Professional Documents

Culture Documents

Powered by Axis Bank: Airport Lounge Access Program

Powered by Axis Bank: Airport Lounge Access Program

Uploaded by

Ratnesh Kr Singh0 ratings0% found this document useful (0 votes)

18 views4 pagesThis document outlines the terms and conditions of an airport lounge access program for eligible credit cardholders of Axis Bank. Cardholders can access over 35 participating airport lounges across India with their eligible credit cards. Lounge access is either complimentary for the cardholder up to a quarterly limit, or for a fee that is paid directly at the lounge. Access is subject to availability and lounge rules, and Axis Bank does not guarantee privileges at participating lounges.

Original Description:

Lic india card

Original Title

lic-lounge-tnc

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the terms and conditions of an airport lounge access program for eligible credit cardholders of Axis Bank. Cardholders can access over 35 participating airport lounges across India with their eligible credit cards. Lounge access is either complimentary for the cardholder up to a quarterly limit, or for a fee that is paid directly at the lounge. Access is subject to availability and lounge rules, and Axis Bank does not guarantee privileges at participating lounges.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

18 views4 pagesPowered by Axis Bank: Airport Lounge Access Program

Powered by Axis Bank: Airport Lounge Access Program

Uploaded by

Ratnesh Kr SinghThis document outlines the terms and conditions of an airport lounge access program for eligible credit cardholders of Axis Bank. Cardholders can access over 35 participating airport lounges across India with their eligible credit cards. Lounge access is either complimentary for the cardholder up to a quarterly limit, or for a fee that is paid directly at the lounge. Access is subject to availability and lounge rules, and Axis Bank does not guarantee privileges at participating lounges.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

Powered by Axis Bank

Airport Lounge Access Program

Eligible Credit Cards:

• LIC Signature Credit Card (2 complimentary lounge access per quarter)

Participating lounges:

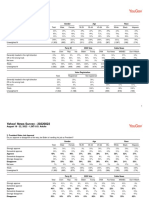

S.No. State City Lounge Terminal

1 Andhra Pradesh Vijayawada Amaravati Domestic

2 Andhra Pradesh Visakhapatnam CIP International

3 Chandigarh Chandigarh Cram Bar Domestic

4 Delhi Delhi Plaza Premium Domestic T1D

5 Delhi Delhi Plaza Premium Domestic T2

6 Delhi Delhi Plaza Premium Domestic T3

7 Delhi Delhi Plaza Premium International 04

8 Delhi Delhi Plaza Premium International 07

9 Goa Goa TFS Domestic

10 Gujarat Ahmedabad Plaza Premium Domestic

11 Gujarat Ahmedabad Plaza Premium International

12 Gujarat Vadodara Premium Domestic

13 Karnataka Bangalore TFS Domestic

14 Karnataka Bangalore TFS International

15 Kerala Calicut Bird International

16 Kerala Cochin Earth Domestic

17 Kerala Cochin Earth International

18 Kerala Trivandrum Bird International

19 Maharashtra Mumbai Clipper International

20 Maharashtra Mumbai MALS Domestic

21 Maharashtra Mumbai OASIS Domestic

22 Maharashtra Mumbai TFS Domestic T1C

23 Maharashtra Nagpur TFS Domestic

24 Maharashtra Nagpur TFS International

25 Maharashtra Pune Bird Domestic

26 Odisha Bhubaneswar Bird Domestic

27 Rajasthan Udaipur Golden Chariot International

28 Tamil Nadu Coimbatore BlackBerry Domestic

29 Tamil Nadu Chennai TFS Domestic A

30 Tamil Nadu Chennai TFS Domestic B

31 Tamil Nadu Chennai TFS International Old

32 Tamil Nadu Chennai TFS International Old Ext

33 Tamil Nadu Chennai TFS International New

34 Telangana Hyderabad Plaza Premium Domestic

35 Telangana Hyderabad Plaza Premium International

36 Uttar Pradesh Lucknow ILE Bar Domestic

37 Uttarakhand Dehradun Bird Domestic

38 West Bengal Kolkata TFS Domestic

39 West Bengal Kolkata TFS International

TERMINOLOGY:

“Eligible Card” under the Program means following card types issued by Axis Bank on Visa Platforms which are

mentioned above.

