Professional Documents

Culture Documents

Spring 2021 - FIN623 - 2

Spring 2021 - FIN623 - 2

Uploaded by

usmanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Spring 2021 - FIN623 - 2

Spring 2021 - FIN623 - 2

Uploaded by

usmanCopyright:

Available Formats

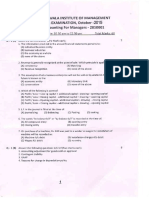

Virtual University of Pakistan

Semester “SPRING 2021”

TAXATION MANAGEMENT (FIN623)

Assignment 02 Marks: 10

“Taxable Income and Tax Liability”

Question

Mr. Toor a Provincial Government employee of Pakistan was deputed on the official task in

Florida in 2016. He returned to Pakistan in July 2020 and remained in Pakistan for the period of 1

year. For the tax year 2021, following are the details of his incomes and other particulars:

Rs.

1. Monthly basic salary 120,000

2. Bonus 90,000

3. Adhoc allowance 50,000

4. Furnished accommodation provided by employer 200,000

5. Utilities paid by employer 80,000

6. Monthly medical allowance 50,000

7. Additional allowance paid by the employer 150,000

8. Conveyance provided for personal use

Value of car purchased by the employer 2,150,000

9. Interest-free loan taken from employer 4,000,000

10. Zakat paid 50,000

11. Investment in shares of a public company listed on

Stock Exchange of Pakistan 100,000

Requirement:

For the tax year 2021, determine for Mr. Toor:

a) Residential status (1 Mark)

b) Taxable income (6 Marks)

c) Tax liability (3 Marks)

You MUST provide all the calculations in DETAIL as each

calculation carry marks.

You MUST mention the relevant section/clause of the ITO 2001

and Income Tax Rules 2002 for the tax year 2021 to support

your answer and calculations as these carry marks.

IMPORTANT

24 hours extra / grace period after the due date is usually available to overcome uploading

difficulties. This extra time should only be used to meet the emergencies and above mentioned

due dates should always be treated as final to avoid any inconvenience.

IMPORTANT INSTRUCTIONS/ SOLUTION GUIDELINES/ SPECIAL

INSTRUCTIONS

BE NEAT IN YOUR PRESENTATION

OTHER IMPORTANT INSTRUCTIONS:

DEADLINE:

Make sure to upload the solution file before the due date on VULMS.

Any submission made via email after the due date will not be accepted.

FORMATTING GUIDELINES:

Use the font style “Times New Roman” or “Arial” and font size “12”.

Do not add watermarks, backgrounds, page colors, page borders, and etcetera.

It is advised to compose your document in MS-Word format ONLY.

You may compose your assignment in Open Office format.

Use black and blue font colors only.

RULES FOR MARKING:

Please note that your assignment will NOT be graded or graded as Zero (0), if:

It is submitted after the due date.

The file you uploaded does not open or is corrupt.

It is in any format other than MS-Word, Excel, or Open Office; e.g. PowerPoint, PDF, etc.

It is cheated or copied from other student(s), internet, given article, books, journals, etc.

Note related to load shedding: Please be proactive

Dear Students,

As you know that load shedding problem is prevailing in our country, therefore,

you all are advised to post your activities as early as possible without waiting for

the due date. For your convenience; activity schedule has already been uploaded on

VULMS for the current semester, therefore no excuse will be entertained after due

date of assignment.

BEST OF LUCK

You might also like

- Statement 21-FEB-23 AC 63299384 23042822Document10 pagesStatement 21-FEB-23 AC 63299384 23042822Daia SorinNo ratings yet

- Customer StatementDocument4 pagesCustomer Statementkeller kyle100% (1)

- Question - Test Acc106 Mac 2021 - 2july2021Document4 pagesQuestion - Test Acc106 Mac 2021 - 2july2021Fara husnaNo ratings yet

- Semester "FALL 2021": Taxation Management (Fin623)Document2 pagesSemester "FALL 2021": Taxation Management (Fin623)Ali Raza NoshairNo ratings yet

- Spring 2024 - FIN623 - 1Document2 pagesSpring 2024 - FIN623 - 1Abdullah ShakeelNo ratings yet

