Professional Documents

Culture Documents

General Banking 01

General Banking 01

Uploaded by

Intiser Rockteem0 ratings0% found this document useful (0 votes)

2 views7 pagesCopyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views7 pagesGeneral Banking 01

General Banking 01

Uploaded by

Intiser RockteemCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 7

General Banking Questioner

1. What is account and who is eligible for opening A/c.

2. What do you meant by trustee account? What are the required papers/documents to open trustee

accounting.

3. What is the procedure of A/c opening of an illiterate person?

4. Club/Society/Trustee/Education Institute A/c. Opening requirements.

5. What papers required to open an account of Masjid/ Madrasha?

6. What is Liquidator A/c?

7. Documents required for opening RFCD account.

8. Required documents for opening Public Limited Company Account.

9. How to open & maintain a Student A/C? 10 features of Student Account.

10. What precaution should be taken during submission /preparing KYC.

11. What is Garnishee order?

12. What are the responsibilities of banker after receiving Garnishee Order?

13. Difference between Mandate & power of attorney 04 difference.

14. Qualification of introducer.

15. Consequence of the Account that has been opened without introducer.

16. What steps to be taken by banker If account holder insane.

17. What is Dormant & inoperative account?

18. What is dividend equalization A/C.

19. What is KYC & TP?

20. Account Close and Account Transfer procedure.

21. What are the reasons for Closing of account?

22. Write 05 reasons not to pay profit to MSB A/c.

23. Mudaraba Short Notice Account 06 features.

24. When MSD account dormant.

25. Describing 5 reasons for stop payment of an account.

26. Balance amount withdrawal in case of Joint Account if one died.

27. What are the different types of deposit accounts of EXIM Bank?

28. What is the meaning of MTDR?

29. What is the procedure and consideration of Issuing Duplicate MTDR?

30. Five scheme deposit product.

31. Dormant/Incorporate/Unclaimed Deposit.

32. CLR, SRR, REPO, Reverse REPO, Contingent Liability.

33. Components of SLR,CRR

34. Types of Mandate.

35. How is profit distributed to Mudaraba Depositors in an Islami Bank?

36. What is Time and Demand deposit? Write some example of Time and demand deposit?

37. What are core deposit, corporate deposit & Bank Deposit?

38. What is customer due diligence (CDD)?

39. CTR & STR definition.

40. What are the document to be retained with STR (05)?

41. What is money laundering? Major ways of Money Laundering.

42. Punishment of AMLD-to attempt assists for person, false statement providing for person.

43. 05 predicate offences in AML.

44. False reporting punishment in AML.

45. 05 reporting organization.

46. 08 detection procedure of AMLD in FEx transaction. 10 symptoms for suspecting money laundering

client as per AMLD.

