Professional Documents

Culture Documents

Divisional Institutional Business Head

Divisional Institutional Business Head

Uploaded by

Msd SaravanaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Divisional Institutional Business Head

Divisional Institutional Business Head

Uploaded by

Msd SaravanaCopyright:

Available Formats

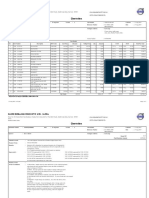

Indian Oil Corporation Limited

Marketing Division : Indian Oil Bhavan

8/1079, Avinashi Road, Coimbatore - 641 018

Website : www.iocl.com

Marketing Division

Rate Revision w.e.f 01.08.2021

AED+SAED+AI VAT(11%) +

HSD EURO VI (IN KL) ASS. VALUE BED FDZ CHARGE SELLING PRICE SUB TOTAL TCS @ 0.1% RATE/KL

DC Add.Cess

IRUGUR (4149) 43089.62 1800 30000 189 75078.62 17878.65 92957.27 92.96 93050.23

SANKARI (4150) 43114.29 1800 30000 189 75103.29 17881.36 92984.65 92.98 93077.64

KARUR (4131) 43095.55 1800 30000 189 75084.55 17879.30 92963.85 92.96 93056.81

TRICHY (4133) 43169.87 1800 30000 189 75158.87 17887.48 93046.35 93.05 93139.39

CHENNAI (4129) 42767.91 1800 30000 189 74756.91 17843.26 92600.17 92.60 92692.77

AED+SAED+AI

HSD EURO VI (IN KL) ASS. VALUE BED SPC SELLING PRICE VAT+Add.Cess SUB TOTAL TCS @ 0.1% RATE/KL

DC

COCHIN (4222) 41725.91 1800 30000 -8 73517.91 17910.00 91427.91 91.43 91519.34

DEVANAGONTHI (4324) 42102.32 1800 30000 -11.28 73891.04 17733.85 91624.89 91.62 91716.51

FO (IN MT) ASS. VALUE CGST(9%) SGST(9%) SUB TOTAL TCS @ 0.1% RATE/MT

CHENNAI 42840.00 3855.60 3855.60 50551.20 50.55 50601.75

IRUGUR 43244.81 3892.03 3892.03 51028.88 51.03 51079.90

IND. SKO (IN KL) ASS. VALUE CGST(9%) SGST(9%) SUB TOTAL TCS @ 0.1% RATE/KL

CHENNAI 77310.00 6957.90 6957.90 91225.80 91.23 91317.03

MADURAI 78154.26 7033.88 7033.88 92222.02 92.22 92314.25

Terms and conditions:

1. Payment : Advance payment through RTGS mode of payment.

2. The price (incl. Taxes, Duties, Transportation, toll charges etc.) prevailing at the time of supply will be

applicable irrespective of payments made and indents placed.

3. Prices are subject to revision without any prior intimation.

4. Please follow all Safety precautions during unloading & storage of HSD.

5. GST No.Tamilnadu: 33AAACI1681G1ZW

6. If PAN is not updated in IOCL customer master TCS applicable is 1%

7. The rates given are inclusive of TCS@0.1% as per section 206C(1H). Incase of customers falling under section 194Q of the income tax act, TDS will be applicable.

Yours faithfully

For IndainOil Corporation Ltd

Divisional Institutional Business Head

You might also like

- International Business 14th Edition Daniels Test Bank DownloadDocument27 pagesInternational Business 14th Edition Daniels Test Bank DownloadChristina Walker100% (24)

- DCF ModelDocument7 pagesDCF ModelSai Dinesh BilleNo ratings yet

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- Industrial Relations and Labour Laws by Arun Monappa PDFDocument357 pagesIndustrial Relations and Labour Laws by Arun Monappa PDFSurbhi Sabharwal80% (10)

- Service InvoiceDocument4 pagesService InvoicekaranbhatnagerNo ratings yet

- 17pgp216 ApolloDocument5 pages17pgp216 ApolloVamsi GunturuNo ratings yet

- Excel FM FinalDocument3 pagesExcel FM FinalNiket AmanNo ratings yet

- Price Circuar 01.05.2024Document1 pagePrice Circuar 01.05.2024Divisional EngineerNo ratings yet

