Professional Documents

Culture Documents

Eco of Pak Report by 44, 40, 34

Eco of Pak Report by 44, 40, 34

Uploaded by

Ahsan IslamCopyright:

Available Formats

You might also like

- Wonder Po FormatDocument2 pagesWonder Po FormatALPIT GANDHINo ratings yet

- IUB NAT GAT General Previous PapersDocument23 pagesIUB NAT GAT General Previous PapersAhsan Islam50% (4)

- How To Play: An Official Guide To TofuDocument64 pagesHow To Play: An Official Guide To TofuAidenNo ratings yet

- Background of The StudyDocument26 pagesBackground of The StudyNoel Bitancor100% (1)

- Internship Report ON NTDC Multan: NFC Institute of Engineering and Technology MultanDocument16 pagesInternship Report ON NTDC Multan: NFC Institute of Engineering and Technology MultanAhsan IslamNo ratings yet

- Role of Financial Institutions in Economic Development of Pakistan Essay Sample - Papers and Articles On Bla Bla WritingDocument5 pagesRole of Financial Institutions in Economic Development of Pakistan Essay Sample - Papers and Articles On Bla Bla WritingMuhammad Shahid Saddique33% (3)

- ASTRAL RECORDS - EditedDocument11 pagesASTRAL RECORDS - EditedNarinderNo ratings yet

- Debt & Econmy of PaistanDocument15 pagesDebt & Econmy of PaistanSajjad Ahmed ShaikhNo ratings yet

- External Debt Accumulation and Its Impact On Economic Growth in PakistanDocument17 pagesExternal Debt Accumulation and Its Impact On Economic Growth in PakistankalaNo ratings yet

- External Debt Accumulation and Its Impact On Economic Growth in PakistanDocument17 pagesExternal Debt Accumulation and Its Impact On Economic Growth in PakistanEngr. Madeeha SaeedNo ratings yet

- Debt Accumulation and Its Implications For GrowthDocument20 pagesDebt Accumulation and Its Implications For GrowthMubasher AliNo ratings yet

- Impact of Pak-IMF Bailout Arrangement On Economic GrowthDocument36 pagesImpact of Pak-IMF Bailout Arrangement On Economic GrowthJournal of Public Policy PractitionersNo ratings yet

- Impact of Domestic and External Debt On The Economic Growth of PakistanDocument10 pagesImpact of Domestic and External Debt On The Economic Growth of PakistanEngr. Madeeha SaeedNo ratings yet

- Macro Project (Pak Economic Survey)Document30 pagesMacro Project (Pak Economic Survey)fiza majidNo ratings yet

- Imf A Blessing or Curse For Pakistan S e 2 PDFDocument7 pagesImf A Blessing or Curse For Pakistan S e 2 PDFinayyatNo ratings yet

- Pak and ImfimfDocument7 pagesPak and ImfimfinayyatNo ratings yet

- Debt Servicing of Pakistan Capitalizing On Chinese InvestmentDocument8 pagesDebt Servicing of Pakistan Capitalizing On Chinese InvestmentNomanNo ratings yet

- Budget Deficit and Economic Growth: A Case Study of PakistanDocument16 pagesBudget Deficit and Economic Growth: A Case Study of Pakistanprince marcNo ratings yet

- Essay On How To Deal With Economic Woes of Pakistan and IMF ConditionalitiesDocument7 pagesEssay On How To Deal With Economic Woes of Pakistan and IMF ConditionalitiesNofil RazaNo ratings yet

- Balance of Payment of PakistanDocument9 pagesBalance of Payment of Pakistanishfaq ameenNo ratings yet

- SMEs 2Document4 pagesSMEs 2Engr Ikram UllahNo ratings yet

- Impact of Foreign Aid On Economic Development in Pakistan (1960-2002)Document20 pagesImpact of Foreign Aid On Economic Development in Pakistan (1960-2002)mbilalNo ratings yet

- Overview of Pakistan's Economy - Articles - Embassy of The Islamic Republic of Pakistan BeijingDocument5 pagesOverview of Pakistan's Economy - Articles - Embassy of The Islamic Republic of Pakistan Beijingawahid1990No ratings yet

- Remarks by Henri Lorie, Senior Resident RepresentativeDocument11 pagesRemarks by Henri Lorie, Senior Resident Representativesaad aliNo ratings yet

- The News ArticlesDocument10 pagesThe News ArticlesTari BabaNo ratings yet

- YearBook2010 11 PDFDocument148 pagesYearBook2010 11 PDFRajesh KumarNo ratings yet

- Impact of External Debt On Economic Growth of Pakistan: Solow Growth Model ApproachDocument10 pagesImpact of External Debt On Economic Growth of Pakistan: Solow Growth Model ApproachDeepa KhatriNo ratings yet

- Pakistan Development Update-Nov 2017 WBDocument92 pagesPakistan Development Update-Nov 2017 WBaamirNo ratings yet

- Impact of IMF On Pakistan Economy: 17221598-144 (Neha Durani) 17221598-154 (Saira Irtaza) 17221598-145 (Fizba Tahir)Document46 pagesImpact of IMF On Pakistan Economy: 17221598-144 (Neha Durani) 17221598-154 (Saira Irtaza) 17221598-145 (Fizba Tahir)Neha KhanNo ratings yet

- 11 Finance and DevelopmentDocument6 pages11 Finance and DevelopmentM IshaqNo ratings yet

- Sadia MehrDocument27 pagesSadia MehrMuhammadHashimRazaNo ratings yet

- Budget Insight 2010Document58 pagesBudget Insight 2010Muhammad Usman AshrafNo ratings yet

- The Way Forward DR AttaurehmanDocument6 pagesThe Way Forward DR AttaurehmanAsif Khan ShinwariNo ratings yet

- Causes and ConsequencesDocument21 pagesCauses and Consequencesraiasad284No ratings yet

- Economic Zones As Key Players in Economic Advancement: The Bangladesh PerspectiveDocument16 pagesEconomic Zones As Key Players in Economic Advancement: The Bangladesh PerspectiveJames XgunNo ratings yet

- Role of Sate - Overview - ENDocument66 pagesRole of Sate - Overview - ENsoysauce powerrangerNo ratings yet

- Research PaperDocument17 pagesResearch PaperAdnan ArshadNo ratings yet

- External Debt and Its Implications On PakistanDocument17 pagesExternal Debt and Its Implications On PakistanSheheryar KhanNo ratings yet

- Foreigndebtsarticle FinalDocument12 pagesForeigndebtsarticle FinalSolgrynNo ratings yet

- Year Book 2018-2019: Government of Pakistan Finance Division Islamabad WWW - Finance.gov - PKDocument171 pagesYear Book 2018-2019: Government of Pakistan Finance Division Islamabad WWW - Finance.gov - PKahmadNo ratings yet

- Policy For Promotion SME FinanceDocument16 pagesPolicy For Promotion SME FinanceUsman ManiNo ratings yet

- Roshaane IntDocument6 pagesRoshaane IntRoshaane GulNo ratings yet

- Causes Obstructing Economic Development & Rostow Model PakistDocument5 pagesCauses Obstructing Economic Development & Rostow Model Pakistmuhammadtaimoorkhan100% (2)

- Economic SurveyDocument47 pagesEconomic Surveytahir dogarNo ratings yet

- MPRA Paper 1211Document20 pagesMPRA Paper 1211Vrdic AbbottabadNo ratings yet

- Analysis of Pakistan EconomyDocument20 pagesAnalysis of Pakistan EconomySadaf KazmiNo ratings yet

- FIP Assignment # 2Document11 pagesFIP Assignment # 2talhashafqaatNo ratings yet

- FatemaTuzZohra, Role of Commercial Banking in The Economic Development of BengladeshDocument12 pagesFatemaTuzZohra, Role of Commercial Banking in The Economic Development of BengladeshsilveR staRNo ratings yet

- Status Paper Govt Debt September 2016Document142 pagesStatus Paper Govt Debt September 2016Uttam KumarNo ratings yet

- Analysis of Pakistan's Debt Situation: 2000 2017Document22 pagesAnalysis of Pakistan's Debt Situation: 2000 2017Ayaz Ahmed KhanNo ratings yet

- Economic Problems of PakistanDocument45 pagesEconomic Problems of PakistanShaheen WaheedNo ratings yet

- IMF Assignment 1Document19 pagesIMF Assignment 1shoaibNo ratings yet

- Virtual University of Pakistan: Assignment NO 1 Spring 2019Document5 pagesVirtual University of Pakistan: Assignment NO 1 Spring 2019Asad ShahNo ratings yet

