Professional Documents

Culture Documents

Government Intervention Activity

Government Intervention Activity

Uploaded by

Martha AntonCopyright:

Available Formats

You might also like

- HW1 Business Economics Spring 2020 AnswersDocument20 pagesHW1 Business Economics Spring 2020 AnswersBo Rae100% (1)

- Micro QsDocument40 pagesMicro QsLiz100% (1)

- Assignment 1-QuestionDocument8 pagesAssignment 1-QuestionFreesyria Campaign56% (9)

- Eco 102 Review Questions 1Document4 pagesEco 102 Review Questions 1Ahmed DahiNo ratings yet

- Econ 201 Exam 2 Study GuideDocument6 pagesEcon 201 Exam 2 Study GuideprojectilelolNo ratings yet

- Practice Questions 2014Document15 pagesPractice Questions 2014Ankit Sahu0% (1)

- Booms and Busts - An Encyclopedia of Economic History From The First Stock Market Crash of 1792 To The Current Global Economic Crisis PDFDocument1,007 pagesBooms and Busts - An Encyclopedia of Economic History From The First Stock Market Crash of 1792 To The Current Global Economic Crisis PDFYudha Siahaan100% (1)

- Assignment Fall 2019 OldDocument8 pagesAssignment Fall 2019 Oldshining starNo ratings yet

- Practice Midterm 1 SolutionsDocument22 pagesPractice Midterm 1 Solutionsanupsoren100% (1)

- Perfect Competition 2Document3 pagesPerfect Competition 2Aakash MehtaNo ratings yet

- Chapter 6 Tutorial Questions PaperDocument4 pagesChapter 6 Tutorial Questions Paperngomanewandile419No ratings yet

- Econ2113 PS2 AnswersDocument5 pagesEcon2113 PS2 Answersjacky114aaNo ratings yet

- Ma 123Document21 pagesMa 123Dean CraigNo ratings yet

- Final Assessment SamplesDocument4 pagesFinal Assessment SamplesJOANNA LAMNo ratings yet

- Problem Set 2Document2 pagesProblem Set 2Saad HassanNo ratings yet

- Mid-term-Microeconomics-Fall 2020Document9 pagesMid-term-Microeconomics-Fall 2020Talha MansoorNo ratings yet

- Tutorial 3 ECON1101Document2 pagesTutorial 3 ECON1101liv tesNo ratings yet

- Problem Set 5Document6 pagesProblem Set 5Thulasi 2036No ratings yet

- Assignment 4Document2 pagesAssignment 4bluestacks3874No ratings yet

- Microeconomics Tutorial 2Document2 pagesMicroeconomics Tutorial 2zillxsNo ratings yet

- Assessment 2Document2 pagesAssessment 2savithri1371969 bhatNo ratings yet

- Group Assignment ECO415 & ECO162Document14 pagesGroup Assignment ECO415 & ECO162syahira izwaniNo ratings yet

- Online Assessment For ECO120 Principles of Economics (Oct 2021 To Feb 2022)Document9 pagesOnline Assessment For ECO120 Principles of Economics (Oct 2021 To Feb 2022)AIN ZULLAIKHANo ratings yet

- Mohammad Ali Jinnah University Karachi: Instruction For Making The AssignmentsDocument3 pagesMohammad Ali Jinnah University Karachi: Instruction For Making The AssignmentsTaha SaleemNo ratings yet

- Tutorial - Chapter 6 - Monopoly QuestionsDocument5 pagesTutorial - Chapter 6 - Monopoly QuestionsNandiieNo ratings yet

- Tutorial 3Document3 pagesTutorial 3Mustolih Hery SaputroNo ratings yet

- Act Grupal 102003 9Document16 pagesAct Grupal 102003 9davidNo ratings yet

- Final Exam QANT630 Fall 2019 (Part-2)Document14 pagesFinal Exam QANT630 Fall 2019 (Part-2)Simran SachdevaNo ratings yet

- Micro Unit 2 Answers 13th EditionDocument5 pagesMicro Unit 2 Answers 13th EditiondasatdeepaNo ratings yet

- ECON5541 Assign 1 PDFDocument2 pagesECON5541 Assign 1 PDF- wurileNo ratings yet

