Professional Documents

Culture Documents

Audit Prob Q6 Proof of Cash 2021

Audit Prob Q6 Proof of Cash 2021

Uploaded by

Ivy BautistaCopyright:

Available Formats

You might also like

- Case Study Royal Bank of CanadaDocument10 pagesCase Study Royal Bank of Canadandgharat100% (1)

- Online Food Ordering System Using Cloud TechnologyDocument8 pagesOnline Food Ordering System Using Cloud Technologybenz bhenzNo ratings yet

- Rental ReceiptDocument11 pagesRental ReceiptGladys Sibi LuceroNo ratings yet

- Audprob Cash2 Bsa4 2Document5 pagesAudprob Cash2 Bsa4 2Mark Gelo WinchesterNo ratings yet

- Sample Auditing Problems Proof of Cash Sample Auditing Problems Proof of CashDocument17 pagesSample Auditing Problems Proof of Cash Sample Auditing Problems Proof of Cashmariyha PalangganaNo ratings yet

- 03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Document5 pages03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Ma Jessa Kathryl Alar IINo ratings yet

- Proof of Cash or Four Column ReconciliationDocument5 pagesProof of Cash or Four Column ReconciliationSB19 ChicKENNo ratings yet

- Chapter 111213Document8 pagesChapter 111213Angel Alejo Acoba0% (1)

- Problems CCEDocument10 pagesProblems CCERafael Renz DayaoNo ratings yet

- Assignment - Aduit of CashDocument5 pagesAssignment - Aduit of CashEdemson NavalesNo ratings yet

- AP.3406 Audit of InvestmentsDocument5 pagesAP.3406 Audit of InvestmentsMonica GarciaNo ratings yet

- SA1 Submissions: Standalone AssessmentDocument11 pagesSA1 Submissions: Standalone AssessmentYenNo ratings yet

- Cash With Cash EqualantDocument5 pagesCash With Cash EqualantkaviyapriyaNo ratings yet

- 03 Quiz 1Document9 pages03 Quiz 1Camille MadlangbayanNo ratings yet

- Development For ProductionDocument6 pagesDevelopment For Productiongazer beamNo ratings yet

- Midterm Exam Part 2 Short ProblemsDocument5 pagesMidterm Exam Part 2 Short Problemsdagohoy kennethNo ratings yet

- CH 17Document32 pagesCH 17Aldrin CabangbangNo ratings yet

- Quiz No. 2Document5 pagesQuiz No. 2VernnNo ratings yet

- Audit of ReceivablesDocument5 pagesAudit of ReceivablesandreamrieNo ratings yet

- Handout Audit of ReceivablesDocument6 pagesHandout Audit of ReceivablesJahanna MartorillasNo ratings yet

- AccountingDocument26 pagesAccountingMuhammad Jaafar AbinalNo ratings yet

- 91 - Final Preaboard Afar (Weekends)Document18 pages91 - Final Preaboard Afar (Weekends)Joris YapNo ratings yet

- AFAR-01 (Partnership Formation & Operations)Document6 pagesAFAR-01 (Partnership Formation & Operations)Nathalie Shien DagaragaNo ratings yet

- Unit IA ID. Rematch Unit Drill On Cash and Cash Equivalents Petty Cash Bank Recon Proof of Cash 1Document5 pagesUnit IA ID. Rematch Unit Drill On Cash and Cash Equivalents Petty Cash Bank Recon Proof of Cash 1MARK JHEN SALANGNo ratings yet

- AFAR ProblemsDocument45 pagesAFAR ProblemsPrima FacieNo ratings yet

- Intermediate Acctg A 1 10Document10 pagesIntermediate Acctg A 1 10Leonila RiveraNo ratings yet

- Karkits Corporation PDFDocument4 pagesKarkits Corporation PDFRachel LeachonNo ratings yet

- Chapter 1-SolutionsDocument14 pagesChapter 1-SolutionsPrince CalicaNo ratings yet

- Problem Set For AR (Ctto)Document16 pagesProblem Set For AR (Ctto)Mariane Jean Guerrero100% (1)

- A. Cash and Cash EquivalentsDocument24 pagesA. Cash and Cash EquivalentskimkimNo ratings yet

- Far Eastern University - Manila Institute of Accounts, Business and Finance Nicanor Reyes Sr. ST., Sampaloc, Manila Applied AuditingDocument6 pagesFar Eastern University - Manila Institute of Accounts, Business and Finance Nicanor Reyes Sr. ST., Sampaloc, Manila Applied AuditingKenneth A. S. AlabadoNo ratings yet

- Partnership LiquidationDocument6 pagesPartnership Liquidationyoj assenavNo ratings yet

