Professional Documents

Culture Documents

Fxgroundworks: Jump Start Education, Got It?

Fxgroundworks: Jump Start Education, Got It?

Uploaded by

Heathcliff NyambiyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fxgroundworks: Jump Start Education, Got It?

Fxgroundworks: Jump Start Education, Got It?

Uploaded by

Heathcliff NyambiyaCopyright:

Available Formats

Chaos Theory The Hunt is ON Why Price Patterns?

10 Cool Ways to Live Again

Learn how using chaos Tell us your stories, the Underpinning nature, Want to improve your life

theory can clear things up! good, the bad and the ugly underpinning the Forex and your trading?

issue 2 | Second Edition

FXGROUNDWORKSMAG

F X G r o u n d w o r k s . c o m / Yo u r P a t t e r n T r a d i n g R e s o u r c e

Jump Start

A 6 month program that will jump start your journey

as an pattern trader.

Education, Got it?

You can spend years figuring it out, or you can start

reading the articles inside this issue!

Trade Validation

A New Proven Tool With Sophisticated Algorithms!

1,450,000+ Patterns

In Our Database

Knowing the statistical odds.

The Hunt is ON!

Another force is at work here...

Brought to you by the leaders in fibonaccipattern trading; FXGroundworks.com

Second Edition

CONTENTS

3. Fibonacci Patterns and have a life?

FXGroundworks

Fibonacci Pattern Trading is the 19. The biggest trade of 2011

most effective way of trading Meet Beezer, the winner of our largest

the Forex Market, with a 70% winning trade.

success rate.

20. Change - why should we?

4. Chaos Theory and the Are you profitable, or not?

Financial Markets

Heard of the butterfly effect? 21. Actions and Reactions

There is order in randomness. Sir Isaac Newton’s law applies to the

Forex too.

5. Strange Attractors

What are they? Are they useful? 22. Riding out Retracements

Can you - do you?

6. The Hunt is ON

How reliable are your brokers? 23. Jump Start your trading

Which ones have cared about 6 months intensive training course for

whether you succeed or fail as a the savvy trader.

trader?

8. Pattern Selection

Good patterns make the differ-

FXGROUNDWORKSMAG

ence between a good pattern

the best practical trading mag

trader and a great pattern trader.

EDITORIAL TEAM

10. Chart Replication John Breen

Joanna Simpson

13. Gambling or trading?

PROOF READERS

How do we know the difference Maggie Smith

between whether we trade or Simone Vaughan

just gamble? Toni-Lee Reardon

14. Coping with Volatility ADVISORS AND RESEARCH

Mike Anderson

How do we manage to keep our

Lana Frederickson

heads when the market is whip-

ping our trades to shreds? And I almost forgot, we want

to thank our readers for their

18. 10 Cool ways to live dedication and faithfulness to this

again magazine. You rock!

Are you so bogged down in the

Copyright © 2012

trading cycle you can’t seem to FXGroundworksMag

FXGROUNDWORKSMAG Second Edition

STRATEGIES | Methods

FIBONACCI PATTERNS &

FXGROUNDWORKS

FXGroundworks.com is the only website that specializes in fibonacci pattern trading by sifting through over 570

charts on every tick of the market to alert traders to specific price patterns. They provide you with the most ad-

vanced tools to seek out the most highly profitable patterns that fit into your trading plan. They focus on finding

price patterns for Forex Traders who want to trade with 70% probability on their side.

By FXGroundworks

F XG R O U N D W O R K S F I B O N A CC I PAT T E R N T R A D I N G I S

T H E M O S T E F F E C T I V E WAY O F T R A D I N G T H E F O R E X

M A R K E T. W I T H A ~70% S U CC E S S R AT E , L I T T L E W O N -

OVER

DER THE POPULARIT Y IT ’S GAINED OVER RECENT 1,450,000

YEARS.

PATTERNS

Fibonacci pattern trading sorts through the chaos of the currency

market and uses its power to harness patterns that make you less

IN THE

emotional when trading to earn money. DATABASE,

FXGroundworks also awakens you to the sheer beauty of the world STATISTICS

around us. They teach you to appreciate the marvel that is in and

around each of us and then they relate that to the currency market. ARE NOT A

The patterns they alert but it ain’t easy. If you’ve traded for a

GUESS, BUT A

you to give you the opportu- while and struggled to make a consis- FACT.

nity to sort out which ones tent profit, you will have learned that

suit your trading plan and already. The market has a mind of its

the most probable trades. own and a will of its own.

Their Education Center However with FXGroundworks,

is one of the best teaching the learning curve is sure and steady.

tools that one could want to You will convert to a safe and reliable

experience and their research currency trader once you become a

and development in this con- member of the site, learn the methods

tinually shifting environment thoroughly and adopt the harmonic

makes sure you learn to stay principles and practices.

at the top of your game.

Want to know more? Go to www.

Don’t let anyone tell you fxgroundworks.com and start your

that trading the Forex is fast journey towards a new career or kick

and easy. It might be fast start your old one as a currency trader.

Second Edition FXGROUNDWORKSMAG

CHAOS

THEORY

AND THE

FINANCIAL

MARKETS

a period of time the environment

does change from what might

have ultimately happened on any

given day. For instance, instead of

a tsunami devastating some island

nation, there may be a tornado in

North America.

These types of incidents are fre-

quently attributed to Chaos Theory

where a small alteration in condi-

tions can have a profound effect on

the longer term state of affairs of a

region.

Lorenz believed it was not fea-

sible to accurately forecast weather

however his experiment ultimately

CHAOS THEORY AND THE FINANCIAL MARKETS became known as Chaos Theory.

BY FXGROUNDWORKS His theory was based on the fact

that starting with the number 2 the

end result could be totally different

C H A O S T H E O R Y I S T H E S T U DY O F N O N - L I N E A R DY N A M I C S . I T S from a result with a starting value of

P R I N C I PA L P U R P O S E I S TO P R O V E T H AT T H E R E I S O R D E R I N 2.000001.

RANDOMNESS.

