional Documents

Culture Documents

Problem 6-5 & 6

Problem 6-5 & 6

Uploaded by

Micah April SabularseOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 6-5 & 6

Problem 6-5 & 6

Uploaded by

Micah April SabularseCopyright:

Available Formats

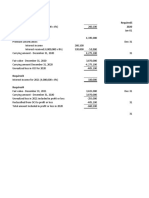

Problem 6-5

Non-interest bearing

Face value of note 400,000

Present value (400,000 x 0.7118) (284,720)

Unearned interest income 115,280

Present value 284,720

Cash received 125,000

Sales price 409,720

Carrying amount (350,000)

Gain on sale 59,720

Cost 500,000

Carrying amount (350,000)

Accumulated depreciation 150,000

Interest rate – 12%

Date Interest Income Unearned Interest Present Value

(PV x 12%) (UII – II) (PV + II)

Jan. 1, 2020 115,280 284,720

Dec. 31, 2020 34,166 81,114 318,886

Dec. 31, 2021 38,266 42,848 357,152

Dec. 31, 2022 42,848 400,000

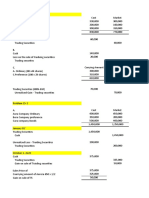

JOURNAL ENTRIES

2020

Jan. 1 Cash 125,000

Notes receivable 400,000

Accumulated depreciation 150,000

Equipment 500,000

Gain on sale 59,720

Unearned interest income 115,280

Dec. 31 Unearned interest income 34,166

Interest income 34,166

2021

Dec. 31 Unearned interest income 38,266

Interest income 38,266

2022

Dec. 31 Unearned interest income 42,848

Interest income 42,848

2023

Jan. 1 Cash 400,000

Notes receivable 400,000

Problem 6-6

1.

Note receivable from sale of building due 5/1/2021 2,500,000

Accrued interest on note receivable from sale of building

From 5/1/2020 to 12/31/2020 (5,000,000 x 9% x 8/12) 300,000

Principal payment of note receivable from sale of land due in 7/1/2021:

Annual installment 880,000

Interest from 7/1/2020 to 12/31/2020 (10% x 2,800,000) 280,000 600,000

Accrued interest on notes receivable from sale of land from

7/1/2020 to 12/31/2020 (1/2 x 280,000) 140,000

Total current receivables 3,540,000

2.

Notes receivable from sale of building due 5/1/2022 2,500,000

Notes receivable from officer 2,000,000

Notes receivable from sale of land – NC

Principal 2,800,000

Due 7/1/2021 (600,000) 2,200,000

Total noncurrent notes receivables 6,700,000

You might also like

- Axis Bank LTD Payslip For The Month of July - 2019Document1 pageAxis Bank LTD Payslip For The Month of July - 2019Rohit Kumar33% (3)

- Dwnload Full Personal Finance Turning Money Into Wealth 6th Edition Keown Solutions Manual PDFDocument36 pagesDwnload Full Personal Finance Turning Money Into Wealth 6th Edition Keown Solutions Manual PDFjulianchghhc100% (15)

- Corporate Finance 3rd Edition Graham Solution ManualDocument15 pagesCorporate Finance 3rd Edition Graham Solution ManualMark PanchitoNo ratings yet

- Bank-Reconciliation IADocument10 pagesBank-Reconciliation IAAnaluz Cristine B. CeaNo ratings yet

- Problem 8-6 & 8-7 ReportDocument3 pagesProblem 8-6 & 8-7 Reportjessamae gundan100% (2)

- Chapter 15 ProblemsDocument7 pagesChapter 15 Problemsmercyvienho50% (2)

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- Mythical Company Requirement A Debit CreditDocument3 pagesMythical Company Requirement A Debit CreditAnonn100% (1)

- Problem 12-2 To 6Document3 pagesProblem 12-2 To 6MYCO PONCE PAQUENo ratings yet

- Tax AljamiaDocument22 pagesTax AljamiaFlash Light100% (2)

- Notes ReceivableDocument2 pagesNotes ReceivableGee Lysa Pascua VilbarNo ratings yet

- Chapter 20 CompilationDocument41 pagesChapter 20 CompilationMaria Licuanan0% (1)

- 6-4 Gullible Company Req 1Document2 pages6-4 Gullible Company Req 1mercyvienhoNo ratings yet

- Dainty Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageDainty Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Pittance Company Requirement: Prepare Journal Entries To Record The Transactions Debit CreditDocument1 pagePittance Company Requirement: Prepare Journal Entries To Record The Transactions Debit CreditAnonnNo ratings yet

- Docile Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageDocile Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Generous Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageGenerous Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Problem 5-4 5-5Document4 pagesProblem 5-4 5-5Jicelle MendozaNo ratings yet

- Machete Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageMachete Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Mythical Company Provided The Following Transactions:: University - Year 2 AccountingDocument2 pagesMythical Company Provided The Following Transactions:: University - Year 2 Accountingcollegestudent2000No ratings yet

- Neophyte Company Required: Debit CreditDocument2 pagesNeophyte Company Required: Debit CreditAnonn100% (1)

