Professional Documents

Culture Documents

Midterm Income Tax

Midterm Income Tax

Uploaded by

Christy BascoCopyright:

Available Formats

You might also like

- PDFDocument1 pagePDFVENKAT RAO0% (1)

- TAXDocument10 pagesTAXJeana Segumalian100% (3)

- BYJU's July PayslipDocument2 pagesBYJU's July PayslipGopi ReddyNo ratings yet

- Protest Letter SampleDocument3 pagesProtest Letter Samplesarah.gleason100% (1)

- The Fisher-Clark HypothesisDocument2 pagesThe Fisher-Clark Hypothesiswake up PhilippinesNo ratings yet

- Limitation of Taxation Power A. Inherent Limilations: Resident Citizen and Domestic CorporationDocument5 pagesLimitation of Taxation Power A. Inherent Limilations: Resident Citizen and Domestic CorporationEunice JusiNo ratings yet

- Mid Term IDocument10 pagesMid Term Ichaos1989No ratings yet

- BIR Form 1702-RTDocument8 pagesBIR Form 1702-RTDianne SantiagoNo ratings yet

- Pay Particulars: Pay and Pension Directorate - Sri Lanka NavyDocument1 pagePay Particulars: Pay and Pension Directorate - Sri Lanka NavySLNS RUHUNA100% (1)

- Midterm (Assignment (1) Income TaxationDocument3 pagesMidterm (Assignment (1) Income TaxationMark Emil BaritNo ratings yet

- JFINEX Accomplishment Report 1st Semester 2022 2023Document20 pagesJFINEX Accomplishment Report 1st Semester 2022 2023Jelwin BautistaNo ratings yet

- HOMEWORK 1 Concept of TaxationDocument5 pagesHOMEWORK 1 Concept of Taxationfitz garlitosNo ratings yet

- Accounting ReviewerDocument6 pagesAccounting ReviewerHarry EvangelistaNo ratings yet

- FM 130 Philippine Monetary PolicyDocument5 pagesFM 130 Philippine Monetary PolicyHerminio NiepezNo ratings yet

- 1 CSR Introd UtionDocument27 pages1 CSR Introd UtionMadelyn SJ PamulaklakinNo ratings yet

- Taxation May Board ExamDocument25 pagesTaxation May Board ExamjaysonNo ratings yet

- Bonds Payable PDFDocument6 pagesBonds Payable PDFAnthony Tunying MantuhacNo ratings yet

- Activity PrefinalDocument2 pagesActivity PrefinalRoNnie RonNie100% (1)

- MC1 Income TaxationDocument5 pagesMC1 Income Taxationjohn carlo tolentinoNo ratings yet

- How Does The Concept ofDocument2 pagesHow Does The Concept ofMaricar TulioNo ratings yet

- TAX-311-InCOME-TAXATION-https Urios - Neolms.com Student Quiz Assignment Submissions 24706119Document6 pagesTAX-311-InCOME-TAXATION-https Urios - Neolms.com Student Quiz Assignment Submissions 24706119Myco PaqueNo ratings yet

- Patriarchal WomenDocument14 pagesPatriarchal WomenElecktra Stiles100% (1)

- Income Tax Schemes, Accounting Periods, Accounting Methods, and ReportingDocument6 pagesIncome Tax Schemes, Accounting Periods, Accounting Methods, and ReportingAilene MendozaNo ratings yet

- Income Taxation DownloadDocument7 pagesIncome Taxation DownloadKaren May JimenezNo ratings yet

- Public Revenue ch-2Document76 pagesPublic Revenue ch-2yebegashetNo ratings yet

- May 28, 2015-CH 10-Basic Income Tax Patterns-Valencia & RoxasDocument18 pagesMay 28, 2015-CH 10-Basic Income Tax Patterns-Valencia & RoxasgoerginamarquezNo ratings yet

- Income Taxation01Document7 pagesIncome Taxation01Ailene MendozaNo ratings yet

- Donor's Tax Exam ReviewerDocument4 pagesDonor's Tax Exam ReviewerCleah WaskinNo ratings yet

