Professional Documents

Culture Documents

VaTech Q1 Result Update

VaTech Q1 Result Update

Uploaded by

Aryan SharmaCopyright:

Available Formats

You might also like

- Holding Company Business PlanDocument59 pagesHolding Company Business PlanFayad CalúNo ratings yet

- Dilapidation FinalDocument22 pagesDilapidation FinalShem HaElohim Ejem100% (1)

- MCRS Fuel System Overview PDFDocument100 pagesMCRS Fuel System Overview PDFAnonymous ABPUPbK91% (11)

- Project 2Document2 pagesProject 2Ritz DeshmukhNo ratings yet

- Exploratory Course - Computer Hardware Servicing For G 7and 8 - Answer Key PDFDocument9 pagesExploratory Course - Computer Hardware Servicing For G 7and 8 - Answer Key PDFSirossi Ven67% (12)

- ISGEC Q1 Result UpdateDocument6 pagesISGEC Q1 Result UpdateAryan SharmaNo ratings yet

- PratibhaInd 18 Jan 2010Document6 pagesPratibhaInd 18 Jan 2010atmaram9999No ratings yet

- Dixon Q1 Result UpdateDocument7 pagesDixon Q1 Result UpdateshrikantbodkeNo ratings yet

- WPIL PYT MultibaggerDocument2 pagesWPIL PYT MultibaggerRajeev GargNo ratings yet

- Aarti Ind. SharekhanDocument8 pagesAarti Ind. SharekhanAniket DhanukaNo ratings yet

- SHAREKHANDocument11 pagesSHAREKHANRajesh SharmaNo ratings yet

- V-Guard Industries: Operationally Strong QuarterDocument5 pagesV-Guard Industries: Operationally Strong QuarterUmesh ThawareNo ratings yet

- Aarti Industries 10-08-2021 KhanDocument8 pagesAarti Industries 10-08-2021 KhanAkchikaNo ratings yet

- Aarti 3R Aug11 - 2022Document7 pagesAarti 3R Aug11 - 2022Arka MitraNo ratings yet

- KEI Q1 Result UpdateDocument7 pagesKEI Q1 Result UpdateAryan SharmaNo ratings yet

- Bharti - Airtel Q1 Result UpdateDocument10 pagesBharti - Airtel Q1 Result UpdateRatan PalankiNo ratings yet

- Polycab India Limited: Business Dynamics Strong, Retain BuyDocument8 pagesPolycab India Limited: Business Dynamics Strong, Retain Buyshankar alkotiNo ratings yet

- SupremeInd 3R Apr29 2022Document7 pagesSupremeInd 3R Apr29 2022bdacNo ratings yet

- Emkay 20080122 Hindustan ConstructionDocument6 pagesEmkay 20080122 Hindustan ConstructionAnkita DasotNo ratings yet

- ABB India: Strong Margin Expansion Valuations Remain ExpensiveDocument5 pagesABB India: Strong Margin Expansion Valuations Remain ExpensiveAmar DoshiNo ratings yet

- TataMotors SharekhanDocument9 pagesTataMotors SharekhanAniket DhanukaNo ratings yet

- Spanco Telesystems Initiating Cov - April 20 (1) .Document24 pagesSpanco Telesystems Initiating Cov - April 20 (1) .KunalNo ratings yet

- State Bank of India: CMP: INR407 TP: INR600 (+47%)Document12 pagesState Bank of India: CMP: INR407 TP: INR600 (+47%)satyendragupta0078810No ratings yet

- Vatech Q2fy23 Jbwa 281122Document7 pagesVatech Q2fy23 Jbwa 281122Manish BNo ratings yet

- ISGEC 3R Nov17 - 2021Document7 pagesISGEC 3R Nov17 - 2021Aayushman GuptaNo ratings yet

- PNC - Infra Q1 Result UpdateDocument7 pagesPNC - Infra Q1 Result UpdateAryan SharmaNo ratings yet

- P.I. Industries (PI IN) : Q3FY20 Result UpdateDocument8 pagesP.I. Industries (PI IN) : Q3FY20 Result UpdateanjugaduNo ratings yet

- 141342112021251larsen Toubro Limited - 20210129Document5 pages141342112021251larsen Toubro Limited - 20210129Michelle CastelinoNo ratings yet

- Ipca 3R Aug11 - 2022Document7 pagesIpca 3R Aug11 - 2022Arka MitraNo ratings yet

- L&T Finance Holdings LTD: ESG Disclosure ScoreDocument6 pagesL&T Finance Holdings LTD: ESG Disclosure ScoreAshwet JadhavNo ratings yet

- Iiww 161210Document4 pagesIiww 161210rinku23patilNo ratings yet

- FY2017AnnualRep L&T Annual Report 2016-17Document488 pagesFY2017AnnualRep L&T Annual Report 2016-17sathishNo ratings yet

- Ipca Laboratories Limited: Promising OutlookDocument8 pagesIpca Laboratories Limited: Promising OutlookanjugaduNo ratings yet

- Tata Elxsi Limited: Result UpdateDocument6 pagesTata Elxsi Limited: Result UpdateinvestfortestNo ratings yet

- Affle Stock PricingDocument8 pagesAffle Stock PricingSandyNo ratings yet

- Ashoka Buidcon 3R Aug11 2022Document7 pagesAshoka Buidcon 3R Aug11 2022Arka MitraNo ratings yet

- Bharti - Airtel SharekhanDocument10 pagesBharti - Airtel SharekhandarshanmaldeNo ratings yet

- Kpil 9 2 24 PLDocument8 pagesKpil 9 2 24 PLrmishraNo ratings yet

- SGS Tekniks Manufacturing PVT LTDDocument7 pagesSGS Tekniks Manufacturing PVT LTDgcgary87No ratings yet

- HSIE Results Daily: Result ReviewsDocument13 pagesHSIE Results Daily: Result ReviewsKiran KudtarkarNo ratings yet

- P.I. Industries (PI IN) : Q1FY21 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- CFRA GROUP 10 Ultratech CementsDocument16 pagesCFRA GROUP 10 Ultratech CementsSitu MohantyNo ratings yet

- P.I. Industries (PI IN) : Q1FY20 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY20 Result UpdateMax BrenoNo ratings yet

