Professional Documents

Culture Documents

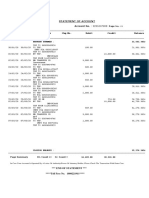

Financial Plan For The Organization

Financial Plan For The Organization

Uploaded by

Rica Mae InamargaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Plan For The Organization

Financial Plan For The Organization

Uploaded by

Rica Mae InamargaCopyright:

Available Formats

Financial Plan for the Organization

Any company, businesses or organization need funds to finance everything needed and to

continue developing the organization there are a lot of options to borrow or finance and organization.

There are two types of financing short term and long term financing.

Short term Financing

To borrow money through short term financing there are some ways just like bank loans,

commercial paper, unsecured and secured bank loans. The benefit of short term financing is that it

provides shorter maturities ranging from 1-5 years. In an organization common problems such as

temporary deficit in money happens for example accounts receivable needs to be financed immediately

and short term borrowing/ financing is one of the solution because it is simple to borrow and the money

will be received quickly by the organization. Paying short term debt is a lot easier and funds are used

more for working capital. Here are some other types of short term financing.

Trade Credit

It is a loan extended by the suppliers where you buy now pay later. This is very convenient and

commonly used for short term financing. Advantage of this is minimal cash outlay or discount for fast

payment. Since through trade credit you have your inventory or keep the shelves of your business

stocked and if you make regular sales you are able to pay seller and at the same time gain net profit.

Most of the sellers give discount if you pay early and this can help to maintain healthy cash flow. The

disadvantage is that there are penalties if you pay them late which can lead also to loss of trade credit

privileges that’s why you need to be a reliable and responsible payer.

Short Term loans

It is considered a valuable option especially for businesses or organization that is just starting. It

is a borrowed capital amount and usually the interest paid according to the said due date, which mostly

lasted for a year. The advantage of it is quick funding time which is easy to acquire because

requirements for this loan is easy to meet. But the disadvantage for this is you can only borrow small

amounts and sometimes it is hard to pay because of shorter time to pay-off debt.

Business Line of Credit

This helps the business to meet short term capital needs it is just like a business credit card

interest begins to accumulate once you draw funds and the amount you pay less the interest will be

available again to be borrowed as you pay down your balance.

Invoice Discounting

This is same with factoring which allows business owners to leverage the value of their sales

ledger. When an invoice was send out to a customer the proportion of the total amount available will

become the source of working capital for a month.

Factoring

It is a transaction when accounts receivable sold to a third party (factor) at a discount to

immediately receive cash.

Long term Financing

In long term financing there are some ways to source fund, there are a lot of companies prefer

long term financing, aside from longer maturities which often allowed for delayed, limitation or no

amortization. If the organization needs to develop or wanted to achieve future plans long term financing

is the most ideal because it is attractive for big investments that take a long time to pay off. Any

organization has its own goals like expansion or wanting for the organization to be known.

Equity Capital

It is a fund paid into a business by investors in exchange for stocks which also makes an investor

to have some degree of control in a business.

Preference Capital

This is a portion of capital raised through the issue of preference share. There is no legal

obligation in the firm to pay dividend to the shareholders.

Debentures

Also known as bond, companies used debentures in order to borrow money from public and be

paid at future date. One of its advantage is fixed income at lesser risk that’s why investors preferred it.

Term Loans

It is a loan from bank with fixed amount and fixed repayment schedule. Commonly used to

purchase equipment or having a new building.

Retained Earnings

It is the amount of net income less the dividends paid to its shareholders. The surplus money

can be utilized to sustain the growth of the business.

Financial Plan

Visualizing everything about your organization either financial or future plan are important to

pinpoint things and monitor for best timing.

1. Have a Strategic Plan

Before creating a financial plan you need to know first the strategic plan

because it will indicate the plans that the organization wants to achieve in the future.

Through that you can make assumptions and projections about the expenses or budget

needed to make those plans into reality. In the organization in strategic plan there are

some expansions or production of new product that is happening and the important

part is you will take that plan into next step of becoming into reality by planning

financial needs of that future plan. Making the organization to be known more to the

people to attract more investors. Boosting the marketing of the organization would be

very helpful also.

2. Develop Financial Projections

Create financial projection on monthly basis, focus on details needed just like

supplies, labour and sales. Realistic projection is needed, there are some instances

where the income of the company/ organization will be positive or negative. It will be

helpful to anticipate the income. If I’m going to choose a source of financing I prefer

long term financing, since this financial plan focuses more on how to grow and develop

more the organization. I need large amount of money to finance the needs of this

organization. In long term financing it is much better to choose Equity Capital because of

the investors doesn’t expect immediate return on their investment and they focus more

on future outcome. It has a lower risk for bankruptcy also.