- ACCE 112 DL Assessment 4 QPDocument4 pagesACCE 112 DL Assessment 4 QPnazmirakaderNo ratings yet

- May 2021 Test 1 QuestionDocument6 pagesMay 2021 Test 1 Questionxfs5k9m8stNo ratings yet

- INS2009 - Nguyên Lý Kế ToánDocument6 pagesINS2009 - Nguyên Lý Kế ToánHuyen NguyenNo ratings yet

- Semester "SPRING 2021": Taxation Management (Fin623)Document2 pagesSemester "SPRING 2021": Taxation Management (Fin623)Sayed AssadullahNo ratings yet

- Nov 22-2Document34 pagesNov 22-2Sreerag R NairNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set ADocument5 pagesFDNACCT - Quiz #1 - Answer Key - Set AleshamunsayNo ratings yet

- Instructions:: 1. Mr. Musfiq Is A Chartered Accountant (CA) - He Started A New Consultancy Firm On July 1Document3 pagesInstructions:: 1. Mr. Musfiq Is A Chartered Accountant (CA) - He Started A New Consultancy Firm On July 1Mahin TabassumNo ratings yet

- Taxation Management Final ExamDocument10 pagesTaxation Management Final ExamWASEEM AKRAMNo ratings yet

- Income Under The Head Salaries Assignment EscholarsDocument38 pagesIncome Under The Head Salaries Assignment EscholarspuchipatnaikNo ratings yet

- Faculty - Accountancy - 2022 - Session 1 - Degree - Tax667 PDFDocument10 pagesFaculty - Accountancy - 2022 - Session 1 - Degree - Tax667 PDFNur Athirah Binti MahdirNo ratings yet

- FDNACCT - Quiz #1 - Answer Key - Set CDocument4 pagesFDNACCT - Quiz #1 - Answer Key - Set CleshamunsayNo ratings yet

- AUDITING-Adjusting Entries-Correction of ErrorsDocument10 pagesAUDITING-Adjusting Entries-Correction of ErrorsJamhel MarquezNo ratings yet

- 97 Practice Question On SALARY by Sir Tariq TunioDocument56 pages97 Practice Question On SALARY by Sir Tariq TunioGhulam Mohyudin KharalNo ratings yet

- A A AaaaaaaaaaaaDocument3 pagesA A AaaaaaaaaaaaRoshan SahooNo ratings yet

- ACCT 312 - Exam 2 (Part 1) - Spring 2022 FinalDocument8 pagesACCT 312 - Exam 2 (Part 1) - Spring 2022 FinalMercy Jerop KimutaiNo ratings yet

- Audit of Long-Term LiabilitiesDocument3 pagesAudit of Long-Term LiabilitiesJhaybie San BuenaventuraNo ratings yet

- Tax667 July 2023 - QDocument10 pagesTax667 July 2023 - Qxfs5k9m8stNo ratings yet

- EXERCISES - Current LiabilitiesDocument6 pagesEXERCISES - Current LiabilitiesClaudette ClementeNo ratings yet

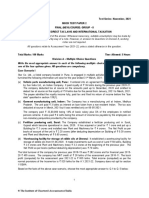

- Test Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument9 pagesTest Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarNo ratings yet

- Semester "SPRING 2022": Taxation Management (Fin623)Document5 pagesSemester "SPRING 2022": Taxation Management (Fin623)Entertainment StatusNo ratings yet

- Quiz 2 DeliveryDocument20 pagesQuiz 2 DeliveryAli Zain ParharNo ratings yet

- Korbel Foundation College Inc.: (Messenger)Document2 pagesKorbel Foundation College Inc.: (Messenger)Jeanmay CalseñaNo ratings yet

- TAX PLANNING & COMPLIANCE - MA-2022 - QuestionDocument6 pagesTAX PLANNING & COMPLIANCE - MA-2022 - QuestionsajedulNo ratings yet

- Final Assessment Far210 Feb2021Document8 pagesFinal Assessment Far210 Feb2021Lampard AimanNo ratings yet

- Fundamentals of Accounting Business and Management - II 2Document4 pagesFundamentals of Accounting Business and Management - II 2Kathlene JaoNo ratings yet