- LQ 2 AnswersDocument21 pagesLQ 2 Answersby ScribdNo ratings yet

- AccountingDocument1 pageAccountingAlexandra Nicole IsaacNo ratings yet

- AC 3101 Discussion ProblemDocument1 pageAC 3101 Discussion ProblemYohann Leonard HuanNo ratings yet

- Auditing Problems 2Document8 pagesAuditing Problems 2Rujean Salar AltejarNo ratings yet

- School of Accountancy & Management Accounting For Special Transaction Midterm ExaminationDocument11 pagesSchool of Accountancy & Management Accounting For Special Transaction Midterm ExaminationTasha MarieNo ratings yet

- AFAR02 04 Franchise AccountingDocument4 pagesAFAR02 04 Franchise AccountingNicoleNo ratings yet

- UNIT 3 Accounts Receivable PDFDocument11 pagesUNIT 3 Accounts Receivable PDFVilma HermosadoNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet

- PNC MT Examination Finacc 3Document3 pagesPNC MT Examination Finacc 3joevitt delfinadoNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- 9101 - Partnership FormationDocument2 pages9101 - Partnership FormationGo FarNo ratings yet

- Midterm Exam No. 3Document3 pagesMidterm Exam No. 3Anie MartinezNo ratings yet

- Chapter 1 Problem 3: Exercises: - Journal EntryDocument18 pagesChapter 1 Problem 3: Exercises: - Journal EntryAlarich CatayocNo ratings yet

- Audit of Investments - Set ADocument4 pagesAudit of Investments - Set AZyrah Mae SaezNo ratings yet

- Ap-5905 Inventories PDFDocument9 pagesAp-5905 Inventories PDFKathleen Jane SolmayorNo ratings yet

- AFAR ReviewDocument11 pagesAFAR ReviewPaupauNo ratings yet

- Proof+of+Cash ProblemsDocument2 pagesProof+of+Cash ProblemshelaihjsNo ratings yet

- Lesson 1 AP: Minimum Composition of The SFP and Some Audit NotesDocument14 pagesLesson 1 AP: Minimum Composition of The SFP and Some Audit NotesDebs FanogaNo ratings yet

- 01 - Audit of Cash & Cash EquivalentsDocument4 pages01 - Audit of Cash & Cash EquivalentsEARL JOHN RosalesNo ratings yet

- On December AcctDocument4 pagesOn December AcctMelody BautistaNo ratings yet

- ACTExamsDocument36 pagesACTExamsKaguraNo ratings yet

- Practice ExercisesDocument2 pagesPractice ExercisesNikki Labial0% (1)

- Decided To Open A Branch in ManilaDocument2 pagesDecided To Open A Branch in Manilaasdfghjkl zxcvbnmNo ratings yet

- Quiz Integ BusCom ForExDocument7 pagesQuiz Integ BusCom ForExPrankyJellyNo ratings yet

- PDF 6Document349 pagesPDF 6Aexisse OrchessaNo ratings yet

- Chapter 1 - Multiple Choice Problem Answers AfarDocument13 pagesChapter 1 - Multiple Choice Problem Answers AfarChincel G. ANINo ratings yet

- Lump Sum LiquidationDocument3 pagesLump Sum LiquidationJose Mariano MelendezNo ratings yet

- Auditing Problems: Jipbautista16 - Cpar - 2021Document2 pagesAuditing Problems: Jipbautista16 - Cpar - 2021Ivy BautistaNo ratings yet

- Audit Quizzer (Cash) - 05Document1 pageAudit Quizzer (Cash) - 05Ivy BautistaNo ratings yet

- Prelim-Pr 2a14fb4488c3b5b235Document11 pagesPrelim-Pr 2a14fb4488c3b5b235Romina LopezNo ratings yet

- Encode JobDocument12 pagesEncode JobRainNo ratings yet

- Audit Cash - Aud ProblemsDocument36 pagesAudit Cash - Aud ProblemsIvy BautistaNo ratings yet

- Partnership Liquidation: Answer: (D)Document2 pagesPartnership Liquidation: Answer: (D)Ivy BautistaNo ratings yet

- Partnership Liquidation: Assets Liabilities & EquityDocument2 pagesPartnership Liquidation: Assets Liabilities & EquityIvy BautistaNo ratings yet

- Auditing Problems: Jipbautista16 - Cpar - 2021Document2 pagesAuditing Problems: Jipbautista16 - Cpar - 2021Ivy BautistaNo ratings yet

- F Accountancy MS XI 2023-24Document9 pagesF Accountancy MS XI 2023-24bhaiyarakesh100% (1)

