Professional Documents

Culture Documents

Liquidity Ratio:: Current Ratio Current Assets Current Liablities

Liquidity Ratio:: Current Ratio Current Assets Current Liablities

Uploaded by

Phương Anh NguyễnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Liquidity Ratio:: Current Ratio Current Assets Current Liablities

Liquidity Ratio:: Current Ratio Current Assets Current Liablities

Uploaded by

Phương Anh NguyễnCopyright:

Available Formats

-

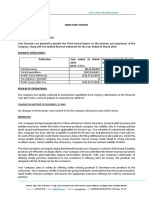

1. Liquidity ratio:

Current Assets

Current ratio=

Current Liablities

2020 2019

( million) (milliom)

Puma Adidas Puma Adidas

Current asset 2.613,00 12.154,00 2.481,20 10.934,00

Current 1.872,80 8.827,00 1.558,90 8.754,00

liability

Current ratio. 1,395237078 1,376911748 1,591635127 1,249029015

( times)

- In 2020

For each euro of current liability, Puma company has 1.395 times its current

assets to convert into cash to pay current liabilities.

For each euro of current liability, Adidas company has 1.377 times its current

assets to convert into cash to pay current liabilities.

- In 2019

For each euro of current liability, Puma company has 1.592 times its

current assets to convert into cash to pay current liabilities.

For each euro of current liability debt, Adidas company has 1.249 times

its current assets to convert into cash to pay current liabilities.

- Puma: A quick analysis of the current ratio tells you that the company's

liquidity has gotten just a little bit worse between 2020 and 2019.

- Adidas: A quick analysis of the current ratio tells you that the company's

liquidity has gotten just a little bit better between 2020 and 2019 since

it rose from 1.249X to 1.377X.

- Comparision : Puma’s current ratio (1,395x) is greater than Adidas’s current

ration( 1.377x) proves that Puma’s liquidity is better (2020) .

Current assets−Inventories

Quick ratio=

Current liablities

2020(miilion) 2019 (million)

Puma Adidas Puma Adidas

Current Asset- ( 2.613,00- 12.154,00- (2.481,20 – (10.934,00 –

Inventories 1.138,00) 4.397,00) 1.110,20 ) 4.085,00)

Current 1.872,80 8.827,00 1.558,90 8.754,00

-

liabilities

Quick ratio 0,79 0,88 0,88 0,78

(times)

- In 2020

For each euro of current liability , Puma company has 0,79 times its current

assets to convert into cash to pay current liabilities.

For each euro of current liability , Adidas company has 0,79 times its current

assets to convert into cash to pay current liabilities.

- In 2019

For each euro of current liability, Puma company has 0,88 times its

current assets to quickly convert into cash to pay current liabilities.

For each euro of current liability, Adidas company has 0,78 times its

current assets to quickly convert into cash to pay current liabilities.

o Both company with a quick ratio less than 1 is unlikely

to be able to repay current liabilities and must be

carefully considered.

- Puma: A quick analysis of the current ratio will tell you that the

company's quick liquidity has gotten just a little bit worse between

2020 and 2019.

- Adidas: A quick analysis of the current ratio will tell you that the

company's quick liquidity has gotten just a little bit better between

2020 and 2019 since it rose from 0,78X to 0,88X.

- Comparison: Puma’s quick ratio (0.79X) is lower than Adidas’s quick

ratio( 0.88X) proves that Puma’s liquidity is worse (2020).

2. Debt Management Ratios:

Total Debt to Capital

Total debt Total debt

=

Total capital Total debt+ Equity(Total captital)

2020 ( million) 2019 ( million)

Puma Adidas Puma Adidas

Total debt 931,7 5.890,00 755,50 4.770,00

Total captital 1.722,40 8.936,00 1.873,60 8.391,00

Debt-to-capital 54% 66% 40% 57%

(%)

-

- In 2020

Puma’s debt ratio is 54%, which means that its creditors

have supplied roughly half of its total funds.

