Professional Documents

Culture Documents

HMGT2280 Chapter 4 Homework

HMGT2280 Chapter 4 Homework

Uploaded by

Adrizal MatorangOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HMGT2280 Chapter 4 Homework

HMGT2280 Chapter 4 Homework

Uploaded by

Adrizal MatorangCopyright:

Available Formats

Chapter 4, Question 7

Spring River Resort Inc. opened for business on June 1 with eight air-conditioned units.

Its trial balance before adjustment on August 31 is as follows.

SPRING RIVER RESORT INC.

Trial Balance

August 31, 2008

Account

Number Debit Credit

101 Cash $19,600

126 Supplies 3,300

130 Prepaid Insurance 6,000

140 Land 25,000

143 Cottages 125,000

149 Furniture 26,000

201 Accounts Payable $6,500

208 Unearned Rent 7,400

275 Mortgage Payable 80,000

311 Common Stock 100,000

320 Retained Earnings -0-

332 Dividends 5,000

429 Rent Revenue 80,000

622 Repair Expense 3,600

726 Salaries Expense 51,000

732 Utilities Expense 9,400

$273,900 $273,900

Other data:

1. Insurance expires at the rate of $400 per month.

2. A count of August 31 shows $900 of supplies on hand.

3. Annual depreciation is $3,600 on cottages and $2,400 on funiture.

4. Unearned rent of $4,100 was earned prior to August 31.

5.Salaries of $400 were unpaid at August 31.

6.Rentals of $800 were due from tenants at August 31.(Use Accounts Receivable)

7. The mortagage interest rate is 9 percent per year. (The mortgage was taken out on

August 1.)

Date Account Titles and Explanation Ref. Debit Credit

Aug 31 Insurance Exp 1,200

Prepaid Inaurance 1,200

Aug 31 Supplies 2,400

Supplies expense 2,400

Dep. Exp- Cottage 900

accumlated Dep. -Cottage 900

Dep. Furniture 600

accumlated Dep. -furniture 600

Unearned rent 4,100

Rent revenue 4,100

Salary Expense 400

Salary Payable 400

Accounts Recievable 800

Rent revenue 800

Interest Expense 600

Interest Payable 600

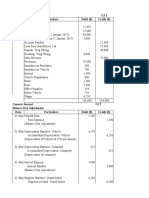

TheChapter 4, Question

Thayer Motel, 10 for business on May 1, 2008. Its trial balance before

Inc., opened

adjustment on May 31

is as follows.

THAYER MOTEL, INC.

Trial Balance

May 31,2008

Account

number Debit Credit

101 Cash $2,500

126 Supplies 1,900

130 Prepaid Insurance 2,400

140 Land 15,000

141 Lodge 70,000

149 Furniture 16,800

201 Accounts Payable $5,300

208 Unearned Rent 4,600

275 Mortgage payable 35,000

311 Common Stock 60,000

332 Dividends 1,000

429 Rent Revenue 9,200

610 Advertising Expenses 500

726 Salaries Expense 3,000

732 Utilities Expense 1,000

$114,100 $114,100

In addition to those accounts listed on the trial balance, the chart of

accounts for Thayer Motel also contains the following accounts and account numbers:

No.142 Accumulated Depreciation-Lodge, No 150 Accumulated Depreciation- funiture, No

212 Salary Payable, No 230 interest Payable, No 320 Retained Earnings, No 619

Depreciation Expense-Lodge, No.621 Depreciation Expense-Funiture, No.631 Supplies

Expense, No 781 Interest Expense, and No. 722 Insurance Expenses.

Other Data:

1. Insurance expires at the rate of $200 per month.

2. A count of supplies shows $900 of unused supplies on May 31.

3. Annual depreciation is $2,400 on the lodge and $3,000 on Funitures.

4, The mortgage interest rate is 12%. (The mortgage was taken out on May 1.)

5. Unearned rent of $2,500 has been earned

6. Salaries of $800 are accrued and unpaid at May 31.

(a) Journalize the adjusting Entries on May 31.

