Professional Documents

Culture Documents

Barriers To M-Commerce Adoption in Developing Countries - A Qualitative Study Among The Stakeholders of Bangladesh Mohammed Mizanur Rahman

Barriers To M-Commerce Adoption in Developing Countries - A Qualitative Study Among The Stakeholders of Bangladesh Mohammed Mizanur Rahman

Uploaded by

Christine LiewCopyright:

Available Formats

You might also like

- Paper 2Document12 pagesPaper 2Jane DDNo ratings yet

- Layered Voice AnalysisDocument10 pagesLayered Voice AnalysisJack and friendNo ratings yet

- Module 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSDocument7 pagesModule 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSNiño Mendoza MabatoNo ratings yet

- Module 8 LIABILITIESDocument5 pagesModule 8 LIABILITIESNiño Mendoza MabatoNo ratings yet

- Campillo vs. CA DIGESTDocument2 pagesCampillo vs. CA DIGESTStephanie Reyes GoNo ratings yet

- Understanding Factors Influencing The Adoption of M-Commerce by SellersDocument10 pagesUnderstanding Factors Influencing The Adoption of M-Commerce by Sellerssd channelNo ratings yet

- Influence Factors of Users Satisfaction of Mobile Commerce - An Empirical Research in ChinaDocument10 pagesInfluence Factors of Users Satisfaction of Mobile Commerce - An Empirical Research in Chinapatelali769No ratings yet

- BRANDDocument13 pagesBRANDTahu BulatNo ratings yet

- Base Paper TamDocument17 pagesBase Paper TamJoseph JohnNo ratings yet

- Understanding Factors Influencing The Adoption of M-Commerce by ConsumersDocument8 pagesUnderstanding Factors Influencing The Adoption of M-Commerce by Consumerssd channelNo ratings yet

- Artikel UtamaDocument25 pagesArtikel UtamaLight DarknessNo ratings yet

- Perceived Values and Motivations Influencing M-Commerce A Nine-Country Comparative Study 2021 PDFDocument17 pagesPerceived Values and Motivations Influencing M-Commerce A Nine-Country Comparative Study 2021 PDFasrmltNo ratings yet

- Topic: A Study To Understand The Factors That Contribute SAMSUNG To Sustain in The Mobile MarketDocument4 pagesTopic: A Study To Understand The Factors That Contribute SAMSUNG To Sustain in The Mobile MarketAkshay GoyalNo ratings yet

- Topic: A Study To Understand The Factors That Contribute SAMSUNG To Sustain in The Mobile MarketDocument4 pagesTopic: A Study To Understand The Factors That Contribute SAMSUNG To Sustain in The Mobile MarketAkshay GoyalNo ratings yet

- The Impact of CSR On Trust and Intention To Adopt Mobile Banking: Evidence From Developing CountryDocument20 pagesThe Impact of CSR On Trust and Intention To Adopt Mobile Banking: Evidence From Developing CountryLee Hock SengNo ratings yet

- Lan-Xiang Yin & Hsien-Cheng Lin - 2022Document31 pagesLan-Xiang Yin & Hsien-Cheng Lin - 2022Mayang SandyNo ratings yet

- Review of LiteratureDocument6 pagesReview of LiteratureNamm EnggNo ratings yet

- Adoption of B2B E-Commerce by The SMEs in Bangladesh, 2011, Al Noor, Arif PDFDocument13 pagesAdoption of B2B E-Commerce by The SMEs in Bangladesh, 2011, Al Noor, Arif PDFFata KeshtoNo ratings yet

- Social Networks Marketing Value Co-Creation and CoDocument22 pagesSocial Networks Marketing Value Co-Creation and ComthienphuNo ratings yet

- Team 2Document11 pagesTeam 2prabanta sienNo ratings yet

- Industrial Marketing Management: Woon Leong Lin, Nick Yip, Jo Ann Ho, Murali SambasivanDocument11 pagesIndustrial Marketing Management: Woon Leong Lin, Nick Yip, Jo Ann Ho, Murali SambasivanazmiNo ratings yet

- Donner 2008Document16 pagesDonner 2008bhavesh1dhondeNo ratings yet

- Factors Influencing Mobile CommerceDocument8 pagesFactors Influencing Mobile CommerceGaurav ThaparNo ratings yet

- Bussiness ResearchDocument16 pagesBussiness ResearchVu Ng Phuong AnhNo ratings yet

- HaftaDocument14 pagesHaftaBüşra CesurNo ratings yet

- 7168 13847 1 SMDocument13 pages7168 13847 1 SMKiều NanaNo ratings yet

- Information Technology IN Developing Countries: EditorialDocument29 pagesInformation Technology IN Developing Countries: EditorialMaimana AhmedNo ratings yet

- SAMPLEPAPERa Framework For Ethical Mobile MarketingDocument5 pagesSAMPLEPAPERa Framework For Ethical Mobile MarketingArif HossenNo ratings yet

- Drivers and Inhibitors For Digital Payment Adoption Using The CashlessDocument9 pagesDrivers and Inhibitors For Digital Payment Adoption Using The Cashlessridho zynNo ratings yet

- Marketing Factors Influencing Theperformance of Mobile Banking (Survey of Equity Bank South Rift Region)Document33 pagesMarketing Factors Influencing Theperformance of Mobile Banking (Survey of Equity Bank South Rift Region)Trivedi UrveshNo ratings yet

- Factors Leading To Consumer Perceived Value of Smartphones and Its Impact On Purchase IntentionDocument30 pagesFactors Leading To Consumer Perceived Value of Smartphones and Its Impact On Purchase IntentionTrần Trọng NhânNo ratings yet

- Concept Paper Sample 1Document5 pagesConcept Paper Sample 1corpin dranNo ratings yet

- Examining The Effect of Mobile Money Transfer (MMT) Capabilities On Business Growth and Development ImpactDocument18 pagesExamining The Effect of Mobile Money Transfer (MMT) Capabilities On Business Growth and Development ImpactEsinam AdukpoNo ratings yet

- MRR 11 2023 0831 - Proof - HiDocument20 pagesMRR 11 2023 0831 - Proof - HiShahid HussainNo ratings yet

- Consumer-Based M-Commerce Exploring Consumer Perception of PDFDocument11 pagesConsumer-Based M-Commerce Exploring Consumer Perception of PDFAna MariaNo ratings yet

- Journal of Research in Interactive MarketingDocument6 pagesJournal of Research in Interactive MarketingHarish VenkatasubramanianNo ratings yet

- Final-Manuscript 123Document36 pagesFinal-Manuscript 123paolamarie.telebNo ratings yet

- 2020 Mobile Banking Acceptance 09Document9 pages2020 Mobile Banking Acceptance 09Che Soh bin Said SaidNo ratings yet

- Strategic - Study On Mobile Marketing As A Sustainable Way To Business (Study With - Reference To Mobile App Users in Thiruvananthapuram District)Document9 pagesStrategic - Study On Mobile Marketing As A Sustainable Way To Business (Study With - Reference To Mobile App Users in Thiruvananthapuram District)sundarsmmNo ratings yet

- Value-Added Services in Mobile Commerce: An Analytical Framework and Empirical Findings From A National Consumer SurveyDocument10 pagesValue-Added Services in Mobile Commerce: An Analytical Framework and Empirical Findings From A National Consumer SurveyMaria SaleemNo ratings yet

- Journal of Business Research: The Effect of Technology, Information, and Marketing On An Interconnected WorldDocument5 pagesJournal of Business Research: The Effect of Technology, Information, and Marketing On An Interconnected WorldTony StyleツNo ratings yet

- Stickines 1Document17 pagesStickines 1ishinkarev610No ratings yet

- Organizational Factors Explaining The Intention To Use Artificial Intelligence Technologies in Companies: Case of The Banking Sector in MoroccoDocument23 pagesOrganizational Factors Explaining The Intention To Use Artificial Intelligence Technologies in Companies: Case of The Banking Sector in MoroccoChoubi RabieNo ratings yet

- Futureinternet 15 00123Document18 pagesFutureinternet 15 00123mychauchuocNo ratings yet

- Impact of Social Media Marketing On Consumer Buying Behaviour: An Empirical StudyDocument10 pagesImpact of Social Media Marketing On Consumer Buying Behaviour: An Empirical StudyDivineNo ratings yet

- Risk Assessment ReportDocument18 pagesRisk Assessment ReportMahnoor AkhtarNo ratings yet

- 10 1108 - Jrim 01 2021 0020Document19 pages10 1108 - Jrim 01 2021 0020NaumaanNo ratings yet

- What Makes GO-JEK Go in Indonesia? The Influences of Social Media Marketing Activities On Purchase IntentionDocument15 pagesWhat Makes GO-JEK Go in Indonesia? The Influences of Social Media Marketing Activities On Purchase IntentionHendra WcsNo ratings yet

- 1 s2.0 S156742232100048X MainDocument15 pages1 s2.0 S156742232100048X Mainhagai vNo ratings yet

- Measuring The Competitiveness Factors in Telecommunication MarketsDocument35 pagesMeasuring The Competitiveness Factors in Telecommunication MarketsVery UselessNo ratings yet

