Professional Documents

Culture Documents

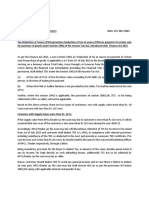

Section 194Q: Provisions On Sale of Goods by A Buyer

Section 194Q: Provisions On Sale of Goods by A Buyer

Uploaded by

kotisrinivasu0 ratings0% found this document useful (0 votes)

11 views3 pagesSection 194Q of the Income Tax Act, effective July 1, 2021, requires buyers making purchases of goods over Rs. 50 lakhs to deduct a 0.1% TDS. Section 206C(1H) requires sellers receiving over Rs. 50 lakhs for goods to collect a 0.1% TCS. For transactions subject to both, the buyer must deduct TDS to avoid double taxation. While Section 194Q applies to resident sellers, e-commerce operators selling to Indian buyers would not trigger it since they are non-residents. Buyers and sellers may need to declare TDS/TCS deductions to ensure no double taxation for a single transaction.

Original Description:

Original Title

book2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSection 194Q of the Income Tax Act, effective July 1, 2021, requires buyers making purchases of goods over Rs. 50 lakhs to deduct a 0.1% TDS. Section 206C(1H) requires sellers receiving over Rs. 50 lakhs for goods to collect a 0.1% TCS. For transactions subject to both, the buyer must deduct TDS to avoid double taxation. While Section 194Q applies to resident sellers, e-commerce operators selling to Indian buyers would not trigger it since they are non-residents. Buyers and sellers may need to declare TDS/TCS deductions to ensure no double taxation for a single transaction.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

11 views3 pagesSection 194Q: Provisions On Sale of Goods by A Buyer

Section 194Q: Provisions On Sale of Goods by A Buyer

Uploaded by

kotisrinivasuSection 194Q of the Income Tax Act, effective July 1, 2021, requires buyers making purchases of goods over Rs. 50 lakhs to deduct a 0.1% TDS. Section 206C(1H) requires sellers receiving over Rs. 50 lakhs for goods to collect a 0.1% TCS. For transactions subject to both, the buyer must deduct TDS to avoid double taxation. While Section 194Q applies to resident sellers, e-commerce operators selling to Indian buyers would not trigger it since they are non-residents. Buyers and sellers may need to declare TDS/TCS deductions to ensure no double taxation for a single transaction.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

section 194Q

which is applicable w.e.f. 1st July 2021. As per Section 194Q(1),

‘Any person, being a buyer who is responsible for paying any sum to any resident

(hereafter in this section referred to as the seller) for purchase of any goods of the

value or aggregate of such value exceeding fifty lakh rupees in any previous year,

shall, at the time of credit of such sum to the account of the seller or at the time of

payment thereof by any mode, whichever is earlier, deduct an amount equal to 0.1

per cent. of such sum exceeding fifty lakh rupees as income-tax.’

In short, conditions to be satisfied for applicability of this section are:-

1. Goods must be purchase from a resident.

2. Goods are purchased for a value or aggregate of value exceeding Rs. 50 lakhs in

any previous year.

3. The turnover of the purchaser shall be more than INR 10 crores in the preceding

Financial year. (i.e. to check the applicability of provisons of Section 194Q for FY

2021-22, turnover fo the purchaser during FY 2020-21 shall be more than INR 10

Crores.

4. TDS has not been deducted under any other provisions of the Income Tax Act

1961.

TDS under section 194Q shall be deducted at the time of credit of such sum to the

account of the seller or at the time of payment thereof by any mode, whichever is

earlier. The tax shall be deducted even if the sum is credited to the ‘Suspense

Account’.

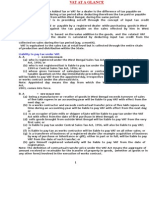

Whereas Section 206C(IH) pertains to TCS provisions on sale of goods by a buyer.

Thus, there may arise a conflict / a lot of doubts whether it will lead to double

taxation or a either of the two section will supersede the another one. In this regards,

Section 194Q clarifies that no tax is required to be deducted by a person under this

provision if tax is deductible under any other provision or tax is collectable under

section 206C. Further, second proviso to section 206C(1H) provides as under:-

“Provided further that the provisions of this sub-section shall not apply, if the buyer

is liable to deduct tax at source under any other provision of this Act on the goods

purchased by him from the seller and has deducted such amount.”