- SalariesDocument35 pagesSalariesSamyak Jirawala100% (1)

- Adjusting Entries Part 1Document3 pagesAdjusting Entries Part 1Jacob BabaranNo ratings yet

- Income Taxation Assignment 1Document2 pagesIncome Taxation Assignment 1Carmela Tuquib RebundasNo ratings yet

- Abm 2 Evaluation Week 1Document3 pagesAbm 2 Evaluation Week 1Christel Fermia RosimoNo ratings yet

- Midterm Quizzes Compilation - Docx-1Document91 pagesMidterm Quizzes Compilation - Docx-1Yess poooNo ratings yet

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesĐức TiếnNo ratings yet

- Bsa Quiz IiDocument2 pagesBsa Quiz IiJanet AnotdeNo ratings yet

- Guided Exercises 1 Current LiabilitiesDocument2 pagesGuided Exercises 1 Current Liabilitiescharizza.ashleyNo ratings yet

- Ap02 Error Corrections and Accounting ChangesDocument2 pagesAp02 Error Corrections and Accounting ChangesJean Fajardo BadilloNo ratings yet

- Tax3226N 3247N October 2024 AssignmentDocument10 pagesTax3226N 3247N October 2024 AssignmentKeaTumi Bokang LeagoNo ratings yet

- Chapter 3 ExercisesDocument7 pagesChapter 3 ExercisesChu Thị ThủyNo ratings yet

- Kenya Methodist University: Endof1 Trimester 2022 (PT) ExaminationDocument5 pagesKenya Methodist University: Endof1 Trimester 2022 (PT) ExaminationJoe 254No ratings yet

- College of Business Management and AccountancyDocument2 pagesCollege of Business Management and AccountancyAlfonso Elpedez PernetoNo ratings yet

- 18222rtp PCC May10 Paper5Document37 pages18222rtp PCC May10 Paper5Kamesh IyerNo ratings yet

- TAX3247N 3226N May 2024 Assignment Question PaperDocument10 pagesTAX3247N 3226N May 2024 Assignment Question PaperfortuinpdNo ratings yet

- Question Analysis: Taxation IDocument9 pagesQuestion Analysis: Taxation IIQBALNo ratings yet

- Chapter 19 Ia2Document11 pagesChapter 19 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- Chapter 9 - Extra Questions & SolutionsDocument19 pagesChapter 9 - Extra Questions & Solutionsandrew.yerokhin1No ratings yet

- Week 4 Tutorial QuestionsDocument5 pagesWeek 4 Tutorial QuestionsDe CemNo ratings yet

- Additional Tutorial Chap 1 2 3Document6 pagesAdditional Tutorial Chap 1 2 3SITI HAMIZAH HAMZAHNo ratings yet

- W1-Unit 5 Assignment Brief V1.2 1 2Document11 pagesW1-Unit 5 Assignment Brief V1.2 1 2himanshusharma9435No ratings yet

- Question Bank 1Document60 pagesQuestion Bank 1rendanitshisevhe4No ratings yet

- Mid Sem 1sem Exam Paper Oct2015Document26 pagesMid Sem 1sem Exam Paper Oct2015angel100% (1)

- Test 2 Acc117 Q Sem Mar 2022 Am1103bDocument6 pagesTest 2 Acc117 Q Sem Mar 2022 Am1103bHUMAIRA LIYANA FARISHA JAFRINo ratings yet

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- A201 Mid Assessment QDocument5 pagesA201 Mid Assessment QSanthiya MogenNo ratings yet

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocument25 pagesCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNo ratings yet

- TPP PP 2024Document225 pagesTPP PP 2024AminaNo ratings yet

- Poa T - 11Document5 pagesPoa T - 11SHEVENA A/P VIJIANNo ratings yet

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- EDU322-Secondary EducationDocument1 pageEDU322-Secondary EducationusmanNo ratings yet

- Spring 2021 - FIN622 - 2Document2 pagesSpring 2021 - FIN622 - 2usmanNo ratings yet

- MKT624Document6 pagesMKT624usmanNo ratings yet

- Allied School System Internship ReportDocument64 pagesAllied School System Internship ReportZahid GondalNo ratings yet

