Professional Documents

Culture Documents

The Analysis and Comparison For The Financials of Treasury Segment in Banks

The Analysis and Comparison For The Financials of Treasury Segment in Banks

Uploaded by

Rohit AggarwalCopyright:

Available Formats

You might also like

- 12 Powerful Trading Set UpsDocument78 pages12 Powerful Trading Set Upsmmanojj63% (49)

- Robinhood:Buying A Stock As Quickly As You'd Post An Instagram PhotoDocument3 pagesRobinhood:Buying A Stock As Quickly As You'd Post An Instagram PhotoHarshil JhaveriNo ratings yet

- LeadingRE - International Project Marketing Program (IPMP)Document8 pagesLeadingRE - International Project Marketing Program (IPMP)Parikshat ChawlaNo ratings yet

- Treasury Management - Assignment No. 1 - Rohit AggarwalDocument2 pagesTreasury Management - Assignment No. 1 - Rohit AggarwalRohit AggarwalNo ratings yet

- PSU Banks Comparative Analysis FY21Document10 pagesPSU Banks Comparative Analysis FY21Ganesh V0% (1)

- Public Sector Banks Comparative Analysis 3QFY24Document10 pagesPublic Sector Banks Comparative Analysis 3QFY24Sujay AnanthakrishnaNo ratings yet

- 4.1.1 - Dự Báo Dòng TiềnDocument5 pages4.1.1 - Dự Báo Dòng TiềnLê TiếnNo ratings yet

- FSA AssignmentDocument4 pagesFSA AssignmentDharmil OzaNo ratings yet

- Financial Model of Dmart - 5Document4 pagesFinancial Model of Dmart - 5Shivam DubeyNo ratings yet

- Maruti Suzuki ValuationDocument39 pagesMaruti Suzuki ValuationritususmitakarNo ratings yet

- Financial Statement of JS Bank: Submitted ToDocument22 pagesFinancial Statement of JS Bank: Submitted ToAtia KhalidNo ratings yet

- Pakistan State Oil Company Limited (Pso)Document6 pagesPakistan State Oil Company Limited (Pso)Maaz HanifNo ratings yet

- 04 02 BeginDocument2 pages04 02 BeginnehaNo ratings yet

- Profit MarginsDocument2 pagesProfit Marginsfady nabilNo ratings yet

- Private Sector Banks Comparative Analysis 1HFY22Document12 pagesPrivate Sector Banks Comparative Analysis 1HFY22Tushar Mohan0% (1)

- Aztecsoft Financial Results Q1-09 Press ReleaseDocument5 pagesAztecsoft Financial Results Q1-09 Press ReleaseMindtree LtdNo ratings yet

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloDocument1 pageDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLNo ratings yet

- We Are Not Above Nature, We Are A Part of NatureDocument216 pagesWe Are Not Above Nature, We Are A Part of NaturePRIYADARSHI GOURAVNo ratings yet

- ITC Financial ModelDocument150 pagesITC Financial ModelKaushik JainNo ratings yet

- ACLEDA Bank - Annual Report 2020 - HighDocument222 pagesACLEDA Bank - Annual Report 2020 - HighRashi KohliNo ratings yet

- Technofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialDocument37 pagesTechnofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialVipulNo ratings yet

- Kelompok 4 - Tugas 8 - ALK CDocument5 pagesKelompok 4 - Tugas 8 - ALK CTheresia TjiaNo ratings yet

- Analisis Common Size PT Vale Indoesia TBKDocument3 pagesAnalisis Common Size PT Vale Indoesia TBKRL. 12No ratings yet

- Aztecsoft Financial Results Q2 09Document5 pagesAztecsoft Financial Results Q2 09Mindtree LtdNo ratings yet

- Financial Modelling and Analysis ITCDocument9 pagesFinancial Modelling and Analysis ITCPriyam SarangiNo ratings yet

- NPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Document11 pagesNPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Ali Hussain Al SalmawiNo ratings yet

- Cash FlowDocument6 pagesCash Flowahmedmostafaibrahim22No ratings yet

- Almarai Finance ReportDocument9 pagesAlmarai Finance ReportVikaas GupthaNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- Axisbank Financial Statements Summary AJ WorksDocument12 pagesAxisbank Financial Statements Summary AJ WorksSoorajKrishnanNo ratings yet

- Contoh Simple FCFFDocument5 pagesContoh Simple FCFFFANNY KRISTIANTINo ratings yet