47. Write 04 profession of Medium risk as per AMLD.

48. Mutual evaluation, when, why (AMLD-APG)

49. What is ACU?

50. Write the name of 6 (six) professions/enterprises carrying high risk for money laundering.

51. Required papers of limited company account covering anti money laundering.

52. Required papers of Mosjid / Madrasa account covering anti money laundering.

53. What is procedure of account opening for Ltd. Company under Money Laundering Prevention act-2012?

54. Write the name of 6 (six) professions/enterprise carrying medium risk for money laundering.

55. Who are the Report submitting Organization of Money Laundering

56. Punishment for non-cooperation (information hides) in Anti Money Laundering.

57. Attempt assist by personal & entity

58. What the crime/offenses & punishments as per Money laundering Prevention act-2012.

59. What are the sign that a customer is involved in Suspicious Transaction.

60. Write eight predictive offense as per Anti money laundering prevention act-2012.

61. MS-Excel 03 functions.

62. What is virus? Function of ADC.

63. Define operating systems, Programming language, Storage device.

64. Write down four advantage of the widespread use of IT in financial sector.

65. Define Pull Service in Mobile Banking, HTTP, MIS

66. What is IT Audit? What is M-Commerce? Write three features of ATM.

67. M Commerce.

68. Write about three different uses of Microsoft Office Excel in Banking.

69. What are the services providing by ADC of Exim Bank?

70. What do you meant by Plastic money?

71. LAN, WAN & ATM and its Functions.

72. What is E banking?

73. Debit Card Vs Credit Card.

74. All mode of Islamic investment BACH

75. What is & how many computer operating system.

76. Software password security.

77. Paragraph: Core banking software & Operational activities of EXIM Bank.

78. Message types of T-24.

79. What is plastic money.

80. E-Banking benefits.

81. Alternative Delivery channel function.

82. What is wallet.

83. Information security

84. IT security & pass word.

85. Advantage of Cash Deposit Machine (CDM).

86. Six features of Aiser (internet banking)

87. Mention four advantages of EXIM Cash as a product of ADC.

88. What is electronic Banking.

89. What is the procedure/formalities to reissue of a card if a holder report lost or destroy of a card.

90. What do you meant by password security? What is the present strategy of our Bank to protect password

security?

91. How data base theft could be solved.

92. How Spread sheet can help in data base.

93. What measures can be taken to protect system from hacking.

94. Write 06 components of e-banking

95. What is cloud storag

96. Short note -BEFTN

97. What is e-commerce

98. EXIM Cash 04 features

99. Work of Call centre

100. MICR cheques 05 security character.

101. What is EXIM Wallet.

102. Characteristics of Mobile Banking.

103. Deceased Account-if nominee is not mentioned & Balance of the account is within Tk.25,000/-

104. Deceased A/C balance of Tk.25,000/- without nominee

105. Deceased procedure without nominee for Tk.25000.00

106. Discuss the procedure for dis. of balance amount from deceased account where the nominee is not

mentioned and balance is not more than Tk.25,000.

107. Risk of banker in case of late payment.

108. Similarities between Cheque & DP Note.

109. Duties of paying Bank in case of crossed cheque.

110. Duties of Collecting Bank.

111. Common standing order for customer

112. 05 Standing instructions

113. 4 parties in Bill of Exchange

114. 6 characteristics in bill of exchange.

115. 04 duties of paying bank.

116. What is Marking of cheque?

117. What is Restrictive crossing?

118. Name of 03 negotiable instruments.

119. Characteristics of Negotiable instrument?

120. Reasons of cheque dishonor.

121. How will a banker respond if a cheque presented whose amount differs in word & figure.

122. What is Negotiable Instrument?

123. What do you meant by Queasy Negotiable Instrument?

124. What is Cheque? What are the characteristics of cheque?

125. Who are the parties of a cheque?

126. What are the duties of collecting bank and payee bank?

127. What are the reasons of dishonoring a cheque?

128. What is the procedure of stop payment?

129. What is endorsement & what are the types of endorsement?

130. Deference between DP Note & Bill of Exchange

131. Paying Bank,Collecting Bank

132. What is Late Payment of Cheque? Why Banker discourage for late payment, what are the formalities of

late payment of cheque.

133. What is DP Note, Characteristics of DP Note, Specimen of DP Note.

134. What is Letter of Disclaimer?

135. Holder, Holder in Due Course, Payment in Due Course

136. Right off , Set off.

137. procedure of Stop Payment of Cheque.