- User Experience (UX) Components of Mobile Wallets Influencing The Post-Adoption Behavior of Millennials in The National Capital Region (NCR)Document7 pagesUser Experience (UX) Components of Mobile Wallets Influencing The Post-Adoption Behavior of Millennials in The National Capital Region (NCR)Journal of Interdisciplinary PerspectivesNo ratings yet

- Impact of Digitization On Mutual Fund Services in India: KeywordsDocument9 pagesImpact of Digitization On Mutual Fund Services in India: KeywordsKapil RewarNo ratings yet

- Ijass 2020 10 (8) 450 457Document8 pagesIjass 2020 10 (8) 450 457jhonny reanNo ratings yet

- User Engagement in Social Network Platforms What Key Strategic Factors Determine Online Consumer Purchase BehaviourDocument33 pagesUser Engagement in Social Network Platforms What Key Strategic Factors Determine Online Consumer Purchase Behaviour解思思No ratings yet

- Sustainability 13 05077 v4Document15 pagesSustainability 13 05077 v4Minh PhươngNo ratings yet

- Science and Business: Factors Affecting Adoption of Fintech in BangladeshDocument9 pagesScience and Business: Factors Affecting Adoption of Fintech in BangladeshAsifNo ratings yet

- Geofencing in The GCC and China: A Marketing Trend That's Not Going AwayDocument15 pagesGeofencing in The GCC and China: A Marketing Trend That's Not Going AwayJoe ViwatNo ratings yet

- Junita2022 Attitude Toward Using Information and Communication Technology Readiness-Study On Manager of Village-Owned Enterprises in Langsa CityDocument16 pagesJunita2022 Attitude Toward Using Information and Communication Technology Readiness-Study On Manager of Village-Owned Enterprises in Langsa CityDR. SYUKRIY ABDULLAH , S.E, M.SINo ratings yet

- International Journal of Research in Marketing: Julian R.K. Wichmann, Abhinav Uppal, Amalesh Sharma, Marnik G. DekimpeDocument20 pagesInternational Journal of Research in Marketing: Julian R.K. Wichmann, Abhinav Uppal, Amalesh Sharma, Marnik G. DekimpeNAMRATA KAMATNo ratings yet

- 1 s2.0 S0048733321000329 MainDocument24 pages1 s2.0 S0048733321000329 Mainphuongdau.31221025187No ratings yet

- Determinants of M-Commerce Adoption: An Empirical StudyDocument12 pagesDeterminants of M-Commerce Adoption: An Empirical StudyChristine LiewNo ratings yet

- Sustainability 13 10705 v2 PDFDocument18 pagesSustainability 13 10705 v2 PDFVũ Ngọc Minh ThuNo ratings yet

- P 16 LILA SKRIPSI 63 HalamanDocument68 pagesP 16 LILA SKRIPSI 63 Halamanhabib rachmanNo ratings yet

- Social Media Marketing: Emerging Concepts and ApplicationsFrom EverandSocial Media Marketing: Emerging Concepts and ApplicationsGitha HeggdeNo ratings yet

- Nature and Definition of Research: Scientific ThinkingDocument14 pagesNature and Definition of Research: Scientific ThinkingNiño Mendoza MabatoNo ratings yet

- Citizen'S Charter: Overseas Workers Welfare AdministrationDocument73 pagesCitizen'S Charter: Overseas Workers Welfare AdministrationNiño Mendoza MabatoNo ratings yet

- Articles of Incorporation of TheDocument15 pagesArticles of Incorporation of TheNiño Mendoza MabatoNo ratings yet

- Introduction To Business Taxation: Chapter 3 (Part 1)Document38 pagesIntroduction To Business Taxation: Chapter 3 (Part 1)Niño Mendoza MabatoNo ratings yet

- Technology and Livelihood EducationDocument16 pagesTechnology and Livelihood EducationNiño Mendoza MabatoNo ratings yet

- Lesson 3 Financial Institutions and MarketsDocument3 pagesLesson 3 Financial Institutions and MarketsNiño Mendoza MabatoNo ratings yet

- Shared Value in Practice: TOMS Business Model: September 2013Document8 pagesShared Value in Practice: TOMS Business Model: September 2013Niño Mendoza MabatoNo ratings yet

- Problem and Its BackgroundDocument19 pagesProblem and Its BackgroundNiño Mendoza MabatoNo ratings yet

- 5 C 8 F 600 BF 3450Document11 pages5 C 8 F 600 BF 3450Niño Mendoza MabatoNo ratings yet

- QUALI Conclusions and Recommendations FormulationDocument6 pagesQUALI Conclusions and Recommendations FormulationNiño Mendoza MabatoNo ratings yet

- Chapter 2 HomeworkDocument4 pagesChapter 2 HomeworkNiño Mendoza MabatoNo ratings yet

- Qualitative ResearchDocument12 pagesQualitative ResearchNiño Mendoza MabatoNo ratings yet

- Manual On Corporate GovernanceDocument86 pagesManual On Corporate GovernanceNiño Mendoza MabatoNo ratings yet

- Module 9 SHAREHOLDERS' EQUITYDocument3 pagesModule 9 SHAREHOLDERS' EQUITYNiño Mendoza MabatoNo ratings yet

- Chapter 1Document20 pagesChapter 1Niño Mendoza MabatoNo ratings yet

- Module 5 INVENTORIES AND RELATED EXPENSESDocument4 pagesModule 5 INVENTORIES AND RELATED EXPENSESNiño Mendoza MabatoNo ratings yet

- Module 1 BASIC CONCEPTS OF FINANCIAL STATEMENT AUDIT PDFDocument8 pagesModule 1 BASIC CONCEPTS OF FINANCIAL STATEMENT AUDIT PDFNiño Mendoza Mabato100% (1)

- Chapter 5Document47 pagesChapter 5Niño Mendoza MabatoNo ratings yet

- Types of Research According To PurposeDocument7 pagesTypes of Research According To PurposeNiño Mendoza MabatoNo ratings yet

- Chapter 4Document51 pagesChapter 4Niño Mendoza MabatoNo ratings yet

- Chapter 2Document34 pagesChapter 2Niño Mendoza MabatoNo ratings yet

- Module 6 INVESTMENT IN FINANCIAL INSTRUMENTS PDFDocument8 pagesModule 6 INVESTMENT IN FINANCIAL INSTRUMENTS PDFNiño Mendoza MabatoNo ratings yet

- Module 4 RECEIVABLES AND RELATED REVENUESDocument5 pagesModule 4 RECEIVABLES AND RELATED REVENUESNiño Mendoza MabatoNo ratings yet

- Sen 1990 Rational FoolsDocument11 pagesSen 1990 Rational FoolsGuilherme MongelóNo ratings yet

- Definition of StagflationDocument5 pagesDefinition of StagflationraghuNo ratings yet

- Bow The KneeDocument12 pagesBow The KneeQueen GersavaNo ratings yet

- LIT 1 Module 3Document14 pagesLIT 1 Module 3ALL ABOUT PAGEANTARYNo ratings yet

- This Study Resource WasDocument1 pageThis Study Resource WasIkhsan MisbahuddinNo ratings yet

- Civil Litigation 2018Document19 pagesCivil Litigation 2018Markus BisteNo ratings yet

- Holiday Inn CaseDocument4 pagesHoliday Inn Casepj_bersamina100% (1)

- 03PN Structural Engineering Fees Calculator For Building Projects 2009 Fee ScalesDocument15 pages03PN Structural Engineering Fees Calculator For Building Projects 2009 Fee ScalesbrianmugadzaNo ratings yet

- GRI Standards 2018Document542 pagesGRI Standards 2018Siddharth Shankar100% (1)

- Neraca PT Indofood 019,020Document2 pagesNeraca PT Indofood 019,020Nur Abdillah AkmalNo ratings yet

- S I A (SIA) 9 C M: Tandard On Nternal Udit Ommunication With AnagementDocument8 pagesS I A (SIA) 9 C M: Tandard On Nternal Udit Ommunication With AnagementDivine Epie Ngol'esuehNo ratings yet

- Essential Teacher TESOLDocument68 pagesEssential Teacher TESOLAlifFajriNo ratings yet

- A Case Study of YahooDocument6 pagesA Case Study of YahooWade EtienneNo ratings yet

- Riph 08Document7 pagesRiph 08Raizamae ArizoNo ratings yet

- Shubham: Admit Card Online Written Test For JUNIOR ENGINEER TRAINEE (JET) - 2020Document2 pagesShubham: Admit Card Online Written Test For JUNIOR ENGINEER TRAINEE (JET) - 2020SHUBHAM YadavNo ratings yet

- Joint Arrangements QuestionsDocument5 pagesJoint Arrangements QuestionsRichard LamagnaNo ratings yet

- Bus Part A2P ReadingBank U1Document2 pagesBus Part A2P ReadingBank U1Anastasia V.No ratings yet

- Structure of Araby by MandelDocument8 pagesStructure of Araby by MandelevansNo ratings yet

- Injury Management:: A Guide For EmployersDocument40 pagesInjury Management:: A Guide For EmployersDerani BlackburnNo ratings yet

