Professional Documents

Culture Documents

Chapter 4 Inspection Inquiry and Invetsigation

Chapter 4 Inspection Inquiry and Invetsigation

Uploaded by

Deepsikha maitiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 4 Inspection Inquiry and Invetsigation

Chapter 4 Inspection Inquiry and Invetsigation

Uploaded by

Deepsikha maitiCopyright:

Available Formats

Chapter 4 Inspection, Inquiry and Investigation

Chapter 4

Inspection, Inquiry and Investigation

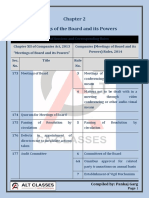

Chapter XIV of Companies Act, 2013 (Sec. 206 – 229)*

Inspection, Inquiry and Investigation

Sec. 206 Power to call for information, Sec. 218 Protection of employees

inspect books and conduct during investigation.

inquiries.

Sec. 207 Conduct of inspection and Sec. 219 Power of inspector to

inquiry. conduct investigation into

affairs of related

companies, etc.

Sec. 208 Report on inspection made. Sec. 220 Seizure of documents by

inspector.

Sec. 209 Search and seizure. Sec. 221 Freezing of assets of

company on inquiry and

investigation.

Sec. 210 Investigation into affairs of Sec. 222 Imposition of restrictions

company. upon securities.

Sec. 211 Establishment of Serious Sec. 223 Inspector’s report.

Fraud Investigation Office.

Sec. 212 Investigation into affairs of Sec. 224 Actions to be taken in

Company by Serious Fraud pursuance of inspector’s

Investigation Office. report.

Compiled by: Pankaj Garg

Page 1

Chapter 4 Inspection, Inquiry and Investigation

Sec. 213 Investigation into company’s Sec. 225 Expenses of investigation.

affairs in other cases.

Sec. 214 Security for payment of costs Sec. 226 Voluntary winding up of

and expenses of investigation. company, etc., not to stop

investigation proceedings.

Sec. 215 Firm, body corporate or Sec. 227 Legal advisers and bankers

association not to be not to disclose certain

appointed as inspector. information.

Sec. 216 Investigation of ownership of Sec. 228 Investigation, etc., of

company. foreign companies.

Sec. 217 Procedure, powers, etc., of Sec. 229 Penalty for furnishing false

inspectors. statement, mutilation,

destruction of documents.

*Related Rules are covered in Companies (Inspection, Investigation and Inquiry)

Rules, 2014

4.1 - Power to call for information, inspect books and conduct inquiries (Sec.

206)

Power of the Circumstances Where

Registrar to in which • on a scrutiny of any document filed by a

call for Registrar can company

information, exercise

or

explanation power

or documents • on any information received by him,

– Sec. 206(1) the Registrar is of the opinion that

Compiled by: Pankaj Garg

Page 2

Chapter 4 Inspection, Inquiry and Investigation

• any further information or

• explanation or

• any further documents relating to the

company

is necessary.

Power of Registrar may by a written notice require the

registrar company—

(a) to furnish in writing such information or

explanation; or

(b) to produce such documents,

within such reasonable time, as may be specified

in the notice.

Duty of the On the receipt of a notice u/s 206(1), it shall be the duty of the

company and company and of its officers concerned

its officers – • to furnish such information or explanation to the best of their

Sec. 206(2) knowledge and power

and

• to produce the documents to the Registrar

within the time specified or extended by the Registrar.

Duty of past officers of the company – Proviso to Sec. 206(2)

Where such information or explanation relates to any past period,

the officers who had been in the employment of the company for

such period, if so called upon by the Registrar through a notice

served on them in writing, shall also furnish such information or

explanation to the best of their knowledge.

Compiled by: Pankaj Garg

Page 3

Chapter 4 Inspection, Inquiry and Investigation

Notice for Circumstances (a) If no information or explanation is furnished

inspection of in which to the Registrar within the time specified u/s

books etc. Notice can be 206(1); or

served

- Sec. 206 (3) (b) If the Registrar on an examination of the

documents furnished is of the opinion that

the information or explanation furnished is

inadequate; or

(c) If the Registrar is satisfied on a scrutiny of

the documents furnished that an

unsatisfactory state of affairs exists in the

company and the information or documents

do not disclose a full and fair statement of

the information required.

However, before serving notice under this sub-

section, the Registrar shall record his reasons in

writing for issuing such notice.

Power of The Registrar may by another written notice

Registrar call on the company to produce for his

inspection such further books of account,

books, papers and explanations as he may

require at such place and at such time as he may

specify in the notice.

Compiled by: Pankaj Garg

Page 4

Chapter 4 Inspection, Inquiry and Investigation

Inquiry by the If the Registrar is satisfied

Registrar • on the basis of information available with or furnished to him

- Sec. 206 (4) or

• on a representation made to him by any person that

• the business of a company is being carried on for a fraudulent

or unlawful purpose or not in compliance with the provisions

of this Act

or

• if the grievances of investors are not being addressed,

the Registrar may by a written order, call on the company to

furnish in writing any information or explanation on matters

specified in the order within such time as he may specify therein

and carry out such inquiry as he deems fit after providing the

company a reasonable opportunity of being heard.

Before passing such an order, the Registrar has to inform the

company of the allegations made against it.

Points to remember

(a) The C.G. may, if it is satisfied that the circumstances so

warrant, direct the Registrar or an inspector appointed by

it for the purpose to carry out the inquiry u/s 206(4).

(b) If it is concluded that business of a company has been or is

being carried on for a fraudulent or unlawful purpose,

every officer of the company who is in default shall be

punishable for fraud in the manner as provided in section

447.

Compiled by: Pankaj Garg

Page 5

Chapter 4 Inspection, Inquiry and Investigation

Inspection by • Without prejudice to the foregoing provisions of Section 206,

C.G. the C.G. may, if it is satisfied that the circumstances so warrant,

– Sec. 206(5) direct inspection of books and papers of a company by an

& 206(6) inspector appointed by it for the purpose.

• The C.G. may, having regard to the circumstances by general or

special order, authorise any statutory authority to carry out

the inspection of books of account of a company or class of

companies.

Points to remember

Power to appoint inspector for inspection of books and papers

has been delegated by C.G. to Regional Directors.

Penalty for • If a company fails to furnish any information or explanation or

Contravention produce any document required under this section, the

– Sec. 206(7) company and every officer of the company, who is in default

shall be punishable with a fine upto Rs. 1 Lac

AND

• in the case of a continuing failure, with an additional fine

which may extend to Rs. 500 for every day after the first

during which the failure continues.

Important Questions

Q. No. 1: A notice was sent to Mr. Left by the registrar to furnish the

information related to a business transacted during his tenure in

the X company. Mr. Left ignored the notice considering that he is no

more an employee of X company. Registrar issued the summon

against Mr. Left. Explain in the light of the Companies Act, 2013

about the liability of the Mr. Left in the given case. [RTP-May 16]

HINT: Mr. Left is liable to provide such information. Refer Section

206(2).

Compiled by: Pankaj Garg

Page 6

Chapter 4 Inspection, Inquiry and Investigation

Q. No. 2: A group of shareholders of M/s. FMG Limited made a complaint to

the concerned Registrar of Companies (RoC) that the business of the

Company is being carried on for unlawful and fraudulent purposes

and filed an application to enquire into the affairs of the Company.

Referring to and analyzing the provisions of the Companies Act,

2013, decide:

(i) Whether the RoC has the power to order for an inquiry into the

affairs of the Company?

(ii) If yes, state the procedure to be followed by the RoC.

(iii) Whether the inquiry should be pursued by the RoC in case the

complaint is withdrawn by the same group of shareholders

subsequent to the Order for enquiry?