- Abdul Manan IS1Document20 pagesAbdul Manan IS1Chakwal ReactionsNo ratings yet

- ETicket NN21SOJP2HA2645Y9803 ParakhDocument5 pagesETicket NN21SOJP2HA2645Y9803 Parakhrashi kumawatNo ratings yet

- Datasheet AP400 PDFDocument4 pagesDatasheet AP400 PDFRaaft riadNo ratings yet

- Statement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceDocument8 pagesStatement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits Balancedinesh namdeoNo ratings yet

- ACFE FinTech Fraud Summit PresentationDocument16 pagesACFE FinTech Fraud Summit PresentationCrowdfundInsider100% (1)

- Cross Docking PPT AVENGERSDocument13 pagesCross Docking PPT AVENGERSRei RacazaNo ratings yet

- ADL 75 E-Commerce V4Document6 pagesADL 75 E-Commerce V4solvedcareNo ratings yet

- Noe FillingDocument2 pagesNoe FillingPankajShuklaNo ratings yet

- Module 6 Travel TradeDocument17 pagesModule 6 Travel TradeSaj Benedict AyalaNo ratings yet

- Freecharge - Deals - Business ProposalDocument11 pagesFreecharge - Deals - Business ProposalneetugNo ratings yet

- 1000g Not Sold OutletDocument182 pages1000g Not Sold Outletkamrulislamaustralia92No ratings yet

- Hindustan Electronic Limited-Case StudyDocument27 pagesHindustan Electronic Limited-Case StudyMayank KothariNo ratings yet

- Diploma in Accountancy Qa March 2022Document217 pagesDiploma in Accountancy Qa March 2022Chanda LufunguloNo ratings yet

- Cisco Sales Expert 2 2Document76 pagesCisco Sales Expert 2 2jamespcurranNo ratings yet

- EAP-110 SPEC v1.1Document3 pagesEAP-110 SPEC v1.1SHING EBNo ratings yet

- 9211stmt 16022017 1499569616627 PDFDocument5 pages9211stmt 16022017 1499569616627 PDFInfohoggNo ratings yet

- Inc09 3Document5 pagesInc09 3Hasan Kadir Uçmazoğlu (Student)No ratings yet

- MS-44J (Working Capital Management)Document13 pagesMS-44J (Working Capital Management)juleslovefenNo ratings yet

- Topic 7 Cash Management & ControlDocument25 pagesTopic 7 Cash Management & ControlMd Jahid HossainNo ratings yet

- Rep Liceum Technikum 79Document52 pagesRep Liceum Technikum 79Sebastian KORCZAKNo ratings yet

- Amazon Chime Voice Connector - SIP Trunk Validation - FreePBX - v1.2Document23 pagesAmazon Chime Voice Connector - SIP Trunk Validation - FreePBX - v1.2Juan Manuel BonillaNo ratings yet

- Rajesh IciciDocument32 pagesRajesh Icicisrinivas rao kNo ratings yet

- CCMF Fund - Financial Statements - 2019Document8 pagesCCMF Fund - Financial Statements - 2019Cindy BartolayNo ratings yet

- MDIS Map 2021 FADocument1 pageMDIS Map 2021 FAMichelleNo ratings yet

- Transport 1Document15 pagesTransport 1angaNo ratings yet

- Cost I Chapter 4 EditedDocument10 pagesCost I Chapter 4 EditedWonde BiruNo ratings yet

Audit Prob Q6 Proof of Cash 2021

Audit Prob Q6 Proof of Cash 2021

Uploaded by

Ivy BautistaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Prob Q6 Proof of Cash 2021

Audit Prob Q6 Proof of Cash 2021

Uploaded by

Ivy BautistaCopyright:

Available Formats

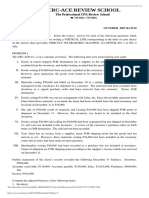

In your audit of the cash account of Maeng

Company, you were requested by the client to prepare a four-column reconciliation of

receipts, disbursements, and balances to reconstruct the balances per books.

Nov. 30 Dec. 31

a. Balances per bank P 15 500 P 20 930

b. Deposits in transit 2 310 3 450

c. Outstanding checks 4 260 3 870

d. Bank collections not in books 1 500 1 900

e. Bank charges not in books ### 640

f. Of the checks outstanding on December 31, one check for P 700 was certified at the request of the payee.

g. Receipts for December per bank statement: P 280 370

h. DAIF check from customer was charged by the bank on December 28 and has not been recorded: P 850

i. DAIF check returned in November and recorded in December: P 1 150

j. DAIF check returned and recorded in December, P 900

k. Check of Maeng Company charged by the bank in error, P 2 350

l. Receipt on December 6 paid out in cash for travel expenses recorded as receipts and disbursements per books, P 750

m. Error in recording customer's check on December 20, P 165 instead of P 365

n. Error in disbursements journal for December, P 3 250 instead of P 325

You noted in your audit that the DAIF checks returned by the bank are recorded as a reduction on the cash receipts journal instead

of recording it at cash disbursements journal; redeposits are recorded as regular cash receipts.

