Professional Documents

Culture Documents

AEC 34 - ACB Assignment: Module 3: Problem 3-1.TRUE OR FALSE

AEC 34 - ACB Assignment: Module 3: Problem 3-1.TRUE OR FALSE

Uploaded by

Drew BanlutaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AEC 34 - ACB Assignment: Module 3: Problem 3-1.TRUE OR FALSE

AEC 34 - ACB Assignment: Module 3: Problem 3-1.TRUE OR FALSE

Uploaded by

Drew BanlutaCopyright:

Available Formats

AEC 34 – ACB Assignment: Module 3

Problem 3-1.TRUE OR FALSE.

TRUE 1. Technically, only the Journals and Ledgers are considered accounting records; the Registries are

budget records.

TRUE 2. Separate accounting records and budget registries are maintained for each fund cluster.

FALSE 3. Government entities and business entities use the terms “obligation” or the phrase “incurrence

of obligation” similarly. *differently

TRUE 4. The various registries maintained by government entities primarily serve as internal control for

controlling and monitoring the conformance of actual results with the approved budget.

TRUE 5. A check disbursement Is normally recorded as a credit to the “Cash-Modified Disbursement

System (MDS), Regular” account.

TRUE 6. Both the ORS and RAODR updated each time an obligation is incurred, a payable is recorded for

the obligation incurred, and disbursements are made to settle the recorded payables.

TRUE 7. At the end of each year, an adjustment is made to revert any unused NCA of a government

entity.

FALSE 8. The GAM for NGAs requires the Collecting Officer to issue an official receipt to acknowledge the

receipt of the Notice of Cash Allocation. *not to issue

TRUE 9. The entry to record the reversion of unused NCA at the end of the period is the exact opposite

of the entry used to record the receipt of NCA.

FALSE 10. The remittance of amounts withheld to the other government agencies such as the BIR, BOC,

GSIS, PhilHealth, and Pag-IBIG, is done through the TRA. *ORS and RAOD-PS

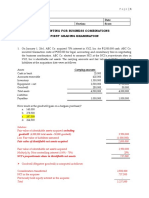

PROBLEM 3-7: WORKSHEET PREPARATION

Entity A is a newly formed government agency. Entity A’s transactions and events during the calendar

year 20X1 are as follows:

a. Received appropriation of ₱500,000.

b. Received allotment of ₱450,000.

c. Incurred obligations amounting to ₱440,000.

d. Received Notice of Cash Allocation of ₱430,000.

e. Accrued ₱80,000 salaries through granting, and liquidation, of cash advance. The breakdown of the

salaries is as follows:

Salaries and Wages 70,000

Personal Economic Relief Allowance (PERA) 10,000

Gross Compensation 80,000

Withholding Tax 18,000

GSIS 4,000

Pag-IBIG 1,000

PhilHealth 2,000

Total Salary Deductions 25,000

f. Received delivery off purchased office equipment Where is ₱200,000. The equipment has an

estimated useful life of 5 years and a 5% residual value. Entity A recognizes monthly depreciation

every end of the month using the straight line method. The equipment is acquired on January 1,

20X1.

g. Paid the accounts payable from the purchase of equipment in (f) above. Taxes withheld amount to

₱12,000.

h. Received delivery of purchased office supplies worth ₱100,000. The office supplies were purchased

through check. Taxes withheld amount to ₱5,000.

i. Issued office supplies worth ₱90,000 to end users.

j. Granted ₱20,000 cash advance to an employee for travelling expenses on an official local travel.

The employee liquidated ₱17,000 and remitted the excess cash advance.

k. Collected unbilled service income for Permit Fees of ₱40,000 and remitted ₱30,000 of the total

collection.

l. Paid water and electricity expenses amounting to ₱5,000 and ₱10,000, respectively. Taxes

withheld amount to ₱2,000.

m. Remitted the taxes withheld to the BIR.

n. Remitted contributions to GSIS, PhilHealth, and Pag-IBIG.