(iv) Whether the Central Government has the power to direct the

RoC to carry out the inquiry? [Nov. 19 – New Syllabus (4 Marks)]

HINT: Refer Sec. 206(4). (i) Yes (iii) Yes (iv) Yes.

4.2 - Conduct of Inspection and Inquiry (Sec. 207)

Duty of Where a Registrar or Inspector calls for the books of account and

director, other books and papers u/s 206, it shall be the duty of every

officer or director, officer or other employee of the company:

employee (a) to produce all such documents to the Registrar or Inspector;

- Sec. 207(1) (b) to furnish him with such statements, information or

explanations in such form as the Registrar or Inspector may

require; and

(c) to render all assistance to the Registrar or Inspector in

connection with such inspection.

Compiled by: Pankaj Garg

Page 7

Chapter 4 Inspection, Inquiry and Investigation

Powers of the The Registrar or Inspector making an inspection or inquiry u/s

Registrar or 206 may, during the course of such inspection or inquiry, as the

inspector to case may be,

make copies (1) make or cause to be made copies of books of account and

– Sec. 207(2) other books and papers;

or

(2) place or cause to be placed any marks of identification in

such books in token of the inspection having been made.

Powers of The Registrar or Inspector making an inspection or inquiry shall

Registrar or have all the powers as are vested in a civil court under the Code of

Inspector as Civil Procedure, 1908, while trying a suit in respect of the

vested in Civil following matters, namely:

Court (1) the discovery and production of books of account and other

- Sec. 207(3) documents, at such place and time as may be specified by

such Registrar or Inspector making the inspection or

inquiry;

(2) summoning and enforcing the attendance of persons and

examining them on oath; and

(3) inspection of any books, registers and other documents of

the company at any place.

Penalty for • If any director or officer of the company disobeys the direction

Contravention issued by the Registrar or the Inspector under this section, the

– Sec. 207(4) director or the officer shall be punishable with imprisonment

which may extend to 1 year AND with fine which ranges from

Rs. 25,000 to Rs. 1 Lac.

Compiled by: Pankaj Garg

Page 8

Chapter 4 Inspection, Inquiry and Investigation

• If a director or an officer of the company has been convicted of

an offence under this section, the director or the officer shall,

on and from the date on which he is so convicted, be deemed to

have vacated his office as such and on such vacation of office,

shall be disqualified from holding an office in any company.

4.3 - Report on inspection made (Sec. 208)

Report to C.G. • The Registrar or inspector shall, after the inspection of the

books of account or an inquiry u/s 206 and other books and

papers of the company u/s section 207, submit a report in

writing to the Central Government* along with such

documents, if any

AND

• such report may, if necessary, include a recommendation that

further investigation into the affairs of the company is

necessary giving his reasons in support.

*Powers are delegated to regional Directors.

Important Questions

Q. No. 3: The Registrar, after inspection of the book of accounts of the PQR

Ltd., submitted its report with further recommendation of

investigation into the affairs of the company. Explain the law as to

the recommendation for further investigation by the registrar.

[MTP-Oct.18]

HINT: Refer Sec. 208.

Compiled by: Pankaj Garg

Page 9

Chapter 4 Inspection, Inquiry and Investigation

4.4 - Search and Seizure (Sec. 209)

Circumstances Where, upon information in his possession or otherwise, the

for seizure Registrar or Inspector has reasonable ground to believe that the

- Sec. 209(1) books and papers of

• a company, or

• relating to the key managerial personnel or any director or

auditor or company secretary in practice if the company has

not appointed a company secretary,

are likely to be destroyed, mutilated, altered, falsified or secreted,

he may, after obtaining an order from the Special Court for

the seizure of such books and papers,

(1) enter, with such assistance as may be required, and search,

the place or places where such books or papers are kept;

AND

(2) seize such books and papers as he considers necessary after

allowing the company to take copies of, or extracts from, such

books or papers at its cost.

Period of • The Registrar or inspector shall return the books and papers

seizure – Sec. seized, as soon as may be, and in any case not later than 180th

209(2) day after such seizure, to the company from whose custody or

power such books or papers were seized.

• The books and papers may be called for by the Registrar or

Inspector for a further period of 180 days by an order in

writing if they are needed again.

Compiled by: Pankaj Garg

Page 10

Chapter 4 Inspection, Inquiry and Investigation

Taking of copies, placing identification marks – 2nd proviso to

Sec. 209(2)

The Registrar or inspector may, before returning such books and

papers as aforesaid, take copies of, or extracts from them or place

identification marks on them or any part thereof or deal with the

same in such other manner as he considers necessary.

Important Question

Q. No. 4: A group of creditors of Mac Trading Limited makes a complaint to

the Registrar of Companies, Hyderabad alleging that the

management of the company is indulging in destruction and

falsification of the accounting records of the company. The

complainants request the Registrar to take immediate steps to seize

the records of the company so that the management may not be

allowed to tamper with the records. The complaint was received at

11 A.M. on 6th June 2019and the ROC entered the premises at 11.30

A.M. for the search.

Examine the powers of the Registrar to seize the books of the

company. [May 16 (4 Marks)]

Or

A group of creditors of XYZ Limited makes a complaint to the

Registrar of Companies, Gujarat alleging that the management of the

company is indulging in destruction and falsification of the

accounting records of the company. The complainants request the

Registrar to take immediate steps to seize the records of the

company so that the management may not be allowed to tamper

with the records. The complaint was received at 11 A.M. on 06th June,

2019 and the registrar has attempted to enter the premise of

company but has been denied by the company, due to not having

Compiled by: Pankaj Garg

Page 11

Chapter 4 Inspection, Inquiry and Investigation

order from special court.

Is the contention of company being valid in terms of Companies Act,

2013? [RTP-Nov. 18]

HINT: Refer Sec. 209(1). Registrar is not authorized to enter, search and

seizure without obtaining order from Special Court.

4.5 - Investigation into affairs of company (Sec. 210)

Circumstances Where the C.G. is of the opinion, that it is necessary to investigate

when into the affairs of a company,

Investigation (a) on the receipt of a report of the Registrar or Inspector u/s

may be 208;

ordered by

(b) on intimation of a special resolution passed by a company

C.G.

that the affairs of the company ought to be investigated; or

- Sec. 210(1)

(c) in public interest,

it may order an investigation into the affairs of the company.

Investigation Where an order is passed by a court or the Tribunal in any

on Court or proceedings before it that the affairs of a company ought to be

Tribunal investigated, the Central Government shall order an investigation

order into the affairs of that company.

– Sec. 210(2)

Appointment For the purposes of this section, the Central Government may

of inspectors appoint one or more persons as inspectors to investigate into the

– Sec. 210(3) affairs of the company and to report thereon in such manner as

the Central Government may direct.

Compiled by: Pankaj Garg

Page 12

Chapter 4 Inspection, Inquiry and Investigation

Important Questions

Q. No. 5: Shareholders of Hide and Seek Ltd. are not satisfied about

performance of the company. It is suspected that some activities

being run in the name of the company are not in the interest of the

company or its members. 101 out of total 500 shareholders of the

company have made an application to the Central Government to

appoint an inspector to carry out investigation and find out the

true picture.

With reference to the provisions of the Companies Act, 2013,

mention whether the shareholders’ application will be accepted?

Elaborate. [Nov. 15 (4 Marks)]

Or

Shareholders of Akash Ltd. not satisfied with the performance of

the company inferred that some activities conducted by the

company are against the interest of the members of the company.

Group of shareholders of the company filed an application to the

Central Government to appoint an inspector to carry out

investigation to look into the matter.

With reference to the provisions of the Companies Act, 2013,

mention whether the shareholders’ application is tenable?

Elaborate.

HINT: Application will not be accepted as special resolution not passed.