“Eligible Cardholder” means only holder of an Eligible Credit Card

“Participating Airport Lounges” means the list of airport lounges that participate in the Program as shown in above.

RULES OF ACCESS UNDER THE PROGRAM

The Program is available till 31st August 2025

Eligible Cardholders will be allowed access to all Participating Airport Lounges under the Program, based on one of

the following entry types:

Entry Type 1: Free entry for Eligible Cardholder only, (subject to a swipe fee of nominal amount for Visa).

All Eligible Cards must be validated at point of entry by swiping a transaction of a nominal fee.

Entry Type 2: Paid entry for the Eligible Cardholder according to the respective prices of usage displayed

at the Participating Airport Lounges, for himself/herself only or for his/her accompanying guests

(payment will be made directly at the Participating Airport Lounge by the Eligible Cardholder).

The offer is not transferable, non-negotiable and cannot be en-cashed.

To use the Participating Airport Lounge, customer’s Card must be validated at point of entry by swiping a

transaction of a nominal amount for Visa. The customer will be denied the free entry if the Card authentication

fails upon this swipe.

Without prejudice to the foregoing paragraphs, Entry Type 1 may be restricted or unavailable:

If Axis Bank withdraws the Entry Type 1 (either as a program or in relation to any Eligible Cardholder or at

any Participating Airport Lounge) for any reason at its sole and absolute discretion; or

If the maximum capacity for Axis Bank cardholders or an Eligible Card type or an Eligible Card type issued

by Axis Bank has been reached at the relevant Participating Airport Lounge. In this regard it is to be noted

that capacity limits at a Participating Airport Lounge may be different for different Eligible Card types

issued by Axis Bank. Axis Bank shall not be held responsible under any circumstances for any such

unavailability

Axis Bank makes no guarantee that any privileges, benefits or facilities under the Program or otherwise

will be made available by the Participating Airport Lounge to an Eligible Cardholder and Axis Bank cannot

be held liable for the same. Specifically, the free lounge access to customer(s) may be suspended if the

validation system at the Participating Airport Lounge is unable to swipe and authorize the customers’ Card

due to any system malfunction or connectivity issues.

Usage of the Participating Airport Lounges under the Program (under both Entry Type 1 and Entry Type 2) is

subject to access limits/quota every quarter that will be determined by Axis Bank in its absolute discretion and any

attempted usage beyond such access limits/quota will be rejected by the Participating Airport Lounge.

All accompanying children (where permitted) will be subject to the full guest fee unless otherwise stated.

Please note that additional charge may occur for meal/food/drink items (especially, Alcoholic Drinks) as well as for

services like Nap, Massage Service and Spa as per the discretion of the Participating Airport Lounge.

Participating Airport Lounge staff are responsible for ensuring that all Eligible Cardholders who are using the

lounge under the Program swipe their Eligible Card (with a swipe fee of nominal amount for Visa), and will record

the usage by swiping their Card and issuing a charge-slip to the Eligible Cardholder.

Eligible Cardholders will be charged on their Eligible Card based on the amount stated on the charge-slip

presented by the Participating Airport Lounge operator. Whilst it is the responsibility of the Participating Airport

Lounge staff to ensure a valid charge-slip is processed and printed by swiping the Eligible card, the Eligible

Cardholder is responsible for ensuring, before using the lounge facilities, that the charge-slip correctly reflects the

applicable usage charges for his entry and that of his/her companion (if applicable). The Eligible Cardholder must

retain the 'Cardholder's' copy of the charge-slip for verification purposes, and no allegations of error in charges

will be entertained without the charge-slip verification.

All usage of the Participating Airport Lounges under the Program is conditional upon presentation of a valid

Eligible Card, and Axis Bank, in its sole and absolute discretion, may alter, cancel, or amend eligibility of any credit

card, or Program benefits, at any time without prior notice.

The privileges under this Program are to be construed as a standalone offer and cannot be clubbed together

and/or in any way be combined with any other offer of the Participating Airport Lounge in any manner, or form.