Date Account Titles and Explanation Ref. Debit Credit

May 31 Insurance Expense 200

Prepaid Insurance 200

31 Supplies Expense 1000

Supplies ($1900-900) 1000

Lodge 67,600

Depreciation 67,600

Furnitures 13,800

Depreciation 13,800

Mortgage Interest 4200

Interest pay 4200

Unearned rent 2500

Rent receivable 2500

Salary expense 800

Salary Payable 800

(b) Prepare a ledger using the three-column form of account. Enter the trial balance amounts, and post

the adjusting enteries. (Use J1 as the posting reference.)

Cash No.101

Date Explanation Ref Debit Credit Balance

31-May 2500

Supplies No.126

Date Explanation Ref Debit Credit Balance

31-May 1900

Prepaid Insurance No.130

Date Explanation Ref Debit Credit Balance

31-May 2400

Land No.140

Date Explanation Ref Debit Credit Balance

31-May 15000

Lodge No.141

Date Explanation Ref Debit Credit Balance

31-May 70,000

Accumulated Depreciation-Lodge No.142

Date Explanation Ref Debit Credit Balance

31-May 67,600

Funiture No.149

Date Explanation Ref Debit Credit Balance

31-May 16800

Accumulated Depreciation-Funiture No.150

Date Explanation Ref Debit Credit Balance

31-May 13,800

Accounts Payable No.201

Date Explanation Ref Debit Credit Balance

31-May 5300

Unearned Rent No.208

Date Explanation Ref Debit Credit Balance

31-May 4600

Salaries Payable No.212

Date Explanation Ref Debit Credit Balance

31-May 800

Interest Payable No.230

Date Explanation Ref Debit Credit Balance

31-May 350

Mortgage Payable No.275

Date Explanation Ref Debit Credit Balance

31-May 3500

Common Stock No.311

Date Explanation Ref Debit Credit Balance

31-May 60,000

Retained Earnings No.320

Date Explanation Ref Debit Credit Balance

31-May 2500

Dividends No.332

Date Explanation Ref Debit Credit Balance

31-May 1000

Rent Revenue No.429

Date Explanation Ref Debit Credit Balance

31-May 9200

Advertising Expense No.610

Date Explanation Ref Debit Credit Balance

31-May 500

Depreciation Expense-Lodge No.619

Date Explanation Ref Debit Credit Balance

31-May 200

Depreciation Expense-Funiture No.621

Date Explanation Ref Debit Credit Balance

31-May 250

Supplies Expense No.631

Date Explanation Ref Debit Credit Balance

31-May 1000

Interest Expense No.718

Date Explanation Ref Debit Credit Balance

31-May 350

Insurance Expense No.722

Date Explanation Ref Debit Credit Balance

31-May 200

Salaries Expense No.726

Date Explanation Ref Debit Credit Balance

31-May 3000

Utilities Expense No.732

Date Explanation Ref Debit Credit Balance

31-May 1000

0

C. Prepare an adjusted trial balance on May 31.

THAYER MOTEL INC.

Adjusted Trial Balance

For the Month Ended May 31, 2008

Debit Credit

Cash $2,500

Supplies 900

Prepaid Insurance 2,200

Land 15,000

Lodge 70,000

Acc. Dep. Lodge 200

Furniture 16,800

Acc. Dep. Furniture 250

Accounts Payable 5,300

Unearned rent 2,100

Salary Payable 800

Interest Payable 350

Mortage Payable 35,000

Common Stock 60,000

Retained Earning 2,500

Dividents 1,000

Rent Revenue 11,700

Advertising Expense 500

Dep. Ex. Lodge 200

Dep. Ex. Furniture 250

Supplies Expense 1,000

Interest Expense 350

Insurance Expense 200

Salary Expense 3,800

Utility Expense 1,000

$115,900 $ 118,000

You might also like

- CH 03Document4 pagesCH 03flrnciairnNo ratings yet

- Strategic Management Cesim Report: Submission DateDocument22 pagesStrategic Management Cesim Report: Submission DateRaj Shekhar GohiyaNo ratings yet