- Chapter 1 Introduction To Taxation: Chapter Overview and ObjectivesDocument30 pagesChapter 1 Introduction To Taxation: Chapter Overview and ObjectivesNoeme LansangNo ratings yet

- Importance of TimeDocument2 pagesImportance of TimeBerlyn Joy SaladoNo ratings yet

- Passive IncomeDocument2 pagesPassive Incomeallain_matiasNo ratings yet

- CHAPTER 4 Regular Income Taxation Individuals ModuleDocument10 pagesCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- Sets Set Theory Is A Branch of Mathematical Logic That Studies Sets, WhichDocument20 pagesSets Set Theory Is A Branch of Mathematical Logic That Studies Sets, WhichGamef54No ratings yet

- Ali Infographic Stsxf2Document1 pageAli Infographic Stsxf2JohairahNo ratings yet

- Unit Iii:: Income Tax ON CorporationsDocument35 pagesUnit Iii:: Income Tax ON CorporationsElleNo ratings yet

- Moi Quiz With AnswersDocument6 pagesMoi Quiz With AnswersLorraine TioNo ratings yet

- HQ01 - General Principles of TaxationDocument14 pagesHQ01 - General Principles of TaxationJimmyChao100% (1)

- Chapter 11-12 VDocument30 pagesChapter 11-12 VAdd AllNo ratings yet

- Midterm Exam On Income Tax - QuestionsDocument11 pagesMidterm Exam On Income Tax - QuestionskeziahNo ratings yet

- Lecture-3 On Classification of IncomeDocument14 pagesLecture-3 On Classification of Incomeimdadul haqueNo ratings yet

- Chapter 2 AssignmentDocument8 pagesChapter 2 AssignmentRoss John JimenezNo ratings yet

- Module 03 - Income Tax ConceptsDocument29 pagesModule 03 - Income Tax ConceptsTrixie OnglaoNo ratings yet

- Chapter 7 VDocument18 pagesChapter 7 VAdd AllNo ratings yet

- Reflection and Oblicon AssDocument2 pagesReflection and Oblicon AssnimnimNo ratings yet

- Module 2 Tax On IndividualsDocument12 pagesModule 2 Tax On Individualscha11No ratings yet

- Income Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxDocument36 pagesIncome Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxPascua PeejayNo ratings yet

- Tax EvasionDocument2 pagesTax EvasionOkwuchi AlaukwuNo ratings yet

- Chapter 9 Communicating in Teams and OrganizationDocument20 pagesChapter 9 Communicating in Teams and OrganizationZihr EllerycNo ratings yet

- INCOME TAX OF INDIVIDUALS Part 2 PDFDocument3 pagesINCOME TAX OF INDIVIDUALS Part 2 PDFADNo ratings yet

- PartnershipDocument20 pagesPartnershipYudna YuNo ratings yet

- Income Taxation Chapter 1Document5 pagesIncome Taxation Chapter 1Princess Ivy PenaflorNo ratings yet

- Case No 4 - Robbin IndustriesDocument3 pagesCase No 4 - Robbin Industriesabegail soquinaNo ratings yet

- Ignorantia Juris Non ExcusatDocument3 pagesIgnorantia Juris Non ExcusatXymon Bassig0% (1)

- 1 PrelimDocument35 pages1 PrelimXerez SingsonNo ratings yet

- Chapter 6 VDocument14 pagesChapter 6 VAdd AllNo ratings yet

- Economic History of The PhilippinesDocument4 pagesEconomic History of The PhilippinesClint Agustin M. RoblesNo ratings yet

- Partnership Chapter 2Document6 pagesPartnership Chapter 2Nyah MallariNo ratings yet

- Finals - II. Deductions & ExemptionsDocument13 pagesFinals - II. Deductions & ExemptionsJovince Daño DoceNo ratings yet

- Midterm Bi ADocument13 pagesMidterm Bi AFabiana BarbeiroNo ratings yet

- Interest Rates and Their Role in FinanceDocument17 pagesInterest Rates and Their Role in FinanceClyden Jaile RamirezNo ratings yet

- Economics ReportDocument32 pagesEconomics ReportGazelle Joy UlalanNo ratings yet

