Professional Documents

Culture Documents

Chapter 8 Companies Incorporated Outside India

Chapter 8 Companies Incorporated Outside India

Uploaded by

Deepsikha maitiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 8 Companies Incorporated Outside India

Chapter 8 Companies Incorporated Outside India

Uploaded by

Deepsikha maitiCopyright:

Available Formats

Chapter 8 Companies Incorporated Outside India

Compiled by: Pankaj Garg

Page 1

Chapter 8 Companies Incorporated Outside India

Chapter – 8

Companies Incorporated Outside India

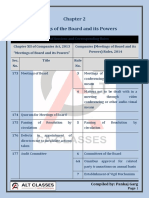

Table of Sections and Corresponding Rules

Chapter XXII of Companies Act, 2013 Companies (Registration of Foreign

“Companies Incorporated Outside Companies) Rules, 2014

India”

Sec. Title Rule Title

No. No.

379 Application of Act to foreign 12 Action for improper use or

companies description as foreign company

380 Documents, etc., to be 3 Particulars relating to directors

delivered to Registrar by and Secretary to be furnished to

foreign companies the Registrar by foreign

Companies

8 Office Where Documents to be

Delivered and Fee for

Registration of Documents

10 Authentication of transalated

documents

381 Accounts of foreign company 4 Financial Statement of Foreign

company

Compiled by: Pankaj Garg

Page 2

Chapter 8 Companies Incorporated Outside India

5 Audit of Accounts of Foreign

Company

6 List of Places of Business of

Foreign Company

382 Display of name, etc., of

Foreign company

383 Service on foreign company

384 Debentures, annual return, 7 Annual Return

registration of charges, books

of account and their inspection

385 Fee for registration of

documents

386 Interpretation

387 Dating of prospectus and

particulars to be contained

therein

388 Provisions as to expert’s

consent and allotment

389 Registration of prospectus

390 Offer of Indian Depository 11 Documents to be Annexed to

Receipts Prospectus

Compiled by: Pankaj Garg

Page 3

Chapter 8 Companies Incorporated Outside India

391 Application of sections 34 to 13 Issue of Indian Depository

36 and Chapter XX Receipts (IDRs)

392 Punishment for contravention

393 Company's failure to comply

with provisions of this Chapter

not to affect validity of

contracts, etc.

8.1 - Definitions

Foreign means any company or body corporate incorporated outside India

Company – which:

Sec. 2(42) (a) has a place of business in India whether by itself or through an

agent, physically or through electronic mode;

and

(b) conducts any business activity in India in any other manner.

Point to Remember

Sec. 386 of Companies Act, 2013 interpreted the expression

“Place of business” as including a share transfer or registration

office.

Accordingly, to qualify as foreign company, a company must have the

following features:

(i) It must be incorporated outside India.

Compiled by: Pankaj Garg

Page 4

Chapter 8 Companies Incorporated Outside India

(ii) It should have a place of business in India.

(iii) Place of Business may be hold by the company directly or through

its agent.

(iv) Place of business may be physically or through electronic mode.

(v) It must conduct a business activity of any nature in India.

Meaning of Electronic Mode - Rule 2(1)(c) of Companies

(Registration of Foreign Companies) Rules, 2014

Electronic mode means carrying out electronically based, -

(a) business to business and business to consumer transactions,

data interchange and other digital supply transactions;

(b) offering to accept deposits or inviting deposits or accepting

deposits or subscriptions in securities, in India or from citizens

of India;

(c) financial settlements, web-based marketing, advisory and

transactional services, database services and products, supply

chain management;

(d) online services such as telemarketing, telecommuting,

telemedicine, education and information research; and

(e) all related data communication services,

whether conducted by e-mail, mobile devices, social media, cloud

computing, document management, voice or data transmission or

otherwise.

It is immaterial whether the main server is installed in India or

outside India.

Compiled by: Pankaj Garg

Page 5

Chapter 8 Companies Incorporated Outside India

Important Questions

Q. No. 1: Examine with reference to the provisions of the Companies Act, 2013

whether the following companies can be treated as foreign

companies:

(i) A company incorporated outside India having a share

registration office at Mumbai.

(ii) Indian citizens incorporated a company in Singapore for the

purpose of carrying on business there. [MTP-April 18]

HINT: (i) Foreign company provided it conducts any business activity in

India. (ii) Not a foreign company as no place of business in India.

Q. No. 2: Indian citizens incorporated a company in U.K. for the purpose of

carrying on business there. Examine with reference to the relevant

provisions of the Companies Act, 2013 whether it is a “Foreign

Company”. What would be your answer in case the U.K. company was

incorporated by a company registered in India? [Nov. 08 (5 Marks)]

HINT: Not a foreign company as conditions specified in Sec. 2(42) not

fulfilled.

Q. No. 3: Examine in the light of the provisions of the Companies Act, 2013

whether the following companies can be considered as "Foreign

Companies":-

(i) A company incorporated outside India having a share

registration office at New Delhi

(ii) A company incorporated outside India having shareholders who

are all Indian citizens;

(iii) A company incorporated in India but all the shares are held by

foreigners.

Compiled by: Pankaj Garg

Page 6

Chapter 8 Companies Incorporated Outside India

Also examine whether the above companies can issue Indian

Depository Receipts under the provisions of the Companies Act,

2013? [May 13 (8 Marks)]

HINT: (i) Foreign company provided it conducts any business activity in

India.

(ii) Not a foreign company assuming that no place of business in India.

(iii) Not a foreign company as it is being incorporated in India.

Issue of IDRs: Refer Sec. 390.

Q. No. 4: Robertson Ltd. is a company registered in Thailand. Although, it has

no place of business established in India, yet it is doing online

business through telemarketing in India. Whether it will be treated as

a Foreign Company under the Companies Act, 2013? Explain.

[Nov. 15 (4 Marks), RTP-May 18]

HINT: Foreign company as having place of business electronically and

involved in business activity through telemarketing.

Q. No. 5: In the light of the provisions of the companies Act, 2013 explain

whether the following Companies can be considered as a ‘Foreign

Company’:

(i) A Company which has no place of business established in India,

yet, is doing online business through telemarketing in India.

(ii) A company which is incorporated outside India employs agents

in India but has no place of business in India.

(iii) A Company incorporated outside India having shareholders

who are all Indian citizens. [Nov. 18-New Syllabus (8 Marks)]

Compiled by: Pankaj Garg

Page 7

Chapter 8 Companies Incorporated Outside India

HINT: Refer Sec. 2(42) of Companies Act, 2013 and Rule 2(1)(c) of

Companies (Registration of Foreign Companies) Rules, 2014.

(i) Foreign company as it is having place of business electronically and

involved in business activity through telemarketing.

(ii) Not a foreign company as it is not having any place of business in

India.