- Afs - QTLDocument6 pagesAfs - QTLKashif SaleemNo ratings yet

- Unitedhealth Care Income Statement & Balance Sheet & PE RatioDocument8 pagesUnitedhealth Care Income Statement & Balance Sheet & PE RatioEhab elhashmyNo ratings yet

- Performance AGlanceDocument1 pagePerformance AGlanceHarshal SawaleNo ratings yet

- Gildan Model BearDocument57 pagesGildan Model BearNaman PriyadarshiNo ratings yet

- ITC Financial ModelDocument24 pagesITC Financial ModelKaushik JainNo ratings yet

- Dietrich Farms - Worksheet 2Document39 pagesDietrich Farms - Worksheet 2spam.ml2023No ratings yet

- Financial Table Analysis of ZaraDocument9 pagesFinancial Table Analysis of ZaraCeren75% (4)

- 2012 Annual ReportDocument156 pages2012 Annual Reportpcelica77No ratings yet

- Financial Analysis Template FinalDocument8 pagesFinancial Analysis Template FinalHarit keshruwalaNo ratings yet

- CiscoDocument6 pagesCiscoAN NGUYEN THANHNo ratings yet

- Almarai Annual Report enDocument128 pagesAlmarai Annual Report enHassen AbidiNo ratings yet

- Mercury Athletic Footwear Case (Work Sheet)Document16 pagesMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaNo ratings yet

- Assignment 2 Task 2 Gui SVDocument2 pagesAssignment 2 Task 2 Gui SVBui Thi Hoai (BTEC HN)No ratings yet

- Doc4 - CorporateDocument10 pagesDoc4 - CorporateRishabhNo ratings yet

- Exhibit in ExcelDocument8 pagesExhibit in ExcelAdrian WyssNo ratings yet

- Vien Dong Pharmacy Income StatementDocument14 pagesVien Dong Pharmacy Income StatementThảo LinhNo ratings yet

- Financial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)Document17 pagesFinancial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)Berkshire Hathway coldNo ratings yet

- DCF 3 CompletedDocument3 pagesDCF 3 CompletedPragathi T NNo ratings yet

- Tgs Ar2020 Final WebDocument157 pagesTgs Ar2020 Final Webyasamin shajiratiNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument5 pagesThe Discounted Free Cash Flow Model For A Complete BusinessSanket DubeyNo ratings yet

- Supreme Annual Report 2019Document148 pagesSupreme Annual Report 2019adoniscalNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationjrcoronel100% (1)

- Section 1: Representative company-MCBDocument13 pagesSection 1: Representative company-MCBHussainNo ratings yet

- Income Statement of Unilever: Jan Feb Mar Apr MayDocument6 pagesIncome Statement of Unilever: Jan Feb Mar Apr MayHossain PieasNo ratings yet

- Adidas Chartgenerator ArDocument2 pagesAdidas Chartgenerator ArTrần Thuỳ NgânNo ratings yet

- Performance Analysis of BATB (2004-2008)Document21 pagesPerformance Analysis of BATB (2004-2008)raihans_dhk3378No ratings yet

- Book 1Document1 pageBook 1api-324903184No ratings yet

- Quiz 1 Acco 204 - GonzagaDocument17 pagesQuiz 1 Acco 204 - GonzagaLalaine Keendra GonzagaNo ratings yet

- Markaz-GL On Financial ProjectionsDocument10 pagesMarkaz-GL On Financial ProjectionsSrikanth P School of Business and ManagementNo ratings yet

- Bcel 2019Q1Document1 pageBcel 2019Q1Dương NguyễnNo ratings yet

- Shreeswaminarayantrustsurat@SbiDocument1 pageShreeswaminarayantrustsurat@SbiRohit AggarwalNo ratings yet

- Procedure For Transfer of Shares To Non-Resident - (FC-TRS) - Taxguru - inDocument2 pagesProcedure For Transfer of Shares To Non-Resident - (FC-TRS) - Taxguru - inRohit AggarwalNo ratings yet

- Rbi Bond Market CircularDocument26 pagesRbi Bond Market CircularRohit AggarwalNo ratings yet

- ThinkPad E14 Gen 4 Intel 21E3S06C00Document2 pagesThinkPad E14 Gen 4 Intel 21E3S06C00Rohit AggarwalNo ratings yet