- As Per Current Market Security Name Qty Avg - Cost HLDG - Cost MKT - Price MKT - ValueDocument6 pagesAs Per Current Market Security Name Qty Avg - Cost HLDG - Cost MKT - Price MKT - ValueAbhay JainNo ratings yet

- Acc205 Ca3Document17 pagesAcc205 Ca3Sabab ZamanNo ratings yet

- Tax InvoiceDocument5 pagesTax InvoiceManu RishabNo ratings yet

- Session XX-classDocument9 pagesSession XX-classswaroop shettyNo ratings yet

- Stock Cues: Amara Raja Batteries Ltd. Company Report Card-StandaloneDocument3 pagesStock Cues: Amara Raja Batteries Ltd. Company Report Card-StandalonekukkujiNo ratings yet

- Jil + Jpil: GeneratorsDocument4 pagesJil + Jpil: GeneratorsAamirMalikNo ratings yet

- PRICE CIRCULAR 01.07.2024Document1 pagePRICE CIRCULAR 01.07.2024Mohamed AliNo ratings yet

- Gain NLossDocument6 pagesGain NLossSANUNo ratings yet

- Secret/Confidential Valuation Study No. 21Document7 pagesSecret/Confidential Valuation Study No. 21jackNo ratings yet

- Comparis I OnDocument2 pagesComparis I Onمحمدعمران شريفNo ratings yet

- Invoice - 202400114325 - Sonu KumarDocument1 pageInvoice - 202400114325 - Sonu KumarservicedeogharNo ratings yet

- Model Portfolio Performance - 15th May 2020Document4 pagesModel Portfolio Performance - 15th May 2020FACTS- WORLDNo ratings yet

- 9e Maruti Suzuki FMDocument2 pages9e Maruti Suzuki FMDedhia Vatsal hiteshNo ratings yet

- Revised Estimate / JobcardDocument2 pagesRevised Estimate / Jobcardinfo.hamrizNo ratings yet

- Bcel 2019Q1Document1 pageBcel 2019Q1Dương NguyễnNo ratings yet

- RAC Discounted - Bandol Chourai RoadDocument20 pagesRAC Discounted - Bandol Chourai Roaddharmendra kumarNo ratings yet

- DAP & PAP Project Cost EstimateDocument8 pagesDAP & PAP Project Cost EstimateSantosh JayasavalNo ratings yet

- A Summer Project Report OnDocument17 pagesA Summer Project Report OnHarsh MidhaNo ratings yet

- Price circular 16.06.2024Document1 pagePrice circular 16.06.2024Mohamed AliNo ratings yet

- 03k065 PortfolioDocument2 pages03k065 Portfoliof20213093No ratings yet

- Supreme Annual Report 15 16Document104 pagesSupreme Annual Report 15 16adoniscalNo ratings yet

- Sampa Video Case SolutionDocument10 pagesSampa Video Case SolutionrahulsinhadpsNo ratings yet

- Assignment 1 PortfolioDocument3 pagesAssignment 1 PortfolioFarman AliNo ratings yet

- BSE Sensex Status: World IndicesDocument28 pagesBSE Sensex Status: World IndicesHirendra PatilNo ratings yet

- Your Holding Details - BAKK1484Document4 pagesYour Holding Details - BAKK1484pandyahitesh6351145099No ratings yet

- Idea Model TemplateDocument22 pagesIdea Model TemplateNaman MalhotraNo ratings yet

- Model Portfolio Performance - 03rd July 2020Document4 pagesModel Portfolio Performance - 03rd July 2020Sandipan DasNo ratings yet

- Corporate Finance Chaitanya Ca 1Document13 pagesCorporate Finance Chaitanya Ca 1Chaitanya GembaliNo ratings yet

- Analysis Report PsoDocument3 pagesAnalysis Report PsoMuhammad Waqas HafeezNo ratings yet

- Components of Beneish M-ScoreDocument27 pagesComponents of Beneish M-ScoreRitu RajNo ratings yet

- GR I Crew XV 2018 TcsDocument79 pagesGR I Crew XV 2018 TcsMUKESH KUMARNo ratings yet