For the avoidance of doubt, privileges under the Program cannot be exchanged or redeemed for cash.

All Participating Airport Lounges are not owned or operated by Axis Bank, but by third party organizations. Eligible

Cardholders and relevant accompanying guests must abide by the rules and policies of each respective

Participating Airport Lounge, which include, without limitation:

Access being denied to the lounge where there are space constraints or if the maximum capacity for

cardholders or an Eligible Card type or an Eligible Card type issued by Axis Bank has been reached at the

relevant Participating Airport Lounge.

Admittance subject to users and their guests (including children) behaving and dressing (no shorts

allowed outside of the USA) in an orderly and correct manner.

Any infants or children causing upset to other users' comfort may be asked to vacate the lounge

facilities. Eligible Cardholders agree and acknowledge that they may be refused entry and/or asked to

vacate for non-compliance with the rules and policies and, for the avoidance of doubt, will not make any

complaints against, or hold Axis Bank responsible.

For the avoidance of doubt, Axis Bank makes no guarantee that any privileges, benefits or facilities under the

Program or otherwise will be made available by the Participating Airport Lounge to an Eligible Cardholder and Axis

Bank will not be liable in any circumstances whatsoever in relation to the provision or non-provision (whether in

whole or in part) of any of the advertised benefits and facilities under the Program.

Participating Airport Lounges may reserve the right to enforce a maximum stay policy (usually 2 or 3 hours) to

prevent overcrowding. This is at the discretion of the individual lounge operator who may impose a charge for

extended stays.

Participating Airport Lounges have no contractual obligation to announce flights, nor to remind guests of their

flight boarding times, and Eligible Cardholders are solely responsible for abiding by boarding times stated on their

flight tickets. Accordingly, for the avoidance of doubt Axis Bank shall not be liable under any circumstances in

relation to any failure to board flights (for any reason) by an Eligible Cardholder.

Axis Bank shall not be held responsible under any circumstances for any disputes that may occur in, or in relation

to the usage of, a Participating Airport Lounge, including without limitation, between the Eligible Cardholder and

another guest, airport user, or Participating Airport Lounge operator staff/representatives.

By participating in or using, or attempting to use, the Participating Airport Lounge under the Program, the Eligible

Cardholder agrees to:

abide by the terms and conditions set out herein and

to defend and indemnify Axis Bank for any loss or damage caused to, or injury to or death of any

person or damage to or destruction of any property arising out of the use of any Participating Airport

Lounge by the Eligible Cardholder and/or his/her accompanying guests.

All disputes, if any, arising out of or in connection with or as a result of above offers or otherwise

relating hereto shall be subject to the exclusive jurisdiction of the competent courts/tribunals in

Mumbai only, irrespective of whether courts/tribunals in other areas have concurrent or similar

jurisdiction.

You might also like

- FinalDocument23 pagesFinalGarcia Azir100% (2)

- Chapter 8 Provisions Common To Pledge and MortgageDocument8 pagesChapter 8 Provisions Common To Pledge and MortgageSteffany Roque100% (2)

- Axis Bank Letter PadDocument3 pagesAxis Bank Letter Padchetan.mle17No ratings yet

- List of Participating Airport Lounges : S.No Lounge State City TerminalDocument4 pagesList of Participating Airport Lounges : S.No Lounge State City TerminalSaahil ShahNo ratings yet

- Axis Lic Lounge ListDocument3 pagesAxis Lic Lounge ListKUNJ BIHARI SINGHNo ratings yet

- List of Participating Airport Lounges :: S.No. City Lounge Name Airport TerminalDocument3 pagesList of Participating Airport Lounges :: S.No. City Lounge Name Airport TerminalSiddharth DasNo ratings yet

- Axis Bank Airport Lounge Access ProgramDocument5 pagesAxis Bank Airport Lounge Access ProgramHimanshuNo ratings yet

- Axis Bank Airport Lounge Access ProgramDocument5 pagesAxis Bank Airport Lounge Access ProgramYashasvi GuptaNo ratings yet