(iii) Not a foreign company, as it is not having any place of business in

India.

Q. No. 6: In the light of the provisions of the Companies Act, 2013, examine

whether the following companies can be considered as a 'Foreign

Company':

(i) M/s Red Stone Limited is a company registered in Singapore. The

Board of Directors meets and executes business decisions at

their Board Meeting held in India.

(ii) M/s Blue Star Public Company Limited registered in Thailand has

authorized Mr. 'Y' in India to find customers and to enter

contracts with them on behalf of the Company.

(iii) M/s. Xex Limited Liability Company registered in Dubai has

installed its main server in Dubai for maintaining office

automation software by Cloud Computing for its client in India.

[Nov. 19 – New Syllabus (8 Marks)]

HINT: Refer Sec. 2(42). (i) Not a Foreign company (ii) Foreign company

(iii) Foreign company.

Compiled by: Pankaj Garg

Page 8

Chapter 8 Companies Incorporated Outside India

8.2 - Application of Act to foreign companies [Sec. 379]

Sections • Sections 380 to 386 (both inclusive) and sections 392 and

Applicable to 393 shall apply to all foreign companies.

all foreign

• However, CG may by order exempt any class of foreign

company

companies, from any of the provisions of Sections 380 to 386

– Sec. 379(1)* and sections 392 and 393 and a copy of every such order

shall, as soon as may be after it is made, be laid before both

houses of Parliament.

Conditions for Where not less than 50% of the paid-up share capital, whether

applicability of equity or preference or partly equity and partly preference, of a

Companies Act, foreign company is held by:

2013 over (i) one or more citizens of India;

foreign

or

companies

(ii) by one or more companies or bodies corporate incorporated

-Sec. 379(2)

in India;

or

(iii) by one or more citizens of India and one or more companies

or bodies corporate incorporated in India,

whether singly or in the aggregate, such company shall comply

with the provisions of Chapter XXII (Section 379 to Sec. 393 –

Companies Incorporated outside India) and such other

provisions of this Act as may be prescribed with regard to the

business carried on by it in India as if it were a company

incorporated in India.

Compiled by: Pankaj Garg

Page 9

Chapter 8 Companies Incorporated Outside India

Rule 12 Action for Improper Use or Description as Foreign Company

If any person trade or carry on business in any manner under

any name or title or description as a foreign company registered

under the Act or the rules made thereunder, that person shall,

unless duly registered as foreign company under the Act and

rules made thereunder, shall be liable for investigation u/s

210 of the Act and action consequent upon that investigation

shall be taken against that person.

Important Questions

Q. No. 7: Trans Asia Limited is registered as a public company u/s 4(7) of the

erstwhile Companies Act, 1956 which is a subsidery of Galilio

Limited, a foreign company. Trans Asia Limited carries in business

in India describing itself as a foreign company. Can it do so? State the

actions that can be taken against the company for improper use or

description as foreign company under the provisions of the

Companies Act, 2013. [Nov. 18-Old Syllabus (4 Marks)]

HINT: Refer Rule 12 of Companies (Registration of Foreign Companies)

Rules, 2014.

8.3 - Documents, etc., to be delivered to Registrar by foreign companies [Sec.

380]

Documents Every foreign company shall, within 30 days of the establishment of

to be its place of business in India, deliver to the Registrar for

delivered - registration:

Sec. 380(1) (a) Certified copy of the charter, statutes or memorandum and

articles, of the company or other instrument constituting or

defining the constitution of the company.

Compiled by: Pankaj Garg

Page 10

Chapter 8 Companies Incorporated Outside India

If the instrument is not in the English language, a certified

translation thereof in the English language.

(b) Full address of the registered or principal office of the company.

(c) List of the directors and secretary of the company containing

such particulars as may be prescribed (Rule 3).

(d) Name and address of one or more persons resident in India

authorised to accept on behalf of the company service of any

notices or other documents required to be served on the

company.

(e) Full address of the office of the company in India which is

deemed to be its principal place of business in India.

(f) Particulars of opening and closing of a place of business in India

on earlier occasion(s).

(g) Declaration that none of the directors of the company or the

authorized representative in India has ever been convicted or

debarred from formation of companies and management in

India or abroad; and

(h) Any other information as may be prescribed.

Particulars relating to directors and Secretary to be furnished

to the Registrar by foreign Companies - Rule 3(2) of the

Companies (Registration of Foreign Companies) Rules, 2014

The list of directors and secretary of the foreign company shall

contain the following particulars, for each of the persons included in

such list, namely:

(a) personal name and surname in full;

Compiled by: Pankaj Garg

Page 11

Chapter 8 Companies Incorporated Outside India

(b) any former name(s) and surname(s) in full;

(c) father’s or mother’s name and spouse’s name;

(d) date of birth;

(e) residential address;

(f) nationality;

(g) if the present nationality is not the nationality of origin, his

nationality of origin;

(h) passport Number, date of issue and country of issue;

(i) Permanent Account Number (PAN), if applicable;

(j) occupation, if any;

(k) where directorship in held any other Indian company, Director

Identification Number (DIN), Name and Corporate Identity

Number (CIN) of such company;

(l) other directorship(s) held by him;

(m) Membership Number (for Secretary only); and

(n) e-mail ID.

Manner of filing the Documents - Rule 3(3) of the Companies

(Registration of Foreign Companies) Rules, 2014

• Information to be delivered to Registrar u/s 380(1) shall be

filed in Form FC-1 along with prescribed fees.

• Application shall also be supported with an attested copy of

approval from the RBI under FEMA and also from other

regulators, if any, to establish a place of business in India.

Compiled by: Pankaj Garg

Page 12

Chapter 8 Companies Incorporated Outside India

• If no such approval is required, a declaration from the

authorised representative shall be furnished that no such

approval is required.

Office where documents to be delivered - Rule 8 of the

Companies (Registration of Foreign Companies) Rules, 2014

• Any document which any foreign company is required to deliver

to the Registrar shall be delivered to the Registrar having

jurisdiction over New Delhi.

• If any foreign company ceases to have a place of business in

India, it shall forthwith give notice of the fact to the Registrar.

• Obligation of the company to deliver any document to the

Registrar shall cease from the date on which notice is so given,

provided it has no other place of business in India.

Authentication of Translated Documents - Rule 10 of the

Companies (Registration of Foreign Companies) Rules, 2014

• All the documents required to be filed with the Registrar by the

foreign companies shall be in English language and where any

such document is not in English language, there shall be attached

a translation thereof in English language duly certified to be

correct in the manner given in these rules.

• Where any such translation is made outside India, it shall be

authenticated by the signature and the seal, if any, of (a) the

official having custody of the original; or (b) a Notary (Public) of

the country (or part of the country) where the company is

incorporated.

