Professional Documents

Culture Documents

UIN: 104N111V02 Page 1 of 3

UIN: 104N111V02 Page 1 of 3

Uploaded by

vivek0955158Copyright:

Available Formats

You might also like

- LLM DissertationDocument102 pagesLLM DissertationPriyankNo ratings yet

- Understanding Aviation InsuranceDocument6 pagesUnderstanding Aviation InsuranceWalid NugudNo ratings yet

- Mangesh Katar SapDocument3 pagesMangesh Katar SapPARIKSHIT GHODKENo ratings yet

- Mangesh Katar SWPDocument3 pagesMangesh Katar SWPPARIKSHIT GHODKENo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vivek0955158No ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3bhavnapal74No ratings yet

- Illustration - 2022-02-16T110618.998Document3 pagesIllustration - 2022-02-16T110618.998mosarafNo ratings yet

- Benefit Illu1212Document3 pagesBenefit Illu1212parikshitNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vishal pNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Aman SaxenaNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Santosh DavaneNo ratings yet

- Mangesh Katar MiapDocument3 pagesMangesh Katar MiapPARIKSHIT GHODKENo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Gurkirt SinghNo ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 2sudithakur2023No ratings yet

- Max MiapDocument3 pagesMax MiapKrishna GoyalNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3parikshitNo ratings yet

- Monthly Income Advantage PlanDocument3 pagesMonthly Income Advantage PlanGurkirt SinghNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 3Document5 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 3Revathy SanthanakrishnanNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 2vivek0955158No ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 3Abhimanyu Singh BhatiNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3Bimal DeyNo ratings yet

- Benefit Illustration: UIN: 104N120V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V02 Page 1 of 4Karthik GopalanNo ratings yet

- Wa0000.Document3 pagesWa0000.NishanthNo ratings yet

- SWP 12 Pay 15, 44 Age, 5 LacDocument2 pagesSWP 12 Pay 15, 44 Age, 5 LacShivaji ReddyNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3parikshitNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Yashwant ojhaNo ratings yet

- Benefit Illustration: UIN: 104N120V01 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V01 Page 1 of 4Gobinda SinhaNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3Vikram KsNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3VISHAL CHAUDHARYNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3babunidoniNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument4 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionrishitrivedi2176No ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionAlok .kNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionKarthik GopalanNo ratings yet

- Illustration 5Document4 pagesIllustration 5logicloverbharatNo ratings yet

- Bi 7313vviwDocument3 pagesBi 7313vviwMahesh GediyaNo ratings yet

- Bi 5774vgsaDocument3 pagesBi 5774vgsaMahesh GediyaNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 2vipinpvNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document4 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Onn InternationalNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionvipin jainNo ratings yet

- Max APE 1 Lac PPT 10 Years PT 25 YearsDocument3 pagesMax APE 1 Lac PPT 10 Years PT 25 YearsSumitt SinghNo ratings yet

- Age - 40 (SWAG RW 10lpa 12+3+10)Document3 pagesAge - 40 (SWAG RW 10lpa 12+3+10)SHREEJI FINANCIAL PLANNERSNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3NagarjunaNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionamarjeet456No ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- UIN: 104N085V04 Page 1 of 2Document2 pagesUIN: 104N085V04 Page 1 of 2Yashwant ojhaNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument4 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionkundan9200No ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- Benefit Illustration: UIN: 104N116V02 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V02 Page 1 of 3Ravindar aNo ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3Aman SaxenaNo ratings yet

- IllustrationDocument6 pagesIllustrationjbarmeda3113No ratings yet

- RaspDocument4 pagesRaspsamvil2007No ratings yet

- IllustrationDocument4 pagesIllustrationnikhilraoNo ratings yet

- IllustrationDocument3 pagesIllustrationnikhilraoNo ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- UIN: 104L115V01 Page 1 of 6Document6 pagesUIN: 104L115V01 Page 1 of 6Gobinda SinhaNo ratings yet

