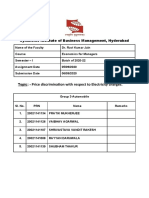

Professional Documents

Culture Documents

Jama Ledley 2020 Oi 200005

Jama Ledley 2020 Oi 200005

Uploaded by

PRATIK MUKHERJEEOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jama Ledley 2020 Oi 200005

Jama Ledley 2020 Oi 200005

Uploaded by

PRATIK MUKHERJEECopyright:

Available Formats

Research

JAMA | Original Investigation

Profitability of Large Pharmaceutical Companies Compared

With Other Large Public Companies

Fred D. Ledley, MD; Sarah Shonka McCoy, PhD; Gregory Vaughan, PhD; Ekaterina Galkina Cleary, PhD

Editorial pages 826, 829, and

IMPORTANCE Understanding the profitability of pharmaceutical companies is essential to 831

formulating evidence-based policies to reduce drug costs while maintaining the industry’s Supplemental content

ability to innovate and provide essential medicines.

CME Quiz at

OBJECTIVE To compare the profitability of large pharmaceutical companies with other jamacmelookup.com and CME

large companies. Questions page 889

DESIGN, SETTING, AND PARTICIPANTS This cross-sectional study compared the annual profits

of 35 large pharmaceutical companies with 357 companies in the S&P 500 Index from 2000

to 2018 using information from annual financial reports. A statistically significant differential

profit margin favoring pharmaceutical companies was evidence of greater profitability.

EXPOSURES Large pharmaceutical vs nonpharmaceutical companies.

MAIN OUTCOMES AND MEASURES The main outcomes were revenue and 3 measures of annual

profit: gross profit (revenue minus the cost of goods sold); earnings before interest, taxes,

depreciation, and amortization (EBITDA; pretax profit from core business activities); and net

income, also referred to as earnings (difference between all revenues and expenses). Profit

measures are described as cumulative for all companies from 2000 to 2018 or annual profit

as a fraction of revenue (margin).

RESULTS From 2000 to 2018, 35 large pharmaceutical companies reported cumulative

revenue of $11.5 trillion, gross profit of $8.6 trillion, EBITDA of $3.7 trillion, and net income of

$1.9 trillion, while 357 S&P 500 companies reported cumulative revenue of $130.5 trillion,

gross profit of $42.1 trillion, EBITDA of $22.8 trillion, and net income of $9.4 trillion. In

bivariable regression models, the median annual profit margins of pharmaceutical companies

were significantly greater than those of S&P 500 companies (gross profit margin: 76.5% vs

37.4%; difference, 39.1% [95% CI, 32.5%-45.7%]; P < .001; EBITDA margin: 29.4% vs 19%;

difference, 10.4% [95% CI, 7.1%-13.7%]; P < .001; net income margin: 13.8% vs 7.7%;

difference, 6.1% [95% CI, 2.5%-9.7%]; P < .001). The differences were smaller in regression

models controlling for company size and year and when considering only companies

reporting research and development expense (gross profit margin: difference, 30.5% [95% Author Affiliations: Center for

Integration of Science and Industry,

CI, 20.9%-40.1%]; P < .001; EBITDA margin: difference, 9.2% [95% CI, 5.2%-13.2%]; P < .001;

Department of Natural & Applied

net income margin: difference, 3.6% [95% CI, 0.011%-7.2%]; P = .05). Sciences, Bentley University,

Waltham, Massachusetts (Ledley);

CONCLUSIONS AND RELEVANCE From 2000 to 2018, the profitability of large pharmaceutical Department of Management, Bentley

companies was significantly greater than other large, public companies, but the difference University, Waltham, Massachusetts

was less pronounced when considering company size, year, or research and development (Ledley); Department of

Accountancy, Bentley University,

expense. Data on the profitability of large pharmaceutical companies may be relevant to

Waltham, Massachusetts (McCoy);

formulating evidence-based policies to make medicines more affordable. Department of Accounting,

University of New Mexico,

Albuquerque, New Mexico (McCoy);

Department of Mathematical

Sciences, Bentley University,

Waltham, Massachusetts (Vaughan);

Center for Integration of Science and

Industry, Department of

Mathematical Sciences, Bentley

University, Waltham, Massachusetts

(Cleary).

Corresponding Author: Fred D.

Ledley, Center for Integration of

Science and Industry, Bentley

University, Jennison Hall 144, 175

Forest St, Waltham, MA 02452

JAMA. 2020;323(9):834-843. doi:10.1001/jama.2020.0442 (fledley@bentley.edu).

834 (Reprinted) jama.com

© 2020 American Medical Association. All rights reserved.

Downloaded From: https://edhub.ama-assn.org/ on 07/26/2021

Profitability of Large Pharmaceutical Companies vs Other Large Public Companies Original Investigation Research

P

olicy makers face growing pressure to reduce the cost

of drugs in the United States.1-6 This pressure arises from Key Points

concern that essential drugs are increasingly unafford-

Question How do the profits of large pharmaceutical companies

able and that excessive pharmaceutical company profits con- compare with those of other companies from the S&P 500 Index?

tribute to high drug prices.1,5,7-11

Findings In this cross-sectional study that compared the profits of

Large, for-profit companies play a central role in provid-

35 large pharmaceutical companies with those of 357 large,

ing medicines to the public. Virtually all of the US Food and

nonpharmaceutical companies from 2000 to 2018, the median

Drug Administration–approved medicines in the United States net income (earnings) expressed as a fraction of revenue was

were developed by for-profit corporations.12 The 25 largest significantly greater for pharmaceutical companies compared with

pharmaceutical companies accounted for 73% of all pharma- nonpharmaceutical companies (13.8% vs 7.7%).

ceutical sales in 2015.5 As such, it has been argued that phar-

Meaning Large pharmaceutical companies were more profitable

maceutical companies have an obligation to balance their re- than other large companies, although the difference was smaller

sponsibility to patients and the profit expectations of their when controlling for differences in company size, research and

shareholders.1-7,10,13 development expense, and time trends.

Thus, evidence-based policy aimed at reducing the cost

of medicines requires a detailed understanding of both drug

costs and company profits. While there is extensive literature of pharmaceutical products from the S&P 500 Index or

on the adverse consequences of high drug prices, there has PharmaExpert “top 50” in 2018. Companies without data in

been little research on industry profits.1 The objective of this Compustat were excluded.

study was to compare the profitability of large, publicly traded The S&P 500 data set comprised companies listed in

companies engaged in the research, development, manufac- the S&P 500 Index in 2018, excluding (1) companies catego-

ture, marketing, and sale of pharmaceutical products with that rized as pharmaceutical, biotechnology, or health care prod-

of other large, publicly traded companies. ucts; (2) companies with data in the financial services format

(mostly banks, savings and loans, insurance, or real estate in-

vestment trust); and (3) fiscal years without necessary data

in Compustat. S&P 500 companies were classified by the

Methods Bloomberg Industry Classification System as communica-

This cross-sectional study compared the profitability of tions, consumer discretionary, consumer staples, energy,

large pharmaceutical companies with companies in the health care (excluding companies in the pharmaceutical data

S&P 500 Index from 2000 to 2018 using information from an- set), industrials, materials, technology, utilities, or other.

nual financial reports. “Other” included primarily banks, savings and loans, insur-

ance, or real estate investment trust with data in the indus-

Data trial format.

Audited financial data for fiscal years 2000 to 2018 were re- The health care data set combined the pharmaceutical data

trieved from Compustat (Wharton Research Data Services), in- set and the health care sector of the S&P 500 data set. These

cluding end of fiscal year stock price; common shares out- companies were subclassified as pharmaceutical; distribu-

standing; revenue; gross profit; net income; research and tion, retail, information; insurance, health services; or other

development expense; in-process research and development products. The list of companies and sector classifications is pro-

expense; selling, general, and administrative expense; and vided in eTable 1 in the Supplement.

earnings before interest, taxes, depreciation, and amortiza- Subset analyses included (1) data from fiscal years with re-

tion (EBITDA). Calculated data included market capitalization ported research and development expense (research and de-

(end of fiscal year stock price × common shares outstanding); velopment >0), (2) data from fiscal years that companies were

cost of goods sold (revenue − gross profit); research and de- listed in the S&P 500 Index, and (3) data only from the years

velopment expense (research and development expense 2014 to 2018. Sector analysis compared pharmaceutical com-

[Compustat variable] + in-process research and development panies with companies in each sector and to a set of the larg-

expense); selling, general, and administrative expense (sell- est technology companies: Alphabet (Google), Amazon, Apple,

ing, general, and administrative expense [Compustat vari- and Microsoft.

able] − research and development expense [Compustat vari-

able]); gross profit margin (gross profit/revenue); EBITDA Outcomes

margin (EBITDA/revenue); and net income margin (net in- The primary outcome was the difference between the profits

come/revenue). Financial terms are described in the Box and of companies in the pharmaceutical data set and the S&P 500

the eAppendix in the Supplement. Financial metrics are pre- data set from 2000 to 2018 expressed as percent of revenue

sented in US dollars adjusted for inflation to 2016 using the (margin) and calculated by median regression. Three distinct

Consumer Price Index for All Urban Consumers data. measures of corporate profit were examined: gross profit, rep-

resenting the difference between revenue and cost of goods

Pharmaceutical, S&P 500, and Health Care Data Sets sold; EBITDA, representing the pretax profit from the core busi-

The pharmaceutical data set comprised companies involved ness activities of the company; and net income (earnings), rep-

in research, development, manufacture, marketing, and sale resenting the difference between all revenue and expenses.

jama.com (Reprinted) JAMA March 3, 2020 Volume 323, Number 9 835

© 2020 American Medical Association. All rights reserved.