Compiled by: Pankaj Garg

Page 13

Chapter 8 Companies Incorporated Outside India

• Where such translation is made within India, it shall be

authenticated by (a) an advocate, attorney or pleader entitled to

appear before any High Court; or (b) an affidavit, of a competent

person having, in the opinion of the Registrar, an adequate

knowledge of the language of the original and of English.

Compliance Every foreign company existing at the commencement of

by existing Companies Act, 2013 shall, if it has not delivered to the Registrar,

companies the documents and particulars specified u/s 592(1) of the

- Sec. 380(2) Companies Act, 1956, continue to be subject to the obligation to

deliver those documents and particulars in accordance with that

Act, i.e. Companies Act, 1956.

Alteration Where any alteration is made in the documents delivered to the

in Registrar, the foreign company shall, within 30 days of such

Documents alteration, deliver to the Registrar for registration, a return

- Sec. 380(3) containing the particulars of the alteration in the prescribed form.

Rule 3(4) of the Companies (Registration of Foreign

Companies) Rules, 2014

Return required to be filed u/s 380(3) shall be in Form FC-2.

Important Questions

Q. No. 8: A company incorporated in Singapore has established its place of

business at Chennai. State the documents which are required to be

furnished on such establishment of business in India under the

Companies Act, 2013 and the authorities to whom such documents

are to be furnished. [May 09 (5 Marks)]

Compiled by: Pankaj Garg

Page 14

Chapter 8 Companies Incorporated Outside India

Or

DEJY Company Limited incorporated in Singapore, desires to

establish a place of business at Mumbai. You being a practicing

Chartered Accountant has been appointed by the company as a

liaison officer, for compliance of legal formalities on behalf of the

company. Examining the provisions of the Companies Act, 2013,

state the documents you are required to furnish on behalf of the

company, on the establishment of a place of business at Mumbai.

[May 12 (8 Marks), RTP-May 19]

Or

State the documents that are required to be delivered by a foreign

company at the time of establishment of a place of business in India.

State to whom the said documents are to be delivered.

[May 14 (4 Marks)]

HINT: Refer Sec. 380(1) of Companies Act, 2013.

Q. No. 9: ABC Ltd., a foreign company having its Indian principal place of

business at Kolkata, West Bengal is required to deliver various

documents to Registrar under the provisions of the Companies Act,

2013. You are required to state, where the said company should

deliver such documents. [MTP-April 18, Oct. 19]

HINT: Registrar having jurisdiction over New Delhi (Refer Rule 8).

Q. No. 10: M/s Joel Ltd. was incorporated in London with a paid-up capital of

10 million pounds. Mr. Y an Indian citizen holds 25% of the paid-up

capital. M/s. X Ltd. a company registered in India holds 30% of the

Compiled by: Pankaj Garg

Page 15

Chapter 8 Companies Incorporated Outside India

paid-up capital of Joel Ltd. M/s. Joel Ltd. has recently established a

share transfer office at New Delhi. The company seeks your advice

as to what formalities it should observe as a foreign company under

Companies Act, 2013.

Or

Mr. Ziyan an Indian citizen holds 25% of the paid-up capital of

Laurel Steven Limited, a company which was incorporated in

Singapore with a paid-up capital of 10 million Singapore Dollars.

Swaraj Limited a company registered in India holds 30% of the paid-

up capital of Laurel Steven Limited. Laurel Steven Limited has

recently established a share transfer office at New Delhi. The

Company seeks your advice as to what formalities it should observe

as a foreign company under the Companies Act, 20l3.

[Nov. 17 (4 Marks)]

HINT: Refer Sections 2(42), 386, 379 and 380(1).

Q. No. 11: Qinghai Huading Industrial Company Ltd., incorporated in China

established a place of business at Mumbai. The Charter/ Documents

constituting the company is in Mandarian Chinese (Chinese local

language). It is required inter alia to file a certified translation of

above Documents with the Registrar of companies in India. Who can

authenticate the translated charter/documents as per the

provisions of the Companies Act, 2013 and rules made there under

governing foreign companies in case such translation is made at

Mumbai? [May 18 – New Syllabus (2 Marks)]

HINT: Refer Rule 10.

Compiled by: Pankaj Garg

Page 16

Chapter 8 Companies Incorporated Outside India

Q. No. 12: Transtar Limited, a company incorporated in Thailand, has a place

of business through an agent in Bangalore. The agent transacts the

business on behalf of the company through electronic mode. As

regards Transtar Limited, answer the following:

(i) Whether, Transtar Limited shall be called a foreign company

within the meaning of the Companies Act, 2013?

(ii) What are the regulatory requirements under the Companies

Act, 2013 to be complied with by a company which has

established its place of business in India with respect to

delivery of documents etc. to Registrar?

[Nov. 19 – Old Syllabus (4 Marks)]

HINT: Refer Sec. 2(42) and 380(1).

8.4 - Accounts of Foreign Company [Sec. 381]

Preparation Every foreign company shall, in every calendar year, make out a

of F.S. balance sheet and profit and loss account

- Sec. 381(1) • in such form as prescribed,

• containing such particulars as prescribed, and

• including or having attached or annexed thereto such documents

as may be prescribed,

and

deliver a copy of those documents to the Registrar.

The Central Government may, by notification, direct that, in the case

of any foreign company or class of foreign companies, the

requirements of clause (a) shall not apply, or shall apply subject to

such exceptions and modifications as may be specified.

Compiled by: Pankaj Garg

Page 17

Chapter 8 Companies Incorporated Outside India

Financial Statement of Foreign company – Rule 4 of the

Companies (Registration of Foreign Companies) Rules, 2014

Manner of Every foreign company shall prepare F.S. of its

preparation Indian business operations in accordance with

of F.S of Schedule III or as near thereto as may be possible

Indian for each financial year including:

Business (i) documents required to be annexed thereto in

Operations accordance with the provisions of Chapter IX of

the Act i.e. Accounts of Companies;

(ii) documents relating to copies of latest

consolidated F.S. of the parent foreign

company, as submitted by it to the prescribed

authority in the country of its incorporation

under the provisions of the law for the time

being in force in that country.

Additional Every foreign company shall, along with the F.S.

documents to required to be filed with the Registrar, attach

be attached thereto the following documents; namely:-

a. Statement of related party transaction

b. Statement of repatriation of profits

c. Statement of transfer of funds (including

dividends if any).

The above statements shall include such other

particulars as are prescribed in the Companies

(Registration of Foreign Companies) Rules, 2014.

Compiled by: Pankaj Garg

Page 18

Chapter 8 Companies Incorporated Outside India

Time limit Documents shall be delivered to the Registrar

for filing within a period of 6 months of the close of the

financial year of the foreign company to which the

documents relate.