- Lounge List For Priority Debit CardDocument3 pagesLounge List For Priority Debit CardDumpDumpNo ratings yet

- Prestige Debit Card Lounge ListDocument3 pagesPrestige Debit Card Lounge ListJagjeet SinghNo ratings yet

- Ilovepdf MergedDocument18 pagesIlovepdf MergedRishuNo ratings yet

- DownloadDocument2 pagesDownloadnisar NissarNo ratings yet

- HDFC Lounge IndiaDocument2 pagesHDFC Lounge Indiassp5375107No ratings yet

- Lounge Access Terms Amp ConditionsDocument3 pagesLounge Access Terms Amp ConditionsNishanth BaratamNo ratings yet

- Burgundy Debit Card Lounge ListDocument4 pagesBurgundy Debit Card Lounge ListDhrumil ShahNo ratings yet

- Debit Card Airport Lounge ProgramDocument3 pagesDebit Card Airport Lounge ProgramApacetech IluvbNo ratings yet

- Axis Bank Airport Lounge Access Program Fy1cDocument3 pagesAxis Bank Airport Lounge Access Program Fy1cSom Dutt VyasNo ratings yet

- VisaAirportLounge T&Cs 300114Document3 pagesVisaAirportLounge T&Cs 300114AhrarNo ratings yet

- BoB RuPay Premier Lounge ListDocument2 pagesBoB RuPay Premier Lounge ListKUNJ BIHARI SINGHNo ratings yet

- Visa Lounge TNCDocument3 pagesVisa Lounge TNCAnkit GadaNo ratings yet

- Airport Lounge Access TNC - BDocument5 pagesAirport Lounge Access TNC - BArun SharmaNo ratings yet

- Ru Pay Select Credit Card Lounge Program 2023Document2 pagesRu Pay Select Credit Card Lounge Program 2023SANKET MORENo ratings yet

- Lounge List VisaDocument5 pagesLounge List VisaNandkishor G MhatreNo ratings yet

- Visa Lounge Location and TNCDocument9 pagesVisa Lounge Location and TNCAnantaNo ratings yet

- Axis Bank Airport Lounge Access ProgramDocument5 pagesAxis Bank Airport Lounge Access ProgramMKChaitanyaNo ratings yet

- Rupay Select Credit Card Airport Lounge Program 2024Document2 pagesRupay Select Credit Card Airport Lounge Program 2024johnhtcxNo ratings yet

- RuPay PlatinumCredit Card - Lounge Program2024Document2 pagesRuPay PlatinumCredit Card - Lounge Program2024Subrat NandaNo ratings yet

- HDFC Regalia CC Lounge ListDocument2 pagesHDFC Regalia CC Lounge ListKumar SarvasvaNo ratings yet

- FIRST Power Plus PrivilegesDocument15 pagesFIRST Power Plus Privilegesmaulik_n_ravalNo ratings yet

- Terms & Conditions: Visa Airport Lounge Access Program (The "Program") TerminologyDocument5 pagesTerms & Conditions: Visa Airport Lounge Access Program (The "Program") TerminologyAnjani KumarNo ratings yet

- List of Participating Airport Lounges : S.No. State City Lounge TerminalDocument5 pagesList of Participating Airport Lounges : S.No. State City Lounge TerminalSwarup M SureshNo ratings yet

- Airport Lounge TNCDocument5 pagesAirport Lounge TNCsanchit1903No ratings yet

- Form of E-Tender: Kerala Livestock Development Board LTD., Gokulam', Pattom, Thiruvananthapuram - 695 004 KeralaDocument18 pagesForm of E-Tender: Kerala Livestock Development Board LTD., Gokulam', Pattom, Thiruvananthapuram - 695 004 KeralakulathuiyerNo ratings yet

- Airport Lounges List and TNCDocument4 pagesAirport Lounges List and TNCpinkflloydNo ratings yet

- PlazaDocument3 pagesPlazaueekim111No ratings yet

- DownloadDocument2 pagesDownloadvikas.sachan588No ratings yet

- International Lounge Access Terms and ConditionsDocument2 pagesInternational Lounge Access Terms and ConditionsDiptajit MukherjeeNo ratings yet