- Chapter:-Cost Allocation, Customer Profitability Analysis, and Sales-Variance AnalysisDocument6 pagesChapter:-Cost Allocation, Customer Profitability Analysis, and Sales-Variance Analysiskareem abozeedNo ratings yet

- Asgn2-MIcro Economics BBA Part 1 2023Document2 pagesAsgn2-MIcro Economics BBA Part 1 2023waqarsindhi136No ratings yet

- Eco Part 02Document7 pagesEco Part 02Amna PervaizNo ratings yet

- Economics AssignmentDocument6 pagesEconomics Assignmenturoosa vayaniNo ratings yet

- Econ2113 PS2Document5 pagesEcon2113 PS2jacky114aaNo ratings yet

- Tutorial 1 Questions EC306 PDFDocument4 pagesTutorial 1 Questions EC306 PDFRoite BeteroNo ratings yet

- Assignment 1Document2 pagesAssignment 1SHAHFAISAL HAMEEDNo ratings yet

- Worksheet - 2 Demand & SupplyDocument2 pagesWorksheet - 2 Demand & SupplyPrince SingalNo ratings yet

- ExerciseDocument6 pagesExerciseNurul Farhan IbrahimNo ratings yet

- Multiple Choice Questions Plus Solutions Flexible Budget and Standard CostingDocument5 pagesMultiple Choice Questions Plus Solutions Flexible Budget and Standard Costingnhu nhuNo ratings yet

- Assigment 4 SolutionDocument2 pagesAssigment 4 SolutionRamy ShabanaNo ratings yet

- Assignment: Managerial Economics Assignment 2: Name: ENTRY NO: 2019SMF6546 Section: A YearDocument2 pagesAssignment: Managerial Economics Assignment 2: Name: ENTRY NO: 2019SMF6546 Section: A YearSantu BiswaaNo ratings yet

- ME QuestionsDocument11 pagesME QuestionsDharmesh GoyalNo ratings yet

- 943 Question PaperDocument2 pages943 Question PaperPacific TigerNo ratings yet

- Document 1Document7 pagesDocument 1madihaadnan1No ratings yet

- Part A. Multiple ChoicesDocument4 pagesPart A. Multiple ChoicesJessica FeliciaNo ratings yet

- Economics Midterm QuestionDocument3 pagesEconomics Midterm Questionসজীব বসুNo ratings yet

- ECON 205 Chapters 3 & 4 Practice QuestionsDocument4 pagesECON 205 Chapters 3 & 4 Practice Questionskely wilsonNo ratings yet

- Economics Practise QuestionDocument6 pagesEconomics Practise QuestionprettyrockNo ratings yet

- Curve of Demand For Agricultural Products and Food: Khadicha AlakbarovaDocument28 pagesCurve of Demand For Agricultural Products and Food: Khadicha AlakbarovaHuseyn GuliyevNo ratings yet

- Microeconomics Handouts UpdatedDocument27 pagesMicroeconomics Handouts UpdatedKhalil FanousNo ratings yet

- Eco1001 - Tutorial Sheet - 3 - 2020.21sem - 1Document3 pagesEco1001 - Tutorial Sheet - 3 - 2020.21sem - 1nervasmith21No ratings yet

- Measuring The Cost of Living: Solutions To Textbook ProblemsDocument7 pagesMeasuring The Cost of Living: Solutions To Textbook ProblemsMainland FounderNo ratings yet

- Introductory MicroeconomicsDocument13 pagesIntroductory Microeconomicsgh982487No ratings yet

- Introduction To Microeconomics, Economics - IMI Preclinical Group - Monetary and Fiscal Policy - TaskDocument2 pagesIntroduction To Microeconomics, Economics - IMI Preclinical Group - Monetary and Fiscal Policy - Taskdv181100No ratings yet

- Pom Mock ExamDocument3 pagesPom Mock ExamManzar HussainNo ratings yet

- Word Note Aurora Textile Case Zinser 351Document6 pagesWord Note Aurora Textile Case Zinser 351alka murarka100% (1)