Audit of Accounts of Foreign company – Rule 5 of The

Companies (Registration of Foreign Companies) Rules, 2014

(a) Every foreign company shall get its accounts, pertaining to the

Indian business operations prepared in accordance with section

381(1) and Rule 4, shall be audited by a practicing Chartered

Accountant in India or a firm or LLP of practicing chartered

accountants.

(b) Provisions of Chapter X i.e. Audit and Auditors and rules made

there under, as far as applicable, shall apply, mutatis mutandis,

to the foreign company.

Translation If any of the document mentioned in Sec. 381(1) is not in the

in English English language, there shall be annexed to it a certified translation

language thereof in the English language.

- Sec 381(2)

List of Every foreign company shall send to the Registrar along with the

places of documents required to be delivered to him u/s 381(1), a copy of a

business in list in the prescribed form of all places of business established by

India the company in India, as at the date with reference to which the

- Sec. 381(3) balance sheet is made out.

Compiled by: Pankaj Garg

Page 19

Chapter 8 Companies Incorporated Outside India

List of Places of Business of Foreign Company – Rule 6 of the

Companies (Registration of Foreign Companies) Rules, 2014

Every foreign company shall file with the Registrar, along with the

F.S., in Form FC-3 with prescribed fee, a list of all the places of

business established by the foreign company in India as on the date

of balance sheet.

Important Question

Q. No. 13: State briefly the requirements relating to filing of accounts with the

Registrar of Companies by the foreign company in respect of its

global business as well as Indian business.

or

Galilio Ltd. is a foreign company in Germany and it established a

place of business in Mumbai. Explain the relevant provisions of the

Companies Act, 2013 and rules made thereunder relating to

preparation and filing of financial statements, as also the

documents to be attached along with the financial statements by

the foreign company. [May 16 (4 Marks)]

HINT: Refer Section 381(1) and Rule 4.

8.5 - Display of name, etc., of foreign company [Sec. 382]

Duty to (a) Every foreign company shall exhibit on the outside of every

display name office or place where it carries on business in India,

etc. outside • the name of the company and

place of

• the country in which it is incorporated.

business

Compiled by: Pankaj Garg

Page 20

Chapter 8 Companies Incorporated Outside India

(b) Display should be in letters easily legible

• in English characters, and

• also in the characters of the local language uses in the

locality in which the place is situated.

Duty to (a) Every foreign company shall cause

mention • the name of the company and

name etc. in

• of the country in which it is incorporated,

bills.

to be stated in all business letters, bill - heads and letter

paper, and in all notices, and other official publications of the

company.

(b) Requirements to be stated in legible English characters.

Duty to state If the liability of the members of the company is limited, every

the facts as to foreign company shall cause notice of that fact —

limited (1) to be stated in every such prospectus issued and in all business

liability of letters, bill-heads, letter paper, notices, advertisements and

members. other official publications of the company, in legible English

characters; and

(2) to be exhibited on the outside of every office or place where it

carries on business in India, in legible English characters and

also in legible characters of the local language uses in the

locality in which the office or place is situated.

Compiled by: Pankaj Garg

Page 21

Chapter 8 Companies Incorporated Outside India

8.6 - Service on foreign company [Sec. 383]

Manner of Any notice, or other document required to be served on a foreign

service of company shall be deemed to be sufficiently served,

notice etc. • if it is addressed to any person whose name and address have

to foreign been delivered to the Registrar u/s 380 of Companies Act, 2013

company

and

• it is left at the address which has been so delivered to the

Registrar, or

sent by post to the address which has been so delivered to the

Registrar, or

sent by electronic mode.

Important Questions

Q. No. 14: X Inc is a company registered in UK and carrying on Trading

Activity, with Principal Place of Business in Chennai. Since the

company did not obtain registration or make arrangement to file

Return, the GST Officer having jurisdiction, intends to serve show

cause notice on the Foreign Company. As Standing Counsel for the

department, advise the GST Officer on valid service of notice.

[Nov. 14 (4 Marks), MTP-Aug. 18]

HINT: Notice may be served in the manner as stated u/s 383.

8.7 - Debentures, annual return, registration of charges, books of account

and their inspection [Sec. 384]

Provisions Sec. Provisions of section 71 (Issue of Debentures) shall apply

as to 384(1) mutatis mutandis to a foreign company.

debentures

Compiled by: Pankaj Garg

Page 22

Chapter 8 Companies Incorporated Outside India

Provisions Sec. Provisions of section 92 (Preparation and filing of Annual

as to Annual 384(2) return) and Section 135 (Corporate Social

Return and Responsibility) shall, subject to such exceptions,

CSR modifications and adaptations as may be made therein

by rules made under this Act, apply to a foreign company

as they apply to a company incorporated in India.

Annual Return – Rule 7 of the Companies

(Registration of Foreign Companies) Rules, 2014

Every foreign company shall prepare and file, within a

period of 60 days from the last day of its financial year, to

the Registrar annual return in Form FC-4 along with

prescribed fee, containing the particulars as they stood

on the close of the financial year.

Provisions Sec. Provisions of section 128 (Books of account, etc., to be

as to Books 384(3) kept by company) shall apply to a foreign company to the

of Account extent of requiring it to keep at its principal place of

business in India, the books of account referred to in that

section, with respect to

• monies received and spent,

• sales and purchases made, and

• assets and liabilities, in the course of or in relation to

its business in India.

Provisions Sec. Provisions of Chapter VI (Registration of Charges,

as to 384(4) Sections 77-87) shall apply mutatis mutandis to charges

registration on properties which are created or acquired by any

of Charge foreign company.

Compiled by: Pankaj Garg

Page 23

Chapter 8 Companies Incorporated Outside India

Provisions Sec. Provisions of Chapter XIV (Inspection, inquiry and

of 384(5) investigation) shall apply mutatis mutandis to the Indian

Inspection, business of a foreign company as they apply to a

inquiry etc. company incorporated in India.

8.8 - Dating of prospectus and particulars to be contained therein [Sec. 387]

Prospectus No person shall issue, circulate or distribute in India any

to be dated prospectus offering to subscribe for securities of a company

and signed – • incorporated or to be incorporated outside India,

Sec. 387(1)

• whether the company has or has not established, or

• when formed will or will not establish, a place of business in

India,

unless the prospectus is dated and signed.

Particulars to be contained in Prospectus

(a) Prospectus must contain particulars with respect to the

following matters, namely:—

(i) the instrument constituting or defining the constitution of

the company

(ii) the enactments under which the company was

incorporated;

(iii) address in India where the said instrument, enactments, or

copies thereof, and if the same are not in the English

Compiled by: Pankaj Garg

Page 24

Chapter 8 Companies Incorporated Outside India

language, a certified translation thereof in the English

language can be inspected;

(iv) the date on which and the country in which the company

would be or was incorporated; and

(v) whether the company has established a place of business in

India and, if so, the address of its principal office in India:

Provided that points (i), (ii) and (iii) shall not apply in the case

of a prospectus issued more than 2 years after the date at which

the company is entitled to commence business.