- Debt ratio of Puma in 2020 ( 54%) is larger than its in 2019( 40%) , proving

that the company has good finance, so it may be willing to borrow debt or

issue common shares to pay for Puma's operations.

- Compared to Adidas, puma has a lower debt ratio( 54% < 66%) , so Puma's

debt protection for creditors is higher, so the company will attract more long-

term debt.

Time - interest – earned ratio ( TIE)

EBIT

TIE=

Interest charges

2020 ( million) 2019 ( million)

PUMA ADIDAS PUMA ADIDAS

EBIT 240,20 739,00 465,40 2.718,00

Interest 77,90 164,00 47,80 160,00

charges

TIE (euro) 3,083440308 4,506097561 8 16,9875

- In 2020

For each euro interest payable, Puma company has 3,08 euro of

profits used before interest and taxes.

For each euro interest payable, Adidas company has 4,51 euro of

profits used before interest and taxes.

- In 2019

For each euro interest payable, Puma company has 8 euro of profits

used before interest and taxes

For each euro interest payable, Puma company has 16, 98 euro of

profits used before interest and taxes

- The Puma's TIE ratio in 2020 (3.08) is less than half of 2019 ( 8 ) and less than

Adidas’s ( 4,51) ,indicating that the company's ability to pay interest has

decreased significantly due to Covid and inefficient use of capital.

3. Market Value Ratio

Price/Earning Ratio ( P/E)

Price per share

P/ E=

Earning per share

-

2020 ( million) 2019 ( million)

PUMA ADIDAS PUMA ADIDAS

Price per 11,42 32,20

share 12,42

33,91

Earning per 0,52 3,36 1,74

share 9,57

P/E ( euro) 21,83016477 9,580856102 7,140243902 3,545122587

- In 2020

Puma: Investors are willing to spend 21,83 euro just to get 1 euro

profit.

Adidas: Investors are willing to spend 9,58 euro just to get 1 euro

profit.

- In 2019

Puma: Investors are willing to spend 7,14 euros just to get 1 euro

profit.

Adidas : Investors are willing to spend 21.83 euros just to get 1 euro

profit.

- Puma’s P/E in 2020 is 3 times larger than that of 2019, showing that

investors' profit expectation is quite high.

- Puma’s P/E is larger than Adidas’s shows that Puma is doing better, more

popular in the market,and higher liquidity.( 2020 )

Market/ Book Ratio ( M/B)

Market price per share

M /B=

Book value per share

2020 ( million) 2019 ( million )

PUMA ADIDAS PUMA ADIDAS

Marker price 11,42 32,20 12,42 33,91

per share

Book value 1.278,90 4.245,00 1.419,00 4.375,00

per share

M/B Ratio 0,008929437 0,007586105 0,008754294 0,007750736

( times)

- Puma’s M/B is keeping stable during 2019 -2020.

-

- The Market to Book ratio of Puma and Adidas are low ratios (less

than 1) could indicate that the stock is undervalued (a bad

investment) and there is something wrong with both of two.

You might also like

- Measurement and Functions of Money: Macro Topic 4.3Document2 pagesMeasurement and Functions of Money: Macro Topic 4.3Preksha Borar100% (2)

- Mock EXAM English MAJDocument11 pagesMock EXAM English MAJNamitBhasinNo ratings yet

- SPACE Matrix - Adidas AGDocument8 pagesSPACE Matrix - Adidas AGRizza Belle Maata100% (2)

- Oliver Wyman Australia NZ Case Competition Group Submission PDFDocument16 pagesOliver Wyman Australia NZ Case Competition Group Submission PDFMiku HatsuneNo ratings yet

- BA RatiosDocument6 pagesBA RatiosBastien ZimmermannNo ratings yet

- 12th Accountancy Chapter 1Document4 pages12th Accountancy Chapter 1Ankit JainNo ratings yet