Refer Section 210(1). Alternatively, in public interest, C.G. has discretion

to order for the investigation.

Q. No. 6: A majority of the Board of directors of M/s High Value InfoTech Ltd.

have realized that some of the business activities carried out in the

name of the company is not in the interest of either the company or

Compiled by: Pankaj Garg

Page 13

Chapter 4 Inspection, Inquiry and Investigation

its members. They want that the company should make an

application to the Central Government to appoint an Inspector to

carry out investigation and find out the whole truth. Explain the

steps that should be taken to achieve the purpose and draft the

application under the Companies Act, 2013.

HINT: Special Resolution need to be passed and application to be made to

C.G. Refer Section 210(1).

4.6 - Establishment of Serious Fraud Investigation Office (SFIO) (Sec. 211)

Setting up of The C.G. shall, by notification, establish an office to be called the

SFIO SFIO to investigate frauds relating to a company.

– Sec.

211(1)

Composition Sec. 211 (2) SFIO shall be headed by a Director, and consist of

of SFIO such number of experts from the following fields to

be appointed by the C.G. from amongst persons of

ability, integrity and experience in,

(1) banking;

(2) corporate affairs;

(3) taxation;

(4) forensic audit;

(5) capital market;

(6) information technology;

(7) law; or

(8) such other fields as may be prescribed (Rule 3).

Compiled by: Pankaj Garg

Page 14

Chapter 4 Inspection, Inquiry and Investigation

Sec. 211(3) The Central Government shall, by notification,

appoint a Director in the SFIO, who shall be an officer

not below the rank of a Joint Secretary to the

Government of India having knowledge and

experience in dealing with matters

relating to corporate affairs.

Sec. 211(4) The Central Government may appoint such experts

and other officers and employees in the SFIO as it

considers necessary for the efficient discharge of its

functions under this Act.

Appointment of persons having expertise in various fields –

Rule 3 of The Companies (Inspection, Investigation and

Inquiry) Rules, 2014,

The Central Government may appoint persons having expertise in

the fields of

• investigations,

• cyber forensics,

• financial accounting,

• management accounting,

• cost accounting and

• any other fields as may be necessary for the efficient discharge of

SFIO functions under the Act.

Terms and • The terms and conditions of service of Director, experts, and

conditions other officers and employees of the SFIO shall be such as may be

of service prescribed.

• Rule 4 of Companies (Inspections, Investigations and Inquiry)

– Sec.

Rules, 2014 laid down the terms and conditions of service of the

211(5)

abovementioned officers.

Compiled by: Pankaj Garg

Page 15

Chapter 4 Inspection, Inquiry and Investigation

Important Question

Q. No. 7: Explain the provisions of the Companies Act, 2013 relating to the

establishment of Serious Fraud Investigation Office by the Central

Government. State its composition. [RTP Nov. 2016]

HINT: Refer Section 211.

4.7 - Investigation into affairs of Company by Serious Fraud Investigation

Office (Sec. 212)

Assigning Without prejudice to the provisions of Sec. 210, where the C.G. is of

investigation the opinion that it is necessary to investigate into the affairs of a

to SFIO company by the SFIO -

– Sec. 212(1) (a) on receipt of a report of the Registrar or inspector u/s 208;

(b) on intimation of a special resolution passed by a company that

its affairs are required to be investigated;

(c) in the public interest; or

(d) on request from any Department of the Central Government or

a State Government,

it may, by order, assign the investigation into the affairs of the said

company to the SFIO.

Designating On receipt of such order, the Director, SFIO may

Inspectors designate such number of inspectors, as he may

consider necessary for the purpose of such

investigation.

Compiled by: Pankaj Garg

Page 16

Chapter 4 Inspection, Inquiry and Investigation

Effect of • Where any case has been assigned by the C.G. to the SFIO for

Assigning investigation under this Act, no other investigating agency of

Investigation Central Government or any State Government shall proceed

to SFIO over with investigation in such case in respect of any offence under

other this Act.

investigation • In case any such investigation has already been initiated, it shall

agencies not be proceeded further with and the concerned agency shall

– Sec. 212(2) transfer the relevant documents and records in respect of such

offences under this Act to SFIO.

Manner of • Where the investigation into the affairs of a company have been

Investigation assigned by the C.G. to SFIO, it shall conduct the investigation in

by SFIO – Sec. the manner and follow the procedure provided in this Chapter

212(3) & (Chapter XIV).

212(4) • SFIO shall submit its report to C.G. within such period as may be

specified in the order.

• The Director, SFIO shall cause the affairs of the company to be

investigated by an Investigating Officer who shall have the

power of the inspector under section 217.

Duties of The company and its officers and employees, who are or have been

company, its in employment of the company shall be responsible to provide

Officers or • all information,

employees

• explanation,

– Sec. 212(5) • documents and

• assistance to the Investigating Officer as he may require for

conduct of the investigation.

Compiled by: Pankaj Garg

Page 17

Chapter 4 Inspection, Inquiry and Investigation

Cognizable Offences covered u/s 447 of this Act shall be cognizable and no

nature of person accused of any such offence shall be released on bail or on

offence – Sec. his own bond unless—

212(6) (a) the Public Prosecutor has been given an opportunity to

oppose the application for such release; and

(b) where the Public Prosecutor opposes the application, the

court is satisfied that there are reasonable grounds for

believing that he is not guilty of such offence and that he is

not likely to commit any offence while on bail.

However, a person, who, is under the age of 16 years or is a

woman or is sick or infirm, may be released on bail, if the Special

Court so directs.

The Special Court shall not take cognizance of any offence referred

in this sub section except upon a complaint in writing made by—

(a) the Director, SFIO; or

(b) any officer of the C.G. authorised, by a general or special

order in writing in this behalf by that Government.

Sec. 212(7) The limitation on granting of bail specified in Sec.

212(6) is in addition to the limitations under the

Code of Criminal Procedure, 1973 or any other law

for the time being in force on granting of bail

Provisions as Sec. 212(8) If any officer not below the rank of Assistant

to powers of

Director of SFIO authorised in this behalf by the

SFIO Officers

to arrest the C.G. by general or special order, has on the basis of

accused material in his possession reason to believe (the

Compiled by: Pankaj Garg

Page 18

Chapter 4 Inspection, Inquiry and Investigation

reason for such belief to be recorded in writing)

that any person has been guilty of any offence

punishable under sections referred to in Sec.

212(6), he may arrest such person and shall, as

soon as may be, inform him of the grounds for

such arrest.

Sec. 212(9) • The Officer authorised u/s 212 (8) shall,

immediately after arrest of such person,

forward a copy of the order, along with the

material in his possession, to the SFIO in a

sealed envelope, in prescribed manner.

• SFIO shall keep such order and material for

such period as may be prescribed.

Sec. 212(10) • Every person so shall within 24 hours, be taken

to a Special Court or Judicial Magistrate or a

Metropolitan Magistrate, as the case may be,

having jurisdiction.

• The period of 24 hours shall exclude the time

necessary for the journey from the place of

arrest to the Special Court or c Magistrate's

court.

Note: Companies (Arrests in connection with Investigation by

SFIO) Rules, 2017 issued by the Central Government for the

purposes of Sec. 212 are given at end of this chapter as

Appendix 1.

Compiled by: Pankaj Garg

Page 19

Chapter 4 Inspection, Inquiry and Investigation

Provisions as Interim The SFIO shall submit an interim report to the C.G.,

to Reports of Report – Sec. if the Central Government so directs.

SFIO 212(11)

Investigation The SFIO shall submit the investigation report to

report – Sec. the Central Government on completion of the

212(12) investigation.

Obtaining a Notwithstanding anything contained in this Act or

copy of in any other law for the time being in force, a copy

report – Sec. of the investigation report may be obtained by any

212(13) person concerned by making an application in this

regard to the court.