138. Duplicate Issue: Pay Order, DD, MTDR, Scheme A/c

139. Differences between :(b) Cheque & Bill of Exchange, (c) DP Note & Bill of Exchange,

140. Write down five differences between cheque & Promissory note.

141. Five precautionary measures to be taken by a paying bank before passing a cheque for payment.

142. What are the liabilities of a paying Banker under NI Act. To collect a crossed cheque?

143. Cheque returns reasons.

144. What steps are taken after submission of Negotiable instrument?

145. If any cheque payment paid by mistake than Payee bank liability.

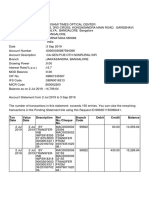

146. What is the calculation of surplus cash? How surplus cash is managed?

147. Banker’s General rights of lien.

148. Procedure if DD lost

149. Dayend voucher

150. What is Green Banking?

151. Customer Service: Definition, Services, who is customer?

152. When we can refuse a Cheque.

153. Six steps of implementing Green Banking.

154. What is legal process in case of presenting built note in counter.

155. What is Bank locker,

156. Write insurance policy of Volt limit, counter limit, cash in transit limit..

157. Rent of Bank locker as per size and realization procedure of such rent.

158. Asian Infrastructure Investment Bank, GSP-Short note.

159. Business unit of Private Economic zone.

160. APG & National Payment System Switch(Paragraph)

161. What are the reason of termination of Contract

162. What is Customer Service? Write 10 major elements of good customer services.

163. Write paragraph on Customer Service & Complaint Management.

164. Write paragraph on BRICS Development Bank.

165. Relationship Manager’s 07 characteristics.

166. Define Leadership.

167. What is Integrity.

168. Islamic Banks & Research Centres : OIC, IDB, ADB, FISB, WTO, WB, IMF, BIBA, CSBIB etc.

169. Service Rule: Code of Conduct, Leave, Punishment

170. CSR Activities/ 04 Exchange House / EIIL of EXIM Bank

171. Write ten laws relating to Banking.

172. What is the objective of Internal control?

173. Paragraph –EXIM Bank Vision-2024

174. Termination of contract-reasons.

175. What is Bank note & currency note?

176. What is maturity mismatch?

177. What is Asset-liability Management

178. What is currency note & Govt. Note.

179. Exim GL account transaction

180. Dept. equity ratio & current ratio

181. What are the constitutes of Financial Institutes?

182. What are the bases for issuing new currency?

183. Money Market (Call Money/ Money at Call) & Capital Market

184. What is Currency note and Government note

185. What is non-issue/soiled note, mutilated note, built up note & Re-issue notes?

186. What are currency note & Govt. note

187. What is venture capital?

188. What is meant by Bank?

189. What do you meant by banking hour?

190. Do you make payment against Cheque presented after Banking Hour. If you want to pay, how?

191. Monetary control mechanism of BB

192. What type of monetary policy applied by Bangladesh Bank to increase/decrease money supply?

193. Write the name against which Central Bank issue and circulate notes in the market.

194. Under what Order Bangladesh Bank Formed?

195. Write the name of Bangladesh Bank Order? Write 10 names of Laws & Ordinance of Banking.

196. Definition of Bank & Banker

197. Function of Central Bank / Commercial Bank/ Islamic bank

198. Written down five functions of Commercial Bank

199. In which year B. B. issue “Guideline for Islamic Banking” and by when did it activated.

200. Write down five agency function of commercial bank.

201. Functions of Central Bank.

You might also like

- HSBC Fund Transfer FORMDocument1 pageHSBC Fund Transfer FORMPinzariuSimona100% (1)

- SwiftDocument96 pagesSwiftVenkat Baliga86% (7)

- Kyc Aml Master Key Module 2Document12 pagesKyc Aml Master Key Module 2anriyasNo ratings yet

- Hand Book On Kyc PDFDocument39 pagesHand Book On Kyc PDFsanty86100% (2)

- Assignment For Artificial Intelligence AI2019Document13 pagesAssignment For Artificial Intelligence AI2019AyushKumarNo ratings yet

- Investment 01Document4 pagesInvestment 01Intiser RockteemNo ratings yet

- Final Placement FAQ 13BSP ADocument7 pagesFinal Placement FAQ 13BSP ARaghav ChordiaNo ratings yet

- Sample Accounting Interview QuestionsDocument9 pagesSample Accounting Interview QuestionsKeysonNo ratings yet

- SuggestionDocument6 pagesSuggestionMeheraf ShamimNo ratings yet

- Banking Important Exam Question and TermsDocument3 pagesBanking Important Exam Question and TermsAnkit JajalNo ratings yet

- Principles of Banking II YearDocument5 pagesPrinciples of Banking II YearKamal GammerNo ratings yet

- Ans (Acc Pumori)Document3 pagesAns (Acc Pumori)Jeeban Krishna TamrakarNo ratings yet