- BI - OutputGBP VDocument4 pagesBI - OutputGBP VSagrika SagarNo ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- Child Max UlipDocument6 pagesChild Max Ulipjagdevwasson761No ratings yet

- Max Life BIDocument8 pagesMax Life BIcambrittvNo ratings yet

- The Future Is Now Wearables For Insurance Risk Assessment PDFDocument4 pagesThe Future Is Now Wearables For Insurance Risk Assessment PDFLeelavathi BakthavathchalamNo ratings yet

- Insurance Product Information Document: What Is This Type of Insurance? What Is Insured? What Is Not Insured?Document2 pagesInsurance Product Information Document: What Is This Type of Insurance? What Is Insured? What Is Not Insured?barryNo ratings yet

- Nina Callaway: Should You Purchase Wedding Insurance? What Does Wedding Insurance Cover? byDocument34 pagesNina Callaway: Should You Purchase Wedding Insurance? What Does Wedding Insurance Cover? byDeeksha ShettyNo ratings yet

- PIP DocumentDocument103 pagesPIP DocumentShaik SariyaNo ratings yet

- Offer To Leases KDocument3 pagesOffer To Leases KNana MarNo ratings yet

- DBP Master AgreementDocument4 pagesDBP Master AgreementElmar AnocNo ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document3 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)sarath potnuriNo ratings yet

- Pdic LawDocument3 pagesPdic LawKriztel CuñadoNo ratings yet

- NORA CANSING SERRANO vs. CA Case DigestDocument2 pagesNORA CANSING SERRANO vs. CA Case DigestMonikka DeleraNo ratings yet

- Rental Agreement and LeaseDocument42 pagesRental Agreement and LeaseKiana HinesNo ratings yet

- Health Advantage BrochureDocument11 pagesHealth Advantage BrochurevenkatNo ratings yet

- Contracts in Maritime IndustryDocument6 pagesContracts in Maritime IndustryTina sharmaNo ratings yet

- PDF Personal Finance Gill Ebook Full ChapterDocument53 pagesPDF Personal Finance Gill Ebook Full Chapterkeith.grimsley488100% (1)

- UECM3463May16 C01 2ph PDFDocument67 pagesUECM3463May16 C01 2ph PDFTonyNo ratings yet

- Torts 2 Case BriefsDocument63 pagesTorts 2 Case BriefsAndrew Smith100% (3)

- Guardian - Dental PPO Plan Summary 2022Document4 pagesGuardian - Dental PPO Plan Summary 2022Jessi ChallagullaNo ratings yet

- Transportation Law - BedaDocument31 pagesTransportation Law - BedaVim MalicayNo ratings yet

- You Are Making: A Good Choice!Document4 pagesYou Are Making: A Good Choice!AMIT RAJNo ratings yet

- Indigo Cadet Programme Course PriceDocument5 pagesIndigo Cadet Programme Course PriceSNo ratings yet

- Recruitment and Selection of Insurance CompaniesDocument17 pagesRecruitment and Selection of Insurance Companies9958086299No ratings yet

- Pruchoice Travel Overseas Study Insurance PolicyDocument17 pagesPruchoice Travel Overseas Study Insurance PolicyAnonymous MJX6BaJyXZNo ratings yet

- Memorial For RespondentDocument28 pagesMemorial For RespondentKunwarbir Singh lohatNo ratings yet

- Session 4 Scaffold For TransferDocument2 pagesSession 4 Scaffold For TransferAngel BagasolNo ratings yet

- Luz Marie S. HaradaDocument12 pagesLuz Marie S. Haradacdf7xsgmnhNo ratings yet

- GSIS TEMPLATE Fire Insurance Application Form (TRAD)Document3 pagesGSIS TEMPLATE Fire Insurance Application Form (TRAD)Ronan MaquidatoNo ratings yet

- Contract To LawrenceDocument6 pagesContract To LawrenceBetrand MuNo ratings yet

- Perkspot Discount Program FlyerDocument2 pagesPerkspot Discount Program FlyerKay BeeNo ratings yet