- Changes by The State Bank of Pakistan From 2019-2020: Ayesha Shoaib 18947 Muskaan ShekhaniDocument30 pagesChanges by The State Bank of Pakistan From 2019-2020: Ayesha Shoaib 18947 Muskaan ShekhaniSadia AbidNo ratings yet

- Malaysian Study AssignmentDocument17 pagesMalaysian Study Assignmenta12701No ratings yet

- Impact of Foreign DebtDocument10 pagesImpact of Foreign Debtgullab khanNo ratings yet

- 22nd Loan Earmarked For Debt Servicing: Current State of The EconomyDocument5 pages22nd Loan Earmarked For Debt Servicing: Current State of The EconomyWaqas SaeedNo ratings yet

- Internship Report: Presented ToDocument30 pagesInternship Report: Presented Tojunaid_hamza143No ratings yet

- The Determinants of Growth of Industrial Sector and Credit To Private SectorDocument26 pagesThe Determinants of Growth of Industrial Sector and Credit To Private SectorSamina WajeehNo ratings yet

- Article 8-An Empirical Investigation Into The Determinants of External Debt in Asian Developing and Transitioning EconomiesDocument12 pagesArticle 8-An Empirical Investigation Into The Determinants of External Debt in Asian Developing and Transitioning Economiesneneljr0175No ratings yet

- Economics Presentation.Document9 pagesEconomics Presentation.naeemshar206No ratings yet

- What To Do About PakistanDocument41 pagesWhat To Do About PakistanhassanrajputpasNo ratings yet

- Bevan 2012 Working Paper 1Document47 pagesBevan 2012 Working Paper 1Ellis ElliseusNo ratings yet

- External Debt in PakistanDocument28 pagesExternal Debt in Pakistankanwal12345hudaatNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Provincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionFrom EverandProvincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionNo ratings yet

- Septum Formation in The VentriclesDocument43 pagesSeptum Formation in The VentriclesAhsan IslamNo ratings yet

- Development - of - CVS-5Document20 pagesDevelopment - of - CVS-5Ahsan IslamNo ratings yet

- RIBSDocument34 pagesRIBSAhsan IslamNo ratings yet

- Pakistan Security Printing Corporation (PVT.) Limited: Application For EmploymentDocument2 pagesPakistan Security Printing Corporation (PVT.) Limited: Application For EmploymentAhsan IslamNo ratings yet

- Governance in PakistanDocument16 pagesGovernance in PakistanAhsan IslamNo ratings yet

- NTDC Past PaperDocument17 pagesNTDC Past PaperAhsan Islam100% (1)

- NTDC 2021Document4 pagesNTDC 2021Ahsan IslamNo ratings yet

- Impact of Foreign Direct Investment On Economic Growth of PakistanDocument13 pagesImpact of Foreign Direct Investment On Economic Growth of PakistanAhsan IslamNo ratings yet

- Monetary PolicyDocument20 pagesMonetary PolicyAhsan IslamNo ratings yet

- Term Report Group No 10Document15 pagesTerm Report Group No 10Ahsan IslamNo ratings yet

- Cpec SezDocument20 pagesCpec SezAhsan IslamNo ratings yet

- Inflation (10 .27 .41 .25)Document5 pagesInflation (10 .27 .41 .25)Ahsan IslamNo ratings yet

- Submitted To: Submitted By:: Term Report On: SubjectDocument20 pagesSubmitted To: Submitted By:: Term Report On: SubjectAhsan IslamNo ratings yet

- Term Report of Group 09Document15 pagesTerm Report of Group 09Ahsan IslamNo ratings yet

- ACFrOgAqLk83B8gwqDJUNOLWFrrYKHlQnPr54K7cvW0veTlN6 eEdLGfI6oNuhPVVQr7AIhYDMJ4RsKwet9kt4ath9gT4D2xdzMivbps T-vHEIx0lt3uU0AUoJtipWhgdkW-AV1lOC9nRb9XOywDocument383 pagesACFrOgAqLk83B8gwqDJUNOLWFrrYKHlQnPr54K7cvW0veTlN6 eEdLGfI6oNuhPVVQr7AIhYDMJ4RsKwet9kt4ath9gT4D2xdzMivbps T-vHEIx0lt3uU0AUoJtipWhgdkW-AV1lOC9nRb9XOywAhsan IslamNo ratings yet

- Term 1 QP XI - Subjective Paper 40 MarksDocument3 pagesTerm 1 QP XI - Subjective Paper 40 MarksAditiNo ratings yet

- Full Result Ip Revised Result 2020Document105 pagesFull Result Ip Revised Result 2020Justin PrabaharNo ratings yet

- Financial Risk Management Notes II Year III Sem Updated.Document95 pagesFinancial Risk Management Notes II Year III Sem Updated.afeefa siddiquaNo ratings yet

- An viyAp2AT - 8RLP9HRnRRQedxBuW CUpDuhWSEV2yaJIskR6XFvudRmtpCgtgyH2mG - QupS83UJDDG0oqMf1hDRnMvlTartYiNExpJJidgHP5 iUniaZ5FqBtUQgDocument3 pagesAn viyAp2AT - 8RLP9HRnRRQedxBuW CUpDuhWSEV2yaJIskR6XFvudRmtpCgtgyH2mG - QupS83UJDDG0oqMf1hDRnMvlTartYiNExpJJidgHP5 iUniaZ5FqBtUQgSourav GuptaNo ratings yet

- Date No Invoice Description in Unit Price: PT Cahaya Inventory Card DESEMBER, 2018Document26 pagesDate No Invoice Description in Unit Price: PT Cahaya Inventory Card DESEMBER, 2018IvankaNo ratings yet

- Mr. Addams' EditingDocument15 pagesMr. Addams' EditingKim KoalaNo ratings yet

- Nama: Nurahma Amalia NIM: 20200070042 Kelas: AK20ADocument4 pagesNama: Nurahma Amalia NIM: 20200070042 Kelas: AK20Aedit andraeNo ratings yet

- Porter's Five Forces: Submitted ToDocument10 pagesPorter's Five Forces: Submitted ToMarian Jane Viñas ObagNo ratings yet

- Method Statement For Installation of Thread Rod Support and Cable Tray Using Boomscissor LiftDocument6 pagesMethod Statement For Installation of Thread Rod Support and Cable Tray Using Boomscissor LiftNaveenNo ratings yet

- Assignment AnualGas 4Document8 pagesAssignment AnualGas 4karimNo ratings yet

- Chapter 6 Consignment SalesDocument12 pagesChapter 6 Consignment SalesAkkamaNo ratings yet

- 06 Consolidation AnnotatedDocument18 pages06 Consolidation AnnotatedLloydNo ratings yet

- Chapter Three Marketing Mix:: ProductDocument17 pagesChapter Three Marketing Mix:: ProductTesfahun tegegnNo ratings yet

- Internship Report Saqlain ArifDocument65 pagesInternship Report Saqlain ArifSaqlain KhanNo ratings yet

- Part Two Civil Review 2 Mid ExamDocument4 pagesPart Two Civil Review 2 Mid ExamKuracha LoftNo ratings yet

- Curriculum Vitae: Personal DataDocument3 pagesCurriculum Vitae: Personal DataRamdani daniNo ratings yet

- Draft AOM On 20% DevelopmentDocument4 pagesDraft AOM On 20% DevelopmentWilliam A. Chakas Jr.No ratings yet

- TRANSPORT MANAGEMENT KPIsDocument1 pageTRANSPORT MANAGEMENT KPIsvijay kanduriNo ratings yet

- Contemporary Issues in Fashion and TextilesDocument5 pagesContemporary Issues in Fashion and TextilesPrasad KumbhareNo ratings yet

- 1 637304139596797833 Stockholders Equity Section AccountingDocument7 pages1 637304139596797833 Stockholders Equity Section AccountingShandaNo ratings yet

- BFCI FINAL ENGAGEMENT PROPOSAL Silver FernDocument2 pagesBFCI FINAL ENGAGEMENT PROPOSAL Silver FernGeram ConcepcionNo ratings yet

- Portfolio Management Tutorial 2 AnswersDocument7 pagesPortfolio Management Tutorial 2 Answersandy033003No ratings yet

- User Manual - X-904 - Rev. 2023.0Document31 pagesUser Manual - X-904 - Rev. 2023.0Sajith VenkitachalamNo ratings yet