(b) Prospectus must state the matters specified u/s 26.

No waiver of Any condition requiring or binding an applicant for securities to

compliance waive compliance with any requirement imposed by virtue of Sec.

in 387(1) shall be void.

prospectus

- Sec. 387(2)

Form of • No person shall issue to any person in India a form of application

application for securities of such a company or intended company, unless the

for form is issued with a prospectus which complies with the

securities to provisions of this Chapter and such issue does not contravene the

be issued provisions of section 388.

along with

• However, this requirement shall not apply if it is shown that the

prospectus-

form of application was issued in connection with a bona fide

Sec. 387(3)

invitation to a person to enter into an underwriting agreement

with respect to securities.

Compiled by: Pankaj Garg

Page 25

Chapter 8 Companies Incorporated Outside India

Exception to (a) Section 387 shall not apply to the issue, to existing members

Sec. 387 or debenture holders of a company, of a prospectus or form of

- Sec. 387(4) application relating to securities of the company, whether an

applicant for securities will or will not have the right to

renounce in favour of other persons;

(b) Section 387 (except in so far as it requires a prospectus to be

dated) shall not apply to the issue of a prospectus relating to

securities which are or are to be in all respects uniform

with securities previously issued and for the time being dealt

in or quoted on a recognised stock exchange.

Important Questions

Q. No. 15: Under section 387 of the Companies Act, 2013, what are particulars

required to be incorporated in a prospectus to be issued by an

existing foreign company?

HINT: Refer Section 387(1)

Q. No. 16: Blue Berry Ltd. is a Company incorporated outside India. 50% of its

preference share capital and 20% of its equity share capital are

held by Companies incorporated in India. It issued prospectus

inviting subscriptions in India for its share but did not state the

Country in which it is incorporated. Examine in the light of the

provisions of the Companies Act, 2013 whether the issue of

prospectus by the Company in valid.

[May 19 – Old Syllabus (2 Marks)]

HINT: Refer Sec. 387(1). Issue of prospectus is not valid as it does not

contain the particulars as prescribed u/s 387(1).

Compiled by: Pankaj Garg

Page 26

Chapter 8 Companies Incorporated Outside India

8.9 - Provisions as to expert’s consent and allotment (Sec. 388)

Requirement No person shall issue, circulate or distribute in India any

as to Expert’s prospectus offering for subscription in securities of a company

consent • incorporated or to be incorporated outside India,

– Sec. 388(1)

• whether the company has or has not been established, or

• when formed will or will not establish, a place of business in

India,—

if, where the prospectus includes a statement purporting to be

made by an expert,

(a) expert has not given his written consent to the issue of

prospectus, or

(b) expert has before delivery of the prospectus for registration

withdrawn, his written consent to the issue of the prospectus,

or

(c) there does not appear in the prospectus a statement that

expert has given and has not withdrawn his consent as

aforesaid.

Deeming A statement shall be deemed to be included in a prospectus, if it is

provision contained in any report or memorandum

- Sec. 388(2) • appearing on the face thereof or

• by reference incorporated therein or

• issued therewith.

Compiled by: Pankaj Garg

Page 27

Chapter 8 Companies Incorporated Outside India

8.10 - Registration of Prospectus (Sec. 389)

Conditions No person shall issue, circulate or distribute in India any

for issue or prospectus offering for subscription in securities of a company

circulation of • incorporated or to be incorporated outside India,

prospectus

• whether the company has or has not established, or

– Sec. 389

• when formed will or will not establish, a place of business in

India,

unless before the issue, circulation or distribution of the

prospectus in India,

(a) a copy thereof certified by the chairperson of the company and

two other directors of the company as having been approved

by resolution of the managing body has been delivered for

registration to the Registrar, and

(b) the prospectus states on the face of it that a copy has been so

delivered, and

(c) there is endorsed on or attached to the copy, any consent to

the issue of the prospectus required by section 388 and such

documents as may be prescribed.

Documents to be Annexed to Prospectus – Rule 11 of the

Companies (Registration of Foreign Companies) Rules, 2014

The following documents shall be annexed to the prospectus,

namely:

Compiled by: Pankaj Garg

Page 28

Chapter 8 Companies Incorporated Outside India

(a) any consent to the issue of the prospectus required from any

person as an expert;

(b) a copy of contracts for appointment of managing director or

manager and in case of a contract not reduced into writing, a

memorandum giving full particulars thereof;

(c) a copy of any other material contracts, not entered in the

ordinary course of business, but entered within preceding 2

years;

(d) a copy of underwriting agreement; and

(e) a copy of power of attorney, if prospectus is signed through

duly authorized agent of directors.

Important Questions

Q. No. 17: Chang Limited, a company incorporated in Singapore proposes to

issue prospectus offering its securities in India. The Company has

no established place of business in India.

The officer in charge of the issue of the prospectus in India seeks

your opinion regarding the provisions relating to registration of

the prospectus under the Companies Act, 2013. List out the

documents required to be enclosed with the prospectus.

[May 18 – Old Syllabus (4 Marks)]

HINT: Refer Section 389 and Rule 11 of the Companies (Registration of

Foreign Companies) Rules, 2014.

Compiled by: Pankaj Garg

Page 29

Chapter 8 Companies Incorporated Outside India

8.11 - Other Provisions (Sec. 390, 391, 392 & 393)

Offer of IDRs Central Government may make rules for:

– Sec. 390 (a) the offer of IDR;

(b) the requirement of disclosures in prospectus or letter of offer

issued in connection with IDRs;

(c) the manner in which the IDRs shall be dealt with in a

depository mode and by custodian and underwriters; and

(d) the manner of sale, transfer or transmission of IDRs,

by a company incorporated or to be incorporated outside India,

whether the company has or has not established, or will or will

not establish, any place of business in India.

Issue of Indian Depository Receipts (IDRs) – Rule 13 of the

Companies (Registration of Foreign Companies) Rules, 2014

For the purpose of section 390, no company incorporated or to be

incorporated outside India, whether the company has or has not

established, or may or may not establish, any place of business in

India shall make an issue of IDRs unless it complies with the

• conditions mentioned under this rule,

• SEBI (ICDR) Regulations, 2009 and

• any directions issued by the RBI.

Application of The provisions of Sections 34 to 36 (both inclusive) shall apply to

sections 34 to (a) the issue of a prospectus by a company incorporated outside

36 and India u/s 389 as they apply to prospectus issued by an Indian

Chapter XX - company;

Sec. 391

(b) the issue of Indian Depository Receipts by a foreign company.