- DownloadDocument2 pagesDownloadSamsung PhoneNo ratings yet

- JetPrivilege Visa Airport Lounge Access ProgramDocument5 pagesJetPrivilege Visa Airport Lounge Access ProgramArun KannaNo ratings yet

- Mastercard Visa India Lounge Program Lounge ListDocument2 pagesMastercard Visa India Lounge Program Lounge Listrjsharma101011No ratings yet

- Infinia LoungesDocument2 pagesInfinia LoungesSUNAEKNo ratings yet

- Tendernotice 2Document13 pagesTendernotice 2vaibhav guptaNo ratings yet

- List of Lounges & Terms and Conditions: Sr. No. City Name Terminal Departures Location Landmark Valid TillDocument2 pagesList of Lounges & Terms and Conditions: Sr. No. City Name Terminal Departures Location Landmark Valid TillingcareersNo ratings yet

- DragonPassVIPloungeservice FAQDocument5 pagesDragonPassVIPloungeservice FAQJason TanNo ratings yet

- DownloadDocument2 pagesDownloadSIDDHANT AHUJANo ratings yet

- CSR Impact Assessment FY 23 - VAL LanjigarhDocument2 pagesCSR Impact Assessment FY 23 - VAL LanjigarhEr Amit ChhonkerNo ratings yet

- DownloadDocument1 pageDownloademail4trustedcontacts3No ratings yet

- Rupay Card - Airport Lounge Program Terms and Conditions As ApplicableDocument2 pagesRupay Card - Airport Lounge Program Terms and Conditions As ApplicableAnkit GadaNo ratings yet

- DownloadDocument5 pagesDownloadmeghraj royNo ratings yet

- Priority Pass Detailed T CDocument4 pagesPriority Pass Detailed T CPragun SaraffNo ratings yet

- In Easemytrip Product Terms and ConditionsDocument4 pagesIn Easemytrip Product Terms and ConditionsMac OSNo ratings yet

- Your Electronic Ticket-EMD ReceiptDocument4 pagesYour Electronic Ticket-EMD ReceiptdushyantNo ratings yet

- MasterCard Lounge Access Program JDCDocument2 pagesMasterCard Lounge Access Program JDCdhavalNo ratings yet

- Ventilator (5 Nos.) : 2764788, 2764188 or 0483-273294 or Through EmailDocument4 pagesVentilator (5 Nos.) : 2764788, 2764188 or 0483-273294 or Through EmailLokesh KuppiliNo ratings yet

- HDFC Regalia Lounge ListDocument1 pageHDFC Regalia Lounge ListKUNJ BIHARI SINGHNo ratings yet

- Code Vita Season 7 - TCS Global Coding ContestDocument8 pagesCode Vita Season 7 - TCS Global Coding ContestkaranNo ratings yet

- In Easemytrip Product Terms and ConditionsDocument4 pagesIn Easemytrip Product Terms and Conditionspradeepkotnana19No ratings yet

- Lounge Program Details and TC1Document1 pageLounge Program Details and TC1Marvel MemesNo ratings yet

- DownloadDocument1 pageDownloadSilambarasan AshokkumarNo ratings yet

- Pay The Smart Way Competition RulesDocument2 pagesPay The Smart Way Competition RulessegaechomooketsiNo ratings yet

- Rules and RegulationsDocument6 pagesRules and Regulationssamk828510No ratings yet

- Performance-Based Road Maintenance Contracts in the CAREC RegionFrom EverandPerformance-Based Road Maintenance Contracts in the CAREC RegionNo ratings yet

- 1 CFAP Syllabus Winter 2020Document17 pages1 CFAP Syllabus Winter 2020Kamran UllahNo ratings yet

- Articles 62 & 63: Presented By: Muhammad Saad Umar FROM: BS (ACF) - B 2K20Document10 pagesArticles 62 & 63: Presented By: Muhammad Saad Umar FROM: BS (ACF) - B 2K20Muhammad Saad UmarNo ratings yet