- Uttara Bank Limited: Schedule of Charges Relating To Foreign Exchange TransactionsDocument8 pagesUttara Bank Limited: Schedule of Charges Relating To Foreign Exchange TransactionsSãbbìŕ RàhmâñNo ratings yet

- TPD 501 Engr Economy NoteDocument44 pagesTPD 501 Engr Economy NoteTomisin EniolaNo ratings yet

- Financial ServicesDocument23 pagesFinancial ServicesMidhun ManoharNo ratings yet

Eco of Pak Report by 44, 40, 34

Eco of Pak Report by 44, 40, 34

Uploaded by

Ahsan IslamOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eco of Pak Report by 44, 40, 34

Eco of Pak Report by 44, 40, 34

Uploaded by

Ahsan IslamCopyright:

Available Formats

0

Report

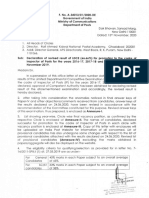

Economy of Pakistan

Submitted to

Ma’am Mehreen

Submitted by

Murtaza Naqvi (44)

Kamla Shahzad (40)

Ushna Qureshi (34)

Master’s in Business Administrations (NBE)

2nd Semester

Session: 2020-22

Institute of Management Sciences

BAHAUDDIN ZAKARIYA UNIVERSITY, MULTAN

Economy of Pakistan MBA (NBE)

1

Table of Content:

Sr No Topic Name Page No

01 Summary 02

02 Key Words 02

03 Objectives 03

04 Introduction 03

05 Foreign Trade 04

06 Foreign Trade of Pakistan 05

07 External Debt 06

08 External Debt of Pakistan 06

09 Impact of External Debt in Economy of Pakistan 08

10 SWOT Analysis 09

11 Current Trends 11

12 Recommendations 13

13 Conclusion 16

14 References 16

Economy of Pakistan MBA (NBE)

2

Foreign Trade: Impact of External Debt in Economy of Pakistan

Summary:

External debt or foreign aid is considered a significant source of income for developing

countries. Pakistan has relied much on foreign debt to finance its balance of payments (BOP)

deficit and saving investment gap. This heavily dependence on external resources became

uncontrollable in late 1980s. Primary objective of this report is to explore the relationship

between external debt and economic growth in Pakistan using time series econometric

technique and the impacts of foreign trade as well. We took a point of glance of external debt

and economic performance of Pakistan from 1947 to till now. The report shows that external

debt is negatively and significantly related with economic growth Pakistan. [ CITATION Far14 \l

1033 ] The evidence suggests that increase in external debt will lead to decline in economic

growth of the country. Debt servicing has also significant and negative impact on GDP

growth rate. As the debt servicing tends to increase, there will be fewer opportunities for

economic growth. Since 1980s, the mounting debts and debt payment service of Pakistan due

focus and consideration from the Policy makers and economists. This report also elaborate

foreign trade of Pakistan with some latest statistical data and also find the relationship

between foreign trade and external debt in Pakistan. To hunt the target of report, five

variables i.e. Growth, external debt servicing, saving, net export, Foreign Direct Investment

were taken to focus their fact association with the GDP or development of the Pakistan's

economy.[ CITATION Ama16 \l 1033 ] Annual panel data was taken from the source World Bank

indicator from the period of 1980 to 2019 and was manipulated through least square multiple

regression models. The main variable external debt has significantly negative impact on

dependent variable GDP so it’s concluded that Pakistan should go for the option of debt

forgiveness and must invite FDI but not much as their overloading may hurt the economy.

Adjusting saving (ADS) highly significant positive relation with GDP reveals that habit of

saving extremely boost up economy growth. Exports is basically good to helping hand for

economy so they must be lifted up. The impact of external debt is quite hostile on growth so

steps must be taken to abolish it in order to growth of economy.[ CITATION Awa20 \l 1033 ]

Key Words:

Foreign Trade; GDP; External debt; Adjusting Saving (ADS); Export; Pakistan; Trends and

Impacts.

Economy of Pakistan MBA (NBE)

3

Objectives:

The main objectives of report are given below:

To study the causes of high volume of Pakistan’s external debt.

To determine the volume of Pakistan’s external debt.

To elaborate the latest trends of foreign trade

To explore the impact of external debt on the economic growth of Pakistan.

To suggest how to control growing foreign debt.

Introduction:

External debt plays both an optimistic and destructive part in forming Economic growth,

especially of the developing nations. External debt is useful when the legislature uses it for

investment-oriented tasks, for example Power sector, base and the horticultural segment.

Then again, it would influence contrarily when it is utilized for private and open utilization

purposes, which don't bring any return. Also, a low level of external debt sways financial

development absolutely; however this relationship gets to be negative at a larger amount. The

particular defining moments are 35-40% of the obligation terrible residential item (GDP)

proportion, and 160-170% of the export debt ratio Pakistan's external debt is seen to be the

reason for all ills besetting the economy. In 1980 the external debt was $869 billion now

external debt expanded from $1901.90 million in 1990 to $2944.80 million in 1999 and

further to $37.362 billion by 2007. Furthermore as indicated by the State Bank of Pakistan

(SBP) the nation's aggregate external debt and liabilities have contracted, by nearly 6 percent,

amid the last logbook year. Pakistan's aggregate external debt and liabilities declined to

$59.383 billion as on December 31, 2013 contrasted with $63.377 billion as on December 31,

2012.[ CITATION Sta19 \l 1033 ] Also, in the greater part of the monetary years since freedom,

the Government's Revenue has not exactly its consumption, which would result in financial

deficiency which could be spanned through acquiring from both interior and external debt

(obligation). At the same time the circumstances gets to be more awful when the nation is not

able to reimburse its debt overhauling. On the other hand, Musharraf's government made

numerous moves to defeat this gigantic external debt including "the debt limitation law"

which is intended to manage diminished of this trouble of external debt, beginning in 2000.

Moreover, after 9/11, the world's key arrangements changed, and Pakistan turned into a

bleeding edge state in the worldwide war on fear. Pakistan was thus capable either to discount

Economy of Pakistan MBA (NBE)

4

or reschedule the outer obligation liabilities. The measure of settlements and outside awards

additionally expanded complex amid this period. Pakistan was in this way ready to reimburse

obligation administrations and enthusiasm of the IMF and the World Bank. Also, if the

government has the capacity follow up on the obligation constraint law, which has been

passed by parliament, it would have the capacity to dispose of obligation owed to both the

IMF and the World Bank. On the other hand, there remains the need of empowering divisions

like industry and agribusiness to overcome the fiscal gap. Shahid Hasan Khan, Special

Assistant on Economic Affairs to the PM of Pakistan in the Benazir Bhuto government in

1993, said that "the monetary shortfall is the essential driver of every last one of ills of the

economy. Therefore, any exertion went for restoring the economy would have the disposal of

monetary deficiency as the most obvious thing on the agenda." (Baksh, 1994). Every single

IMF and World Bank report on Pakistan additionally says that the outside obligation trouble

has been the essential driver of every last one of ills of economy, particularly since the begin

of the structural change programs in 1988 [ CITATION FAR19 \l 1033 ] . As per the World Bank

downright external debt may be characterized as obligation owed to non-resident repayable as

far as foreign currency, services and goods. External debt is the piece of long haul obligation

(open and freely ensured obligation in addition to private non ensured obligation), fleeting

business obligation and International Monetary Fund (IMF) advances. Preceding early 1970s

the outer obligation of creating nations was essentially little and authority sensation, the

larger part of banks being outside governments and worldwide money related organizations

offer advance for development project [ CITATION Eff15 \l 1033 ]

What is Foreign Trade?

Foreign trade is exchange of capital, goods, and services across international borders or

territories. In most countries, it represents a significant share of gross domestic product

(GDP). While international trade has been present throughout much of history, its economic,

social, and political importance has been on the rise in recent centuries. All countries need

goods and services to satisfy wants of their people. Production of goods and services requires

resources. Every country has only limited resources. No country can produce all the goods

and services that it requires. It has to buy from other countries what it cannot produce or can

produce less than its requirements. Similarly, it sells to other countries the goods which it has

in surplus quantities. India too, buys from and sells to other countries various types of goods

and services. Generally no country is self-sufficient. It has to depend upon other countries for

importing the goods which are either non-available with it or are available in insufficient

Economy of Pakistan MBA (NBE)

5

quantities. Similarly, it can export goods, which are in excess quantity with it and are in high

demand outside. International trade means trade between the two or more countries.