- Final Exam Taxation 101Document8 pagesFinal Exam Taxation 101Live LoveNo ratings yet

- Midterm Exam - An Inventor For A Day - What Can Change The WorldDocument4 pagesMidterm Exam - An Inventor For A Day - What Can Change The WorldMikko LaurenNo ratings yet

- Taxation Review Final Income TaxDocument4 pagesTaxation Review Final Income TaxGendyBocoNo ratings yet

- Double Entry Bookkeeping: 7 Step Guide To Processing Business AccountsDocument18 pagesDouble Entry Bookkeeping: 7 Step Guide To Processing Business AccountsChristy BascoNo ratings yet

- Chart of AccountsDocument8 pagesChart of AccountsChristy BascoNo ratings yet

- DIDM ChecklistDocument1 pageDIDM ChecklistChristy Basco100% (2)

- Cash Book Ledger Account: Learn More AboutDocument2 pagesCash Book Ledger Account: Learn More AboutChristy BascoNo ratings yet

- Balance Sheet: The Accounting Is One of The Major Financial Statements Used by Accountants and Business OwnersDocument4 pagesBalance Sheet: The Accounting Is One of The Major Financial Statements Used by Accountants and Business OwnersChristy BascoNo ratings yet

- TAX 2202E TBS02 02.solutionDocument3 pagesTAX 2202E TBS02 02.solutionZhitong LuNo ratings yet

- Revised TDS TCS Rate ChartDocument3 pagesRevised TDS TCS Rate ChartMandar KadamNo ratings yet

- Fee Receipt 323103Document1 pageFee Receipt 323103Niharika KerawatNo ratings yet

- Individual Inc Tax Exam 1 Study GuideDocument20 pagesIndividual Inc Tax Exam 1 Study GuideMary Tol100% (1)

- Taxable Person Under GST: Find GST Rate, HSN Code & Sac CodeDocument2 pagesTaxable Person Under GST: Find GST Rate, HSN Code & Sac CodeAnonymous uHT7dDNo ratings yet

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- US Internal Revenue Service: I2555ez - 2002Document3 pagesUS Internal Revenue Service: I2555ez - 2002IRSNo ratings yet

- Rajasthan - State FormatDocument9 pagesRajasthan - State FormatvjvksNo ratings yet

- Practice Questions Residential Status 1Document2 pagesPractice Questions Residential Status 1Varsha .kNo ratings yet

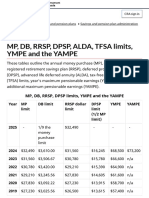

- MP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - CaDocument4 pagesMP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - Caag9004282No ratings yet

- BIR Form No. 1700Document2 pagesBIR Form No. 1700mijareschabelita2No ratings yet

- 1099-r FREEDocument11 pages1099-r FREEItzFire2kNo ratings yet

- CBIC Civil List As On 01.01.2016Document433 pagesCBIC Civil List As On 01.01.2016रुद्र प्रताप सिंह ८२No ratings yet

- CTC Break Up For Appointment LetterDocument4 pagesCTC Break Up For Appointment LetterWall Street Forex (WSFx)No ratings yet

- Ftsfi Template of Certificate of Donation or Bir Form 2322Document2 pagesFtsfi Template of Certificate of Donation or Bir Form 2322Marinez BaretaNo ratings yet

- SupplyOutward CE 028Document1 pageSupplyOutward CE 028skgts787737No ratings yet

- BIR Form 2307 - May2022Document12 pagesBIR Form 2307 - May2022Mae Ann Aguila100% (1)

- 1604-Cf 2013 Global EcoDocument1 page1604-Cf 2013 Global Ecostringwinds101No ratings yet

- BIR Form 1Document1 pageBIR Form 1Mark De JesusNo ratings yet

- Payslip 59904 202401Document1 pagePayslip 59904 202401Sk Imran IslamNo ratings yet

- Income From Dairy Farming Not in Agricultural IncomeDocument3 pagesIncome From Dairy Farming Not in Agricultural Incomearpit85No ratings yet

- 10.20.22 Letter Congresswoman Velazquez CTC PRDocument2 pages10.20.22 Letter Congresswoman Velazquez CTC PRMetro Puerto RicoNo ratings yet