- Pres PerfDocument3 pagesPres PerfAndrei MilitaruNo ratings yet

- The Vertues and Vertuous Actions of The Scared Month of Rajab by Ataul Mustafa AmjadiDocument4 pagesThe Vertues and Vertuous Actions of The Scared Month of Rajab by Ataul Mustafa AmjadiMohammad Izharun Nabi HussainiNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S ChargesLokesh NANo ratings yet

- 12814/STEEL EXP Second Sitting (2S)Document2 pages12814/STEEL EXP Second Sitting (2S)AYUSH SINGHNo ratings yet

- Week 13-AbolitionDocument3 pagesWeek 13-Abolitionapi-327441821No ratings yet

- OneSheet AVEVA System Platform 2023WhatsNew 22-07.pdf - Coredownload.inlineDocument3 pagesOneSheet AVEVA System Platform 2023WhatsNew 22-07.pdf - Coredownload.inlineFirstface LastbookNo ratings yet

- People V CamanoDocument2 pagesPeople V CamanoMikhel BeltranNo ratings yet

- A STUDY ON DEPOSITORY SYSTEM - Docx NewDocument19 pagesA STUDY ON DEPOSITORY SYSTEM - Docx NewRajni WaswaniNo ratings yet

- How Do You "Design" A Business Ecosystem?: by Ulrich Pidun, Martin Reeves, and Maximilian SchüsslerDocument18 pagesHow Do You "Design" A Business Ecosystem?: by Ulrich Pidun, Martin Reeves, and Maximilian Schüsslerwang raymondNo ratings yet

Barriers To M-Commerce Adoption in Developing Countries - A Qualitative Study Among The Stakeholders of Bangladesh Mohammed Mizanur Rahman

Barriers To M-Commerce Adoption in Developing Countries - A Qualitative Study Among The Stakeholders of Bangladesh Mohammed Mizanur Rahman

Uploaded by

Christine LiewOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Barriers To M-Commerce Adoption in Developing Countries - A Qualitative Study Among The Stakeholders of Bangladesh Mohammed Mizanur Rahman

Barriers To M-Commerce Adoption in Developing Countries - A Qualitative Study Among The Stakeholders of Bangladesh Mohammed Mizanur Rahman

Uploaded by

Christine LiewCopyright:

Available Formats

The International Technology Management Review, Vol. 3 (2013), No.

2, 80-91

Barriers to M-commerce Adoption in Developing Countries – A Qualitative Study among the

Stakeholders of Bangladesh

Mohammed Mizanur Rahman

School of Business, University of Western Sydney

Parramatta, New South Wales, 2150, Australia

Email: mizan.rahman@uws.edu.au, mizan1214@yahoo.com.au

Abstract

The purpose of this qualitative study is to explore the key factors that act as a barrier to

m-commerce (e-commerce through mobile phone or any wireless device) adoption in developing

countries, and to investigate the ways to overcome these barriers. 27 face to face in-depth

interviews were conducted among the participants who were classified as bankers, solution

providers, telcos, retailers and government official. Lack of literacy, trust and conflict of interest

between telcos and banks were found to be the major barriers to the adoption of m-commerce in

Bangladesh. The research output can help in the design of a long term policy to build up a large

and sustainable m-commerce enabled society.

Keywords: M-commerce, E-commerce, Barriers, Qualitative study, Bangladesh,

1. Introduction

There are a number of variations in the definition SMS, mobile internet, games, music, video, news

of m-commerce. Many scholars considered m- and sports.6 Location tracking of goods and people

commerce to be mobile e-commerce.1 Smith2 is also one of the latest applications of m-

defined m-commerce as the buying and selling of commerce. Online retailers have started to realize

goods and services through wireless handheld the potential of m-commerce market, with 48% of

devices such as cellular phones and Personal them already having developed mobile optimized

Digital Assistants (PDA). According to others m-commerce site.7 Figure1, based upon the work of

m-commerce is the exchange of goods, services two separate studies (see Refs. 8 & 9), gives an

and information using mobile Information and overview of different types of m-commerce

Communication Technology (ICT).3 applications.

M-commerce is a rapidly growing market, The number of mobile phone subscribers

especially in recent years and there are signs that worldwide surpassed 6 billion in 2011, with three

this growth will continue. The widespread quarters of them coming from developing

penetration of mobile phone coupled with some of countries.10 The number of the mobile phone users

its key characteristics including versatility, in developing countries provides many

portability, personalized, 24/7 connectivity and opportunities for the exploration of an m-commerce

ease of use, has made m-commerce a trading tool market in these regions. However mobile

with huge potential for the global marketplace. broadband, the key technology of m-commerce, is

According to Gartner research,4 mobile payment highly adopted in developed countries, accounting

transaction worldwide has reached $105.9 billion in for 701 million subscribers compared to 484

2011 and is predicted to be $617 billion by 2016. million in developing world.10 Understandably,

Mobile payment users worldwide will exceed 2.5 developing countries fall behind the developed

billion in 2015, a 40% increase from 1.8 billion in world in utilizing the power and potential of m-

2011.5 Today mobile phones are not simply being commerce. Mobile banking and shopping, mobile

used for conversation only, but 40% of subscribers advertising, mobile ticketing, mobile movies and

are accessing different mobile services such as videos are commonly used applications in

Published by Atlantis Press

Copyright: the authors

80

developed countries, however in the developing focused on the factors that positively influence the

world mobile phones are mainly used as tools of adoption of m-commerce. Perceived usefulness

personal communication. (PU) and perceived ease of use (PEOU) have been

identified as major contributing factors for m-

commerce adoption worldwide.14-27 However

perceived usefulness was not found to be

significant in Bangladesh and Sub-Saharan Africa

by some studies.28 & 29

Numerous studies also found little or no significant

impact of perceived ease of use in the adoption of

m-commerce.29-42 Research revealed that there are

many other factors that affect m-commerce

adoption positively such as attitude ( see Refs. 14,

17, 19, 25, 33, 38, 41, 43, 44), subjective norm (see

Refs. 24, 25, 35 & 37) social influence (see Refs.

22, 29, 30, 32, 35, 36, 45 & 46), self efficacy (see

Refs. 25, 28, 36, 37), facilitating condition (see

Refs. 14, 22, 25, 36, 41 & 48), effort expectancy

(see Refs. 45, 48 & 49),performance expectanc,47-49

job relevance,24 & 39 reputation,42 & 50 perceived

credibility,14 experience (see Refs. 17, 24, 44 & 48-

Figure 1: Applications of m-commerce, complied 51), mobility,52 knowledge,21,53-55 compatibility (see

from two sources 8 & 9 Refs. 16, 31, 34, 35, 38 & 52), convenience,16, 56, 57

perceived enjoyment (see Refs. 31, 35, 40 & 58),

perceived playfulness,17 quality (see Refs. 17, 36,

M-commerce is an advanced and fast growing

39, 50 & 51) and speed.16, 21 & 57

technology which has many barriers that are unlike

those of other new technologies.11 These barriers

Little research has addressed the barriers that have

need to be identified as they will affect the steady

negative impact in the adoption of m-commerce.

adoption of m-commerce applications.12

Perceived risk has been identified as among the

Bangladesh has been chosen as the location for this

major barriers of m-commerce adoption effecting

research due to its developing country status and its

the penetration negatively (see Refs. 25, 34, 37, 38,

substantial mobile phone penetration, reported as

42, 47 & 57). Consumers are highly concerned

65% (~98.5 million) by February 2013.13 The

about their privacy and security, if not assured that

purpose of this paper is to investigate the barriers to

would deter m-commerce penetration. The effect of

m-commerce adoption in developing countries and

perceived security and privacy was found to be

to find the ways to overcome those barriers. The

significant in Bangladesh from consumer’s

main research question set for this study is as

perspective.28, 33 Lack of trust was found to be

follows:

another major barrier to m-commerce adoption.

What are barriers to m-commerce adoption in Luo et. al.47 validated the negative correlation

developing countries? between trust and perceived risk; meaning lack of

trust poses a high risk to the adoption of

Literature on m-commerce adoption will be m-commerce. Various issues are involved with

reviewed in the next section followed by the trust such as user’s experience, poor relationship,

research method, results and implications, and bad reputation, stakeholder’s unethical business

conclusion respectively. The last section will practice and risk (see Refs. 47, 51, 60 & 61). All

address the limitations of the current research and these issues need to be addressed when dealing

pathways for future research. with trust. Perceived cost acts as a barrier to m-

commerce adoption as higher cost lowers the user’s

intention to use m-commerce services (see Refs.