International trade involves different currencies of different countries and is regulated by

laws, rules and regulations of the concerned countries. Thus, International trade is more

complex. [ CITATION For21 \l 1033 ]

Importance of Foreign or International trade:

International trade is in principle not different from domestic trade as the motivation and the

behavior of parties involved in a trade do not change fundamentally regardless of whether

trade is across a border or not. The main difference is that international trade is typically

more costly than domestic trade. The reason is that a border typically imposes additional

costs such as tariffs, time costs due to border delays and costs associated with country

differences such as language, the legal system or culture. International trade consists of

‘export trade’ and ‘import trade’. Export involves sale of goods and services to other

countries. Import consists of purchases from other countries.

International or Foreign trade is recognized as the most significant determinants of economic

development of a country, all over the world. The foreign trade of a country consists of

inward (import) and outward (export) movement of goods and services, which results into.

Outflow and inflow of foreign exchange. Thus it is also called EXIM Trade. For providing,

regulating and creating necessary environment for its orderly growth, several Acts have been

put in place. The foreign trade of India is governed by the Foreign Trade (Development &

Regulation) Act, 1992 and the rules and orders issued there under. Payments for import and

export transactions are governed by Foreign Exchange Management Act, 1999. Customs Act,

1962 governs the physical movement of goods and services through various modes of

transportation.[ CITATION For21 \l 1033 ]

Foreign Trade of Pakistan:

Pakistan has bilateral and multilateral trade agreements with many nations and international

organizations. It is a member of the World Trade Organization, part of the South Asian Free

Trade Area agreement and the China–Pakistan Free Trade Agreement. Fluctuating world

demand for its exports, domestic political uncertainty, and the impact of occasional droughts

on its agricultural production have all contributed to variability in Pakistan's trade deficit. The

trade deficit for the fiscal year 2013/14 is $7.743 billion, exports are $10.367 billion in July–

Economy of Pakistan MBA (NBE)

6

November 2013 and imports are $18.110 billion. Pakistan's exports continue to be dominated

by men power export in the subcontinent, cotton textiles and apparel. Imports include

petroleum and petroleum products, chemicals, fertilizer, capital goods, industrial raw

materials, and consumer products. On 12 December 2013, the European Union granted GSP

Plus status to Pakistan until 2017, which enabled it to export 20% of its good with 0 tariff and

70 percent at preferential rates to the EU market. This status was given after the European

Parliament passed the resolution by 406-186 votes.[ CITATION Lan20 \l 1033 ]

What is External Debt?

External debt (or foreign debt) is the total debt which the residents of a country owe to

foreign creditors; its complement is internal debt, which is owed to domestic lenders. The

debtors can be the government, corporations or citizens of that country. In simply words the

external debt as percentage of Gross Domestic Product (GDP) is the ratio between the debt a

country owes to non-resident creditors and its nominal GDP. External debt is the part of a

country’s total debt that was borrowed from foreign lenders, including commercial banks,

governments or international financial institutions. Debtors can be individuals, corporations

or the government. The external debt comprises the outstanding amount of those actual

current and not contingent, liabilities owed to non-residents by residents of country, which

Economy of Pakistan MBA (NBE)

7

require the debtor to pay principal and/or interest at some point(s) in the future. External debt

is also referred to as foreign debt.[ CITATION Eff15 \l 1033 ]

External Debt of Pakistan:

External Debt in Pakistan increased to 115756 USD Million in the fourth quarter of 2020

from 113803 USD Million in the third quarter of 2020. Similarly, as of December

2020, external Debt of Pakistan is now around US$115.7 billion. Pakistan owes US$11.3

billion to Paris Club, US$33.1 billion to multilateral donors, US$7.4 billion to International

Monetary Fund, and US$12 billion to international bonds such as Eurobond, and skunk.

Pakistan External Debt reached 113.8 USD billion in Sep 2020, compared with 112.9 USD

billion in the previous quarter. Pakistan External Debt: USD million data is updated

quarterly, available from Jun 2006 to Sep 2020. The data reached an all-time high of 113.8

USD billion in Sep 2020 and a record low of 37.2 USD billion in Jun 2006.

In the latest reports of Pakistan, Current Account recorded a surplus of 266.0 USD milion in

Dec 2020. Foreign Direct Investment (FDI) increased by 317.4 USD million in Oct 2020.

Pakistan Direct Investment Abroad expanded by 4.0 USD million in Dec 2020. Its Foreign

Portfolio Investment fell by 292.0 USD million in Dec 2020. The country's Nominal GDP

was reported at 264.1 USD billion in Jun 2020.[ CITATION Rif12 \l 1033 ]

Total external debt is debt owed to nonresidents repayable in currency, goods, or services.

Total external debt is the sum of public, publicly guaranteed, and private nonguaranteed long-

term debt, use of IMF credit, and short-term debt. Short-term debt includes all debt having an

Economy of Pakistan MBA (NBE)

8

original maturity of one year or less and interest in arrears on long-term debt. Data are in

current U.S. dollars. [ CITATION Awa20 \l 1033 ]

Pakistan external debt for 2019 was $100,818,526,514, a 7.79% increase from 2021.

Pakistan external debt for 2018 was $93,531,752,991, a 8.72% increase from 2020.

Pakistan external debt for 2017 was $86,031,955,223, a 17.79% increase from 2019.

Pakistan external debt for 2016 was $73,041,126,773, a 9.52% increase from 2018.

Impact of External Debt in economy of Pakistan:

The external debt exerts significant negative impact on economic growth. This confirmed the

existence of debt overhang in Pakistan in both long and short run. Labor force affect GNP

negatively in long run and short run as well, but in short run impact is insignificant. Pakistan

faces serious debt problem, which threaten the economic future of the country. External debt

to GDP ratio declined by a 0.8 percentage point to stand at 59.3 percent during FY2011,

below the ceiling of 60 percent envisaged in the FRDL Act 2005. Fiscal control and a limit

on borrowing from SBP facilitated this reduction. However, public debt to GDP may be

understated as this ratio does not include any estimates of contingent liabilities, which might

materialize in future. Unfortunately, government has not installed any system to quantify and

manage the fiscal impact of these contingent liabilities, rather these liabilities are created

essentially on an ad hoc basis and without regard to fiscal consequences. Pakistan’s external

debt and debt servicing in terms of foreign exchange earnings stood at 1.3 times and 11.4

percent during 2011-12 compared to 1.5 times and 16.5 percent respectively in 20010-11,

within the acceptable threshold of 2 times and debt servicing below 20 percent of foreign

exchange earnings. However, repayment of IMF debt starting from 2HFY2013 will put

pressure on external debt servicing in coming years, therefore it is imperative for the

government to take measures for attracting both debt and non-debt foreign currency flows. In

the current global economic scenario it will be uphill task for the government to manage

external account solvency. Burden of external debt and debt servicing have continued to grow

over time.[ CITATION Ama16 \l 1033 ]

There are different indicators of debt service burden such as;

Economy of Pakistan MBA (NBE)

9

Debt servicing as percentage of export receipts measures the ability of debt repayment

and creditworthiness of a country. According to the World Bank, when debt servicing

of a country go beyond 20 percent of its export earnings then its debt becomes

unsustainable.

Debt servicing as a percentage of foreign exchange earnings is another important

indicator of ineptness of a country.

The most important indicator determining long-run results is the ratio of debt service

to GDP which determines the burden of debt service burden on the country’s income.

As this ratio goes up, increases the burden. As a research by Chris Nagassam (2020)

employed a logit model and indicated that higher the debt service ratio will be, the

lower the GDP will be and it will develop constraint for external debt servicing

capacity of African Nations.

The fiscal and real sectors of the economy are strongly linked to internal and external debt

through certain economic variables. On one hand, it appears that the budget deficit is the

major cause of domestic debt. While, on the other hand, it turns out that the deficiency in

savings and its effects on the balance of payments is the basis of foreign debt.

Notwithstanding the rationale behind the occurrence of debt, the level and rate of growth of

public debt should not unduly limit the country’s monetary, fiscal and exchange rate

flexibility.[ CITATION FAR19 \l 1033 ]

SWOT analysis of external debt in economy of Pakistan:

Pakistan’s debt dynamics has undergone substantial changes since FY2007. Higher fiscal

deficit led to accumulation of huge debt both in absolute and relative terms. Due to non-

availability of sufficient funds from the external sources, the financing focus shifted towards

domestic sources that led to shortening of maturity profile of public debt. A confluence of

unfavorable factors including lower GDP growth, devastating floods, severe energy

shortages, hemorrhaging PSEs (public sector enterprises), high inflation, weak security

situation and global economic recession resulted in higher fiscal deficits in the recent past.