- LipiLMP6800Series Rev CDocument2 pagesLipiLMP6800Series Rev CRohit AggarwalNo ratings yet

- Dell Latitude 3420Document23 pagesDell Latitude 3420Rohit AggarwalNo ratings yet

- Treasury Management Week 3Document86 pagesTreasury Management Week 3Rohit AggarwalNo ratings yet

- Treasury Management - Assignment No. 1 - Rohit AggarwalDocument2 pagesTreasury Management - Assignment No. 1 - Rohit AggarwalRohit AggarwalNo ratings yet

- Bond Price With Excel FunctionsDocument6 pagesBond Price With Excel Functionsapi-3763138No ratings yet

- The Clearing Corporation of India LTD: Summary-Securities Segment For July 06, 2012Document5 pagesThe Clearing Corporation of India LTD: Summary-Securities Segment For July 06, 2012Rohit AggarwalNo ratings yet

- Treasury ManagementDocument32 pagesTreasury ManagementRohit AggarwalNo ratings yet

- Treasury ManagementDocument54 pagesTreasury ManagementRohit AggarwalNo ratings yet

- Treasury ManagementDocument89 pagesTreasury ManagementRohit AggarwalNo ratings yet

- Treasury ManagementDocument97 pagesTreasury ManagementRohit AggarwalNo ratings yet

- Treasury ManagementDocument39 pagesTreasury ManagementRohit AggarwalNo ratings yet

- Circular No 6Document2 pagesCircular No 6Rohan PatilNo ratings yet

- Comparison Table - CREDITRANSDocument21 pagesComparison Table - CREDITRANSJoshua TanNo ratings yet

- Construction Equipment Lease ProposalDocument11 pagesConstruction Equipment Lease Proposaljegdis83100% (1)

- Magno v. CADocument10 pagesMagno v. CAChristine Karen BumanlagNo ratings yet

- Withholding of Tax On Nonresident Aliens and Foreign EntitiesDocument55 pagesWithholding of Tax On Nonresident Aliens and Foreign EntitiesAnyelin Joany Gutierrez ArroyoNo ratings yet

- Revisionary Test Paper: FoundationDocument155 pagesRevisionary Test Paper: FoundationkapsicumadNo ratings yet

- Tax Digest (Manila Gas)Document1 pageTax Digest (Manila Gas)Cass CataloNo ratings yet

- MCOM Syllabus 2016Document54 pagesMCOM Syllabus 2016Rahul ThapaNo ratings yet

- 1613735996670resume RupendraDocument3 pages1613735996670resume RupendraAbhay ThakurNo ratings yet

- Adam Rizk Tenancy Application FormDocument2 pagesAdam Rizk Tenancy Application FormRam PNo ratings yet

- Business Administration Ing. Kateřina Maršíková, PH.DDocument26 pagesBusiness Administration Ing. Kateřina Maršíková, PH.DBrian ShannyNo ratings yet

- Industry Analysis - Charu JindalDocument25 pagesIndustry Analysis - Charu Jindalsangeeta jinNo ratings yet

- IRS Decoding Manual 6209-2003Document674 pagesIRS Decoding Manual 6209-2003Julie Hatcher-Julie Munoz Jackson100% (6)

- Credit and Collection For The Small Entrepreneur: By: John Xavier S. Chavez, MFMDocument46 pagesCredit and Collection For The Small Entrepreneur: By: John Xavier S. Chavez, MFMRheneir MoraNo ratings yet

- CM Practioners HandbookDocument22 pagesCM Practioners Handbookwilli brordusNo ratings yet

- Inventories: Florendo Dauz JR., CPA, MBA, MSADocument17 pagesInventories: Florendo Dauz JR., CPA, MBA, MSASkyline PiscesNo ratings yet

- Aditya Birla CapitalDocument42 pagesAditya Birla CapitalKush100% (4)

- B03-003 Six Ways To Perform Economic Evaluations of Projects PDFDocument26 pagesB03-003 Six Ways To Perform Economic Evaluations of Projects PDFsamehNo ratings yet

- Audit of Current LiabilitiesDocument4 pagesAudit of Current LiabilitiesMark Anthony TibuleNo ratings yet

- Ambit - Strategy - ERr GRP - The Rebooting of IndiaDocument25 pagesAmbit - Strategy - ERr GRP - The Rebooting of Indiaomkarb87No ratings yet