Compiled by: Pankaj Garg

Page 30

Chapter 8 Companies Incorporated Outside India

Subject to the provisions of Sec. 376, the provisions of Chapter

XX (Winding up) shall apply mutatis mutandis for closure of

the place of business of a foreign company in India as if it were

a company incorporated in India in case such foreign company

has raised monies through offer or issue of securities under

this Chapter which have not been repaid or redeemed.

Punishment If a foreign company contravenes the provisions of this Chapter,

for (a) the foreign company shall be punishable with

contravention

• fine which shall not be less than Rs. 1 lakh but which may

- Sec. 392

extend to Rs. 3 lakhs and

• in the case of a continuing offence, with an additional

fine which may extend to Rs. 50,000 for every day after

the first during which the contravention continues and

(b) every officer of the foreign company who is in default shall

be punishable with imprisonment for a term which may

extend to 6 months or with fine which shall not be less than

Rs. 25,000 but which may extend to Rs. 5 lakhs or with both.

Company’s (a) Any failure by a company to comply with the provisions of

failure to this Chapter shall not affect

comply with • the validity of any contract, dealing or transaction entered

provisions of into by the company or

this Chapter

• its liability to be sued in respect thereof.

not to affect

validity of (b) The company shall not be entitled to bring any suit, claim any

contracts, etc. set-off, make any counter-claim or institute any legal

- Sec. 393 proceeding in respect of any such contract, dealing or

transaction, until the company has complied with the

provisions of this Act applicable to it.

Compiled by: Pankaj Garg

Page 31

Chapter 8 Companies Incorporated Outside India

Important Questions

Q. No. 18: In case, a foreign company does not deliver its documents to the

Registrar of Companies as required u/s 380 of the Companies Act,

2013, state the penalty prescribed under the said Act, which can be

levied. [RTP-May 18]

Or

Ronnie Coleman ltd., a foreign company failed to deliver some

documents to the Registrar of Companies as required under section

380 of the companies Act, 2013. State the provisions of penalty

prescribed under the Act, which can be levied on Ronnie Coleman

Ltd. for its failure to deliver the documents.

[Nov. 18-New Syllabus (2 Marks)]

HINT: Refer Section 392.

----------------------

Compiled by: Pankaj Garg

Page 32

Chapter 8 Companies Incorporated Outside India

Scanner of Past Exam Questions – New Syllabus

Attempt Q. Topic Suggested Answer Marks

No. / Hints*

May 18 6(b) Practical Illustration on Rule 10 Refer Q. No. 11 2

Nov. 18 3(b) Determining status of foreign Refer Q. No. 5 8

company

6(b) Penalty for failure to deleiver the Refer Q. No. 18 2

documents

May 19# No Question asked 0

Nov. 19# 3(a) Determining status of foreign Refer Q. No. 6 8

company

May 20

Nov. 20

May 21

Nov. 21

*detailed answers are given in Practice Manual cum Scanner.

#From May 2019 exam, questions are covered only for Descriptive Part of Paper.

--------------------------

Compiled by: Pankaj Garg

Page 33

Chapter 8 Companies Incorporated Outside India

NOTES

_____________________________________ _____________________________________________

____________________________________________________ ______________________________

__________________________________________________________________________________

_____________________________________ _____________________________________________

__________________________________________________________________________________

_____________________________________ _____________________________________________

____________________________________________________ ______________________________

__________________________________________________________________________________

_____________________________________ _____________________________________________

__________________________________________________________________________________

_____________________________________ _____________________________________________

____________________________________________________ ______________________________

__________________________________________________________________________________

_____________________________________ _____________________________________________

__________________________________________________________________________________

_____________________________________ _____________________________________________

____________________________________________________ ______________________________

__________________________________________________________________________________

_____________________________________ _____________________________________________

__________________________________________________________________________________

_____________________________________ _____________________________________________

____________________________________________________ ______________________________

__________________________________________________________________________________

_____________________________________ _____________________________________________

__________________________________________________________________________________

_____________________________________ _____________________________________________

____________________________________________________ ______________________________

Compiled by: Pankaj Garg

Page 34

You might also like

- Business Plan For Direct Lending BusinessDocument5 pagesBusiness Plan For Direct Lending BusinessRhap Sody91% (11)

- The Ultimate Solution Summary Book Nov'23Document225 pagesThe Ultimate Solution Summary Book Nov'23r79qwkxcfj100% (1)

- Questions On Value PF SupplyDocument4 pagesQuestions On Value PF SupplyMadhuram SharmaNo ratings yet

- IPCC - FAST TRACK MATERIAL - 35e PDFDocument69 pagesIPCC - FAST TRACK MATERIAL - 35e PDFKunalKumarNo ratings yet

- Ooin@A/Sparchansraj: S.P.A.R.CDocument155 pagesOoin@A/Sparchansraj: S.P.A.R.CadsaNo ratings yet

- Ca Ipcc Accounts Suggested Answers May 2016 PDFDocument16 pagesCa Ipcc Accounts Suggested Answers May 2016 PDFMahavir ShahNo ratings yet

- GST Scanner by Meeta Mangal Mam PDFDocument86 pagesGST Scanner by Meeta Mangal Mam PDFRoopika Shetty100% (1)

- Questions - Income Tax Divyastra CH 7 - PGBPDocument19 pagesQuestions - Income Tax Divyastra CH 7 - PGBPArjun ThawaniNo ratings yet

- CA Inter Short Notes 2019 20 PDFDocument89 pagesCA Inter Short Notes 2019 20 PDFPrashant KumarNo ratings yet

- Chapter 8 Law DividendDocument39 pagesChapter 8 Law DividendNOOB GAMER RELOADEDNo ratings yet

- Income Tax AY 18-19 Vol I PDFDocument224 pagesIncome Tax AY 18-19 Vol I PDFAashish Kumar SinghNo ratings yet

- DT Combined CA INTERDocument203 pagesDT Combined CA INTERkarthick rajNo ratings yet

- AmalgamationDocument34 pagesAmalgamationNishant Jha Mcom 2No ratings yet

- Chapter 2 - IND AS 1 Presentation of Financial StatementsDocument22 pagesChapter 2 - IND AS 1 Presentation of Financial StatementsAmbati Madhava ReddyNo ratings yet

- Chapter 4 Share Capital and DebenturesDocument102 pagesChapter 4 Share Capital and DebenturesAbhay Sharma100% (1)

- Inter QuestionnareDocument23 pagesInter QuestionnareAnsh NayyarNo ratings yet

- PGBPDocument45 pagesPGBPNidhi Lath100% (1)

- Chapter - 2 Incorporation of CompanyDocument34 pagesChapter - 2 Incorporation of CompanyShyam ShelkeNo ratings yet

