Professional Documents

Culture Documents

Accounting - UCO Bank - Assignment2

Accounting - UCO Bank - Assignment2

Uploaded by

KummOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting - UCO Bank - Assignment2

Accounting - UCO Bank - Assignment2

Uploaded by

KummCopyright:

Available Formats

Submission#2 Company Assigned: UCO Bank

1) Please state the summarized income statement equation for the last two years from the latest given company annual

report with all figures in Rs. Crores (or billions) … Please comment within 100 words.

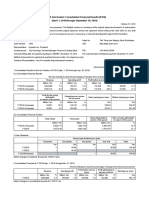

Summarized Income Statement equation year 2019 and 2020 in Rs. Cr

Specific Income Expenses Retained Profit Total

Items (I) (E) Earnings (Loss)

for the During bought

year end Interest Other Interest Operating Provisions Contingencies Deferred Provision the forward

31st Earned Income Expended Expenses & Arrear Tax Towards Period =

March - - = (I)-(E)-(T)

Wages Tax

2020 15,134.3 2,871.21 10,042.06 3,127.88 8,350.34 197.80 -1275.71 0.00 -2,436.83 -9975.45 -12,412.28

3

2019 14,330.6 1,513.51 10,019.47 3,064.42 9,696.48 128.61 -2759.12 15.36 -4,321.08 -5603.83 -9924.91

3

Variance 5.61% 89.71% 0.23% 2.07% -13.88% 53.80% -53.76% -100.00% -43.61% 78.01% 25.06%

Sale of Investments and Recovery in Written off Accounts (Miscellaneous Income) have contributed to the Increase in

Income. Under Miscellaneous provisions scheme 1970 the Expense has increased from Rs.1132.80 Cr to Rs.1806.77 Cr.

Miscellaneous provisions scheme 1970 talks of elected director, board members and renumerations. The Bank does not have

any current Income Tax obligation during the year 2020. During the 2020 net amount of Rs.1275.71/- Cr (Rs.2759.12 Cr for FY

2018-19) has been recognized as Deferred Tax Assets. Loss of Rs. -9975.45/- Cr loss was bought forward to the year 2020

when compared to loss of Rs. -5603.87/- Cr in year 2019.

2) Mention five biggest items as part of the “sales / revenue / income” and “expenses / dividends / deductions” (along with

their proportions) as mentioned in the annual report (to the extent available) for last two years … if needed, you may like

referring to the notes/ schedules as well. Please give your comments within 100 words

%

Year End Year End

Change

31.03.2020 Proportion 31.03.2019

Sr Item Sub-Item Specific b/w Observations

(Rs. (2020) (Rs.

two

Crores) Crores)

years

1 Expense Interest Interest 9,308.69 45.54% 9,329.26 -0.22% Interest on Deposits have decreased between

on 2019 and 2020 is because, the Cost of deposits

Deposits has decreased from 5.07 % in FY 2019 to 4.90 %

in FY 2020, as the Global Deposits has decreased

by 2.38% as of 31.03.2020

2 Revenue Income Interest 8,140.50 45.21% 7,824.75 4.04% International Business Advances increased to Rs.

on 9,503 Crore in March 20 from Rs. 7,834 Crore in

Advances March 2019 with y-o-y growth of 21.30%.

Increase of 71% of Unsecured Advances from

Rs.7075 Cr in 2019 to Rs.12,121.38 Cr in 2020

3 Revenue Income Income 5,939.08 32.98% 5,348.27 11.05% Non-SLR investments (Domestic) such as

on investments in bonds, capital market and mutual

Investments fund grew by 21.96%.

4 Expense Operating Employee 1929.39 9.44% 1,946.21 -0.86% Major portion of employee payments is used for

Expenses Payments Pension

5 Revenue Other Miscellaneous 1404.59 7.80% 825.00 70.25% Recoveries in Written off Advances / Investments

Income Income are accounted for as 'Miscellaneous Income'.

3) Referring to the format given to you, mention one item that is missing and mention one item that you have found

interesting in the income statement. Elaborate within 100 words.

Missing Item: Dividends: Since Bank posted loss of Rs. -2436.83 Crore during the year 2020, no dividend has been given,

note there has been no dividend given since the year 2015. In addition, unpaid/unclaimed dividends are transferred into

“Investor Education and Protection Funds”

Interesting Item: Depreciation: As per RBI guidelines the depreciation of the software which forms an integral part of the

computer hardware is provided at ‘Straight Line Method’ and is fixed at the rate of 33.33%, which is the highest value than

the depreciation allocated for any of the other category of assets.