- Tax SyllabusDocument27 pagesTax SyllabusMaria Theresa AlarconNo ratings yet

- Bir CalendarDocument40 pagesBir CalendarMd PrejulesNo ratings yet

- Rent Control Act RADocument3 pagesRent Control Act RAJanna SalvacionNo ratings yet

- Power Vs SECDocument2 pagesPower Vs SECJanine Fabe100% (2)

- Kierra Warren: ObjectiveDocument1 pageKierra Warren: Objectiveapi-354400568No ratings yet

The Analysis and Comparison For The Financials of Treasury Segment in Banks

The Analysis and Comparison For The Financials of Treasury Segment in Banks

Uploaded by

Rohit AggarwalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Analysis and Comparison For The Financials of Treasury Segment in Banks

The Analysis and Comparison For The Financials of Treasury Segment in Banks

Uploaded by

Rohit AggarwalCopyright:

Available Formats

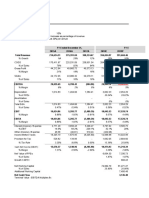

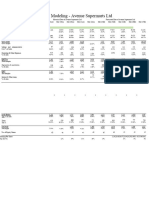

The Analysis and Comparison For the Financials of Treasury Segment in Banks

Bank of

Name of the bank SBI ICICI Bank PNB Bank of India HDFC Bank IDBI Bank CITI Bank

Baroda

Consolidated / Standalone s s s s s s s s

Bank Aggregate

Assets 1,335,519.23 467,685.62 458,194.00 447,321.47 384,535.47 337,909.49 253,376.79 126,026.06

Liabilities 1,251,568.02 473,286.76 430,376.93 419,844.62 363,573.69 307,985.11 240,734.98 112,443.05

Revenue 120,872.90 76,306.18 40,630.64 33,096.05 31,860.61 53,154.37 30,564.67 9,160.87

Profit 18,483.31 8,803.43 10,614.29 6,025.80 3,577.52 7,513.15 2,280.98 3,296.68

Capital Employed 83,951.21 (5,601.14) 27,817.07 27,476.85 20,961.78 29,924.38 12,641.81 13,583.01

Return on Capital employed 22% -157% 38% 22% 17% 25% 18% 24%

Treasury Segment

Assets 335,016.51 201,506.31 127,987.11 85,948.22 116,936.59 121,349.00 4,125.14 76,976.19

Liabilities 196,222.07 208,358.98 120,912.23 80,901.71 110,866.24 26,142.72 732.54 43,134.35

Revenue 23,874.88 30,141.42 8,509.45 7,325.07 8,971.13 7,823.56 287.88 1,943.64

Profit 217.24 2,080.68 801.19 887.72 1,615.23 381.99 127.90 930.53

Capital Employed 138,794.44 (6,852.67) 7,074.88 5,046.51 6,070.35 95,206.28 3,392.60 33,841.84

Return on Capital employed 0% -30% 11% 18% 27% 0% 4% 3%

Treasury Segment As a Percentage of Aggregate

Assets 25% 43% 28% 19% 30% 36% 2% 61%

Liabilities 16% 44% 28% 19% 30% 8% 0% 38%

Revenue 20% 40% 21% 22% 28% 15% 1% 21%

Profit 1% 24% 8% 15% 45% 5% 6% 28%

Capital Employed 165% 122% 25% 18% 29% 318% 27% 249%

Return on Capital employed 1% 19% 30% 80% 156% 2% 21% 11%

1. All the figures are in Rs Crores

2. The figures are inclusive of unallocated Items (except for ICICI and CITI Bank where unallocated Assets and Liabilites are not included)

3. All the figures are audited figures year ending March 31, 2012, except for IDBI Bank where figures are year ending March 31, 2011

4. Return on capital employed is taken as "PBT/Capital Employed for the segment"

You might also like

- 12 Powerful Trading Set UpsDocument78 pages12 Powerful Trading Set Upsmmanojj63% (49)

- Robinhood:Buying A Stock As Quickly As You'd Post An Instagram PhotoDocument3 pagesRobinhood:Buying A Stock As Quickly As You'd Post An Instagram PhotoHarshil JhaveriNo ratings yet

- LeadingRE - International Project Marketing Program (IPMP)Document8 pagesLeadingRE - International Project Marketing Program (IPMP)Parikshat ChawlaNo ratings yet

- Treasury Management - Assignment No. 1 - Rohit AggarwalDocument2 pagesTreasury Management - Assignment No. 1 - Rohit AggarwalRohit AggarwalNo ratings yet