- ECO101: Introduction To Economics (Summer Semester, 2019) Tutorial Problem Set - 01Document3 pagesECO101: Introduction To Economics (Summer Semester, 2019) Tutorial Problem Set - 01Shubham KumarNo ratings yet

- Where Do We Go From Here?: U.S. - China Trade Agreement: Frayne Olson, PHDDocument26 pagesWhere Do We Go From Here?: U.S. - China Trade Agreement: Frayne Olson, PHDbioseedNo ratings yet

- Asm Chap 4 Bus 3382Document9 pagesAsm Chap 4 Bus 3382Đào ĐăngNo ratings yet

- Assignment 1ADocument5 pagesAssignment 1Agreatguy_070% (1)

- Aid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentFrom EverandAid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentNo ratings yet

- Accounting Principle NotesDocument22 pagesAccounting Principle NotesMartha AntonNo ratings yet

- Gr11 April P1 2020 - Marking SchemeDocument9 pagesGr11 April P1 2020 - Marking SchemeMartha AntonNo ratings yet

- Gr11 April P2 2020 Marking SchemeDocument10 pagesGr11 April P2 2020 Marking SchemeMartha AntonNo ratings yet

- Chapter 11-Service LogisticsDocument8 pagesChapter 11-Service LogisticsMartha AntonNo ratings yet

- Lecture 6 Inflation Fiscal MonetaryDocument15 pagesLecture 6 Inflation Fiscal MonetaryMartha AntonNo ratings yet

- Research Methodology: Experimental and Causal-Comparative Designs Topic 10Document20 pagesResearch Methodology: Experimental and Causal-Comparative Designs Topic 10Martha AntonNo ratings yet

- Examining Reasons For Poor Performance of Grade 7 Learners in MathematicsDocument30 pagesExamining Reasons For Poor Performance of Grade 7 Learners in MathematicsMartha AntonNo ratings yet

- Accounting Grade 9 (Regional)Document14 pagesAccounting Grade 9 (Regional)Martha AntonNo ratings yet

- Aggregate Demand and Aggregated Supply: Namibian Business SchoolDocument42 pagesAggregate Demand and Aggregated Supply: Namibian Business SchoolMartha AntonNo ratings yet

- Business Studies WorksheetDocument2 pagesBusiness Studies WorksheetMartha AntonNo ratings yet

- Business Environment NotesDocument2 pagesBusiness Environment NotesMartha AntonNo ratings yet

- Accounting WorksheetDocument3 pagesAccounting WorksheetMartha AntonNo ratings yet

- English Second Language Grade 4 AdjectivesDocument2 pagesEnglish Second Language Grade 4 AdjectivesMartha AntonNo ratings yet

- Bank Reconciliation TestDocument3 pagesBank Reconciliation TestMartha AntonNo ratings yet

- Corrected Net Profit ExersiceDocument2 pagesCorrected Net Profit ExersiceMartha AntonNo ratings yet

- Accounting Equation Grade 12Document1 pageAccounting Equation Grade 12Martha Anton100% (1)

- A Lament To A Struggle Companion - Marco HousikuDocument1 pageA Lament To A Struggle Companion - Marco HousikuMartha AntonNo ratings yet

- Accounting Equation Test 10Document2 pagesAccounting Equation Test 10Martha AntonNo ratings yet

- Online Case Assessment 2021 Marks: 100 Windhoek Duration: 3 HoursDocument1 pageOnline Case Assessment 2021 Marks: 100 Windhoek Duration: 3 HoursMartha AntonNo ratings yet

- Write-Up - GraphDocument17 pagesWrite-Up - GraphMartha AntonNo ratings yet

- CXC CSEC POB Notes - Elements of EconomicsDocument35 pagesCXC CSEC POB Notes - Elements of EconomicsLori-Rae100% (1)

- EC1301 Semester 1 Tutorial 2 Short Answer QuestionsDocument2 pagesEC1301 Semester 1 Tutorial 2 Short Answer QuestionsShuMuKongNo ratings yet

- Managerial Economics: Applications, Strategies and Tactics, 14eDocument39 pagesManagerial Economics: Applications, Strategies and Tactics, 14ecatherine sevidalNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document5 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)Sohail Liaqat AliNo ratings yet

