Professional Documents

Culture Documents

Far1 Ias 40 Icap Past Papers With Solution

Far1 Ias 40 Icap Past Papers With Solution

Uploaded by

kamal asgharOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Far1 Ias 40 Icap Past Papers With Solution

Far1 Ias 40 Icap Past Papers With Solution

Uploaded by

kamal asgharCopyright:

Available Formats

FAR1 ICAP PAST PAPERS [IAS-40 INVESTMENT PROPERTY]

WITH SOLUTION

Question 1 (CFAP-01 D-18)

You are the Finance Manager of Mehran Limited (ML). Your staff has prepared draft financial

statements of ML for the year ended 31 December 2017.

Net profit for 2017 (draft), 2016 (audited) and 2015 (audited) was Rs. 355 million, Rs. 281 million and Rs.

228 million respectively. There was no item of other comprehensive income.

The draft statement of financial position as on 31 December 2017 shows total assets and total liabilities

of Rs. 2,627 million and Rs. 440 million respectively

Property, plant and equipment include a warehouse which was given on rent in January 2017 for two

years. Previously, the warehouse was in use of ML.

ML carries its property, plant and equipment at cost model whereas investment property is carried at

fair value model. Carrying value and remaining useful life of the warehouse on 1 January 2017 was Rs.

55 million and 11 years respectively. Fair values of the warehouse on 1 January 2017 and 31 December

2017 were Rs. 80 million and Rs. 75 million respectively. Depreciation for 2017 has not yet been

charged.

Required:

Determine the revised amounts of total assets and total liabilities after incorporating effects of the

above corrections (05)

Question 2 (CFAP-01 D-18)

Gee Investment Company limited (GICL) acquires properties and develops them for diversified purpose.

i.e. resale, leasing and its own use. GILC applies the fair value model for investment properties and cost

model for property, plant equipment. The details of the buildings owned are as follows:

The following information is also available:

Property Date of Useful life Cost Residual Fair value as on 31

acquisition (years) value December

2011 2010

Rs. in million

B 1 January 2009 15 240 24 240 10

D 1 July 2008 10 10 1 Not available

E 1 August 2011 20 48 4 51 -

Property B The possession of this property was acquired from the tenants on 30 June 2010 when the

company shifted its head office from property C to property B. the fair value on the above date was Rs.

195 million.

Property D This property is situated outside the main city and its fair value cannot be determined. It was

rented to a government organization soon after the acquisition.

Property E this property is an office building comprising of three floors. After acquisition, two floors

were rented out. On 1 November 2011, GICL established a branch office on the third floor.

1 | COMPILED BY FAHAD IRFAN

FAR1 ICAP PAST PAPERS [IAS-40 INVESTMENT PROPERTY]

WITH SOLUTION

Details of cost incurred on acquisition are as follows:

Rs. in million

Purchase price 42.50

Agent’s commission 0.50

Registration fees and taxes 2.00

Administrative costs allocated 3.00

48.0

Required:

Prepare a note on investment property, for inclusion in GICL’s separate financial statements for the year

ended 31 December 2011. (Ignore comparative figures).

2 | COMPILED BY FAHAD IRFAN

FAR1 ICAP PAST PAPERS [IAS-40 INVESTMENT PROPERTY]

WITH SOLUTION

Solution 1

Solution 2

Property B

Since property B was transferred to property plant and equipment on 30 June 2010, it will not be

considered as investment property.

Property D

This property rented out to tenants is situated outside the main city and therefore fair value is not

determinable.

The building is being depreciated over a period of 10 years on straight line method.

Property 2011

Carried at cost Carried at fair value Total

Rupees

E Additions during the year*2 30.00 30.00

D Depreciation*3 (0.90) (0.90)

Fair for value adjustment (W-I) 14.00 14.00

Cost/fair value as on 31 December 10.00 284.00 294.00

Accumulated depreciation (3.15) -- (3.15)

*2: (48 - 3) * 2/3

*3: (Rs. 10m – Rs. 1m)/10

3 | COMPILED BY FAHAD IRFAN

You might also like

- Updated - FAR 1 Sir ARM Final BookDocument527 pagesUpdated - FAR 1 Sir ARM Final BookZain Jamil100% (1)

- CPA Ireland Financial Accounting 2015-18Document161 pagesCPA Ireland Financial Accounting 2015-18Ahmed Raza Tanveer100% (1)