You might also like

- Problem Statement: Sub-Task 1Document12 pagesProblem Statement: Sub-Task 1Preethi Ravi100% (2)

- STATEMENTDocument3 pagesSTATEMENTncrgurukripaNo ratings yet

- BCG InsideSherpa Core Strategy - Telco (Task 2 Model Answer) - FinalDocument10 pagesBCG InsideSherpa Core Strategy - Telco (Task 2 Model Answer) - Finalbura100% (1)

- Reading 26 Financial Reporting QualityDocument8 pagesReading 26 Financial Reporting QualityARPIT ARYANo ratings yet

- 2021 Vietnam Startup Report (Nexttrans)Document34 pages2021 Vietnam Startup Report (Nexttrans)Trần Thủy VânNo ratings yet

- Mary The Queen College of Pampanga IncDocument14 pagesMary The Queen College of Pampanga Inculan0% (1)

- BCG InsideSherpa Core Strategy - Telco (Task 2 Model Answer) - FinalDocument10 pagesBCG InsideSherpa Core Strategy - Telco (Task 2 Model Answer) - FinalAkshayBhutadaNo ratings yet

- Earnings Management: Reconciling The Views of Accounting Academics, Practitioners, and RegulatorsDocument17 pagesEarnings Management: Reconciling The Views of Accounting Academics, Practitioners, and RegulatorsMaenNo ratings yet

- Accounting Revision QuestionsDocument8 pagesAccounting Revision QuestionsFranswa MateteNo ratings yet

- Ii. Financial Performance: Assets and Liabilities Net Interest IncomeDocument2 pagesIi. Financial Performance: Assets and Liabilities Net Interest IncomeAnuska MohantyNo ratings yet

- Uol Group Fy2020 Results 26 FEBRUARY 2021Document33 pagesUol Group Fy2020 Results 26 FEBRUARY 2021Pat KwekNo ratings yet

- Estados Financieros 2018 2019 SubaruDocument26 pagesEstados Financieros 2018 2019 SubaruManuel Eduardo Herrera AguilaNo ratings yet

- CFLB Annual Report 31 03 2020Document172 pagesCFLB Annual Report 31 03 2020pasanNo ratings yet

- Investor Presentation Mar21Document34 pagesInvestor Presentation Mar21Sanjay RainaNo ratings yet

- UntitledDocument176 pagesUntitledPriya NairNo ratings yet

- Financial Summary: Toyota Motor CorporationDocument33 pagesFinancial Summary: Toyota Motor CorporationHassan PansariNo ratings yet

- Data AnalysisDocument12 pagesData Analysisloic.seguin.proNo ratings yet

- Phiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001.: BSE Limited National Stock Exchange of India LimitedDocument6 pagesPhiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001.: BSE Limited National Stock Exchange of India LimitedJITHIN KRISHNAN MNo ratings yet

- Q2 FY2019 Consolidated Results: (Quarter Ended September 30,2019)Document19 pagesQ2 FY2019 Consolidated Results: (Quarter Ended September 30,2019)TheDeathFromHellNo ratings yet

- BCG InsideSherpa Core Strategy - Telco (Task 2 Model Answer) - FinalDocument10 pagesBCG InsideSherpa Core Strategy - Telco (Task 2 Model Answer) - FinalburaNo ratings yet

- Appendix 4E and Annual Report FY20Document79 pagesAppendix 4E and Annual Report FY20Gursheen KaurNo ratings yet

- Analysis of Anuual Report of Tata Consultancy Services (TCS) 2019Document17 pagesAnalysis of Anuual Report of Tata Consultancy Services (TCS) 2019AparnaNo ratings yet

- 1 956 1 BOBAnalystPresentationQ4FY20Document71 pages1 956 1 BOBAnalystPresentationQ4FY20SannihithNo ratings yet

- FY2019 2nd Quarter Consolidated Financial Results (IFRS) (April 1, 2018 Through September 30, 2018)Document7 pagesFY2019 2nd Quarter Consolidated Financial Results (IFRS) (April 1, 2018 Through September 30, 2018)Papa Ekow ArmahNo ratings yet

- Further Resource Sharing: Interim Report 2020Document50 pagesFurther Resource Sharing: Interim Report 2020mailimailiNo ratings yet

- Finance ProjectDocument5 pagesFinance ProjectSanjana Premkumar1998No ratings yet

- Webslides Q221 FinalDocument19 pagesWebslides Q221 FinalxtrangeNo ratings yet

- q4 Fy20 EarningsDocument20 pagesq4 Fy20 EarningsKJ HiramotoNo ratings yet

- Financial Statement AnalysisDocument23 pagesFinancial Statement AnalysisFeMakes MusicNo ratings yet