- Syllabus - Economics - IDocument8 pagesSyllabus - Economics - IBoiled PotatoNo ratings yet

- Master of Environmental PlanningDocument38 pagesMaster of Environmental PlanningSonalSinghNo ratings yet

- Cash Balance ApproachDocument6 pagesCash Balance ApproachSumantra BhattacharyaNo ratings yet

- Demand and Analysis NumericalsDocument31 pagesDemand and Analysis NumericalsRajan BhadoriyaNo ratings yet

- Imi611s - Intermediate Microeconomics - 1ST Opp - June 2019Document3 pagesImi611s - Intermediate Microeconomics - 1ST Opp - June 2019Smart Academic solutionsNo ratings yet

- Microeconomics - 7Document19 pagesMicroeconomics - 7Linh Trinh NgNo ratings yet

- Module 2 Applied Economics Week 5 6Document10 pagesModule 2 Applied Economics Week 5 6Sheena Mae PeraltaNo ratings yet

- AP Microeconomics Full Review: Updated: 2015-2016Document58 pagesAP Microeconomics Full Review: Updated: 2015-2016Richelle Anne JamoralinNo ratings yet

- Economic EssayDocument2 pagesEconomic EssayPasinda PiyumalNo ratings yet

- Market (Economics)Document14 pagesMarket (Economics)gian reyesNo ratings yet

- The Economic Theory of ChoiceDocument23 pagesThe Economic Theory of ChoiceMinhaz Hossain OnikNo ratings yet

- Chapter 13 - Firms in Competitive MarketsDocument32 pagesChapter 13 - Firms in Competitive MarketsdreeNo ratings yet

- Economics Final Exam Review Sheet Multiple Choice: 61 Questions Exam Total: 243 PtsDocument3 pagesEconomics Final Exam Review Sheet Multiple Choice: 61 Questions Exam Total: 243 Ptsapi-305875450No ratings yet

- TG17 BAM040 Second Periodical ExamDocument6 pagesTG17 BAM040 Second Periodical ExamAmielyn Kieth L. SarsalejoNo ratings yet

- Group 6: Statistical Estimation of Demand Function: Reporters: Collator: PPT MakerDocument25 pagesGroup 6: Statistical Estimation of Demand Function: Reporters: Collator: PPT MakerPiola Marie LibaNo ratings yet

- Team 5 Econs Ch7Document12 pagesTeam 5 Econs Ch7larizaNo ratings yet

- Lecture 4 - Determining Foreign Exchange RatesDocument40 pagesLecture 4 - Determining Foreign Exchange RateslekokoNo ratings yet

- Economic System of PakistanDocument6 pagesEconomic System of PakistanSyed Hassan Raza75% (4)

- Microeconomics SyllabusDocument3 pagesMicroeconomics SyllabusPaulyne Pascual100% (1)

- M12 Bade 9418 04 Ch10aDocument16 pagesM12 Bade 9418 04 Ch10aVanny Van Sneidjer100% (2)

- BE AMC-34-All Branches With IndexDocument223 pagesBE AMC-34-All Branches With IndexSrikanth RangdalNo ratings yet

- Chapter 2 Competitive Market - Video-LectureDocument25 pagesChapter 2 Competitive Market - Video-LectureVulindhlela SitholeNo ratings yet

Government Intervention Activity

Government Intervention Activity

Uploaded by

Martha AntonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Government Intervention Activity

Government Intervention Activity

Uploaded by

Martha AntonCopyright:

Available Formats

Government Intervention Activity

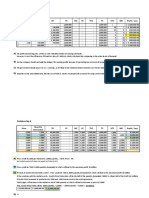

1) The table below shows the demand for and supply of rental housing in Crainsboro. The city

government is considering imposing a rent ceiling of $700 a month. Help the government to analyze the

effects of the proposed rent ceiling.

Quantity

Rent Quantity supplied

demanded

(dollars per month) (units per month)

(units per month)

500 1,200 0

600 1,000 100

700 800 200

800 600 300

900 400 400

1,000 200 500

1,100 0 600

a) Draw the demand and supply curves. With no rent ceiling, what is the rent and how many

apartments are rented?

b) With the rent ceiling, what is the rent and how many apartments are rented? What is the shortage of

housing? Explain.

c) If the rent ceiling is strictly enforced, what is the maximum price that someone is willing to pay for

the last unit of housing available? Is the housing market efficient? Explain.

d) If a black market develops, how high could the black market rent be? Explain your answer.