How much is the unadjusted book receipts for December?

A. P 285 440

B. P 280, 760

C. P 279, 445

D. P 279, 610

REF Bank to Book Method

Nov. 30 Receipts Disbursement Dec. 31

A./G. Bank balance 15,500 280,370 274,940 20,930

B. Deposit in Transit

November 2,310 -2,310

December 3,450 3,450

C. Outstanding Checks

November -4,260 -4,260

December 3,870 -3,870

D. Collections by bank not recorded to book

November -1,500 1,500

December -1,900 -1,900

E. Bank charges

November 950 950

December -640 640

F. Certified check request of the payee -700 700

NSF Checks returned

H. December and not recorded -850 850

I. November and recorded in Dec. 1,150 -1,150

J. December and recorded in Dec. -900 -900

K. Check of another company erroneously charged by the bank -2,350 2,350

L. Cash receipts used as payment 750 750

M. Book error – overstatement of recording customer’s check -200 -200

N. Book error – overstatement of disbursement 2,925 -2,925

Book Balance 14,150 279,610 273,735 20,025

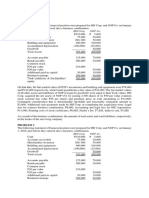

PROBLEM for Proof of Cash

In your audit of the cash account of Maeng Company, you were requested by the client to prepare a four-column reconciliation of receipts, disbursements, and balances to

reconstruct the balances per books.

Nov. 30 Dec. 31

a. Balances per bank P 15 500 P 20 930

b. Deposits in transit 2 310 3 450

c. Outstanding checks 4 260 3 870

d. Bank collections not in books 1 500 1 900

e. Bank charges not in books ### 640

f. Of the checks outstanding on December 31, one check for P 700 was certified at the request of the payee.

g. Receipts for December per bank statement: P 280 370

h. DAIF check from customer was charged by the bank on December 28 and has not been recorded: P 850

i. DAIF check returned in November and recorded in December: P 1 150

j. DAIF check returned and recorded in December, P 900

k. Check of Maeng Company charged by the bank in error, P 2 350

l. Receipt on December 6 paid out in cash for travel expenses recorded as receipts and disbursements per books, P 750

m. Error in recording customer's check on December 20, P 165 instead of P 365

n. Error in disbursements journal for December, P 3 250 instead of P 325

You noted in your audit that the DAIF checks returned by the bank are recorded as a reduction on the cash receipts journal instead of recording it at cash disbursements

journal; redeposits are recorded as regular cash receipts.

How much is the unadjusted book receipts for December?

A. P 285 440

B. P 280, 760

C. P 279, 445

D. P 279, 610

SUMMARY OF TREATMENT FOR PROOF OF CASH

ADJUSTED BALANCE METHOD BEG CR CD END

Cash in Banks per BOOKS 13,550 281,510 274,550 20,510

CM - LM - Credit Memo Last Month xx (xx)

CM - TM - Credit Memo this Month xx xx

DM - LM - Debit Memo Last Month (xx) (xx)

DM - TM - Debit Memo this Month xx (xx)

ADJUSTED BALANCE XXX XXX XXX XXX

BANK TO BOOK METHOD

Cash in Banks per BANK 15,500 280,370 274,940 20,930

DIT Last Month 2,310 (2,310)

DIT this Month 3,450 3,450

OC Last Month (4,260) (4,260)

OC this Month 3,870 (3,870)

ADJUSTED BALANCE 13,550 281,510 274,550 20,510

REF Bank to Book Method

Nov. 30 Receipts Disbursement Dec. 31

A./G. Bank balance 15,500 280,370 274,940 20,930

B. Deposit in Transit

November 2,310 -2,310

December 3,450 3,450

C. Outstanding Checks

November -4,260 -4,260

December 3,870 -3,870

F. Certified check request of the payee -700 700

K. Check of another company erroneously charged by the bank -2,350 2,350

L. Cash receipts used as payment 750 750

D. Collections by bank not recorded to book

November -1,500 1,500

December -1,900 -1,900

E. Bank charges

November 950 950

December -640 640

NSF Checks returned

H. December and not recorded -850 850

I. November and recorded in Dec. 1,150 -1,150

J. December and recorded in Dec. -900 -900

M. Book error – overstatement of recording customer’s check -200 -200

N. Book error – overstatement of disbursement 2,925 -2,925

Book Balance 14,150 279,610 273,735 20,025

Source: AUDPROB | Audit of Cash & Cash Equivalents | SureCPAiPASS2021 | jipb162021

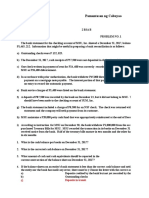

PROBLEM for Proof of cash

In your audit of the cash account of Cebu Company, you were requested by the client to prepare a four-column reconciliation of receipts, disbursements, and

balances to reconstruct the balances per books.