Using Chaos Theory provides us

with a way of taking something very

The Markets (Stocks, Futures or Forex), being non-linear, chaotic like the financial markets

suit this type of theory – the theory that from repetitive, and organizing the data so that we

seemingly haphazard behaviour, an orderly pattern emerges. can forecast future moves. We orga-

nize this data by using patterns and

In 1960, a meteorologist named Edward Lorenz set up an different principles.

experiment in which he attempted to model the weather. His

experiment eventually led to what has been termed ‘the but- We cannot calculate every pos-

terfly effect’ whereby the difference in the starting points of sible move in the market and which

an event could be so tiny that it can be compared to a butter- events will unfold and which will

fly flapping its wings. not, however we can use this infor-

mation to give us a statistical edge

Such flapping of a butterfly’s wings can produce a minus- and then it would just be a matter of

cule alteration in the atmosphere. The theory goes that over playing the odds and obeying your

FXGROUNDWORKSMAG Second Edition

money management rules when you

trade. STRANGE

Fibonacci Pattern Trading is one

such method that embraces Chaos

Theory and attempts to harness its

ATTRACTORS

pandemonium into predicted direc- Strange attractors are used in the

tions within the financial markets. market to further help us pinpoint

when we should be trading, and When trading around the attrac-

FXGroundworks.com is the pri- when we should just be watching. tor we have to be extremely care-

mary educational site that can teach ful, as price could tend to get very

traders about Chaos Theory, Fractals Have you ever looked at a chart violent and sporadic. When price

and human repetition. and wondered when it’s the right moves away from the attractor we

time to get in? Of course - and this can gain more of a statistical edge.

Amid the chaos of the market how is the problem our attractors can One of the first questions people

can we predict where price might go? solve for us and further organize our usually ask about an attractor is how

How can we envisage that self-or- charts. they can spot them or see them in

ganising clusters of price bars might the market.

show us that there is order in chaos? An attractor is a set towards which

a variable, moving according to We have many lessons on this

FXGroundworks.com have the dictates of a dynamic system, however the best way is presented

utilised a way discovered many evolves over time - such as the in our videos in the Educational Cen-

years ago to harness the power of financial markets. ter. These quick resources will bring

fibonacci pattern trading and to to you everything you need to know

organise those patterns into their There are different types of about attractors.

site to give a more predictable way attractors - for instance the LORENZ

of trading. point attractor or the limit cycle

attractor, however we use a strange ATTRACTOR

Not all of these patterns will work attractor because it is a non-integer

out well and unless we keep the dimension attractor. (EXAMPLE OF

losses on those pattern trades small,

and let the patterns that do work out An example of a strange attractor A STRANGE

well have their head, we won’t suc- would be the Lorenz system. It looks

ceed as traders. like a crazy 8 type pattern. ATTRACTOR)

Price will not always go where

we want it to go, however fibonacci

pattern alerts give you many op-

portunities to test the Chaos Theory.

In markets there is much success

to be had when price follows the

predicted pattern conjecture.

MANY

PATTERN

TRADERS USE

ATTRACTORS

TO HELP

EXPLAIN THE

F XG R O U N D W O R K S E D U C AT I O N A L C E N T E R

MARKET.

MORE IN CHAPTER 7 OF OUR VIDEO EDUCATION

Second Edition FXGROUNDWORKSMAG

THE HUNT IS ON

I N T H I S V O L AT I L E F O R E X M A R K E T, H O W H A R D I S I T F O R U S TO F I N D A

R E P U TA B L E B R O K E R T H AT O F F E R S U S T H E B E S T S E R V I C E P O S S I B L E ?

How do we know which brokers have We all have stories of our successes

BY FXGROUNDWORKS

good spreads and which ones may and failures with brokers. At the

widen spreads on us in times of time of writing, some of us have

unpredictable price fluctuation? had several negative experiences

with brokers. One trader told us that

The answer lies in examining the his broker closed a trade for a loss

brokers’ service and keeping an eye when price went nowhere near his

on how they deal with our accounts. stop – making it painfully obvious

This can be a time-consuming they were after his money. In this

exercise, with many traders too instance when challenged, the broker

busy analyzing charts and watching reinstated his trade, realizing that

for good opportunities to be able they had hunted stops before price

to closely monitor the brokers’ had even reached that point.

activities. However unless we can do

that regularly, we may be susceptible An experience with a different broker

to some creative market makers came about when another trader

making off with more of our hard- had a stop at break-even and a

earned pips than we want them to. news event occurred, causing price

FXGROUNDWORKSMAG Second Edition

Most people when asked what constitutes a decent broker will reply,

‘one where I know my money is safe, and where they’re not likely to

go into liquidation, taking my money with them’.

to spike. The broker stopped the trade out for -34 pips,

even though it was at break-even. In this instance, they Others might say, ‘a decent broker is one who doesn’t hunt my stops

would not make good the trade nor reinstate it to break- and allows me to have a fair go when trading’. Yet others have an

even and the money was lost. The broker’s reasoning opinion of good customer service getting their vote.

was that they could not prevent some trades from being

affected in high-volatility markets and they could not These things would be ideal but we know we don’t live in an ideal

guarantee stops even though this trade was at break- world. Brokers would not be in business if traders won all the time

even. In effect they assured the trader that having her and they (the brokers) lost money.

trades at break-even was not safe during high-volatility

market movement. So be aware of this problem if you So the hunt for a reliable, ‘decent’ broker is on.

have an open trade in a volatile environment such as

NFP or around news announcements; there may be a We’d like your stories – horror stories or good stories so we can

detrimental effect on your pair of choice. collate a general overview of traders’ best and worst experiences.

Email your stories to:

These and other instances leave us wondering how we

find a decent broker and what does the term ‘decent’ info@fxgroundworks.com

mean? .

Second Edition FXGROUNDWORKSMAG

PATTERN

SELECTION

MADE EASY

Pattern selection and pattern

validation techniques can mean the

difference between a good pattern built upon. When we take out the microscope

trader, and a great pattern trader. we can start to examine more of the

This can best be explained by specifics.

As we commenced the develop- a little adventure I had recently.

ment of creating the “score” that How many bars should a pattern

analyzes the validation of the struc- I was looking at an invest- contain before it’s considered struc-

ture of the pattern (and thus help us ment property that was right turally sound? How many pips from

with our pattern selection) we took along the Atlantic Ocean. A the first fib of the reversal zone to

into account over 1,450,000 pat- beautiful Condo with suites large the last valid fib of the reversal zone

terns that are now in our database. enough to be considered the do we allow when giving the trade

same area as your medium-sized enough time to work out?

Statistics play a huge role in your house. However, the developer

decision making skills, and with well ran into a problem. The build- We can dive deeper and ask the

over half a million patterns turning ing was later ruled unsafe and question, what is more important, a

out some of the most tested fibo- didn’t get licensed because the pattern with lots of bars or a pattern

nacci pattern research the industry ground it was built on, wasn’t where the ratios are most preferred?

has yet to see, you can be confident safe. So even though the build- Does one give more significance

that the information we share with ing looked great, the investment than the other?

you is well tested. did not.