- Job WorkDocument2 pagesJob WorkPragasNo ratings yet

- ATO ID 2002 - 319 Beverage Analyst - Purchase of Wine For TastingDocument4 pagesATO ID 2002 - 319 Beverage Analyst - Purchase of Wine For Tastingjo lamosNo ratings yet

- Vesta Property Vs CIRDocument1 pageVesta Property Vs CIRLouie SalladorNo ratings yet

- Rohit BBA (G) V Sem GSTDocument16 pagesRohit BBA (G) V Sem GSTAnnu KashyapNo ratings yet

Midterm Income Tax

Midterm Income Tax

Uploaded by

Christy BascoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Midterm Income Tax

Midterm Income Tax

Uploaded by

Christy BascoCopyright:

Available Formats

INCOME TAXATION 1

MM 2E

MIDTERM EXAMINATION

I- IDENTIFICATION:

1. The due date on filing of return and payment of excise taxes on importation.

2-3 What are the collection remedies available to the government?

4. System of collecting taxes in accordance with country’s tax policies.

5. This is the government agency principally responsible for the fiscal policies and general management

of the Philippine Government’s financial resources.

6.What is TIN?

7. This is also tax minimization; reducing or totally escaping payment of taxes through legally permissible

way.

8. When should a self-employed be first registered with the BIR?

9. What is tax return?

10. How much is the initial bond of those manufacturers and importers of alcohol and tobacco products?

II- Problem solving: Choose the correct answer. Support your answer. (5 pts each)

1. Annual registration

Jollimacs is a food chain corporation with a principal office in Mandaluyong City. It has two factories

located in Cavite and Cebu, 12 warehouses and 45 branches throughout the Philippines. How much is the

total annual registration fees of Jollimacs?

a.) P30,000 c.)P29,000

b.) P29,500 d.)P28,500

2. Minimum Compromise

A criminal case was filed in court against Mr. Garcia for obtaining three (3) different Tax Identification

Number (TIN) resulting to an estimated tax fraud of P50M.

If Mr. Garcia proposed for a compromise to the BIR Commissioner, how much is the minimum

compromise that is allowed to Mr. Garcia?

a.) P20 million c.) P5 million

b.) P10 million d.) P – 0 –

3. Minimum Compromise

Francis Co declared bankruptcy with the following financial conditions:

Cash P100,000

` Non cash assets 1,000,000

Bank loans payable 600,000

Trade creditors payable 800,000

Income Tax payable 1,000,000

Accumulated Losses 1,300,000

The non-cash assets were liquidated for P600,000. Francis Co was able to negotiate compromise due to

financial incapability. Assuming that income tax payable of Francis Co has been due for 6 months, how

much is the minimum amount due for compromise?

a.) P550,000 c.) P270,000

b.) P400,000 d.) P200,000

4. Wrong RDO

A certain taxpayer has a basic tax due amounting to P10,000 pertaining to his 2017 ITR but was filed only

on June 30, 2018 to wrong Revenue District Office. How much would be the total amount due by the

taxpayer inclusive of surcharge and interest?

a.) P12,500 c.) P15,417

b.) P15,000 d.) P17,417

5. Importer’s Bond

Y company is an importer of liquor products that need to pay an importer’s bond on excise taxes. During

the first year of importation, the following was taken from the record of Y Company:

First 6-month bond P100,000

Actual excise tax on the:

First 6 months 200,000

Last 6 months 250,000

How much is the required bond on the last 6 months of the first year?

a.) P250,000 c.) P400,000

b.) P300,000 d.) P450,000

You might also like

- PDFDocument1 pagePDFVENKAT RAO0% (1)

- TAXDocument10 pagesTAXJeana Segumalian100% (3)

- BYJU's July PayslipDocument2 pagesBYJU's July PayslipGopi ReddyNo ratings yet

- Protest Letter SampleDocument3 pagesProtest Letter Samplesarah.gleason100% (1)

- The Fisher-Clark HypothesisDocument2 pagesThe Fisher-Clark Hypothesiswake up PhilippinesNo ratings yet