Downloaded From: https://edhub.ama-assn.org/ on 07/26/2021

Research Original Investigation Profitability of Large Pharmaceutical Companies vs Other Large Public Companies

dian regression model were assessed via residual vs fitted val-

Box. Accounting and Finance Termsa ues plots, and no evidence of a violation of the median regres-

sion assumption was found. Pseudo R2 value was calculated

Revenue

Total amount of sales after discounts, credits, or rebates. to assess the explanatory power of the model.

The median and 95% CI of the difference in profit mar-

Market capitalization

gins of pharmaceutical and S&P 500 companies were esti-

A measure of company size calculated as the stock price multiplied

mated by bivariable regressions for each profit measure. Two

by the number of shares outstanding.

similar bivariable models with a single indicator variable

Expense metrics (PHARMA) were used. In the first model, with PHARMA = 0

Cost of goods sold

for pharmaceutical companies, the intercept estimated the

Costs of producing or purchasing products that are sold.

median pharmaceutical profit margin and the coefficient

Research and development expense estimated the median difference between pharmaceutical

Costs of both basic research and development. and S&P 500 companies. In the second model, with

Selling, general, and administrative expense PHARMA = 1 for pharmaceutical companies, the intercept

Costs of marketing and sales as well as administration and estimated the median S&P 500 profit margin and the coeffi-

management. cient estimated the median difference between S&P 500 and

Profit metrics pharmaceutical companies.

Gross profit The multivariable model included the PHARMA indica-

The difference between revenue and cost of goods sold. Gross tor variable set to 0 for S&P 500 companies and 1 for phar-

profit margin is gross profit as a percentage of revenue. maceutical companies, market capitalization as a proxy for

Earnings before interest, tax, depreciation, and amortization company size, and year fixed effects to account for time

(EBITDA) trends. The model specification was as follows: PROFIT

The difference between revenue and expenses related to the core METRICi,t =β0i,t +β1PHARMAi + β2Market Capitalizationi,t + β

business, but not expenses related to interest, taxes, or the (Year Fixed Effects) + εi,t.

reduction in the value of assets over time. EBITDA margin is Standard errors were estimated using the bootstrapping

EBITDA as a percentage of revenue.

method (10 000 bootstrap replications; initial seed set equal

Net income to 495) with samples drawn from company clusters with re-

The difference between all revenues and expenses, often referred placement to address time-series correlation in the residual.15

to as the bottom line or earnings. Net income margin is net income Bonferroni correction was unnecessary for these analyses.

as a percentage of revenue.

Secondary analyses were the difference between pharma-

a

A detailed description of accounting and finance terms is provided in the ceutical and S&P 500 profit margins in subsets of the data in-

eAppendix in the Supplement. cluding (1) years with reported research and development ex-

pense (research and development >0), (2) years when these

Financial terms are described in the Box and defined in the eAp- companies were listed in the S&P 500 Index, and (3) the years

pendix in the Supplement. 2014 to 2018.

For sector analysis, the multivariable model eliminated the

Statistical Analyses PHARMA indicator and included an indicator for each of

Cumulative financial metrics were calculated as the sum of an- the 10 industrial sectors (industry fixed effects): PROFIT

nual values from 2000 to 2018. Normality of data was as- METRICi,t =β0i,t +β1Market Capitalizationi,t +β(Year Fixed Ef-

sessed using the Kolmogorov-Smirnov test. Descriptive analy- fects)+β(Industry Fixed Effects)+ εi,t.

sis included calculation of median and interquartile range, In this model, the coefficients for each sector indicator rep-

Mann-Whitney tests of significance, and Hodges-Lehman es- resented the difference in profit between pharmaceutical com-

timator of median difference. The Hodges-Lehman estimator panies and that sector. Because 10 sectors were examined, sig-

accounts for variation within data sets and is not equivalent nificance was interpreted with a Bonferroni correction of 10,

to the difference of the medians. Because this analysis in- meaning that P < .005 was considered significant.

volved 20 comparisons, significance was interpreted with a All tests were 2-tailed. Except where previously noted,

Bonferroni correction of 20, meaning that P < .0025 was con- a 2-sided P value less than .05 was considered signifi-

sidered significant. cant. Kolmogorov-Smirnov and Mann-Whitney tests, as well

The profit margins of pharmaceutical companies were as the Hodges-Lehman estimator, were performed using

compared with subsectors of the health care data set by Mann- SPSS version 26. Median regression was performed using

Whitney tests and the Hodges-Lehman estimator. Because this Stata/SE version 15.

analysis involved 3 comparisons, significance was inter-

preted with a Bonferroni correction of 3, meaning that P < .016

was considered significant.

Results

As the normality of residuals of classic linear regression es-

timated by the Shapiro-Wilk W test was rejected (P < .001), pri- Data Description

mary outcomes were examined by median regression.14 The The pharmaceutical data set comprised 35 companies and

linearity and additivity of explanatory variables in the me- 631 fiscal years of data, the S&P 500 data set comprised 357

836 JAMA March 3, 2020 Volume 323, Number 9 (Reprinted) jama.com

© 2020 American Medical Association. All rights reserved.

Downloaded From: https://edhub.ama-assn.org/ on 07/26/2021

Profitability of Large Pharmaceutical Companies vs Other Large Public Companies Original Investigation Research

companies and 6258 fiscal years of data, and the health care

Figure 1. Annual Financial Metrics of 35 Large Pharmaceutical

data set comprised 87 companies and 1552 fiscal years and 357 Companies From the S&P 500, 2000-2018

of data.

From 2000 to 2018, the cumulative revenue of compa- A Annual financial metrics

nies in the pharmaceutical data set was $11.5 trillion, with gross Revenue

profit of $8.6 trillion (74.5% of cumulative revenue), EBITDA Pharmaceutical (n = 35)

S&P 500 (n = 357)

of $3.7 trillion (32.2% of cumulative revenue), and net in- Cost of goods sold

come of $1.9 trillion (16.2% of cumulative revenue) (eTable 2 Pharmaceutical (n = 35)

S&P 500 (n = 357)

in the Supplement). The cumulative revenue of companies Research and development

in the S&P 500 data set was $130.5 trillion, with gross Pharmaceutical (n = 35)

S&P 500 (n = 357)

profit of $42.1 trillion (32.3% of cumulative revenue),

Selling, general, and administrative

EBITDA of $22.8 trillion (17.5% of cumulative revenue), and net Pharmaceutical (n = 35)

S&P 500 (n = 357)

income of $9.4 trillion (7.2% of cumulative revenue) (eTable 2

Gross profit

in the Supplement). Pharmaceutical (n = 35)

S&P 500 (n = 357)

The Kolmogorov-Smirnov test rejected the null hypoth-

EBITDA

esis that corporate profit data was normally distributed Pharmaceutical (n = 35)

S&P 500 (n = 357)

(P < .001), indicating that statistical tests comparing mean val-

Net income

ues were not appropriate, so analyses were performed using Pharmaceutical (n = 35)

S&P 500 (n = 357)

tests of median values.