- Biden Hopeful On Social Bills, Threatens Putin Over Ukraine: Expected Fed Tightening Weighs On Crypto MarketDocument29 pagesBiden Hopeful On Social Bills, Threatens Putin Over Ukraine: Expected Fed Tightening Weighs On Crypto MarketGU XiaomiNo ratings yet

UIN: 104N111V02 Page 1 of 3

UIN: 104N111V02 Page 1 of 3

Uploaded by

vivek0955158Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UIN: 104N111V02 Page 1 of 3

UIN: 104N111V02 Page 1 of 3

Uploaded by

vivek0955158Copyright:

Available Formats

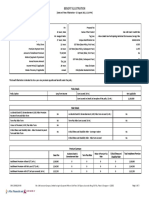

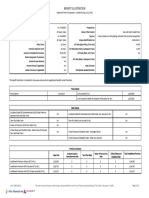

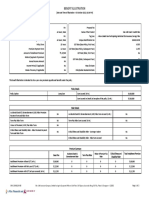

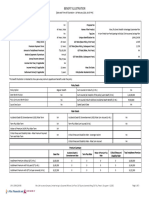

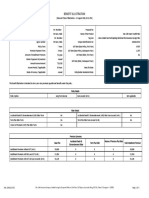

Proposal No:

Name of the Prospect/Policyholder: Mr. Abc Name of the Product: Max Life Savings Advantage Plan

Age & Gender: 20 Years, Male Tag Line: A Non-Linked Participating Individual Life Insurance Savings Plan

Name of the Life Assured: Mr. Abc Unique Identification No: 104N111V02

Age & Gender: 20 Years, Male GST Rate: 4.50%

Policy Term: 15 Years Max Life State: Rajasthan

Premium Payment Term: 10 Years Policyholder Residential State: Rajasthan

Amount of Installment Premium: `26,125

Mode of payment of premium: Annual

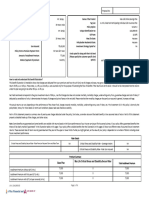

How to read and understand this benefit illustration?

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy, at two assumed rates of interest i.e., 8% p.a. and 4% p.a.

Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers guaranteed benefits then these

will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable benefits then the illustration on this page will show two different rates of assumed future investment returns, of

8%p.a. and 4% p.a. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including

future investment performance.

Policy Details

Policy Option Sum Assured (in Rs.) 2,11,381

Bonus Type Premium Offset Sum Assured on Death (at inception of the policy) (in Rs.) 2,75,000

Rider Details

Accidental Death & Dismemberment (ADD) Rider Premium

NA Accidental Death & Dismemberment (ADD) Rider Sum Assured (in Rs.) NA

Payment Term and Rider Term

Term Plus Rider Term NA Term Plus Rider Sum Assured (in Rs.) NA

Waiver of Premium (WOP) Plus Rider Term NA

Critical Illness and Disability Rider - Rider Premium

NA Critical Illness and Disability Rider Variant NA

Payment Term and Rider Term

Critical Illness and Disability Rider Sum Assured NA

Premium Summary

Base Plan Riders Total Installment Premium

Installment Premium without GST (in Rs.) 25,000 - 25,000

Installment Premium with first year GST (in Rs.) 26,125 - 26,125

Installment Premium with GST 2nd year onwards (in Rs.) 25,563 - 25,563

UIN: 104N111V02 Page 1 of 3

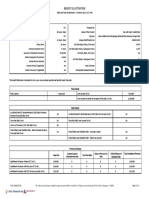

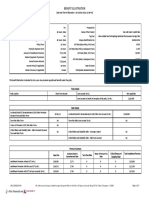

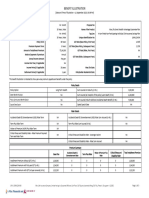

(Amount in Rupees)

Total Benefits including Guaranteed and Non- Guaranteed

Non-Guaranteed Benefits Non-Guaranteed Benefits Benefits

Guaranteed Benefits

@ 4% p.a. @ 8% p.a.