- JAIIB Notes 2023 - PPB - Objective TypeDocument174 pagesJAIIB Notes 2023 - PPB - Objective TypeDevkinandan JharwalNo ratings yet

- Flip Smart Banker Program: A Quality E-Learning Program byDocument4 pagesFlip Smart Banker Program: A Quality E-Learning Program byLamka VijayNo ratings yet

- Question Bank AFMDocument5 pagesQuestion Bank AFMkamalpreetkaur_mbaNo ratings yet

- Reading 2 KeyDocument4 pagesReading 2 KeyNguyễn Văn NguyênNo ratings yet

- Demat Refers To A Dematerialised AccountDocument9 pagesDemat Refers To A Dematerialised AccountPreetam KothariNo ratings yet

- Oracle Receivables Interview Question and AnswersDocument2 pagesOracle Receivables Interview Question and AnswersL Venkata NareshNo ratings yet

- Kyc Project ReportDocument12 pagesKyc Project Reportanam kazi100% (2)

- ICICI Demat Account ChargesDocument14 pagesICICI Demat Account Chargesnarsimha_4_uNo ratings yet

- Demat AccountDocument25 pagesDemat AccountSanjay ChinnalaNo ratings yet

- IAPDA Mod 1-5 Training QuestionsDocument3 pagesIAPDA Mod 1-5 Training QuestionsErnest Drumn100% (1)

- List of Accounts Payable Interview QuestionsDocument2 pagesList of Accounts Payable Interview QuestionsOana_27No ratings yet

- CAMELS Rating SystemDocument17 pagesCAMELS Rating SystemgelcodoNo ratings yet

- Question For ATM RequirementsDocument1 pageQuestion For ATM RequirementsCristea Maria ClaudiaNo ratings yet

- Interview Questions - ConsultingDocument2 pagesInterview Questions - Consultingshagun guptaNo ratings yet

- FInal Exam ReviewDocument3 pagesFInal Exam ReviewAliya JamesNo ratings yet

- General Information About BankDocument83 pagesGeneral Information About Banksamiullah.rashidhotakNo ratings yet

- Banking Related QuestionDocument1 pageBanking Related Questionsalahuddinjewel5No ratings yet

- Common Bank Interview QuestionsDocument23 pagesCommon Bank Interview Questionssultan erbo0% (1)

- Understanding The Letter of Credit Process: What Every Exporter Needs To KnowDocument34 pagesUnderstanding The Letter of Credit Process: What Every Exporter Needs To KnowMuhammadSohailNo ratings yet

- ICICI Direct FAQ PDFDocument101 pagesICICI Direct FAQ PDFSanjeev KulkarniNo ratings yet

- e-TDR/e-STDR (MOD) Frequently Asked QuestionsDocument2 pagese-TDR/e-STDR (MOD) Frequently Asked Questions44abcNo ratings yet

- Banking & Its Operation: Finance SpecialisationDocument4 pagesBanking & Its Operation: Finance SpecialisationManojkumar HegdeNo ratings yet

- RoopaDocument5 pagesRoopaRoopaJayaramNo ratings yet

- Credit Operations QuestionDocument2 pagesCredit Operations QuestionSumon AhmedNo ratings yet

- Accounting Question BankDocument5 pagesAccounting Question Banksiva883No ratings yet

- SoniDocument41 pagesSonisetiarickyNo ratings yet

- Sir Syed Institute of Sciences and CommerceDocument3 pagesSir Syed Institute of Sciences and CommerceMian Hidayat ShahNo ratings yet

- BFSI SSC Video TopicsDocument2 pagesBFSI SSC Video TopicsDr.Boby AntonyNo ratings yet

- Questions On Importance of Deposit in BanksDocument1 pageQuestions On Importance of Deposit in BanksKhan Kamranur Rahman ShovonNo ratings yet

- Auto Industry FinalreportDocument22 pagesAuto Industry FinalreportroNo ratings yet

- Final Report ON Executive Training: TITLE: To Sell 24 Demat Accounts WorthDocument17 pagesFinal Report ON Executive Training: TITLE: To Sell 24 Demat Accounts Worth29rkscribdNo ratings yet