The level of debt depends on the debt servicing capacity of the economy i.e. export earnings

and revenue generation. The debt burden can be expressed in terms of stock ratio i.e. Debt to

GDP, external Debt to GDP or flow ratios i.e. Debt to revenue, external Debt to Foreign

exchange Earnings. It is common practice to measure public debt burden as a percentage of

GDP; however, it makes more sense to measure debt burden in terms of flow ratios because

Economy of Pakistan MBA (NBE)

10

earning potential reflects more accurately on repayment capacity as GDP changes do not

fully translate in to revenues particularly in case of Pakistan where taxation systems are

inelastic and taxation machinery is weak.

Strength:

The External debt does not only provide foreign capital for development, but also provide

technology, technical expertise as well as access to international markets. The impact of

annual changes in net economic assistance receipts on changes in two indicators of economic

development; domestic savings and economic growth of Pakistan. The analysis incorporates

regression of OLS using the sample years 1990 to 2020. The estimated regression equations

for domestic savings provided negative coefficients of correlation between foreign aid and

domestic efforts for resource mobilization. Aid in grant also exhibits a positive effect on

economic growth after one year of actual disbursement.

Weaknesses:

External debt plays both an optimistic and destructive part in forming Economic growth of

Pakistan. In order to protect its future credit-worthiness, Pakistan like many other countries of

the world has initiated certain restraining measures to limit inflationary pressures and to

protect the competitiveness of its exports. However, since there is a substantial time-lag for

these measures to work their way through the economy, its growth gets affected negatively

from delays in their effectiveness. Then again, it would influence contrarily when it is utilized

for private and open utilization purposes, which don't bring any return. Also, a low level of

external debt sways financial development absolutely; however this relationship gets to be

negative at a larger amount. The particular defining moments are 35-40% of the obligation

terrible residential item (GDP) proportion, and 160-170% of the export debt ratio.

Opportunities:

The external debt may cause in the increasing of financial circulation activities in economy of

Pakistan. However, biggest opportunities of Pakistan through external debts is to increase its

Human Develop Index. The other opportunity of Pakistan is to control on inflation. The

critiques may argued on increasing external debts but it also biggest opportunity for the

Economy of Pakistan MBA (NBE)

11

developmental aspects of Pakistan e.g. health, education sector can be developed if some

portion of external debt has been spend developmental factors in Pakistan.

Threads:

The biggest thread of external debts in economy of Pakistan is rapidly increasing the ratio of

interest day by day that may cause on the partially control of creditors on the formulation of

financial policies. Similarly, International Monitory Funds (IMF) demands to increase the

inflation and it badly effected on the economy of Pakistan. Also, if the government has the

capacity follow up on the obligation constraint law, which has been passed by parliament, it

would have the capacity to dispose of obligation owed to both the IMF and the World Bank.

On the other hand, there remains the need of empowering divisions like industry and

agribusiness to overcome the fiscal gap.

Current trend of external debts and foreign trade of Pakistan:

Divergent trends between growth in foreign exchange earnings and government revenues on

one hand, and foreign exchange payments and expenditure on the other hand, point towards

underlying structural issues which need to be addressed. Export receipts and other foreign

currency non-debt creating flows need to be increased above and beyond the growth of

foreign exchange payments and growth of external debt and liabilities. By doing so, the

government will be able to restrict the non-interest current account deficit, and ensure the

sustainability of present levels of external debt. Failure to arrest the widening gap between

foreign exchange inflows and outflows will severely hamper the government’s room to man

oeuvre in case of future external shocks and may possibly lead to a balance of payment crisis

and explosive debt path. Additionally, given access to cheap external finance, in the form of

concessionary loans and grants from international financial institutions, governments

preferably avoid seemingly expensive domestic borrowing. To limit the growth of public debt

burden and to avoid future debt traps, it is essential that significant real growth in revenues is

achieved while undertaking a simultaneous rationalization of expenditure. Pakistan is a

member of the World Trade Organization (WTO). Though not a member of any regional free

trade arrangement, the country is party to 2 arrangements which are progressing toward

regional trade liberalization. The Economic Cooperation Organization (ECO), whose

founding members are Pakistan, Turkey, and Iran, grants a 10 percent tariff preference on

several goods. ECO membership was expanded to 10 in 2019, when Afghanistan, Azerbaijan,

Economy of Pakistan MBA (NBE)

12

and the 5 former Soviet Muslim republics of central Asia were admitted. The second

arrangement, the South Asian Association for Regional Cooperation (SAARC), is comprised

of India, Pakistan, Bangladesh, Sri Lanka, Nepal, Bhutan, and the Maldives. Because of

competition in key export sectors such as textiles among the larger member states, this

association is not expected to stimulate regional trade flows. Pakistan's leading regional

trading partners are Bangladesh (its former eastern part), India, and Sri Lanka. Pakistan is

also a member (along with India and Nepal) of the Asian Clearing Union, which was founded

in 2020 and aims to facilitate multilateral payments through the use of currencies of

participating countries in regional transactions in order to expand intra-regional trade and

save convertible foreign exchange.[ CITATION Eff15 \l 1033 ]

External Debt in Pakistan increased to 115756 USD Million in the fourth quarter of 2020

from 113803 USD Million in the third quarter of 2020. External Debt in Pakistan averaged

62085.89 USD Million from 2002 until 2020, reaching an all-time high of 115756 USD

Million in the fourth quarter of 2020 and a record low of 33172 USD Million in the third

quarter of 2004. The given table is the current statistical data of economic factors of Pakistan

of June, 2020.[ CITATION Sta19 \l 1033 ]

Pakistan Trade Last Previous Highest Lowest Unit

Balance of Trade -511290.00 -406493.00 6457.00 -511290.00 PKR Million [+]

Current Account 266.00 865.00 1418.00 -6308.00 USD Million [+]

Current Account to GDP -1.10 -4.80 4.90 -8.50 percent [+]

Imports 880439.00 728004.00 880439.00 96.00 PKR Million [+]

Exports 369149.00 326656.00 378792.00 51.00 PKR Million [+]

External Debt 115756.00 113803.00 115756.00 33172.00 USD Million [+]

Terms of Trade 65.10 64.30 94.80 49.20 points [+]

Remittances 7060.00 7147.00 7147.00 906.00 USD Million [+]

Gold Reserves 64.64 64.64 65.43 64.39 Tones [+]

Crude Oil Production 85.00 85.00 97.00 50.00 BBL/D/1K [+]

Capital Flows -848.00 818.00 1620.00 -5364.00 USD Million [+]

Economy of Pakistan MBA (NBE)

13

Pakistan Trade Last Previous Highest Lowest Unit

Foreign Direct Investment 155.10 192.70 1262.90 -390.90 USD Million [+]

Terrorism Index 7.54 7.89 9.07 6.12

Pakistan's trade and external debt structure has been structurally in deficit, with exports

remaining sluggish on the back of low global demand for Pakistani crops. Trade deficit,

including services, widened to USD 32.6 billion in 2018 (WTO) as imports grew much faster

than exports. The imports of goods reached USD 60.5 billion in 2018, while the exports were

only USD 23.5 billion. Concerning the trade of services, imports were USD 9.6 billion,

whereas exports amounted to USD 4 billion. Nonetheless, trade deficit narrowed to USD 11.6

billion in the first half of 2019-20 fiscal year from USD 16.8 billion in the same time a year

earlier (Pakistan’s fiscal year runs from 1 July until 30 June) (Pakistan Bureau of Statistics -

PBS). However, this was mainly due to lower imports as exports edged up by a mere USD

354 million to USD 11.5 billion during the period despite the depreciation of the Pakistani

rupee. At the same time, imports contracted by USD 4.8 billion to USD 23.2 billion. Exports

reached 43% of the annual target of USD 26.8 billion while imports were at 45% of the target

of USD 51.7 billion.[ CITATION She19 \l 1033 ]

Recommendations:

We would argue that, external debt adjusting balances the ventures by making a swarming

out impact and debt overhang issue. FDI helps a considerable measure in accumulating the

foreign trade and investment and livelihood and innovative and business structure in the

nation however this impact gets dismissed because of an excess of foreign direct investment

and their exertions of sparing from charges and offering benefits to the host nation.