Initiation of On receipt of the investigation report, the C.G. may, after

Prosecution – examination of the report (and after taking such legal advice, as it

Sec. 212(14) may think fit), direct the SFIO to initiate prosecution against the

company and its officers or employees, who are or have been in

employment of the company or any other person directly or

indirectly connected with the affairs of the company.

Filing Where the report under sub-section (11) or sub-section (12)

application states that fraud has taken place in a company and due to such

by C.G. for fraud any director, key managerial personnel, other officer of

disgorgement the company or any other person or entity, has taken undue

of assets etc. advantage or benefit, whether in the form of any asset,

– Sec. 212 property or cash or in any other manner, the Central

(14A)* Government may file an application before the Tribunal for

appropriate orders with regard to disgorgement of such asset,

property or cash and also for holding such director, key

managerial personnel, other officer or any other person liable

personally without any limitation of liability.

*inserted by Companies (Amendment) Act, 2019 w.e.f.

15.08.2019

Compiled by: Pankaj Garg

Page 20

Chapter 4 Inspection, Inquiry and Investigation

Other Sec. 212(15) Notwithstanding anything contained in this Act or

Provisions in any other law, the investigation report filed

with the Special Court for framing of charges shall

be deemed to be a report filed by a police officer

u/s 173 of the Code of Criminal Procedure, 1973.

Sec. 212(16) Notwithstanding anything contained in this Act,

any investigation or other action taken or initiated

by SFIO under the provisions of the Companies

Act, 1956 shall continue to be proceeded with

under that Act as if this Act had not been passed.

Sec. 212(17) • In case SFIO has been investigating any offence

under this Act, any other investigating agency,

State Government, police authority, income-tax

authorities having any information or documents

in respect of such offence shall provide all such

information or documents available with it to the

SFIO.

• The SFIO shall share any information or

documents available with it, with any

investigating agency, State Government, police

authority or income tax authorities, which may

be relevant or useful for such investigating

agency, State Government, police authority or

income-tax authorities in respect of any offence

or matter being investigated or examined by it

under any other law.

Compiled by: Pankaj Garg

Page 21

Chapter 4 Inspection, Inquiry and Investigation

Important Questions

Q. No. 8: What are the grounds on which the investigation is assigned to

Serious Fraud Investigation Office?

HINT: Refer Sec. 212(1).

Q. No. 9: Mrs. Preeti, a lady aged about 32 years and Managing Director of M/s

Growmore plantations Ltd., has been arrested for an offence covered

under section 447 of the Companies Act, 2013 on a complaint made

by the Director, Serious Fraud Investigation Officer. Mrs. Preeti

seeks your legal advise as to the conditions under which she can be

released on bail and the role of Special Court in this regard.

[Nov. 17 (4 Marks)]

HINT: She may be released on bail if the Special Court so directs. Refer

Section 212(6).

Q. No. 10: Answer the following:

(i) The shareholders of Kumar Ltd. passed a special resolution that

the affairs of the company ought to be investigated. The

company submitted the special resolution to the Central

Government. Examine, explaining the relevant provisions of the

companies Act, 2013, whether the power of the Central

Government to order an investigation is mandatory or

discretionary?

(ii) Enumerate the procedures to be followed by the Serious Fraud

Investigation Office to arrest a person who has been found

guilty of an offence committed under section 447 of the

Companies Act, 2013. [Nov. 18-New Syllabus (7 Marks)]

HINT: Refer Sec. 210 and 212 and Companies (Arrests in connection with

Investigation by SFIO) Rules, 2017. Use of the term ‘may’ in Sec. 210 make

it clear that the power of the Central Government to order an

investigation is discretionary.

Compiled by: Pankaj Garg

Page 22

Chapter 4 Inspection, Inquiry and Investigation

4.8 - Investigation into company’s affairs in other cases (Sec. 213)

Circumstances (a) On an application made by:

in which (i) not less than 100 members or members holding not

Tribunal may less than 1/10th of the total voting power, in the case of

pass order a company having a share capital;

or

(ii) not less than 1/5th of the persons on the company’s

register of members, in the case of a company having no

share capital,

and supported by such evidence as may be necessary for the

purpose of showing that the applicants have good reasons

for seeking an order for conducting an investigation into the

affairs of the company.

(b) On an application made to it by any other person or

otherwise, if it is satisfied that there are circumstances

suggesting that—

(i) the business of the company is being conducted with

intent to defraud its creditors, members or any other

person or otherwise for a fraudulent or unlawful

purpose, or in a manner oppressive to any of its

members or that the company was formed for any

fraudulent or unlawful purpose;

(ii) persons concerned in the formation of the company or

the management of its affairs have in connection

therewith been guilty of fraud, misfeasance or other

misconduct towards the company or towards any of its

members; or

Compiled by: Pankaj Garg

Page 23

Chapter 4 Inspection, Inquiry and Investigation

(iii) the members of the company have not been given all

the information with respect to its affairs which they

might reasonably expect, including information

relating to the calculation of the commission payable

to a managing or other director, or the manager, of the

company,

Order by • In the circumstances mentioned above, Tribunal may order

Tribunal that the affairs of the company ought to be investigated by an

inspector or inspectors appointed by the Central Government.

• Order shall be passed after giving a reasonable opportunity of

being heard to the parties concerned.

Appointment Where such an order is passed, the Central Government shall

of Inspector appoint one or more competent persons as inspectors to

investigate into the affairs of the company in respect of such

matters and to report thereupon to it in such manner as the

Central Government may direct.

Punishment If after investigation it is proved that

for fraud (i) the business of the company is being conducted with intent to

defraud its creditors, members or any other persons or

otherwise for a fraudulent or unlawful purpose, or that the

company was formed for any fraudulent or unlawful purpose; or

(ii) any person concerned in the formation of the company or the

management of its affairs have in connection therewith been

guilty of fraud,

then, every officer of the company who is in default and the

person or persons concerned in the formation of the company or

the management of its affairs shall be punishable for fraud in the

manner as provided in section 447.

Compiled by: Pankaj Garg

Page 24

Chapter 4 Inspection, Inquiry and Investigation

Important Question

Q. No. 11: Some creditors of NTY Limited approached you to guide them to

apply to the Tribunal for seeking an order for conducting an

investigation into the affairs of the company due to the fact that the

business of the company is being conducted with intention to

defraud its creditors. Referring to the provisions of the Companies

Act, 2013, guide them regarding the circumstances under which

and how a person, not being a member of the company can apply to

the Tribunal to seek an order for conducting an investigation into

the affairs of a company.

[May 18 – Old Syllabus (4 Marks), RTP-Nov. 18]

HINT: Refer Sec. 213 – Topic “Circumstances in which Tribunal may

pass order”.

4.9 - Security for payment of costs and expenses of investigation (Sec. 214)

Investigation Where an investigation is ordered by the Central Government

in which • in pursuance of clause (b) of sub-section (1) of section 210,

security may

or

be

demanded • in pursuance of an order made by the Tribunal under section

213.

Requirement • C.G. may before appointing an inspector u/s 210 or u/s 213,

of security require the applicant to give such security not exceeding Rs.

25,000 as may be prescribed, for payment of the costs and

expenses of the investigation.

• Such security shall be refunded to the applicant if the

investigation results in prosecution.

Compiled by: Pankaj Garg

Page 25

Chapter 4 Inspection, Inquiry and Investigation

Important Questions

Q. No. 12: The business of Weak Fabrication Limited is conducted

fraudulently and the management activities are not in the

interests of the company. The paid-up capital of the company is

one crore rupees. A group of shareholders numbering 110

members representing 1/9 of total voting power decided to

approach Tribunal (NCLT) to carryout investigation into the

company’s affairs under the provisions of the Companies Act,

2013. They seek your advice in the following matters, stating the

relevant provisions of the companies Act, 2013.

