Professional Documents

Culture Documents

Net Operating Revenues 33,014 37,266 31,856 35,410 Total Assets 87,296 86,381 83,216 87,896

Net Operating Revenues 33,014 37,266 31,856 35,410 Total Assets 87,296 86,381 83,216 87,896

Uploaded by

Hania AmirOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Net Operating Revenues 33,014 37,266 31,856 35,410 Total Assets 87,296 86,381 83,216 87,896

Net Operating Revenues 33,014 37,266 31,856 35,410 Total Assets 87,296 86,381 83,216 87,896

Uploaded by

Hania AmirCopyright:

Available Formats

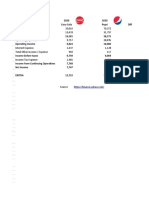

Dec 31, 2020 Dec 31, 2019 Dec 31, 2018 Dec 31, 2017

Reported

Selected Financial Data (US$ in millions)

Net operating revenues 33,014 37,266 31,856 35,410

Total assets 87,296 86,381 83,216 87,896

Activity Ratio

Total asset turnover 1

0.38 0.43 0.38 0.40

Adjusted

Selected Financial Data (US$ in millions)

Net operating revenues 33,014 37,266 31,856 35,410

Adjusted total assets 2

85,362 84,493 81,505 88,553

Activity Ratio

Adjusted total asset turnover 3

0.39 0.44 0.39 0.40

Based on: 10-K (filing date: 2021-02-25), 10-K (filing date: 2020-02-24), 10-K (filing date: 2019-02-21), 10-K (filing date: 2018-02-

23), 10-K (filing date: 2017-02-24).

1

2020 Calculation

Total asset turnover = Net operating revenues ÷ Total assets

= 33,014 ÷ 87,296 = 0.38

2

Adjusted total assets. See details »

3

2020 Calculation

Adjusted total asset turnover = Net operating revenues ÷ Adjusted total assets

= 33,014 ÷ 85,362 = 0.39

Fixed asset turnover ratio

fixed assets.

Fixed assets turnover ratio = revenues

It measures the efficiency of a company in using fixed assets in the

generation of revenue. The higher the better. A high fixed assets ratio means that the company utilizes

its fixed assets well to generate revenues for the company. A low fixed assets turnover ratio means that

the company has overinvested in its Average net fixed assets

Coca cola’s fixed assets turnover ratio is 3.10. This shows that for every dollar held up in fixed assets,

they make $3.89. This shows that the company has less cash being tied up by fixed assets.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Balance Sheet Horizontal Analysis TemplateDocument2 pagesBalance Sheet Horizontal Analysis TemplateHania AmirNo ratings yet

- Year Over Year Analysis (Yoy) : Strictly ConfidentialDocument3 pagesYear Over Year Analysis (Yoy) : Strictly ConfidentialLalit KheskwaniNo ratings yet

- Vertical Income Statement Analysis Coca Cola Vs Pepsi Download FreeDocument4 pagesVertical Income Statement Analysis Coca Cola Vs Pepsi Download FreeHania AmirNo ratings yet

- Assignment: English Comprehensive and CompositionDocument5 pagesAssignment: English Comprehensive and CompositionHania AmirNo ratings yet

- DOH AG III - Accomplishment ReportDocument18 pagesDOH AG III - Accomplishment Reportshane natividadNo ratings yet

- Erm Coso PDFDocument2 pagesErm Coso PDFLindsay0% (1)

- Jo It Governance Guide 2020Document25 pagesJo It Governance Guide 2020sajad salehiNo ratings yet

- Amo GLB PP 101195Document2 pagesAmo GLB PP 101195Prakash JadhavNo ratings yet

- HSE Plan SubcontDocument22 pagesHSE Plan SubcontTaufan Arif ZulkarnainNo ratings yet

- JHA For Positive IsolationDocument1 pageJHA For Positive IsolationShahid RazaNo ratings yet

- Excel Performance Dashboard TemplateDocument1 pageExcel Performance Dashboard TemplateJacqueline Mariame Mamadouno100% (1)

- 1 PasDocument2 pages1 PasEliz QilNo ratings yet

- Masa Plant InchargeDocument3 pagesMasa Plant InchargeAnaswar harilalNo ratings yet

- Summer Training Report 12 PDF FreeDocument111 pagesSummer Training Report 12 PDF FreeAKKY JAINNo ratings yet

- T523 - Cashflow and Payment SchedDocument2 pagesT523 - Cashflow and Payment Schedbert cruzNo ratings yet

- Innovation in Consulting Firms An Area To ExploreDocument9 pagesInnovation in Consulting Firms An Area To Explorenqa1994No ratings yet

- HI5017 2023 T1 Individual Assignment (Individual Assessment)Document13 pagesHI5017 2023 T1 Individual Assignment (Individual Assessment)bikash khanalNo ratings yet

- Andhra Pradesh LLPDocument4 pagesAndhra Pradesh LLPRamiahNagarajanNo ratings yet

- Screw Conv Comp WebDocument92 pagesScrew Conv Comp WebHannan yusuf KhanNo ratings yet

- 01 - EN Why Invest in Rixos Brochure - Accor Global Development Q12021Document40 pages01 - EN Why Invest in Rixos Brochure - Accor Global Development Q12021Turky AlbawardyNo ratings yet

- Erico Dwi Septiawan - C1i021033 - Summary Chapter 1-6 PDFDocument5 pagesErico Dwi Septiawan - C1i021033 - Summary Chapter 1-6 PDFNdewo ErikoNo ratings yet

- Engr. OluwafemiDocument3 pagesEngr. Oluwafemiadetokunbo fapuroNo ratings yet

- Six Sigma at EricssonDocument49 pagesSix Sigma at Ericssonghafoorian_khoshgovar1488No ratings yet

- On-the-Job Training Blueprint - Front Office Manager - Operations ManagerDocument44 pagesOn-the-Job Training Blueprint - Front Office Manager - Operations ManagerRHTi BDNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document13 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Thompson Et Al 2021 The Impact of Transformational Leadership and Interactional Justice On Follower Performance andDocument10 pagesThompson Et Al 2021 The Impact of Transformational Leadership and Interactional Justice On Follower Performance andBiya RasyidNo ratings yet

- SCM Standard Costing and Variance AnalysisDocument22 pagesSCM Standard Costing and Variance AnalysisBaby Joisue KallabueliaNo ratings yet

- Deltron Company's Break Even Analysis Particulars Amount: PV RatioDocument7 pagesDeltron Company's Break Even Analysis Particulars Amount: PV RatiorajyalakshmiNo ratings yet

- Mapping Your Competitive PositionDocument14 pagesMapping Your Competitive PositionAmanpreet RandhawaNo ratings yet

- Packaged CleanDrinking Water Business PlanDocument12 pagesPackaged CleanDrinking Water Business PlanRita Tamrakar100% (1)

- 100 Things Successful Leaders Do - Little Lessons in LeadershipDocument332 pages100 Things Successful Leaders Do - Little Lessons in LeadershipKapil AroraNo ratings yet

- DNO Permit To Work (PTW) Procedure GuidanceDocument29 pagesDNO Permit To Work (PTW) Procedure GuidanceYasir AmerNo ratings yet

- Inspiring Founders 1684828617737Document35 pagesInspiring Founders 1684828617737syed fadzilNo ratings yet

- 11Document3 pages11Carlo ParasNo ratings yet