It means that where a buyer is liable to deduct TDS on a purchase transaction under

Section 194Q, the seller shall not collect TCS on same transaction on which buyer

has already deducted TDS. In other words, the buyer shall have the primary and

foremost obligation to deduct the tax.

Now, considering limb of Equalization levy on such transactions, one may conclude

that where an e-commerce operator sell goods to an Indian resident who qualifies all

the conditions in relation to turnover, the buyer (Indian resident) shall be liable to

deduct TDS on such transaction as well. In this regard, Section 194Q provides that a

buyer is liable to deduct TDS only where the purchase of goods is made from a

resident. So, an e-commerce being a non-resident, applicability of Section 194Q

shall not be triggered in such a scenario and equalization levy shall be charged on

this such transactions.

In practical scenario, insertion of this section shall pose a difficulty while executing

purchase orders and sales. Generally, in order to execute a sale, first, a purchase

order is made by the buyer, then the same is executed by seller and goods are

delivered to the buyer. But payment by the buyer is not made instantly, in many

cases a credit facility is also provided by the seller to buyer. Section 206C(1H) is

applicable only at the time of receipt of payment whereas TDS under Section 194Q

is applicable at the time of payment of credit in books of account, whichever is

earlier.

In such a scenario, an ideal solution would be that a buyer shall deduct TDS at the

time of making the purchase order, in case TCS provisions under section 206C(1H)

and Section 194Q are applicable in single transaction.

Hypothetical Example

If the turnover of both the seller and buyer exceeds INR 10crores in the preceding

FY, but the sales made by seller in October 2021 exceeds INR 50lakhs and

purchases made by buyer exceeds the threshold limit provided in the section in

January 2021.

In this case, since the receipt of sales by seller exceeds INR 50 lakhs, the seller shall

comply with the provisions of Section 206C(1H) and file the TCS return of Quarter 3,

FY 2021-22 with TCS being collected on sale proceeds exceeding INR 50lakhs. On

the other hand, the buyer shall be under obligation to deduct TDS from January

onwards on purchase exceeding INR 50 lakhs. So, there arise a need for a

declaration through which the buyer may declare that TDS has been deducted under

section 194Q and vice versa for TCS collected by seller under section 206C(1H) so

as to ensure that tax has not been deducted on the same transaction twice.

Comparison of Sec 194Q and 206C(1H) of Income Tax Act, 1961

Particulars 194Q 206C(1H)

Purpose Tax to be DEDUCTED Tax to be COLLECTED

Applicable to Buyer/Purchaser Seller

With effect from 01/07/2021 01/10/2020

When Deducted or Payment or credit, whichever is At the time of receipt

collected earlier

Advances TDS shall be deducted on advance TCS shall be collected on advance receipts

payments made

Rate of TDS/TCS 0.1% 0.1% (0.075% for FY 2020-21)

PAN not available 5% 1%

Triggering point Turnover/Gross Receipts/Sales Turnover/Gross Receipts/Sales from the

from the business of BUYER business of SELLER should exceed Rs.10cr

should exceed Rs.10cr during during previous year (Excluding GST)

previous year (Excluding GST) Sale consideration received exceeds

Purchase of goods of Rs.50Lakhs in P.Y. (The value of goods

aggregate value exceeding includes GST)

Rs.50Lakhs in P.Y. (The value

of goods includes GST)

When to Tax so deducted shall be Tax so collected shall be deposited with

deposit/collect deposited with government by 7th government by 7th day of subsequent month

day of subsequent month

Quarterly 26Q 27EQ

statement to be

filed

You might also like

- Mahindra Satyam Offer LetterDocument20 pagesMahindra Satyam Offer LetterMegaladevi Arumugam50% (2)

- Certificate of ChallengeDocument1 pageCertificate of ChallengeVlad Reyes100% (1)

- Personhood - Mariam Abuikhdair (Final)Document132 pagesPersonhood - Mariam Abuikhdair (Final)Mariam AbuikhdairNo ratings yet

- Notes On MVAT Act For StudentsDocument23 pagesNotes On MVAT Act For StudentsDeepali SolankiNo ratings yet

- Creditable Withholding Tax ReviewerDocument6 pagesCreditable Withholding Tax ReviewerMark Rainer Yongis LozaresNo ratings yet