1. Whether the group can make valid application?

2. Other than member, can any other person make application?

3. Are the applicants required to furnish security for payment of

cost and expenses of investigation?

[May 18 – New Syllabus (7 Marks)]

HINT: Refer Sec. 213 & 214.

1. Group as stated in the question can make valid application as the

group consists of more than 100 members.

2. Persons other than Shareholders can also make application as per

the circumstances mentioned above.

3. Applicants are required to furnish security as per the provisions of

Sec. 214 which states that C.G. may before appointing an inspector

u/s 213, require the applicant to give such security not exceeding

Rs. 25,000 as may be prescribed, for payment of the costs and

expenses of the investigation.

Compiled by: Pankaj Garg

Page 26

Chapter 4 Inspection, Inquiry and Investigation

4.10 - Firm, body corporate or association not to be appointed as inspector

(Sec. 215)

No firm, body corporate or other association shall be appointed as an inspector.

4.11 - Investigation of ownership of company (Sec. 216)

Purposes for Where it appears to the C.G. that there is a reason so to do, it may

which appoint one or more inspectors to investigate and report on

investigation matters relating to the company, and its membership for the

may be purpose of determining the true persons-

ordered – (a) who are or have been financially interested in the success or

Sec. 216(1) failure, whether real or apparent, of the company; or

(b) who are or have been able to control or to materially influence

the policy of the company; or

(c) who have or had beneficial interest in shares of a company

or who are or have been beneficial owners or significant

beneficial owner of a company*.

*inserted by Companies (Amendment) Act, 2017 w.e.f.

13.06.2018.

Appointment Without prejudice to its powers under sub-section (1), the C.G.

of inspectors shall appoint one or more inspectors, if the Tribunal, in the course

on directions of any proceeding before it, directs by an order that the affairs of

of Tribunal the company ought to be investigated as regards the membership

– Sec. 216(2) of the company and other matters relating to the company, for the

purposes specified in Sec. 216(1).

Compiled by: Pankaj Garg

Page 27

Chapter 4 Inspection, Inquiry and Investigation

Scope of While appointing an inspector, the C.G. Government may define the

Investigation scope of the investigation,

– Sec. 216(3) • whether as respects the matters or

• the period to which it is to extend or

• otherwise,

and in particular, may limit the investigation to matters connected

with particular shares or debentures.

Powers of Powers of the inspectors shall extend to the investigation of any

Inspectors – circumstances suggesting the existence of any arrangement or

Sec. 216(4) understanding which, though not legally binding, is or was

observed or is likely to be observed in practice and which is

relevant for the purposes of his investigation.

4.12 - Procedure, powers, etc., of inspectors (Sec. 217)

Duty to It shall be the duty of all officers and other employees and agents

produce including the former officers, employees and agents of a company

books and which is under investigation and where the affairs of any other

render body corporate or a person are investigated u/s 219, of all officers

assistance and other employees and agents including former officers,

– Sec. employees and agents of such body corporate or a person-

217(1) (a) to preserve and to produce to an inspector or any person

authorised by him in this behalf all books and papers of, or

relating to, the company or, as the case may be, relating to the

other body corporate or the person, which are in their custody

or power; and

(b) otherwise to give to the inspector all assistance in connection

with the investigation which they are reasonably able to give.

Compiled by: Pankaj Garg

Page 28

Chapter 4 Inspection, Inquiry and Investigation

Obtaining The inspector may require any body corporate, other than a body

information corporate whose affairs are investigated u/s 219 to

from other • furnish such information to, or

body

• produce such books and papers before him or any person

corporate

authorised by him in this behalf as he may consider necessary,

– Sec.

if the furnishing of such information or the production of such

217(2)

books and papers is relevant or necessary for the purposes of his

investigation.

Period of • The inspector shall not keep in his custody any books and papers

Retention of produced to him u/s 217(1) or 217(2) for more than 180 days.

books – Sec. • He shall return the same to the company, body corporate, firm or

217(3) individual by whom or on whose behalf the books and papers

were produced.

• The books and papers may be called for by the inspector if they

are needed again for a further period of 180 days by an order in

writing.

Power to An inspector may examine on oath:

examine a (a) any of the persons referred to in Sec. 217(1); and

person on (b) any other person, with the prior approval of the Central

Oath – Sec. Government,

217(4)

in relation to the affairs of the company, or other body corporate or

person, as the case may be, and for that purpose may require any of

those persons to appear before him personally.

However, in case of an investigation u/s 212, the prior approval of

Director, SFIO shall be sufficient under clause (b).

Compiled by: Pankaj Garg

Page 29

Chapter 4 Inspection, Inquiry and Investigation

Powers of Notwithstanding anything contained in any other law for the time

Civil Court – being in force or in any contract to the contrary, the inspector, being

Sec. 217(5) an officer of the C.G. making an investigation under this chapter,

shall have all the powers as are vested in a civil court under the

Code of Civil Procedure, 1908, while trying a suit in respect of the

following matters, namely:

(a) the discovery and production of books of account and other

documents, at such place and time as may be specified by such

person;

(b) summoning and enforcing the attendance of persons and

examining them on oath; and

(c) inspection of any books, registers and other documents of the

company at any place.

Penalty If any director or officer of the company disobeys the direction

provisions – issued by the Registrar or the inspector under this section, the

Sec. 217(6) director or the officer shall be punishable

• with imprisonment which may extend to 1 year

and

• with fine which shall not be less than Rs. 25,000 but which may

extend to Rs. 1 lakh.

If a director or an officer of the company has been convicted of an

offence under this section, he shall, on and from the date on which

he is so convicted, be deemed to have vacated his office as such and

on such vacation of office, shall be disqualified from holding an

office in any company.

Compiled by: Pankaj Garg

Page 30

Chapter 4 Inspection, Inquiry and Investigation

Notes of The notes of any examination u/s 217(4), shall be taken down in

Examination writing

– Sec. and

217(7)

shall be read over to, or by, and signed by, the person examined,

and

may thereafter be used in evidence against him.

Penalty for If any person fails without reasonable cause or refuses—

failure to (a) to produce to an inspector or any person authorised by him in

comply with this behalf any book or paper which is his duty u/s 217(1) or

the 217(2) to produce;

provisions –

(b) to furnish any information which is his duty u/s 217(2) to

Sec. 217(8)

furnish;

(c) to appear before the inspector personally when required to do

so u/s 217(4) or to answer any question which is put to him by

the inspector in pursuance of that point; or

(d) to sign the notes of any examination referred to in Sec. 217(7),

he shall be punishable

• with imprisonment for a term which may extend to 6 months

and

• with fine which shall not be less than Rs. 25,000 rupees but

which may extend to Rs. 1 lakh,

and

• with a further fine which may extend to Rs. 2,000 for every day

after the first during which the failure or refusal continues.

Compiled by: Pankaj Garg

Page 31

Chapter 4 Inspection, Inquiry and Investigation

Duty of The officers of the C.G., S.G., police or statutory authority shall

certain provide assistance to the inspector for the purpose of inspection,

persons to inquiry or investigation, which the inspector may, with the prior

assist approval of the C.G., require.

inspector

– Sec.

217(9)

Agreement The C.G. may enter into an agreement with the Government of a

with foreign State for reciprocal arrangements to assist in any inspection,

Foreign inquiry or investigation under this Act or under the corresponding

Countries law in force in that State.

– Sec.