- PSU Banks Comparative Analysis FY21Document10 pagesPSU Banks Comparative Analysis FY21Ganesh V0% (1)

- Public Sector Banks Comparative Analysis 3QFY24Document10 pagesPublic Sector Banks Comparative Analysis 3QFY24Sujay AnanthakrishnaNo ratings yet

- 4.1.1 - Dự Báo Dòng TiềnDocument5 pages4.1.1 - Dự Báo Dòng TiềnLê TiếnNo ratings yet

- FSA AssignmentDocument4 pagesFSA AssignmentDharmil OzaNo ratings yet

- Financial Model of Dmart - 5Document4 pagesFinancial Model of Dmart - 5Shivam DubeyNo ratings yet

- Maruti Suzuki ValuationDocument39 pagesMaruti Suzuki ValuationritususmitakarNo ratings yet

- Financial Statement of JS Bank: Submitted ToDocument22 pagesFinancial Statement of JS Bank: Submitted ToAtia KhalidNo ratings yet

- Pakistan State Oil Company Limited (Pso)Document6 pagesPakistan State Oil Company Limited (Pso)Maaz HanifNo ratings yet

- 04 02 BeginDocument2 pages04 02 BeginnehaNo ratings yet

- Profit MarginsDocument2 pagesProfit Marginsfady nabilNo ratings yet

- Private Sector Banks Comparative Analysis 1HFY22Document12 pagesPrivate Sector Banks Comparative Analysis 1HFY22Tushar Mohan0% (1)

- Aztecsoft Financial Results Q1-09 Press ReleaseDocument5 pagesAztecsoft Financial Results Q1-09 Press ReleaseMindtree LtdNo ratings yet

- Description 2019 2018 2017 2016: Statement of Consolidated Cash FloDocument1 pageDescription 2019 2018 2017 2016: Statement of Consolidated Cash FloAspan FLNo ratings yet

- We Are Not Above Nature, We Are A Part of NatureDocument216 pagesWe Are Not Above Nature, We Are A Part of NaturePRIYADARSHI GOURAVNo ratings yet

- ITC Financial ModelDocument150 pagesITC Financial ModelKaushik JainNo ratings yet

- ACLEDA Bank - Annual Report 2020 - HighDocument222 pagesACLEDA Bank - Annual Report 2020 - HighRashi KohliNo ratings yet

- Technofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialDocument37 pagesTechnofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialVipulNo ratings yet

- Kelompok 4 - Tugas 8 - ALK CDocument5 pagesKelompok 4 - Tugas 8 - ALK CTheresia TjiaNo ratings yet

- Analisis Common Size PT Vale Indoesia TBKDocument3 pagesAnalisis Common Size PT Vale Indoesia TBKRL. 12No ratings yet

- Aztecsoft Financial Results Q2 09Document5 pagesAztecsoft Financial Results Q2 09Mindtree LtdNo ratings yet

- Financial Modelling and Analysis ITCDocument9 pagesFinancial Modelling and Analysis ITCPriyam SarangiNo ratings yet

- NPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Document11 pagesNPV Function: Discount Rate Time Periods 2 3 4 Cash Flows NPV $35.9Ali Hussain Al SalmawiNo ratings yet

- Cash FlowDocument6 pagesCash Flowahmedmostafaibrahim22No ratings yet

- Almarai Finance ReportDocument9 pagesAlmarai Finance ReportVikaas GupthaNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- Axisbank Financial Statements Summary AJ WorksDocument12 pagesAxisbank Financial Statements Summary AJ WorksSoorajKrishnanNo ratings yet

- Contoh Simple FCFFDocument5 pagesContoh Simple FCFFFANNY KRISTIANTINo ratings yet

- Afs - QTLDocument6 pagesAfs - QTLKashif SaleemNo ratings yet

- Unitedhealth Care Income Statement & Balance Sheet & PE RatioDocument8 pagesUnitedhealth Care Income Statement & Balance Sheet & PE RatioEhab elhashmyNo ratings yet

- Performance AGlanceDocument1 pagePerformance AGlanceHarshal SawaleNo ratings yet

- Gildan Model BearDocument57 pagesGildan Model BearNaman PriyadarshiNo ratings yet

- ITC Financial ModelDocument24 pagesITC Financial ModelKaushik JainNo ratings yet