–10 0 10 20 30 40 50 60 70

Comparison of Pharmaceutical and S&P 500 Profits $ Billions

Figure 1A shows the distribution of annual financial metrics

for companies in the pharmaceutical and S&P 500 data sets. B Annual revenue

There was no significant difference between the median an- Cost of goods sold

Pharmaceutical (n = 35)

nual revenue of pharmaceutical and S&P 500 companies S&P 500 (n = 357)

($10.6 billion vs $8.4 billion; median difference, −$289 mil- Research and development

lion [95% CI, −$971 million to $569 million]; P = .47). Pharmaceutical (n = 35)

S&P 500 (n = 357)

However, pharmaceutical companies were significantly Selling, general, and administrative

larger than S&P 500 companies as measured by median mar- Pharmaceutical (n = 35)

S&P 500 (n = 357)

ket capitalization ($36.1 billion vs $12.2 billion; median differ- Gross profit

ence, $15.6 billion [95% CI, $12.0 billion to $19.7 billion]; Pharmaceutical (n = 35)

S&P 500 (n = 357)

P < .001) (Table 1). EBITDA

Figure 1B shows the distribution of annual expenses and Pharmaceutical (n = 35)

S&P 500 (n = 357)

profit metrics as a fraction of annual revenue. Pharmaceuti- Net income

cal companies had significantly lower median cost of goods Pharmaceutical (n = 35)

S&P 500 (n = 357)

sold as a fraction of revenues than S&P 500 companies

(23.5% vs 62.6%; median difference, –32.6% [95% CI, −34.5% –20 0 20 40 60 80 100 120

Revenue, %

to −30.6%]; P < .001), but significantly higher median

research and development expense as a fraction of revenue

Box plot lines represent the 25th percentile, median, and 75th percentile.

(16.2% vs 0%; median difference, 14.5% [95% CI, 14.0%- Whiskers are 1.5 times the interquartile ranges. Financial terms are defined in

14.9%]; P < .001) and median sales, general, and administra- the Box. A, Annual financial metrics in millions of US dollars inflation adjusted to

tive expense as a fraction of revenue (28.2% vs 16.6%; 2016. B, Annual financial metrics as a percentage of annual revenue. Gross

profit; earnings before interest, taxes, depreciation, and amortization (EBITDA);

median difference, 10.7% [95% CI, 9.8%-11.5%]; P < .001) and net income expressed as a percent of revenues represent gross profit

(Table 1). Distributions of these data are illustrated in eFig- margin, EBITDA margin, and net income margin, respectively.

ure 1 in the Supplement.

Pharmaceutical companies had significantly higher

annual profit margins than S&P 500 companies for the able median regression, the difference in median gross

3 primary outcome measures of gross profit, EBITDA, and profit margin was 39.1% ([95% CI, 32.5%-45.7%]; P < .001),

net income (P < .001) (Table 1). These results were con- the difference in EBITDA margin was 10.4% ([95% CI, 7.1%-

firmed using bivariable median regression (Table 2). For 13.7%]; P < .001), and the difference in net income margin

pharmaceutical companies, the median gross profit margin was 6.1% ([95% CI, 2.5%-9.7%]; P < .001).

was 76.5% (95% CI, 70.3%-82.7%), the median EBITDA mar-

gin was 29.4% (95% CI, 26.3%-32.5%), and the median Controls and Subset Analysis

net income margin was 13.8% (95% CI, 10.2%-17.4%). For The difference in annual profit margins for pharmaceutical and

S&P 500 companies, the median gross profit margin was S&P 500 companies was estimated with controls for com-

37.4% (95% CI, 35.2%-39.6%), the median EBITDA margin pany size (market capitalization) and time trends (year fixed

was 19% (95% CI, 17.8%-20.3%), and the median net income effects) using median multivariable regression (Table 2). Com-

margin was 7.7% (95% CI, 7.2%-8.2%) (Table 2). In bivari- plete results of the regression analyses are available in eTable 7

jama.com (Reprinted) JAMA March 3, 2020 Volume 323, Number 9 837

© 2020 American Medical Association. All rights reserved.

Downloaded From: https://edhub.ama-assn.org/ on 07/26/2021

Research Original Investigation Profitability of Large Pharmaceutical Companies vs Other Large Public Companies

Table 1. Financial Metrics for Large Pharmaceutical and S&P 500 Companies From 2000 to 2018

Median Amount, $b Median Revenue, %c

Pharmaceutical S&P 500 Pharmaceutical S&P 500

(35 companies; (357 companies; (35 companies; (357 companies;

a

Financial Metric 631 fiscal yearsd) 6258 fiscal yearsd) Difference (95% CI) e

631 fiscal yearsd) 6258 fiscal yearsd) Difference (95% CI)e

Market capitalization 36 103 12 159 15 562 (12 024 to 19 737) NA NA NA

Revenues 10 564 8426 −289 (−971 to 569) NA NA NA

Expense metrics

Cost of goods sold 2276 5265 −2147 (−2558 to −1733) 23.5 62.6 −32.6 (−34.5 to −30.6)

Research and 1247 0 982 (861 to 1141) 16.2 0.00 14.5 (14.0 to 14.9)

development

Selling, general, 3528 1216 1589 (1232 to 1969) 28.2 16.6 10.7 (9.8 to 11.5)

and administrative

Profit metrics

Gross profit 6556 2885 2528 (1755 to 3440) 76.5 37.4 32.6 (30.6 to 34.5)

EBITDA 3152 1535 886 (562 to 1257) 29.4 19.0 8.8 (7.7 to 9.9)

Net income 1147 574 420 (256 to 612) 13.8 7.7 4.5 (3.6 to 5.4)

d

Abbreviations: EBITDA, earnings before interest, tax, depreciation, and One fiscal year represents 1 observation in the statistical analysis.

amortization; NA, not applicable. e

Median difference between pharmaceutical and S&P 500 data sets, with 95%

a

For definitions of financial metrics, see the Box or the eAppendix in the CI calculated as Hodges-Lehman estimator. This value is calculated as the

Supplement. median of differences between all pairs of observations from the

b

Value in US dollars inflation adjusted to 2016. pharmaceutical and S&P 500 data set and may not be equivalent to the simple

c

difference between medians or to the differential profit margins calculated

Profit metrics expressed as percentage of annual revenue represent

using multivariable regression models with controls.

profit margins.

in the Supplement. With these controls, pharmaceutical com- company size and time trends. In this analysis, the difference

panies were significantly more profitable, although there was in gross profit margin was 37.2% ([95% CI, 25.4%-49.0%];

less of a difference between pharmaceutical and S&P 500 com- P < .001); EBITDA margin, 11.1% ([95% CI, 5.4%-16.8%];

panies. The difference in gross profit margin was 34.6% ([95% P < .001); and net income margin, 6.8% ([95% CI, 3.5%-

CI, 25.3%-44.0%]; P < .001), the difference in EBITDA mar- 10.1%]; P < .001) (Table 2). While these estimates of the dif-

gin was 8.6% ([95% CI, 4.7%-12.5%]; P < .001), and the differ- ferential profit were higher than those calculated with the

ence in net income margin was 4.1% ([95% CI, 0.6%-7.5%]; complete data set, they were not outside the 95% CI of the

P = .02) (Table 2). complete data set.

While pharmaceutical companies reported research The profit margins of pharmaceutical and S&P 500 com-

and development expense in every year from 2000 to 2018, panies over the past 5 years were compared using a subset of

S&P 500 companies reported research and development data from 2014 to 2018 with controls for company size and time

expense in less than half of those years (Table 1). Considering trends. Over this interval, the median gross profit and EBITDA

a subset of data with nonzero research and development margins of pharmaceutical companies were significantly higher

expense and controls for company size and time trends, than S&P 500 companies, but there was no significant differ-

pharmaceutical companies were significantly more profitable ence in the median net income margin. The difference in gross

than S&P 500 companies, although the difference in net profit margin was 35.8% ([95% CI, 28.3%-43.4%]; P < .001);

income margin was reduced. In this analysis, the difference EBITDA margin, 9.0% ([95% CI, 2.9%-15.1%]; P = .004); and

in gross profit margin was 30.5% ([95% CI, 20.9%-40.1%]; net income margin, 2.3% ([95% CI, −1.0% to 5.6%]; P = .17)

P < .001), the difference in EBITDA margin was 9.2% ([95% (Table 2).

CI, 5.2%-13.2%]; P < .001), and the difference in net income

margin was 3.6% ([95% CI, 0.01%-7.2%]; P = .05) (Table 2). Comparison of Pharmaceutical Companies

These estimates of the differential profit were not outside the and S&P 500 Sectors

95% CI for the complete data set. The profit margins of pharmaceutical companies and compa-

Both the pharmaceutical and S&P 500 data sets included nies in 10 sectors of the S&P 500 (eTable 3 in the Supple-

data from companies such as Incyte, Gilead, Vertex, Amazon, ment) were compared. Medians and interquartile ranges

Salesforce, and Twitter in the years before they were listed in are shown in Figure 2A and median regression with con-

the S&P 500 Index. To assess whether the inclusion of data trols for company size and time trends is shown in Table 3.

from these years biased estimates of differential profit, the Complete results of regression analysis are available in

profits of pharmaceutical and S&P 500 companies were com- eTable 8 in the Supplement. In this analysis, the median

pared using a subset of data comprising years that companies gross profit margin of pharmaceutical companies was signifi-

were listed in the S&P 500 Index along with controls for cantly higher than that of companies in each of the S&P 500

838 JAMA March 3, 2020 Volume 323, Number 9 (Reprinted) jama.com

© 2020 American Medical Association. All rights reserved.