3. Complete Financial Plan

Use those projections to know your financing needs. Seek for advice to other

financial partners and discuss the plan and possibilities that might happen. This will

became an assurance for the organization that the financial management is solid and

well managed.

4. Plan for Contingencies or Possible Financial Loss

No one wants to think about negative things that might happened in an

organization but being realistic is much important. Having plans if finances suddenly

deteriorated is important to know some emergency source of money to avoid bigger

loss or problem. If this thing happened in the organization there are a lot of options to

immediately have a cash and there are many short term financing that could help to

cover up some financial problems. Choosing short term loans would be very useful.

5. Always Monitor the Plan

Every year there are changes that is happening and comparing projection to the

present situation is important to know what to adjust and to spot problems that might

occur. Achieving a goal doesn’t happened for just a year it will took a lot of years in

order to achieve it monitoring the plan will keep you right on track.

You might also like

- Dokumen - Tips Risk Management and Insurance Mcgraw Hill PDF Management and Insurance Mcgraw HillDocument2 pagesDokumen - Tips Risk Management and Insurance Mcgraw Hill PDF Management and Insurance Mcgraw HillGayathry Rajendran RCBSNo ratings yet

- Assignment 4Document6 pagesAssignment 4Oktami IndriyaniNo ratings yet

- New Microsoft Office Word DocumentDocument50 pagesNew Microsoft Office Word Documentkrishna bajaitNo ratings yet

- Profile On The Production of Corrugated Iron SheetDocument26 pagesProfile On The Production of Corrugated Iron SheetTSEDEKE40% (5)

- Sources of FinanceDocument3 pagesSources of Financealok19886No ratings yet

- MFRD EssayDocument6 pagesMFRD Essaydoll3kittenNo ratings yet

- Best Sources of FinanceDocument14 pagesBest Sources of Financegodwillinno1997No ratings yet

- Discuss Five Sources FinanceDocument6 pagesDiscuss Five Sources Financen02315027fNo ratings yet

- E Book ENDocument17 pagesE Book ENtechnicaljeet8No ratings yet

- Banks and Other Commercial Lenders: 3 Effective Ways To Utilize Your Working Capital WiselyDocument2 pagesBanks and Other Commercial Lenders: 3 Effective Ways To Utilize Your Working Capital Wiselymariel buyagonNo ratings yet

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Financial Management: Hopeful Oby Kessa Diaz Rhealyn Vilasquez Shaira Mae TuazonDocument46 pagesFinancial Management: Hopeful Oby Kessa Diaz Rhealyn Vilasquez Shaira Mae TuazonDivine ParagasNo ratings yet

- Gayda KateDocument12 pagesGayda KateJessa GallardoNo ratings yet

- Chapter 9Document5 pagesChapter 9api-338827544No ratings yet

- Debt Vs EquityDocument4 pagesDebt Vs EquityNooraghaNo ratings yet

- CF Assignment 2 Noel George MathewDocument10 pagesCF Assignment 2 Noel George MathewNoel GeorgeNo ratings yet

- Topic 2.1 - Raising Finance Learning Outcome The Aim of This Section Is For Students To Understand The FollowingDocument8 pagesTopic 2.1 - Raising Finance Learning Outcome The Aim of This Section Is For Students To Understand The FollowinggeorgianaNo ratings yet

- Asses The Various Methods Through Which Organization Access Funding and When To Use Different Types of FundingDocument11 pagesAsses The Various Methods Through Which Organization Access Funding and When To Use Different Types of FundingAhmad Sheikh100% (1)

- A. Discuss The Advantages of Financing Capital Expenditures With DebtDocument5 pagesA. Discuss The Advantages of Financing Capital Expenditures With DebtMark SantosNo ratings yet

- Here Are Five Reasons Why Should I Study FinanceDocument5 pagesHere Are Five Reasons Why Should I Study Financekazi A.R RafiNo ratings yet

- Afm TheoryDocument4 pagesAfm TheoryMd YusufNo ratings yet

- Week 05Document6 pagesWeek 05Mohammad Tahir MehdiNo ratings yet

- Financial ManagementDocument16 pagesFinancial ManagementRahul PuriNo ratings yet

- Financing A New BusinessDocument4 pagesFinancing A New BusinessmahimenNo ratings yet