2) The table above shows the demand and supply schedules for the market for coffee in Roastville. A tax

on coffee of 75 cents per pound is proposed and the local government asks you to examine the effects of

the tax.

Quantity

Price Quantity supplied

demanded

(dollars per pound) (pounds per day)

(pounds per day)

1 480 0

2 360 0

3 240 240

4 120 480

5 0 720

a) Draw the demand and supply curves. If there is no tax on coffee, what is the price and how many

pounds are sold?

b) With the tax, what is the price that consumers pay? What is the price that sellers receive? How many

pounds of coffee are sold?

c) What is the government's total tax revenue? How much of the 75¢ per pound tax is paid by buyers?

How much is paid by sellers?

d) If there are no external costs and benefits, what is the efficient level of coffee production?

e) If the tax is imposed, will the level of production be efficient? Why or why not?

You might also like

- HW1 Business Economics Spring 2020 AnswersDocument20 pagesHW1 Business Economics Spring 2020 AnswersBo Rae100% (1)

- Micro QsDocument40 pagesMicro QsLiz100% (1)

- Assignment 1-QuestionDocument8 pagesAssignment 1-QuestionFreesyria Campaign56% (9)

- Eco 102 Review Questions 1Document4 pagesEco 102 Review Questions 1Ahmed DahiNo ratings yet

- Econ 201 Exam 2 Study GuideDocument6 pagesEcon 201 Exam 2 Study GuideprojectilelolNo ratings yet

- Practice Questions 2014Document15 pagesPractice Questions 2014Ankit Sahu0% (1)

- Booms and Busts - An Encyclopedia of Economic History From The First Stock Market Crash of 1792 To The Current Global Economic Crisis PDFDocument1,007 pagesBooms and Busts - An Encyclopedia of Economic History From The First Stock Market Crash of 1792 To The Current Global Economic Crisis PDFYudha Siahaan100% (1)

- Assignment Fall 2019 OldDocument8 pagesAssignment Fall 2019 Oldshining starNo ratings yet

- Practice Midterm 1 SolutionsDocument22 pagesPractice Midterm 1 Solutionsanupsoren100% (1)

- Perfect Competition 2Document3 pagesPerfect Competition 2Aakash MehtaNo ratings yet

- Chapter 6 Tutorial Questions PaperDocument4 pagesChapter 6 Tutorial Questions Paperngomanewandile419No ratings yet

- Econ2113 PS2 AnswersDocument5 pagesEcon2113 PS2 Answersjacky114aaNo ratings yet

- Ma 123Document21 pagesMa 123Dean CraigNo ratings yet

- Final Assessment SamplesDocument4 pagesFinal Assessment SamplesJOANNA LAMNo ratings yet

- Problem Set 2Document2 pagesProblem Set 2Saad HassanNo ratings yet

- Mid-term-Microeconomics-Fall 2020Document9 pagesMid-term-Microeconomics-Fall 2020Talha MansoorNo ratings yet

- Tutorial 3 ECON1101Document2 pagesTutorial 3 ECON1101liv tesNo ratings yet

- Problem Set 5Document6 pagesProblem Set 5Thulasi 2036No ratings yet

- Assignment 4Document2 pagesAssignment 4bluestacks3874No ratings yet

- Microeconomics Tutorial 2Document2 pagesMicroeconomics Tutorial 2zillxsNo ratings yet

- Assessment 2Document2 pagesAssessment 2savithri1371969 bhatNo ratings yet

- Group Assignment ECO415 & ECO162Document14 pagesGroup Assignment ECO415 & ECO162syahira izwaniNo ratings yet

- Online Assessment For ECO120 Principles of Economics (Oct 2021 To Feb 2022)Document9 pagesOnline Assessment For ECO120 Principles of Economics (Oct 2021 To Feb 2022)AIN ZULLAIKHANo ratings yet