Nov. 30 Dec. 31

a. Balances per bank P 14,010 P 19,630

b. Deposits in transit 2,740 3,110

c. Outstanding checks 4,260 3,870

d. Bank collections not in books 1,200 1,600

e. Bank charges not in books 950 640

f. Of the checks outstanding on December 31, one check for P700 was certified at the request of the payee.

g. Receipts for December, per bank statement P281,070.

h. DAIF check from customer was charged by the bank on December 28, and has not been recorded P 800.

i. DAIF check returned in November and recorded in December P1,050.

j. DAIF check returned and recorded in December, P900.

k. Check of Cibo Company charged by the hank in error, P2,010.

l. Receipt on December 6 paid out in cash for travel expenses, P 750 Recorded as receipts and disbursements per books.

m. Error in recording customer's check on December 20, P165 instead P465.

n. Error in disbursements journal for December, P3,250 instead of P325:

You noted in your audit that the DAIF checks returned by the bank recorded as a reduction on the cash receipts journal instead of recording it at cash

disbursements journal; redeposits are recorded as regular cash receipts.

REQUIRED:

1. Prepare a 4-column bank reconciliation for the month December

a. Bank to book method;

b. Book to bank method; and

c. Adjusted balance method

2. Adjusting entries as of December 31, 2015.

1. Prepare a 4-column bank reconciliation for the month December a. Bank to book method;

REF Bank to Book Method

Nov. 30 Receipts Disbursement Dec. 31 LEGEND:

A./G. Bank balance 14,010 281,070 275,450 19,630 BOOK 700

B. Deposit in Transit BANK 0

November 2,740 -2,740 -430

December 3,110 3,110 -340

C. Outstanding Checks 0

November -4,260 -4,260 0

December 3,870 -3,870 0

F. Certified check request of the payee -700 700 0

K. Check of another company erroneously charged by the bank -2,010 2,010 0

L. Cash receipts used as payment 750 750 0

D. Collections by bank not recorded to book 0

November -1,200 1,200 -300

December -1,600 -1,600 300

E. Bank charges 0

November 950 950 0

December -640 640 0

NSF Checks returned 0

H. December and not recorded -800 800 0

I. November and recorded in Dec. 1,050 -1,050 100

J. December and recorded in Dec. -900 -900 0

M. Book error – overstatement of recording customer’s check -300 -300 -100

N. Book error – overstatement of disbursement 2,925 -2,925 0

Book Balance 13,290 279,540 274,635 18,195 -70

Source: AUDPROB | Audit of Cash & Cash Equivalents | SureCPAiPASS2021 | jipb162021

1. Prepare a 4-column bank reconciliation for the month December b. Book to bank method; and

REF Book to Bank Method

Nov. 30 Receipts Disbursement Dec. 31 LEGEND:

A./G. Book Balance 13,290 279,540 274,635 18,195 BOOK

E. Bank charges BANK

November -950 -950

December 640 -640

D. Collections by bank not recorded to book

November 1,200 -1200

December 1600 1,600

NSF Checks returned

I. November and recorded in Dec. -1,050 1,050

J. December and recorded in Dec. 900 900

H. December and not recorded 800 -800

M. Book error – overstatement of recording customer’s check 300 300

N. Book error – overstatement of disbursement -2925 2925

B. Deposit in Transit

November -2740 2740

December -3110 -3110

C. Outstanding Checks

November 4260 4260

December -3,870 3,870

F. Certified check request of the payee 700 -700

K. Check of another company erroneously charged by the bank 2010 -2010

L. Cash receipts used as payment -750 -750

Book Balance 14,010 281,070 275,450 19,630

Source: AUDPROB | Audit of Cash & Cash Equivalents | SureCPAiPASS2021 | jipb162021

1. Prepare a 4-column bank reconciliation for the month December c. Adjusted balance method

REF Adjusted Bank Method

Nov. 30 Receipts Disbursement Dec. 31 LEGEND:

Unadjusted Book Balance 13,290 279,540 274,635 18,195 BOOK

E. Bank charges BANK

November (950) (950)

December 640 (640)