- CH 03Document4 pagesCH 03Rabie HarounNo ratings yet

- Pembahasan CH 3 4 5Document30 pagesPembahasan CH 3 4 5bella0% (1)

- Exercises Finalaccounts ExDocument2 pagesExercises Finalaccounts ExSounak NathNo ratings yet

- Homework Chapter 4Document17 pagesHomework Chapter 4Trung Kiên Nguyễn100% (1)

- P3 2A AnswerDocument2 pagesP3 2A AnswerMinh NhậtNo ratings yet

- 592198Document11 pages592198mohitgaba19No ratings yet

- 3 2aDocument9 pages3 2aHumna IlyasNo ratings yet

- Chapter 4 Exercises & SolutionsDocument13 pagesChapter 4 Exercises & SolutionsMariamNo ratings yet

- Roshita Desthi Nurimah - A20 - Tugas BAB 3Document12 pagesRoshita Desthi Nurimah - A20 - Tugas BAB 3Roshita Desthi NurimahNo ratings yet

- General Journal Date Accounts and Explanation Debit CreditDocument6 pagesGeneral Journal Date Accounts and Explanation Debit CreditShaina AragonNo ratings yet

- Semere Tesfaye MBAO 8977 14B - 2Document17 pagesSemere Tesfaye MBAO 8977 14B - 2amirhaile71No ratings yet

- Pt. Prima Jaya Trial Balance Maret 31, 2019 No - Acc Account Title Debet CreditDocument9 pagesPt. Prima Jaya Trial Balance Maret 31, 2019 No - Acc Account Title Debet CreditDinda AldiraNo ratings yet

- ISSo FPDocument6 pagesISSo FPabbeangedesireNo ratings yet

- Kidusan Amha Mbao-6074-15A FMA Assignment-11111Document13 pagesKidusan Amha Mbao-6074-15A FMA Assignment-11111Kidusan AmhaNo ratings yet

- P4 5BDocument15 pagesP4 5BAngel JNo ratings yet

- Exercises - Trial Balance and Final Accounts - PracticeDocument23 pagesExercises - Trial Balance and Final Accounts - PracticeDilfaraz Kalawat79% (38)

- Chapter 5Document27 pagesChapter 5nadima behzadNo ratings yet

- Igcse - Extented Tutoring - 2023 - 2024 - Final AccountsDocument7 pagesIgcse - Extented Tutoring - 2023 - 2024 - Final AccountsMUSTHARI KHANNo ratings yet

- HW CH2Document3 pagesHW CH2Hà HoàngNo ratings yet

- Financial Accounting - Tugas 1Document6 pagesFinancial Accounting - Tugas 1Alfiyan100% (1)

- Homework - Chapter 3Document3 pagesHomework - Chapter 3JunnieNo ratings yet

- Corrected TB CH 2Document1 pageCorrected TB CH 2Birhanu DesalegnNo ratings yet

- Faculty Business and Management Bbf211: Financial Reporting AnanlsisDocument7 pagesFaculty Business and Management Bbf211: Financial Reporting AnanlsisMichael AronNo ratings yet

- Item (A) Type of Adjustment (B) Accounts Before AdjustmentDocument11 pagesItem (A) Type of Adjustment (B) Accounts Before Adjustmentsuci monalia putriNo ratings yet

- Tutorial 23 Financial Statement 1 2 Management SkillsDocument4 pagesTutorial 23 Financial Statement 1 2 Management SkillsOkgar Myint SoeNo ratings yet

- FINANCIALREPORTINGand Analysis ExamDocument7 pagesFINANCIALREPORTINGand Analysis ExamKizito KizitoNo ratings yet

- Tugas Akuntansi 5 William MangumbanDocument6 pagesTugas Akuntansi 5 William MangumbanWilliam MangumbanNo ratings yet

- Acct225 Cap3Document17 pagesAcct225 Cap3devoflashNo ratings yet

- Groenke Construction Co, Adjustments December 31, 20X7: Adjust # Account Names Debit CreditDocument5 pagesGroenke Construction Co, Adjustments December 31, 20X7: Adjust # Account Names Debit Creditfarhann JattNo ratings yet