- Group Histopath 1Document7 pagesGroup Histopath 1SAMMYNo ratings yet

- FCD PAWNSHOP vs. UNION BANKDocument2 pagesFCD PAWNSHOP vs. UNION BANKShaira Mae CuevillasNo ratings yet

- TMOHentai - Sono Zunou Wa Otona No Tame Ni - ReaderDocument73 pagesTMOHentai - Sono Zunou Wa Otona No Tame Ni - ReaderNoxinvictus IncorporatedNo ratings yet

- Color Purple Research Paper TopicsDocument4 pagesColor Purple Research Paper Topicsaflbqtfvh100% (1)

- Haryana General Knowledge For HCS Examinations - General Knowledge TodayDocument14 pagesHaryana General Knowledge For HCS Examinations - General Knowledge Todayas_5kNo ratings yet

- LTD Hermoso Vs CADocument8 pagesLTD Hermoso Vs CADennis Dwane MacanasNo ratings yet

- G-11 BST Ch02Document71 pagesG-11 BST Ch02Abel Soby JosephNo ratings yet

- Incontestability ClauseDocument2 pagesIncontestability ClauseSamJadeGadianeNo ratings yet

- Intentional Spending TrackerDocument12 pagesIntentional Spending TrackerAzooz AbbasNo ratings yet

- Persuasiveness of Natural LawDocument19 pagesPersuasiveness of Natural LawnimusiimamirianNo ratings yet

- 19-Pormento SR Vs PontevedraDocument7 pages19-Pormento SR Vs PontevedraLexter CruzNo ratings yet

- Villasis - CorderoDocument4 pagesVillasis - CorderoBlaise VENo ratings yet

- Turquoise Blue Simple Organized Timeline PosterDocument3 pagesTurquoise Blue Simple Organized Timeline PosterSITTHIPHONH PATHAMMAVONGNo ratings yet

- Article I - National TerritoryDocument4 pagesArticle I - National TerritoryLyka Lizeth DuldulaoNo ratings yet

- Sim-Ge: Q1) Suggested AnswersDocument12 pagesSim-Ge: Q1) Suggested AnswersDương DươngNo ratings yet

- 11 - Arroyo vs. de Lima, G.R. No. 199034, November 15, 2011 ResolutionDocument13 pages11 - Arroyo vs. de Lima, G.R. No. 199034, November 15, 2011 ResolutionMichelle T. CatadmanNo ratings yet

- UNHCR 018 - Assistant Security Officer NOA PN10028522 YangonDocument3 pagesUNHCR 018 - Assistant Security Officer NOA PN10028522 YangonNanda Win LwinNo ratings yet

- The Great Speeches of Modern India (Mukherjee, Rudrangshu) (Z-Library)Document441 pagesThe Great Speeches of Modern India (Mukherjee, Rudrangshu) (Z-Library)Amit BhagatNo ratings yet

- Tia Rowe - Donovan Gold - Andrew Knight Payan - Los Angeles Felony Arrest RecordsDocument3 pagesTia Rowe - Donovan Gold - Andrew Knight Payan - Los Angeles Felony Arrest RecordsJacky J. JasperNo ratings yet

- Realstate Feasibility Report - New Version-1Document54 pagesRealstate Feasibility Report - New Version-1madford.303No ratings yet

- Hotel SeoulDocument1 pageHotel SeoulSiv HuongNo ratings yet

- CRBT Charging Terms: 1. Use of The ServiceDocument4 pagesCRBT Charging Terms: 1. Use of The ServiceGway ZiNo ratings yet

- A12 - KolkataDocument2 pagesA12 - KolkataVbs ReddyNo ratings yet

- Yahoo Tabs Biden EconomyDocument89 pagesYahoo Tabs Biden EconomyKelli R. Grant0% (1)

- W-8BEN: Do NOT Use This Form IfDocument1 pageW-8BEN: Do NOT Use This Form IfdoyokaNo ratings yet

- Face Negotiation Theory (Stella Ting-Toomey) - SimplifiedDocument3 pagesFace Negotiation Theory (Stella Ting-Toomey) - SimplifiedRajesh Cheemalakonda100% (1)