Requirements:

a. Record the transactions and events above. If no journal entry is needed, state the registry or other

documents where the transaction or event is recorded.

b. Post the transactions in the Ledger. Use T-accounts.

c. Prepare the unadjusted trial balance.

d. Prepare the adjustments, if any.

e. Prepare a complete worksheet showing columns for a post-closing trial balance.

f. Prepare the closing entries.

You might also like

- Accounting For Business Combinations First Grading ExaminationDocument18 pagesAccounting For Business Combinations First Grading Examinationjoyce77% (13)

- The Miracle of Tax Recovery - Roger ElvickDocument140 pagesThe Miracle of Tax Recovery - Roger Elvickwd3712419250% (2)

- Chapter c5Document25 pagesChapter c5bobNo ratings yet

- BusCom AssetAcquisitionDocument5 pagesBusCom AssetAcquisitionDanna Claire0% (1)

- CH Proble 3 8 PDFDocument29 pagesCH Proble 3 8 PDFYogun Bayona100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- AC - Acctg Gov Quiz 01 SolutionsDocument12 pagesAC - Acctg Gov Quiz 01 SolutionsErjohn Papa100% (1)

- Assets Liabilities + Equity + Income - Expenses: Oct. TransactionsDocument4 pagesAssets Liabilities + Equity + Income - Expenses: Oct. Transactionsalford sery Cammayo0% (1)

- JAM For Quiz MasterDocument10 pagesJAM For Quiz MasterJulie VelasquezNo ratings yet

- S170318 Financial Planning For Salaried Employee and Strategies For Tax Savings PDFDocument4 pagesS170318 Financial Planning For Salaried Employee and Strategies For Tax Savings PDFSURAJNo ratings yet

- Assignment Module 3Document2 pagesAssignment Module 3Drew BanlutaNo ratings yet

- Problem 3-7:worksheet PreparationDocument3 pagesProblem 3-7:worksheet PreparationMaria Erica AligamNo ratings yet

- AC - Acctg Gov Quiz 01Document2 pagesAC - Acctg Gov Quiz 01Erjohn PapaNo ratings yet

- AC - Acctg Gov Quiz 01Document2 pagesAC - Acctg Gov Quiz 01Merliza JusayanNo ratings yet

- Instructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Document7 pagesInstructions:: University of San Jose-Recoletos Online Class For The School Year 2020-2021 2 Semester ACTIVITY 03 (A03)Leila OuanoNo ratings yet

- SOLUTION Illustrative Problem Government Accounting ProcessDocument7 pagesSOLUTION Illustrative Problem Government Accounting ProcessVicente, Liza Mae C.No ratings yet

- Chapter 9 - Interim Financial ReportingDocument8 pagesChapter 9 - Interim Financial ReportingXiena0% (1)

- Quiz JournalizingDocument24 pagesQuiz JournalizingSharlene AberosNo ratings yet

- Principles of Accounting Code 8401 Assignments of Spring 2023Document13 pagesPrinciples of Accounting Code 8401 Assignments of Spring 2023zainabjutt0303No ratings yet

- Fundamentals of Financial AccountingDocument9 pagesFundamentals of Financial AccountingEmon EftakarNo ratings yet

- MidTerm-Govt.-accounting-RAMOS, ROSEMARIE CDocument12 pagesMidTerm-Govt.-accounting-RAMOS, ROSEMARIE Cagentnic100% (1)

- Quiz 2 - Accounting ProcessDocument3 pagesQuiz 2 - Accounting ProcessPrincess NozalNo ratings yet

- Midterm Exam 2021 1Document3 pagesMidterm Exam 2021 1justinedeguzmanNo ratings yet

- Assign. 2 Module 2Document9 pagesAssign. 2 Module 2Kristine VertucioNo ratings yet

- Acc05 Far Handout 7Document5 pagesAcc05 Far Handout 7Jullia BelgicaNo ratings yet