- Bank of Baroda - KRC - 15 10 09Document2 pagesBank of Baroda - KRC - 15 10 09sudhirbansalNo ratings yet

- Upll 2 8 20 PL PDFDocument9 pagesUpll 2 8 20 PL PDFwhitenagarNo ratings yet

- Stock Update: Relaxo FootwearsDocument3 pagesStock Update: Relaxo FootwearsADNo ratings yet

- Tata Steel - Q4FY22 Result Update - 05052022 - 05-05-2022 - 11Document9 pagesTata Steel - Q4FY22 Result Update - 05052022 - 05-05-2022 - 11varanasidineshNo ratings yet

- Coromandel Q1 Result UpdateDocument8 pagesCoromandel Q1 Result UpdateshrikantbodkeNo ratings yet

- Jyothy - Lab Sharekhan PDFDocument7 pagesJyothy - Lab Sharekhan PDFAniket DhanukaNo ratings yet

- Sequent - Scien Nirmal 130222Document9 pagesSequent - Scien Nirmal 130222Sarah AliceNo ratings yet

- CuminsIndia 3R Aug11 2022Document7 pagesCuminsIndia 3R Aug11 2022Arka MitraNo ratings yet

- TCI Express SharekhanDocument7 pagesTCI Express SharekhanAniket DhanukaNo ratings yet

- HDFC Bank: Strong Performance Yet AgainDocument6 pagesHDFC Bank: Strong Performance Yet AgainTotmolNo ratings yet

- BKT - Investor Presentation - February 2021 PDFDocument33 pagesBKT - Investor Presentation - February 2021 PDFYAP designerNo ratings yet

- JM - RepcohomeDocument12 pagesJM - RepcohomeSanjay PatelNo ratings yet

- Pakistan Cables Limited: Electrical Goods in FocusDocument2 pagesPakistan Cables Limited: Electrical Goods in Focusdon5450No ratings yet

- Motilal Oswal Sees 8% UPSIDE in Wipro Near Term Outlook Weak DespiteDocument10 pagesMotilal Oswal Sees 8% UPSIDE in Wipro Near Term Outlook Weak DespiteDivyansh TiwariNo ratings yet

- BANCO SAFRA MRV & CoDocument7 pagesBANCO SAFRA MRV & CoJoão FrancoNo ratings yet

- PNC Infratech LTD: ESG Disclosure ScoreDocument5 pagesPNC Infratech LTD: ESG Disclosure ScoredarshanmaldeNo ratings yet

- Bharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Document9 pagesBharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Sanjeedeep Mishra , 315No ratings yet

- LNT AnalysisDocument7 pagesLNT AnalysisGagan KarwarNo ratings yet

- TechnoFunda - PowerGridDocument3 pagesTechnoFunda - PowerGridparchure123No ratings yet

- Ashok Leyland LTD: ESG Disclosure ScoreDocument8 pagesAshok Leyland LTD: ESG Disclosure ScoreRomelu MartialNo ratings yet

- Greenlam Q1 Result UpdateDocument7 pagesGreenlam Q1 Result UpdateshrikantbodkeNo ratings yet

- An Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipFrom EverandAn Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipNo ratings yet

- Accenture: Not RatedDocument4 pagesAccenture: Not RatedAryan SharmaNo ratings yet

- United SpiritsDocument8 pagesUnited SpiritsAryan SharmaNo ratings yet

- Action Construction Equipment: Sturdy Performance..Document6 pagesAction Construction Equipment: Sturdy Performance..Aryan SharmaNo ratings yet

- Tata Motors Limited: Business OverviewDocument5 pagesTata Motors Limited: Business OverviewAryan SharmaNo ratings yet

- Pharma: Non-COVID Portfolio Dominates Contribution For IPM Growth in Aug-21Document15 pagesPharma: Non-COVID Portfolio Dominates Contribution For IPM Growth in Aug-21Aryan SharmaNo ratings yet

- ISGEC Q1 Result UpdateDocument6 pagesISGEC Q1 Result UpdateAryan SharmaNo ratings yet

- Accelya Solutions: Improving Travel Demand To Drive GrowthDocument5 pagesAccelya Solutions: Improving Travel Demand To Drive GrowthAryan SharmaNo ratings yet

- Finquilibria - Case Study: Deluxe Auto LimitedDocument4 pagesFinquilibria - Case Study: Deluxe Auto LimitedAryan SharmaNo ratings yet

- PNC - Infra Q1 Result UpdateDocument7 pagesPNC - Infra Q1 Result UpdateAryan SharmaNo ratings yet

- Insecticides Q1 Result UpdateDocument7 pagesInsecticides Q1 Result UpdateAryan SharmaNo ratings yet

- Gati Q1 Result UpdateDocument7 pagesGati Q1 Result UpdateAryan SharmaNo ratings yet

- KEI Q1 Result UpdateDocument7 pagesKEI Q1 Result UpdateAryan SharmaNo ratings yet

- Two-Year MBA: Summer Placement Report (Unaudited)Document10 pagesTwo-Year MBA: Summer Placement Report (Unaudited)Aryan SharmaNo ratings yet

- Next Pot of Gold!Document10 pagesNext Pot of Gold!Aryan SharmaNo ratings yet

- Science-Based Target Setting Manual: Version 4.1 - April 2020Document64 pagesScience-Based Target Setting Manual: Version 4.1 - April 2020Aryan SharmaNo ratings yet

- Financial Management Program (FMP)Document1 pageFinancial Management Program (FMP)Aryan SharmaNo ratings yet

- Enhancement of InfotypesDocument8 pagesEnhancement of InfotypesAshok KancharlaNo ratings yet

- Nato Joint DoctrineDocument121 pagesNato Joint DoctrineEdwin Sen100% (1)

- Gate Preparation Strategy: Reservoir EngineeringDocument1 pageGate Preparation Strategy: Reservoir EngineeringHemant SrivastavaNo ratings yet

- Reducer: Sweat Reducer Hydraulic Concentric Eccentric ReducersDocument1 pageReducer: Sweat Reducer Hydraulic Concentric Eccentric ReducersMayur MandrekarNo ratings yet