- TA Chuyên NgànhDocument10 pagesTA Chuyên NgànhChan NuckNo ratings yet

- Case Study On HDFC and Icici Demate AccountDocument3 pagesCase Study On HDFC and Icici Demate Accountnishu_dhiman1350% (2)

- Big 4 Interview QuestionsDocument4 pagesBig 4 Interview Questionszhrsm2002No ratings yet

- CMDocument84 pagesCMMuhammad NiazNo ratings yet

- Trade Finance 01Document4 pagesTrade Finance 01Intiser RockteemNo ratings yet

- Top 50 Banking Interview Questions & Answers: 1) What Is Bank? What Are The Types of Banks?Document11 pagesTop 50 Banking Interview Questions & Answers: 1) What Is Bank? What Are The Types of Banks?Rahul mitraNo ratings yet

- Long AnswersDocument9 pagesLong Answersapi-3823681100% (2)

- Case of Cross Company Code Transactions?Document17 pagesCase of Cross Company Code Transactions?shekarNo ratings yet

- SwiftDocument96 pagesSwiftPushkar Anand100% (1)

- Downloadfile 1Document7 pagesDownloadfile 1Anshul NemaNo ratings yet

- How To Open Demat 2Document7 pagesHow To Open Demat 2ROHIT SINGHNo ratings yet

- AssignmentDocument2 pagesAssignmentRajalingamNo ratings yet

- CRM Case Study LPBCDocument4 pagesCRM Case Study LPBCyhjoshi0010% (1)

- Accounting Concepts-1 - 230714 - 002332Document14 pagesAccounting Concepts-1 - 230714 - 002332karthikdsk1810No ratings yet

- MCBDocument16 pagesMCBTariq SiddiqNo ratings yet

- You’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountFrom EverandYou’Re a Business Owner, Not a Dummy!: Understand Your Merchant AccountRating: 2 out of 5 stars2/5 (1)

- Amazing Credit Repair: Boost Your Credit Score, Use Loopholes (Section 609), and Overcome Credit Card Debt ForeverFrom EverandAmazing Credit Repair: Boost Your Credit Score, Use Loopholes (Section 609), and Overcome Credit Card Debt ForeverNo ratings yet

- Review of Some Online Banks and Visa/Master Cards IssuersFrom EverandReview of Some Online Banks and Visa/Master Cards IssuersNo ratings yet

- Evsjv 1G Cî: We.' . Iwr ÷ KB I FWZ© PJ Q - WD: 3,500/, Iwk' M Vi - Wekvk B I: 01715156047 (CV M©VBVJ)Document1 pageEvsjv 1G Cî: We.' . Iwr ÷ KB I FWZ© PJ Q - WD: 3,500/, Iwk' M Vi - Wekvk B I: 01715156047 (CV M©VBVJ)Intiser RockteemNo ratings yet

- English Grammar Book - 2021Document2 pagesEnglish Grammar Book - 2021Intiser RockteemNo ratings yet

- Balance Chemical EquationsDocument2 pagesBalance Chemical EquationsIntiser RockteemNo ratings yet

- Assignment Class 09 Covid Short SyllabusDocument7 pagesAssignment Class 09 Covid Short SyllabusIntiser RockteemNo ratings yet

- Degree-Comparison of AdjectiveDocument25 pagesDegree-Comparison of AdjectiveIntiser RockteemNo ratings yet

- Trade Finance 01Document4 pagesTrade Finance 01Intiser RockteemNo ratings yet

- Investment 01Document4 pagesInvestment 01Intiser RockteemNo ratings yet

- Islamic Economy: ObjectivesDocument6 pagesIslamic Economy: ObjectivesIntiser RockteemNo ratings yet

- Fair and Festivals of Bangladesh: Pahela BaishakhDocument33 pagesFair and Festivals of Bangladesh: Pahela BaishakhIntiser RockteemNo ratings yet

- Valence Electrons Valency Structural FormulaDocument2 pagesValence Electrons Valency Structural FormulaIntiser RockteemNo ratings yet