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- Ariana Peterson Recently Opened Her Own Law Office Which SheDocument1 pageAriana Peterson Recently Opened Her Own Law Office Which Shehassan taimourNo ratings yet

- Aafr Ias 12 Icap Past Paper With SolutionDocument17 pagesAafr Ias 12 Icap Past Paper With SolutionAqib Sheikh100% (1)

- SBR - Mock B - QuestionsDocument3 pagesSBR - Mock B - Questionsriya_pramodNo ratings yet

- Week 1 - Problem SetDocument3 pagesWeek 1 - Problem SetIlpram YTNo ratings yet

- Questions & Solutions ACCTDocument246 pagesQuestions & Solutions ACCTMel Lissa33% (3)

- PDF VERSION Highveld BPP Amended CONSOLIDATION QUESTIONDocument2 pagesPDF VERSION Highveld BPP Amended CONSOLIDATION QUESTIONGueagen1969No ratings yet

- Great Zimbabwe University Faculty of CommerceDocument6 pagesGreat Zimbabwe University Faculty of CommerceTawanda Tatenda HerbertNo ratings yet

- Section A - Group DDocument6 pagesSection A - Group DAbhishek Verma100% (1)

- Maf 603 Suggested Solutions Solution 1Document5 pagesMaf 603 Suggested Solutions Solution 1anis izzatiNo ratings yet

- RISE All CAF Subj Mocks QP With Solutions Autumn 2022Document130 pagesRISE All CAF Subj Mocks QP With Solutions Autumn 2022Hadeed HafeezNo ratings yet

- Aafr Ifrs 5 Icap Past Papers With SolutionDocument8 pagesAafr Ifrs 5 Icap Past Papers With SolutionTsegay ArayaNo ratings yet

- Crescent All CAF Mocks With Solutions Compiled by Saboor AhmadDocument123 pagesCrescent All CAF Mocks With Solutions Compiled by Saboor AhmadsheldonjabrazaNo ratings yet

- FAR-I Borrowing Cost IAS-23 Sir MMDocument7 pagesFAR-I Borrowing Cost IAS-23 Sir MMarhamNo ratings yet

- Aafr Ifrs 15 Icap Past Papers With SolutionDocument10 pagesAafr Ifrs 15 Icap Past Papers With SolutionAqib Sheikh0% (1)

- Fa Mcqs (Icap)Document133 pagesFa Mcqs (Icap)MUHAMMAD ASLAMNo ratings yet

- Past Paper FAR1Document105 pagesPast Paper FAR1Hamza VirkNo ratings yet

- Financial Reporting Final Mock: Barcelona Madrid Non-Current AssetsDocument7 pagesFinancial Reporting Final Mock: Barcelona Madrid Non-Current AssetsMuhammad AsadNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument32 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsAmrita TamangNo ratings yet

- 06 Ifrs 5Document3 pages06 Ifrs 5Irtiza Abbas100% (1)

- c6 Question BankDocument25 pagesc6 Question BankWaseem Ahmad QurashiNo ratings yet

- Icag FM Past QuestionsDocument398 pagesIcag FM Past QuestionsMelvin AmohNo ratings yet

- CA - Advanced Reporting Revision Kit PDFDocument451 pagesCA - Advanced Reporting Revision Kit PDFSyed Arham MurtazaNo ratings yet

- PAC All CAF Subjects Mock QP With Solutions Compiled by Saboor AhmadDocument132 pagesPAC All CAF Subjects Mock QP With Solutions Compiled by Saboor AhmadHadeed HafeezNo ratings yet

- ICAEW CLass NotesDocument60 pagesICAEW CLass Notestouseef100% (1)

- IAS 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument5 pagesIAS 20 Accounting For Government Grants and Disclosure of Government Assistancemanvi jainNo ratings yet

- 2001-SEPTEMBER To 2013-SEPTEMBER-Q - TAHA POPATIA - PAST PAPERS OLD PAST PAPERSDocument106 pages2001-SEPTEMBER To 2013-SEPTEMBER-Q - TAHA POPATIA - PAST PAPERS OLD PAST PAPERSShehrozSTNo ratings yet

- 3 Non-Current Assets TopicDocument43 pages3 Non-Current Assets TopicpesseNo ratings yet

- Tax Icap Chapterwise PP With Solution Prepared by Fahad IrfanDocument79 pagesTax Icap Chapterwise PP With Solution Prepared by Fahad IrfanHareem100% (1)