D. Collections by bank not recorded to book

November 1,200 (1,200)

December 1,600 1,600

NSF Checks returned

I. November and recorded in Dec. (1,050) 1,050

J. December and recorded in Dec. 900 900

H. December and not recorded 800 (800)

M. Book error – overstatement of recording customer’s check 300 300

N. Book error – overstatement of disbursement (2,925) 2,925

Adjusted Cash Balances 12,490 282,190 273,100 21,580

Nov. 30 Receipts Disbursement Dec. 31

Unadjusted Bank Balance 14,010 281,070 275,450 19,630

B. Deposit in Transit

November 2,740 (2,740)

December 3,110 3,110

C. Outstanding checks

November (4,260) (4,260)

December 3,870 (3,870)

F. Certified check request of the payee (700) 700

K. Check of another company erroneously charged by the bank (2,010) 2,010

L. Cash receipts used as payment 750 750

Book Balance 12,490 282,190 273,100 21,580

2. Adjusting entries as of December 31, 2015.

a. Cash in Bank 1,600

Notes Receivable 1,600

b. Bank Service Charge 640

Cash in Bank 640

c. Accounts Receivable 800

Cash in Bank 800

d. Cash in Bank 300

Accounts Receivable 300

e. Cash in Bank 2,925

Accounts Payable 2,925

Source: AUDPROB | Audit of Cash & Cash Equivalents | SureCPAiPASS2021 | jipb162021

You might also like

- Case Study Royal Bank of CanadaDocument10 pagesCase Study Royal Bank of Canadandgharat100% (1)

- Online Food Ordering System Using Cloud TechnologyDocument8 pagesOnline Food Ordering System Using Cloud Technologybenz bhenzNo ratings yet

- Rental ReceiptDocument11 pagesRental ReceiptGladys Sibi LuceroNo ratings yet

- Audprob Cash2 Bsa4 2Document5 pagesAudprob Cash2 Bsa4 2Mark Gelo WinchesterNo ratings yet

- Sample Auditing Problems Proof of Cash Sample Auditing Problems Proof of CashDocument17 pagesSample Auditing Problems Proof of Cash Sample Auditing Problems Proof of Cashmariyha PalangganaNo ratings yet

- 03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Document5 pages03 ACCTNG-FOR-BUSINESS-COMBINATION-MERGER-AND-CONSOLIDATION-Problems-Part-1Ma Jessa Kathryl Alar IINo ratings yet

- Proof of Cash or Four Column ReconciliationDocument5 pagesProof of Cash or Four Column ReconciliationSB19 ChicKENNo ratings yet

- Chapter 111213Document8 pagesChapter 111213Angel Alejo Acoba0% (1)

- Problems CCEDocument10 pagesProblems CCERafael Renz DayaoNo ratings yet

- Assignment - Aduit of CashDocument5 pagesAssignment - Aduit of CashEdemson NavalesNo ratings yet

- AP.3406 Audit of InvestmentsDocument5 pagesAP.3406 Audit of InvestmentsMonica GarciaNo ratings yet

- SA1 Submissions: Standalone AssessmentDocument11 pagesSA1 Submissions: Standalone AssessmentYenNo ratings yet

- Cash With Cash EqualantDocument5 pagesCash With Cash EqualantkaviyapriyaNo ratings yet

- 03 Quiz 1Document9 pages03 Quiz 1Camille MadlangbayanNo ratings yet

- Development For ProductionDocument6 pagesDevelopment For Productiongazer beamNo ratings yet

- Midterm Exam Part 2 Short ProblemsDocument5 pagesMidterm Exam Part 2 Short Problemsdagohoy kennethNo ratings yet

- CH 17Document32 pagesCH 17Aldrin CabangbangNo ratings yet

- Quiz No. 2Document5 pagesQuiz No. 2VernnNo ratings yet

- Audit of ReceivablesDocument5 pagesAudit of ReceivablesandreamrieNo ratings yet

- Handout Audit of ReceivablesDocument6 pagesHandout Audit of ReceivablesJahanna MartorillasNo ratings yet

- AccountingDocument26 pagesAccountingMuhammad Jaafar AbinalNo ratings yet

- 91 - Final Preaboard Afar (Weekends)Document18 pages91 - Final Preaboard Afar (Weekends)Joris YapNo ratings yet

- AFAR-01 (Partnership Formation & Operations)Document6 pagesAFAR-01 (Partnership Formation & Operations)Nathalie Shien DagaragaNo ratings yet

- Unit IA ID. Rematch Unit Drill On Cash and Cash Equivalents Petty Cash Bank Recon Proof of Cash 1Document5 pagesUnit IA ID. Rematch Unit Drill On Cash and Cash Equivalents Petty Cash Bank Recon Proof of Cash 1MARK JHEN SALANGNo ratings yet