- US Dept of State Consular Notification and Access Manual 5th Edition September 2018Document130 pagesUS Dept of State Consular Notification and Access Manual 5th Edition September 2018Kenya Monique Huston El100% (1)

- Tax Deduction at Source On Purchase of Goods (Section 194 Q)Document7 pagesTax Deduction at Source On Purchase of Goods (Section 194 Q)Pallavi SharmaNo ratings yet

- Faqs On Tds Under Section 194Q On Purchase of GoodsDocument11 pagesFaqs On Tds Under Section 194Q On Purchase of GoodsAbhishek GuptaNo ratings yet

- TDS & TCSDocument19 pagesTDS & TCSpawan dhokaNo ratings yet

- Note On Applicability of TDS Under Section 194Q and TCS Under Section 206CDocument15 pagesNote On Applicability of TDS Under Section 194Q and TCS Under Section 206CvamshiNo ratings yet

- How To Deal With 206AADocument5 pagesHow To Deal With 206AAnamanojhaNo ratings yet

- S 206C (1H) – Updated - Taxguru - inDocument11 pagesS 206C (1H) – Updated - Taxguru - inHEMANT PARMARNo ratings yet

- Article On Section 194Q and Common Queries TheretoDocument5 pagesArticle On Section 194Q and Common Queries TheretonamanojhaNo ratings yet

- 30.draft Section 194Q and 206C (1H) MBRC Circular Modified 03072021Document6 pages30.draft Section 194Q and 206C (1H) MBRC Circular Modified 03072021ashok babuNo ratings yet

- AssignmentDocument5 pagesAssignmentsakshizanjage7888No ratings yet

- Recent Development of 194QDocument4 pagesRecent Development of 194QnamanojhaNo ratings yet

- New TDS Provisions: Rmaconsultancy - in +91-9672372075 Office@rmaconsultancy - inDocument7 pagesNew TDS Provisions: Rmaconsultancy - in +91-9672372075 Office@rmaconsultancy - inCA Ranjan MehtaNo ratings yet

- Taxguru - in-TaxGuru Consultancy Amp Online Publication LLPDocument7 pagesTaxguru - in-TaxGuru Consultancy Amp Online Publication LLPsamratsom1947No ratings yet

- New Section 194Q Applicable From 1.7.2021Document14 pagesNew Section 194Q Applicable From 1.7.2021ramanmaharishiNo ratings yet

- TCS On Sale of Goods: Padmanathan K V, Chartered AccountantDocument20 pagesTCS On Sale of Goods: Padmanathan K V, Chartered AccountantSainaath RNo ratings yet

- May 2022Document6 pagesMay 2022Chandu NeredibilliNo ratings yet

- Note On TDSDocument3 pagesNote On TDSRadha KrishnaNo ratings yet

- Guideline 0212 21Document8 pagesGuideline 0212 21canamanagrawal11No ratings yet

- TDS On Real Estate IndustryDocument5 pagesTDS On Real Estate IndustryKirti SanghaviNo ratings yet

- TCS On Sale of GoodsDocument16 pagesTCS On Sale of GoodsAshish ModiNo ratings yet

- Communication and Declarations To CustomerDocument5 pagesCommunication and Declarations To CustomerMuzaffar Ali ShaikhNo ratings yet

- TDS On Purchase-Sec 194Q of Income Tax ActDocument1 pageTDS On Purchase-Sec 194Q of Income Tax ActUpendra BardhanNo ratings yet

- Tcs On Sales From 01102020Document2 pagesTcs On Sales From 01102020akanshaNo ratings yet

- Taxguru - in-TCS On Sales of Goods Wef 1st October 2020Document12 pagesTaxguru - in-TCS On Sales of Goods Wef 1st October 2020javed aliNo ratings yet

- All About TDS On Immovable Property Purchase (194IA) - Taxguru - inDocument5 pagesAll About TDS On Immovable Property Purchase (194IA) - Taxguru - inKhusboo ChowdhuryNo ratings yet

- Nov 2022Document12 pagesNov 2022Chandu NeredibilliNo ratings yet

- Tax Collection at SourceDocument1 pageTax Collection at SourceobayapalliNo ratings yet

- Taxguru - in-tDS Implication On Purchase of Property From NRIDocument7 pagesTaxguru - in-tDS Implication On Purchase of Property From NRIP Mathavan RajkumarNo ratings yet