All these questions have answers;

There are two critical conditions Likewise with patterns, even and all the answers once compiled

when looking at the structure of the if a pattern looks good, some- give us results. When you use the

pattern. One of the most critical times the investment or trade pattern validation tool at FXGround-

conditions you can observe when we make doesn’t always make works you will discover the ability

looking at a pattern is the internal sense based on external factors. to quickly identify the structure of

structure, and the other; the external In the building example, the every pattern without the need to

structure. Both get presented at the building could fall over, and in do all the analysis yourself.

time a pattern is identified and both our case the trade would stand

are equally important. a greater chance of failing. Experience fibonacci patterns

without the difficulties most pat-

Imagine you’re building an apart- What goes into the pattern tern traders face. Just another tool

ment building that is going to be 18 validation? Understand that the available at FXGroundworks.com.

stories high. The internal strucutre elements we use to “score”

(the support columns for example) of these patterns are long and

the building has to be engineered to rather complex. We don’t just

hold the weight of all the floors, to look at the pattern, but we look

stand up during an earth quake and at the surrounding candlesticks

to be able to withstand strong winds. of the pattern to identify the vol-

The external structure also has to be atility of the external structure.

strong - that could be likened to the

soil that the building is going to be And this is just the beginning.

FXGROUNDWORKSMAG Second Edition

Pattern Validation

Analyzes the structure of every fibonacci pattern!

Now Available!

FXGroundworks.com

Second Edition FXGROUNDWORKSMAG

ONE OF THE BIGGEST CHALLENGES TRADERS FACE

DA I LY I S F I G U R I N G O U T H O W M U C H TO R I S K O N

ANY PAR TICULAR TR ADE. C AN WE C ALCULATE IT

Bad Example

S TAT I S T I C A L LY ?

Risk is equal to

GAMBLING OR the reward.

TRADING?

The long-term outcome of gambling is loss.

Gamblers who started the habit in their teens are

around three times more likely to remain habitual adult

gamblers. Life in general seems to endorse gambling,

with lotteries, well-known horse races, dog races; in fact

some people will bet on two flies crawling up a wall, if

they have a predilection to gamble. Gambling is a very

broad problem and is not as clear cut as we think. It is

in every walk of life.

As traders, we need to learn not to be gamblers. Our

approach when trading should be based on consid-

ered, practical and techni-

cal evaluation of our price

pattern trading opportu-

nity; our position and our

risk. The question to ask

ourselves is, are we gam-

bling instead of trading? Do

we need to get immediate

results from trading, or are

we content to let a trade

ride and be able to accept

a small loss or appreciate a

good winner.

Bad

If traders gamble, they consider jumping into a trade loss will sometimes hold the platform until price moves

around news, trying to capitalize on which way the in their brokerage’s favor. The trader who has closed out

market might head. Some traders take what’s known as the short trade is now forced into a losing position that

OCO trades (one cancels the other) which simply means can’t be closed out because the broker may have frozen

they will put two trades on the same pair, one short, the the platform. This freezing of the platform and move-

other long. They are gambling with a 50-50 chance of be- ment of the spread by the broker, is called slippage.

ing right (or wrong). The difficulty with this gamble is the Brokers often blame this slippage on their liquidity

stop placement and the risk involved and the fact that providers. It could be a combination of both companies

price may not continue the way they think it should. For conspiring against the poor luckless news trader.

instance a pair might go up (long) which results in the

trader closing out his short position. The pair can move Risk versus reward objectives help counter the tendency

up 20 - 30 pips before slamming back down again in one for traders to jump into a trade based on emotion. They

fell swoop. The broker, unable and unwilling to take the can take a considered approach based on pure math-

FXGROUNDWORKSMAG Second Edition

ematical calculations. This objective is consequently tak-

Good Example ing away the aspect of gambling on a trade and replacing

it with more of a premeditated assessment of a reason-

able outcome.

Risk is half the Analysis and decision-making helps remove the emo-

reward. tional (gambling) aspect and allows traders to confine

their prospective trading strategy to a 1:2 – 1:6 risk ver-

sus reward base.

Anything less than 1:2 becomes unworthy of the time

to trade when the return is no more than risking one

pip to gain one or one and one half pips. Anything more

than a ratio of 1:6 becomes an improbable trading sce-

nario.

If we find we are unable to cease trading breakouts,

fake-outs, news and volatility then we know we have an

urge to gamble. And we know our long-term prognosis as

traders if we are just gamblers, is failure. So, don’t let’s

speculate on the news events or similar volatile times

like Non-farm Payroll (NFP) out of the United States.

Let’s take a studied, calculated statistical approach.

While we cannot predict when we’re going to take a

winning trade, we can use fibonacci pattern trading to

give us an edge to know that 70% of the time, the PRZ

will give us a measured point where price might turn.

Good Let’s not gamble at all...let’s use price pattern trading to

give us an edge.

That edge is available through the tools at FXGround-

works where the site automatically scans for a valid risk

vs reward and then lets you filter these results to show

the good patterns to take rather than the bad.

Good

LEGEND

Yellow is the entry point.

Red is the point where you get

out of the trade.

Green = Target Point (1st)

Second Edition FXGROUNDWORKSMAG

BY FXGROUNDWORKS

COPING WITH

VOLATILITY

2008 = Subprime Mortgage Crisis

FOR A FEW MONTHS A YEAR, For a few months a year, we

WE WONDER WHY WE CHOSE wonder why we chose the career we

THE CAREER WE CARVED OUT carved out for ourselves as currency

F O R O U R S E LV E S A S C U R R E N C Y traders.

TRADERS. VOLATILIT Y WILL PLAY Those months are generally when

A B I G R O L E I N YO U R B I G G E S T the market movers are on holidays

W I N N E R S A N D YO U R B I G G E S T and volume dries up. It can also

LO S E R S . H O W E V E R , I F YO U R happen when countries intervene in

MONE Y MANAGEMENT IS TIGHT the future of their home currency to

E N O U G H YO U R LO S E R S W I L L B E influence its strength and bring their

K E P T S H O R T, A N D YO U R W I N - currency back to a more manageable

N E R S W I L L B E L E F T TO G R O W level.

A N D T U R N O U T TO B E S O M E O F There are reasons markets are

T H E G R E AT E S T T R A D E S YO U ’ V E volatile. It is generally caused by

EVER MADE. human intervention or catastrophic

events that are beyond our control.

As pattern traders, we need to care

less about that unpredictability – all less you’re riding it in the right direc-

we need to do is lower our risk and tion, and unless you have decisive

make the most of our opportunities and affordable stops in place, it can

after these large movements occur. be a heart stopper.

VOLATILITY Ever been in a trade where you If a trader was holding a short po-

have no stop or have placed a wide sition on a pair that has a high ATR,

CAN HURT stop to try to avoid that ever-present they could suffer a shattering 1,000

threat of being stopped out? The pip move against them within a

YOU IF NOT precariousness of the market can couple of days. If they’d had a valid

impact on traders who have this long price pattern and it went their

RESPECTED. approach to trading. It is the most way, giving them 1,000 pips in the

probable way of draining your ac- bank, they would have been happy

USE IT count balance. with the direction and figured they

These explosive trades that move were a hero.