2. Literature Review 17, 28, 32 & 38). The effect of anxiety has also

been found to be negative, more anxiety leads to

In the last twelve years a large number of research less adoption, to mobile shopping adoption in

papers have been published that studied the key Taiwan.62 Venkatesh et. al.49 found negative

factors of m-commerce/e-commerce adoption in relationship between anxiety and the intention to

both developed and developing countries. Papers use IT adoption. Some other factors, although

published before 2000 were not reviewed because rarely studied, were found to have been acted as a

of the newness and rapidly changing nature of m- barrier to m-commerce adoption such as

commerce technology. Prior studies frequently

Published by Atlantis Press

Copyright: the authors

81

complexity,15, 22 & 59 slow connection,57 and limited 3.2 Data Analysis

capacity.57

There has been little research that has explored the As the current research is more exploratory than

barriers to m-commerce adoption in developing confirmatory in nature, content analysis was chosen

countries. The majority of the authors have studied to analyze the interview transcript.70 Qualitative

the barriers to m-commerce adoption in developed content analysis is defined as “a research method

countries from the user’s perspective; relying on for the subjective interpretation of the content of

quantitative methods (for example Refs. 14, 15, 28, text data through the systematic classification

29, 30, 32, 33, 34, 53 & 56). Very few researchers process of coding and identifying themes or

have studied these barriers from the stakeholder’s patterns”.71, p.1278

perspective using qualitative methods. As the

qualitative methodology provides a deeper and Nvivo software was used for the analysis,

more detailed understanding on the subject than the especially during coding and annotating. All the

quantitative approach,63 this study used this method transcripts were thoroughly reviewed and then

in exploring the key barriers to commerce adoption coded by organizing key words/phrase under

in developing countries. different nodes, to uncover the key

pattern/themes.70 Each node was then carefully

reviewed to look for any similarities and

3. Research method differences in the argument raised around various

issues/factors. Obviously not all the participants

M-commerce is a new concept in Bangladesh and agreed on the same issue or concept. They varied in

people have not yet realized the benefits of using their ideas, thinking and reasoning. The

this new technology. Studying the barriers to m- factor/barriers with strong arguments, supported by

commerce adoption in Bangladesh will assist in the many, were identified as the major barriers to m-

development of an in-depth understanding of the commerce adoption. In contrast, the factors/barriers

key issues and challenges to its rapid uptake. justified by weak arguments and with less support

Qualitative research has been chosen as it allows were identified as having minor impact to m-

the researcher to gain better understanding of the commerce adoption in Bangladesh.

problem and to identify any phenomena, patterns,

behaviour and attitudes.67 This qualitative research

relied on analyzing textual data from interviews 4. Results and Implications

rather than numerical data of survey research.68

4.1 Demography

3.1 Sample

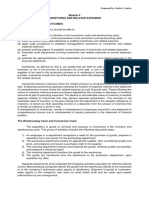

The participant’s demographic information is

It is usual that small and selective samples are used presented in table 1. All the participants were

in qualitative research as it requires in-depth stakeholders of m-commerce, being actively

analysis of a large volume of data.69 For this project involved in m-commerce business either directly or

27 face to face in-depth interviews were conducted indirectly. They were categorized as telcos,

to build on the preliminary insights into what bankers, solution providers, retailers and

people of different social categories think and government officials. Among the twenty seven

believe about m-commerce. Initially it was not interviewees thirteen were retailers, five telco’s

known how many interviews would be required to employees, four from banks, four from solution

explore the research objective, but the intention providers and one government official. Although a

was to carry on until similar and repetitive large number of participants were retailers,

responses were gathered on the subject matter.64 individuals who are not usually highly qualified

Respondents from different sub categories who and work as agents on behalf of a telco, their

were actively involved in the m-commerce arena contribution in the study was found to be minimal.

were the target participants during the interviews. In most cases their answers were recorded without

Convenience sampling was used to select the sufficient explanation and justification; normally

participants, who were later classified as solutions short reply that answers what rather than why.

providers, telcos, banks, government officials and They possessed practical experience in dealing with

retailers. All the participants were assured of their telcos, and that experience was found to be an

confidentiality and anonymity. important information source for analyzing some

major issues.

Published by Atlantis Press

Copyright: the authors

82

Table 1: Demographic information

Interviewee’s Brief introduction about the organization Interviewee’s Qualification

Identity position

(anonymous)

Telco 1 One of the largest mobile Operators in M-commerce manager Highly educated

Bangladesh

Telco 2 One of the largest mobile Operators in Head of business development & Highly educated

Bangladesh financial services

Telco 3 Mobile operator in Bangladesh Manager of m-commerce division Highly educated

Telco 4 Mobile operator in Bangladesh Manager responsible for m-commerce Highly educated

Telco 5 Mobile operator in Bangladesh Head of distribution Highly educated

Banker 1 Private bank – received permission to run Head of alternate/mobile banking Highly educated

mobile banking at the time of interview

Banker 2 Private bank – received permission to run Assistant vice president of mobile Highly educated

mobile banking at the time of interview banking

Banker 3 Private bank – But did not received permission Head of kishoreganj (district) branch Highly educated

to run mobile banking at the time of interview

Banker 4 Public bank – But did not receive permission Manager of IT section, Main branch, Highly educated

to run mobile banking at the time of interview Dhaka

Solution provider 1 Develop software and application for mobile Assistant general manager Highly educated

banking services

Solution provider 2 Develop software and application for mobile Head of project management and IT Highly educated

banking services services

Solution provider 3 Develop software and application for mobile CEO Highly educated

banking services

Solution provider 4 Conduct research in the field of mobile Professor of a private university, Highly educated

commerce, on behalf of a private university Bangladesh

Govt. official Government’s regulatory body Chairman Highly educated

Retailer 1 Shop (in Dhaka city) for mobile recharge & Shop owner Moderate

utility billing through m-billing services educated

Retailer 2 Shop (in a rural area) for mobile recharge & Shop owner Lower educated

utility billing through m-billing services

Retailer 3 Shop (in Chittagong city) for mobile recharge Shop owner Lower educated

& utility billing through m-billing

Retailer 4 Shop (in a rural area) for mobile recharge & Shop owner Moderate

utility billing through m-billing services educated

Retailer 5 Shop (in a rural area) for mobile recharge & Employee Lower educated

utility billing through m-billing services

Retailer 6 Shop (in a rural area) for mobile recharge & Shop owner Lower educated

utility billing through m-billing services

Retailer 7 Shop (in a rural area) for mobile recharge & Shop owner Moderate

utility billing through m-billing services educated

Retailer 8 Shop (in Dhaka City) for mobile recharge & Shop owner Moderate

utility billing through m-billing services educated

Retailer 9 Shop (in a district town ) for mobile recharge Employee Lower educated

& utility billing through m-billing

Retailer 10 Shop (in a district town) for mobile recharge & Shop owner Highly educated

utility billing through m-billing

Retailer 11 Shop (in a district town) for mobile recharge & Shop owner Lower educated

utility billing through m-billing

Retailer 12 Shop (in a rural area) for mobile recharge & Shop owner Lower educated

utility billing through m-billing services

Retailer 13 Shop (in a rural area) for mobile recharge & Employee Lower educated

utility billing through m-billing services

Highly educated: Bachelor or above

Moderate educated: Between year 8 and year 12

Lower educated: below year 7

Published by Atlantis Press

Copyright: the authors

83

4.2 Lack of literacy- One of the major barriers password, his account details which must not be

to m-commerce adoption compromised to third party such as agent.”

– Banker 1

Although the lack of literacy is not a big challenge

for mobile phone adoption in Bangladesh, it was It has become clear that low literacy levels have

noted by a number of interviewees as one of the been recognized as among the major barriers to

biggest barriers to rapid uptake of mobile banking m-commerce adoption in Bangladesh because a

and other m-commerce services in this country. reasonable level of literacy is required to read an

They were asked why lack of literacy is seen to be SMS and use the keypad for various m-commerce

the major barrier to m-commerce adoption. Some services. Although customer care points (CCP)

reported that the skill of illiterate people, being have been widely used by both literate and illiterate

limited to receiving and sending a call, restricts people in Bangladesh, they are not suitable for

them from engaging in m-commerce activities. conducting mobile banking services as an

individual’s password and account details can’t be

“Literacy is the main barrier to using m-commerce disclosed to a third party. That means illiterate

service.”– Telco 5 people need to use this confidential information by

themselves without the help of CCP or others,

“But in case of mobile banking literacy is required obviously a hurdle for them. From the

as the customer should be able to read the SMS. stakeholder’s point of view, the illiterate population

Forget about English SMS, how many people can remains a great potential m-commerce market in

read Bangla? Also when they will be asked to enter Bangladesh as they are the majority, and many of

their password, will they be able to enter that them are already using mobile phone. It is therefore

without the help of any one? That is a question and hoped that soon a compatible and comfortable

it needs some research to get a solution of it.” solution will be provided for illiterate people to

– Banker 2 integrate them into various m-commerce services.

It’s been acknowledged that illiteracy can’t be

removed from the country quickly but there is a 4.3 Perceived risk

way for illiterate people to get the maximum

benefit from m-commerce services. One possible Previous studies had identified perceived risk as

solution is the Customer Care Point (CCP), highly one of the major factors affecting m-commerce

used in Bangladesh by both literate and illiterate adoption negatively, although the current study

people. Customer Care Points (CCP), are spread found risk to be lower in Bangladesh from

like mushrooms in Bangladesh, helping customers stakeholder’s perspective. In Bangladesh

to pay their utility bills through mobile phone with stakeholders are well aware of the negative impact

a small charge. of risk in m-commerce adoption and considered

this issue as high priority, but remained confident

“To be honest 90% customers are still paying of the security and privacy of the mobile network.

through our outlets (CCP). It’s no matter the They believed that the mobile network of

customer is educated or not and it’s because of Bangladesh is secure enough to prevent any loss or

convenience and tradition.” – Telco 2 fraud in monetary transactions, and also to protect

the confidentiality of the user.