- Article On Section 194QDocument4 pagesArticle On Section 194QRicha SachdevaNo ratings yet

- India Of: SS, S A o OweveDocument6 pagesIndia Of: SS, S A o OwevevijayNo ratings yet

- PPT-CA Ketan Vajani - TCS and TDS - Recent Amendments - 19.11.2020Document37 pagesPPT-CA Ketan Vajani - TCS and TDS - Recent Amendments - 19.11.2020Kartik AgrawalNo ratings yet

- Value Added TaxationDocument6 pagesValue Added Taxationapi-3822396No ratings yet

- Section 194Q - TDS On Certain PurchasesDocument1 pageSection 194Q - TDS On Certain PurchasesNishanth JoseNo ratings yet

- TDS On Goods 194QDocument4 pagesTDS On Goods 194QPankaj KothariNo ratings yet

- Maharashtra Value Added Tax Act 2Document27 pagesMaharashtra Value Added Tax Act 2Minal ShethNo ratings yet

- Goa VAT LawDocument23 pagesGoa VAT LawSiddesh ChimulkerNo ratings yet

- Frequently Asked QuestionsDocument8 pagesFrequently Asked QuestionsKrissNo ratings yet

- Analysis of Section 194Q - Proposed in Budget 2021-22: Team TRDDocument3 pagesAnalysis of Section 194Q - Proposed in Budget 2021-22: Team TRDTAX HEAVENNo ratings yet

- New Income Tax Provisions On TDS and TCS On GoodsDocument31 pagesNew Income Tax Provisions On TDS and TCS On Goodsऋषिपाल सिंहNo ratings yet

- 10 42 Vat at GlanceDocument19 pages10 42 Vat at Glanceemmanuel JohnyNo ratings yet

- Procedure To Be Followed For Delhi Value Added TaxDocument6 pagesProcedure To Be Followed For Delhi Value Added TaxChirag MalhotraNo ratings yet

- Tds Amendements Via Finance Bill 2020Document12 pagesTds Amendements Via Finance Bill 2020ABHISHEKNo ratings yet

- Resource Material On TCS Us 206C (1H) SSADocument14 pagesResource Material On TCS Us 206C (1H) SSASankaran SwaminathanNo ratings yet

- All About New TDS Section 194R and Section 194S - Taxguru - inDocument7 pagesAll About New TDS Section 194R and Section 194S - Taxguru - inParag Jain DugarNo ratings yet

- Budget 2021Document15 pagesBudget 2021RohitKumarDiwakarNo ratings yet

- Vat at A GlanceDocument19 pagesVat at A GlanceABHIJIT MONDAL100% (1)

- BIR - Remittance of CWT (Form 1606) Discussion 1Document92 pagesBIR - Remittance of CWT (Form 1606) Discussion 1Roy RitagaNo ratings yet

- Dividend Received From A Domestic CompanyDocument9 pagesDividend Received From A Domestic Companyshiraz shabbirNo ratings yet

- Insertion of New Provisions in Tcs S&A Knowledge Series: Applicable From 1 OCTOBER 2020Document5 pagesInsertion of New Provisions in Tcs S&A Knowledge Series: Applicable From 1 OCTOBER 2020Shatir LaundaNo ratings yet

- Refunds Under GST: Chapter Thirty FourDocument21 pagesRefunds Under GST: Chapter Thirty FourRajNo ratings yet

- TCS Practical Cases With Points - SRBDocument3 pagesTCS Practical Cases With Points - SRBsbaheti48No ratings yet

- Withholding TaxDocument18 pagesWithholding Taxraju aws100% (1)

- 2declaration FormatDocument2 pages2declaration FormatSACH KI TALASHNo ratings yet

- TCS On Sales of GoodsDocument11 pagesTCS On Sales of GoodsAnsari NaeemuddinNo ratings yet

- TCS On Sale of Goods vs. TDS On Purchase of GoodsDocument6 pagesTCS On Sale of Goods vs. TDS On Purchase of Goodsdrishtijain22No ratings yet

- TDS On Sale of Property by NRI in 2022 Complete GuideDocument7 pagesTDS On Sale of Property by NRI in 2022 Complete Guideoffice201 207No ratings yet