217(10)

Reference of Notwithstanding anything contained in this Act or in the Code of

certain Criminal Procedure, 1973 if, in the course of an investigation into

matters to the affairs of the company, an application is made to the competent

Foreign court in India by the inspector stating that evidence is, or may be,

Court – Sec. available in a country or place outside India, such court may issue a

217(11) letter of request to a court or an authority in such country or place,

competent to deal with such request,

• to examine orally, or otherwise, any person, supposed to be

acquainted with the facts and circumstances of the case,

• to record his statement made in the course of such examination,

• to require such person or any other person to produce any

document or thing, which may be in his possession pertaining to

the case, and

Compiled by: Pankaj Garg

Page 32

Chapter 4 Inspection, Inquiry and Investigation

• to forward all the evidence so taken or collected or the

authenticated copies thereof or the things so collected to the

court in India which had issued such letter of request.

The letter of request shall be transmitted in such manner as the C.G.

may specify in this behalf.

Every statement recorded or document or thing received under this

subsection shall be deemed to be the evidence collected during the

course of investigation.

Reference of Upon receipt of a letter of request from a court or an authority in a

certain country or place outside India, competent to issue such letter in that

matters by country or place for the examination of any person or production of

Foreign any document or thing in relation to affairs of a company under

Court – Sec. investigation in that country or place, the C.G. may, if it thinks fit,

217(12) forward such letter of request to the court concerned, which shall

thereupon

• summon the person before it and record his statement or cause

any document or thing to be produced, or

• send the letter to any inspector for investigation, who shall

thereupon investigate into the affairs of company in the same

manner as the affairs of a company are investigated under this

Act and the inspector shall submit the report to such court

within 30 days or such extended time as the court may allow for

further action

The evidence taken or collected as above or authenticated copies

thereof or the things so collected shall be forwarded by the court, to

the C.G. for transmission, in such manner as the C.G. may deem fit, to

the court or the authority in country or place outside India which

had issued the letter of request.

Compiled by: Pankaj Garg

Page 33

Chapter 4 Inspection, Inquiry and Investigation

4.13 - Protection of employees during investigation (Sec. 218)

Requirement If during the course of any investigation of the affairs and other

of Tribunal matters of or relating to a company, other body corporate or

Approval to person u/s 210, 212, 213 or 219 or of the membership and other

take any matters of or relating to a company, or the ownership of shares in

action or debentures of a company or body corporate, or the affairs and

against other matters of or relating to a company, other body corporate or

employee person, u/s 216

– Sec. 218(1) or

during the pendency of any proceeding against any person

concerned in the conduct and management of the affairs of a

company under Chapter XVI (Sec. 241 to 246 – Prevention of

Oppression and Mismanagement) such company, other body

corporate or person proposes:

(i) to discharge or suspend any employee; or

(ii) to punish him, whether by dismissal, removal, reduction in

rank or otherwise; or

(iii) to change the terms of employment to his disadvantage,

the company, other body corporate or person, as the case may be,

shall obtain approval of the Tribunal of the action proposed against

the employee.

If the Tribunal has any objection to the action proposed, it shall

send by post notice thereof in writing to the company, other body

corporate or person concerned.

Compiled by: Pankaj Garg

Page 34

Chapter 4 Inspection, Inquiry and Investigation

Non-receipt If the company, other body corporate or person concerned does not

of approval receive within 30 days of making of application, the approval of the

from Tribunal, then and only then, the company, other body corporate or

Tribunal person concerned may proceed to take against the employee, the

– Sec. 218(2) action proposed.

Appeal • If the company, other body corporate or person concerned is

against dissatisfied with the objection raised by the Tribunal, it may,

Tribunal within a period of 30 days of the receipt of the notice of the

Objection objection, prefer an appeal to the Appellate Tribunal in such

– Sec. 218(3) manner and on payment of such fees as may be prescribed.

& 218(4) • The decision of the Appellate Tribunal on such appeal shall be

final and binding on the Tribunal and on the company, other

body corporate or person concerned.

Important Questions

Q. No. 13: Mr. Atul is an employee of the company ABC Limited and

investigation is going on him under the provisions of Companies

Act, 2013. The company wants to terminate the employee on the

ground of investigation is going against him. They have filed the

application to tribunal for approval of termination. Company has

not received any reply from the tribunal within 30 days of filling

an application. The company consider it as a deemed approval

and terminated Mr. Atul.

(a) Is the contention of company being valid in law?

(b) What is remedy available to Mr. Atul?

(c) What is remedy available to Mr. Atul, if reply of Tribunal has

been received within 30 days of application?

[MTP-March 18, March 19]

Compiled by: Pankaj Garg

Page 35

Chapter 4 Inspection, Inquiry and Investigation

HINT: (a) Valid Contention (b) No Remedy (c) Appeal to Appellate

Tribunal. Refer Section 218.

Q. No. 14: Damage Ltd., the Company wanted to suspend Mr. Z, the CFO of the

Company during the pendency of an investigation being conducted

under the provisions of the Companies Act, 2013 on the order of

Tribunal. The Company approached the Tribunal on 3rdJanuary,

2019 for the proposed action. The Company on 15thFebruary, 2019

passed an order of suspension without waiting for the orders from

Tribunal. Comment upon the action taken by the Company with

reference to the relevant provisions of the Act.

[May 17 (4 Marks)]

HINT: Action taken by company is valid as suspension takes place after

30 days. Refer Section 218.

Q. No. 15: Pursuant to Section 210 of the Companies Act, 2013 an Inspector

was appointed to investigate the affairs of Sterling Trading Limited.

Mr. Ahmed the General Manager (Operations) who is aware of

certain misdeeds of the management, desires to know whether he

is entitled to any protection against dismissal by the company if he

discloses the misdeeds during the course of examination by the

Inspector. Advise him explaining the relevant provisions of the

Companies Act, 2013. [Nov. 17 (3 Marks)]

HINT: Protection available u/s 218 of Companies Act, 2013.

Compiled by: Pankaj Garg

Page 36

Chapter 4 Inspection, Inquiry and Investigation

4.14 - Power of inspector to conduct investigation into affairs of related

companies, etc. (Sec. 219)

Investigation If an inspector appointed u/s 210 or 212 or 213 to investigate into

into affairs the affairs of a company considers it necessary for the purposes of

of related the investigation, shall also investigate the affairs of—

companies (a) any other body corporate which is, or has at any relevant time

been the company’s subsidiary company or holding company,

or a subsidiary company of its holding company;

(b) any other body corporate which is, or has at any relevant time

been managed by any person as managing director or as

manager, who is, or was, at the relevant time, the managing

director or the manager of the company;

(c) any other body corporate whose Board of Directors

comprises nominees of the company or is accustomed to act

in accordance with the directions or instructions of the

company or any of its directors; or

(d) any person who is or has at any relevant time been the

company’s managing director or manager or employee.

Such Investigation is allowed only with prior approval of the

Central Government.

Report of Inspector shall report on the affairs of the other body corporate or

inspector of the managing director or manager, in so far as he considers that

the results of his investigation are relevant to the investigation of

the affairs of the company for which he is appointed.

Compiled by: Pankaj Garg

Page 37

Chapter 4 Inspection, Inquiry and Investigation

Important Questions

Q. No. 16: Discuss the powers of Inspectors regarding investigation into

affairs of related companies.

Or

What are the circumstances in which an inspector appointed under

section 210 of the Companies Act, 2013, can investigate into affairs

of related companies also?

HINT: Refer Sec. 219.