CAREFULLY. hundreds of pips in a day or two are It shows what can happen in the

the ones some people clamour to market in the blink of an eye and

ride all the way to the bank. But un- gives the reason for setting valid

FXGROUNDWORKSMAG Second Edition

Wall Street crash of 1987

more opportunity for traders to place the saying ‘there is no such thing as

stops even more importance. their trades. a free lunch’ has never been more

Volatility is not a long term recipe The other thing to consider is that self-evident. Borrowed money is

for success as a trader; it can be a with economies struggling through never acceptable to use as collateral;

recipe for a short term career as a the financial burdens of depres- if you find you’re in trouble after a

trader. sion or the heady signs of regrowth, particularly volatile trade and your

Not all markets experience volatil- many traders tend to speculate on account is compromised, make sure

ity. The more stable markets don’t which way they think the currencies you don’t use borrowed money to

experience it so much but the Forex may go. Given the thrashing about in top up your account balance.

market, with its high demand - trad- the European economies, it’s almost So the next time you’re tempted

ers moving money around - is often impossible to get a handle on that or to place an order with no stop or

quite volatile. There are pairs that know which way the Euro will head. a wide stop, think again and put

are not as volatile as others and Rescue packages abound where something manageable in place.

these pairs suit the more conserva- countries are financially ‘propped up’ Better to take a small loss if things

tive trader. The pairs that are volatile by others however in the long run, don’t go your way, than a huge one.

need a well disciplined trader who is someone has to pay the fiddler and

able to control their trade and their

risk and not take profits too soon.

Currency pairs that are unstable

are not preferred for the special-

ist trader. Low volume in the Forex

market is also an environment where STOCK MARKET

many gains can be wiped out be-

cause traders feel they ‘have to be in CRASH OF 1929.

a trade’ no matter whether the rest

of the world is on holiday, or not. ONE OF THE

Price levels themselves are not

only critical, it is the movement of MOST VOLATILE

price levels that we focus on to form

our patterns. Of course, if volume is DAYS IN THE

low it takes much more time for pat-

terns to form but in higher volume HISTORY OF

environments, the patterns form

more quickly and therefore offer TRADING.

Second Edition FXGROUNDWORKSMAG

exit trades. Choose a time frame that trade.

10

suits your lifestyle and the hours

you want to devote to trading. Lower 6. Be satisfied to take targets at

time frames mean more volatile set points.

price movement and more attention;

higher timeframes (with stops to Don't trust your emotional self to be

suit and with less volatility) allow us able to figure out whether to stay

more time away from the screen. in a trade or not. Trust the pattern

points and take some of your trade

3. Are you managing your risk off when price reaches those targets.

so that a couple of trades don't wipe Even though Michael Douglas made

out your account balance and end the phrase well known in the movie

COOL WAYS your trading career?

Place stops in a logical place and

'Wall Street', ‘Greed is good’, greed is

not good.

TO HELP leave them there. If they get hit,

then you're as well out of the trade.

7. Don't take things personally.

IMPROVE If you move them, you stand to lose

more pips if price continues to move

We are not wrong when we take a

trade and it goes against us - it's

YOUR against you. Although if a big move

looks like it's going against you and

just the way the market is moving.

If you become depressed or in the

TRADING you think your stop will be taken

out, consider killing the trade early if

you have a reasonably wide stop.

doldrums because you've had sev-

eral losing trades, re-evaluate your

reasons for taking the trades in the

AND LIVE 4. Watch news events - are you

first place (FXGW teaches us how to

do that) otherwise we do ourselves

LIFE AGAIN up to speed with where your pairs

are and when they are at the mercy

an injustice. It isn't personal - it's

merely a losing trade.

of news?

8. Get up early (unless you

1. Have a look whether the Always look to see what news events trade a session that doesn't al-

method you're using is allowing are scheduled before entering a new low you to trade until the wee

you to live the lifestyle you want. trade. You need to consider your cur- small hours of the morning) and go

rent trade too, if you are in a trade through your charts diligently.

If it isn't, then it's time to look for with scheduled news. Don't neces-

a new method. Some people think sarily close the trade out, but make Go to bed early (don't burn the

the harmonic method of trading is sure your stops are either at break- midnight oil) and get up early. Tired

hard, but things are only as hard as even or are at a place where you traders are not the best traders to be

we make them. You've heard many can protect some pips if price goes around or to be making decisions.

people say, 'trade what you see'. against your trade. Many trades that we shouldn't have

That also applies to harmonic trad- taken are taken when our concentra-

ing. Don't try to guess where the 5. Don't invent ways to stay in tion levels are shot.

harmonic trade might go - use the a losing trade.

pattern alerts on FXGroundworks. 9. Never stop learning about

com to show you the trades, and Necessity is the mother of all inven- the markets and learn as much as

wait until the pattern forms be- tions. However it isn't necessary for you can about how your preferred

fore choosing your entry and stop you to stay in a losing trade but it pairs fluctuate.

points. is essential to make sure your stops

are not at the point where the los- Without studying the markets, the

2. Are you stuck in front of ing trade is killing your account. If charts and the pairs you want to

the screen all day, worried that if you've placed a reasonable stop then trade, you will be bewildered when

you leave it you will miss a great be satisfied with that choice. If you things don't go your way and pleas-

opportunity or get stopped out? are sure price is going to turn in the antly surprised if they do. Knowledge

next time frame or you know there's is power - the power to make good,

Harmonic trading allows us to see a news event coming up later that harmonic trading decisions.

more clearly where to enter and day and you move your stops, you

are inventing ways to stay in that 10. Improve your memory.

FXGROUNDWORKSMAG Second Edition

Study pairs more closely so you can

tune in to where your trade is without YOUR BEST

necessarily being in front of your screen.

A good memory (such as counting the

cards as they come out in poker) will

FIBONACCI TRADE?

always give you an edge. It will also help LARGEST TRADE OF 2011

you remember that person you bump Instrument: GBPCHF

into in the street :)

Timeframe: H1

Pattern: Butterfly

Method: HAT - Harmonic Auto Trader

Most traders at some point INTERVIEW: was almost fun to see how far I

in a year of trading will hit a FXGW: Beezer, the GBPCHF trade could let it go, and once we got

worked out really well for you. over 1600 pips I had pulled the

losing streak no matter what Can you tell us when this trade plug. By the time the trade was

system you trade. was fired off and what you were done I only had 1 lot left.

doing?