- 2020 Interim: For The Period Ended 31 March 2020Document42 pages2020 Interim: For The Period Ended 31 March 2020foohuiyinNo ratings yet

- GB - Accounting and Financial Reporting ProjectDocument9 pagesGB - Accounting and Financial Reporting Projectshe.holmes.2004No ratings yet

- Consolidated Financial Results For The Second Quarter of The Fiscal Year Ending March 31, 2020 (IFRS)Document11 pagesConsolidated Financial Results For The Second Quarter of The Fiscal Year Ending March 31, 2020 (IFRS)jaykrsNo ratings yet

- Cocoaland Holdings Berhad: (Incorporated in Malaysia)Document15 pagesCocoaland Holdings Berhad: (Incorporated in Malaysia)Sajeetha MadhavanNo ratings yet

- Titan LTD Project - by Team QUANTUMDocument5 pagesTitan LTD Project - by Team QUANTUMutkrsh raghavNo ratings yet

- Final IFRS For SMEs Illustrator ExampleDocument30 pagesFinal IFRS For SMEs Illustrator ExampleleekosalNo ratings yet

- BCG InsideSherpa Core Strategy - Telco (Task 2 Model Answer) - FinalDocument10 pagesBCG InsideSherpa Core Strategy - Telco (Task 2 Model Answer) - FinalSiddharthNo ratings yet

- Kirk Fulford - AASB PresentationDocument33 pagesKirk Fulford - AASB PresentationTrisha Powell CrainNo ratings yet

- Financial Statements March 31 2020Document15 pagesFinancial Statements March 31 2020Ahmad FikriNo ratings yet

- Pep Technologies - Annual Report - FY21Document38 pagesPep Technologies - Annual Report - FY21Sagar SangoiNo ratings yet

- 4Q 2020 - Analyst Meeting (LONG FORM)Document80 pages4Q 2020 - Analyst Meeting (LONG FORM)Giang NguyenNo ratings yet

- Pleasanton City Council Report On Budget Revisions 4/15/2020Document7 pagesPleasanton City Council Report On Budget Revisions 4/15/2020Courtney TeagueNo ratings yet

- Far670 Solution Jul 2020Document4 pagesFar670 Solution Jul 2020siti hazwaniNo ratings yet

- Britannia Industries LTD: Index DetailsDocument13 pagesBritannia Industries LTD: Index DetailsÀbhîñáy Sîñgh RâjpôôtNo ratings yet

- Good Hope PLC: Annual ReportDocument11 pagesGood Hope PLC: Annual ReporthvalolaNo ratings yet

- Assignment 01Document18 pagesAssignment 01Md. Real MiahNo ratings yet

- Uts Finance IvanDocument28 pagesUts Finance IvanIvan ZackyNo ratings yet

- 2020-08-31 Ar20Document68 pages2020-08-31 Ar20Daniel ManNo ratings yet

- (12-02-21) Managerial AccountingDocument3 pages(12-02-21) Managerial AccountingShivi CholaNo ratings yet

- Group 54 Bata India WorldcomDocument15 pagesGroup 54 Bata India WorldcomS BajpaiNo ratings yet

- Nepal Budget 2076-77 (2019-20)Document38 pagesNepal Budget 2076-77 (2019-20)Menuka SiwaNo ratings yet

- 1 (A) - As Compared To The Year 2019, The Owners' Equity Has Decreased in The Year 2020. What Is The Most Important Reason For The Same?Document5 pages1 (A) - As Compared To The Year 2019, The Owners' Equity Has Decreased in The Year 2020. What Is The Most Important Reason For The Same?Akshat BansalNo ratings yet

- Accounts Finance - AssignmentDocument16 pagesAccounts Finance - AssignmentvellithodiresmiNo ratings yet

- Annexes 2021Document19 pagesAnnexes 2021Charish LariosaNo ratings yet

- Growth of The Textile and Apparel Industry Sector 2011 - 2021Document6 pagesGrowth of The Textile and Apparel Industry Sector 2011 - 2021Kenny FamelikaNo ratings yet

- Phiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001Document5 pagesPhiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001Namrata ShahNo ratings yet

- Investor Presentation Q1 FY21 July 2020Document55 pagesInvestor Presentation Q1 FY21 July 2020vvpvarunNo ratings yet

- Estimated Revenues, Profits and Expenditure For Next Three YearsDocument6 pagesEstimated Revenues, Profits and Expenditure For Next Three YearsRajeev Kumar GottumukkalaNo ratings yet