- General Fundtrial Balance JANUARY 1, 2018 Debits CreditsDocument2 pagesGeneral Fundtrial Balance JANUARY 1, 2018 Debits CreditsTehone TeketelewNo ratings yet

- Engaging Activity 1-Unit 3 Government Accounting ProcessDocument6 pagesEngaging Activity 1-Unit 3 Government Accounting ProcessJaihlyn DemataNo ratings yet

- Pract ExDocument3 pagesPract ExRomyleen WennaNo ratings yet

- Acc 1 QuizDocument7 pagesAcc 1 QuizAyat MukahalNo ratings yet

- 94 Final PB FAR PDFDocument16 pages94 Final PB FAR PDFfanchasticommsNo ratings yet

- Local Media6884512623317631833Document29 pagesLocal Media6884512623317631833Yogun BayonaNo ratings yet

- POFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredDocument3 pagesPOFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredAli Zain ParharNo ratings yet

- Group Assignment Accounting Cycle - ADDocument4 pagesGroup Assignment Accounting Cycle - ADShewatatek MelakuNo ratings yet

- Government Accounting QuestionsDocument12 pagesGovernment Accounting QuestionsJoana Poala AbunganNo ratings yet

- Share MO Chapter 3 Excercises and SolutionsDocument6 pagesShare MO Chapter 3 Excercises and SolutionsHesham AhmedNo ratings yet

- Chapter 3 The Government Accounting ProcessDocument10 pagesChapter 3 The Government Accounting ProcessEthel Joy Tolentino GamboaNo ratings yet

- Acp - Acc417 Case Study 1Document6 pagesAcp - Acc417 Case Study 1Faker MejiaNo ratings yet

- General Instruction: Auditing, Part II: Instruction To Fund AccountingDocument5 pagesGeneral Instruction: Auditing, Part II: Instruction To Fund AccountingtemedebereNo ratings yet

- Final - Unit - 10 - Financial Accounting - TrangDocument5 pagesFinal - Unit - 10 - Financial Accounting - TrangKevin PhạmNo ratings yet

- Chapter 10 In-Class WorksheetDocument2 pagesChapter 10 In-Class Worksheetrwh2nNo ratings yet

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Document9 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Business (Part Ii-A)Tumamudtamud, JenaNo ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash Flowsnot funny didn't laughNo ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- Chapter 5 Solutions To Assigned HomeworkDocument9 pagesChapter 5 Solutions To Assigned HomeworkLiyue QiNo ratings yet

- Valix Book Chapt 1 5 Probs PDFDocument34 pagesValix Book Chapt 1 5 Probs PDFRengeline LucasNo ratings yet

- Accounting Battaglia 1 Question and AnswersDocument7 pagesAccounting Battaglia 1 Question and AnswersRina RaymundoNo ratings yet

- Income Tax Finals Sample Questions Final ExamDocument19 pagesIncome Tax Finals Sample Questions Final ExamAnie P. Martinez0% (1)

- Acc 109 P3 Quiz No 2Document2 pagesAcc 109 P3 Quiz No 2Wilmz SalacsacanNo ratings yet

- Financial Accounting AssignmentDocument6 pagesFinancial Accounting Assignmentpunya guptaNo ratings yet

- Ifrs December 2020 EnglishDocument10 pagesIfrs December 2020 Englishjad NasserNo ratings yet

- Government Accounting Finals 2021Document21 pagesGovernment Accounting Finals 2021Michael Bongalonta100% (1)

- Review Notes #2 - Comprehensive Problem PDFDocument3 pagesReview Notes #2 - Comprehensive Problem PDFtankofdoom 4No ratings yet

- PDF May 2017 - CompressDocument7 pagesPDF May 2017 - Compresscasual viewerNo ratings yet

- 0456Document4 pages0456Usman Shaukat Khan100% (1)