“But does really an individual paying his bill from

his mobile phone? No he goes to the Customer care “Actually security is a big issue for any financial

point or outlet of that mobile company and pay network.” – Banker 1

cash to that outlet people and those outlet people

are paying the bill on his behalf from their own “Fully secured. Security is our first priority that’s

mobile phone.” – Banker 1 why we are upgrading our software and hardware

equipments.... and obviously all the SMS will be

Customer care point might be a solution for encrypted.” – Solution provider 2

integrating illiterate people with m-commerce

services such as m-billing, m-ticketing and “This infrastructure is secure enough for mobile

m-remittance, but might not be sufficient for banking. Already Bangladeshi mobile operators

mobile banking which requires a higher level of are handling lots of money through this

literacy to maintain the confidentiality of the infrastructure.” – Solution provider 3

account details.

The existing literature on m-commerce or

“But mobile banking is not that simple............as e-commerce adoption views risk purely from the

you know confidentiality has to be maintained technical point of view, where the consumers were

when someone doing mobile banking, such as his found to perceive that the mobile network is not

Published by Atlantis Press

Copyright: the authors

84

sufficiently secure to prevent any loss of

confidentiality and/or money (see Refs. 34, 72-75). “But they (telcos) don’t want to share the risk; they

As the technological risk is high in m-commerce only want to share the profit”. – Govt. official

adoption, with costs of £1 trillion annually due to

cybercrime,76 the interviewees mainly considered Telcos need to buildup trust by providing excellent

risk from the technological point of view customer service. Some participants seemed to

overlooking other issues of risk such lack of trust have lost their trust on telcos due its poor customer

and poor business practices. These will be service, as reported

discussed separately in the next section.

“I moved from Post paid to prepaid service

The technology employed and its security features because of unexpected billing from GP (Grameen

are beyond the scope of this study. It can be Phone), but even the prepaid is also eating you

assumed that the mobile network in Bangladesh is fast.” – Retailer 2

as technically secure as those in developed

countries as internationally recognized telcos are “As you know that their (telcos) customer service is

behind the operation and development of this not free. On top of that you can’t reach them until a

network, implementing the same technology as in long paid waiting, and once you reached them they

developed countries. From the stakeholder’s started to behave unprofessional, rude then how do

perception, the mobile network of Bangladesh is you feel that.” – Retailer 3

secure enough to conduct any monetary

transactions without compromising confidentiality. The allegations against telcos were not investigated

However this study does not reflect consumer’s to determine their validity as that was not within

perception of risk that may be different than the the scope of the current study. The objective was to

perception of the providers. see how those different perceptions and beliefs

affect m-commerce adoption in Bangladesh. Some

major stakeholders do not recognize telcos as

4.4 How trustworthy the telcos are trustworthy enough when dealing with mobile

financial services. Their past business experience

Almost all the interviewees were impressed with with the telcos has led them to think this way. Trust

Bangladesh Bank and the Bangladesh needs to be built up by the telcos to enhance

Telecommunication Regulatory Commission confidence among the users and other stakeholders.

(BTRC), the major government bodies regulating Assurance of technological security alone will not

m-commerce services and industries in Bangladesh. build up that trust; it needs professionalism in

No question or suspicion was raised about the doing business such as excellent customer service,

trustworthiness of banks who have long been ethical business practice and reputation. When all

serving the customers in Bangladesh. The only of these are in place, users and other stakeholders

provider of m-commerce that received complaints will be in a position to place their trust in telcos to

(mostly minor) from the participants was a telco. achieve the expected goal.

Telcos may be trusted in the security of their

network, but how trustworthy are they in their

business, especially while dealing with the 4.5 Telco-led vs. Bank-led mobile banking

customers for mobile financial services? As

reported by some interviewees Today the model of mobile banking has become

another important issue among the stakeholders of

“How can I trust them (telcos) that they won’t m-commerce in Bangladesh, especially between the

disclose my transaction details; because the mobile operators and the banks. Telcos are the

payment information will be stored at the telco’s pioneers of mobile financial services in

server and telco’s staff can access them? They Bangladesh. They are giving backend support to

could provide that information to third parties if the bank’s SMS banking, which is a kind of

they have a close tie with them or if sufficient information based mobile banking. As a result they

amount of bribe is given. You know I can retrieve want to lead mobile banking in Bangladesh.

your call history from your mobile operator just by Although none of the telcos drew attention to this

paying some money.” – Retailer 1 stand-off in their interviews, it was raised by

bankers, solution providers and the government

official.

“The trust we had in the mobile operators is

already sliding down, now if we open the windows “They still believe and dream in telco led model

for doing financial business as well then the rest of mobile banking in Bangladesh” – Govt. official

the trust will have to be sacrificed.” - Solution

provider 3 Bangladesh Bank intervened to resolve the conflict

Published by Atlantis Press

Copyright: the authors

85

by imposing clear and strict regulations that Bank. Secondly this decision has been accepted as

favored the banks, i.e. adopting a Bank-led mobile legitimate by the interviewees since the telcos are

banking model. Telcos will get a fee for the use of reluctant to take any liabilities or risks in mobile

their network but will not receive any share in the banking. Thirdly, the stakeholders of m-commerce

revenue generated by mobile banking. The such as bankers, solution providers and government

Governor of Bangladesh Bank made it clear that officials are still not confident of the success of

mobile banking in Bangladesh would be a Bank-led Bank-led mobile banking due to the potential non-

model and that the both parties must obey the cooperation from the telcos. Telcos are suspected

ruling to run their businesses seamlessly. of being unreliable because of their past attitude

where some stakeholders experienced limited

“And you know that Bangladesh Bank governor cooperation or non cooperation from them when

already announced clearly that mobile banking in something went against their (telcos) interests.

Bangladesh would be a Bank-led model not Telco- Telcos have wanted to lead mobile banking in the

led. So definitely they have to comply with this past, and this desire may have not yet been

regulation to run their business.” – Solution dispelled. They might defy regulations that are

provider 2 unfavorable to them by not fully cooperating with

the stakeholders. For this reason some stakeholders

How far the telcos will cooperate with the banks in advised for the mixed-model of mobile banking,

Bank-led mobile banking is yet to be seen, and where the telcos and the banks work as partners

some interviewees expressed their reservations and share the revenue is the most likely to succeed.

about it. Their reasoning is that the telcos are one

of the most powerful stakeholders of m-commerce

in Bangladesh who might defy or express their 4.6 Perceived Cost

dissatisfaction by providing limited or no access to

their network. They have done this in the past and Perceived cost was hypothized to be a barrier in

are still limiting access on some occasions, which many studies, and its effect was also found to be

raised questions from the interviewees about their significant in some countries. The current study

willingness to comply with regulations. As noted focused on this issue by posing a question, asking

by some of the interviewees to what degree cost influences the user’s intention

to use m-commerce. The cost includes the average

“Although we are saying that mobile banking price of a mobile phone as well as the access fee

would be a Bank-led model but you know telco’s for using various m-commerce services such as

are still not giving access in many cases and it’s a m-billing, m-ticketing, etc. The average cost of

big problem.” – Govt. official using m-commerce service was found to be

affordable by the mass population of the country,

“From my experience I’m in doubt as to whether as reported

the mobile operators will cooperate with the banks

for implementing mobile banking.” – Solution “The price (mobile phone set) could be in between

provider 3 1300 to 1900Tk (~$16-$22) by which you can

perform your all mobile financial activities.”

These suspicions and the potential non-cooperation – Telco 4

from the telcos may lead the stakeholders and

government to rethink the Bank-led model and It (mobile phone set) could cost between 1100Tk to

advocate for a mixed model where the banks and 1500Tk (~$15 -$20).” – Telco 3

the telcos will share the revenue. This mixed model

could help to resolve the conflict between the “It (fee for m-billing) is the market standard, 5Tk

parties. Some banks and even the authorized bodies (~$0.06) for up to the bill 400Tk, 10Tk for between

of the government have agreed to work towards 401 to 1500Tk, 15TK for between 1501Tk to

this co-operative model, indicated as follows 5000Tk and 25TK (~$0.3) for over 5000Tk.”