- Tata Motors .Document14 pagesTata Motors .Shweta MaltiNo ratings yet

- K10 SFMDocument6 pagesK10 SFMSrijan AgarwalNo ratings yet

- q4 Fy21 EarningsDocument19 pagesq4 Fy21 EarningsJoseph Adinolfi Jr.No ratings yet

- Results For Announcement To The MarketDocument63 pagesResults For Announcement To The MarketTimBarrowsNo ratings yet

- CAG Report - 5.Chapter-II - Finances-of-the-State-062483127404258.80044065Document48 pagesCAG Report - 5.Chapter-II - Finances-of-the-State-062483127404258.80044065Rudresh KarnNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Overcoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyFrom EverandOvercoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyNo ratings yet

- Economic Indicators for East Asia: Input–Output TablesFrom EverandEconomic Indicators for East Asia: Input–Output TablesNo ratings yet

- Name of Assessee: Chandadevi Ghevarchand Jain PAN: ACLPJ0515ADocument3 pagesName of Assessee: Chandadevi Ghevarchand Jain PAN: ACLPJ0515ADpr MachineriesNo ratings yet

- Inequality Could Be Lower Than You ThinkDocument4 pagesInequality Could Be Lower Than You ThinkPRANAY GOYALNo ratings yet

- Servlet ControllerDocument1 pageServlet ControllerRohit SolomonNo ratings yet

- TUGAS Topik Bab 5Document2 pagesTUGAS Topik Bab 5Imanuel ChrisNo ratings yet

- NCIIIDocument76 pagesNCIIIJennica Montanes0% (1)

- NVIDIA Announces Financial Results For Fourth Quarter and Fiscal 2023Document10 pagesNVIDIA Announces Financial Results For Fourth Quarter and Fiscal 2023Andrei SeimanNo ratings yet

- Tugas - Rate of Return AnalysisDocument2 pagesTugas - Rate of Return AnalysisJoshua HutaurukNo ratings yet

- Suzuki Motor Corporation Balance Sheet AS ON DEC 31 .. AssetsDocument3 pagesSuzuki Motor Corporation Balance Sheet AS ON DEC 31 .. AssetsM Bilal KNo ratings yet

- Accounting For Construction Contracts As 7Document6 pagesAccounting For Construction Contracts As 7Ruthvik SharmaNo ratings yet

- Part-A - Strategic Management Accounting: Multiple Choice Questions (MCQS)Document33 pagesPart-A - Strategic Management Accounting: Multiple Choice Questions (MCQS)ARIF HUSSAIN AN ENGLISH LECTURER FOR ALL CLASSESNo ratings yet

- Activity - Chapter 4Document2 pagesActivity - Chapter 4Greta DuqueNo ratings yet

- 11 DepartmentalDocument15 pages11 DepartmentalBharat ThackerNo ratings yet

- BFINMAX Handout - Gross Profit Variance AnalysisDocument6 pagesBFINMAX Handout - Gross Profit Variance AnalysisAdrian MontemayorNo ratings yet

- Marketing Plan WIDocument33 pagesMarketing Plan WIAlliah Mari Pelitro BairaNo ratings yet

- Ca Foundation Lacture 1 ppt-1Document23 pagesCa Foundation Lacture 1 ppt-1idealNo ratings yet

- What Is An Advance Payment?Document2 pagesWhat Is An Advance Payment?Niño Rey LopezNo ratings yet

- Company Profile: 1.1 General IntroductionDocument67 pagesCompany Profile: 1.1 General IntroductionClick PickNo ratings yet

- Tugas Akuntansi Closing EntriesDocument8 pagesTugas Akuntansi Closing EntriesFidya AdystiaraNo ratings yet

- Lecture 9 Shri Govind NumericalDocument1 pageLecture 9 Shri Govind Numericalhimanshumaholia0% (1)

- LBR JWB Sesi 2 - CDocument12 pagesLBR JWB Sesi 2 - CAzka RainayokyNo ratings yet

- Bank of Baroda PPF Withdrawal Form PDFDocument1 pageBank of Baroda PPF Withdrawal Form PDFmufaddal.pittalwala51350% (2)

- Choose Letter of The Correct Answer.Document3 pagesChoose Letter of The Correct Answer.Peng GuinNo ratings yet

- MBA CapitalBudgetingDocument34 pagesMBA CapitalBudgetinganvita raoNo ratings yet

- Accounting Concepts & PrinciplesDocument8 pagesAccounting Concepts & PrinciplesJonalyn abesNo ratings yet

- Elite Events Corporation Has Provided Event Planning Services For SeveralDocument1 pageElite Events Corporation Has Provided Event Planning Services For SeveralFreelance WorkerNo ratings yet