- Dietrich Farms - Worksheet 2Document39 pagesDietrich Farms - Worksheet 2spam.ml2023No ratings yet

- Financial Table Analysis of ZaraDocument9 pagesFinancial Table Analysis of ZaraCeren75% (4)

- 2012 Annual ReportDocument156 pages2012 Annual Reportpcelica77No ratings yet

- Financial Analysis Template FinalDocument8 pagesFinancial Analysis Template FinalHarit keshruwalaNo ratings yet

- CiscoDocument6 pagesCiscoAN NGUYEN THANHNo ratings yet

- Almarai Annual Report enDocument128 pagesAlmarai Annual Report enHassen AbidiNo ratings yet

- Mercury Athletic Footwear Case (Work Sheet)Document16 pagesMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaNo ratings yet

- Assignment 2 Task 2 Gui SVDocument2 pagesAssignment 2 Task 2 Gui SVBui Thi Hoai (BTEC HN)No ratings yet

- Doc4 - CorporateDocument10 pagesDoc4 - CorporateRishabhNo ratings yet

- Exhibit in ExcelDocument8 pagesExhibit in ExcelAdrian WyssNo ratings yet

- Vien Dong Pharmacy Income StatementDocument14 pagesVien Dong Pharmacy Income StatementThảo LinhNo ratings yet

- Financial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)Document17 pagesFinancial (Rs Million) Mar-19 Mar-18 Mar-17 Mar-16 Mar-15 Y-O-Y Change (%) Y-O-Y Change (%)Berkshire Hathway coldNo ratings yet

- DCF 3 CompletedDocument3 pagesDCF 3 CompletedPragathi T NNo ratings yet

- Tgs Ar2020 Final WebDocument157 pagesTgs Ar2020 Final Webyasamin shajiratiNo ratings yet

- The Discounted Free Cash Flow Model For A Complete BusinessDocument5 pagesThe Discounted Free Cash Flow Model For A Complete BusinessSanket DubeyNo ratings yet

- Supreme Annual Report 2019Document148 pagesSupreme Annual Report 2019adoniscalNo ratings yet

- Business ValuationDocument2 pagesBusiness Valuationjrcoronel100% (1)

- Section 1: Representative company-MCBDocument13 pagesSection 1: Representative company-MCBHussainNo ratings yet

- Income Statement of Unilever: Jan Feb Mar Apr MayDocument6 pagesIncome Statement of Unilever: Jan Feb Mar Apr MayHossain PieasNo ratings yet

- Adidas Chartgenerator ArDocument2 pagesAdidas Chartgenerator ArTrần Thuỳ NgânNo ratings yet

- Performance Analysis of BATB (2004-2008)Document21 pagesPerformance Analysis of BATB (2004-2008)raihans_dhk3378No ratings yet

- Book 1Document1 pageBook 1api-324903184No ratings yet

- Quiz 1 Acco 204 - GonzagaDocument17 pagesQuiz 1 Acco 204 - GonzagaLalaine Keendra GonzagaNo ratings yet

- Markaz-GL On Financial ProjectionsDocument10 pagesMarkaz-GL On Financial ProjectionsSrikanth P School of Business and ManagementNo ratings yet

- Bcel 2019Q1Document1 pageBcel 2019Q1Dương NguyễnNo ratings yet

- Shreeswaminarayantrustsurat@SbiDocument1 pageShreeswaminarayantrustsurat@SbiRohit AggarwalNo ratings yet

- Procedure For Transfer of Shares To Non-Resident - (FC-TRS) - Taxguru - inDocument2 pagesProcedure For Transfer of Shares To Non-Resident - (FC-TRS) - Taxguru - inRohit AggarwalNo ratings yet

- Rbi Bond Market CircularDocument26 pagesRbi Bond Market CircularRohit AggarwalNo ratings yet

- ThinkPad E14 Gen 4 Intel 21E3S06C00Document2 pagesThinkPad E14 Gen 4 Intel 21E3S06C00Rohit AggarwalNo ratings yet

- LipiLMP6800Series Rev CDocument2 pagesLipiLMP6800Series Rev CRohit AggarwalNo ratings yet

- Dell Latitude 3420Document23 pagesDell Latitude 3420Rohit AggarwalNo ratings yet

- Treasury Management Week 3Document86 pagesTreasury Management Week 3Rohit AggarwalNo ratings yet

- Treasury Management - Assignment No. 1 - Rohit AggarwalDocument2 pagesTreasury Management - Assignment No. 1 - Rohit AggarwalRohit AggarwalNo ratings yet