- AFAR ProblemsDocument45 pagesAFAR ProblemsPrima FacieNo ratings yet

- Intermediate Acctg A 1 10Document10 pagesIntermediate Acctg A 1 10Leonila RiveraNo ratings yet

- Karkits Corporation PDFDocument4 pagesKarkits Corporation PDFRachel LeachonNo ratings yet

- Chapter 1-SolutionsDocument14 pagesChapter 1-SolutionsPrince CalicaNo ratings yet

- Problem Set For AR (Ctto)Document16 pagesProblem Set For AR (Ctto)Mariane Jean Guerrero100% (1)

- A. Cash and Cash EquivalentsDocument24 pagesA. Cash and Cash EquivalentskimkimNo ratings yet

- Far Eastern University - Manila Institute of Accounts, Business and Finance Nicanor Reyes Sr. ST., Sampaloc, Manila Applied AuditingDocument6 pagesFar Eastern University - Manila Institute of Accounts, Business and Finance Nicanor Reyes Sr. ST., Sampaloc, Manila Applied AuditingKenneth A. S. AlabadoNo ratings yet

- Partnership LiquidationDocument6 pagesPartnership Liquidationyoj assenavNo ratings yet

- LQ 2 AnswersDocument21 pagesLQ 2 Answersby ScribdNo ratings yet

- AccountingDocument1 pageAccountingAlexandra Nicole IsaacNo ratings yet

- AC 3101 Discussion ProblemDocument1 pageAC 3101 Discussion ProblemYohann Leonard HuanNo ratings yet

- Auditing Problems 2Document8 pagesAuditing Problems 2Rujean Salar AltejarNo ratings yet

- School of Accountancy & Management Accounting For Special Transaction Midterm ExaminationDocument11 pagesSchool of Accountancy & Management Accounting For Special Transaction Midterm ExaminationTasha MarieNo ratings yet

- AFAR02 04 Franchise AccountingDocument4 pagesAFAR02 04 Franchise AccountingNicoleNo ratings yet

- UNIT 3 Accounts Receivable PDFDocument11 pagesUNIT 3 Accounts Receivable PDFVilma HermosadoNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet

- PNC MT Examination Finacc 3Document3 pagesPNC MT Examination Finacc 3joevitt delfinadoNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- 9101 - Partnership FormationDocument2 pages9101 - Partnership FormationGo FarNo ratings yet

- Midterm Exam No. 3Document3 pagesMidterm Exam No. 3Anie MartinezNo ratings yet

- Chapter 1 Problem 3: Exercises: - Journal EntryDocument18 pagesChapter 1 Problem 3: Exercises: - Journal EntryAlarich CatayocNo ratings yet

- Audit of Investments - Set ADocument4 pagesAudit of Investments - Set AZyrah Mae SaezNo ratings yet

- Ap-5905 Inventories PDFDocument9 pagesAp-5905 Inventories PDFKathleen Jane SolmayorNo ratings yet

- AFAR ReviewDocument11 pagesAFAR ReviewPaupauNo ratings yet

- Proof+of+Cash ProblemsDocument2 pagesProof+of+Cash ProblemshelaihjsNo ratings yet

- Lesson 1 AP: Minimum Composition of The SFP and Some Audit NotesDocument14 pagesLesson 1 AP: Minimum Composition of The SFP and Some Audit NotesDebs FanogaNo ratings yet

- 01 - Audit of Cash & Cash EquivalentsDocument4 pages01 - Audit of Cash & Cash EquivalentsEARL JOHN RosalesNo ratings yet

- On December AcctDocument4 pagesOn December AcctMelody BautistaNo ratings yet

- ACTExamsDocument36 pagesACTExamsKaguraNo ratings yet

- Practice ExercisesDocument2 pagesPractice ExercisesNikki Labial0% (1)

- Decided To Open A Branch in ManilaDocument2 pagesDecided To Open A Branch in Manilaasdfghjkl zxcvbnmNo ratings yet

- Quiz Integ BusCom ForExDocument7 pagesQuiz Integ BusCom ForExPrankyJellyNo ratings yet

- PDF 6Document349 pagesPDF 6Aexisse OrchessaNo ratings yet

- Chapter 1 - Multiple Choice Problem Answers AfarDocument13 pagesChapter 1 - Multiple Choice Problem Answers AfarChincel G. ANINo ratings yet

- Lump Sum LiquidationDocument3 pagesLump Sum LiquidationJose Mariano MelendezNo ratings yet