- mcc2020 Webinar Series - Episode 01Document80 pagesmcc2020 Webinar Series - Episode 01Daniel DNo ratings yet

- Assignment 1 (Financial Ratio Analysis)Document22 pagesAssignment 1 (Financial Ratio Analysis)Syafiqah AmranNo ratings yet

- DepreciationDocument8 pagesDepreciationfarhadcse30No ratings yet

- FAM Text BookDocument2 pagesFAM Text BookSumitNo ratings yet

- Adidas Financial Report PerfomanceDocument10 pagesAdidas Financial Report PerfomanceJoan NdungwaNo ratings yet

- Adidas Space PDFDocument8 pagesAdidas Space PDFBowo YuniartoNo ratings yet

- Atlas CycleDocument8 pagesAtlas Cyclepriyacharan5454No ratings yet

- Advanced Micro Devices Financial Report By: Student Number: LectururDocument9 pagesAdvanced Micro Devices Financial Report By: Student Number: LectururAnonymous PeZgsTNo ratings yet

- Multi Sour - Equidam Valuation Report 2019-08-08Document25 pagesMulti Sour - Equidam Valuation Report 2019-08-08Raja EhtishamNo ratings yet

- Kimberly - Business Management Internal AssesmentDocument9 pagesKimberly - Business Management Internal Assesmentkimberly.weynata.4055No ratings yet

- Business Plan Presentation-2020 PDFDocument26 pagesBusiness Plan Presentation-2020 PDFIkram UllahNo ratings yet

- Financial Statement Analysisof PumaDocument10 pagesFinancial Statement Analysisof Pumadevansharora997No ratings yet

- Sample ReportDocument25 pagesSample ReportTolga BilgiçNo ratings yet

- Acko 157 Annual Report 2018 19Document89 pagesAcko 157 Annual Report 2018 19sdfsadfdsas223No ratings yet

- FINANCIAL STATEMENT ANALYSIS (Assignment 1)Document21 pagesFINANCIAL STATEMENT ANALYSIS (Assignment 1)Syafiqah AmranNo ratings yet

- CORE Analysis of Puma SEDocument8 pagesCORE Analysis of Puma SEPiyushNo ratings yet

- Test 2Document16 pagesTest 2Anh TramNo ratings yet

- Asset Management RatiosDocument5 pagesAsset Management RatiosJhon Ray RabaraNo ratings yet

- Financial Analysis of Pakistan State Oil For The Period July 2017-June 2020Document9 pagesFinancial Analysis of Pakistan State Oil For The Period July 2017-June 2020Adil IqbalNo ratings yet

- Almarai 2020 EngDocument6 pagesAlmarai 2020 EngHala NajiNo ratings yet

- Ana CostaDocument85 pagesAna CostaParashan HillsNo ratings yet

- Mitra Adiperkasa: Indonesia Company GuideDocument14 pagesMitra Adiperkasa: Indonesia Company GuideAshokNo ratings yet

- Analysis and InterpretationDocument5 pagesAnalysis and InterpretationAakankshaNo ratings yet

- ACC 404 RatiosDocument11 pagesACC 404 RatiosMahmud TuhinNo ratings yet

- Summative Assessment: Financial Performance ManagementDocument24 pagesSummative Assessment: Financial Performance ManagementAshley WoodNo ratings yet

- Helmet Manufacturing Industry-293269 PDFDocument68 pagesHelmet Manufacturing Industry-293269 PDFJaydeep MoharanaNo ratings yet

- B292-TMA-Summer 2022-2023-ADocument5 pagesB292-TMA-Summer 2022-2023-Aadel.dahbour97No ratings yet

- Ford Moto Company Ratio AnalysisDocument7 pagesFord Moto Company Ratio AnalysisEmon hassanNo ratings yet

- Audi Annual Financial Report 2019 PDFDocument274 pagesAudi Annual Financial Report 2019 PDFluckyNo ratings yet

- Altamira Situation AnalysisDocument6 pagesAltamira Situation Analysisashutoshdabas17No ratings yet