- Bond Price With Excel FunctionsDocument6 pagesBond Price With Excel Functionsapi-3763138No ratings yet

- The Clearing Corporation of India LTD: Summary-Securities Segment For July 06, 2012Document5 pagesThe Clearing Corporation of India LTD: Summary-Securities Segment For July 06, 2012Rohit AggarwalNo ratings yet

- Treasury ManagementDocument32 pagesTreasury ManagementRohit AggarwalNo ratings yet

- Treasury ManagementDocument54 pagesTreasury ManagementRohit AggarwalNo ratings yet

- Treasury ManagementDocument89 pagesTreasury ManagementRohit AggarwalNo ratings yet

- Treasury ManagementDocument97 pagesTreasury ManagementRohit AggarwalNo ratings yet

- Treasury ManagementDocument39 pagesTreasury ManagementRohit AggarwalNo ratings yet

- Circular No 6Document2 pagesCircular No 6Rohan PatilNo ratings yet

- Comparison Table - CREDITRANSDocument21 pagesComparison Table - CREDITRANSJoshua TanNo ratings yet

- Construction Equipment Lease ProposalDocument11 pagesConstruction Equipment Lease Proposaljegdis83100% (1)

- Magno v. CADocument10 pagesMagno v. CAChristine Karen BumanlagNo ratings yet

- Withholding of Tax On Nonresident Aliens and Foreign EntitiesDocument55 pagesWithholding of Tax On Nonresident Aliens and Foreign EntitiesAnyelin Joany Gutierrez ArroyoNo ratings yet

- Revisionary Test Paper: FoundationDocument155 pagesRevisionary Test Paper: FoundationkapsicumadNo ratings yet

- Tax Digest (Manila Gas)Document1 pageTax Digest (Manila Gas)Cass CataloNo ratings yet

- MCOM Syllabus 2016Document54 pagesMCOM Syllabus 2016Rahul ThapaNo ratings yet

- 1613735996670resume RupendraDocument3 pages1613735996670resume RupendraAbhay ThakurNo ratings yet

- Adam Rizk Tenancy Application FormDocument2 pagesAdam Rizk Tenancy Application FormRam PNo ratings yet

- Business Administration Ing. Kateřina Maršíková, PH.DDocument26 pagesBusiness Administration Ing. Kateřina Maršíková, PH.DBrian ShannyNo ratings yet

- Industry Analysis - Charu JindalDocument25 pagesIndustry Analysis - Charu Jindalsangeeta jinNo ratings yet

- IRS Decoding Manual 6209-2003Document674 pagesIRS Decoding Manual 6209-2003Julie Hatcher-Julie Munoz Jackson100% (6)

- Credit and Collection For The Small Entrepreneur: By: John Xavier S. Chavez, MFMDocument46 pagesCredit and Collection For The Small Entrepreneur: By: John Xavier S. Chavez, MFMRheneir MoraNo ratings yet

- CM Practioners HandbookDocument22 pagesCM Practioners Handbookwilli brordusNo ratings yet

- Inventories: Florendo Dauz JR., CPA, MBA, MSADocument17 pagesInventories: Florendo Dauz JR., CPA, MBA, MSASkyline PiscesNo ratings yet

- Aditya Birla CapitalDocument42 pagesAditya Birla CapitalKush100% (4)

- B03-003 Six Ways To Perform Economic Evaluations of Projects PDFDocument26 pagesB03-003 Six Ways To Perform Economic Evaluations of Projects PDFsamehNo ratings yet

- Audit of Current LiabilitiesDocument4 pagesAudit of Current LiabilitiesMark Anthony TibuleNo ratings yet

- Ambit - Strategy - ERr GRP - The Rebooting of IndiaDocument25 pagesAmbit - Strategy - ERr GRP - The Rebooting of Indiaomkarb87No ratings yet

- Tax SyllabusDocument27 pagesTax SyllabusMaria Theresa AlarconNo ratings yet

- Bir CalendarDocument40 pagesBir CalendarMd PrejulesNo ratings yet

- Rent Control Act RADocument3 pagesRent Control Act RAJanna SalvacionNo ratings yet

- Power Vs SECDocument2 pagesPower Vs SECJanine Fabe100% (2)

- Kierra Warren: ObjectiveDocument1 pageKierra Warren: Objectiveapi-354400568No ratings yet