- 助教課講義 Ch.4Document12 pages助教課講義 Ch.45213adamNo ratings yet

- Activity1 JournalizingDocument3 pagesActivity1 JournalizingLightNo ratings yet

- Unexpired Insurance: Furniture and FixtureDocument1 pageUnexpired Insurance: Furniture and FixtureFucio, Mark JeroldNo ratings yet

- FYJC Book Keeping and Accuntancy Topic Final AccountDocument4 pagesFYJC Book Keeping and Accuntancy Topic Final AccountRavichandraNo ratings yet

- Acctg 6c 1st Exam FinalDocument3 pagesAcctg 6c 1st Exam FinalJao FloresNo ratings yet

- Eos Cupfinal RoundDocument7 pagesEos Cupfinal RoundSheena Pearl AlinsanganNo ratings yet

- Government & NPF AssignmentDocument10 pagesGovernment & NPF AssignmentkiduseNo ratings yet

- Working Paper-Chapters 1-4 Naser AbdelkarimDocument5 pagesWorking Paper-Chapters 1-4 Naser AbdelkarimHasan NajiNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Business Tax GuideDocument1 pageBusiness Tax GuideDrew BanlutaNo ratings yet

- Introduction To Business TaxDocument7 pagesIntroduction To Business TaxDrew BanlutaNo ratings yet

- Business Tax - VATable Transactions PracticeDocument2 pagesBusiness Tax - VATable Transactions PracticeDrew BanlutaNo ratings yet

- Income Taxation - Regular Income TaxDocument4 pagesIncome Taxation - Regular Income TaxDrew BanlutaNo ratings yet

- Income Taxation - Rules of Income TaxDocument2 pagesIncome Taxation - Rules of Income TaxDrew BanlutaNo ratings yet

- Income Taxation - Regular Income Tax 2Document5 pagesIncome Taxation - Regular Income Tax 2Drew BanlutaNo ratings yet

- Business Tax - Applicable Business Tax PracticeDocument3 pagesBusiness Tax - Applicable Business Tax PracticeDrew BanlutaNo ratings yet

- Income Taxation - Final Taxes and CGTDocument3 pagesIncome Taxation - Final Taxes and CGTDrew BanlutaNo ratings yet

- Business Tax - Output VAT ActivityDocument4 pagesBusiness Tax - Output VAT ActivityDrew BanlutaNo ratings yet

- Ecsalao BlogspotDocument70 pagesEcsalao BlogspotDrew BanlutaNo ratings yet

- Midterm ExamDocument14 pagesMidterm ExamDrew BanlutaNo ratings yet

- Corporation Is An Artificial Being, Invisible, Intangible and Existing Only in Contemplation of Law. It Has Neither A Mind Nor A Body of Its OwnDocument7 pagesCorporation Is An Artificial Being, Invisible, Intangible and Existing Only in Contemplation of Law. It Has Neither A Mind Nor A Body of Its OwnDrew BanlutaNo ratings yet

- Lesson1 ObliconDocument4 pagesLesson1 ObliconDrew BanlutaNo ratings yet

- Advacc 2 Guerrero Chapter 14Document15 pagesAdvacc 2 Guerrero Chapter 14Drew BanlutaNo ratings yet

- Chapter 6 ADVAC (Excel +Document43 pagesChapter 6 ADVAC (Excel +Christine Jane RamosNo ratings yet

- Lesson 2-ObliconDocument14 pagesLesson 2-ObliconDrew BanlutaNo ratings yet

- PART 1-THEORIES (1pt. Each) "A" If TRUE, "B" If FALSEDocument7 pagesPART 1-THEORIES (1pt. Each) "A" If TRUE, "B" If FALSEDrew BanlutaNo ratings yet

- BC Royalty Review Independent AssessmentDocument106 pagesBC Royalty Review Independent AssessmentAlaskaHighwayNews100% (1)