- CA Test - 4 Key AnswerDocument5 pagesCA Test - 4 Key AnswerVaishnavi SNo ratings yet

- Alteration of MOADocument2 pagesAlteration of MOAVishnu Teja AnnamrajuNo ratings yet

- Chapter 5 GST - ProblemsDocument10 pagesChapter 5 GST - Problemsbalaji RNo ratings yet

- FCRA (PPT Notes)Document26 pagesFCRA (PPT Notes)Udaykiran Bheemagani100% (1)

- 03c GST Question Bank CA Inter June 2020 Exam 5th EditionDocument178 pages03c GST Question Bank CA Inter June 2020 Exam 5th Editionk kakkarNo ratings yet

- 3-Charge GSTDocument19 pages3-Charge GSTamit jangraNo ratings yet

- 7 Finalnew Sugg June09Document17 pages7 Finalnew Sugg June09mknatoo1963No ratings yet

- FM Rocks Book by CA Swapnil PatniDocument124 pagesFM Rocks Book by CA Swapnil Patniraj bawaNo ratings yet

- Advanced Accounting Study MaterialDocument974 pagesAdvanced Accounting Study MaterialPrashant Sagar Gautam100% (2)

- 02D. Cma Inter Direct Tax Practice Test Series - Ay 2020-21Document210 pages02D. Cma Inter Direct Tax Practice Test Series - Ay 2020-21Himanshu RajNo ratings yet

- Chapter 10 Set Off and Carry Forward of Losses PMDocument12 pagesChapter 10 Set Off and Carry Forward of Losses PMMohammad Yusuf NabeelNo ratings yet

- Unit 5: Account Current: Learning OutcomesDocument16 pagesUnit 5: Account Current: Learning OutcomessajedulNo ratings yet

- Accounts RTP May 23Document34 pagesAccounts RTP May 23ShailjaNo ratings yet

- CG Notes PDFDocument49 pagesCG Notes PDFT S NarasimhanNo ratings yet

- Final Accounts/ Financial StatementsDocument53 pagesFinal Accounts/ Financial Statementsrachealll100% (1)

- CA Inter - Law - IL - 13052023 - May23 - CompressedDocument276 pagesCA Inter - Law - IL - 13052023 - May23 - CompressedFlying fish100% (1)

- CA Inter Cost Blast From The Past PDFDocument83 pagesCA Inter Cost Blast From The Past PDFAashish TiwariNo ratings yet

- 1a CA Intermediate Income Tax Volume I Ay 23-24-20th EditionDocument426 pages1a CA Intermediate Income Tax Volume I Ay 23-24-20th EditionPRITESH JAINNo ratings yet

- Corporate Accounting AssignmentDocument6 pagesCorporate Accounting AssignmentKarthikacauraNo ratings yet

- Accounting Standard - 20 Earning Per Share Full NotesDocument16 pagesAccounting Standard - 20 Earning Per Share Full NotesKumar SwamyNo ratings yet

- Bos 58983Document20 pagesBos 58983Kartik0% (1)

- Ca Inter GST Module 1Document46 pagesCa Inter GST Module 1sukritisuman2No ratings yet

- GST - Last Day Revision Notes PDFDocument98 pagesGST - Last Day Revision Notes PDFShubham PathakNo ratings yet

- AS-20 QuestionDocument7 pagesAS-20 QuestionDeepthi R TejurNo ratings yet

- Honda Activa 4G Owners ManualDocument75 pagesHonda Activa 4G Owners ManualRoyal ENo ratings yet

- CS Executive Tax Laws Suggested Answers-1Document21 pagesCS Executive Tax Laws Suggested Answers-1nehaNo ratings yet

- E-Book On GST by CA. (DR.) G. S. Grewal - 2020Document58 pagesE-Book On GST by CA. (DR.) G. S. Grewal - 2020Aarav DhingraNo ratings yet

- Chapter - 5: Toppers Institute N.P.O.-QuestionsDocument32 pagesChapter - 5: Toppers Institute N.P.O.-QuestionsVivek kumarNo ratings yet

- House PropertyDocument18 pagesHouse PropertyNidhi LathNo ratings yet

- Law MTPDocument21 pagesLaw MTPMohit SharmaNo ratings yet

- DT Concept BookDocument268 pagesDT Concept BookAk KhanNo ratings yet

- Inp 2234 Tax Question PaperDocument11 pagesInp 2234 Tax Question PaperAnshit BahediaNo ratings yet

- Income TaxDocument79 pagesIncome TaxRaj HanumanteNo ratings yet

- Audit Under Fiscal Laws GST AuditDocument4 pagesAudit Under Fiscal Laws GST AuditRanjit BhogesaraNo ratings yet

- Paper - 4: Taxation Section A: Income TaxDocument24 pagesPaper - 4: Taxation Section A: Income TaxChhaya JajuNo ratings yet

- Limited Liability Partnership, 2008: © CA Darshan D. KhareDocument7 pagesLimited Liability Partnership, 2008: © CA Darshan D. KhareAshutosh shriwasNo ratings yet

- CA Inter Mighty 50Document47 pagesCA Inter Mighty 50INTER SMARTIANSNo ratings yet

- DepreciationDocument15 pagesDepreciationYash AggarwalNo ratings yet

- GST Notes For Vi SemesterDocument55 pagesGST Notes For Vi SemesterNagashree RANo ratings yet

- CA Inter GST Marathon NotesDocument133 pagesCA Inter GST Marathon NotesNandan Gambhir100% (1)

- Unit 5: Death of A PartnerDocument23 pagesUnit 5: Death of A PartnerKARTIK CHADHANo ratings yet

- 74739bos60488 m2 cp11Document38 pages74739bos60488 m2 cp11jhaa62538No ratings yet

- Foreign CompanyDocument36 pagesForeign Companysubhajit BeraNo ratings yet

- MTP 4 (Additional MCQ) - Q&ADocument19 pagesMTP 4 (Additional MCQ) - Q&ADeepsikha maitiNo ratings yet

- IBC Question BankDocument32 pagesIBC Question BankDeepsikha maitiNo ratings yet

- Ca Final SFM Super 100 Class 6 To 10 1Document32 pagesCa Final SFM Super 100 Class 6 To 10 1Deepsikha maitiNo ratings yet

- Time Limit Provision Page NoDocument4 pagesTime Limit Provision Page NoDeepsikha maitiNo ratings yet

- MTP 2 (Extra MCQ) - Question PaperDocument13 pagesMTP 2 (Extra MCQ) - Question PaperDeepsikha maitiNo ratings yet

- Financial Reporting ConceptsDocument240 pagesFinancial Reporting ConceptsDeepsikha maitiNo ratings yet

- Important Case Law Under Customs - CA Final Nov 20Document20 pagesImportant Case Law Under Customs - CA Final Nov 20Deepsikha maitiNo ratings yet