- Group No. 2 (CF)Document15 pagesGroup No. 2 (CF)Dhrupal TripathiNo ratings yet

- Group 12 - Final SubmissionDocument19 pagesGroup 12 - Final SubmissionSHIVAM DUBEYNo ratings yet

- Homepage: o o o o o o o o o o o o o o o oDocument5 pagesHomepage: o o o o o o o o o o o o o o o oReynel BringasNo ratings yet

- Adidas Case AnalysisDocument9 pagesAdidas Case AnalysismsklggNo ratings yet

- ADIDAS Credit Suisse 220218Document31 pagesADIDAS Credit Suisse 220218THANASIS SKOURGIASNo ratings yet

- Group 54 Bata India WorldcomDocument15 pagesGroup 54 Bata India WorldcomS BajpaiNo ratings yet

- Adidas AG - Financial and Strategic Analysis Review: Company Snapshot Company OverviewDocument5 pagesAdidas AG - Financial and Strategic Analysis Review: Company Snapshot Company OverviewNicolas Melo VegaNo ratings yet

- Everbright Greentech Research Report 05.12.21Document4 pagesEverbright Greentech Research Report 05.12.21Ralph SuarezNo ratings yet

- Coronavirus Pandemic Weighs On Adidas' First Quarter ResultsDocument6 pagesCoronavirus Pandemic Weighs On Adidas' First Quarter Results윤보현No ratings yet

- Ssliquidurea Formaldehyderesinmanufacturingindustry 181201131452Document65 pagesSsliquidurea Formaldehyderesinmanufacturingindustry 181201131452mikaela05No ratings yet

- En Executive-Summary 2019Document29 pagesEn Executive-Summary 2019Kaushik MahapatraNo ratings yet

- COSTINGDocument6 pagesCOSTINGriyaNo ratings yet

- Note On: Bata India LTD: Footwear Industry India (CR.)Document10 pagesNote On: Bata India LTD: Footwear Industry India (CR.)Avaneesh SinghNo ratings yet

- IFA - Individual Assignment - Adidas Scenario 3 - 2371571Document9 pagesIFA - Individual Assignment - Adidas Scenario 3 - 2371571Yi ChloeNo ratings yet

- Newsletter 27 - Shareholders Meeting 2017Document2 pagesNewsletter 27 - Shareholders Meeting 2017CGT AmadeusNo ratings yet

- 7 May Adidas AnalysisDocument11 pages7 May Adidas Analysissardar hussain0% (1)

- Inditex Finance Report 2020Document18 pagesInditex Finance Report 2020david juNo ratings yet

- Mario Heinold 2019-20 33854Document42 pagesMario Heinold 2019-20 33854Trần Thuỳ NgânNo ratings yet

- RyanairDocument7 pagesRyanairJoão CaladoNo ratings yet

- LP Applications - ExampleDocument13 pagesLP Applications - ExampleGamer zoneNo ratings yet

- Cab Service ModelDocument2 pagesCab Service ModelPooja AdhikariNo ratings yet

- Corporate Finance Decisions For Wealth Maximization: Capital Budgeting DecisionDocument9 pagesCorporate Finance Decisions For Wealth Maximization: Capital Budgeting DecisionJoseph JohnNo ratings yet

- Business Feasibility AfzalDocument6 pagesBusiness Feasibility AfzalSonam RajKumarNo ratings yet

- Aam Annual Report 2018Document131 pagesAam Annual Report 2018shountyNo ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- Hostile Takeover Defenses-I: - Goutham G ShettyDocument42 pagesHostile Takeover Defenses-I: - Goutham G ShettymahtuoggsNo ratings yet

- Modelling Risk in Central Counterparty Clearing Houses:: A ReviewDocument13 pagesModelling Risk in Central Counterparty Clearing Houses:: A ReviewrinkidinkNo ratings yet

- Money & Banking - MGT411 QuizDocument21 pagesMoney & Banking - MGT411 QuizAmjadNo ratings yet