- Solved On January 1 of The Current Year Scott Borrows 80 000Document1 pageSolved On January 1 of The Current Year Scott Borrows 80 000Anbu jaromiaNo ratings yet

- ACCTG 1 Week 2-3 - Accounting in BusinessDocument13 pagesACCTG 1 Week 2-3 - Accounting in BusinessReygie FabrigaNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 524687300050920 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 524687300050920 Assessment Year: 2020-21asmit somNo ratings yet

- Buy Vs Lease CarDocument6 pagesBuy Vs Lease Caraftab_sweet3024No ratings yet

- Salary IllustrationDocument10 pagesSalary IllustrationSarvar Pathan100% (1)

- SWIFT Notes To Financial StatementsDocument11 pagesSWIFT Notes To Financial StatementsArvin TejonesNo ratings yet

- Carlos Superdrug Vs DSWD: Modes of Eliminating Double TaxationDocument2 pagesCarlos Superdrug Vs DSWD: Modes of Eliminating Double TaxationGabriel HernandezNo ratings yet

- Solution Tax667 - Jun 2016-1Document8 pagesSolution Tax667 - Jun 2016-1Zahiratul QamarinaNo ratings yet

- Buyong Online Grocery Application Comparative Statement of Cash FlowDocument2 pagesBuyong Online Grocery Application Comparative Statement of Cash FlowRonna Mae MendozaNo ratings yet

- Taxation Unit 2 NewDocument4 pagesTaxation Unit 2 NewgarntethNo ratings yet

- (Solution) Take Home Assignment 3 (2023S)Document3 pages(Solution) Take Home Assignment 3 (2023S)何健珩No ratings yet

- 10 Exercises BE Solutions-1Document40 pages10 Exercises BE Solutions-1loveliangel0% (2)

- 7 Depreciation, Deplbtion, Amortization, and Cash FlowDocument52 pages7 Depreciation, Deplbtion, Amortization, and Cash FlowRiswan Riswan100% (1)

- Steuerbuch2022 en v03 BarrierefreiDocument204 pagesSteuerbuch2022 en v03 BarrierefreilaescuderoNo ratings yet

- TaxationDocument6 pagesTaxationAlexa ParkNo ratings yet

- Tamil Nadu Value Added Tax Act, 2006Document67 pagesTamil Nadu Value Added Tax Act, 2006Viswanathan SivaramanNo ratings yet

- Itr File 2023:24Document9 pagesItr File 2023:24Aatif KhanNo ratings yet

- Basics of Income Tax of India PDFDocument19 pagesBasics of Income Tax of India PDFJai VermaNo ratings yet

- Parent Involvement and Community Partnership: Doris J. Yu School Head, TnhsDocument63 pagesParent Involvement and Community Partnership: Doris J. Yu School Head, TnhsTupsan Nhs Mambajao CamiguinNo ratings yet

- Finance Budget 2023Document4 pagesFinance Budget 2023SakshamNo ratings yet

- Income Tax Act, 1961: Section 28. Profits and Gains of Business or ProfessionDocument6 pagesIncome Tax Act, 1961: Section 28. Profits and Gains of Business or Professiongslahoti70No ratings yet

- Sales Tax (Module C) Short NotesDocument87 pagesSales Tax (Module C) Short NotesSohail MerchantNo ratings yet

- Journal of Public Economics: Thiess Buettner, Michael Overesch, Ulrich Schreiber, Georg WamserDocument9 pagesJournal of Public Economics: Thiess Buettner, Michael Overesch, Ulrich Schreiber, Georg WamserArnita VedianaNo ratings yet

- Section 80P - Deduction For Co-Operative SocietiesDocument15 pagesSection 80P - Deduction For Co-Operative SocietiesSURESHNo ratings yet

- LTA PolicyDocument2 pagesLTA PolicyAnuradha ParasaramNo ratings yet

- Solutions To Income Tax ComputationDocument12 pagesSolutions To Income Tax Computationqmwdb2k27kNo ratings yet