Maturity Benefit Death Benefit

Single/

Policy Total Maturity Total Death

Annualized Total Maturity Total Death

Year Benefit, incl. Benefit, incl.

Premium Benefit, incl. Benefit, incl.

Terminal of Terminal

Guaranteed Survival Surrender Death Maturity Paid Up Surrender Paid Up Surrender Terminal of Terminal

Cash Bonus Cash Bonus Bonus, if any Bonus, if any

Additions Benefit Benefit Benefit Benefit Additions Benefit Additions Benefit Bonus, if any Bonus, if any

@ @ 4%(6+8+9)

@ 4%(7+8+9) @

8%(7+11+12)

8%(6+11+12)

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17

1 25,000 11,626 - - 2,75,000 - - - - - - - - - 2,86,626 2,86,626

2 25,000 11,626 - 20,384 2,75,000 - - 1,351 20,384 - 1,596 20,384 - - 2,98,252 2,98,252

3 25,000 11,626 - 35,278 2,75,000 - - 1,393 35,278 - 1,695 35,278 - - 3,09,878 3,09,878

4 25,000 11,626 - 63,460 2,75,000 - - 1,435 63,460 - 1,801 63,460 - - 3,21,504 3,21,504

5 25,000 11,626 - 83,817 2,75,000 - - 1,478 83,817 - 1,915 83,817 - - 3,33,130 4,02,399

6 25,000 - - 1,02,049 2,75,000 - - 1,522 1,02,049 - 2,033 1,02,049 - - 3,33,130 4,02,399

7 25,000 - - 1,21,551 2,75,000 - - 1,568 1,21,551 - 2,162 1,21,551 - - 3,33,130 4,02,399

8 25,000 - - 1,48,155 2,75,000 - - 1,617 1,48,155 - 2,298 1,48,155 - - 3,33,130 4,02,399

9 25,000 - - 1,77,322 2,75,000 - - 1,666 1,77,322 - 2,444 1,77,322 - - 3,33,130 4,02,399

10 25,000 - - 2,09,518 2,75,000 - - 1,716 2,09,518 - 2,596 2,17,262 - - 3,33,130 4,02,399

11 - - - 2,25,465 3,02,500 - - 1,769 2,25,465 - 2,761 2,41,421 - - 3,60,630 4,29,899

12 - - - 2,42,138 3,02,500 - - 1,822 2,42,138 - 2,934 2,66,041 - - 3,60,630 4,29,899

13 - - - 2,59,095 3,02,500 - - 1,879 2,59,095 - 3,120 2,92,589 - - 3,60,630 4,29,899

14 - - - 2,76,902 3,02,500 - - 1,936 2,76,902 - 3,319 3,21,171 - - 3,60,630 4,29,899

15 - - - 2,83,130 3,02,500 2,32,519 - 1,995 2,92,644 - 3,528 3,63,446 2,92,644 3,63,446 3,60,630 4,29,899

Notes: Annualized Premium excludes underwriting extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any, and Goods and Service Tax. Refer Sales literature for explanation of terms used in

this illustration.

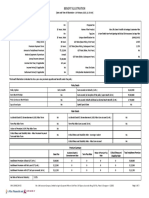

UIN: 104N111V02 Page 2 of 3

I, ……………………………………………. (name), have explained the premiums, and benefits I, ……………………………………………. (name), having received the information with respect

under the product fully to the prospect / policyholder. to the above, have understood the above statement before entering into the contract.

Place:

Date: 8/8/21 Signature / OTP Confirmation Date / Thumb Impression / Date:8/8/21 Signature / OTP Confirmation Date / Thumb Impression /

Electronic Signature of Agent/ Intermediary / Official Electronic Signature of Prospect/ Policyholder

This system generated benefit illustration shall be treated as signed by me.