The question is, can you

BEEZER: It was automatically FXGW: Was that a record trade for

keep doing what you’re do- triggered in July. I was actually you?

ing regardless of the results, asleep at the time as it was a

knowing you will overcome trade that got fired during the BEEZER: Yes, but when you take

these losses? European session. When I woke trades like this there is also a little

up it was up about 30 pips. luck on your side. I can’t remem-

ber a time in recent past I saw any

If one trade matters to you, FXGW: Can you tell me about the pair drop almost 2,000 pips in a

then you’re trading the trade? How many lots you had couple weeks. I’ve had a couple of

on? Where you took profit? Or any other trades around 500+ and love

wrong way. However, if you other information you recall about to see the patterns work out like

are basing your results over the trade etc... this. 50 pips seems small now!

many trades, then you’re

going to understand that BEEZER: I had 3 lots that were FXGW: How has your trading been

entered for me and I always take going since you started with har-

sitting through both winning one of the lots off at the B point. monics and the HAT?

and losing streaks becomes a From there I did let the trade run

walk in the park. and it seemed like every day it BEEZER: Good, overall I’ve been

kept going and going. Soon it pleased. I feel like I’ve been mak-

ing a lot of progress.

FXGW: Well thank you for letting us

know all about the GBP/CHF. Amaz-

ing trade and great job!

Second Edition FXGROUNDWORKSMAG

CHANGE?

SHOULD WE CHANGE WHAT WE ARE DOING?

H O W N E C E S S A R Y I S I T T H AT, W E C H A N G E T H E WAY W E T R A D E ?

what we’ve learned so far has not

given us the edge we need.

Many traders use systems that

How neccessary is change in our trading?

rely on linear math but as the Forex

market is non-linear it’s impossible

to see how two such systems fit

together. Fibonacci Pattern Trading

is based on non-linear data and an

approach that sends clear signals on

entry and exit points.

Some people are uncomfortable

with the fact they have to learn pat-

tern ratios and fib levels; some over-

analyze and try to micro-manage

the process of learning the patterns.

We can make learning pattern trad-

ing easy or we can make it hard.

The method itself is simple

Change...should we? involves personal growth, along with enough; it’s we humans who tend

a shift in mindset to face the fact to over-complicate things. The fact

How necessary is it that we that we will never succeed as traders that these fibonacci patterns are

change the way we trade and the unless we understand that maybe found in nature, found in wildlife

method we trade with? our approach and our attitude need and subsequently found in the

modification. Forex market, make them a strong

The answer is simple. If we are influence and give a physiological

making plenty of money trading the We need a clear picture of where connection with traders.

method we’re using and there’s little we want to be as traders and then

or no room for improvement, change take the steps to get to our goal. It’s FXGroundworks teaches traders

isn’t necessary. not enough to say, ‘I want to be rich the Fibonacci pattern trading ap-

beyond my dreams’ because unless proach and they provide those pat-

But if we’re not making money; if we have a great method of how to terns alerted on the MT4 platform,

we’re in that group of 95% of trad- ‘get rich’ we simply can’t succeed. to make it easy to learn the method.

ers who can’t seem to succeed; if

we’re digging ourselves into a hole So how do we succeed? Go to FXGroundworks.com and

with our account balance plummet- check out the patterns. Make time

ing, it’s time to alter our approach. To some degree we need to ‘re- for a change.

The messenger for change is our lack program’ our view of the market and

of success in our chosen career as a the signals it sends us. We need to

trader. revisit our trading plan to make sure

our risk is within acceptable bound-

We need to employ a strategy that aries and we need to realise that

FXGROUNDWORKSMAG Second Edition

ACTIONS REACTIONS

The trader who is yet to learn the

law of action and reaction might set

no stop or a stop hundreds of pips

away thinking that the currency

couldn’t possible move that far.

The trader might learn that currency

pairs with a high ATR (average true

range) can move hundreds of pips in

one market trading day, if an unex-

pected (or even an expected) event

occurs.

Traders who trade longer term time

frames such as Daily / Weekly /

Thrust is the forward force that pushes the engine and, therefore, Monthly, may have a reasonably

the airplane forward. Sir Isaac Newton discovered that for “every distant stop but they should never

action there is an equal and opposite reaction.” An engine uses trade without a stop.

this principle.

Traders who trade 15 minute up to

Let’s consider Sir Isaac Newton’s third The main thing to remember when 4-hour time frames should place a

law of motion: ‘To every action there is trading the market, is the ebb and more limited stop, based on their

always an equal and opposite reaction: flow of money that is based on peo- positions and their trading plan

or the forces of two bodies on each ple’s emotions. So you take a trade, which will include their risk toler-

other are always equal and are direct- an unexpected news event comes ance. The lower the time frame, the

ed in opposite directions’. out and fear and greed take over. The smaller the stop but remember, the

trade goes your way...you feel like the lower the time frame, also the more

This is very true when applied to the world is your oyster. You take another volatile price action may be.

Bull and Bear Forex Market. If fear trade and it also goes your way and

grips the trading world, the herd you’re flying high. Trading takes some time to learn

mentality seems to take effect and and price pattern trading is no ex-

stampedes people into selling what Then the rot sets in. The unkind ception. However, it’s an easier path

they consider to be a currency that is market takes a swing at your position than trying to figure out moving

at risk. (literally) and heads the wrong way. averages or complicated indicators

This is the time for your action and and trying to trade a method that

The equal and opposite reaction is reaction to come into play. uses linear math in a non-linear

when other traders see the sell-off of market.

the currency as an opportunity and So, have you set a reasonable stop,

begin buying the currency, causing it to so that the market won’t trample your Better to trade fibonacci patterns,

rise in value once more, albeit a little account on its way to oblivion? Or the method that uses non-linear

slower than the rush of selling. (Gen- have you set a wide stop, or no stop math.

erally, the bearish trade moves three in the hope of lasting the swing out

times more quickly than the bullish and recovering the pips you thought Go check out FXGroundworks.com

trade - the exception to this rule is on you’d already won? and take the six-month Jump Start

NFP data and news releases.) Program for the best leg-in to trading

The law of the Forex Market is to un- The smart trader, who will live to fight you can get.

derstand the risk and keep that risk to another day, sets a reasonable stop.

a minimum; that way, we will survive Always. And doesn’t move their stop.

the roar of the market whether it goes Ever.

for us, or against us. Second Edition FXGROUNDWORKSMAG

The importance of stop placement.

RIDING OUT THE RE

One of the most emotional parts of

trading is watching our pair retrace,

either working itself toward our stop

or cutting some of our profits.

WHY DO MOST PEOPLE LOSE MONEY AS So how do we survive the emo-

tional roller coaster of retracements?

INDIVIDUAL INVESTORS OR TRADERS?

The first step is recognizing that

BECAUSE THEY’RE NOT FOCUSING ON there is a retracement. The second

step is realizing our emotional self

LOSING MONEY. THEY NEED TO FOCUS ON and that self is fearful that price will

go against us.

THE MONEY THAT THEY HAVE AT RISK

William Delbert (WD) Gann (1878 -

AND HOW MUCH CAPITAL IS AT RISK IN 1955), one of the recorded greatest

traders in technical trading grew up

ANY SINGLE INVESTMENT THEY HAVE. IF a Christian on cotton land. At the

tender age of 24 in 1902, he made

EVERYONE SPENT 90 PERCENT OF THEIR his first trade in cotton futures and

became a devotee of trading.