- Alvin Patrimonio, Petitioner, vs. Napoleon Gutierrez and Octavio Marasigan G.R. No. 187769, Second Division, June 4, 2014, Brion, J.Document3 pagesAlvin Patrimonio, Petitioner, vs. Napoleon Gutierrez and Octavio Marasigan G.R. No. 187769, Second Division, June 4, 2014, Brion, J.ryan resultsNo ratings yet

- Foreign Exchange Shamim BhaiDocument39 pagesForeign Exchange Shamim BhaiAbdullah Al NomanNo ratings yet

- NEGO (Hizon Notes)Document86 pagesNEGO (Hizon Notes)Bethany MangahasNo ratings yet

- Foreclosure StatementDocument2 pagesForeclosure Statementlavbhardwaj5No ratings yet

- Engleski Jezik Za Ekonomiste 2 - PismeniDocument12 pagesEngleski Jezik Za Ekonomiste 2 - PismeniLudiMedaNo ratings yet

- Damodar S Prabhu Vs Sayed Babalal H On 3 May2010Document8 pagesDamodar S Prabhu Vs Sayed Babalal H On 3 May2010vikash kumarNo ratings yet

- FemaDocument34 pagesFemaAnirudh AroraNo ratings yet

- AttachmentDocument414 pagesAttachmentPriya DharshiniNo ratings yet

- Eusebio V PeopleDocument7 pagesEusebio V PeopleArgel Joseph CosmeNo ratings yet

- 1567496511412VyAvOJ9gFZxAPRBX PDFDocument22 pages1567496511412VyAvOJ9gFZxAPRBX PDFManju Purushothama Manju PurushothamaNo ratings yet

- SABB Signature Visa CC User Guide - Jan. 23Document29 pagesSABB Signature Visa CC User Guide - Jan. 23amirNo ratings yet

- Conquest of Poverty (1933) Gerald Grattan McGeerDocument236 pagesConquest of Poverty (1933) Gerald Grattan McGeerDaniel ThompsonNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting EntriesAdrianIlaganNo ratings yet

- Crossing of Cheques 1223537775987301 9Document16 pagesCrossing of Cheques 1223537775987301 9siddharthasaha8570No ratings yet

- 138 Case (Maulik Shah)Document14 pages138 Case (Maulik Shah)Hiren MehtaNo ratings yet

- FT2033I004596554 MoovoeDocument2 pagesFT2033I004596554 MoovoeSuresh RadhakrishnanNo ratings yet

- Srs ExampleDocument44 pagesSrs ExampleVaruna MathurNo ratings yet

- S A 20190623Document4 pagesS A 20190623Ralph Bernard Dela RosaNo ratings yet

- MBA-Financial and Managerial Accounting Question BankDocument87 pagesMBA-Financial and Managerial Accounting Question BankElroy Barry100% (3)

- 8 - Year End Closure Checklist - 04-September-2014Document19 pages8 - Year End Closure Checklist - 04-September-2014joyteferaNo ratings yet

- Challan 280Document1 pageChallan 280Jayesh BajpaiNo ratings yet

- Electricity Bill AprilDocument1 pageElectricity Bill Aprilyouvsyou333No ratings yet

- Bharat Sanchar Nigam Limited: Application Form For New Mobile Connection (D-Kyc Process)Document3 pagesBharat Sanchar Nigam Limited: Application Form For New Mobile Connection (D-Kyc Process)Sales CTO LucknowNo ratings yet

- Insurance 2022Document11 pagesInsurance 2022Naseeb SinghNo ratings yet

- Petty Cash Fund EstablishmentDocument18 pagesPetty Cash Fund EstablishmentLeticia RagaNo ratings yet

- TOEIC Versi 1 - 2Document23 pagesTOEIC Versi 1 - 2Cindy Agustin67% (3)

- Smart Banking For Business Price ListDocument3 pagesSmart Banking For Business Price ListcrownicleNo ratings yet

- 2011 Supreme Court Decisions On Commercial LawDocument9 pages2011 Supreme Court Decisions On Commercial LawMartin MartelNo ratings yet