- RLE MaterialsDocument22 pagesRLE MaterialsXan LopezNo ratings yet

- Case Analysis: WAC Report: (HPCL-Driving Change Through Internal Communication)Document7 pagesCase Analysis: WAC Report: (HPCL-Driving Change Through Internal Communication)Parul VaryaniNo ratings yet

- Kalinga University at A Glance 1Document40 pagesKalinga University at A Glance 1Pranav Shukla PNo ratings yet

- Cloud Computing Challenges and Related Security Issues: Prof. Raj JainDocument10 pagesCloud Computing Challenges and Related Security Issues: Prof. Raj JainMuhammad Razzaq ChishtyNo ratings yet

- Police ProjectDocument15 pagesPolice ProjectArpit SinghalNo ratings yet

- North America - GCT Report 2023 (Digital)Document20 pagesNorth America - GCT Report 2023 (Digital)Ali AlharbiNo ratings yet

- S7 M WE4 RWBu QCCJs EDocument8 pagesS7 M WE4 RWBu QCCJs Eindasijames06No ratings yet

- Holiday Homework: FUN INDocument25 pagesHoliday Homework: FUN INSunita palNo ratings yet

- Job - M Business Law 260323Document5 pagesJob - M Business Law 260323Nabila JasmineNo ratings yet

- NX Shop Documentation Plug-In BaseDocument10 pagesNX Shop Documentation Plug-In BaseLÊ VĂN ĐỨCNo ratings yet

- Coupled Level-Set and Volume of Fluid (CLSVOF) Solver ForDocument18 pagesCoupled Level-Set and Volume of Fluid (CLSVOF) Solver ForBharath kumarNo ratings yet

- BaristaDocument5 pagesBaristaAabbhas GargNo ratings yet

- Duo Check Valve MaintenanceDocument2 pagesDuo Check Valve Maintenanceddoyle1351100% (1)

- Bescom Public Grievance Redressal System (PGRS) : User ManualDocument13 pagesBescom Public Grievance Redressal System (PGRS) : User Manualgurt sityNo ratings yet

- BBA Project Guidelines-2016Document38 pagesBBA Project Guidelines-2016vntkhatri100% (1)

- Buffering DataDocument4 pagesBuffering DataLeonard-Tiberiu SandorNo ratings yet

- Radio Planning Design Guidelines (RDU-0008-01 V1.11) PDFDocument82 pagesRadio Planning Design Guidelines (RDU-0008-01 V1.11) PDForany milano100% (1)

- Sump Well-20 KL PDFDocument3 pagesSump Well-20 KL PDFvisali garikapatiNo ratings yet

- Manzo Food and Cocktail MenuDocument2 pagesManzo Food and Cocktail MenuNell CaseyNo ratings yet

- Implementation and Monitoring:: Assessing Performance in Contract RelationshipsDocument49 pagesImplementation and Monitoring:: Assessing Performance in Contract RelationshipsReddy SumanthNo ratings yet

- Datasheet VM Seires Solar InverterDocument1 pageDatasheet VM Seires Solar Invertermohamed husseinNo ratings yet

VaTech Q1 Result Update

VaTech Q1 Result Update

Uploaded by

Aryan SharmaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VaTech Q1 Result Update

VaTech Q1 Result Update

Uploaded by

Aryan SharmaCopyright:

Available Formats

Stock Update

Va Tech Wabag Ltd

Strong Q1; eyeing steady order flow

Powered by the Sharekhan 3R Research Philosophy Capital Goods Sharekhan code: WABAG Result Update

3R MATRIX + = - Summary

We maintain Buy on Va Tech Wabag with unchanged target price of Rs 435 considering

Right Sector (RS) ü strong balance sheet led by robust operating and free cash-flow generation allays

investors concerns on future growth.

Right Quality (RQ) ü Well-funded strong order book at Rs 10,400 crore provides comfort on collections and

execution fronts.

Right Valuation (RV) ü Structural growth tailwinds owing to leading global positioning, the government’sspends

on water supply, and impetus on industrial waste-water management.

+ Positive = Neutral - Negative In the recent years, the management has seen government push in the segment to have

water availability and improve water security and sanitation. This helps the company going

ahead as increase in government capex will further add to the thriving business of the

What has changed in 3R MATRIX company.

Old New

Q1FY22 numbers were slightly above our estimates with revenue/ EBITDA/ PAT at Rs.

RS 658 crore/ Rs. 33 crore/ Rs. 15 crore (up 53%, up 13%, up 189% y-o-y) owing to increased

execution and the operations are at almost pre-COVID level. GPM stood at 19% (-581bps

RQ y-o-y) whereas OPM was reported at 5% (-174 bps y-o-y) due to extended stay costs on

few projects and increase in cost of metals and plastics. The order book stands at over Rs.

RV 10,400 crore including framework orders whereas order intake is over Rs. 1,445 crore. Of

the total order intake, 96% is from the EPC segment. The EPC segment’s revenues grew by

71% y-o-y to Rs. 550 crore. During the quarter, the pace of execution has improved slowly

Reco/View Change and the activities are at pre-COVID levels. The company has received a good intake

or orders and are expecting the business environment to improve. In the recent years,

Reco: Buy the management has seengovernment push in the segment to have water availability

CMP: Rs. 357 and improve water security and sanitation. Thus, they expect many large projects

coming up in metros as well as good order prospects in The Middle East and Africa. The

Price Target: Rs. 435 management expects the current order book to provide visibility for the next 3-3.5 years.

The management mentioned that most Indian orders covers 60-70% inflation in raw

á Upgrade Maintain â Downgrade material prices, whereas, government orders do not cover 100% inflation of commodities

as part is fixed costs. Other income high due to dividend income from associate entity

Company details of Rs 5.5 crore and forex gain of Rs. 7 crore. The company turned net cash positive in

FY2021 from a peak net debt of Rs. 433 crore in FY2019 to net cash of Rs. 44 crore in

Market cap: Rs. 2,221 cr FY2021. The company is well placed to receive continuous flow of orders having strong

52-week high/low: Rs. 404/132 project execution track record and marquee clients led by its asset-light business model

and strengthened balance sheet profile.

NSE volume:

7.7 lakh Key positives

(No of shares)

Order book stands at over Rs. 10,400 crore including framework orders whereas order

BSE code: 533269 intake is over Rs. 1,445 crore.