- Mohammad Ali Jinnah University Karachi: Instruction For Making The AssignmentsDocument3 pagesMohammad Ali Jinnah University Karachi: Instruction For Making The AssignmentsTaha SaleemNo ratings yet

- Tutorial - Chapter 6 - Monopoly QuestionsDocument5 pagesTutorial - Chapter 6 - Monopoly QuestionsNandiieNo ratings yet

- Tutorial 3Document3 pagesTutorial 3Mustolih Hery SaputroNo ratings yet

- Act Grupal 102003 9Document16 pagesAct Grupal 102003 9davidNo ratings yet

- Final Exam QANT630 Fall 2019 (Part-2)Document14 pagesFinal Exam QANT630 Fall 2019 (Part-2)Simran SachdevaNo ratings yet

- Micro Unit 2 Answers 13th EditionDocument5 pagesMicro Unit 2 Answers 13th EditiondasatdeepaNo ratings yet

- ECON5541 Assign 1 PDFDocument2 pagesECON5541 Assign 1 PDF- wurileNo ratings yet

- Chapter:-Cost Allocation, Customer Profitability Analysis, and Sales-Variance AnalysisDocument6 pagesChapter:-Cost Allocation, Customer Profitability Analysis, and Sales-Variance Analysiskareem abozeedNo ratings yet

- Asgn2-MIcro Economics BBA Part 1 2023Document2 pagesAsgn2-MIcro Economics BBA Part 1 2023waqarsindhi136No ratings yet

- Eco Part 02Document7 pagesEco Part 02Amna PervaizNo ratings yet

- Economics AssignmentDocument6 pagesEconomics Assignmenturoosa vayaniNo ratings yet

- Econ2113 PS2Document5 pagesEcon2113 PS2jacky114aaNo ratings yet

- Tutorial 1 Questions EC306 PDFDocument4 pagesTutorial 1 Questions EC306 PDFRoite BeteroNo ratings yet

- Assignment 1Document2 pagesAssignment 1SHAHFAISAL HAMEEDNo ratings yet

- Worksheet - 2 Demand & SupplyDocument2 pagesWorksheet - 2 Demand & SupplyPrince SingalNo ratings yet

- ExerciseDocument6 pagesExerciseNurul Farhan IbrahimNo ratings yet

- Multiple Choice Questions Plus Solutions Flexible Budget and Standard CostingDocument5 pagesMultiple Choice Questions Plus Solutions Flexible Budget and Standard Costingnhu nhuNo ratings yet

- Assigment 4 SolutionDocument2 pagesAssigment 4 SolutionRamy ShabanaNo ratings yet

- Assignment: Managerial Economics Assignment 2: Name: ENTRY NO: 2019SMF6546 Section: A YearDocument2 pagesAssignment: Managerial Economics Assignment 2: Name: ENTRY NO: 2019SMF6546 Section: A YearSantu BiswaaNo ratings yet

- ME QuestionsDocument11 pagesME QuestionsDharmesh GoyalNo ratings yet

- 943 Question PaperDocument2 pages943 Question PaperPacific TigerNo ratings yet

- Document 1Document7 pagesDocument 1madihaadnan1No ratings yet

- Part A. Multiple ChoicesDocument4 pagesPart A. Multiple ChoicesJessica FeliciaNo ratings yet

- Economics Midterm QuestionDocument3 pagesEconomics Midterm Questionসজীব বসুNo ratings yet

- ECON 205 Chapters 3 & 4 Practice QuestionsDocument4 pagesECON 205 Chapters 3 & 4 Practice Questionskely wilsonNo ratings yet

- Economics Practise QuestionDocument6 pagesEconomics Practise QuestionprettyrockNo ratings yet

- Curve of Demand For Agricultural Products and Food: Khadicha AlakbarovaDocument28 pagesCurve of Demand For Agricultural Products and Food: Khadicha AlakbarovaHuseyn GuliyevNo ratings yet

- Microeconomics Handouts UpdatedDocument27 pagesMicroeconomics Handouts UpdatedKhalil FanousNo ratings yet

- Eco1001 - Tutorial Sheet - 3 - 2020.21sem - 1Document3 pagesEco1001 - Tutorial Sheet - 3 - 2020.21sem - 1nervasmith21No ratings yet