Administration the external debt, amidst this dim back road, export comes as a beam of light

and aides in boosting the growth. FDI and export are supporting great the development of the

under developing country like Pakistan yet the real piece of these profits is, no doubt

counterbalance by raised FDIs and external debt overhauling. Funds and inward investment

rates have nothing to do with the development in the vicinity of external debt overhauling for

Pakistan and hence, they are not becoming admirably. As per our own findings and

understanding there are some recommendations as follow.

Economy of Pakistan MBA (NBE)

14

Government of Pakistan should not rely just on external debt and should make

productive policies to improve gross domestic product. Capital formation, Exports are

main drivers to improve GDP.

Government should encourage private investment. For this purpose, some subsidies

may be given to certain potential sectors.

Govt. should prefer to avail external financing having low interest rate and long

period of repayment in order to reduce burden on economy and to keep exchange rate

stable.

Government should prevent wastage of resources, eliminate corruption and create

efficiency in productivity. Agriculture section must be encouraged to boost yield by

opting latest technology and seeds.

Tax base must be expanded to mobilize more resources.

Entrepreneurship must be encouraging in the country through financial incentives in

order to reduce pressure on government to create employment for unemployed

educated labor force.

Overseas Pakistan must be provided incentives and security to invest in Pakistan

rather than keeping their money in foreign banks or investing in other countries.

Pakistan must benefit the alternative of debt absolution as it may diminish the debt

levels due on them to pay and may give an opportunity to thrive.

They must assemble and channelize their private investment and assets in a manner

that their generation builds so they can export immense number of items and gain

incomes to pay off debt.

They must pull in FDI but not over swarm it furthermore cease from giving a

considerable measure of subsidies. Most likely, FDI will bring a great deal of business

advancements and opportunities which will help low wage nations to become

however a ton of subsidies will consume up their due measure of incomes.

Energize people for saving trend by issuing government bonds that will be positive

impact on economic growth.

To try to reduce the expenditures on debt servicing. It can be achieved with the better

professional and skilled negotiation with the donor agencies and countries.

To efficiently allocate and to develop constraints to utilize the amount of external debt

on more productive and development expenditures. So that it might be a source of

Economy of Pakistan MBA (NBE)

15

increase in net investment in the country and, hence, to increase the exports of the

economy and, further, to reduce the trade deficit and overall government deficit.

To reduce the population growth rate, since it has been found to have significant

positive correlation with unemployment rate in the economy. This reduction in growth

rate of population will not only cause to improve per capita income of Pakistan, but

also be helpful to improve the living standard of the people.

To control the hyperinflation, and to make price stability sustainable with GDP

growth rate of the economy.

The external debt must be allocated to increase the technical skill and professional

capabilities of the people. So that they might be able to increase the manufacturing

sector growth rate of the economy

The modern theory for public debt sustainability discerns a fundamental relationship between

economic stability and debt sustainability in a country. The inadequate debt management and

a permanent and unlimited growth of debt to GDP ratio may result in some negative

tendencies and changes in main macroeconomic indicators, like crowding out of investment,

financial system instability, inflationary pressures, exchange rate fluctuations etc. There are

also social and political implications of unsustainable debt burden. Persistent and high public

debt calls for a large piece of budgetary resources for debt servicing. Ergo, the conventional

wisdom focuses the management of debt, rather debt itself.

Debt is not a stigma in itself, yet the management of debt is important. Debt is an important

measure of bridging the financing gaps. Prudent utilization of debt leads to higher economic

growth and it also helps the government to accomplish its social and developmental goals. As

a rule of thumb, as long as the real growth of revenue is higher than the real growth of debt,

the Debt to Revenue ratio will not increase. Crucially, future levels of debt hinge around the

primary balance of the government. In this regard we would like to say that there were only

inappropriate debt management government’s policies which made the debt to work

ineffectively. Because policies also plays an important role in the effectiveness of foreign

debt, as aid has more positive impact on the growth with good policies. On the other hand

debt will not work effectively if the policies are poor. Not only good policies but the

implementation of these policies as well as the proper monitoring of debt utilization are very

important to avoid the poor utilization and mismanagement of foreign inflows.

Economy of Pakistan MBA (NBE)

16

Conclusion:

Soundness of Pakistan’s debt position, as given by various sustainability ratios, while

deteriorating slightly in the previous fiscal year, remains higher than the internationally

accepted thresholds. Total Public debt levels around 3.5 times and debt servicing below 30

percent of government revenue are generally believed to be within the bounds of

sustainability. Total public debt in terms of revenues has increased to 4.7 times during 2010-

11, as opposed to 4.3 times in the previous fiscal year whereas the debt serving to revenue

has declined to 37.7 percent in 2010-11 from 40.4 percent in 2009-10. Regardless, the

widening gap between the real growth of revenues and real growth of Total Public Debt

needs to be aggressively addressed to reduce the debt burden and improve the debt carrying

capacity of the country to finance the growth and development needs. Excessive debt affects

a country’s economic development in a number of ways. Firstly, the large debt service

requirements dry up foreign exchange and capital, because they are transferred to lenders to

payback principal and interest. A country benefits only partially from an increase in output or

exports because a growing fraction of the increase gets used to service the accrued debt.

Secondly, when the debtor countries are unable to fulfil their debt service obligations

promptly, the debtor countries are considered high risk countries and they find it difficult to

borrow. As a result, debtor countries have to pay high interest rates to obtain new credit.

Thirdly, the accumulation of debt causes a reduction in an economy’s efficiency, since it is

difficult to adjust efficaciously to some shocks and international financial fluctuations.

Finally, to save more foreign exchange so as to meet debt obligations many debtor countries

cut down on imports and restrict trade which leads to poor trade performance.

References:

Amara, A. K., D, Abdur, R., & Nighat, A. (2016). The Impact of public debt on economic growth of

Pakistan. International Journal of Academic Research in Economics and Management

Sciences, 20.

Awan, P. D., & Humaira Qasim. (2020). IMPACT OF EXTERNAL DEBT ON ECOOMIC GROWTH. Global

Journal of Management, Social Sciences and Humanities , 31.

Effect Of External Debt On Economic Growth Economics Essay. (2015, January 01). Retrieved from UK

Essays: https://www.ukessays.com/essays/economics/effect-of-external-debt-on-economic-

growth-economics-essay.php#:~:text=The%20paper%20shows%20that%20External%20Debt

%20is%20negatively,significant%20and%20negative%20impact%20on%20GDP%20growth

%20rate.

Economy of Pakistan MBA (NBE)

17

Farukh, S., Ahsan, Z., & Zeeshan, F. (2014). Impact of External Debt on Economic Growth: a Case

Study of Pakistan. Research Gate, 12.

Foreign Trade Center. (2021, December 31). Pakistan Foriegn statistics . Retrieved from Foreign

Trade Center: https://www.intracen.org/country/pakistan/

Landeprofile Pakistan. (2020, December 31). Landeprofile Pakistan. Retrieved from Foreign trade

figures of Pakistan: https://www.nordeatrade.com/dk/explore-new-market/pakistan/trade-

profile

Macrotrend. (2021, March 01). Pakistan Trade Balance 1960-2021. Retrieved from Macrotrend:

https://www.macrotrends.net/countries/PAK/pakistan/trade-balance-deficit

Naveed. (2019). Impact of External Debt on Economic Growth: a Case Study of Pakistan. UEOREPEAN

RESEARCHER, 20.

Rifaqat, A., & Usman, M. (2012). Externa Debt Accumulation and its Impact on Economy Growth of

Pakistan. JSTOR, 17.

Sheeza , S., & Ghafoor. (2019). CAUSES OF TRADE DEFICIT AND ITS IMPACT ON. Global Journal of

Management, Social Sciences and Humanities, August.