- Chapter 3 Appointment and Remuneration of Managerial PersonnelDocument67 pagesChapter 3 Appointment and Remuneration of Managerial PersonnelDeepsikha maitiNo ratings yet

- Chapter 2 Meetings of The Board and Its PowersDocument125 pagesChapter 2 Meetings of The Board and Its PowersDeepsikha maitiNo ratings yet

- Chapter 16 SARFESI, 2002Document58 pagesChapter 16 SARFESI, 2002Deepsikha maitiNo ratings yet

- Chapter 5 Compormises and ArrangementDocument41 pagesChapter 5 Compormises and ArrangementDeepsikha maitiNo ratings yet

- Chapter 15 FEMA 1999Document136 pagesChapter 15 FEMA 1999Deepsikha maitiNo ratings yet

- Direct Tax Laws & International Taxation Mock Test Paper SeriesDocument10 pagesDirect Tax Laws & International Taxation Mock Test Paper SeriesDeepsikha maitiNo ratings yet

- Direct Tax Laws & International Taxation Mock Test Paper SeriesDocument12 pagesDirect Tax Laws & International Taxation Mock Test Paper SeriesDeepsikha maitiNo ratings yet

- MTP 7Document17 pagesMTP 7Deepsikha maitiNo ratings yet

- Mock Test - 4-2Document16 pagesMock Test - 4-2Deepsikha maitiNo ratings yet

- Direct Tax Laws & International Taxation Mock Test Paper SeriesDocument11 pagesDirect Tax Laws & International Taxation Mock Test Paper SeriesDeepsikha maitiNo ratings yet

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiNo ratings yet

- Mock Test - Ca Final File-2Document16 pagesMock Test - Ca Final File-2Deepsikha maitiNo ratings yet

- CHAPTER 18 Professional EthicsDocument66 pagesCHAPTER 18 Professional EthicsDeepsikha maitiNo ratings yet

- CHAPTER 5 Company AuditDocument47 pagesCHAPTER 5 Company AuditDeepsikha maitiNo ratings yet

- Capital Budgeting Challenger SeriesDocument17 pagesCapital Budgeting Challenger SeriesDeepsikha maitiNo ratings yet

- viewNitPdf 4141648Document7 pagesviewNitPdf 4141648Gaurav JainNo ratings yet

- A Report On Big Bazaar - Pantaloon Retail (India) Ltd.Document109 pagesA Report On Big Bazaar - Pantaloon Retail (India) Ltd.SUMANTO SHARAN82% (11)

- Commonwealth Bank StatementDocument5 pagesCommonwealth Bank StatementKate YehNo ratings yet

- Impact of Advertisement On Children Behaviour - Sanjukta BanerjeeDocument57 pagesImpact of Advertisement On Children Behaviour - Sanjukta BanerjeeSanjukta BanerjeeNo ratings yet

- 11 - Chapter 4 The Valuation of Long-Term SecuritiesDocument53 pages11 - Chapter 4 The Valuation of Long-Term SecuritiesIni Ichiii100% (1)

- Ohs-Pr-09-26-F01 Initial Incident Notification 26.1 (2022)Document2 pagesOhs-Pr-09-26-F01 Initial Incident Notification 26.1 (2022)Shafie ZubierNo ratings yet

- CREDAI MCHI Property Exhibition Exhibitor Catalogue 2019 NewDocument67 pagesCREDAI MCHI Property Exhibition Exhibitor Catalogue 2019 NewMithun LokareNo ratings yet

- Edelweiss Small Cap Fund - PresentationDocument33 pagesEdelweiss Small Cap Fund - PresentationIshteyaq SiddiquiNo ratings yet

- Cost of Capital: Required Returns and The Cost of Capital Required Returns and The Cost of CapitalDocument51 pagesCost of Capital: Required Returns and The Cost of Capital Required Returns and The Cost of CapitalDanielNo ratings yet

- MATERI - HRA N OH Program SHED May 2023.Document23 pagesMATERI - HRA N OH Program SHED May 2023.muhammad sandriyanNo ratings yet

- 005 - 1965 - Law Relating To TaxationDocument15 pages005 - 1965 - Law Relating To TaxationSubhayan BoralNo ratings yet

- Rafhan Maize Products Company LTDDocument10 pagesRafhan Maize Products Company LTDALI SHER HaidriNo ratings yet

- Day Trading PEG Red To Green SetupsDocument5 pagesDay Trading PEG Red To Green Setupsarenaman0528No ratings yet

- Appointment Letter-Sayali Maral - For MergeDocument7 pagesAppointment Letter-Sayali Maral - For MergeSEPADU TECH PVT. LTDNo ratings yet

- Punjab National Bank LTD Vs Shri Vikram Cotton Mis690032COM866345Document7 pagesPunjab National Bank LTD Vs Shri Vikram Cotton Mis690032COM866345Ishaan ShettyNo ratings yet

- Take Home ExamDocument12 pagesTake Home ExamShar KhanNo ratings yet

- Principles and Framework For Procuring Sustainably - Guide: BSI Standards PublicationDocument78 pagesPrinciples and Framework For Procuring Sustainably - Guide: BSI Standards PublicationAlejandro SoraireNo ratings yet

- Florida Sport Fishing November-December 2017Document164 pagesFlorida Sport Fishing November-December 2017rwplothowNo ratings yet

- Unit 2: General Concepts and Principles of AccountingDocument12 pagesUnit 2: General Concepts and Principles of AccountingChen HaoNo ratings yet

- Define Negotiation. and Discuss Various Tactics Adopted in NegotiationDocument7 pagesDefine Negotiation. and Discuss Various Tactics Adopted in NegotiationRicha UpadhyayNo ratings yet

- Other Disclosures and AuthorizationsDocument13 pagesOther Disclosures and AuthorizationsANKIT SINGHNo ratings yet

- Terms and Conditions For Wholesale Supply of Goods Template SampleDocument3 pagesTerms and Conditions For Wholesale Supply of Goods Template SampleLegal ZebraNo ratings yet

- Chapter 6 LearningDocument28 pagesChapter 6 Learningفيصل ابراهيمNo ratings yet

- Soumil Final Project PDFDocument56 pagesSoumil Final Project PDFSoumil SoganiNo ratings yet

- Valuation Report - Lot No.2 - BelgaumDocument13 pagesValuation Report - Lot No.2 - BelgaumOmkar BhosaleNo ratings yet

- Chapter 2Document4 pagesChapter 2Roselie Cuenca94% (16)

- Warehouse InchargeDocument2 pagesWarehouse InchargeAmanullah AmarNo ratings yet

- OSX ManagerialAccounting Ch12 PPTDocument40 pagesOSX ManagerialAccounting Ch12 PPTDiệp ThanhNo ratings yet