- Pakistan Stock Exchange LimitedDocument1 pagePakistan Stock Exchange LimitederfanxpNo ratings yet

- StockTracker Rev2 OrigDocument149 pagesStockTracker Rev2 OrigPuneet100% (2)

- AVIVADocument5 pagesAVIVAHAFIS JAVEDNo ratings yet

- ROI CalculationDocument18 pagesROI CalculationShivamNo ratings yet

- Holding Equity OpenDocument36 pagesHolding Equity Opengame treeNo ratings yet

- Dhanuka Annual RPTDocument225 pagesDhanuka Annual RPTJeet SinghNo ratings yet

- FinacialDocument11 pagesFinacialSubudhi Techno DesignNo ratings yet

- AtmsDocument2 pagesAtmsKCC Watul-Talgaon NH66No ratings yet

- Price Circular 01.06.2024Document1 pagePrice Circular 01.06.2024Mohamed AliNo ratings yet

- Hindustan Aeronautics LTD.: BY Gurnoor Singh MBA-2CDocument18 pagesHindustan Aeronautics LTD.: BY Gurnoor Singh MBA-2CHIMANSHU RAWATNo ratings yet

- Pakistan Stock Exchange Limited: Indus Motor Company LimitedDocument1 pagePakistan Stock Exchange Limited: Indus Motor Company Limitedmusab nawazNo ratings yet

- ValueResearchFundcard HDFCEquity 2012jul30Document6 pagesValueResearchFundcard HDFCEquity 2012jul30Rachit GoyalNo ratings yet

- Teja WorkDocument12 pagesTeja WorkSiddhant SrivastavaNo ratings yet

- RNO 1RFQ004208 PKI Comparision Sheet 20-2-2023 2Document7 pagesRNO 1RFQ004208 PKI Comparision Sheet 20-2-2023 2THE CPRNo ratings yet

- Asian Paints (Autosaved) 2Document32,767 pagesAsian Paints (Autosaved) 2niteshjaiswal8240No ratings yet

- Annual ReportDocument171 pagesAnnual ReportKshatrapati SinghNo ratings yet

- Wa0071 PDFDocument3 pagesWa0071 PDFBalraj BawaNo ratings yet

- Bharti - Airtel Enterprise Services BCG Matrix StudyDocument9 pagesBharti - Airtel Enterprise Services BCG Matrix StudyVipul PatelNo ratings yet

- Bharti - Airtel Enterprise Services BCG Matrix StudyDocument9 pagesBharti - Airtel Enterprise Services BCG Matrix Studysaravindh1234No ratings yet

- 01 RAC Undiscounted - Bandol Chourai RoadDocument20 pages01 RAC Undiscounted - Bandol Chourai Roaddharmendra kumarNo ratings yet

- ATC Valuation - Solution Along With All The ExhibitsDocument20 pagesATC Valuation - Solution Along With All The ExhibitsAbiNo ratings yet

- Axv PDFDocument5 pagesAxv PDFramel sigueNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Viraganoor Details: Fiel IES AnnanagarDocument2 pagesViraganoor Details: Fiel IES AnnanagarMsd SaravanaNo ratings yet

- Vaccination 06 AugustDocument3 pagesVaccination 06 AugustMsd SaravanaNo ratings yet

- Covering Letter For NH 49E 90.0-96.0Document40 pagesCovering Letter For NH 49E 90.0-96.0Msd SaravanaNo ratings yet

- Keymap ModelDocument1 pageKeymap ModelMsd SaravanaNo ratings yet

- Barriers To Women's Participation in and Contribution To Leadership in Ethiopian Higher EducationDocument17 pagesBarriers To Women's Participation in and Contribution To Leadership in Ethiopian Higher EducationYonael TesfayeNo ratings yet

- Damodaram Sanjivayya National Law University Visakhapatnam, A.P., IndiaDocument8 pagesDamodaram Sanjivayya National Law University Visakhapatnam, A.P., IndiaAshirbad SahooNo ratings yet

- 1IIC AI Report 2020Document88 pages1IIC AI Report 2020Steve SandersNo ratings yet