UIN: 104N111V02 Page 3 of 3

54,20,211380,2,25000.00,M,b54

You might also like

- LLM DissertationDocument102 pagesLLM DissertationPriyankNo ratings yet

- Understanding Aviation InsuranceDocument6 pagesUnderstanding Aviation InsuranceWalid NugudNo ratings yet

- Mangesh Katar SapDocument3 pagesMangesh Katar SapPARIKSHIT GHODKENo ratings yet

- Mangesh Katar SWPDocument3 pagesMangesh Katar SWPPARIKSHIT GHODKENo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vivek0955158No ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3bhavnapal74No ratings yet

- Illustration - 2022-02-16T110618.998Document3 pagesIllustration - 2022-02-16T110618.998mosarafNo ratings yet

- Benefit Illu1212Document3 pagesBenefit Illu1212parikshitNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vishal pNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Aman SaxenaNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Santosh DavaneNo ratings yet

- Mangesh Katar MiapDocument3 pagesMangesh Katar MiapPARIKSHIT GHODKENo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Gurkirt SinghNo ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 2sudithakur2023No ratings yet

- Max MiapDocument3 pagesMax MiapKrishna GoyalNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3parikshitNo ratings yet

- Monthly Income Advantage PlanDocument3 pagesMonthly Income Advantage PlanGurkirt SinghNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 3Document5 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 3Revathy SanthanakrishnanNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 2vivek0955158No ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 3Abhimanyu Singh BhatiNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3Bimal DeyNo ratings yet

- Benefit Illustration: UIN: 104N120V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V02 Page 1 of 4Karthik GopalanNo ratings yet

- Wa0000.Document3 pagesWa0000.NishanthNo ratings yet

- SWP 12 Pay 15, 44 Age, 5 LacDocument2 pagesSWP 12 Pay 15, 44 Age, 5 LacShivaji ReddyNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3parikshitNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Yashwant ojhaNo ratings yet

- Benefit Illustration: UIN: 104N120V01 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V01 Page 1 of 4Gobinda SinhaNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3Vikram KsNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3VISHAL CHAUDHARYNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3babunidoniNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument4 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionrishitrivedi2176No ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionAlok .kNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionKarthik GopalanNo ratings yet

- Illustration 5Document4 pagesIllustration 5logicloverbharatNo ratings yet

- Bi 7313vviwDocument3 pagesBi 7313vviwMahesh GediyaNo ratings yet

- Bi 5774vgsaDocument3 pagesBi 5774vgsaMahesh GediyaNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 2vipinpvNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document4 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Onn InternationalNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionvipin jainNo ratings yet

- Max APE 1 Lac PPT 10 Years PT 25 YearsDocument3 pagesMax APE 1 Lac PPT 10 Years PT 25 YearsSumitt SinghNo ratings yet

- Age - 40 (SWAG RW 10lpa 12+3+10)Document3 pagesAge - 40 (SWAG RW 10lpa 12+3+10)SHREEJI FINANCIAL PLANNERSNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3NagarjunaNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionamarjeet456No ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Lakhwinder RaundNo ratings yet

- UIN: 104N085V04 Page 1 of 2Document2 pagesUIN: 104N085V04 Page 1 of 2Yashwant ojhaNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument4 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionkundan9200No ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- Benefit Illustration: UIN: 104N116V02 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V02 Page 1 of 3Ravindar aNo ratings yet

- UIN: 104N111V02 Page 1 of 3Document3 pagesUIN: 104N111V02 Page 1 of 3Aman SaxenaNo ratings yet

- IllustrationDocument6 pagesIllustrationjbarmeda3113No ratings yet

- RaspDocument4 pagesRaspsamvil2007No ratings yet

- IllustrationDocument4 pagesIllustrationnikhilraoNo ratings yet

- IllustrationDocument3 pagesIllustrationnikhilraoNo ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- UIN: 104L115V01 Page 1 of 6Document6 pagesUIN: 104L115V01 Page 1 of 6Gobinda SinhaNo ratings yet

- BI - OutputGBP VDocument4 pagesBI - OutputGBP VSagrika SagarNo ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- Child Max UlipDocument6 pagesChild Max Ulipjagdevwasson761No ratings yet