- 1971 82 ITR 363 SC 17-08-1971 Kedarnath Jute MFG Co LTD Vs Commissioner of IncomeDocument5 pages1971 82 ITR 363 SC 17-08-1971 Kedarnath Jute MFG Co LTD Vs Commissioner of IncomeAnanya SNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Women & Criminal Law Answer SheetDocument15 pagesWomen & Criminal Law Answer SheetShailesh BhoyarNo ratings yet

- Hire Purchase and Credit Sale Act 2013Document35 pagesHire Purchase and Credit Sale Act 2013karlpragassenNo ratings yet

- Heirs of Tranquilano Labiste Vs Heirs of Jose LabisteDocument4 pagesHeirs of Tranquilano Labiste Vs Heirs of Jose LabisteCarie LawyerrNo ratings yet

- TQ Ucsp12Document9 pagesTQ Ucsp12Deron C. De Castro100% (1)

- LAS For Summative Assessment Written Work Performance TaskDocument4 pagesLAS For Summative Assessment Written Work Performance TaskMalenkov Lyndon Torres100% (1)

- Ayush Transfer Schedule 2022 Application Form 08 02 2022Document4 pagesAyush Transfer Schedule 2022 Application Form 08 02 2022Villan PiratesNo ratings yet

- Austin's Conception of SovereigntyDocument22 pagesAustin's Conception of SovereigntyFarha RahmanNo ratings yet

- #8. Arsenia T Bergonia Vs Atty. Arsenio A Merrera AC No. 5024. February 20, 2003Document4 pages#8. Arsenia T Bergonia Vs Atty. Arsenio A Merrera AC No. 5024. February 20, 2003Joseph John Santos Ronquillo100% (1)

- Complete The Sentences Using The Words in Bold. Use Modal Verbs or Modal PhrasesDocument6 pagesComplete The Sentences Using The Words in Bold. Use Modal Verbs or Modal PhrasesМирослава РипкоNo ratings yet

- Venminder - Framework For A Successful Third Party Risk Management ProgramDocument36 pagesVenminder - Framework For A Successful Third Party Risk Management ProgramMohd Khusairy Bin HaronNo ratings yet

- 1998 Southwark London Borough Council ElectionDocument10 pages1998 Southwark London Borough Council Electionkimtaey212No ratings yet

- Atienza (1990) On The Reasonable in Law PDFDocument14 pagesAtienza (1990) On The Reasonable in Law PDFJoséDuarteCoimbraNo ratings yet

- Docs 154627E2Document6 pagesDocs 154627E2Amanda MicicNo ratings yet

- On Powers of Parliment of IndiaDocument17 pagesOn Powers of Parliment of Indiacifax83051No ratings yet

- LGBTDocument2 pagesLGBTonlyforpahedownloadsNo ratings yet

- QUIZ 2019 Insights Current Affairs Quiz 09 December 2019 2Document12 pagesQUIZ 2019 Insights Current Affairs Quiz 09 December 2019 2Ravi TejaNo ratings yet

- Academic Freedom in IndiaDocument16 pagesAcademic Freedom in IndiaGandhi ManimuthuNo ratings yet

- Feminist Theory and Indian Perspective ProjectDocument21 pagesFeminist Theory and Indian Perspective Projecthimanshu verma67% (3)

- Reading in Philippine History - Learning Activity 2 GOLDEN AGEDocument1 pageReading in Philippine History - Learning Activity 2 GOLDEN AGEClaro M. GarchitorenaNo ratings yet

- South Daanghari Chapter PpfmiDocument2 pagesSouth Daanghari Chapter PpfmiRommel Lizardo NobleNo ratings yet

- D. Elangovan v. Shrenik Kumar, 2020 SCC OnLine Mad 367Document2 pagesD. Elangovan v. Shrenik Kumar, 2020 SCC OnLine Mad 367saket bansalNo ratings yet

- Project NuisanceDocument29 pagesProject NuisanceIshwar ranNo ratings yet

- Determining The Trend of The Market by The Daily Vertical ChartDocument22 pagesDetermining The Trend of The Market by The Daily Vertical ChartcarlopanicciaNo ratings yet

- 3rd Alternative-The - Covey.EBS PDFDocument8 pages3rd Alternative-The - Covey.EBS PDFbakuri0% (1)

- TPD 501 Engr Economy NoteDocument44 pagesTPD 501 Engr Economy NoteTomisin EniolaNo ratings yet

- Forestry TIP Exposure DraftDocument29 pagesForestry TIP Exposure DraftbomiNo ratings yet