NSE code: WABAG Key negatives

Free float: GPM stood at 19% (-581 bps y-o-y) whereas OPM was reported at 5% (-174 bps y-o-y) due

4.9 cr

(No of shares) to extended stay costs on few projects and increase in cost of metals and plastics.

Our Call

Shareholding (%)

Valuation – Maintain Buy with unchanged PT of Rs. 435: Va Tech Wabag is on a strong

Promoters 21.7 earnings growth trajectory going ahead with concerns of high leverage led by increasing

working capital now behind it.A well-funded strong order book provides comfort on execution

FII 15.9 and collections going ahead. Further, the government’s focus is expected to remain on

water-related investments providing healthy order intake tailwinds for the company going

DII 3.8 ahead. At CMP, the stock trades at a P/E of 12/10x its FY2023/24E earnings which we believe

is attractive considering its strong net earnings growth outlook and strengthened balance

Others 58.61 sheet. Hence, we maintain Buy with an unchanged PT of Rs 435.

Price chart Key Risks

450 Decline in domestic capex and impact on gross margins due to a rise in commodity costs.

400 Problems in execution could impact earnings growth.

350

300

250

200

Valuation (Consolidated) Rs cr

150 Particulars FY21 FY22E FY23E FY24E

100

Revenue from Operations 2,834 3,235 3,677 4,132

Dec-20

Aug-20

Aug-21

Apr-21

Operating Profit Margin (%) 7.7 8.4 8.7 9.0

RPAT 100 134 180 218

Price performance AEPS (Rs.) 16.1 21.5 29.0 35.1

P/E (x) 22.1 16.6 12.3 10.2

(%) 1m 3m 6m 12m

Price/ Book (x) 1.6 1.4 1.3 1.1

Absolute -4 33 79 154

EV/EBITDA (x) 10.0 8.3 7.1 6.2

Relative to RoCE (%) 10.9 12.9 14.2 14.8

5 12 7 43

Sensex

RoE (%) 7.8 9.0 10.9 11.7

Sharekhan Research, Bloomberg Source: Company; Sharekhan estimates

August 12, 2021 23

Stock Update

Powered by the Sharekhan

3R Research Philosophy

Strong quarter

Q1FY22 numbers were slightly above our estimates with revenue/ EBITDA/ PAT at Rs. 658 crore/ Rs. 33 crore/

Rs. 15 crore (up 53%, up 13%, up 189% y-o-y) owing to increased execution and the operations are at almost

pre-COVID level. GPM stood at 19% (-581 bps y-o-y) whereas OPM was reported at 5% (-174 bps y-o-y) due

to extended stay costs on few projects and increase in cost of metals and plastics. The order book stands

at over Rs. 10,400 crore including framework orders whereas order intake is over Rs. 1,445 crore. Of the total

order intake, 96% is from the EPC segment. The EPC segment’s revenues grew by 71% y-o-y to Rs. 550 crore.

During the quarter, the pace of execution has improved slowly and the activities are at pre-COVID levels.

The company has received a good intake or orders and are expecting the business environment to improve.

Government push on infra projects:

The government is focussing making clean water available to its masses and thus creating thriving hygienic

conditions in the country. The company plans to ride on digital and advanced technologies in the post-Covid

world and bring in artificial intelligence (AI) for water treatment. VATW has been successful in pioneering

removal of micro pollutants and has also licensed and worked upon the Nereda technology, which will play a

significant role in wastewater treatment in future. The focus on water crisis, conservation and the governments’

spending through various schemes and policies to meet the ever-growing demand for water presents a huge

opportunity for future business. The company has state-of-the-art research and development centres that

have developed advanced technologies to treat wastewater to directly be used as water of potable grade.

Concall highlights:

Covid impact: Despite challenges amid the second wave of COVID-19, the company has done well during the

quarter. Construction activities and supply chain are currently at pre-COVID levels. However, the management

believed that the margins could have been up 1.5-2% in the absence of the second wave COVID-19.

Order book: Order book stands at over Rs. 10,400 crore including framework orders whereas order intake is

over Rs. 1,445 crore. Of the total order intake, 96% is from the EPC segment.The management expects current

order book to provide visibility for the next 3-3.5 years.

Russia Project: The management believed that they have consolidated their market position in the oil & gas

sector further, by securing a EPC order worth $165mn (about Rs 1,230 Crore) from Amur Gas Chemical Complex

LLC., CAGCC’) in Russia. VATW shall perform the scope of Design, Engineering, Procurement, Supply and

Supervision of the facilities during erection and commissioning including process & technology equipment,

piping system, electrical, instrumentation / control systems and building and architectural materials. The

company won this order amidst highly competitive circumstances.

Marafiq Project: The project in Saudi Arabia (Marafiq) is nearing completion and all engineering work and

equipment deliveries have been completed and installation is underway. The management expects pre-

commission activities to commence in FY2022.

Jeddah Airport Project: The project at Jeddah Airport 2 in Jeddah, Saudi Arabia is progressing well with

engineering works and ordering nearly complete and construction activity from customer side is underway.

Romania Project: This project involves 15 years of operation and maintenance work and has been

commissioned ahead of schedule and the company is awaiting clearance for commencement of operations.

VATW expects maintenance works to begin from H2FY22.

Doha Project: The project from public works authority for rehabilitation of south Doha, to treat sewage from

2022 football world cup stadium, is expected to be completed by year end.

Tunisia Project: The engineering worksand ordering are completed with civil work at peak. The equipment

delivery and installation are underway.

Government Impetus: In recent years, the management has seen government push in the segment to have

water availability and improve water security and sanitation. Thus, Va Tech expects many large projects

coming up in metros as well as good order prospects in Middle East and Africa.

Book Keeping: The management mentioned that most Indian orders covers 60-70% inflation in raw material

costs, whereas, government orders do not cover 100% inflation of commodities as part is fixed costs.Other

income high due to dividend income from associate entity of Rs 5.5 crore and forex gain of Rs.7 crore.