- Measuring The Cost of Living: Solutions To Textbook ProblemsDocument7 pagesMeasuring The Cost of Living: Solutions To Textbook ProblemsMainland FounderNo ratings yet

- Introductory MicroeconomicsDocument13 pagesIntroductory Microeconomicsgh982487No ratings yet

- Introduction To Microeconomics, Economics - IMI Preclinical Group - Monetary and Fiscal Policy - TaskDocument2 pagesIntroduction To Microeconomics, Economics - IMI Preclinical Group - Monetary and Fiscal Policy - Taskdv181100No ratings yet

- Pom Mock ExamDocument3 pagesPom Mock ExamManzar HussainNo ratings yet

- Word Note Aurora Textile Case Zinser 351Document6 pagesWord Note Aurora Textile Case Zinser 351alka murarka100% (1)

- ECO101: Introduction To Economics (Summer Semester, 2019) Tutorial Problem Set - 01Document3 pagesECO101: Introduction To Economics (Summer Semester, 2019) Tutorial Problem Set - 01Shubham KumarNo ratings yet

- Where Do We Go From Here?: U.S. - China Trade Agreement: Frayne Olson, PHDDocument26 pagesWhere Do We Go From Here?: U.S. - China Trade Agreement: Frayne Olson, PHDbioseedNo ratings yet

- Asm Chap 4 Bus 3382Document9 pagesAsm Chap 4 Bus 3382Đào ĐăngNo ratings yet

- Assignment 1ADocument5 pagesAssignment 1Agreatguy_070% (1)

- Aid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentFrom EverandAid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentNo ratings yet

- Accounting Principle NotesDocument22 pagesAccounting Principle NotesMartha AntonNo ratings yet

- Gr11 April P1 2020 - Marking SchemeDocument9 pagesGr11 April P1 2020 - Marking SchemeMartha AntonNo ratings yet

- Gr11 April P2 2020 Marking SchemeDocument10 pagesGr11 April P2 2020 Marking SchemeMartha AntonNo ratings yet

- Chapter 11-Service LogisticsDocument8 pagesChapter 11-Service LogisticsMartha AntonNo ratings yet

- Lecture 6 Inflation Fiscal MonetaryDocument15 pagesLecture 6 Inflation Fiscal MonetaryMartha AntonNo ratings yet

- Research Methodology: Experimental and Causal-Comparative Designs Topic 10Document20 pagesResearch Methodology: Experimental and Causal-Comparative Designs Topic 10Martha AntonNo ratings yet

- Examining Reasons For Poor Performance of Grade 7 Learners in MathematicsDocument30 pagesExamining Reasons For Poor Performance of Grade 7 Learners in MathematicsMartha AntonNo ratings yet

- Accounting Grade 9 (Regional)Document14 pagesAccounting Grade 9 (Regional)Martha AntonNo ratings yet

- Aggregate Demand and Aggregated Supply: Namibian Business SchoolDocument42 pagesAggregate Demand and Aggregated Supply: Namibian Business SchoolMartha AntonNo ratings yet

- Business Studies WorksheetDocument2 pagesBusiness Studies WorksheetMartha AntonNo ratings yet

- Business Environment NotesDocument2 pagesBusiness Environment NotesMartha AntonNo ratings yet

- Accounting WorksheetDocument3 pagesAccounting WorksheetMartha AntonNo ratings yet

- English Second Language Grade 4 AdjectivesDocument2 pagesEnglish Second Language Grade 4 AdjectivesMartha AntonNo ratings yet

- Bank Reconciliation TestDocument3 pagesBank Reconciliation TestMartha AntonNo ratings yet

- Corrected Net Profit ExersiceDocument2 pagesCorrected Net Profit ExersiceMartha AntonNo ratings yet

- Accounting Equation Grade 12Document1 pageAccounting Equation Grade 12Martha Anton100% (1)

- A Lament To A Struggle Companion - Marco HousikuDocument1 pageA Lament To A Struggle Companion - Marco HousikuMartha AntonNo ratings yet

- Accounting Equation Test 10Document2 pagesAccounting Equation Test 10Martha AntonNo ratings yet