TIME ON THAT, NOT 90 PERCENT OF

Studying many forms and move-

THE TIME ON PIE-IN-THE-SKY IDEAS ON ment of the markets, he concluded

that the market was moved by ‘vi-

HOW MUCH MONEY THEY’RE GOING TO brations’. He claimed that he could

forecast the market’s movement with

MAKE, THEN THEY WOULD BE INCREDIBLY mathematics.

SUCCESSFUL INVESTORS. Opinions are divided over the rel-

evance or the accuracy of his analy-

sis. So be that as it may, how do we

make the most of Gann’s theories to

help us with controlling our emo-

tions?

18 | Magazine First Edition

FXGROUNDWORKSMAG Second Edition

Have you heard some of the stories your

colleagues tell about the trade that ‘was’?

H AV E A G O O D W I N N I N G T R A D E T U R N I N TO A B A D LO S I N G T R A D E?

TRADERS BLOWING A GOOD OPPORTUNIT Y? THIS DOESN’ T HAPPEN

I F YO U L E A R N TO T R A D E W I T H F XG W - K E E P YO U R P R O F I T S

RETRACEMENTS no loss); only to see the loss esca-

By considering the Gann principle It’s up to us to ignore the fear of late as price retreats further from

(whether we believe his work was missing out, the fear of losing our our entry and turns into a bad losing

accurate or not), where geometrical hard-won pips, the fear of being trade.

mathematics and vibrations move wrong and it’s up to us to keep our

the market, we can start to under- losses within our budget and make So watch these retracements;

stand that pullbacks, reversals or the most of our profits. figure out if you need to trail stops;

movements in the market are natural consider your trading plan and stick

and those movements are non-linear. Fear is also our primary emotion if to it. A lot of traders don’t focus on

we let our winning trade turn into a how they take profits - that it is just

The market does not and can- losing trade. as important as how they protect

not move in a straight line. Humans themselves from risk.

move the market, entering and exit- Many traders have second-

ing trades many times in one day, guessed their strategy after they’ve We need to have a little faith in

with over three trillion dollars traded witnessed a reasonable profit return ourselves, a little faith in our meth-

daily - a phenomenal feat, unheard to their entry point; march endlessly od, a little faith in our trading plan

of in Gann’s time. on past the break-even mark (where and a whole lot of patience.

they could have exited the trade for

Therefore it’s necessary to recog-

nize that we can always expect price

to move around, not descending or

ascending in a straight line but in

an ordered chaotic method and once

we make sense of that, we can then

cope with the fact that retracements

will always occur.

Fear is one of several emotions

that drives traders to reconsider their

positions when they see their pips

being eroded; greed is not an emo-

tion but is an offshoot of fear. Put

these two things together and they

make a powerful force to be reck- U S E S E N S I B L E S TO P P L A C E M E N T S , R E L A X A N D H AV E P E A C E

oned with. O F M I N D.

BY FXGROUNDWORKS

Second Edition FXGROUNDWORKSMAG

JUMP START!

When you join us for 6

T H E A I M I S TO G E T YO U E D U C AT E D

months you’ll get access to AND PROFIT BY KNOWING AND

U N D E R S TA N D I N G H O W A N D W H E R E

the ‘Jump Start’ videos. T R A D E S M I G H T S E T U P, H O W A N D

W H E R E TO E N T E R A N D E X I T T R A D E S ,

J U M P S TA R T I S A N E XC I T I N G N E W H O W TO TA K E P R O F I T S A N D H O W TO

F O R E X T R A I N I N G PA C K A G E TO H E L P M A N A G E YO U R R I S K .

FA S T - T R A C K YO U R PAT T E R N T R A D I N G

LEARNING CURVE. A LO N G W I T H T H E M E M B E R S H I P A N D

T H E T R A I N I N G PA C K A G E CO M E S F XG W ’ S

W H E T H E R YO U ’ V E H E A R D O F PAT T E R N I N D I C ATO R S , P LU S T H E I R

F I B O N A CC I PAT T E R N T R A D I N G PAT T E R N A L E R T S T H AT S O R T T H R O U G H

B E F O R E , O R N OT, T H I S PA C K A G E A N D T H E PAT T E R N S TO TA K E .

I T S R E L AT I N G F XG R O U N D W O R K S . CO M

SIX-MONTH MEMBERSHIP WILL TEACH THERE’S NO NEED FOR GUESS-WORK; ALL

YO U T H I S M O R E R E L I A B L E WAY O F THE R ATIOS ARE WORKED OUT FOR YOU. WE

TRADING IN NO TIME. A L S O O F F E R M E N TO R I N G B Y S E N I O R

TRADING STRATEGISTS AND WE ENCOURAGE

T H E T R A I N I N G PA C K A G E TA K E S YO U YO U TO AT T E N D T H E L I V E W E B I N A R S H E L D

THROUGH THE PROCESS, STEP- E V E RY DAY M O N DAY T H R O U G H T H U R S DAY

B Y - S T E P, G I V I N G YO U A G O O D TO B E N E F I T F R O M T H E E X P E R I E N C E O F

G R O U N D I N G I N T H E P R I C E PAT T E R N T H O S E S T R AT E G I S T S .

T E C H N I Q U E . I T T E L L S YO U A L L YO U

N E E D TO K N O W A B O U T H O W TO B Y T H E T I M E YO U G R A D UAT E T H E C L A S S ,

TRADE THE FOREX MARKET WITH A YO U ’ L L B E T R A D I N G P R O F I C I E N T LY A N D

S A F E R , M O R E R E L I A B L E M E T H O D. PAT I E N T LY.

CONTACT US

Got a question?

We have answers!