- Caf 8 Cma ST PDFDocument656 pagesCaf 8 Cma ST PDFAbdullah DildarNo ratings yet

- Assignment IAS 23 Borrowing Costs PDFDocument7 pagesAssignment IAS 23 Borrowing Costs PDFmirirai midziNo ratings yet

- Saad SB (Q (4+9) ) FinalDocument4 pagesSaad SB (Q (4+9) ) Finalayazmustafa100% (1)

- CP 10Document48 pagesCP 10Mohammad FaridNo ratings yet

- IntermediateDocument139 pagesIntermediateabdulramani mbwanaNo ratings yet

- CPA Ireland Corporate Reporting 2015-18Document174 pagesCPA Ireland Corporate Reporting 2015-18Ahmed Raza Tanveer100% (1)

- Topic 6 - ACCA Cash Flow Q SDocument8 pagesTopic 6 - ACCA Cash Flow Q SGeorge Wang100% (1)

- ICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKDocument206 pagesICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKSaiful Islam MozumderNo ratings yet

- Orchid LimitedDocument3 pagesOrchid LimitedANo ratings yet

- F5 Division Roi RiDocument16 pagesF5 Division Roi RiMazni Hanisah100% (1)

- Qa Ca Zambia Programme December 2019 ExaminationDocument449 pagesQa Ca Zambia Programme December 2019 ExaminationimasikudenisiahNo ratings yet

- Cost Accounting 1 (Acct 403)Document43 pagesCost Accounting 1 (Acct 403)OFORINo ratings yet

- Accounting: The Institute of Chartered Accountants in England and WalesDocument26 pagesAccounting: The Institute of Chartered Accountants in England and WalesPhuong ThanhNo ratings yet

- Ifrs 9 - Financial Instruments Review QuestionsDocument9 pagesIfrs 9 - Financial Instruments Review QuestionsHamad Sadiq100% (1)

- Incomplete RecordsDocument9 pagesIncomplete RecordsOkasha AliNo ratings yet

- SBR Kit 2025 - Mock Exam 3Document26 pagesSBR Kit 2025 - Mock Exam 3Myo NaingNo ratings yet

- Acca Strategic Business Reporting (International) Mock Examination 2Document8 pagesAcca Strategic Business Reporting (International) Mock Examination 2Asad MuhammadNo ratings yet

- Chap 4 - IAS 36 (Questions)Document4 pagesChap 4 - IAS 36 (Questions)Kamoke LibraryNo ratings yet

- ACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFDocument11 pagesACCA F7 Revision Mock June 2013 QUESTIONS Version 4 FINAL at 25 March 2013 PDFPiyal HossainNo ratings yet

- Practice Cases For Chapter 12 Case 1Document3 pagesPractice Cases For Chapter 12 Case 1Lê Minh TríNo ratings yet

- CA Inter Costing Practical Questions With SolutionsDocument311 pagesCA Inter Costing Practical Questions With SolutionsAnkit KumarNo ratings yet

- f7 Mock QuestionDocument20 pagesf7 Mock Questionnoor ul anumNo ratings yet

- BBA - Business Law and Taxation Course Outline Updated 24.11.2020Document7 pagesBBA - Business Law and Taxation Course Outline Updated 24.11.2020Maryam AslamNo ratings yet

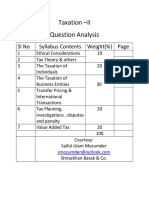

- Question Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Document68 pagesQuestion Analysis ICAB Application Level TAXATION-II (Syllabus Weight Based)Optimal Management SolutionNo ratings yet

- F2 Notes LatestDocument267 pagesF2 Notes LatestWaseem Ahmad100% (1)

- CA Inter Costing Scanner by Enkindled MindsDocument259 pagesCA Inter Costing Scanner by Enkindled MindsILLEGAL SUNNo ratings yet

- IAS 36 Impairment of Assets (ICAP C6 S10)Document2 pagesIAS 36 Impairment of Assets (ICAP C6 S10)Mauhammad Najam100% (1)

- F7 June 2013 BPP Answers - LowresDocument16 pagesF7 June 2013 BPP Answers - Lowreskumassa kenya100% (1)

- Financial Accounting and Reporting 1Document6 pagesFinancial Accounting and Reporting 1BablooNo ratings yet