August 12, 2021 24

Stock Update

Powered by the Sharekhan

3R Research Philosophy

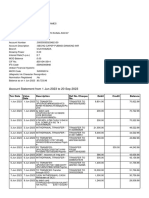

Result (Consolidated) Rs cr

Particulars Q1FY22 Q1FY21 y-o-y (%) Q4FY21 q-o-q (%)

Total Income 658 431 53% 999 -34%

EBITDA 33 29 13% 76 -57%

Depreciation 3 3 -8% 3 -2%

Interest 20 21 -8% 22 -11%

Other Income 14 1 - 2 -

PBT 20 7 176% 55 -63%

Total Tax 6 2 147% 11 -47%

Reported PAT 15 5 189% 44 -67%

Adjusted PAT 15 5 189% 44 -67%

EPS 2.34 0.81 189% 7.04 -67%

Margins (%) Bps Bps

EBITDA Margin 5.0% 6.7% -174 7.6% -268

PAT Margin 2.2% 1.2% 104 4.4% -217

Tax Rate 28% 31% - 20% -

Source: Company, Sharekhan Research

August 12, 2021 25

Stock Update

Powered by the Sharekhan

3R Research Philosophy

Outlook and Valuation

n Sector view - Investments by Governments and Private Sectors will play a vital role in water

Waste-water technology is primarily used by municipal authoritiesto treat waste-water in various Indian cities.

Rising urban population in major Indian cities has created demand for waste-water treatment facilities, to

balance the population with the availability of freshwater. In the coming years, desalination is expected to be

a prominent technology in Indian cities for filtration of water, due to the rising scarcity of fresh water. Global

water treatment industry has undergone a sea change over the past decade. This is owing to rising awareness

about water scarcity, innovations in water treatment technologies and investments by governments and

private sectors in this segment. The global water &wastewater treatment market is estimated to reach a size

of $211 billion by 2025, at a CAGR of 6.5% over 2019-2025.The India water and wastewater treatment (WWT)

technology market is partially consolidated, with the major players accounting for a moderate share of the

market. Key players in the market include Veolia, Suez, Thermax Limited, VA TECH WABAG LIMITED, and

DuPont.The increasing demand for water-treatment facilities across the world will have a positive impact on

the growth of the market in the coming years.

n Company outlook - Creating Enduring Value

The company has a strong order book of Rs. 9,584 crore (3.4x FY2021 consolidated revenues, largely

executable with financial closure of HAM projects) funded by the Centre, multilateral agencies or sovereign

entities which provides comfort on cash collections and execution. The company generated Rs. 380 crore of

net operating cash flows over FY2020-FY2021 and managed to curtail the rising working capital requirement,

which strengthened the balance sheet. Further, the company generated free cash flows of Rs. 300 croreduring

FY2020-FY2021, which is also aided by its asset light model. Going ahead, we expect the company to

generate over Rs. 300 crore of free cash flows over FY2022-FY2023 led by strong operating cash flow

generation, tighter control on working capital and lower capex requirements.The company is well-placed to

receive continuous flow of orders having strong project execution track record and marquee clients led by its

asset-light business model and strengthened balance sheet profile.

n Valuation - Maintain Buy with unchanged PT of Rs. 435

Va Tech Wabag is on a strong earnings growth trajectory going ahead with concerns of high leverage led by

increasing working capital now behind it. A well-funded strong order book provides comfort on execution and

collections going ahead. Further, the government’s focus is expected to remain on water-related investments

providing healthy order intake tailwinds for the company going ahead. At CMP, the stock trades at a P/E

of 12/10x its FY2023/24E earnings which we believe is attractive considering its strong net earnings growth

outlook and strengthened balance sheet. Hence, we maintain Buy with an unchanged PT of Rs 435.

One-year forward P/E (x) band

60

50

40

30

20

10

0

Sep-15

Sep-16

Jan-16

Sep-17

Jan-17

Sep-18

Jan-18

Sep-19

Jan-19

Sep-20

Jan-20

Mar-15

Jan-21

Mar-16

Mar-17

Mar-18

Mar-19

Mar-20

Mar-21

Jul-15

Jul-16

Jul-17

Jul-18

Jul-19

Jul-20

Jul-21

May-15

May-16

Nov-15

May-17

Nov-16

May-18

Nov-17

May-19

Nov-18

May-20

Nov-19

May-21

Nov-20

1 yr Fwd PE (x) Avg 1 yr Fwd PE (x) Peak Trough

Source: Sharekhan Research

August 12, 2021 26

Stock Update

Powered by the Sharekhan

3R Research Philosophy

About company

Va Tech Wabag is known for its innovative and successful solutions in the water engineering sector around

the globe. The company is a systems specialist and full-service provider focusing on the planning, installation

and operations of drinking and wastewater plants for local government and industry in the growth markets

of Asia, North Africa, Middle East and Central and Eastern Europe. The company represents a leading

multinational player with a workforce of over 1,600 and has companies and offices in more than 20 countries.

Investment theme

Va Tech Wabag has unique technological knowhow, based on innovative, patented technologies and long-

term experience. For over 95 years, the Company has been facilitating access to clean and safe water to

over 500 million people. With decades of rich experience, over 6,000 projects across multiple sectors and

state-of the-art plants in over 20 countries, WABAG is a globally respected organisation. Va Tech Wabag is

on a strong earnings growth trajectory going ahead with concerns of high leverage led by increasing working

capital now behind it. The company’s well funded strong order book provides comfort on execution and

collections going ahead. Further, the government’s focus is expected to remain on water-related investments

providing healthy order intake tailwinds for the company going ahead.

Key Risks

Slowdown in economic activity might impact order intake visibility and delay in execution of existing order

book might impact revenue booking.

Hike in interest rate might impact the profitability as the company has a stretched working capital situation.