– Telco 4

“But in such case the two parties, for example a

bank and a mobile operator make mutual deal “I think it is affordable by the lower income people

where bank agree to give some share to the even though we charge between 5Tk to 25Tk

operator then we don’t stop them. In that case it ……people still think our service is cheaper than

could be a telco led model or mix model.” – Govt. banks.” - Telco 2

official

From these and other comments, clearly the

From the above analysis a few things have become average cost of a mobile phone in Bangladesh that

clear. First, the model of mobile banking adopted, is compatible with m-commerce service ranges

has been decided as Bank-led model by Bangladesh from $15 to $22, equivalent to the world’s cheapest

Published by Atlantis Press

Copyright: the authors

86

phone, at below $15 launched by Vodafone in “And you know that Bangladesh Bank governor

2010.65 The service fee is also not seemed to be already announced clearly that mobile banking in

very expensive. For example, the access fee for m- Bangladesh would be a Bank-led model not Telco-

billing ranges from $0.06 to $0.3 and is reported to led.” – Solution provider 2

be affordable by the majority of the people of

Bangladesh, whose GDP per capita (PPP) is “At present person to person fund transfer in

$1700.66 The stakeholders believe that the negative mobile banking has not been approved by

effect of cost in the adoption of m-commerce is Bangladesh Bank yet. It can be done but not person

minor in Bangladesh. to person but from business to person, govt. to govt.

or govt. to business. For example, salary or wages

can be paid to the employees through mobile

4.7 Government regulation phone.” – Banker 1

‘Bangladesh Bank’ (BB) and the ‘Bangladesh There is some evidence to suggest that the majority

Telecommunication and Regulatory Commission’ of the stakeholders are satisfied with the way

(BTRC) are the two major government bodies that m-commerce business is regulated by the

regulate the stakeholders of mobile commerce. government. Bangladesh Bank has made some

Telcos and banks do expect cooperation and a progress in the field of m-commerce regulation and

positive response from these two authorities. Most is thought to be proceeding to the right direction.

of the interviewees expressed their satisfaction The second government body, Bangladesh

when asked about the cooperation they often Telecommunication and Regulation Commission

receive from these two government bodies. (BTRC), is also cooperative and positive according

to most interviewees. The Bangladeshi

“Bangladesh government is doing very good job. Government, like other governments of third world

BTRC is also very cooperative. Bangladesh Bank is countries, is seen as being a bit slow and sometimes

also slowly opening up.” – Telco 1 stuck in the middle. While it may be quite obvious

that government needs to do a lot for launching

“I would say government is more positive now than fully fledged m-commerce services, it appears to be

ever before on digitalization…They are also very moving towards that goal slowly.

active and positive.” – Telco 2

“So far I think they (BB & BTRC) are cooperative 4.8 Others factors – not considered as barriers

enough because as soon as I convince them about

any new product they respond quickly.” – Telco 3 During the face to face interview the participants

were asked open ended questions regarding the

“Yes, I think they (BB & BTRC) are very barriers to m-commerce adoption in Bangladesh.

cooperative and positive that’s why we have done The motive was to get their own perception

that much until today.” – Telco 4 spontaneously, and caution was taken so that they

were not biased by the interviewer’s view. The

It is apparent that Bangladesh Bank has the right to interviewer’s own opinion, based on the results of

make a final decision on m-commerce services in the literature review, was presented to them later at

Bangladesh, and almost all the interviewees were the interview to facilitate discussion. In most cases

found to be positive and impressed with the they seemed to support their own arguments and

activities of Bangladesh Bank. Bangladesh Bank justify why some factors although found to be

has the authority to resolve any dispute by barriers to m-commerce adoption in other

regulating the mobile financial services. For countries, were not seen as such in Bangladesh.

example, recently Bangladesh Bank resolved the Sometimes they agreed with the interviewer’s view

debate between Telco-led vs. Bank-led mobile that some factors also have a big impact in the

banking by making the final decision in favour of adoption of m-commerce in Bangladesh, but

the banks, meaning it would be a Bank-led model. seemed to be confused not recognizing them as

The types of business that can be conducted by the barriers, but rather calling them positive factors.

banks through mobile phones have also been Examples of some factors are perceived usefulness,

determined by Bangladesh Bank. These are almost perceived ease of use, speed, quality and

anything but not P2P, person to person mobile knowledge which were found to have a positive

transaction, which has yet to be approved. influence on m-commerce adoption in previous

studies.

“Bangladesh Bank has given the permission for

mobile banking only to the banks not to the telcos.” “Knowledge is a precondition for m-commerce

– Banker 2 adoption rather as a factor or barrier.”- Govt.

official

Published by Atlantis Press

Copyright: the authors

87

Lack of literacy was viewed as the major barrier to

“We get proper training from telcos so found them m-commerce adoption in Bangladesh by the

(m-billing and m-remittance) easy to use. Also majority of the stakeholders, they noted m-

customer’s think it is useful otherwise why would commerce in Bangladesh is SMS based, and

they use it?” – Retailer 4 customers need to be able to read and write to use

SMS to conduct any m-commerce services.

“Obviously these (usefulness and user friendliness) However the reality for most Bangladeshi

are very important for any new technologies. But customers is that they are not accessing m-

when you talk about barriers then that do not commerce services independently, but through the

sound appropriate for these cases. Barrier is customer care points (CCP) which are spread

something that drags you behind but their whole over the country. The role of the CCPs may

(usefulness and user friendliness) job is to push you overcome the barrier to m-commerce adoption in

ahead.” – Solution provider 3 Bangladesh presented by illiteracy. Other barriers

to m-commerce such as perceived risk, lack of

“These (usefulness, user friendliness, speed and knowledge, government regulation and cost were

quality - in response to the interviewer’s query in also raised by the participants, but these were not

regard) all are just the characteristics of a product, considered to be significant barriers to the adoption

naturally we must have these things to get the of m-commerce in Bangladesh.

market. But people still lose market even though

they have the quality products. Why? Because they

do not consider other external factors that could 6. Limitation and future research

wipeout the market, you can say those as barrier.”

– Telco 4 This research is neither a technical paper of m-

commerce nor does it discuss the government

In conclusion the stakeholders have differentiated policies or regulations; rather the adoption behavior

between positive factors and barriers to m- of this technology is studied across a wide range of

commerce adoption. Perceived usefulness, population of a developing country. Secondly,

perceived ease of use, speed and quality are the although Bangladesh has been selected as an

characteristics of a product required to gain access example of developing country, what works in

to market. In contrast barriers are perceived to have Bangladesh may not be universally transferable to

negative impact to the adoption that act as a other developing countries. Thirdly, smart phone

drawback to that market. The participants realized and iPad technologies were not considered as

the importance of those factors and agreed on it’s mediums of m-commerce in this research, as these

positive impact towards m-commerce adoption, but were widely adopted only after this research had

disagreed in some extent to consider them as commenced.

barrier. The impact of other factors such as

complexity, anxiety, limited capacity and size were It would be interesting to study the link between

perceived to have negative but minimal impact to personal awareness of m-commerce and media

m-commerce adoption. advertising to see the effectiveness of advertising in

raising m-commerce awareness. Another

perspective would be to investigate how a

5. Conclusions and Implications company’s performance, growth, reputation,

solvency and profitability can affect the adoption of

The current research has investigated some factors m-commerce. These factors were, however, beyond

of m-commerce adoption not studied previously in the scope of this research project.

the context of Bangladesh, including lack of

literacy, the conflict of interest between the banks

and telcos as to who should lead mobile banking,

along with risk and trust. These factors emerged References

from the qualitative analysis of this research.

1. J. Zhang and Y. Yuan, M-Commerce Vs E-

On behalf of the Bangladesh Government Commerce, Key Differences. Americas Conference

Bangladesh Bank (BB) has resolved the conflict by on Information Systems (AMCIS),2002 pp.1891-

ruling in favour of the banks, meaning Bank-led 1901.

2. A. Smith, Exploring m-commerce in terms of

mobile banking is the preferred adopted model. It is

viability growth and challenges. International

yet to be seen how well the telcos cooperate with Journal of Mobile Communication, 4(6) (2006)

the banks and with other stakeholders in this pp.682-703.

Bank-led model, as some would still prefer a 3. H. Feng, T. Hoegler, and W. Stucky, Exploring the

Telco-led model mobile banking. Critical Success Factors for Mobile Commerce.

Published by Atlantis Press

Copyright: the authors

88

Proceedings of the International Conference on and behavioral impacts. International Journal of

Mobile Business (ICMB’06), (2006) pp.1-8. Man Machine Studies, 1993 pp.475-487.

4. Gartner Research, The future of payments, viewed 20. F. D. Davis, Perceived Usefulness, Perceived Ease

on 9th April 2013, of Use, and User Acceptance of Information

www.pymnts.com/assets/Uploads/The-Future-of- Technology. MIS Quarterly, 13(3) (1989) pp.319-

Payments.pdf 340.

5. Juniper Research, Press release of Juniper 21. M. Pagani, Determinants of adoption of third

Research, Viewed on 9th January 2013 on generation mobile Multimedia services. Journal of

http://www.juniperresearch.com/viewpressrelease.p Interactive Marketing, 18(3) (2004) pp.46-59.

hp?pr=249 22. S. Snowden, J. Spafford, R. Michaelides, and J.

6. M. A. Srivastra, D. R. Tassabehji and D. J. Wallace, Hopkins, Technology acceptance and m-commerce

Incorporating M-Commerce into Organizational in an operational environment. Journal of

Strategy- case study tourism sector. Working Paper Enterprise Information Management, Volume. 19

Series, (2008) pp.1-20. No. 5 (2006) pp. 525-539.