- Assignment Unit VIDocument21 pagesAssignment Unit VIHạnh NguyễnNo ratings yet

- FinancingDocument3 pagesFinancingAbdul KhanNo ratings yet

- Arrangement of Funds LPSDocument57 pagesArrangement of Funds LPSRohan SinglaNo ratings yet

- Financing ConceptsDocument5 pagesFinancing ConceptsSoothing BlendNo ratings yet

- Chapter 5 Financial Plan and Resource GenerationDocument4 pagesChapter 5 Financial Plan and Resource GenerationNazie BangayanNo ratings yet

- BT IndvidualDocument19 pagesBT IndvidualDesmondNo ratings yet

- Finance InternalDocument4 pagesFinance Internalanupam.chatterjee23-25No ratings yet

- Lecture Notes 8 On Sources of FinanceDocument31 pagesLecture Notes 8 On Sources of FinanceJohn Bates Blankson100% (7)

- What Is Business Financing?: Key TakeawaysDocument4 pagesWhat Is Business Financing?: Key TakeawaysRica RaviaNo ratings yet

- Raising Finance: Your Business PlanDocument3 pagesRaising Finance: Your Business PlanallaNo ratings yet

- HSC - Notes (Finance)Document13 pagesHSC - Notes (Finance)Devinna GraceNo ratings yet

- ES - Managing The Finance Function - FINALDocument12 pagesES - Managing The Finance Function - FINALMaj FernandezNo ratings yet

- Unit 3 Innovation & Entrepreneurship KMBN302Document21 pagesUnit 3 Innovation & Entrepreneurship KMBN302Prerna JhaNo ratings yet

- 003251-3.1 Sources of FinanceDocument53 pages003251-3.1 Sources of FinanceMirellaNo ratings yet

- Finance FunctionsDocument7 pagesFinance FunctionsTushar Mahmud SizanNo ratings yet

- Ecu302 Financial ManagementDocument5 pagesEcu302 Financial ManagementJack KimaniNo ratings yet

- Managing Financial Resources and DecisionsDocument18 pagesManaging Financial Resources and DecisionsAbdullahAlNomunNo ratings yet

- Financial Management-Compre-ReviewerDocument22 pagesFinancial Management-Compre-ReviewerDaily TaxPHNo ratings yet

- Cash Flow and Credit and Background InvestigationDocument5 pagesCash Flow and Credit and Background Investigationjan francis marianoNo ratings yet

- Entrepreneurship Chapter 11 - Sources of CapitalDocument3 pagesEntrepreneurship Chapter 11 - Sources of CapitalSoledad Perez100% (7)

- Chapter 6Document7 pagesChapter 6Elijah IbsaNo ratings yet

- UNIT-1: Corporate Finance & Its ScopeDocument7 pagesUNIT-1: Corporate Finance & Its ScopeTanya MalviyaNo ratings yet

- Financail Market Institution and Financial ServiceDocument6 pagesFinancail Market Institution and Financial Servicesuraj agarwalNo ratings yet

- Chandan Project PDFDocument95 pagesChandan Project PDFChandan Kumar NNo ratings yet

- What Is Financing?: Business Activities Financial InstitutionsDocument3 pagesWhat Is Financing?: Business Activities Financial InstitutionsRica RaviaNo ratings yet

- Financial Planning & Budgeting RAK: Sbs/Abs - Bba Assignment - 2021Document19 pagesFinancial Planning & Budgeting RAK: Sbs/Abs - Bba Assignment - 2021Toppers AENo ratings yet

- Generation and Allocation of FundsDocument2 pagesGeneration and Allocation of FundsTHUNDER STORMNo ratings yet

- Essential Guide To Financing Your StartDocument8 pagesEssential Guide To Financing Your Startgp.mishraNo ratings yet

- Individual Assignment On Intermediate Financial Accounting Feyissa Taye PDFDocument15 pagesIndividual Assignment On Intermediate Financial Accounting Feyissa Taye PDFEYOB AHMEDNo ratings yet

- Sources of Finance Table Dominic ClarkDocument4 pagesSources of Finance Table Dominic Clarkapi-285196994No ratings yet

- Financial Management SkillsDocument110 pagesFinancial Management SkillsGalwng Grace Paul (Grace papa)No ratings yet

- Tema #5. Financiamiento Y Generación de Recursos "Con Qué" 5.1. Plan FinancieroDocument6 pagesTema #5. Financiamiento Y Generación de Recursos "Con Qué" 5.1. Plan FinancieroCatalina GómezNo ratings yet