Additional Data

Key management personnel

Malay Mukherjee Chairman (Non-Executive Independent Director)

Rajiv Mittal Managing Director & Group CEO

Pankaj Sachdeva Chief Executive Officer

Sandeep Kumar Agrawal Chief Financial Officer

R Swaminathan Company Secretary & Compliance Officer

Source: Bloomberg

Top 10 shareholders

Sr. No. Holder Name Holding (%)

1 Mittal Rajiv Devaraj 15.61

2 JhunjhunwalaRekha Rakesh 8.04

3 Varadarajan Subramanian 3.51

4 Government Pension Fund – Global 3.22

5 Norges Bank 3.21

6 KBI Global Investors 2.75

7 SarafShivnarayan J 2.57

8 SBI Funds Management Pvt Ltd 2.54

9 Massachusetts Institute of Technology 2.52

10 Basera Home Finance 2.41

Source: Bloomberg

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

August 12, 2021 27

Understanding the Sharekhan 3R Matrix

Right Sector

Positive Strong industry fundamentals (favorable demand-supply scenario, consistent

industry growth), increasing investments, higher entry barrier, and favorable

government policies

Neutral Stagnancy in the industry growth due to macro factors and lower incremental

investments by Government/private companies

Negative Unable to recover from low in the stable economic environment, adverse

government policies affecting the business fundamentals and global challenges

(currency headwinds and unfavorable policies implemented by global industrial

institutions) and any significant increase in commodity prices affecting profitability.

Right Quality

Positive Sector leader, Strong management bandwidth, Strong financial track-record,

Healthy Balance sheet/cash flows, differentiated product/service portfolio and

Good corporate governance.

Neutral Macro slowdown affecting near term growth profile, Untoward events such as

natural calamities resulting in near term uncertainty, Company specific events

such as factory shutdown, lack of positive triggers/events in near term, raw

material price movement turning unfavourable

Negative Weakening growth trend led by led by external/internal factors, reshuffling of

key management personal, questionable corporate governance, high commodity

prices/weak realisation environment resulting in margin pressure and detoriating

balance sheet

Right Valuation

Positive Strong earnings growth expectation and improving return ratios but valuations

are trading at discount to industry leaders/historical average multiples, Expansion

in valuation multiple due to expected outperformance amongst its peers and

Industry up-cycle with conducive business environment.

Neutral Trading at par to historical valuations and having limited scope of expansion in

valuation multiples.

Negative Trading at premium valuations but earnings outlook are weak; Emergence of

roadblocks such as corporate governance issue, adverse government policies

and bleak global macro environment etc warranting for lower than historical

valuation multiple.

Source: Sharekhan Research

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may

receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the

views expressed in this document accurately reflect his or her personal views about the subject company or companies and its or

their securities and do not necessarily reflect those of SHAREKHAN. The analyst and SHAREKHAN further certifies that neither he

or his relatives or Sharekhan associates has any direct or indirect financial interest nor have actual or beneficial ownership of 1% or

more in the securities of the company at the end of the month immediately preceding the date of publication of the research report

nor have any material conflict of interest nor has served as officer, director or employee or engaged in market making activity of the

company. Further, the analyst has also not been a part of the team which has managed or co-managed the public offerings of the

company and no part of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or

views expressed in this document. Sharekhan Limited or its associates or analysts have not received any compensation for investment

banking, merchant banking, brokerage services or any compensation or other benefits from the subject company or from third party

in the past twelve months in connection with the research report.

Either, SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Mr. Joby John Meledan; Tel: 022-61150000; email id: compliance@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg

Railway Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos.: BSE

/ NSE / MSEI (CASH / F&O / CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786;

Mutual Fund: ARN 20669; Research Analyst: INH000006183;

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.com;

Investment in securities market are subject to market risks, read all the related documents carefully before investing.

You might also like

- Holding Company Business PlanDocument59 pagesHolding Company Business PlanFayad CalúNo ratings yet

- Dilapidation FinalDocument22 pagesDilapidation FinalShem HaElohim Ejem100% (1)

- MCRS Fuel System Overview PDFDocument100 pagesMCRS Fuel System Overview PDFAnonymous ABPUPbK91% (11)

- Project 2Document2 pagesProject 2Ritz DeshmukhNo ratings yet

- Exploratory Course - Computer Hardware Servicing For G 7and 8 - Answer Key PDFDocument9 pagesExploratory Course - Computer Hardware Servicing For G 7and 8 - Answer Key PDFSirossi Ven67% (12)

- ISGEC Q1 Result UpdateDocument6 pagesISGEC Q1 Result UpdateAryan SharmaNo ratings yet

- PratibhaInd 18 Jan 2010Document6 pagesPratibhaInd 18 Jan 2010atmaram9999No ratings yet

- Dixon Q1 Result UpdateDocument7 pagesDixon Q1 Result UpdateshrikantbodkeNo ratings yet

- WPIL PYT MultibaggerDocument2 pagesWPIL PYT MultibaggerRajeev GargNo ratings yet

- Aarti Ind. SharekhanDocument8 pagesAarti Ind. SharekhanAniket DhanukaNo ratings yet

- SHAREKHANDocument11 pagesSHAREKHANRajesh SharmaNo ratings yet

- V-Guard Industries: Operationally Strong QuarterDocument5 pagesV-Guard Industries: Operationally Strong QuarterUmesh ThawareNo ratings yet

- Aarti Industries 10-08-2021 KhanDocument8 pagesAarti Industries 10-08-2021 KhanAkchikaNo ratings yet

- Aarti 3R Aug11 - 2022Document7 pagesAarti 3R Aug11 - 2022Arka MitraNo ratings yet

- KEI Q1 Result UpdateDocument7 pagesKEI Q1 Result UpdateAryan SharmaNo ratings yet

- Bharti - Airtel Q1 Result UpdateDocument10 pagesBharti - Airtel Q1 Result UpdateRatan PalankiNo ratings yet

- Polycab India Limited: Business Dynamics Strong, Retain BuyDocument8 pagesPolycab India Limited: Business Dynamics Strong, Retain Buyshankar alkotiNo ratings yet

- SupremeInd 3R Apr29 2022Document7 pagesSupremeInd 3R Apr29 2022bdacNo ratings yet

- Emkay 20080122 Hindustan ConstructionDocument6 pagesEmkay 20080122 Hindustan ConstructionAnkita DasotNo ratings yet

- ABB India: Strong Margin Expansion Valuations Remain ExpensiveDocument5 pagesABB India: Strong Margin Expansion Valuations Remain ExpensiveAmar DoshiNo ratings yet

- TataMotors SharekhanDocument9 pagesTataMotors SharekhanAniket DhanukaNo ratings yet