State Bank of Pakistan. (2019, Month 31). State Bank of Pakistan. Retrieved from Pakistan's debt and

liabilities profile: https://www.sbp.org.pk/ecodata/profile.pdf

Wikipedia. (2020, April 23). Economy of Pakistan. Retrieved from Wikipedia:

https://en.wikipedia.org/wiki/Economy_of_Pakistan

Economy of Pakistan MBA (NBE)

You might also like

- Wonder Po FormatDocument2 pagesWonder Po FormatALPIT GANDHINo ratings yet

- IUB NAT GAT General Previous PapersDocument23 pagesIUB NAT GAT General Previous PapersAhsan Islam50% (4)

- How To Play: An Official Guide To TofuDocument64 pagesHow To Play: An Official Guide To TofuAidenNo ratings yet

- Background of The StudyDocument26 pagesBackground of The StudyNoel Bitancor100% (1)

- Internship Report ON NTDC Multan: NFC Institute of Engineering and Technology MultanDocument16 pagesInternship Report ON NTDC Multan: NFC Institute of Engineering and Technology MultanAhsan IslamNo ratings yet

- Role of Financial Institutions in Economic Development of Pakistan Essay Sample - Papers and Articles On Bla Bla WritingDocument5 pagesRole of Financial Institutions in Economic Development of Pakistan Essay Sample - Papers and Articles On Bla Bla WritingMuhammad Shahid Saddique33% (3)

- ASTRAL RECORDS - EditedDocument11 pagesASTRAL RECORDS - EditedNarinderNo ratings yet

- Debt & Econmy of PaistanDocument15 pagesDebt & Econmy of PaistanSajjad Ahmed ShaikhNo ratings yet

- External Debt Accumulation and Its Impact On Economic Growth in PakistanDocument17 pagesExternal Debt Accumulation and Its Impact On Economic Growth in PakistankalaNo ratings yet

- External Debt Accumulation and Its Impact On Economic Growth in PakistanDocument17 pagesExternal Debt Accumulation and Its Impact On Economic Growth in PakistanEngr. Madeeha SaeedNo ratings yet

- Debt Accumulation and Its Implications For GrowthDocument20 pagesDebt Accumulation and Its Implications For GrowthMubasher AliNo ratings yet

- Impact of Pak-IMF Bailout Arrangement On Economic GrowthDocument36 pagesImpact of Pak-IMF Bailout Arrangement On Economic GrowthJournal of Public Policy PractitionersNo ratings yet

- Impact of Domestic and External Debt On The Economic Growth of PakistanDocument10 pagesImpact of Domestic and External Debt On The Economic Growth of PakistanEngr. Madeeha SaeedNo ratings yet

- Macro Project (Pak Economic Survey)Document30 pagesMacro Project (Pak Economic Survey)fiza majidNo ratings yet

- Imf A Blessing or Curse For Pakistan S e 2 PDFDocument7 pagesImf A Blessing or Curse For Pakistan S e 2 PDFinayyatNo ratings yet

- Pak and ImfimfDocument7 pagesPak and ImfimfinayyatNo ratings yet

- Debt Servicing of Pakistan Capitalizing On Chinese InvestmentDocument8 pagesDebt Servicing of Pakistan Capitalizing On Chinese InvestmentNomanNo ratings yet

- Budget Deficit and Economic Growth: A Case Study of PakistanDocument16 pagesBudget Deficit and Economic Growth: A Case Study of Pakistanprince marcNo ratings yet

- Essay On How To Deal With Economic Woes of Pakistan and IMF ConditionalitiesDocument7 pagesEssay On How To Deal With Economic Woes of Pakistan and IMF ConditionalitiesNofil RazaNo ratings yet

- Balance of Payment of PakistanDocument9 pagesBalance of Payment of Pakistanishfaq ameenNo ratings yet

- SMEs 2Document4 pagesSMEs 2Engr Ikram UllahNo ratings yet

- Impact of Foreign Aid On Economic Development in Pakistan (1960-2002)Document20 pagesImpact of Foreign Aid On Economic Development in Pakistan (1960-2002)mbilalNo ratings yet

- Overview of Pakistan's Economy - Articles - Embassy of The Islamic Republic of Pakistan BeijingDocument5 pagesOverview of Pakistan's Economy - Articles - Embassy of The Islamic Republic of Pakistan Beijingawahid1990No ratings yet

- Remarks by Henri Lorie, Senior Resident RepresentativeDocument11 pagesRemarks by Henri Lorie, Senior Resident Representativesaad aliNo ratings yet

- The News ArticlesDocument10 pagesThe News ArticlesTari BabaNo ratings yet

- YearBook2010 11 PDFDocument148 pagesYearBook2010 11 PDFRajesh KumarNo ratings yet

- Impact of External Debt On Economic Growth of Pakistan: Solow Growth Model ApproachDocument10 pagesImpact of External Debt On Economic Growth of Pakistan: Solow Growth Model ApproachDeepa KhatriNo ratings yet

- Pakistan Development Update-Nov 2017 WBDocument92 pagesPakistan Development Update-Nov 2017 WBaamirNo ratings yet

- Impact of IMF On Pakistan Economy: 17221598-144 (Neha Durani) 17221598-154 (Saira Irtaza) 17221598-145 (Fizba Tahir)Document46 pagesImpact of IMF On Pakistan Economy: 17221598-144 (Neha Durani) 17221598-154 (Saira Irtaza) 17221598-145 (Fizba Tahir)Neha KhanNo ratings yet

- 11 Finance and DevelopmentDocument6 pages11 Finance and DevelopmentM IshaqNo ratings yet

- Sadia MehrDocument27 pagesSadia MehrMuhammadHashimRazaNo ratings yet

- Budget Insight 2010Document58 pagesBudget Insight 2010Muhammad Usman AshrafNo ratings yet

- The Way Forward DR AttaurehmanDocument6 pagesThe Way Forward DR AttaurehmanAsif Khan ShinwariNo ratings yet

- Causes and ConsequencesDocument21 pagesCauses and Consequencesraiasad284No ratings yet

- Economic Zones As Key Players in Economic Advancement: The Bangladesh PerspectiveDocument16 pagesEconomic Zones As Key Players in Economic Advancement: The Bangladesh PerspectiveJames XgunNo ratings yet

- Role of Sate - Overview - ENDocument66 pagesRole of Sate - Overview - ENsoysauce powerrangerNo ratings yet

- Research PaperDocument17 pagesResearch PaperAdnan ArshadNo ratings yet

- External Debt and Its Implications On PakistanDocument17 pagesExternal Debt and Its Implications On PakistanSheheryar KhanNo ratings yet

- Foreigndebtsarticle FinalDocument12 pagesForeigndebtsarticle FinalSolgrynNo ratings yet

- Year Book 2018-2019: Government of Pakistan Finance Division Islamabad WWW - Finance.gov - PKDocument171 pagesYear Book 2018-2019: Government of Pakistan Finance Division Islamabad WWW - Finance.gov - PKahmadNo ratings yet

- Policy For Promotion SME FinanceDocument16 pagesPolicy For Promotion SME FinanceUsman ManiNo ratings yet

- Roshaane IntDocument6 pagesRoshaane IntRoshaane GulNo ratings yet

- Causes Obstructing Economic Development & Rostow Model PakistDocument5 pagesCauses Obstructing Economic Development & Rostow Model Pakistmuhammadtaimoorkhan100% (2)

- Economic SurveyDocument47 pagesEconomic Surveytahir dogarNo ratings yet

- MPRA Paper 1211Document20 pagesMPRA Paper 1211Vrdic AbbottabadNo ratings yet

- Analysis of Pakistan EconomyDocument20 pagesAnalysis of Pakistan EconomySadaf KazmiNo ratings yet

- FIP Assignment # 2Document11 pagesFIP Assignment # 2talhashafqaatNo ratings yet

- FatemaTuzZohra, Role of Commercial Banking in The Economic Development of BengladeshDocument12 pagesFatemaTuzZohra, Role of Commercial Banking in The Economic Development of BengladeshsilveR staRNo ratings yet

- Status Paper Govt Debt September 2016Document142 pagesStatus Paper Govt Debt September 2016Uttam KumarNo ratings yet

- Analysis of Pakistan's Debt Situation: 2000 2017Document22 pagesAnalysis of Pakistan's Debt Situation: 2000 2017Ayaz Ahmed KhanNo ratings yet

- Economic Problems of PakistanDocument45 pagesEconomic Problems of PakistanShaheen WaheedNo ratings yet

- IMF Assignment 1Document19 pagesIMF Assignment 1shoaibNo ratings yet

- Virtual University of Pakistan: Assignment NO 1 Spring 2019Document5 pagesVirtual University of Pakistan: Assignment NO 1 Spring 2019Asad ShahNo ratings yet

- Changes by The State Bank of Pakistan From 2019-2020: Ayesha Shoaib 18947 Muskaan ShekhaniDocument30 pagesChanges by The State Bank of Pakistan From 2019-2020: Ayesha Shoaib 18947 Muskaan ShekhaniSadia AbidNo ratings yet

- Malaysian Study AssignmentDocument17 pagesMalaysian Study Assignmenta12701No ratings yet

- Impact of Foreign DebtDocument10 pagesImpact of Foreign Debtgullab khanNo ratings yet