- Max Life BIDocument8 pagesMax Life BIcambrittvNo ratings yet

- The Future Is Now Wearables For Insurance Risk Assessment PDFDocument4 pagesThe Future Is Now Wearables For Insurance Risk Assessment PDFLeelavathi BakthavathchalamNo ratings yet

- Insurance Product Information Document: What Is This Type of Insurance? What Is Insured? What Is Not Insured?Document2 pagesInsurance Product Information Document: What Is This Type of Insurance? What Is Insured? What Is Not Insured?barryNo ratings yet

- Nina Callaway: Should You Purchase Wedding Insurance? What Does Wedding Insurance Cover? byDocument34 pagesNina Callaway: Should You Purchase Wedding Insurance? What Does Wedding Insurance Cover? byDeeksha ShettyNo ratings yet

- PIP DocumentDocument103 pagesPIP DocumentShaik SariyaNo ratings yet

- Offer To Leases KDocument3 pagesOffer To Leases KNana MarNo ratings yet

- DBP Master AgreementDocument4 pagesDBP Master AgreementElmar AnocNo ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document3 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)sarath potnuriNo ratings yet

- Pdic LawDocument3 pagesPdic LawKriztel CuñadoNo ratings yet

- NORA CANSING SERRANO vs. CA Case DigestDocument2 pagesNORA CANSING SERRANO vs. CA Case DigestMonikka DeleraNo ratings yet

- Rental Agreement and LeaseDocument42 pagesRental Agreement and LeaseKiana HinesNo ratings yet

- Health Advantage BrochureDocument11 pagesHealth Advantage BrochurevenkatNo ratings yet

- Contracts in Maritime IndustryDocument6 pagesContracts in Maritime IndustryTina sharmaNo ratings yet

- PDF Personal Finance Gill Ebook Full ChapterDocument53 pagesPDF Personal Finance Gill Ebook Full Chapterkeith.grimsley488100% (1)

- UECM3463May16 C01 2ph PDFDocument67 pagesUECM3463May16 C01 2ph PDFTonyNo ratings yet

- Torts 2 Case BriefsDocument63 pagesTorts 2 Case BriefsAndrew Smith100% (3)

- Guardian - Dental PPO Plan Summary 2022Document4 pagesGuardian - Dental PPO Plan Summary 2022Jessi ChallagullaNo ratings yet

- Transportation Law - BedaDocument31 pagesTransportation Law - BedaVim MalicayNo ratings yet

- You Are Making: A Good Choice!Document4 pagesYou Are Making: A Good Choice!AMIT RAJNo ratings yet

- Indigo Cadet Programme Course PriceDocument5 pagesIndigo Cadet Programme Course PriceSNo ratings yet

- Recruitment and Selection of Insurance CompaniesDocument17 pagesRecruitment and Selection of Insurance Companies9958086299No ratings yet

- Pruchoice Travel Overseas Study Insurance PolicyDocument17 pagesPruchoice Travel Overseas Study Insurance PolicyAnonymous MJX6BaJyXZNo ratings yet

- Memorial For RespondentDocument28 pagesMemorial For RespondentKunwarbir Singh lohatNo ratings yet

- Session 4 Scaffold For TransferDocument2 pagesSession 4 Scaffold For TransferAngel BagasolNo ratings yet

- Luz Marie S. HaradaDocument12 pagesLuz Marie S. Haradacdf7xsgmnhNo ratings yet

- GSIS TEMPLATE Fire Insurance Application Form (TRAD)Document3 pagesGSIS TEMPLATE Fire Insurance Application Form (TRAD)Ronan MaquidatoNo ratings yet

- Contract To LawrenceDocument6 pagesContract To LawrenceBetrand MuNo ratings yet

- Perkspot Discount Program FlyerDocument2 pagesPerkspot Discount Program FlyerKay BeeNo ratings yet

- Biden Hopeful On Social Bills, Threatens Putin Over Ukraine: Expected Fed Tightening Weighs On Crypto MarketDocument29 pagesBiden Hopeful On Social Bills, Threatens Putin Over Ukraine: Expected Fed Tightening Weighs On Crypto MarketGU XiaomiNo ratings yet