Downloaded From: https://edhub.ama-assn.org/ on 07/26/2021

Profitability of Large Pharmaceutical Companies vs Other Large Public Companies Original Investigation Research

Table 2. Differential Profit Margins of Pharmaceutical and S&P 500 Companies

Differential

Profit Margin

of Pharmaceutical

Reference Companies Relative

No. of No. of Profit Margin to S&P 500 Companies

Profit Margina Sample Period Companies Fiscal Yearsb (95% CI), % Revenuec (95% CI), % Revenued Pseudo R2

Gross profit margin

Bivariablee 2000-2018 392 6889 37.4 (35.2 to 39.6) 39.1 (32.5 to 45.7) .06

Multivariablef 2000-2018 392 6889 32.1 (28.8 to 35.4) 34.6 (25.3 to 44.0) .07

Multivariable 2000-2018 219 3553 37.6 (33.1 to 42.0) 30.5 (20.9 to 40.1) .08

(R&D >0)g

Multivariable 2000-2018 378 5087 30.9 (27.6 to 34.2) 37.2 (25.4 to 49.0) .09

(S&P 500)h

Multivariable 2014-2018 392 1918 37.5 (35.6 to 39.5) 35.8 (28.3 to 43.4) .11

(2014-2018)i

EBITDA margin

Bivariablee 2000-2018 392 6889 19.0 (17.8 to 20.3) 10.4 (7.1 to 13.7) .01

Multivariablef 2000-2018 392 6889 15.9 (14.5 to 17.4) 8.6 (4.7 to 12.5) .02

Multivariable 2000-2018 219 3553 15.3 (13.7 to 16.9) 9.2 (5.2 to 13.2) .04

(R&D >0)g

Multivariable 2000-2018 378 5087 17.2 (15.4 to 19.0) 11.1 (5.4 to 16.8) .06

(S&P 500)h

Multivariable 2014-2018 392 1918 19.7 (18.6 to 20.7) 9.0 (2.9 to 15.1) .04

(2014-2018)i

Net income margin

Bivariablee 2000-2018 392 6889 7.7 (7.2 to 8.2) 6.1 (2.5 to 9.7) .003

Multivariablef 2000-2018 392 6889 5.4 (4.7 to 6.2) 4.1 (0.6 to 7.5) .01

Multivariable 2000-2018 219 3553 6.1 (4.9 to 7.3) 3.6 (1.1x10−2 to 7.2) .02

(R&D >0)g

Multivariable 2000-2018 378 5087 5.9 (5.0 to 6.8) 6.8 (3.5 to 10.1) .05

(S&P 500)h

Multivariable 2014-2018 392 1918 8.0 (7.3 to 8.8) 2.3 (-1.0 to 5.6) .02

(2014-2018)i

a f

For definitions of financial metrics, see the Box or eAppendix in the Supplement. The multivariable median regression model included an indicator variable

b

Each fiscal year represents 1 observation in the statistical analysis. (PHARMA) set equal to 1 for pharmaceutical companies, a variable to control

c

for company size (market capitalization), and an indicator variable for each

The reference profit margin is the intercept of the median regression models.

year to control for time trends.

In the bivariable model, the intercept represents the median profit margins of

g

S&P 500 companies. In the multivariable model, the intercept represents the Estimates of differential profit by multivariable median regression on data only

median profit margin of S&P 500 companies when all year indicator variables from fiscal years with nonzero research and development (R&D) expense. All

and the company size variable are set equal to zero. pharmaceutical companies had nonzero R&D expense for all years in the study.

d

This model compares the profitability of pharmaceutical companies to only

The differential profit margin of pharmaceutical companies relative to the

those S&P 500 companies with nonzero R&D expense in a given year.

S&P 500 is the coefficient of the PHARMA indicator variable. The coefficient

h

value represents the differential profit margin for pharmaceutical companies Estimates of differential profit by multivariable median regression on data only

compared with S&P 500 companies (after controlling for size and year in the from fiscal years during which a company was included in the S&P 500 Index.

multivariable model). This excludes data from companies in the years before they were included in

e

the S&P 500 Index.

The bivariable median regression model included an indicator variable

i

(PHARMA) set equal to 1 for pharmaceutical companies. The bivariable model Estimates of differential profit by multivariable median regression on data only

does not include terms for company size (market capitalization) or year from 2014 to 2018.

(year fixed effects).

sectors. The median EBITDA margin of pharmaceutical com- (83.1%) were similar to those of pharmaceutical companies,

panies was significantly greater than that of companies in the while those of Apple (40.8%) and Amazon (26.8%) were lower.

consumer staples, materials, industrials, consumer discre- The median annual EBITDA margin of Apple was 29.0%;

tionary, and health care sectors, but not companies in the tech- Alphabet, 33.0%; Microsoft, 41.7%; and Amazon, 6.0%.

nology, other, utilities, communications, or energy sectors. The The median annual net income margin of Apple was 19.2%;

net income margin of pharmaceutical companies was higher Alphabet, 21.9%; Microsoft, 27.6%; and Amazon, 1.7% (eTable 4

than that of companies in each sector except for technology in the Supplement).

and other, although the difference was only significant for the The profit margins of pharmaceutical companies were

consumer discretionary and health care sectors. compared with 3 other subsectors of the health care data set

Considering 4 of the largest S&P 500 companies, Amazon, (Figure 2B and eTable 5 in the Supplement). Pharmaceutical

Alphabet (Google), Apple, and Microsoft, the median an- companies had significantly higher median gross profit mar-

nual gross profit margins of Alphabet (65.8%) and Microsoft gins and EBITDA margins than companies in other health

jama.com (Reprinted) JAMA March 3, 2020 Volume 323, Number 9 839

© 2020 American Medical Association. All rights reserved.

Downloaded From: https://edhub.ama-assn.org/ on 07/26/2021

Research Original Investigation Profitability of Large Pharmaceutical Companies vs Other Large Public Companies

Figure 2. Annual Profit Margins of Pharmaceutical Companies Compared With Other Industrial Sectors

A Pharmaceutical companies vs S&P 500 industrial sectors

Gross profit

Pharmaceutical (n = 35)

S&P 500

Technology (n = 65)

Other (n = 8)

Utilities (n = 29)

Consumer staples (n = 35)

Materials (n = 25)

Communications (n = 22)

Industrials (n = 54)

Consumer discretionary (n = 71)

Energy (n = 31)

Health care (other) (n = 17)

EBITDA

Pharmaceutical (n = 35)

S&P 500

Technology (n = 65)

Other (n = 8)

Utilities (n = 29)

Consumer staples (n = 35)

Materials (n = 25)

Communications (n = 22)

Industrials (n = 54)

Consumer discretionary (n = 71)

Energy (n = 31)

Health care (other) (n = 17)

Net income

Pharmaceutical (n = 35)

S&P 500

Technology (n = 65)

Other (n = 8)

Utilities (n = 29)

Consumer staples (n = 35)

Materials (n = 25)

Communications (n = 22)

Industrials (n = 54)

Consumer discretionary (n = 71)

Energy (n = 31)

Health care (other) (n = 17)

–40 –20 0 20 40 60 80 100

Revenue, %

B Pharmaceutical companies vs S&P 500 health care subsectors

Gross profit

Pharmaceutical (n = 35)

S&P 500

Distribution, retail, information (n = 12)

Insurance and health services (n = 18)

Other products (n = 22) Box plot lines represent the 25th

EBITDA

percentile, median, and 75th

Pharmaceutical (n = 35)

percentile. Whiskers are 1.5 times the

S&P 500

interquartile ranges. Financial terms

Distribution, retail, information (n = 12)

are defined in the Box. Annual profit

Insurance and health services (n = 18)

Other products (n = 22)

margins are expressed as a

Net income percentage of annual revenue. A,

Pharmaceutical (n = 35) Comparison of pharmaceutical

S&P 500 companies with 10 industrial sectors

Distribution, retail, information (n = 12) in the S&P 500 data set. B,

Insurance and health services (n = 18) Comparison of pharmaceutical

Other products (n = 22) companies with 3 other subsectors of

the health care data set. EBITDA

–40 –20 0 20 40 60 80 100 indicates earnings before interest,

Revenue, % taxes, depreciation, and

amortization.

care sectors. Pharmaceutical companies also had signifi- health services (P < .001), but not higher than other product

cantly higher median net income margins than companies companies (median difference, −1.6% [95% CI, −3.1% to

in distribution, retail, and information and insurance and −0.1%]; P = .035) (eTable 6 in the Supplement).