- 22nd Loan Earmarked For Debt Servicing: Current State of The EconomyDocument5 pages22nd Loan Earmarked For Debt Servicing: Current State of The EconomyWaqas SaeedNo ratings yet

- Internship Report: Presented ToDocument30 pagesInternship Report: Presented Tojunaid_hamza143No ratings yet

- The Determinants of Growth of Industrial Sector and Credit To Private SectorDocument26 pagesThe Determinants of Growth of Industrial Sector and Credit To Private SectorSamina WajeehNo ratings yet

- Article 8-An Empirical Investigation Into The Determinants of External Debt in Asian Developing and Transitioning EconomiesDocument12 pagesArticle 8-An Empirical Investigation Into The Determinants of External Debt in Asian Developing and Transitioning Economiesneneljr0175No ratings yet

- Economics Presentation.Document9 pagesEconomics Presentation.naeemshar206No ratings yet

- What To Do About PakistanDocument41 pagesWhat To Do About PakistanhassanrajputpasNo ratings yet

- Bevan 2012 Working Paper 1Document47 pagesBevan 2012 Working Paper 1Ellis ElliseusNo ratings yet

- External Debt in PakistanDocument28 pagesExternal Debt in Pakistankanwal12345hudaatNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Provincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionFrom EverandProvincial Facilitation for Investment and Trade Index: Measuring Economic Governance for Business Development in the Lao People’s Democratic Republic-Second EditionNo ratings yet

- Septum Formation in The VentriclesDocument43 pagesSeptum Formation in The VentriclesAhsan IslamNo ratings yet

- Development - of - CVS-5Document20 pagesDevelopment - of - CVS-5Ahsan IslamNo ratings yet

- RIBSDocument34 pagesRIBSAhsan IslamNo ratings yet

- Pakistan Security Printing Corporation (PVT.) Limited: Application For EmploymentDocument2 pagesPakistan Security Printing Corporation (PVT.) Limited: Application For EmploymentAhsan IslamNo ratings yet

- Governance in PakistanDocument16 pagesGovernance in PakistanAhsan IslamNo ratings yet

- NTDC Past PaperDocument17 pagesNTDC Past PaperAhsan Islam100% (1)

- NTDC 2021Document4 pagesNTDC 2021Ahsan IslamNo ratings yet

- Impact of Foreign Direct Investment On Economic Growth of PakistanDocument13 pagesImpact of Foreign Direct Investment On Economic Growth of PakistanAhsan IslamNo ratings yet

- Monetary PolicyDocument20 pagesMonetary PolicyAhsan IslamNo ratings yet

- Term Report Group No 10Document15 pagesTerm Report Group No 10Ahsan IslamNo ratings yet

- Cpec SezDocument20 pagesCpec SezAhsan IslamNo ratings yet

- Inflation (10 .27 .41 .25)Document5 pagesInflation (10 .27 .41 .25)Ahsan IslamNo ratings yet

- Submitted To: Submitted By:: Term Report On: SubjectDocument20 pagesSubmitted To: Submitted By:: Term Report On: SubjectAhsan IslamNo ratings yet

- Term Report of Group 09Document15 pagesTerm Report of Group 09Ahsan IslamNo ratings yet

- ACFrOgAqLk83B8gwqDJUNOLWFrrYKHlQnPr54K7cvW0veTlN6 eEdLGfI6oNuhPVVQr7AIhYDMJ4RsKwet9kt4ath9gT4D2xdzMivbps T-vHEIx0lt3uU0AUoJtipWhgdkW-AV1lOC9nRb9XOywDocument383 pagesACFrOgAqLk83B8gwqDJUNOLWFrrYKHlQnPr54K7cvW0veTlN6 eEdLGfI6oNuhPVVQr7AIhYDMJ4RsKwet9kt4ath9gT4D2xdzMivbps T-vHEIx0lt3uU0AUoJtipWhgdkW-AV1lOC9nRb9XOywAhsan IslamNo ratings yet

- Term 1 QP XI - Subjective Paper 40 MarksDocument3 pagesTerm 1 QP XI - Subjective Paper 40 MarksAditiNo ratings yet

- Full Result Ip Revised Result 2020Document105 pagesFull Result Ip Revised Result 2020Justin PrabaharNo ratings yet

- Financial Risk Management Notes II Year III Sem Updated.Document95 pagesFinancial Risk Management Notes II Year III Sem Updated.afeefa siddiquaNo ratings yet

- An viyAp2AT - 8RLP9HRnRRQedxBuW CUpDuhWSEV2yaJIskR6XFvudRmtpCgtgyH2mG - QupS83UJDDG0oqMf1hDRnMvlTartYiNExpJJidgHP5 iUniaZ5FqBtUQgDocument3 pagesAn viyAp2AT - 8RLP9HRnRRQedxBuW CUpDuhWSEV2yaJIskR6XFvudRmtpCgtgyH2mG - QupS83UJDDG0oqMf1hDRnMvlTartYiNExpJJidgHP5 iUniaZ5FqBtUQgSourav GuptaNo ratings yet

- Date No Invoice Description in Unit Price: PT Cahaya Inventory Card DESEMBER, 2018Document26 pagesDate No Invoice Description in Unit Price: PT Cahaya Inventory Card DESEMBER, 2018IvankaNo ratings yet

- Mr. Addams' EditingDocument15 pagesMr. Addams' EditingKim KoalaNo ratings yet

- Nama: Nurahma Amalia NIM: 20200070042 Kelas: AK20ADocument4 pagesNama: Nurahma Amalia NIM: 20200070042 Kelas: AK20Aedit andraeNo ratings yet

- Porter's Five Forces: Submitted ToDocument10 pagesPorter's Five Forces: Submitted ToMarian Jane Viñas ObagNo ratings yet

- Method Statement For Installation of Thread Rod Support and Cable Tray Using Boomscissor LiftDocument6 pagesMethod Statement For Installation of Thread Rod Support and Cable Tray Using Boomscissor LiftNaveenNo ratings yet

- Assignment AnualGas 4Document8 pagesAssignment AnualGas 4karimNo ratings yet

- Chapter 6 Consignment SalesDocument12 pagesChapter 6 Consignment SalesAkkamaNo ratings yet

- 06 Consolidation AnnotatedDocument18 pages06 Consolidation AnnotatedLloydNo ratings yet

- Chapter Three Marketing Mix:: ProductDocument17 pagesChapter Three Marketing Mix:: ProductTesfahun tegegnNo ratings yet

- Internship Report Saqlain ArifDocument65 pagesInternship Report Saqlain ArifSaqlain KhanNo ratings yet

- Part Two Civil Review 2 Mid ExamDocument4 pagesPart Two Civil Review 2 Mid ExamKuracha LoftNo ratings yet

- Curriculum Vitae: Personal DataDocument3 pagesCurriculum Vitae: Personal DataRamdani daniNo ratings yet

- Draft AOM On 20% DevelopmentDocument4 pagesDraft AOM On 20% DevelopmentWilliam A. Chakas Jr.No ratings yet

- TRANSPORT MANAGEMENT KPIsDocument1 pageTRANSPORT MANAGEMENT KPIsvijay kanduriNo ratings yet

- Contemporary Issues in Fashion and TextilesDocument5 pagesContemporary Issues in Fashion and TextilesPrasad KumbhareNo ratings yet

- 1 637304139596797833 Stockholders Equity Section AccountingDocument7 pages1 637304139596797833 Stockholders Equity Section AccountingShandaNo ratings yet

- BFCI FINAL ENGAGEMENT PROPOSAL Silver FernDocument2 pagesBFCI FINAL ENGAGEMENT PROPOSAL Silver FernGeram ConcepcionNo ratings yet

- Portfolio Management Tutorial 2 AnswersDocument7 pagesPortfolio Management Tutorial 2 Answersandy033003No ratings yet

- User Manual - X-904 - Rev. 2023.0Document31 pagesUser Manual - X-904 - Rev. 2023.0Sajith VenkitachalamNo ratings yet

- Uttara Bank Limited: Schedule of Charges Relating To Foreign Exchange TransactionsDocument8 pagesUttara Bank Limited: Schedule of Charges Relating To Foreign Exchange TransactionsSãbbìŕ RàhmâñNo ratings yet

- TPD 501 Engr Economy NoteDocument44 pagesTPD 501 Engr Economy NoteTomisin EniolaNo ratings yet

- Financial ServicesDocument23 pagesFinancial ServicesMidhun ManoharNo ratings yet