CLIENT SER VICES / NE W ACCOUNTS

ACCOUNTS@FXGROUNDWORKS.COM

SUPPORT

SUPPORT@FXGROUNDWORKS.COM

L I V E C H AT ( O N O U R W E B S I T E )

ISSUE 1 - GRAB IT. FXGROUNDWORKS.COM

O R C A L L U S : 866.501.5499

You might also like

- The Complete Guide To Forex Trading - by PriceActionLTD PDFDocument339 pagesThe Complete Guide To Forex Trading - by PriceActionLTD PDFLineekela91% (54)

- US Bank Business Statement - Mbcvirtual 4Document4 pagesUS Bank Business Statement - Mbcvirtual 4Aleesha Aleesha100% (2)

- Laurent Bernut - Algorithmic Short-Selling With Python - Refine Your Algorithmic Trading Edge, Consistently Generate Investment Ideas, and Build A Robust Long - Short Product-Packt Publishing (2021)Document377 pagesLaurent Bernut - Algorithmic Short-Selling With Python - Refine Your Algorithmic Trading Edge, Consistently Generate Investment Ideas, and Build A Robust Long - Short Product-Packt Publishing (2021)pardhunani143100% (5)

- FX ORDER BLOCKS - Journey To A MillionDocument32 pagesFX ORDER BLOCKS - Journey To A MillionDave Library95% (19)

- The Power62 System 4 Forex PDFDocument37 pagesThe Power62 System 4 Forex PDFBtrades Rise-up100% (1)

- Professional Sniper-Advanced Course Vol IIDocument171 pagesProfessional Sniper-Advanced Course Vol IIandrei dumitru89% (18)

- Credit Dispute Letters-8814829Document102 pagesCredit Dispute Letters-8814829Mindy Horn100% (1)

- Project Selection, Approval and Activation E. AgtarapDocument29 pagesProject Selection, Approval and Activation E. AgtarapEvangeline Chua Agtarap67% (3)

- The Complete Guide To Forex TradingDocument339 pagesThe Complete Guide To Forex TradingSaid100% (9)

- 4uiX4srlSKuX8MEdCX48 - Profitable Trading Made Possible Extended VersionDocument34 pages4uiX4srlSKuX8MEdCX48 - Profitable Trading Made Possible Extended Versiontoughnedglass100% (2)

- Renko TradingDocument25 pagesRenko TradingBors György88% (17)

- Risk Management in Banking Sector MainDocument54 pagesRisk Management in Banking Sector MainJahanvi Bansal55% (11)

- Fineprint CaseDocument13 pagesFineprint CaseShenRaman100% (9)

- How To Trade Like A Pro BdforexproDocument58 pagesHow To Trade Like A Pro BdforexproSakir HasanNo ratings yet

- InFX Forex Mastery Program BrochureDocument4 pagesInFX Forex Mastery Program BrochurecfchaiNo ratings yet

- Axitrader Ebook1 7 Lessons Forex Market Types v2 PDFDocument18 pagesAxitrader Ebook1 7 Lessons Forex Market Types v2 PDFem00105No ratings yet

- MTA 5TradingStrategies EbookDocument18 pagesMTA 5TradingStrategies EbookBobNo ratings yet

- Ebook - High Probability TradingDocument12 pagesEbook - High Probability TradingRogerio Araujo100% (1)

- Chart Patterns Cheat SheetDocument7 pagesChart Patterns Cheat SheetsanthociNo ratings yet

- Abundantly Erica Trading SystemDocument19 pagesAbundantly Erica Trading SystemrtaylorfamilyNo ratings yet

- Trend Trading for a Living: Learn the Skills and Gain the Confidence to Trade for a LivingFrom EverandTrend Trading for a Living: Learn the Skills and Gain the Confidence to Trade for a LivingRating: 5 out of 5 stars5/5 (1)

- The War2Document44 pagesThe War2Akingbemi Morakinyo100% (1)

- Learnforexforex Market StructureDocument9 pagesLearnforexforex Market Structurelewgraves33No ratings yet

- Jeff Cooper Harry Boxer: Wizards Hit and Run The TechtraderDocument182 pagesJeff Cooper Harry Boxer: Wizards Hit and Run The TechtraderSonu KumarNo ratings yet

- The Complete Guide To Price Action Trading Strategies: Want To Learn More About Africa? Join UsDocument13 pagesThe Complete Guide To Price Action Trading Strategies: Want To Learn More About Africa? Join Uscherrylannez053No ratings yet

- 52patterns - 7 Chart PatternsDocument64 pages52patterns - 7 Chart PatternspravinyNo ratings yet

- Why Trade Forex Forex vs. FuturesDocument1 pageWhy Trade Forex Forex vs. FuturesDickson MakoriNo ratings yet

- 6-Trading Price Action Using Your Intuition Learn To Trade The Market PDFDocument7 pages6-Trading Price Action Using Your Intuition Learn To Trade The Market PDFJulio Cezar Do Nascimento100% (1)

- A Must For Traders!Document31 pagesA Must For Traders!eddiestoica20No ratings yet

- Forex TradingDocument22 pagesForex TradingEstrella M. Ramirez-Lawas100% (4)

- File 444e4b01a5a1f79400866Document37 pagesFile 444e4b01a5a1f79400866Sudhakar ReddyNo ratings yet

- Fta ModulesDocument91 pagesFta ModulesGio GameloNo ratings yet

- Stock Market Training PDFDocument14 pagesStock Market Training PDFAravind RoyNo ratings yet

- En 1 70Document70 pagesEn 1 70Vitaliy KlimenkoNo ratings yet

- Know Your Retail Forex History!Document1 pageKnow Your Retail Forex History!Dickson MakoriNo ratings yet

- Candlesticks FormationDocument233 pagesCandlesticks FormationDavidNo ratings yet

- The Profit Strategies of The Investment BanksDocument19 pagesThe Profit Strategies of The Investment BanksAlan MurrayNo ratings yet

- Trading Life Level in Forex Trading. PDFDocument16 pagesTrading Life Level in Forex Trading. PDFMREACE ElijahNo ratings yet

- Edit - Guerrilla Trading Path To Trading Success White 2Document10 pagesEdit - Guerrilla Trading Path To Trading Success White 2Thembokuhle50% (2)

- Learnforexmarket PlayersDocument12 pagesLearnforexmarket Playerslewgraves33No ratings yet

- Forex Trading Secrets: Woman’s Guide to Passive Income and Financial FreedomFrom EverandForex Trading Secrets: Woman’s Guide to Passive Income and Financial FreedomNo ratings yet

- 1025335821Document8 pages1025335821Kairós Consultores0% (4)

- 5 Trading Clichés That Can Keep You From Building WealthDocument13 pages5 Trading Clichés That Can Keep You From Building WealthChiedozie OnuegbuNo ratings yet

- Marty Interview 4Document16 pagesMarty Interview 4Health NobelNo ratings yet

- The Definitive Guide To Building A: Winning Forex Trading SystemDocument63 pagesThe Definitive Guide To Building A: Winning Forex Trading SystemStephen ShekwonuDuza HoSeaNo ratings yet

- Forex Mastery: Smart Strategies by The MastersDocument4 pagesForex Mastery: Smart Strategies by The MastersjjaypowerNo ratings yet

- Learnforexforex Vs FuturesDocument8 pagesLearnforexforex Vs Futureslewgraves33No ratings yet

- Learnforexforex Vs StocksDocument8 pagesLearnforexforex Vs Stockslewgraves33No ratings yet

- The Woodchuck and The Possum: Rob Booker'sDocument10 pagesThe Woodchuck and The Possum: Rob Booker'sCompte1No ratings yet

- 1-Advanced Fibonacci Techniques & StudiesDocument42 pages1-Advanced Fibonacci Techniques & Studiesabbaroda236No ratings yet