- IAS-40 testDocument1 pageIAS-40 testBasit MehrNo ratings yet

- CAF 5 FAR2 Spring 2022Document7 pagesCAF 5 FAR2 Spring 2022Ushna RajputNo ratings yet

- Questions On Accounting StandardsDocument6 pagesQuestions On Accounting StandardsDEENo ratings yet

- H16 Preferential Taxation PDFDocument7 pagesH16 Preferential Taxation PDFJoshlyne MijaresNo ratings yet

- Elliott Management - JNPRDocument28 pagesElliott Management - JNPRWall Street Wanderlust100% (1)

- Topic 6 - Capital Investment Dec MakingDocument52 pagesTopic 6 - Capital Investment Dec MakingChoirul HudaNo ratings yet

- Pa 2Document3 pagesPa 2vi ngelsNo ratings yet

- Commercial Banking Operations:: Types of Commercial BanksDocument6 pagesCommercial Banking Operations:: Types of Commercial BanksKhyell PayasNo ratings yet

- PRE - BOARD - 2 (2023-2024) : Grade: 12 Marks: 80 Subject: Accountancy Time: 3HRS General InstructionsDocument12 pagesPRE - BOARD - 2 (2023-2024) : Grade: 12 Marks: 80 Subject: Accountancy Time: 3HRS General InstructionsKaustav DasNo ratings yet

- Management Name DesignationDocument5 pagesManagement Name DesignationDt.vijaya ShethNo ratings yet

- Esg Scores Fact SheetDocument2 pagesEsg Scores Fact SheetfalakiltafNo ratings yet

- SCH 07Document9 pagesSCH 07Hemali MehtaNo ratings yet

- Ratio Analysis of HR TextilesDocument26 pagesRatio Analysis of HR TextilesOptimistic Eye100% (1)

- Voucher 2023 03 01Document1 pageVoucher 2023 03 01Mir Mazhar Ali MagsiNo ratings yet

- Management Accounting - Fund Flow AnalysisDocument30 pagesManagement Accounting - Fund Flow AnalysisT S Kumar KumarNo ratings yet

- Nature of Financial Accounting InformationDocument7 pagesNature of Financial Accounting Informationajeng.saraswatiNo ratings yet

- UntitledDocument6 pagesUntitledomdeviNo ratings yet

- Direct Tax Ca FinalDocument10 pagesDirect Tax Ca FinalGaurav GaurNo ratings yet

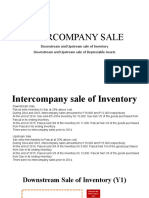

- Intercompany Sale: Downstream and Upstream Sale of Inventory Downstream and Upstream Sale of Depreciable AssetsDocument13 pagesIntercompany Sale: Downstream and Upstream Sale of Inventory Downstream and Upstream Sale of Depreciable AssetsShaina AragonNo ratings yet

- ACF 103 Revision Qns Solns 20141Document12 pagesACF 103 Revision Qns Solns 20141danikadolorNo ratings yet

- Module 11 Current Liabilities Provisions and ContingenciesDocument14 pagesModule 11 Current Liabilities Provisions and ContingenciesZyril RamosNo ratings yet

- Lecture 08Document27 pagesLecture 08simraNo ratings yet

- Quiz BFDocument3 pagesQuiz BFlope pecayo0% (1)

- Conn's Inc.: Investor Meetings Recap - Good Visibility Into Impressive EPS GrowthDocument10 pagesConn's Inc.: Investor Meetings Recap - Good Visibility Into Impressive EPS GrowthAshokNo ratings yet

- Nama Anggota: Ardhe Nareswari S Ghaida Aulia P Salsabila Eka S Kelas: 2B - Keuangan Syariah P6-6A March 1 (195144033) (195144042) (195144057)Document5 pagesNama Anggota: Ardhe Nareswari S Ghaida Aulia P Salsabila Eka S Kelas: 2B - Keuangan Syariah P6-6A March 1 (195144033) (195144042) (195144057)Ghaida AuliaNo ratings yet

- Pas 1Document26 pagesPas 1Princess Jullyn ClaudioNo ratings yet

- Chapter 9 PDFDocument29 pagesChapter 9 PDFYhunie Nhita Itha50% (2)

- CHAPTER 3 - PracticeExerciseDocument5 pagesCHAPTER 3 - PracticeExerciseSerenity CarlyeNo ratings yet

- FA IV Rewritten070306Document549 pagesFA IV Rewritten070306Collins Abere100% (1)