- Spanco Telesystems Initiating Cov - April 20 (1) .Document24 pagesSpanco Telesystems Initiating Cov - April 20 (1) .KunalNo ratings yet

- State Bank of India: CMP: INR407 TP: INR600 (+47%)Document12 pagesState Bank of India: CMP: INR407 TP: INR600 (+47%)satyendragupta0078810No ratings yet

- Vatech Q2fy23 Jbwa 281122Document7 pagesVatech Q2fy23 Jbwa 281122Manish BNo ratings yet

- ISGEC 3R Nov17 - 2021Document7 pagesISGEC 3R Nov17 - 2021Aayushman GuptaNo ratings yet

- PNC - Infra Q1 Result UpdateDocument7 pagesPNC - Infra Q1 Result UpdateAryan SharmaNo ratings yet

- P.I. Industries (PI IN) : Q3FY20 Result UpdateDocument8 pagesP.I. Industries (PI IN) : Q3FY20 Result UpdateanjugaduNo ratings yet

- 141342112021251larsen Toubro Limited - 20210129Document5 pages141342112021251larsen Toubro Limited - 20210129Michelle CastelinoNo ratings yet

- Ipca 3R Aug11 - 2022Document7 pagesIpca 3R Aug11 - 2022Arka MitraNo ratings yet

- L&T Finance Holdings LTD: ESG Disclosure ScoreDocument6 pagesL&T Finance Holdings LTD: ESG Disclosure ScoreAshwet JadhavNo ratings yet

- Iiww 161210Document4 pagesIiww 161210rinku23patilNo ratings yet

- FY2017AnnualRep L&T Annual Report 2016-17Document488 pagesFY2017AnnualRep L&T Annual Report 2016-17sathishNo ratings yet

- Ipca Laboratories Limited: Promising OutlookDocument8 pagesIpca Laboratories Limited: Promising OutlookanjugaduNo ratings yet

- Tata Elxsi Limited: Result UpdateDocument6 pagesTata Elxsi Limited: Result UpdateinvestfortestNo ratings yet

- Affle Stock PricingDocument8 pagesAffle Stock PricingSandyNo ratings yet

- Ashoka Buidcon 3R Aug11 2022Document7 pagesAshoka Buidcon 3R Aug11 2022Arka MitraNo ratings yet

- Bharti - Airtel SharekhanDocument10 pagesBharti - Airtel SharekhandarshanmaldeNo ratings yet

- Kpil 9 2 24 PLDocument8 pagesKpil 9 2 24 PLrmishraNo ratings yet

- SGS Tekniks Manufacturing PVT LTDDocument7 pagesSGS Tekniks Manufacturing PVT LTDgcgary87No ratings yet

- HSIE Results Daily: Result ReviewsDocument13 pagesHSIE Results Daily: Result ReviewsKiran KudtarkarNo ratings yet

- P.I. Industries (PI IN) : Q1FY21 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- CFRA GROUP 10 Ultratech CementsDocument16 pagesCFRA GROUP 10 Ultratech CementsSitu MohantyNo ratings yet

- P.I. Industries (PI IN) : Q1FY20 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY20 Result UpdateMax BrenoNo ratings yet

- Bank of Baroda - KRC - 15 10 09Document2 pagesBank of Baroda - KRC - 15 10 09sudhirbansalNo ratings yet

- Upll 2 8 20 PL PDFDocument9 pagesUpll 2 8 20 PL PDFwhitenagarNo ratings yet

- Stock Update: Relaxo FootwearsDocument3 pagesStock Update: Relaxo FootwearsADNo ratings yet

- Tata Steel - Q4FY22 Result Update - 05052022 - 05-05-2022 - 11Document9 pagesTata Steel - Q4FY22 Result Update - 05052022 - 05-05-2022 - 11varanasidineshNo ratings yet

- Coromandel Q1 Result UpdateDocument8 pagesCoromandel Q1 Result UpdateshrikantbodkeNo ratings yet

- Jyothy - Lab Sharekhan PDFDocument7 pagesJyothy - Lab Sharekhan PDFAniket DhanukaNo ratings yet

- Sequent - Scien Nirmal 130222Document9 pagesSequent - Scien Nirmal 130222Sarah AliceNo ratings yet

- CuminsIndia 3R Aug11 2022Document7 pagesCuminsIndia 3R Aug11 2022Arka MitraNo ratings yet

- TCI Express SharekhanDocument7 pagesTCI Express SharekhanAniket DhanukaNo ratings yet

- HDFC Bank: Strong Performance Yet AgainDocument6 pagesHDFC Bank: Strong Performance Yet AgainTotmolNo ratings yet

- BKT - Investor Presentation - February 2021 PDFDocument33 pagesBKT - Investor Presentation - February 2021 PDFYAP designerNo ratings yet

- JM - RepcohomeDocument12 pagesJM - RepcohomeSanjay PatelNo ratings yet

- Pakistan Cables Limited: Electrical Goods in FocusDocument2 pagesPakistan Cables Limited: Electrical Goods in Focusdon5450No ratings yet

- Motilal Oswal Sees 8% UPSIDE in Wipro Near Term Outlook Weak DespiteDocument10 pagesMotilal Oswal Sees 8% UPSIDE in Wipro Near Term Outlook Weak DespiteDivyansh TiwariNo ratings yet

- BANCO SAFRA MRV & CoDocument7 pagesBANCO SAFRA MRV & CoJoão FrancoNo ratings yet

- PNC Infratech LTD: ESG Disclosure ScoreDocument5 pagesPNC Infratech LTD: ESG Disclosure ScoredarshanmaldeNo ratings yet

- Bharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Document9 pagesBharti Airtel Q3FY24 Result Update - 07022024 - 07-02-2024 - 12Sanjeedeep Mishra , 315No ratings yet

- LNT AnalysisDocument7 pagesLNT AnalysisGagan KarwarNo ratings yet

- TechnoFunda - PowerGridDocument3 pagesTechnoFunda - PowerGridparchure123No ratings yet

- Ashok Leyland LTD: ESG Disclosure ScoreDocument8 pagesAshok Leyland LTD: ESG Disclosure ScoreRomelu MartialNo ratings yet

- Greenlam Q1 Result UpdateDocument7 pagesGreenlam Q1 Result UpdateshrikantbodkeNo ratings yet