- Learnforexcan Forex Trading Make You RichDocument7 pagesLearnforexcan Forex Trading Make You Richlewgraves33No ratings yet

- Why Trade Forex Forex vs. StocksDocument1 pageWhy Trade Forex Forex vs. StocksDickson MakoriNo ratings yet

- No Fail ForexDocument39 pagesNo Fail ForexVincent Sampieri100% (5)

- UntitledDocument27 pagesUntitledMabitsoNo ratings yet

- 10 Forex Sins and Trader TypesDocument6 pages10 Forex Sins and Trader TypesnauliNo ratings yet

- 2022 ICT Mentorship Episode 7 PDFDocument38 pages2022 ICT Mentorship Episode 7 PDFpape meissaNo ratings yet

- Forex Trading HomeworkDocument6 pagesForex Trading Homeworkafetdyaay100% (2)

- How To Earn Money At Home With FX Trading: How A Woman Achieves Financial Freedom For Passive Income: (Workbook And Powerful Forex Trading Strategy For ∅ 2000+ Pips Every Month to Your Account)From EverandHow To Earn Money At Home With FX Trading: How A Woman Achieves Financial Freedom For Passive Income: (Workbook And Powerful Forex Trading Strategy For ∅ 2000+ Pips Every Month to Your Account)No ratings yet

- Keys To Trading SuccessDocument15 pagesKeys To Trading SuccesssritraderNo ratings yet

- Forex Trading For BeginnersDocument30 pagesForex Trading For BeginnersRoberto Passero100% (1)

- Forex - Trading - For - Beginners 0 PDFDocument30 pagesForex - Trading - For - Beginners 0 PDFPedro ArteagaNo ratings yet

- How Successful Traders Think And Act: Basics And Strategies For Successful Daytrading ...: On The International Stock Exchanges (Optimize Your Investments For Passive Income: Workbook Incl. FX Strategy)From EverandHow Successful Traders Think And Act: Basics And Strategies For Successful Daytrading ...: On The International Stock Exchanges (Optimize Your Investments For Passive Income: Workbook Incl. FX Strategy)No ratings yet

- Performance ReportDocument18 pagesPerformance ReportHeathcliff NyambiyaNo ratings yet

- FXGroundworksMag Issue1Document13 pagesFXGroundworksMag Issue1Heathcliff NyambiyaNo ratings yet

- Credit Suisse's Guide To Global Tradable and Benchmark Index ProductsDocument115 pagesCredit Suisse's Guide To Global Tradable and Benchmark Index ProductsHeathcliff NyambiyaNo ratings yet

- Chapter 9 - Valuations Acquisitions and Mergers Section 1Document6 pagesChapter 9 - Valuations Acquisitions and Mergers Section 1Heathcliff NyambiyaNo ratings yet

- Madlena Korkeliia ResumeDocument2 pagesMadlena Korkeliia ResumeGosha DimitrovNo ratings yet

- Form Reimbursement Boy (Bali 14-20 May)Document10 pagesForm Reimbursement Boy (Bali 14-20 May)David ValentinoNo ratings yet

- June - JulyDocument1 pageJune - Julynaveen kumarNo ratings yet

- SICI Cosigner's StatementDocument2 pagesSICI Cosigner's StatementFei XiaoNo ratings yet

- Case 8 - Pacific Grove Spice CompanyDocument29 pagesCase 8 - Pacific Grove Spice CompanyMorten LassenNo ratings yet

- GST 307Document300 pagesGST 307Lawal OlanrewajuNo ratings yet

- Estatements 95311410 357036083439 2021 12 31 1676141578166Document1 pageEstatements 95311410 357036083439 2021 12 31 1676141578166tryphene kamaNo ratings yet

- Better Together Dorset HealthCares Five-Year StrategyDocument57 pagesBetter Together Dorset HealthCares Five-Year StrategyApopei Ana MariaNo ratings yet

- Aia Smart Growth BrochureDocument8 pagesAia Smart Growth BrochurebutterNo ratings yet

- COOPERATIVESDocument9 pagesCOOPERATIVESMarian's PreloveNo ratings yet

- E StatementDocument2 pagesE Statementsheikh abdullah aleemNo ratings yet

- Derivatives and Risk ManagementDocument5 pagesDerivatives and Risk ManagementPuneet GargNo ratings yet

- Syllabus in Theory and Practice in Public AdministrationDocument6 pagesSyllabus in Theory and Practice in Public AdministrationLeah MorenoNo ratings yet

- Handouts ACCOUNTING-2Document39 pagesHandouts ACCOUNTING-2Marc John IlanoNo ratings yet

- PO 160 Heresite Coating UnpriceDocument1 pagePO 160 Heresite Coating UnpricedennisjuntakNo ratings yet

- Market Leader Advanced 3rd Student S BookDocument184 pagesMarket Leader Advanced 3rd Student S BookMarco Damele AssumpçãoNo ratings yet

- Chapter 11Document17 pagesChapter 11jonaNo ratings yet

- Jit Q Only 1Document2 pagesJit Q Only 1api-529669983No ratings yet

- Legal Notice To Syndicate Bank-01 (Sai Sikshan Sanstha)Document5 pagesLegal Notice To Syndicate Bank-01 (Sai Sikshan Sanstha)hariomNo ratings yet

- Flow Chart of Corporate Insolvency Resolution Process (CIRP) Under Insolvency and Bankruptcy Code, 2016 by CS Anand ChuraDocument9 pagesFlow Chart of Corporate Insolvency Resolution Process (CIRP) Under Insolvency and Bankruptcy Code, 2016 by CS Anand ChuraHolani Consultants Pvt LtdNo ratings yet

- Production and Cost AnalysisDocument1 pageProduction and Cost AnalysishmughalgNo ratings yet

- Salvador P. Escaño and Mario M. Silos, Petitioners, vs. Rafael Ortigas, JR., Respondent. (G.R. No. 151953. June 29, 2007.)Document3 pagesSalvador P. Escaño and Mario M. Silos, Petitioners, vs. Rafael Ortigas, JR., Respondent. (G.R. No. 151953. June 29, 2007.)YPENo ratings yet

- Innovative Access To HSBC's Unique Network of FX LiquidityDocument2 pagesInnovative Access To HSBC's Unique Network of FX LiquidityDev GogoiNo ratings yet

- Test Bank For Entrepreneurship 4th Edition ZacharakisDocument10 pagesTest Bank For Entrepreneurship 4th Edition ZacharakisMonica Degan100% (36)

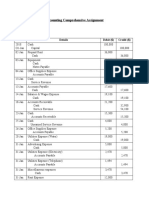

- Accounting Comprehensive AssignmentDocument11 pagesAccounting Comprehensive AssignmentSadia ShithyNo ratings yet