- Solved Indicate Which Courts Decided The Cases Cited Below Also IndicateDocument1 pageSolved Indicate Which Courts Decided The Cases Cited Below Also IndicateAnbu jaromiaNo ratings yet

- Unity University: Department: CourseDocument5 pagesUnity University: Department: CourseMike Dolla SignNo ratings yet

- Airtel BillDocument9 pagesAirtel Billvikas aroraNo ratings yet

- IRM 5300 Balance Due Account Procedures, Form #09.062Document156 pagesIRM 5300 Balance Due Account Procedures, Form #09.062Sovereignty Education and Defense Ministry (SEDM)No ratings yet

- Self-Employed: Set Up As A Sole TraderDocument2 pagesSelf-Employed: Set Up As A Sole TraderKecskeméty BoriNo ratings yet

- Ankara (Turkey) National Officer Category - Annual Salaries and Allowances (In New Turkish Lira) A/ Effective 1 May 2019Document10 pagesAnkara (Turkey) National Officer Category - Annual Salaries and Allowances (In New Turkish Lira) A/ Effective 1 May 2019ba1ar11irinNo ratings yet

- CA Pragya Singh Rajpurohit: Documents List - BasicDocument30 pagesCA Pragya Singh Rajpurohit: Documents List - BasicsankNo ratings yet

- Phil Bank Vs CIRDocument9 pagesPhil Bank Vs CIRCarol JacintoNo ratings yet

- Chapter 2. VatDocument97 pagesChapter 2. VatVu Thi ThuongNo ratings yet

- Delegate Registration FormDocument2 pagesDelegate Registration FormNaveen LawrenceNo ratings yet

- Acca P6Document11 pagesAcca P6novetanNo ratings yet

- Income Taxation Week 1Document19 pagesIncome Taxation Week 1Hannah Rae ChingNo ratings yet

- 2307 Iseco VatDocument18 pages2307 Iseco VatWILBERT QUINTUANo ratings yet

- Chapter 2 - Income TaxDocument30 pagesChapter 2 - Income TaxRochelle ChuaNo ratings yet

- In Case of Denial of Protest: Referral To Solgen For CollectionDocument2 pagesIn Case of Denial of Protest: Referral To Solgen For Collectionkim_santos_20100% (1)

- Commercial Invoice: 2101 East St. Elmo Road, Ste 275 Austin, TX 78744 Phone: 512-326-3244 Fax: 512-326-3299Document1 pageCommercial Invoice: 2101 East St. Elmo Road, Ste 275 Austin, TX 78744 Phone: 512-326-3244 Fax: 512-326-3299Muhammad Shahzad AkramNo ratings yet

- Learning Guide: Accounts and Budget ServiceDocument24 pagesLearning Guide: Accounts and Budget ServiceMitiku Berhanu100% (1)

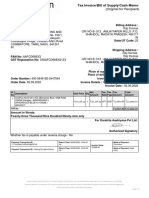

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)RoxdNo ratings yet

- Pa 9 24 2021Document14 pagesPa 9 24 2021Johanes TayamNo ratings yet

- Scale of Charges 2019Document1 pageScale of Charges 2019Er Supramita GhoraiNo ratings yet

- Income Tax Trust EstatesDocument65 pagesIncome Tax Trust EstatesWeiwen Wang100% (1)

- Memory Aid COMMLDocument100 pagesMemory Aid COMMLAnna ArabaniNo ratings yet

- Super Care Pharma Bank Statement-May-2021Document4 pagesSuper Care Pharma Bank Statement-May-2021AKM Anwar SadatNo ratings yet

- Bharat Sanchar Nigam Limited: Invoice For Post Paid ServicesDocument2 pagesBharat Sanchar Nigam Limited: Invoice For Post Paid ServicessuryaNo ratings yet

- Basic Taxation Law SyllabusDocument7 pagesBasic Taxation Law SyllabusKameesa FateNo ratings yet

- CA Rajat Jain: Career ObjectiveDocument3 pagesCA Rajat Jain: Career ObjectiveThe Cultural CommitteeNo ratings yet

- Account StatementDocument8 pagesAccount StatementfredrickthanksNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)sundhar mohanNo ratings yet