- PA-HW Chap3 + 4Document8 pagesPA-HW Chap3 + 4Hà Anh ĐỗNo ratings yet

- WS ProblemDocument1 pageWS ProblemadbNo ratings yet

- Problems of Worksheet: Disney Amusement Park August 31, 2020 Trial BalanceDocument3 pagesProblems of Worksheet: Disney Amusement Park August 31, 2020 Trial BalanceDipika tasfannum salam100% (1)

- Review Accounting 1Document9 pagesReview Accounting 1jhouvanNo ratings yet

- Assignment Questions For Financial StatementsDocument5 pagesAssignment Questions For Financial StatementsAejaz Mohamed100% (2)

- P&LAC Exercises PracticeDocument5 pagesP&LAC Exercises PracticeDilfaraz KalawatNo ratings yet

- AFR Session 4 ExercisesDocument10 pagesAFR Session 4 ExercisesSherif KhalifaNo ratings yet

- DBM 611 Question Papers 2022Document3 pagesDBM 611 Question Papers 2022julierienyeNo ratings yet

- Financial Statement Assignment 1Document3 pagesFinancial Statement Assignment 1tahasafdari772No ratings yet

- Question 1Document2 pagesQuestion 1Charles MachuvaireNo ratings yet

- Group Assignment 1ST YR MBADocument5 pagesGroup Assignment 1ST YR MBASosi SissayNo ratings yet

- Partnership Class ExercisesDocument2 pagesPartnership Class ExercisesPetrinaNo ratings yet

- Jawaban KuisDocument3 pagesJawaban KuisWidad NadiaNo ratings yet

- ExercisesDocument3 pagesExercisesThiều Xuân LamNo ratings yet

- Tugas Akuntansi 5 Siti Ananda MaisyahDocument6 pagesTugas Akuntansi 5 Siti Ananda MaisyahWilliam MangumbanNo ratings yet

- (Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearDocument3 pages(Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearFlorencia IrenaNo ratings yet

- Tugas 3 - Lat Adjusment - Sri KurniawatiDocument11 pagesTugas 3 - Lat Adjusment - Sri KurniawatiSher Kurnia100% (1)

- Tugas Akuntansi 5 Irensyah Payungbua'Document6 pagesTugas Akuntansi 5 Irensyah Payungbua'William MangumbanNo ratings yet

- Exercise Principles Accounting IDocument5 pagesExercise Principles Accounting Imerkineh fantaNo ratings yet

- Final Marryland AccountingDocument15 pagesFinal Marryland AccountingNatnael AsnakeNo ratings yet

- Financial Statements (Basic)Document7 pagesFinancial Statements (Basic)Mohamed MubarakNo ratings yet

- Worksheet - Class PracticeDocument3 pagesWorksheet - Class PracticeMahmudul Hassan RohidNo ratings yet

- Chapter 3 Practice QuestionsDocument3 pagesChapter 3 Practice QuestionsFamily PicturesNo ratings yet

- General Journal GJ1 Date Particulars Debit ($) Credit ($)Document25 pagesGeneral Journal GJ1 Date Particulars Debit ($) Credit ($)Jennifer ChandraNo ratings yet

- Unit 1 Practice QuestionsDocument3 pagesUnit 1 Practice Questionskbarrett20No ratings yet

- Homework For Chapter 4 - Problem 4-2ADocument8 pagesHomework For Chapter 4 - Problem 4-2ATyra CoyNo ratings yet

- Adjusting Entry Math LatestDocument4 pagesAdjusting Entry Math LatestOyon Nur newazNo ratings yet

- DR CR Le LeDocument7 pagesDR CR Le LeKANGOMA FODIE MansarayNo ratings yet

- Additional Class Tutorial Basic Sopl SofpDocument2 pagesAdditional Class Tutorial Basic Sopl Sofpazra balqisNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Last 5 Years Question PaperDocument5 pagesLast 5 Years Question Papersimran KeswaniNo ratings yet