840 JAMA March 3, 2020 Volume 323, Number 9 (Reprinted) jama.com

© 2020 American Medical Association. All rights reserved.

Downloaded From: https://edhub.ama-assn.org/ on 07/26/2021

Profitability of Large Pharmaceutical Companies vs Other Large Public Companies Original Investigation Research

Table 3. Differential Profit Margins of Pharmaceutical Companies and Sectors Within the S&P 500a

Differential Differential Differential

Gross Profit Margin EBITDA Margin Net Income Margin

Sector (95% CI), % Revenueb (95% CI), % Revenueb (95% CI), % Revenueb

Pharmaceutical reference)c 70.3 (61.1 to 79.5) 25.2 (21.3 to 29.2) 10.2 (6.6 to 13.8)

Sector within S&P 500d

Technology −14.4 (−24.0 to −4.9) −3.2 (−7.9 to 1.4) 0.9 (−2.9 to 4.7)

Otherd −32.2 (−49.3 to −15.1) −1.4 (−7.8 to 5.1) 0.3 (−4.8 to 5.3)

Utilities −45.9 (−54.7 to −37.1) 1.6 (−2.5 to 5.8) −3.3 (−6.9 to 0.3)

Consumer staples −33.6 (−43.9 to −23.3) −10.1 (−14.9 to −5.2) −3.9 (−7.7 to 0.0)

Materials −40.3 (−51.0 to −29.7) −8.5 (−13.5 to −3.6) −4.3 (−8.1 to −0.6)

Communications −27.5 (−40.9 to −14.0) −4.2 (−10.5 to 2.0) −4.6 (−8.1 to −1.0)

Industrials −43.7 (−53.0 to −34.4) −12.0 (−16.1 to −7.8) −4.9 (−8.4 to −1.4)

Consumer discretionary −39.4 (−49.0 to −29.9) −13.1 (−17.1 to −9.0) −5.4 (−9.0 to −1.8)

Energy −40.4 (−54.1 to −26.8) −4.0 (−15.9 to 8.0) −5.7 (−9.9 to −1.5)

Health care (other) −48.3 (−64.5 to −32.0) −12.3 (−18.7 to −5.9) −5.8 (−9.7 to −1.9)

Pseudo R2 .17 .06 .02

a c

Differential profit was estimated using the multivariable median regression The reference profit margin is the intercept of the median multivariable

model including an indicator variable for each sector, a control for company regression model. In these multivariable models, the reference profit margin

size (market capitalization), and indicator variables for each year (year fixed reflects the median profit margin of pharmaceutical companies when all year

effects) to control for time trends. Regressions were performed with 6889 indicator variables and the company size variable are set equal to zero.

fiscal years (observations) for the years 2000 to 2018, representing the d

Companies in the S&P 500 data set were classified by the Bloomberg Industry

combined pharmaceutical and S&P 500 data sets. For definitions of profit Classification System. Health care (other) comprised companies classified as

metrics, see the Box or eAppendix in the Supplement. health care, excluding pharmaceutical companies. Other comprised primarily

b

The differential profit margin of companies in each of the S&P 500 sectors companies in the financial services and real estate sectors that were not

relative to pharmaceutical companies was estimated as the coefficient on the excluded from the S&P 500 data set under initial sample criteria. Sectors are

indicator variable for that sector. This represents the differential profit margin ordered by the differential net income margin of the sector relative to

between companies in that sector and pharmaceutical companies after pharmaceuticals.

controlling for size and year. Negative values indicate that the profit margins of

pharmaceutical companies were larger than those for that sector.

These analyses also showed that there was consider-

Discussion able complexity underlying the differential profitability

of pharmaceutical companies. The estimated differential

In this study, the profitability of a set of large, fully integrated profitability of pharmaceutical companies was lower

pharmaceutical companies, which generate revenue primar- when controlling for company size and time trends, and was

ily from the sale of pharmaceutical products, was shown to be even lower when the analysis was restricted to years of data

significantly greater than that of other large, nonpharmaceu- with reported research and development expense. In con-

tical companies in the S&P 500 Index from 2000 to 2018. Three trast, the estimated differential profit of pharmaceutical

metrics for profitability were examined. companies was larger when the analysis was restricted to

The greatest difference between pharmaceutical and years when companies were listed in the S&P 500 Index.

S&P 500 companies was in the gross profit margin, a measure Moreover, sector analysis showed considerable overlap

of the difference between the cost of goods sold and total rev- between the EBITDA margins and net income margins of

enue. This profit measure does not take into account ex- pharmaceutical companies and those in certain other indus-

penses related to research and development or the costs of sell- trial sectors.

ing a product or managing the company. Pharmaceutical The differential profitability of pharmaceutical compa-

companies also had a significantly greater EBITDA margin, nies was also markedly lower over the past 5 years (2014 to

a measure of pretax profits from the company’s core opera- 2018), and there was no significant difference between the

tions, which does not consider nonoperational expenses, in- net income margin of pharmaceutical and S&P 500 compa-

cluding interest, taxes, or the accounting expense associated nies during this interval. Further research is required to

with reductions, in the value of company assets over time assess whether the lower differential net income of pharma-

(depreciation or amortization). In addition, pharmaceutical ceutical companies over the past 5 years represents a mean-

companies had significantly greater net income margin, a mea- ingful trend.

sure of posttax profit accounting for all revenue and ex- The present analysis focused explicitly on accounting

penses. Net income, also called earnings, represents a compa- metrics based on generally accepted accounting principles.

ny’s “bottom line” and is used to calculate earnings per share, These metrics are designed to promote consistency and com-

an important measure of profit for shareholders. parability in financial statements16 and represent important

jama.com (Reprinted) JAMA March 3, 2020 Volume 323, Number 9 841

© 2020 American Medical Association. All rights reserved.

Downloaded From: https://edhub.ama-assn.org/ on 07/26/2021

Research Original Investigation Profitability of Large Pharmaceutical Companies vs Other Large Public Companies

benchmarks for corporate performance. However, these met- Second, this analysis did not consider other companies in

rics do not reflect cash balance or cash flow in any single fis- the layered pharmaceutical distribution system. Thus, these

cal year and may not correspond with public conceptions of data do not describe the fraction of the sale price ultimately

profitability.17 Accounting terms have technical definitions recognized as profit by the health care industry.8 Such an analy-

that are often not synonymous with colloquial meaning. For sis must take into account not only the profits of pharmaceu-

example, expense is not synonymous with spending and does tical companies, but also those of insurers, pharmacy benefit

not include long-time capital investments in tangible assets managers, pharmacies, and wholesalers.6,8

(eg, facilities or equipment), capitalized acquisitions of intel- Third, this analysis did not consider whether companies

lectual property, or distributions of earnings through divi- in the pharmaceutical data set had excess profit. In accounting

dends or stock buybacks. and finance, excess profit is defined as profit over and above a

The median net income margins calculated in this report “normal” return on capital invested in the company—a return

are lower than the weighted mean net income margins that is commonly associated with the risk of the investment.

reported by the US Government Accountability Office.5 The Future research can be directed at examining the relationship

report described a weighted mean net income margin of between investment risk, returns on capital investments, and

20.1% for the 25 largest pharmaceutical companies compared reported profits.

with weighted mean net income margins ranging from 21.7% Fourth, this analysis focused explicitly on pharmaceuti-

in 2006 to 13.4% in 2015 for the 25 largest software compa- cal revenue and profit, which are only indirectly related to drug

nies and 8.9% in 2006 to 6.7% in 2015 for the largest S&P 500 prices in the United States.6,8 Pharmaceutical revenues do not

companies by revenue.5 These values are substantially lower reflect the list price of medicines, but the net received from

than those in a National Academies of Sciences, Engineering, intermediaries in the pharmaceutical distribution system af-

and Medicine report,1 which quoted an estimate of 25.5% “net ter rebates or discounts.6,8,19,20 Moreover, while the US mar-

margin” from an article in Forbes and a mean 28% margin based ket represents 47% of global pharmaceutical sales (2016-2018),21

on work from University of Southern California’s Leonard D. it generates a disproportionately larger fraction of pharmaceu-

Schaeffer Center for Health Policy and Economics.8 How- tical profits.8 Thus, while understanding pharmaceutical profits

ever, the latter value represents the profit margins of branded is essential to formulating evidence-based policy regarding

products from United States–based activities, not total com- drug pricing, considerable caution is required in applying

pany profits. these results to policies aimed at controlling drug prices in the

United States.