- Auditing Problems: Jipbautista16 - Cpar - 2021Document2 pagesAuditing Problems: Jipbautista16 - Cpar - 2021Ivy BautistaNo ratings yet

- Audit Quizzer (Cash) - 05Document1 pageAudit Quizzer (Cash) - 05Ivy BautistaNo ratings yet

- Prelim-Pr 2a14fb4488c3b5b235Document11 pagesPrelim-Pr 2a14fb4488c3b5b235Romina LopezNo ratings yet

- Encode JobDocument12 pagesEncode JobRainNo ratings yet

- Audit Cash - Aud ProblemsDocument36 pagesAudit Cash - Aud ProblemsIvy BautistaNo ratings yet

- Partnership Liquidation: Answer: (D)Document2 pagesPartnership Liquidation: Answer: (D)Ivy BautistaNo ratings yet

- Partnership Liquidation: Assets Liabilities & EquityDocument2 pagesPartnership Liquidation: Assets Liabilities & EquityIvy BautistaNo ratings yet

- Auditing Problems: Jipbautista16 - Cpar - 2021Document2 pagesAuditing Problems: Jipbautista16 - Cpar - 2021Ivy BautistaNo ratings yet

- F Accountancy MS XI 2023-24Document9 pagesF Accountancy MS XI 2023-24bhaiyarakesh100% (1)

- Abdul Manan IS1Document20 pagesAbdul Manan IS1Chakwal ReactionsNo ratings yet

- ETicket NN21SOJP2HA2645Y9803 ParakhDocument5 pagesETicket NN21SOJP2HA2645Y9803 Parakhrashi kumawatNo ratings yet

- Datasheet AP400 PDFDocument4 pagesDatasheet AP400 PDFRaaft riadNo ratings yet

- Statement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceDocument8 pagesStatement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits Balancedinesh namdeoNo ratings yet

- ACFE FinTech Fraud Summit PresentationDocument16 pagesACFE FinTech Fraud Summit PresentationCrowdfundInsider100% (1)

- Cross Docking PPT AVENGERSDocument13 pagesCross Docking PPT AVENGERSRei RacazaNo ratings yet

- ADL 75 E-Commerce V4Document6 pagesADL 75 E-Commerce V4solvedcareNo ratings yet

- Noe FillingDocument2 pagesNoe FillingPankajShuklaNo ratings yet

- Module 6 Travel TradeDocument17 pagesModule 6 Travel TradeSaj Benedict AyalaNo ratings yet

- Freecharge - Deals - Business ProposalDocument11 pagesFreecharge - Deals - Business ProposalneetugNo ratings yet

- 1000g Not Sold OutletDocument182 pages1000g Not Sold Outletkamrulislamaustralia92No ratings yet

- Hindustan Electronic Limited-Case StudyDocument27 pagesHindustan Electronic Limited-Case StudyMayank KothariNo ratings yet

- Diploma in Accountancy Qa March 2022Document217 pagesDiploma in Accountancy Qa March 2022Chanda LufunguloNo ratings yet

- Cisco Sales Expert 2 2Document76 pagesCisco Sales Expert 2 2jamespcurranNo ratings yet

- EAP-110 SPEC v1.1Document3 pagesEAP-110 SPEC v1.1SHING EBNo ratings yet

- 9211stmt 16022017 1499569616627 PDFDocument5 pages9211stmt 16022017 1499569616627 PDFInfohoggNo ratings yet

- Inc09 3Document5 pagesInc09 3Hasan Kadir Uçmazoğlu (Student)No ratings yet

- MS-44J (Working Capital Management)Document13 pagesMS-44J (Working Capital Management)juleslovefenNo ratings yet

- Topic 7 Cash Management & ControlDocument25 pagesTopic 7 Cash Management & ControlMd Jahid HossainNo ratings yet

- Rep Liceum Technikum 79Document52 pagesRep Liceum Technikum 79Sebastian KORCZAKNo ratings yet

- Amazon Chime Voice Connector - SIP Trunk Validation - FreePBX - v1.2Document23 pagesAmazon Chime Voice Connector - SIP Trunk Validation - FreePBX - v1.2Juan Manuel BonillaNo ratings yet

- Rajesh IciciDocument32 pagesRajesh Icicisrinivas rao kNo ratings yet

- CCMF Fund - Financial Statements - 2019Document8 pagesCCMF Fund - Financial Statements - 2019Cindy BartolayNo ratings yet

- MDIS Map 2021 FADocument1 pageMDIS Map 2021 FAMichelleNo ratings yet

- Transport 1Document15 pagesTransport 1angaNo ratings yet

- Cost I Chapter 4 EditedDocument10 pagesCost I Chapter 4 EditedWonde BiruNo ratings yet