- Estimates of Expenditure For The Financial Year 2021Document448 pagesEstimates of Expenditure For The Financial Year 2021The Dirty NapkinNo ratings yet

- URG Nsi Perlindungan Hukum Bagi Pembela Hak Asasi Manusia (Human Rights Defender) Di IndonesiaDocument9 pagesURG Nsi Perlindungan Hukum Bagi Pembela Hak Asasi Manusia (Human Rights Defender) Di IndonesiaAisy BrotherhoodNo ratings yet

- "Dynamic Password Policy Generation System: A Project Report OnDocument76 pages"Dynamic Password Policy Generation System: A Project Report OnSharonNo ratings yet

- DraftRajasthan State Women PolicyDocument29 pagesDraftRajasthan State Women PolicyAADYA SHARMANo ratings yet

- Reconsideration PDFDocument2 pagesReconsideration PDFayam dinoNo ratings yet

- Constitution & Bill of RightsDocument15 pagesConstitution & Bill of RightsAnonymous puqCYDnQ100% (4)

- Doi - 10.1016 - J.ecolecon.2004.12.001Document15 pagesDoi - 10.1016 - J.ecolecon.2004.12.001Gabriel Paiva RegaNo ratings yet

- Protecting The Integrity of Government Science - January 2022Document67 pagesProtecting The Integrity of Government Science - January 2022CFHeatherNo ratings yet

- De-Trumping U.S. Foreign Policy Can Biden Bring America Back (Stanley R. Sloan)Document108 pagesDe-Trumping U.S. Foreign Policy Can Biden Bring America Back (Stanley R. Sloan)Pablo Fernando Suárez RubioNo ratings yet

- 6527 19882 1 SMDocument17 pages6527 19882 1 SMjbrinkNo ratings yet

- Powers and Position of President of IndiaDocument9 pagesPowers and Position of President of IndiaSakshamNo ratings yet

- Environmental Policy and Law: The Ethiopian Context: - IntroductionDocument35 pagesEnvironmental Policy and Law: The Ethiopian Context: - Introductionf212No ratings yet

- Quick Guide ISO 55000Document36 pagesQuick Guide ISO 55000Edu100% (2)

- Practical Research 1 Group 1Document7 pagesPractical Research 1 Group 1Aevan Joseph100% (1)

- PetitionerDocument14 pagesPetitionerRoshini SrinivasanNo ratings yet

- Ch-5 Policies in Functional AreasDocument4 pagesCh-5 Policies in Functional AreasTanya MadraNo ratings yet

- Contested Extractivism, Society and The State: Struggles Over Mining and LandDocument281 pagesContested Extractivism, Society and The State: Struggles Over Mining and LandCoco Vidaurre ReyesNo ratings yet

- Budget ReportingDocument92 pagesBudget ReportingAtif RehmanNo ratings yet

- ScriptDocument2 pagesScriptJanica DivinagraciaNo ratings yet

- Research PaperDocument24 pagesResearch PaperNeethu RoyNo ratings yet

- Case Digest: Valmonte Vs BelmonteDocument1 pageCase Digest: Valmonte Vs Belmontemee tooNo ratings yet

- Kinh Te Quoc Te - Vu Thanh Huong - Chapter 09 - Session 1 Nontariff Trade Barriers and The New ProtectionismDocument10 pagesKinh Te Quoc Te - Vu Thanh Huong - Chapter 09 - Session 1 Nontariff Trade Barriers and The New ProtectionismTho NguyenNo ratings yet

- Administrative Law Ii: Prepared by Datiuce Didace LwabugirwaDocument24 pagesAdministrative Law Ii: Prepared by Datiuce Didace LwabugirwaFrancisco Hagai GeorgeNo ratings yet

- PBC Proposals For The Finance Bill 2020Document79 pagesPBC Proposals For The Finance Bill 2020Riz DeenNo ratings yet

- Bertrand Ramcharan - Judicial Protection of Economic, Social and Culture Rights - Case and Materials (Raoul Wallenberg Institute Human Rights) (2005)Document574 pagesBertrand Ramcharan - Judicial Protection of Economic, Social and Culture Rights - Case and Materials (Raoul Wallenberg Institute Human Rights) (2005)flor_14895No ratings yet