- Limitation of Taxation Power A. Inherent Limilations: Resident Citizen and Domestic CorporationDocument5 pagesLimitation of Taxation Power A. Inherent Limilations: Resident Citizen and Domestic CorporationEunice JusiNo ratings yet

- Mid Term IDocument10 pagesMid Term Ichaos1989No ratings yet

- BIR Form 1702-RTDocument8 pagesBIR Form 1702-RTDianne SantiagoNo ratings yet

- Pay Particulars: Pay and Pension Directorate - Sri Lanka NavyDocument1 pagePay Particulars: Pay and Pension Directorate - Sri Lanka NavySLNS RUHUNA100% (1)

- Midterm (Assignment (1) Income TaxationDocument3 pagesMidterm (Assignment (1) Income TaxationMark Emil BaritNo ratings yet

- JFINEX Accomplishment Report 1st Semester 2022 2023Document20 pagesJFINEX Accomplishment Report 1st Semester 2022 2023Jelwin BautistaNo ratings yet

- HOMEWORK 1 Concept of TaxationDocument5 pagesHOMEWORK 1 Concept of Taxationfitz garlitosNo ratings yet

- Accounting ReviewerDocument6 pagesAccounting ReviewerHarry EvangelistaNo ratings yet

- FM 130 Philippine Monetary PolicyDocument5 pagesFM 130 Philippine Monetary PolicyHerminio NiepezNo ratings yet

- 1 CSR Introd UtionDocument27 pages1 CSR Introd UtionMadelyn SJ PamulaklakinNo ratings yet

- Taxation May Board ExamDocument25 pagesTaxation May Board ExamjaysonNo ratings yet

- Bonds Payable PDFDocument6 pagesBonds Payable PDFAnthony Tunying MantuhacNo ratings yet

- Activity PrefinalDocument2 pagesActivity PrefinalRoNnie RonNie100% (1)

- MC1 Income TaxationDocument5 pagesMC1 Income Taxationjohn carlo tolentinoNo ratings yet

- How Does The Concept ofDocument2 pagesHow Does The Concept ofMaricar TulioNo ratings yet

- TAX-311-InCOME-TAXATION-https Urios - Neolms.com Student Quiz Assignment Submissions 24706119Document6 pagesTAX-311-InCOME-TAXATION-https Urios - Neolms.com Student Quiz Assignment Submissions 24706119Myco PaqueNo ratings yet

- Patriarchal WomenDocument14 pagesPatriarchal WomenElecktra Stiles100% (1)

- Income Tax Schemes, Accounting Periods, Accounting Methods, and ReportingDocument6 pagesIncome Tax Schemes, Accounting Periods, Accounting Methods, and ReportingAilene MendozaNo ratings yet

- Income Taxation DownloadDocument7 pagesIncome Taxation DownloadKaren May JimenezNo ratings yet

- Public Revenue ch-2Document76 pagesPublic Revenue ch-2yebegashetNo ratings yet

- May 28, 2015-CH 10-Basic Income Tax Patterns-Valencia & RoxasDocument18 pagesMay 28, 2015-CH 10-Basic Income Tax Patterns-Valencia & RoxasgoerginamarquezNo ratings yet

- Income Taxation01Document7 pagesIncome Taxation01Ailene MendozaNo ratings yet

- Donor's Tax Exam ReviewerDocument4 pagesDonor's Tax Exam ReviewerCleah WaskinNo ratings yet

- Chapter 1 Introduction To Taxation: Chapter Overview and ObjectivesDocument30 pagesChapter 1 Introduction To Taxation: Chapter Overview and ObjectivesNoeme LansangNo ratings yet

- Importance of TimeDocument2 pagesImportance of TimeBerlyn Joy SaladoNo ratings yet

- Passive IncomeDocument2 pagesPassive Incomeallain_matiasNo ratings yet

- CHAPTER 4 Regular Income Taxation Individuals ModuleDocument10 pagesCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- Sets Set Theory Is A Branch of Mathematical Logic That Studies Sets, WhichDocument20 pagesSets Set Theory Is A Branch of Mathematical Logic That Studies Sets, WhichGamef54No ratings yet