7. Forester Research, Market overview - Mobile 23. S. Taylor and P. A. Todd, Understanding

commerce solutions for retail, viewed on 9th January information technology usage: A test of competing

2013 models. Information Systems Research, 6(2) (1995)

http://www.forrester.com/Market+Overview+Mobil pp.144-76.

e+Commerce+Solutions+For+Retail/fulltext/-/E- 24. V. Venkatesh and F. D. Davis, A Theoretical

RES59095 Extension of the Technology Acceptance Model:

8. C. Coursaris, K. Hassanein and M. Head, M- Four Longitudinal Field Studies. INFORMS, 46(2)

Commerce in Canada: An Interaction Framework (2000) pp.186-204.

for Wireless Privacy. Canadian Journal of 25. K. O'Reilly, S. Goode, and D. Hart, Exploring

Administrative Sciences, 20(1) (2003) pp.54-73. mobile commerce intention: Evidence from

9. R. Tiwari, S. Buse, and C. Herstatt, From Electronic Australia. In Communications and Information

to Mobile Commerce: Opportunities through Technologies (ISCIT), October 2010 International

Technology Convergence for Business Services. Symposium on, IEEE, pp.1120-1125

Asia Pacific Tech Monitor, 23(5) (2006) pp.38-45. 26. K. K. Kim and B. Prabhakar, Initial trust and the

10. ITU (International Telecommunication Union) adoption of B2C e-commerce: The case of internet

Statistics on mobile cellular subscriptions. banking. ACM SIGMIS Database, 35, 2004 pp.50–

http://www.itu.int/ITU-D/ict/statistics, accessed on 64.

29th June 2012. 27. I. M. Klopping, E. Mckiinneyy, Extending the

11. C. N. Srivanand, M. Geeta and Suleep, Barriers to Technology Acceptance Model and the Task-

mobile internet banking services adoption: An Technology Fit Model to Consumer E-Commerce.

empirical study in Klang valley of Malaysia. The Information Technology, Learning, and

internet Business Review, Issue 1, October 2004 Performance, 22(1) 2004 pp.35-47.

12. B. Anckar, C. Carlsson, and P. Walden, Factors 28. A. Islam, M. Khan, T. Ramayah, and M. Hossain,

Affecting Consumer Adoption Decisions of m- The Adoption of Mobile Commerce Service among

Commerce. 16th Bled eCommerce Conference, Employed Mobile Phone Users in Bangladesh: Self-

(2003) pp.886-902. efficacy as A Moderator, International Business

13. BTRC ( Bangladesh Telecommunication Regulatory Research, Volume 4, No. 2 (April 2011) pp. 80-89.

Commission), accessed on 9th April 2013 29. P. Meso, P. Musa and V. Mbarika, Towards a model

http://www.btrc.gov.bd/index.php?option=com_cont of consumer use of mobile information and

ent&view=article&id=681:mobile-phone- communication technology in LDCs: the case of

subscribers-in-bangladesh-january- sub-Saharan Africa. Info Systems J, 15 (2005)

2012&catid=49:Telco-news&Itemid=502 pp.119-146.

14. M. Crabbe, C. Standing, S. Standing and H. 30. X. Cheng, L. Wang, A comparative study of

Karjaluoto, An adoption model for mobile banking consumers' acceptance model in mobile-commerce.

in Ghana. International Journal of Mobile In Computer Engineering and Technology (ICCET),

Communications, 7(5) (2009) pp.515-543. 2nd International Conference on Computer

15. J. Lu, C. Liu, C. S. Yu, and J. E. Yao, Exploring Engineering and Technology. IEEE, Volume 7

factors associated with wireless internet via mobile (2010) pp.637-641

technology acceptance in Mainland China. 31. H. P. Lu and P. Y. J. Su, Factors affecting purchase

Communications of the International Information intention on mobile shopping web sites. Internet

Management Association, 3(1) (2003) pp.101-120. Research, 19(4) (2009) pp.442-458.

16. L. D. Chen, A model of consumer acceptance of 32. T. T. Wei, G. Marthandan, A. Y. L. Chong, K. B.

mobile payment. Inderscience Enterprises Ltd., 6(1) Ooi and S. Arumugam, What drives Malaysian m-

(2008) pp.32-52. commerce adoption-An empirical analysis.

17. J. Cheong, and M. Park, Mobile Internet acceptance Industrial Management & Data Systems, 109(3)

in Korea. Internet Research 15 (2) (2005) (2009) pp.370-388.

pp.125–140. 33. N. Jahangir and N. Begum, The role of perceived

18. L. Leong, Theoretical Models in IS Research and usefulness, perceived ease of use, security and

the Technology Acceptance Model (TAM). Idea privacy, and customer attitude to engender customer

Group Inc, (2003) pp.1-31. adaptation in the context of electronic banking.

19. F.D. Davis, User acceptance of information African Journal of Business Management, Volume 2

technology: system characteristics, user perceptions, No. 1 (2008) pp.32-40.

Published by Atlantis Press

Copyright: the authors

89

34. J. Wu and S. Wang, What drives mobile commerce? System Sciences, Proceedings of the 41st Annual.

An empirical evaluation of the revised technology IEEE (2008) pp.219-219.

acceptance model Science Direct. Information and 49. V. Venkatesh, M. G. Morris, G. B. Davis and F. D.

Management. 42 (2005) pp.719-729. Davis, User Acceptance of Information Technology:

35. H. Dai and P. C. Palvia, Mobile Commerce Toward a Unifined View. MIS Quarterly, 27 (2003)

Adoption in China and the United States: A Cross- pp.425-478.

Cultural Study. The DATA BASE for Advances in 50. Z. Chen and A. J. Dubinsky, A conceptual model of

Information Systems, 40(4) (2009) pp.43 – 61 perceived customer value in e-‐commerce: A

36. J. C. Gu, S. C. Lee and Y. H. Suh, Determinants of preliminary investigation. Psychology & Marketing,

behavioral intention to mobile banking. Expert 20(4) (2003) pp.323-347.

Systems with Applications, 36(9) (2009) pp.11605- 51. B. J. Corbitt, T. Thanasankit and H. Yi, Trust and e-

11616. commerce: a study of consumer perceptions.

37. M. Khalifa and N. K. Shen, Explaining the adoption Electronic Commerce Research & Applications,

of transactional B2C mobile commerce. Journal of Volume 2 No. 3 (2003) pp.203-215.

Enterprise Information Management, Volume 21 52. N. Mallat, M. Rossi, V. K. Tuunainen and A. Oorni,

No. 2 (2008) pp. 110-24. The impact of use context on mobile service

38. J. Drennan and L.Wessels, An investigation of acceptance: the case of mobile ticketing.

consumer acceptance of M-Banking in Australia. Information & Management, 46 (2009) pp.190–195.

In Proceedings of Australian and New Zealand 53. A. Molla, P. S. Licker, Perceived e-readiness factors

Marketing Academy Conference 2009: Sustainable in e-commerce adoption: an empirical investigation

Management and Marketing. in a developing country. International Journal of

39. W. G. Chismar and S. Wiley-patton, Does the Electronic Commerce, 10(1) (2005) pp.83-110.

extended technology acceptance model apply to 54. P. Verdegem and G. Verleye, User-centered E-

physicians. Proceedings of the 36th Hawaii Government in practice -A comprehensive model

International Conference on System Sciences, 2003 for measuring user satisfaction. Government

pp.1-8. Information Quarterly, 26(3) (2009) pp.487–497.

40. M. Koufaris, Applying the technology acceptance 55. P. Mahatanankoon and J. Vila-Ruiz, Why Won't

model and flow theory to online consumer behavior. Consumers Adopt M-Commerce- An Exploratory

Information Systems Research, 13 (2) (2002) Study. Journal of Internet Commerce, 6(4) (2008)

pp.205–223. pp.113-128.

41. P. E. Pedersen and H. Nysveen, Usefulness and 56. R. A. Boadi, R. Boateng, R. Hinson and R. A.

Self-Expressiveness: Extending TAM to Explain the Opoku, Preliminary Insights into M-commerce

Adoption of a Mobile Parking Service. 16th Bled Adoption in Ghana. Information Development (ISSN

eCommerce Conference, 2003 pp.705-717. 0266-6669), 23(4) (2007) pp.253-265.

42. P. A. Pavlou, Consumer acceptance of electronic 57. B. Anckar, C. Carlsson and P. Walden, Factors

commerce – Integrating trust and risk with the Affecting Consumer Adoption Decisions of m-

technology acceptance model. International Journal Commerce. 16th Bled eCommerce Conference,

of Electronic Commerce, Volume.7 No. 3 (2003) (2003) pp.886-902.

pp.101-34. 58. H. Nysveen, P. E. Pedersen and H. Thorbjørnsen,

43. P. E. Pedersen, Adoption of mobile internet Intentions to use mobile services: antecedents and

services: an exploratory study of mobile commerce cross-service comparisons. Journal of the Academy

early adopters. Journal of Organizational of Marketing Science, 33(3) (2005) pp.330-346.