- IA Activity 2 Chapter 4&5Document9 pagesIA Activity 2 Chapter 4&5Sunghoon SsiNo ratings yet

- Computation:: Freeway Company Requirement1: Books of Motorway Company Debit CreditDocument2 pagesComputation:: Freeway Company Requirement1: Books of Motorway Company Debit CreditAnonn100% (1)

- Bleak Company Requirement A Debit Credit Requirement BDocument2 pagesBleak Company Requirement A Debit Credit Requirement BAnonn100% (1)

- " Represents Only Claims Arising From Sale ofDocument3 pages" Represents Only Claims Arising From Sale ofprecious2lojaNo ratings yet

- ACC 101 - NR Assignment SolutionDocument6 pagesACC 101 - NR Assignment SolutionAdyangNo ratings yet

- Ia Activity 4Document23 pagesIa Activity 4WeStan LegendsNo ratings yet

- National Bank Grants A 10Document2 pagesNational Bank Grants A 10George PascualNo ratings yet

- Mortel-BSA1202 (Inventories)Document5 pagesMortel-BSA1202 (Inventories)Aphol Joyce MortelNo ratings yet

- PledgingDocument55 pagesPledgingGwyneth Joy Luzon100% (1)

- Proof of CashDocument11 pagesProof of CashAndrea FontiverosNo ratings yet

- Financial Asset at Fair ValueDocument4 pagesFinancial Asset at Fair ValueDianna DayawonNo ratings yet

- IA Activity 3 Chapter 6Document2 pagesIA Activity 3 Chapter 6Sunghoon SsiNo ratings yet

- Chapter16 BuenaventuraDocument11 pagesChapter16 BuenaventuraAnonn100% (1)

- Problem 9-1, 2 & 3Document3 pagesProblem 9-1, 2 & 3Micah April SabularseNo ratings yet

- Pittance Company Requirement: Prepare Journal Entries To Record The Transactions Debit CreditDocument23 pagesPittance Company Requirement: Prepare Journal Entries To Record The Transactions Debit CreditAnonnNo ratings yet

- Chameleon Company Requirement1 Debit CreditDocument3 pagesChameleon Company Requirement1 Debit CreditAnonnNo ratings yet

- Accounting - Prob.3Document2 pagesAccounting - Prob.3Dellosa, Jierstine Shaney R.No ratings yet

- Chapter 20Document74 pagesChapter 20astherille caxxNo ratings yet

- Problem 21-1Document7 pagesProblem 21-1camilleescote562No ratings yet

- Quiz 2Document7 pagesQuiz 2Fiona MiralpesNo ratings yet

- Zeta Company Required1 Required5 2020 Required2Document2 pagesZeta Company Required1 Required5 2020 Required2AnonnNo ratings yet

- Vain Company Requirement: Prepare Journal Entries On The Books of Assignor Debit CreditDocument1 pageVain Company Requirement: Prepare Journal Entries On The Books of Assignor Debit CreditAnonnNo ratings yet

- IA Chapter 15Document12 pagesIA Chapter 15Blue Sky100% (1)

- Chapter 3-5 To 3-13Document9 pagesChapter 3-5 To 3-13XENA LOPEZNo ratings yet

- IntAcc 6-3Document1 pageIntAcc 6-3Shirley Cortez-David100% (3)

- Problem 4-2 (IAA)Document6 pagesProblem 4-2 (IAA)Rose Aubrey A CordovaNo ratings yet

- Ia Problem SolvingDocument3 pagesIa Problem SolvingApple RoncalNo ratings yet

- Chapter5 IA Problems1 9Document16 pagesChapter5 IA Problems1 9Anonn100% (1)

- Chapter 1 Cash and Cash EquivalentsDocument29 pagesChapter 1 Cash and Cash EquivalentsENCARNACION Princess MarieNo ratings yet

- Adjusted Bank BalanceDocument2 pagesAdjusted Bank BalanceChristy HabelNo ratings yet

- Proof of CashDocument22 pagesProof of CashYen RabotasoNo ratings yet

- Chapter 19 20Document11 pagesChapter 19 20Kyle Francine BoloNo ratings yet

- Intermediate Accounting Chapter 17 and 18Document9 pagesIntermediate Accounting Chapter 17 and 18avilastephjaneNo ratings yet

- Christian Paul D. Legaspi Easy Problem 1, CCEDocument16 pagesChristian Paul D. Legaspi Easy Problem 1, CCELyca Mae CubangbangNo ratings yet

- Accounting 1Document3 pagesAccounting 1Kairan CrisologoNo ratings yet

- Problem 7 - 6 & 7Document2 pagesProblem 7 - 6 & 7Micah April SabularseNo ratings yet

- Zodiac Company: Balance Per Book, April 30Document5 pagesZodiac Company: Balance Per Book, April 30Rhea Sismo-anNo ratings yet

- Problem 13 - 1 To Problem 13 - 8Document4 pagesProblem 13 - 1 To Problem 13 - 8Jem ColebraNo ratings yet

- Problem 6-8 Answer A Savage CompanyDocument6 pagesProblem 6-8 Answer A Savage CompanyJurie BalandacaNo ratings yet