- Ali Infographic Stsxf2Document1 pageAli Infographic Stsxf2JohairahNo ratings yet

- Unit Iii:: Income Tax ON CorporationsDocument35 pagesUnit Iii:: Income Tax ON CorporationsElleNo ratings yet

- Moi Quiz With AnswersDocument6 pagesMoi Quiz With AnswersLorraine TioNo ratings yet

- HQ01 - General Principles of TaxationDocument14 pagesHQ01 - General Principles of TaxationJimmyChao100% (1)

- Chapter 11-12 VDocument30 pagesChapter 11-12 VAdd AllNo ratings yet

- Midterm Exam On Income Tax - QuestionsDocument11 pagesMidterm Exam On Income Tax - QuestionskeziahNo ratings yet

- Lecture-3 On Classification of IncomeDocument14 pagesLecture-3 On Classification of Incomeimdadul haqueNo ratings yet

- Chapter 2 AssignmentDocument8 pagesChapter 2 AssignmentRoss John JimenezNo ratings yet

- Module 03 - Income Tax ConceptsDocument29 pagesModule 03 - Income Tax ConceptsTrixie OnglaoNo ratings yet

- Chapter 7 VDocument18 pagesChapter 7 VAdd AllNo ratings yet

- Reflection and Oblicon AssDocument2 pagesReflection and Oblicon AssnimnimNo ratings yet

- Module 2 Tax On IndividualsDocument12 pagesModule 2 Tax On Individualscha11No ratings yet

- Income Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxDocument36 pagesIncome Tax 1. Definition, Nature, and General Principles A. Criteria in Imposing Philippine Income TaxPascua PeejayNo ratings yet

- Tax EvasionDocument2 pagesTax EvasionOkwuchi AlaukwuNo ratings yet

- Chapter 9 Communicating in Teams and OrganizationDocument20 pagesChapter 9 Communicating in Teams and OrganizationZihr EllerycNo ratings yet

- INCOME TAX OF INDIVIDUALS Part 2 PDFDocument3 pagesINCOME TAX OF INDIVIDUALS Part 2 PDFADNo ratings yet

- PartnershipDocument20 pagesPartnershipYudna YuNo ratings yet

- Income Taxation Chapter 1Document5 pagesIncome Taxation Chapter 1Princess Ivy PenaflorNo ratings yet

- Case No 4 - Robbin IndustriesDocument3 pagesCase No 4 - Robbin Industriesabegail soquinaNo ratings yet

- Ignorantia Juris Non ExcusatDocument3 pagesIgnorantia Juris Non ExcusatXymon Bassig0% (1)

- 1 PrelimDocument35 pages1 PrelimXerez SingsonNo ratings yet

- Chapter 6 VDocument14 pagesChapter 6 VAdd AllNo ratings yet

- Economic History of The PhilippinesDocument4 pagesEconomic History of The PhilippinesClint Agustin M. RoblesNo ratings yet

- Partnership Chapter 2Document6 pagesPartnership Chapter 2Nyah MallariNo ratings yet

- Finals - II. Deductions & ExemptionsDocument13 pagesFinals - II. Deductions & ExemptionsJovince Daño DoceNo ratings yet

- Midterm Bi ADocument13 pagesMidterm Bi AFabiana BarbeiroNo ratings yet

- Interest Rates and Their Role in FinanceDocument17 pagesInterest Rates and Their Role in FinanceClyden Jaile RamirezNo ratings yet

- Economics ReportDocument32 pagesEconomics ReportGazelle Joy UlalanNo ratings yet

- Final Exam Taxation 101Document8 pagesFinal Exam Taxation 101Live LoveNo ratings yet

- Midterm Exam - An Inventor For A Day - What Can Change The WorldDocument4 pagesMidterm Exam - An Inventor For A Day - What Can Change The WorldMikko LaurenNo ratings yet

- Taxation Review Final Income TaxDocument4 pagesTaxation Review Final Income TaxGendyBocoNo ratings yet

- Double Entry Bookkeeping: 7 Step Guide To Processing Business AccountsDocument18 pagesDouble Entry Bookkeeping: 7 Step Guide To Processing Business AccountsChristy BascoNo ratings yet