- Preparation of Financial Statements: The Balance SheetDocument7 pagesPreparation of Financial Statements: The Balance SheetArnav ChaturvediNo ratings yet

- Final Account - Sole Trader - Practice QuestionDocument3 pagesFinal Account - Sole Trader - Practice QuestionMUSTHARI KHANNo ratings yet

- Paper-12: Management Accounting Suggested Answers Section - ADocument5 pagesPaper-12: Management Accounting Suggested Answers Section - AQuestion BankNo ratings yet

- Funds Flow AnalysisDocument39 pagesFunds Flow AnalysisvishnupriyaNo ratings yet

- Inari Amertron Berhad (0166)Document27 pagesInari Amertron Berhad (0166)Cindy TohNo ratings yet

- Powerol - Monthly MIS FormatDocument34 pagesPowerol - Monthly MIS Formatdharmender singhNo ratings yet

- Lettuce ProductionDocument14 pagesLettuce ProductionJay ArNo ratings yet

- Contract CostingDocument11 pagesContract CostingMalayaranjan PanigrahiNo ratings yet

- Graduated - Tax Base Is Net Income 8% - Tax Base Is Gross IncomeDocument9 pagesGraduated - Tax Base Is Net Income 8% - Tax Base Is Gross IncomeFrancis Kyle Cagalingan SubidoNo ratings yet

- Audit Scope - HariDocument444 pagesAudit Scope - HarisridhoolaNo ratings yet

- Chap 009Document57 pagesChap 009palak32100% (3)

- H One (PVT) LTD 20-21-ExemptDocument164 pagesH One (PVT) LTD 20-21-ExemptShehara GamlathNo ratings yet

- Atty. Elizabeth S. ZosaDocument92 pagesAtty. Elizabeth S. ZosaKriston LipatNo ratings yet

- IcaiDocument12 pagesIcaibasanisujithNo ratings yet

- Income Tax TableDocument6 pagesIncome Tax TableMarian's PreloveNo ratings yet

- Holiday Homework 2023-24 (Class Xi)Document5 pagesHoliday Homework 2023-24 (Class Xi)Sukhpreet KaurNo ratings yet

- 4765 Law Union and Rock Ins. Plc. Financial Statements November 2013 PDFDocument105 pages4765 Law Union and Rock Ins. Plc. Financial Statements November 2013 PDFamamdikwaNo ratings yet

- Request For Local Fieldtrip2016Document4 pagesRequest For Local Fieldtrip2016Lenard MartinNo ratings yet

- Chapter 11 12Document29 pagesChapter 11 12Add All31% (13)

- DCF Valuation Sheet For CiplaDocument114 pagesDCF Valuation Sheet For CiplaGourav BansalNo ratings yet

- Full Ebook of Business Financial Planning With Microsoft Excel 1St Edition Gavin Powell Online PDF All ChapterDocument69 pagesFull Ebook of Business Financial Planning With Microsoft Excel 1St Edition Gavin Powell Online PDF All Chapterlyndausaful100% (7)

- Founders Guide To Financial Modeling Dave LishegoDocument117 pagesFounders Guide To Financial Modeling Dave Lishegomitu lead01No ratings yet

- Deposits - Audit ProgramDocument5 pagesDeposits - Audit ProgramGrecio CaguisaNo ratings yet

- DPNS (PT Duta Pertiwi Nusantara)Document4 pagesDPNS (PT Duta Pertiwi Nusantara)ayusekariniNo ratings yet

- Cambridge Ordinary LevelDocument20 pagesCambridge Ordinary LevelVimansa JayakodyNo ratings yet

- Income Tax Law and PracticesDocument26 pagesIncome Tax Law and Practicesremruata rascalralteNo ratings yet

- Journal, Ledger and Trial Balance: Dr. Sharon Sophia, Vellore Institute of TechnologyDocument11 pagesJournal, Ledger and Trial Balance: Dr. Sharon Sophia, Vellore Institute of Technologyermias100% (1)

- Unit 03 Double Entry AccountingDocument41 pagesUnit 03 Double Entry AccountingPraveen ParocheNo ratings yet