Limitations

This study has several limitations. First, this analysis focused

on large, fully integrated pharmaceutical companies that gen-

erate revenue and profit primarily from drug sales. It did not

Conclusions

consider small or midsized biopharmaceutical companies or From 2000 to 2018, the profitability of large pharmaceutical

biotechnology companies engaged in discovery research or companies was significantly greater than other large, public

early-stage development, which typically have little revenue companies, but the difference was less pronounced when con-

and negative profits (losses).18 As such, the pharmaceutical data sidering company size, year, or research and development ex-

set was not representative of the broad biopharmaceutical in- pense. Data on the profitability of large pharmaceutical com-

dustry and the results cannot be extrapolated to the industry panies may be relevant to formulating evidence-based policies

as a whole. to make medicines more affordable.

ARTICLE INFORMATION Role of the Funder/Sponsor: The National University or their role in this study. The authors

Accepted for Publication: January 14, 2020. Biomedical Research Foundation had no role in also thank Bentley University undergraduate

the design and conduct of the study; collection, researchers Liam Fitzgerald, Jeremy Holden, and

Author Contributions: Dr Ledley had full access to management, analysis, and interpretation of the John Reddington for assistance in data collection

all of the data in the study and takes responsibility data; preparation, review, or approval of the and Danielle Solar, BA, for assistance in preparation

for the integrity of the data and the accuracy of the manuscript; or decision to submit the manuscript of the manuscript.

data analysis. for publication. The funder did not have the right to

Concept and design: Ledley, McCoy. Data Sharing Statement: All data used in this study

veto publication or to control the decision are publicly available.

Acquisition, analysis, or interpretation of data: All regarding to which journal the manuscript

authors. was submitted.

Drafting of the manuscript: Ledley, McCoy. REFERENCES

Critical revision of the manuscript for important Disclaimer: The Center for Integration of Science 1. National Academies of Sciences, Engineering,

intellectual content: All authors. and Industry at Bentley University does not receive and Medicine. Making Medicines Affordable:

Statistical analysis: All authors. corporate support. a National Imperative. Washington, DC: National

Obtained funding: Ledley. Additional Contributions: The authors thank Steve Academies Press; 2018.

Administrative, technical, or material support: Wasserman, MBA (Bentley University); Michael 2. Skyrocketing drug prices: year one of the Trump

Ledley, McCoy. Boss, PhD (executive in residence, Bentley Administration [press release]. Washington, DC:

Supervision: Ledley. University); and Nancy Hsiung, PhD (executive in Committee on Oversight and Government Reform;

Conflict of Interest Disclosures: None reported. residence, Bentley University), for advice and May 11, 2018.

critical reading of the manuscript. Mr Wasserman is

Funding/Support: This work was supported by the faculty at Bentley University. Drs Boss and Hsiung 3. Sachs R. Prescription drug policy: the year in

National Biomedical Research Foundation. received no compensation for their work at Bentley review, and the year ahead. Health Affairs Blog

842 JAMA March 3, 2020 Volume 323, Number 9 (Reprinted) jama.com

© 2020 American Medical Association. All rights reserved.

Downloaded From: https://edhub.ama-assn.org/ on 07/26/2021

Profitability of Large Pharmaceutical Companies vs Other Large Public Companies Original Investigation Research

website. https://www.healthaffairs.org/do/10.1377/ profitable-industries-in-2016/. Accessed February 16. Conceptual Framework For Financial Reporting.

hblog20190103.183538/full/. Published January 3, 15, 2019. Norwalk, CT: Financial Accounting Standards Board;

2019. Accessed January 10, 2019. 10. Anderson R. Pharmaceutical industry gets high 2018. https://www.fasb.org/resources/ccurl/515/

4. Kesselheim AS, Avorn J, Sarpatwari A. The high on fat profits. BBC News. November 6, 2014. 412/Concepts%20Statement%20No%208.pdf.

cost of prescription drugs in the United States: https://www.bbc.com/news/business-28212223. Accessed September 22, 2019.

origins and prospects for reform. JAMA. 2016;316 Accessed November 21, 2018. 17. Kirzinger A, Lopes L, Wu B, Brodie M. KFF

(8):858-871. doi:10.1001/jama.2016.11237 11. Kirzinger A, Wu B, Brodie M. Kaiser health health tracking poll – February 2019: prescription

5. United States Government Accountability tracking poll – March 2018: views on prescription drugs. The Henry J. Kaiser Family Foundation

Office. Drug Industry: Profits, Research and drug pricing and Medicare-for-all proposals. The website. https://www.kff.org/health-costs/poll-

Development Spending, and Merger and Henry J. Kaiser Family Foundation website. finding/kff-health-tracking-poll-february-2019-

Acquisition Deals. Washington, DC: United States https://www.kff.org/health-costs/poll-finding/ prescription-drugs/. Published March 1, 2019.

Government Accountability Office; 2017. kaiser-health-tracking-poll-march-2018- Accessed March 15, 2019.

https://www.gao.gov/assets/690/688472.pdf. prescription-drug-pricing-medicare-for-all- 18. Pisano G. Science Business: the Promise, the

Accessed June 13, 2018. proposals/. Published March 23, 2018. Accessed reality, and the Future of Biotech. Boston, MA:

6. Califf RM, Slavitt A. Lowering cost and increasing September 23, 2019. Harvard Business School Press; 2006.

access to drugs without jeopardizing innovation. 12. Kinch MS, Haynesworth A, Kinch SL, Hoyer D. 19. Yu NL, Atteberry P, Bach PB. Spending on

JAMA. 2019;321(16):1571-1573. doi:10.1001/jama.2019. An overview of FDA-approved new molecular prescription drugs in the US: where does all the

3846 entities: 1827-2013. Drug Discov Today. 2014;19(8): money go? Health Affairs Blog. July 31, 2018.

7. Angell M. The pharmaceutical industry–to whom 1033-1039. doi:10.1016/j.drudis.2014.03.018 https://www.healthaffairs.org/do/10.1377/

is it accountable? N Engl J Med. 2000;342(25): 13. Lazonick W, Hopkins M, Jacobson K, Sakinç ME, hblog20180726.670593/full/. Accessed September

1902-1904. doi:10.1056/NEJM200006223422509 Tulum Ö. US pharma’s financialized business model. 23, 2019.

8. Sood N, Shih T, Van Nuys K, Goldman D. The https://www.ineteconomics.org/uploads/papers/ 20. Dusetzina SB, Bach PB. Prescription drugs—list

Flow of Money Through the Pharmaceutical WP_60-Lazonick-et-al-US-Pharma-Business-Model. price, net price, and the rebate caught in the

Distribution System. Los Angeles, CA: Leonard D. pdf. Institute for New Economic Thinking working middle. JAMA. 2019;321(16):1563-1564. doi:10.

Schaeffer Center for Health Policy & Economics; paper No. 60. Published July 13, 2017. Accessed 1001/jama.2019.2445

2017. https://healthpolicy.usc.edu/wp-content/ July 16, 2017. 21. Global pharmaceutical sales from 2016-2018,

uploads/2017/06/USC_Flow-of-MoneyWhitePaper_ 14. Koenker R. Quantile Regression. Cambridge, by region (in billion US dollars). Statista website.

Final_Spreads.pdf. Accessed February 2, 2019. United Kingdom: Cambridge University Press; 2005. https://www.statista.com/statistics/272181/world-

9. Chen L. The most profitable industries in 2016. 15. Bertrand M, Duflo E, Mullainathan S. How much pharmaceutical-sales-by-region/. Accessed April 3,

Forbes. December 21, 2015. https://www.forbes. should we trust differences-in-differences 2019.

com/sites/liyanchen/2015/12/21/the-most- estimates? Q J Econ. 2004;119(1):249-275. doi:10.

1162/003355304772839588

jama.com (Reprinted) JAMA March 3, 2020 Volume 323, Number 9 843

© 2020 American Medical Association. All rights reserved.