- IA Valix 2020 (Problem 4-3 Answer Key) PDFDocument4 pagesIA Valix 2020 (Problem 4-3 Answer Key) PDFBaby MushroomNo ratings yet

- Chapter6 BuenaventuraDocument11 pagesChapter6 BuenaventuraAnonnNo ratings yet

- IA 1 - Chapter 6 Notes Receivable Problems Part 1Document6 pagesIA 1 - Chapter 6 Notes Receivable Problems Part 1John CentinoNo ratings yet

- Loans ReceivableDocument3 pagesLoans ReceivableGee Lysa Pascua VilbarNo ratings yet

- Problem 9-1, 2 & 3Document3 pagesProblem 9-1, 2 & 3Micah April SabularseNo ratings yet

- Problem 7 - 6 & 7Document2 pagesProblem 7 - 6 & 7Micah April SabularseNo ratings yet

- Problem 7-5Document2 pagesProblem 7-5Micah April SabularseNo ratings yet

- Petty Cash Problem - SWDocument1 pagePetty Cash Problem - SWMicah April SabularseNo ratings yet

- PROBLEM 2 Cash and Cash Equivalent ValixDocument2 pagesPROBLEM 2 Cash and Cash Equivalent ValixMicah April SabularseNo ratings yet

- Income Tax Rates/Slabs For A.Y. (2011-12) : Slab (RS.) Tax (RS.)Document4 pagesIncome Tax Rates/Slabs For A.Y. (2011-12) : Slab (RS.) Tax (RS.)Achal MittalNo ratings yet

- National Income: Submitted To: - Dr. Hiranmoy RoyDocument30 pagesNational Income: Submitted To: - Dr. Hiranmoy RoyAbhishek ChopraNo ratings yet

- Tax EvasionDocument5 pagesTax Evasiongfreak0100% (1)

- The Hon'Ble Supreme Court of India: BeforeDocument17 pagesThe Hon'Ble Supreme Court of India: BeforeNandini SrivastavaNo ratings yet

- EPF Contribution Calculation: Key-In Your Basic Pay HereDocument1 pageEPF Contribution Calculation: Key-In Your Basic Pay HereKuzairi TokMahrajaNo ratings yet

- Balance Sheet: Alexei Alvarez Drobush, CFA, FRM Fabricio Chala, CFA, FRMDocument43 pagesBalance Sheet: Alexei Alvarez Drobush, CFA, FRM Fabricio Chala, CFA, FRMJhonatan Perez VillanuevaNo ratings yet

- Forecasting Financial Statements StepsDocument7 pagesForecasting Financial Statements Stepspallavi thakurNo ratings yet

- ABM11 BussMath Q2 Wk2 Gross-And-Net-EarningsDocument9 pagesABM11 BussMath Q2 Wk2 Gross-And-Net-EarningsArchimedes Arvie Garcia100% (1)

- IsDB Group Report On Covid-19 and Islamic Finance - FINALDocument65 pagesIsDB Group Report On Covid-19 and Islamic Finance - FINALAna FienaNo ratings yet

- Financial Accounting ProblemsDocument37 pagesFinancial Accounting ProblemsBambie MontillaNo ratings yet

- Exercises - Financial Statements - 8.1.18Document3 pagesExercises - Financial Statements - 8.1.18Hanjin Margaret ZaportezaNo ratings yet

- 21decentralized Operations and Segment ReportingDocument130 pages21decentralized Operations and Segment ReportingAilene QuintoNo ratings yet

- General Income TaxDocument3 pagesGeneral Income TaxFlorean SoniaNo ratings yet

- Keerthika Case StudiesDocument9 pagesKeerthika Case StudiesAarti SaxenaNo ratings yet

- Eco Notes-1Document27 pagesEco Notes-1Shivendra ShrivastavaNo ratings yet

- Simp Ar 2011Document245 pagesSimp Ar 2011Holis AdeNo ratings yet

- Unit III A. IndividualsDocument31 pagesUnit III A. IndividualsBea BernardoNo ratings yet

- Script in Cash FlowDocument7 pagesScript in Cash FlowMaxine Ayesha GabrielNo ratings yet

- Unit One Process CostingDocument9 pagesUnit One Process CostingDzukanji SimfukweNo ratings yet

- Module 3 in FIN GE ELEC 1Document23 pagesModule 3 in FIN GE ELEC 1Melg VieNo ratings yet

- Financial Plan: Projected SalesDocument4 pagesFinancial Plan: Projected SalesjemmieNo ratings yet

- ACCT ProblemsDocument3 pagesACCT ProblemsNanya BisnestNo ratings yet

- Statement of Comprehensive IncomeDocument23 pagesStatement of Comprehensive IncomeMarie FeNo ratings yet

- National Income AssignmentDocument5 pagesNational Income AssignmentSATYAM RANANo ratings yet

- OSN Ekonomi 2012 - SoalDocument14 pagesOSN Ekonomi 2012 - Soaldr Ahmad RidwanNo ratings yet

- Factor PricingDocument18 pagesFactor PricingOnindya MitraNo ratings yet