Computing and Electronic Commerce, Volume. 15 59. P. S. Bamoriya and P. Singh, Issues & challenges in

No. 3 (2005) pp.203-222. mobile banking in India: a customers'

44. E. Bigne, C. Ruiz and S. Sanz, Key Drivers of m- perspective. Research Journal of Finance and

commerce adoption: An exploratory study of Accounting, 2(2) (2011) pp.112-120

Spanish mobile users. Journal of Theoritical and 60. A. Jøsang, R. Ismail and C. Boyd, A survey of trust

Applied Electronic Commerce Research, 2(2) and reputation systems for online service

(2007) pp.48-60. provision. Decision support systems, 43(2) (2007)

45. J. T. Marchewka and C. Liu, An application of pp.618-644.

UTAUT Model for Understanding student’s 61. J. A. Hill, S. Eckerd, D. Wilson and B. Greer, The

perception using Management software. Effect of Unethical Behavior on Trust in a Buyer–

Communications of the IIMA, 7(2) (2007) Supplier Relationship: The Mediating Role of

pp.93-104. Psychological Contract Violation. Journal of

46. D. Gefen and D. W. Straub, Consumer trust in B2C Operations Management, 27(4) (2009) pp.281–293.

e-commerce and the importance of social presence: 62. H. P. Lu and P. Y. J. Su, Factors affecting purchase

experiments in e-products and e-services. Omega, intention on mobile shopping web sites. Internet

Volume 32 (2004) pp.407-424. Research, 19(4) (2009) pp.442-458.

47. X. Luo, H. Li, J. Zhang and J. P. Shim, Examining 63. M. E. Duffy, Quantitative and qualitative research

multi-dimensional trust and multi-faceted risk in antagonistic or complementary' Nursing and Health

initial acceptance of emerging technologies: an Care, 8(6) (1986) pp.356-357

empirical study of mobile banking services. 64. R. K. Yin, Case study research: Design and

Decision Support Systems, Volume 49 No. 2 (2010) methods. Sage Publications, Incorporated, (Vol. 5)

pp.222-234. 2008.

48. S. Alawadhi and A. Morris, The Use of the UTAUT 65. BBC News, Vodafone launch world’s cheapest

Model in the Adoption of E-government Services in phone, accessed on 6th Jan 2012,

Kuwait. In Hawaii International Conference on http://news.bbc.co.uk/2/hi/technology/8516079.stm,

Published by Atlantis Press

Copyright: the authors

90

66. CIA Fact Book, accessed on 11th January 2012

https://www.cia.gov/library/publications/the-world-

factbook/geos/bg.html.

67. S. Rotchanakitumnuai and M. Speece, Barriers to

internet banking adoption: a qualitative study

among corporate customers in Thailand.

International Journal of Bank Marketing, 21(6/7)

(2003) pp.312-323.

68. T. A. Schwandt, Dictionary of qualitative inquiry.

SAGE Publications, Incorporated, 2001.

69. L. T. Carr, The strengths and weaknesses of

quantitative and qualitative research: what method

for nursing? Journal of Advanced Nursing, 20(4)

(1994) pp.716-721.

70. M. Quaddus and J. Xu, Adoption and diffusion of

knowledge management systems: field studies of

factors and variables. Knowledge-Based

Systems, 18(2) (2005) pp.107-115.

71. H. F. Hsieh and S. E. Shannon, Three approaches to

qualitative content analysis. Qualitative Health

Research, 15(9) (2005) pp.1277-1288.

72. K. Kim and B. Prabhakar, Initial Trust, Perceived

Risk, and the Adoption of Internet Banking.

Proceedings of ICIS, 2000.

73. S. Laforet and X. Li, Consumers' attitudes towards

online and mobile banking in China. International

Journal of Bank Marketing, 23 (5) (2005)

pp.362–380.

74. E. J. Lee, K. N. Kwon and D. W. Schumann,

Segmenting the non-adopter category in the

diffusion of internet banking. International Journal

of Bank Marketing, 23 (5) (2005) pp.414–437.

75. M. Tan and T. S. H. Teo, Factors influencing the

adoption of Internet banking. Journal of the

Association for Information Systems, 1es (5) (2000)

pp.1–42.

76. P. Reich, Cybercrime, Cyber security, and Financial

Institutions Worldwide. Book chapter of Cyber Law

for Global E-Business: Finance, Payment and

Dispute Resolution. Copyright © 2008, IGI Global

Published by Atlantis Press

Copyright: the authors

91

You might also like

- Paper 2Document12 pagesPaper 2Jane DDNo ratings yet

- Layered Voice AnalysisDocument10 pagesLayered Voice AnalysisJack and friendNo ratings yet

- Module 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSDocument7 pagesModule 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSNiño Mendoza MabatoNo ratings yet

- Module 8 LIABILITIESDocument5 pagesModule 8 LIABILITIESNiño Mendoza MabatoNo ratings yet

- Campillo vs. CA DIGESTDocument2 pagesCampillo vs. CA DIGESTStephanie Reyes GoNo ratings yet

- Understanding Factors Influencing The Adoption of M-Commerce by SellersDocument10 pagesUnderstanding Factors Influencing The Adoption of M-Commerce by Sellerssd channelNo ratings yet

- Influence Factors of Users Satisfaction of Mobile Commerce - An Empirical Research in ChinaDocument10 pagesInfluence Factors of Users Satisfaction of Mobile Commerce - An Empirical Research in Chinapatelali769No ratings yet

- BRANDDocument13 pagesBRANDTahu BulatNo ratings yet

- Base Paper TamDocument17 pagesBase Paper TamJoseph JohnNo ratings yet

- Understanding Factors Influencing The Adoption of M-Commerce by ConsumersDocument8 pagesUnderstanding Factors Influencing The Adoption of M-Commerce by Consumerssd channelNo ratings yet

- Artikel UtamaDocument25 pagesArtikel UtamaLight DarknessNo ratings yet

- Perceived Values and Motivations Influencing M-Commerce A Nine-Country Comparative Study 2021 PDFDocument17 pagesPerceived Values and Motivations Influencing M-Commerce A Nine-Country Comparative Study 2021 PDFasrmltNo ratings yet

- Topic: A Study To Understand The Factors That Contribute SAMSUNG To Sustain in The Mobile MarketDocument4 pagesTopic: A Study To Understand The Factors That Contribute SAMSUNG To Sustain in The Mobile MarketAkshay GoyalNo ratings yet

- Topic: A Study To Understand The Factors That Contribute SAMSUNG To Sustain in The Mobile MarketDocument4 pagesTopic: A Study To Understand The Factors That Contribute SAMSUNG To Sustain in The Mobile MarketAkshay GoyalNo ratings yet

- The Impact of CSR On Trust and Intention To Adopt Mobile Banking: Evidence From Developing CountryDocument20 pagesThe Impact of CSR On Trust and Intention To Adopt Mobile Banking: Evidence From Developing CountryLee Hock SengNo ratings yet

- Lan-Xiang Yin & Hsien-Cheng Lin - 2022Document31 pagesLan-Xiang Yin & Hsien-Cheng Lin - 2022Mayang SandyNo ratings yet

- Review of LiteratureDocument6 pagesReview of LiteratureNamm EnggNo ratings yet

- Adoption of B2B E-Commerce by The SMEs in Bangladesh, 2011, Al Noor, Arif PDFDocument13 pagesAdoption of B2B E-Commerce by The SMEs in Bangladesh, 2011, Al Noor, Arif PDFFata KeshtoNo ratings yet

- Social Networks Marketing Value Co-Creation and CoDocument22 pagesSocial Networks Marketing Value Co-Creation and ComthienphuNo ratings yet

- Team 2Document11 pagesTeam 2prabanta sienNo ratings yet

- Industrial Marketing Management: Woon Leong Lin, Nick Yip, Jo Ann Ho, Murali SambasivanDocument11 pagesIndustrial Marketing Management: Woon Leong Lin, Nick Yip, Jo Ann Ho, Murali SambasivanazmiNo ratings yet

- Donner 2008Document16 pagesDonner 2008bhavesh1dhondeNo ratings yet

- Factors Influencing Mobile CommerceDocument8 pagesFactors Influencing Mobile CommerceGaurav ThaparNo ratings yet

- Bussiness ResearchDocument16 pagesBussiness ResearchVu Ng Phuong AnhNo ratings yet

- HaftaDocument14 pagesHaftaBüşra CesurNo ratings yet

- 7168 13847 1 SMDocument13 pages7168 13847 1 SMKiều NanaNo ratings yet

- Information Technology IN Developing Countries: EditorialDocument29 pagesInformation Technology IN Developing Countries: EditorialMaimana AhmedNo ratings yet

- SAMPLEPAPERa Framework For Ethical Mobile MarketingDocument5 pagesSAMPLEPAPERa Framework For Ethical Mobile MarketingArif HossenNo ratings yet

- Drivers and Inhibitors For Digital Payment Adoption Using The CashlessDocument9 pagesDrivers and Inhibitors For Digital Payment Adoption Using The Cashlessridho zynNo ratings yet