Downloaded From: https://edhub.ama-assn.org/ on 07/26/2021

You might also like

- Case 7 SolutionsDocument3 pagesCase 7 SolutionsMichale Jacomilla50% (2)

- MetricWarsDocument11 pagesMetricWarsMehmet MustafaogluNo ratings yet

- AKM Lanjutan 5Document12 pagesAKM Lanjutan 5busyaib syamsul sirotNo ratings yet

- Artikel 1Document17 pagesArtikel 1SITI NURHALIZHA SRNo ratings yet

- DECISION SCIENCE INSTITUTE 2015 CongressDocument18 pagesDECISION SCIENCE INSTITUTE 2015 CongressmarcelobronzoNo ratings yet

- Predicting The Performance of Msmes: A Hybrid Dea-Machine Learning ApproachDocument23 pagesPredicting The Performance of Msmes: A Hybrid Dea-Machine Learning Approachprasant barlaNo ratings yet

- 1b - McKinsey - How-Pharma-Can-Accelerate-Business-Impact-From-Advanced-Analytics PDFDocument10 pages1b - McKinsey - How-Pharma-Can-Accelerate-Business-Impact-From-Advanced-Analytics PDFDinesh PillaipakkamnattNo ratings yet

- Journal of Cleaner ProductionDocument20 pagesJournal of Cleaner ProductionHeidi RosalesNo ratings yet

- Research Notes and Commentaries Innovation Practice and Its Performance Implications in Small and Medium Enterprises (Smes) in The Manufacturing Sector: A Resource-Based ViewDocument11 pagesResearch Notes and Commentaries Innovation Practice and Its Performance Implications in Small and Medium Enterprises (Smes) in The Manufacturing Sector: A Resource-Based ViewvodrolokNo ratings yet

- Article 7Document11 pagesArticle 7Charbel KaddoumNo ratings yet

- ERP TextDocument20 pagesERP TextjohnmorriscryptoNo ratings yet

- Efficiency in The CRO Industry 2010 2019Document30 pagesEfficiency in The CRO Industry 2010 2019cd74dd9qttNo ratings yet

- The Contingent Fit Between Management Control System and Capabilities On Sustainability PerformanceDocument12 pagesThe Contingent Fit Between Management Control System and Capabilities On Sustainability PerformanceDani RahmanNo ratings yet

- Strategic Alliances Influence On SMEs Performance PDFDocument11 pagesStrategic Alliances Influence On SMEs Performance PDFDesyNo ratings yet

- Ac 2020 118Document8 pagesAc 2020 118Phạm Bảo DuyNo ratings yet

- 4500 Words Project - EditedDocument35 pages4500 Words Project - Editedkellyanne MutwiriNo ratings yet

- UntitledDocument42 pagesUntitledY-Celiboy OrochimaruNo ratings yet

- Literature Review On Management Accounting SystemDocument6 pagesLiterature Review On Management Accounting Systemea6z9033No ratings yet

- P - 16 - Farias - Gasparetto - (2016) - Inhibiting Factors of Inter-Organizational Cost Management Complementary Study - IBRDocument15 pagesP - 16 - Farias - Gasparetto - (2016) - Inhibiting Factors of Inter-Organizational Cost Management Complementary Study - IBRRafael FariasNo ratings yet

- P - 16 - Farias - Gasparetto - (2016) - Inhibiting Factors of Inter-Organizational Cost Management Complementary Study - IBRDocument15 pagesP - 16 - Farias - Gasparetto - (2016) - Inhibiting Factors of Inter-Organizational Cost Management Complementary Study - IBRRafael FariasNo ratings yet

- x3 White Paper 3Document9 pagesx3 White Paper 3djdazedNo ratings yet

- ProjDocument16 pagesProjPreethi .RNo ratings yet

- Differentiation Strategy, PerfDocument22 pagesDifferentiation Strategy, Perfclaudia90No ratings yet

- Good Criteria List For AHPDocument24 pagesGood Criteria List For AHPEng.shadid1 Sh123456No ratings yet

- 1 s2.0 S0890838921000639 MainDocument17 pages1 s2.0 S0890838921000639 MainBENJAMIN IGNACIO ABARZUA ABARZUANo ratings yet

- Abbott Memo Draft 1Document8 pagesAbbott Memo Draft 1uygh gNo ratings yet

- Effects of Working Capital Management On SME Profitability: Evidence From An Emerging EconomyDocument11 pagesEffects of Working Capital Management On SME Profitability: Evidence From An Emerging EconomyHargobind CoachNo ratings yet

- Majority Voting Ensemble With A Decision Trees For Bus - 2021 - Journal of InnovDocument12 pagesMajority Voting Ensemble With A Decision Trees For Bus - 2021 - Journal of InnovronaldwquezadaNo ratings yet

- Orking Aper Eries: 2019/26 August 2019 ISSN (ONLINE) 2284-0400Document26 pagesOrking Aper Eries: 2019/26 August 2019 ISSN (ONLINE) 2284-0400orivilNo ratings yet

- Effect of Product Development Strategy On Performance in Sugar Industry in KenyaDocument16 pagesEffect of Product Development Strategy On Performance in Sugar Industry in KenyapatNo ratings yet

- Business Model - ChallengeDocument24 pagesBusiness Model - ChallengeArun KumarNo ratings yet

- J&J Supply Chain Strategy - OdpDocument10 pagesJ&J Supply Chain Strategy - OdpChanaka PradeepNo ratings yet

- The Influence of Intellectual Capital and Institutional Ownership Towards The Firm Value in Food & Beverages Industries Period 2018-2021Document9 pagesThe Influence of Intellectual Capital and Institutional Ownership Towards The Firm Value in Food & Beverages Industries Period 2018-2021International Journal of Innovative Science and Research TechnologyNo ratings yet

- Developing ADocument15 pagesDeveloping AJivesh RajputNo ratings yet

- Q1 Knowledge Management Capabilities and Organizational Risk-Taking For Business Model Innovation in - SMEsDocument15 pagesQ1 Knowledge Management Capabilities and Organizational Risk-Taking For Business Model Innovation in - SMEstedy hermawanNo ratings yet

- The Impact of Strategic Costing Techniques On The Performance of Jordanian Listed Manufacturing CompaniesDocument13 pagesThe Impact of Strategic Costing Techniques On The Performance of Jordanian Listed Manufacturing CompaniesFeri HarnandoNo ratings yet

- 14) Loureiro et al. 2021_EJIMDocument27 pages14) Loureiro et al. 2021_EJIMandreiaNo ratings yet

- The British Accounting Review: Adam S. Maiga, Anders Nilsson, Fred A. JacobsDocument14 pagesThe British Accounting Review: Adam S. Maiga, Anders Nilsson, Fred A. JacobsMohammed SulaivanyNo ratings yet

- (2020) EML Advertising ExpendituresDocument15 pages(2020) EML Advertising ExpendituresMubashir TanveerNo ratings yet

- Swinburne Library: Swinburne University of Technology - CRICOS Provider 00111D - Swinburne - Edu.auDocument20 pagesSwinburne Library: Swinburne University of Technology - CRICOS Provider 00111D - Swinburne - Edu.auKirat GillNo ratings yet

- Impact of Total Quality Management (TQM) On Operational Performance of Ethiopian Pharmaceutical Manufacturing PlantsDocument9 pagesImpact of Total Quality Management (TQM) On Operational Performance of Ethiopian Pharmaceutical Manufacturing PlantsIJEMR JournalNo ratings yet

- Comparison of Recent Developments in Productivity Estimation: Application On Ethiopian Manufacturing SectorDocument12 pagesComparison of Recent Developments in Productivity Estimation: Application On Ethiopian Manufacturing SectorMihaela SburleaNo ratings yet

- Generic Strategies and Performance - Evidence From Manufacturing FirmsDocument30 pagesGeneric Strategies and Performance - Evidence From Manufacturing FirmsPattyNo ratings yet

- How Supply Chain Strategies Moderate The Relationsh - 2020 - Journal of PurchasiDocument14 pagesHow Supply Chain Strategies Moderate The Relationsh - 2020 - Journal of PurchasiRoshanNo ratings yet

- Company Bankruptcy Prediction With SMOTEDocument8 pagesCompany Bankruptcy Prediction With SMOTEIJRASETPublicationsNo ratings yet

- Improving Working Capital-The Next Step in Big Pharma's Transformation EffortsDocument4 pagesImproving Working Capital-The Next Step in Big Pharma's Transformation EffortssmartsandyNo ratings yet

- Neil NagyDocument32 pagesNeil Nagymasyuki1979No ratings yet

- The Application of The LogistiDocument14 pagesThe Application of The LogistiManuel LeonNo ratings yet

- Exploring The Link Between Competitive Strategies and Organizational Per-Formance in Beverage Industry. (A Case of Nestle PLC)Document11 pagesExploring The Link Between Competitive Strategies and Organizational Per-Formance in Beverage Industry. (A Case of Nestle PLC)Rana ShaheryarNo ratings yet

- Decision Sciences - 2021 - Narayanan - The Effects of Lean Implementation On Hospital Financial PerformanceDocument21 pagesDecision Sciences - 2021 - Narayanan - The Effects of Lean Implementation On Hospital Financial PerformancevikkiswarnakarNo ratings yet

- 2015-Supply Chain Collaboration AmongDocument7 pages2015-Supply Chain Collaboration AmongRosnani Ginting TBANo ratings yet

- Barclays:Florentina Felicia Barbu: G3578Document10 pagesBarclays:Florentina Felicia Barbu: G3578Barbu Florentina-FeliciaNo ratings yet