- Online Case Assessment 2021 Marks: 100 Windhoek Duration: 3 HoursDocument1 pageOnline Case Assessment 2021 Marks: 100 Windhoek Duration: 3 HoursMartha AntonNo ratings yet

- Write-Up - GraphDocument17 pagesWrite-Up - GraphMartha AntonNo ratings yet

- CXC CSEC POB Notes - Elements of EconomicsDocument35 pagesCXC CSEC POB Notes - Elements of EconomicsLori-Rae100% (1)

- EC1301 Semester 1 Tutorial 2 Short Answer QuestionsDocument2 pagesEC1301 Semester 1 Tutorial 2 Short Answer QuestionsShuMuKongNo ratings yet

- Managerial Economics: Applications, Strategies and Tactics, 14eDocument39 pagesManagerial Economics: Applications, Strategies and Tactics, 14ecatherine sevidalNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document5 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)Sohail Liaqat AliNo ratings yet

- Syllabus - Economics - IDocument8 pagesSyllabus - Economics - IBoiled PotatoNo ratings yet

- Master of Environmental PlanningDocument38 pagesMaster of Environmental PlanningSonalSinghNo ratings yet

- Cash Balance ApproachDocument6 pagesCash Balance ApproachSumantra BhattacharyaNo ratings yet

- Demand and Analysis NumericalsDocument31 pagesDemand and Analysis NumericalsRajan BhadoriyaNo ratings yet

- Imi611s - Intermediate Microeconomics - 1ST Opp - June 2019Document3 pagesImi611s - Intermediate Microeconomics - 1ST Opp - June 2019Smart Academic solutionsNo ratings yet

- Microeconomics - 7Document19 pagesMicroeconomics - 7Linh Trinh NgNo ratings yet

- Module 2 Applied Economics Week 5 6Document10 pagesModule 2 Applied Economics Week 5 6Sheena Mae PeraltaNo ratings yet

- AP Microeconomics Full Review: Updated: 2015-2016Document58 pagesAP Microeconomics Full Review: Updated: 2015-2016Richelle Anne JamoralinNo ratings yet

- Economic EssayDocument2 pagesEconomic EssayPasinda PiyumalNo ratings yet

- Market (Economics)Document14 pagesMarket (Economics)gian reyesNo ratings yet

- The Economic Theory of ChoiceDocument23 pagesThe Economic Theory of ChoiceMinhaz Hossain OnikNo ratings yet

- Chapter 13 - Firms in Competitive MarketsDocument32 pagesChapter 13 - Firms in Competitive MarketsdreeNo ratings yet

- Economics Final Exam Review Sheet Multiple Choice: 61 Questions Exam Total: 243 PtsDocument3 pagesEconomics Final Exam Review Sheet Multiple Choice: 61 Questions Exam Total: 243 Ptsapi-305875450No ratings yet

- TG17 BAM040 Second Periodical ExamDocument6 pagesTG17 BAM040 Second Periodical ExamAmielyn Kieth L. SarsalejoNo ratings yet

- Group 6: Statistical Estimation of Demand Function: Reporters: Collator: PPT MakerDocument25 pagesGroup 6: Statistical Estimation of Demand Function: Reporters: Collator: PPT MakerPiola Marie LibaNo ratings yet

- Team 5 Econs Ch7Document12 pagesTeam 5 Econs Ch7larizaNo ratings yet

- Lecture 4 - Determining Foreign Exchange RatesDocument40 pagesLecture 4 - Determining Foreign Exchange RateslekokoNo ratings yet

- Economic System of PakistanDocument6 pagesEconomic System of PakistanSyed Hassan Raza75% (4)

- Microeconomics SyllabusDocument3 pagesMicroeconomics SyllabusPaulyne Pascual100% (1)

- M12 Bade 9418 04 Ch10aDocument16 pagesM12 Bade 9418 04 Ch10aVanny Van Sneidjer100% (2)

- BE AMC-34-All Branches With IndexDocument223 pagesBE AMC-34-All Branches With IndexSrikanth RangdalNo ratings yet

- Chapter 2 Competitive Market - Video-LectureDocument25 pagesChapter 2 Competitive Market - Video-LectureVulindhlela SitholeNo ratings yet