- JANA PetSmart LetterDocument5 pagesJANA PetSmart Lettermarketfolly.com100% (1)

- Executive Summary:: Title of ProjectDocument93 pagesExecutive Summary:: Title of ProjectNaveen Kumar NcNo ratings yet

- FX4Cash Currency Guide 2021Document133 pagesFX4Cash Currency Guide 2021Jairo BastidasNo ratings yet

- Bloomberg Credit Default Swap Cheat SheetDocument1 pageBloomberg Credit Default Swap Cheat Sheetmodulus97No ratings yet

- Accounting Chapter 15Document4 pagesAccounting Chapter 15justinnNo ratings yet

- The Journal Oct-Dec 2022Document106 pagesThe Journal Oct-Dec 2022zoey thakuriiNo ratings yet

- Ddmmyyyy: Application For Closing An Trading/ Demat Account (Resident Individual) To, Kotak Securities LTDDocument1 pageDdmmyyyy: Application For Closing An Trading/ Demat Account (Resident Individual) To, Kotak Securities LTDMohit SingalNo ratings yet

- SEC Form 23-A NerineDocument5 pagesSEC Form 23-A NerineJulius Mark Carinhay TolitolNo ratings yet

- BAC1644 Principles of Finance AssignmentDocument33 pagesBAC1644 Principles of Finance Assignmentyuyin.gohyyNo ratings yet

- The Market Direction Indicator Anticipating Moving Average CrossoversDocument4 pagesThe Market Direction Indicator Anticipating Moving Average CrossoversPRABHASH SINGHNo ratings yet

- Innovative Financial Services QBDocument32 pagesInnovative Financial Services QBLeo Bogosi MotlogelwNo ratings yet

- Chapter 13 Market EfficiencyDocument2 pagesChapter 13 Market EfficiencySajib KarNo ratings yet

- Financial System of Nepal: Kiran ThapaDocument22 pagesFinancial System of Nepal: Kiran ThapaAnuska JayswalNo ratings yet

- Chap 3Document26 pagesChap 3Yeshiwork GirmaNo ratings yet

- IGWT Report 23 - Nuggets 15 - Showdown in Sound MoneyDocument24 pagesIGWT Report 23 - Nuggets 15 - Showdown in Sound MoneySerigne Modou NDIAYENo ratings yet

- Divya Singh ResumeDocument1 pageDivya Singh Resumetcsdelhi.officialNo ratings yet

- Investors Behavior Towards Mutual Funds in Surat City: A Study OnDocument64 pagesInvestors Behavior Towards Mutual Funds in Surat City: A Study OnRavish ChhabraNo ratings yet

- FAQ For GStocksDocument25 pagesFAQ For GStocksCaila FacturanNo ratings yet

- Fixed Income Asset AllocationDocument42 pagesFixed Income Asset AllocationCynric HuangNo ratings yet

- Sebi MCQDocument19 pagesSebi MCQvishalNo ratings yet

- MBA560 Chapter 14 10thDocument51 pagesMBA560 Chapter 14 10thAshok Chowdary GNo ratings yet

- Interest Rates and BondsDocument2 pagesInterest Rates and Bondstawhid anamNo ratings yet

- 50 Largest Hedge Fund Managers in USDocument12 pages50 Largest Hedge Fund Managers in UShttp://besthedgefund.blogspot.com100% (1)

- Influence of Stocks Intrinsic Valuation On Investment Decision MaDocument9 pagesInfluence of Stocks Intrinsic Valuation On Investment Decision Marao sahabNo ratings yet

- PS 10 - Chapter 12 - Standard Setting - Economic Issues (Solutions)Document33 pagesPS 10 - Chapter 12 - Standard Setting - Economic Issues (Solutions)Matteo VidottoNo ratings yet

- Bond Valuation PresentationDocument16 pagesBond Valuation PresentationJACOB GAMUNo ratings yet