Q. No. 17: During investigations conducted on the affairs of a company in the

public interest, the inspector observed that the Directors of the

company had been acting on the instructions of the holding

company and he proceeded to investigate the holding company. Is

Inspector permitted to do under the provisions of the Companies

Act, 2013? [May 17 (4 Marks)]

Or

Members of Sarat Solutions Ltd. are concerned about the

performance of the company as they suspect gross negligence and

mismanagement of the affairs of the company that may be

detrimental to the interests of the company and therefore filed an

application to the Central Government to appoint an inspector to

carry on the investigation. Mr. X, who was appointed as inspector,

is of the view that to find out the true picture it is necessary to

investigate into the affairs of M/s. Hemant Softech Solutions Ltd.,

which is a subsidiary of Sarat Solutions Ltd. Referring to and

analysing the provisions of the Companies Act, 2013 decide,

whether the inspector has powers to investigate into of M/s.

Compiled by: Pankaj Garg

Page 38

Chapter 4 Inspection, Inquiry and Investigation

Hemant Softech Solutions Ltd. [May 19 – Old Syllabus (4 Marks)]

HINT: Inspector is permitted to investigate the affairs of related

companies, but only after obtaining prior approval from C.G. Refer

Section 219.

4.15 - Seizure of documents by Inspector (Sec. 220)

Seizure of Where in the course of an investigation, the inspector has

books and reasonable grounds to believe that the books and papers of, or

papers relating to, any company or other body corporate or managing

director or manager of such company are likely to be destroyed,

– Sec.

mutilated, altered, falsified or secreted, the inspector may:

220(1)

(a) enter, with such assistance as may be required, the place or

places where such books and papers are kept in such manner as

may be required;

and

(b) seize books and papers as he considers necessary after allowing

the company to take copies of, or extracts from, such books and

papers at its cost for the purposes of his investigation.

Time period • The inspector shall keep in his custody the books and papers

for keeping seized under this section for such a period not later than the

books and conclusion of the investigation as he considers necessary

papers and

– Sec.

• thereafter shall return the same to the company or the other

220(2)

body corporate, or, as the case may be, to the managing director

or the manager or any other person from whose custody or

power they were seized.

Compiled by: Pankaj Garg

Page 39

Chapter 4 Inspection, Inquiry and Investigation

Point to remember

The inspector may, before returning such books and papers as

aforesaid, take copies of, or extracts from them or place

identification marks on them or any part thereof or deal with

the same in such manner as he considers necessary.

Application The provisions of the Code of Criminal Procedure, 1973, relating to

of searches or seizures shall apply mutatis mutandisto every search or

provisions seizure made under this section.

of Code of

Criminal

Procedure

– Sec.

220(3)

4.16 - Freezing of assets of company on inquiry and investigation (Sec. 221)

Circumstance Where it appears to the Tribunal,

s in which • on a reference made to it by the C.G. or

assets may be

• in connection with any inquiry or investigation into the affairs

freezed – Sec.

of a company under this Chapter or

221(1)

• on any complaint made by such number of members as

specified u/s 244(1) or

• a creditor having Rs. 1 lakh outstanding against the company or

• any other person

having a reasonable ground to believe that the removal, transfer

or disposal of funds, assets, properties of the company is likely to

Compiled by: Pankaj Garg

Page 40

Chapter 4 Inspection, Inquiry and Investigation

take place in a manner that is prejudicial to the interests of the

company or its shareholders or creditors or in public interest, it

may by order direct that such transfer, removal or disposal shall

not take place during such period not exceeding 3 years as may be

specified in the order or may take place subject to such conditions

and restrictions as the Tribunal may deem fit.

Points to remember

Number of Members specified u/s 244(1):

(a) in the case of a • Lower of 100 members or 1/10th of

company having a the total number of members.

share capital or

• Any member or members holding

not less than 1/10th of the issued

share capital of the company

provided the applicant has paid all

calls and other sums due on his

shares.

(b) in the case of a Atleast 1/5th of the total number of its

company not members.

having a share

capital

Penalty In case of any removal, transfer or disposal of funds, assets, or

provisions – properties of the company in contravention of the order of the

Sec. 221(2) Tribunal u/s 221(1),

• the company shall be punishable with fine which shall not be

less than Rs. 1 lakh but which may extend to Rs. 25 lakh

Compiled by: Pankaj Garg

Page 41

Chapter 4 Inspection, Inquiry and Investigation

and

• every officer of the company who is in default shall be

punishable with imprisonment for a term which may extend to

3 years or with fine which shall not be less than Rs. 50,000 but

which may extend to Rs. 5,00,000, or with both.

Important Questions

Q. No. 18: The members of company with no paid-up share capital, filed a

complaint against change in the management of the company due

to which it was likely that the affairs of the company will be

conducted in a manner that it will be prejudicial to the interest of

its 25 members. Total number of members of company were 100.

On inquiry and investigation on the complaint, having a reasonable

ground to believe that the transfer or disposal of assets of the

company may be against to the interests of its shareholders. The

Tribunal passed an order that such transfer or disposal of assets

shall not be made during one year of such order.

Evaluate on the basis of the given facts, the following situations

according to the Companies Act, 2013:

(a) Eligibility of the members to file a complaint.

(b) Where if the management dispose of the certain assets in

contravention to the order of the Tribunal.

[MTP-March 18, Oct. 19]

HINT: Refer Sec. 221 & 244. (a) 1/5th of members (b) Penalty will be

imposed u/s 221(2).

Compiled by: Pankaj Garg

Page 42

Chapter 4 Inspection, Inquiry and Investigation

Q. No. 19: XYZ Ltd. proposed for amalgamation with the PQR Ltd. The issued

and paid up capital of XYZ Ltd. is Rs. 5 crore consisting of 5,00,000

equity shares of Rs. 100 each. The said company has 500 members.

It was believed by certain members of the company that the

proposed Scheme of amalgamation resulting into the transfer and

disposal of funds and assets of the company to the transferee will

be effecting their interest. So, 80 members holding 10,000 equity

shares of the company decided to file an application for relief

before the Tribunal.

Examine the given situation in the light of the Companies Act, 2013-

(i) Whether the said petition will be maintainable.

(ii) In case where it appears to the Tribunal, that such proposal is

likely to effect the interest of the members, remedy available

to the aggrieved members. [MTP-Aug. 18]

HINT: Refer Sec. 221 & 244. (i) Petition is maintainable (ii) Tribunal

may pass order u/s 221(1). Contravention of order will attract penalty

u/s 221(2).

4.17 - Imposition of restrictions upon securities (Sec. 222)

Circumstances • Where it appears to the Tribunal, in connection with any

in which investigation u/s 216 or on a complaint made by any person in

restrictions this behalf, that there is good reason to find out the relevant

may be facts about any securities issued or to be issued by a company

imposed on and

securities

• the Tribunal is of the opinion that such facts cannot be found

– Sec. 222(1)

out unless certain restrictions, as it may deem fit, are imposed,

Compiled by: Pankaj Garg

Page 43

Chapter 4 Inspection, Inquiry and Investigation

the Tribunal may, by order, direct that the securities shall be

subject to such restrictions as it may deem fit for such period not

exceeding 3 years as may be specified in the order.

Penalty Where securities in any company are issued or transferred or

Provisions – acted upon in contravention of an order of the Tribunal u/s

Sec. 222(2) 222(1),

• the company shall be punishable with fine which shall not be

less than Rs. 1 lakh but which may extend to Rs. 25lakh

and

• Every officer of the company who is in default shall be

punishable with imprisonment for a term which may extend to

6 Months or with fine which shall not be less than Rs. 25,000

but which may extend to Rs. 5lakh, or withboth.

Important Question

Q. No. 20: Remedial Pharma Limited, over the years, enjoys a high reputation

in the market and its general reserves are ten times more than the

paid-up capital of the company. There is a serious apprehension of

cornering the share of the company by a group of unscrupulous

persons likely to result in change in the Board of directors which

may be prejudicial to the public interest. The company seeks your

advice as to how it can block the transfer of shares of the company

under the provisions of the Companies Act, 2013.