- Chart of AccountsDocument8 pagesChart of AccountsChristy BascoNo ratings yet

- DIDM ChecklistDocument1 pageDIDM ChecklistChristy Basco100% (2)

- Cash Book Ledger Account: Learn More AboutDocument2 pagesCash Book Ledger Account: Learn More AboutChristy BascoNo ratings yet

- Balance Sheet: The Accounting Is One of The Major Financial Statements Used by Accountants and Business OwnersDocument4 pagesBalance Sheet: The Accounting Is One of The Major Financial Statements Used by Accountants and Business OwnersChristy BascoNo ratings yet

- TAX 2202E TBS02 02.solutionDocument3 pagesTAX 2202E TBS02 02.solutionZhitong LuNo ratings yet

- Revised TDS TCS Rate ChartDocument3 pagesRevised TDS TCS Rate ChartMandar KadamNo ratings yet

- Fee Receipt 323103Document1 pageFee Receipt 323103Niharika KerawatNo ratings yet

- Individual Inc Tax Exam 1 Study GuideDocument20 pagesIndividual Inc Tax Exam 1 Study GuideMary Tol100% (1)

- Taxable Person Under GST: Find GST Rate, HSN Code & Sac CodeDocument2 pagesTaxable Person Under GST: Find GST Rate, HSN Code & Sac CodeAnonymous uHT7dDNo ratings yet

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- US Internal Revenue Service: I2555ez - 2002Document3 pagesUS Internal Revenue Service: I2555ez - 2002IRSNo ratings yet

- Rajasthan - State FormatDocument9 pagesRajasthan - State FormatvjvksNo ratings yet

- Practice Questions Residential Status 1Document2 pagesPractice Questions Residential Status 1Varsha .kNo ratings yet

- MP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - CaDocument4 pagesMP, DB, RRSP, DPSP, Alda, Tfsa Limits, Ympe and The Yampe - Canada - Caag9004282No ratings yet

- BIR Form No. 1700Document2 pagesBIR Form No. 1700mijareschabelita2No ratings yet

- 1099-r FREEDocument11 pages1099-r FREEItzFire2kNo ratings yet

- CBIC Civil List As On 01.01.2016Document433 pagesCBIC Civil List As On 01.01.2016रुद्र प्रताप सिंह ८२No ratings yet

- CTC Break Up For Appointment LetterDocument4 pagesCTC Break Up For Appointment LetterWall Street Forex (WSFx)No ratings yet

- Ftsfi Template of Certificate of Donation or Bir Form 2322Document2 pagesFtsfi Template of Certificate of Donation or Bir Form 2322Marinez BaretaNo ratings yet

- SupplyOutward CE 028Document1 pageSupplyOutward CE 028skgts787737No ratings yet

- BIR Form 2307 - May2022Document12 pagesBIR Form 2307 - May2022Mae Ann Aguila100% (1)

- 1604-Cf 2013 Global EcoDocument1 page1604-Cf 2013 Global Ecostringwinds101No ratings yet

- BIR Form 1Document1 pageBIR Form 1Mark De JesusNo ratings yet

- Payslip 59904 202401Document1 pagePayslip 59904 202401Sk Imran IslamNo ratings yet

- Income From Dairy Farming Not in Agricultural IncomeDocument3 pagesIncome From Dairy Farming Not in Agricultural Incomearpit85No ratings yet

- 10.20.22 Letter Congresswoman Velazquez CTC PRDocument2 pages10.20.22 Letter Congresswoman Velazquez CTC PRMetro Puerto RicoNo ratings yet

- Job WorkDocument2 pagesJob WorkPragasNo ratings yet

- ATO ID 2002 - 319 Beverage Analyst - Purchase of Wine For TastingDocument4 pagesATO ID 2002 - 319 Beverage Analyst - Purchase of Wine For Tastingjo lamosNo ratings yet

- Vesta Property Vs CIRDocument1 pageVesta Property Vs CIRLouie SalladorNo ratings yet

- Rohit BBA (G) V Sem GSTDocument16 pagesRohit BBA (G) V Sem GSTAnnu KashyapNo ratings yet