- Leverage Capital Markets Money Management: FinanceDocument13 pagesLeverage Capital Markets Money Management: FinanceIYSWARYA GNo ratings yet

- Business Finance TADocument9 pagesBusiness Finance TAOlivier MNo ratings yet

- Finance For ManagesDocument9 pagesFinance For ManagesKhadeja RemizNo ratings yet

- Venture CapitalDocument6 pagesVenture CapitalBrilliant MycriNo ratings yet

- Management AccountingDocument8 pagesManagement AccountingAKSHAY KATARENo ratings yet

- Externalities and Government PolicyDocument10 pagesExternalities and Government PolicyRica Mae InamargaNo ratings yet

- Public FinanceDocument4 pagesPublic FinanceRica Mae InamargaNo ratings yet

- Strength Weaknesses: Apple IncorporationDocument4 pagesStrength Weaknesses: Apple IncorporationRica Mae InamargaNo ratings yet

- Since Today It Is Not Easy To Trust Your Assets To Anyone Because of Scammers and Other People Will Take Advantage of Your MoneyDocument2 pagesSince Today It Is Not Easy To Trust Your Assets To Anyone Because of Scammers and Other People Will Take Advantage of Your MoneyRica Mae InamargaNo ratings yet

- VICTORY ProposalDocument18 pagesVICTORY ProposalVictory technology100% (1)

- A Project ReportDocument5 pagesA Project ReportShree DhuleNo ratings yet

- Zosky ResumeDocument5 pagesZosky ResumeBernieOHareNo ratings yet

- MKT 465 ch2 SehDocument45 pagesMKT 465 ch2 SehNurEZahanKantaNo ratings yet

- 7 ProfitabilityDocument28 pages7 ProfitabilityBahadır ArıkanNo ratings yet

- Curriculum VitaeDocument4 pagesCurriculum VitaeKrishna SawantNo ratings yet

- Annex 05 - Oral Quotation SheetDocument1 pageAnnex 05 - Oral Quotation SheetPrince Yaz ElardoNo ratings yet

- Proposal For Edumate: (SEO: Search Engine OptimizerDocument14 pagesProposal For Edumate: (SEO: Search Engine Optimizerseoservices singaporeNo ratings yet

- 01-Job Application FormDocument3 pages01-Job Application FormKing D ThreesixNo ratings yet

- Summer Internship Project ON A Study On Consumer Perception About Insurance CompanyDocument13 pagesSummer Internship Project ON A Study On Consumer Perception About Insurance CompanySHARMA TECHNo ratings yet

- Pepsi ColaDocument41 pagesPepsi ColaSathish Chandramouli0% (1)

- Manual On CAS For PACSDocument6 pagesManual On CAS For PACSManohara PrakashNo ratings yet

- WSO FT Banking ResumeDocument1 pageWSO FT Banking ResumeJohn MathiasNo ratings yet

- 08 Ias 2Document3 pages08 Ias 2Irtiza AbbasNo ratings yet

- PTCL ReportDocument199 pagesPTCL ReportSalman SaeedNo ratings yet

- Customer Inquiry ReportDocument17 pagesCustomer Inquiry ReportBukan DrummerNo ratings yet

- Unit 5Document85 pagesUnit 5be pandaNo ratings yet

- BACLIAT - Business AdaptaitonDocument32 pagesBACLIAT - Business Adaptaitonclimateready.org.ukNo ratings yet

- Answers: External Factors Weight Rating Weighted Score Comments OpportunitiesDocument3 pagesAnswers: External Factors Weight Rating Weighted Score Comments OpportunitiesheizaNo ratings yet

- The Crescent Standard Investment Bank LimitedDocument3 pagesThe Crescent Standard Investment Bank LimitedhammasNo ratings yet

- Statement of Account PDFDocument3 pagesStatement of Account PDFPradyumn MangalNo ratings yet

- Business PlanDocument8 pagesBusiness PlanShajin SanthoshNo ratings yet

- WWW Indiabix Com PDFDocument4 pagesWWW Indiabix Com PDFAnil Kumar Gorantala100% (1)

- Healthcare Operations Management.: Sabu V U. DMS, (Hma), MbaDocument20 pagesHealthcare Operations Management.: Sabu V U. DMS, (Hma), Mbamy Vinay100% (1)

- Tutorial 3 - Law 580Document5 pagesTutorial 3 - Law 580sofiaNo ratings yet

- CH 12 SM AssigDocument6 pagesCH 12 SM AssigJefferson SarmientoNo ratings yet