[Nov. 17 (4 Marks)]

HINT: Application can be made to Tribunal u/s 222 for imposition of

restriction on securities.

Compiled by: Pankaj Garg

Page 44

Chapter 4 Inspection, Inquiry and Investigation

Q. No. 21: The Central Government ordered an investigation under Section

216 of Companies Act, 2013 against M/s Green Wood Limited for

determining the true membership of the company. In connection

with this investigation a reference was made to the Tribunal. It

appears to the Tribunal that there is a good reason to find out the

relevant facts about the company and the Tribunal is of the opinion

that unless restrictions are imposed on further issue of such equity

shares for two years, the purpose cannot be solved.

Referring to the provisions of the Companies Act, 2013 and Rules

framed in this regard, answer:

(i) Can the Tribunal put such a restriction on further issue of

shares?

(ii) Period for which such a restriction can be imposed by the

Tribunal? [Nov. 18-Old Syllabus (4 Marks)]

HINT: Refer Sec. 222. Tribunal may restrict further issue of shares for any

period not exceeding 3 years.

Q. No. 22: An investigation was ordered by the Central Government under

section 216 of the Companies Act, 2013, against PKR Limited for

determining the true membership of the Company. In connection

with this investigation, it appears to the Tribunal that there is good

reason to find out the relevant facts about 9% Redeemable

Cumulative Preference Shares (RCPS) issued by the company on

15.10.2018 and the Tribunal is of the opinion that unless restriction

is imposed on further issue of such shares, the purpose cannot be

solved. Accordingly, the Tribunal, by an Order dated 15.08.2019,

directed the Company that the further issue of RCPS shall be subject

to restrictions for a period of four years. Despite the order of the

Tribunal as above, PKR Limited proceeded with further issue of

RCPS on 20.08.2019 in order to fund the working capital requirements

Compiled by: Pankaj Garg

Page 45

Chapter 4 Inspection, Inquiry and Investigation

for its expansion project.

Referring to the provisions of the Companies Act, 2013, examine the

following:

(i) Can the Tribunal restrict further issue of RCPS? If yes, then to what

period?

(ii) What are the penal provisions in case of contravention to the

above order? [Nov. 18-New Syllabus (5 Marks)]

HINT: Refer Sec. 222. Tribunal may restrict further issue of RCPS for any

period not exceeding three years.

4.18 - Inspector’s Report – Sec. 223

Submission of • An inspector appointed under this Chapter may, and if so

interim report directed by the Central Government shall, submit interim

and final reports to that Government,

report and

– Sec. 223(1) • on the conclusion of the investigation, shall submit a final

report to the Central Government.

Report to be Every report made u/s 223(1) shall be in writing or printed as

writing or

the C.G. may direct.

printed

– Sec. 223(2)

Obtaining A copy of the above report may beobtained by members,

copy or report creditors or any other person whose interest is likely to be

– Sec. 223(3) affected* making an application in this regard to the C.G.

*inserted by Companies (Amendment) Act, 2017 w.e.f.

09.02.2018

Compiled by: Pankaj Garg

Page 46

Chapter 4 Inspection, Inquiry and Investigation

Authentication The report of inspector appointed under this Chapter shall be

of report authenticated either:

– Sec. 223(4) (a) by the seal, if any, of the company whose affairs have been

investigated;

or

(b) by a certificate of a public officer having the custody of the

report, as provided u/s 76 of the Indian Evidence Act, 1872,

Such report shall be admissible in any legal proceeding as

evidence in relation to any matter contained in the report.

Exceptions Nothing in this section shall apply to the report referred to in

– Sec. 223(5) Section 212.

Important Question

Q. No. 23: What the duties of the inspector as enumerated in section 223 of

the Companies Act, 2013, in relation to his report.

4.19 - Actions to be taken in pursuance of inspector’s report (Sec. 224)

Prosecution • If, from an inspector’s report, made u/s 223, it appears to the

– Sec. 224(1) C.G. that any person has, in relation to the company or in

relation to any other body corporate or other person whose

affairs have been investigated under this Chapter been guilty

of any offence for which he is criminally liable, the C.G. may

prosecute such person for the offence

and

Compiled by: Pankaj Garg

Page 47

Chapter 4 Inspection, Inquiry and Investigation

• it shall be the duty of all officers and other employees of the

company or body corporate to give the C.G. the necessary

assistance in connection with the prosecution.

Petition for • If any company or other body corporate is liable to be wound

Winding up or up under this Act or under the Insolvency and Bankruptcy

Application for Code 2016

relief from and

Oppression and

• it appears to the C.G. from any such report made u/s 223 that

Mismanagement

it is expedient so to do by reason of any such circumstances

– Sec. 224(2)

as are referred to in section 213,

the C.G. may, unless the company or body corporate is already

being wound up by the Tribunal, cause to be presented to the

Tribunal by any person authorised by the C.G. in this behalf—

(a) a petition for the winding up of the company or body

corporate on the ground that it is just and equitable that it

should be wound up;

(b) an application u/s 241 (claiming relief from oppression and

mismanagement); or

(c) both.

Proceedings for If from the inspector’s report, it appears to the C.G. that

for recovery of proceedings ought, in the public interest, to be brought by the

damages company or any body corporate whose affairs have been

– Sec. 224(3) investigated under this Chapter:

(a) for the recovery of damages in respect of any fraud,

misfeasance or other misconduct in connection with the

Compiled by: Pankaj Garg

Page 48

Chapter 4 Inspection, Inquiry and Investigation

promotion or formation, or the management of the affairs,

of such company or body corporate;

or

(b) for the recovery of any property of such company or body

corporate which has been misapplied or wrongfully

retained,

the C.G. may itself bring proceedings for that purpose in the

name of such company or body corporate.

Indemnity to The C.G. shall be indemnified by such company or body

C.G. – Sec. corporate against any costs or expenses incurred by it in, or in

224(4) connection with, any proceedings brought by virtue of Sec.

224(3).

Application Where the report made by an inspector states that fraud has

w.r.t. taken place in a company and due to such fraud any director,

disgorgement key managerial personnel, other officer of the company or any

and personal other person or entity, has taken undue advantage or benefit,

liability of whether in the form of any asset, property or cash or in any

directors etc. other manner, the Central Government may file an application

– Sec. 224(5) before the Tribunal for appropriate orders

• with regard to disgorgement of such asset, property or cash,

as the case may be,

and

• also for holding such director, key managerial personnel,

officer or other person liable personally without any

limitation of liability.

Compiled by: Pankaj Garg

Page 49

Chapter 4 Inspection, Inquiry and Investigation

4.20 - Expenses of investigation (Sec. 225)

Expenses to be The expenses of, and incidental to, an investigation by an

borne by C.G. inspector appointed by the C.G. under this Chapter) other than

expenses of inspection u/s 214 (Security for payment of costs

and expenses of investigation) shall be borne in the first

instance by the C.G.

Reimbursement Expenses of investigation shall be reimbursed by the following

of Expenses persons to the extent mentioned below, namely:

(a) any person who is convicted on a prosecution instituted, or

who is ordered to pay damages or restore any property in

proceedings brought, u/s 224, to the extent specified by the

court convicting such person, or ordering him to pay such

damages or restore such property, as the case may be;

(b) any company or body corporate in whose name proceedings

are brought, to the extent of the amount or value of any

sums or property recovered by it as a result of such

proceedings;

(c) unless, as a result of the investigation, a prosecution is

instituted u/s 224, —

(1) any company, body corporate, managing director or

manager dealt with by the report of the inspector; and

(2) the applicants for the investigation, where the

inspector was appointed u/s 213,

to such extent as the C.G. may direct.

Compiled by: Pankaj Garg

Page 50

Chapter 4 Inspection, Inquiry and Investigation