- Project Term Report QuantitativeDocument18 pagesProject Term Report QuantitativeMoizShakeelNo ratings yet

- PetMeds Analysis 3Document9 pagesPetMeds Analysis 3Марго КоваленкоNo ratings yet

- Assessment of Occupational Health and Safety Performance Evaluation ToolsDocument8 pagesAssessment of Occupational Health and Safety Performance Evaluation ToolsdewiNo ratings yet

- Wiley Journal of Accounting Research: This Content Downloaded From 132.174.250.76 On Tue, 01 Sep 2020 21:56:03 UTCDocument20 pagesWiley Journal of Accounting Research: This Content Downloaded From 132.174.250.76 On Tue, 01 Sep 2020 21:56:03 UTCBenjamin NaulaNo ratings yet

- Gebaurer Service Business DevelopmentDocument17 pagesGebaurer Service Business DevelopmentAlvaro DanielNo ratings yet

- Unleashing PharmaDocument16 pagesUnleashing Pharmamrwild1976No ratings yet

- Pavlatos Jamis2018Document20 pagesPavlatos Jamis2018marygrace04152021No ratings yet

- Strategic Antecedents and Organisational Consequences of IMC in Different Economy TypesDocument23 pagesStrategic Antecedents and Organisational Consequences of IMC in Different Economy TypesVera FierijaNo ratings yet

- EIB Working Papers 2019/02 - How energy audits promote SMEs' energy efficiency investmentFrom EverandEIB Working Papers 2019/02 - How energy audits promote SMEs' energy efficiency investmentNo ratings yet

- (CAS) - GLobal Detergents (A)Document6 pages(CAS) - GLobal Detergents (A)PRATIK MUKHERJEENo ratings yet

- High Involvement ProductsDocument11 pagesHigh Involvement ProductsPRATIK MUKHERJEENo ratings yet

- Global Detergents (C) /FM-II/003Document3 pagesGlobal Detergents (C) /FM-II/003PRATIK MUKHERJEENo ratings yet

- Legal Aspects of Business MCQ Questions and Answers Part - 3 - SAR PublisherDocument8 pagesLegal Aspects of Business MCQ Questions and Answers Part - 3 - SAR PublisherPRATIK MUKHERJEENo ratings yet

- Global Detergents (B) /FM-II/002Document3 pagesGlobal Detergents (B) /FM-II/002PRATIK MUKHERJEENo ratings yet

- Legal Aspects of Business MCQ Questions and Answers Part - 2 - SAR PublisherDocument8 pagesLegal Aspects of Business MCQ Questions and Answers Part - 2 - SAR PublisherPRATIK MUKHERJEENo ratings yet

- MCQs Unit 1 Human Resource Management and Planning PDFDocument16 pagesMCQs Unit 1 Human Resource Management and Planning PDFPRATIK MUKHERJEENo ratings yet

- Or Project Report - Group B02Document9 pagesOr Project Report - Group B02PRATIK MUKHERJEENo ratings yet

- Symbiosis Institute of Business Management, Hyderabad: East Is East and West Is WestDocument3 pagesSymbiosis Institute of Business Management, Hyderabad: East Is East and West Is WestPRATIK MUKHERJEENo ratings yet

- Theories of Motivation and Application: DR A Jagan Mohan Reddy SIBM, SIU, HyderabadDocument38 pagesTheories of Motivation and Application: DR A Jagan Mohan Reddy SIBM, SIU, HyderabadPRATIK MUKHERJEENo ratings yet

- HRM For Online ClassDocument39 pagesHRM For Online ClassPRATIK MUKHERJEENo ratings yet

- Erikson's Psychosocial Theory of Development: DR A Jagan Mohan Reddy SIBM, SIU, HyderabadDocument9 pagesErikson's Psychosocial Theory of Development: DR A Jagan Mohan Reddy SIBM, SIU, HyderabadPRATIK MUKHERJEENo ratings yet

- Team Work - MY SpeechDocument3 pagesTeam Work - MY SpeechPRATIK MUKHERJEENo ratings yet

- 6 Pricing BasicsDocument3 pages6 Pricing BasicsPRATIK MUKHERJEENo ratings yet

- Fa MCQDocument259 pagesFa MCQPRATIK MUKHERJEENo ratings yet

- Men Material Money MachineryDocument34 pagesMen Material Money MachineryPRATIK MUKHERJEENo ratings yet

- Old Multichoice AnswersDocument9 pagesOld Multichoice AnswersPRATIK MUKHERJEENo ratings yet

- Price Discrimination of Electricity - Group3 - AutomobileDocument6 pagesPrice Discrimination of Electricity - Group3 - AutomobilePRATIK MUKHERJEENo ratings yet

- 1 Defining MarketingDocument2 pages1 Defining MarketingPRATIK MUKHERJEENo ratings yet

- 2 Basic Concepts Part 1 - MarketDocument2 pages2 Basic Concepts Part 1 - MarketPRATIK MUKHERJEENo ratings yet

- Class Discussion and Assignment: DifferentiatedDocument15 pagesClass Discussion and Assignment: DifferentiatedPRATIK MUKHERJEENo ratings yet

- Liberty Mills Limited: Audit ReportDocument41 pagesLiberty Mills Limited: Audit ReportAmad MughalNo ratings yet

- ENGG ECON Part2Document11 pagesENGG ECON Part2shinamaevNo ratings yet

- Ingles en GrupoDocument8 pagesIngles en GrupoDiana RiañoNo ratings yet

- Study Guide 3030Document14 pagesStudy Guide 3030arsenal2687100% (1)

- POA Test - Accruals and PrepaymentsDocument2 pagesPOA Test - Accruals and PrepaymentsGeneva GomezNo ratings yet

- Advanced Accounting - Part 2 - New CourseDocument456 pagesAdvanced Accounting - Part 2 - New Courseimayushms15No ratings yet

- TEMLDocument57 pagesTEMLANNA BABU KOONAMAVU RCBSNo ratings yet

- Depreciation: Depreciation Value Purpose of Depreciation Types of DepreciationDocument23 pagesDepreciation: Depreciation Value Purpose of Depreciation Types of DepreciationMarcial Jr. MilitanteNo ratings yet

- 04 TP FinancialDocument4 pages04 TP Financialbless erika lendroNo ratings yet

- Doubtful AccountsDocument2 pagesDoubtful AccountsCharles Reginald K. HwangNo ratings yet

- Doid - Icmd 2009 (B04)Document4 pagesDoid - Icmd 2009 (B04)IshidaUryuuNo ratings yet

- 03 ValuationDocument114 pages03 ValuationquentindavignonNo ratings yet

- Mind Map of Accounting ElementsDocument4 pagesMind Map of Accounting ElementsSapphire Au MartinNo ratings yet

- M8 CHP 12 4 Allocation of Joint CostsDocument2 pagesM8 CHP 12 4 Allocation of Joint CostsQueennie EllamNo ratings yet

- Deptals ActDocument10 pagesDeptals ActGenalin Muaña EbonNo ratings yet

- Bhupendra Imrt B School Lucknow Difference Between Eps N DpsDocument15 pagesBhupendra Imrt B School Lucknow Difference Between Eps N Dpsbhupendra pt singhNo ratings yet

- Hawkins Cooker LimitedDocument9 pagesHawkins Cooker LimitedShreshtha SinghNo ratings yet

- Multiple Choice Answer For FM2Document14 pagesMultiple Choice Answer For FM2Sen Siew LingNo ratings yet

- Homework 1 - BSC 402Document7 pagesHomework 1 - BSC 402Filip Cano100% (1)

- Property, Plant and EquipmentDocument8 pagesProperty, Plant and EquipmentMark John Malazo RiveraNo ratings yet

- Robinsons-1DY (Recovered)Document19 pagesRobinsons-1DY (Recovered)Dyrelle ReyesNo ratings yet

- IA ActivityDocument2 pagesIA ActivityCASTRO, JHONLY ROEL C.No ratings yet

- Aspire Global Q2-21-ReportDocument25 pagesAspire Global Q2-21-Reportl chanNo ratings yet

- FM - Sept 2021Document2 pagesFM - Sept 2021Vishnu DevNo ratings yet

- Inventories TheoryDocument3 pagesInventories Theoryinfo4chaituNo ratings yet

- Auditors Report 2012Document89 pagesAuditors Report 2012Md MasumNo ratings yet

- (Chp10-12) Pas 2 - Inventory, Inventory Valuation and Inventory EstimationDocument10 pages(Chp10-12) Pas 2 - Inventory, Inventory Valuation and Inventory Estimationbigbaek0% (3)

- DuPont ModelDocument4 pagesDuPont Modelw_fibNo ratings yet