- An Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipFrom EverandAn Analysis of the Product-Specific Rules of Origin of the Regional Comprehensive Economic PartnershipNo ratings yet

- Accenture: Not RatedDocument4 pagesAccenture: Not RatedAryan SharmaNo ratings yet

- United SpiritsDocument8 pagesUnited SpiritsAryan SharmaNo ratings yet

- Action Construction Equipment: Sturdy Performance..Document6 pagesAction Construction Equipment: Sturdy Performance..Aryan SharmaNo ratings yet

- Tata Motors Limited: Business OverviewDocument5 pagesTata Motors Limited: Business OverviewAryan SharmaNo ratings yet

- Pharma: Non-COVID Portfolio Dominates Contribution For IPM Growth in Aug-21Document15 pagesPharma: Non-COVID Portfolio Dominates Contribution For IPM Growth in Aug-21Aryan SharmaNo ratings yet

- ISGEC Q1 Result UpdateDocument6 pagesISGEC Q1 Result UpdateAryan SharmaNo ratings yet

- Accelya Solutions: Improving Travel Demand To Drive GrowthDocument5 pagesAccelya Solutions: Improving Travel Demand To Drive GrowthAryan SharmaNo ratings yet

- Finquilibria - Case Study: Deluxe Auto LimitedDocument4 pagesFinquilibria - Case Study: Deluxe Auto LimitedAryan SharmaNo ratings yet

- PNC - Infra Q1 Result UpdateDocument7 pagesPNC - Infra Q1 Result UpdateAryan SharmaNo ratings yet

- Insecticides Q1 Result UpdateDocument7 pagesInsecticides Q1 Result UpdateAryan SharmaNo ratings yet

- Gati Q1 Result UpdateDocument7 pagesGati Q1 Result UpdateAryan SharmaNo ratings yet

- KEI Q1 Result UpdateDocument7 pagesKEI Q1 Result UpdateAryan SharmaNo ratings yet

- Two-Year MBA: Summer Placement Report (Unaudited)Document10 pagesTwo-Year MBA: Summer Placement Report (Unaudited)Aryan SharmaNo ratings yet

- Next Pot of Gold!Document10 pagesNext Pot of Gold!Aryan SharmaNo ratings yet

- Science-Based Target Setting Manual: Version 4.1 - April 2020Document64 pagesScience-Based Target Setting Manual: Version 4.1 - April 2020Aryan SharmaNo ratings yet

- Financial Management Program (FMP)Document1 pageFinancial Management Program (FMP)Aryan SharmaNo ratings yet

- Enhancement of InfotypesDocument8 pagesEnhancement of InfotypesAshok KancharlaNo ratings yet

- Nato Joint DoctrineDocument121 pagesNato Joint DoctrineEdwin Sen100% (1)

- Gate Preparation Strategy: Reservoir EngineeringDocument1 pageGate Preparation Strategy: Reservoir EngineeringHemant SrivastavaNo ratings yet

- Reducer: Sweat Reducer Hydraulic Concentric Eccentric ReducersDocument1 pageReducer: Sweat Reducer Hydraulic Concentric Eccentric ReducersMayur MandrekarNo ratings yet

- RLE MaterialsDocument22 pagesRLE MaterialsXan LopezNo ratings yet

- Case Analysis: WAC Report: (HPCL-Driving Change Through Internal Communication)Document7 pagesCase Analysis: WAC Report: (HPCL-Driving Change Through Internal Communication)Parul VaryaniNo ratings yet

- Kalinga University at A Glance 1Document40 pagesKalinga University at A Glance 1Pranav Shukla PNo ratings yet

- Cloud Computing Challenges and Related Security Issues: Prof. Raj JainDocument10 pagesCloud Computing Challenges and Related Security Issues: Prof. Raj JainMuhammad Razzaq ChishtyNo ratings yet

- Police ProjectDocument15 pagesPolice ProjectArpit SinghalNo ratings yet

- North America - GCT Report 2023 (Digital)Document20 pagesNorth America - GCT Report 2023 (Digital)Ali AlharbiNo ratings yet

- S7 M WE4 RWBu QCCJs EDocument8 pagesS7 M WE4 RWBu QCCJs Eindasijames06No ratings yet

- Holiday Homework: FUN INDocument25 pagesHoliday Homework: FUN INSunita palNo ratings yet

- Job - M Business Law 260323Document5 pagesJob - M Business Law 260323Nabila JasmineNo ratings yet

- NX Shop Documentation Plug-In BaseDocument10 pagesNX Shop Documentation Plug-In BaseLÊ VĂN ĐỨCNo ratings yet

- Coupled Level-Set and Volume of Fluid (CLSVOF) Solver ForDocument18 pagesCoupled Level-Set and Volume of Fluid (CLSVOF) Solver ForBharath kumarNo ratings yet

- BaristaDocument5 pagesBaristaAabbhas GargNo ratings yet

- Duo Check Valve MaintenanceDocument2 pagesDuo Check Valve Maintenanceddoyle1351100% (1)

- Bescom Public Grievance Redressal System (PGRS) : User ManualDocument13 pagesBescom Public Grievance Redressal System (PGRS) : User Manualgurt sityNo ratings yet

- BBA Project Guidelines-2016Document38 pagesBBA Project Guidelines-2016vntkhatri100% (1)

- Buffering DataDocument4 pagesBuffering DataLeonard-Tiberiu SandorNo ratings yet

- Radio Planning Design Guidelines (RDU-0008-01 V1.11) PDFDocument82 pagesRadio Planning Design Guidelines (RDU-0008-01 V1.11) PDForany milano100% (1)

- Sump Well-20 KL PDFDocument3 pagesSump Well-20 KL PDFvisali garikapatiNo ratings yet

- Manzo Food and Cocktail MenuDocument2 pagesManzo Food and Cocktail MenuNell CaseyNo ratings yet

- Implementation and Monitoring:: Assessing Performance in Contract RelationshipsDocument49 pagesImplementation and Monitoring:: Assessing Performance in Contract RelationshipsReddy SumanthNo ratings yet

- Datasheet VM Seires Solar InverterDocument1 pageDatasheet VM Seires Solar Invertermohamed husseinNo ratings yet