Professional Documents

Culture Documents

Accounting 200

Accounting 200

Uploaded by

sushilprajapati10_770 ratings0% found this document useful (0 votes)

8 views8 pages6

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document6

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

8 views8 pagesAccounting 200

Accounting 200

Uploaded by

sushilprajapati10_776

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 8

2

QUESTION + (25 MARKS)

[Nymeria Lid is @ motorcycle accessory menufactunng ently specialising n performance

‘exhausts for KTMB motorcycles,

(0n 4 Januaty 2015 the share capital of Nymera Li conshted of the folowing

Class A (ordinary) share capital Number of shares

Authorised share capital, 1500 000

feeued share capital ‘850.000

less B share capital

(Cumulative non-redeemable 12% preference shares)

‘Authorised share capital 500 000

tsued share capt 500 000

ADDITIONAL INFORMATION:

‘The Class A shares wore iseued at R12.50 per share a incorporation of the compary,

‘The Class B shares wore issued at R15.00 per share on 1 June 2010,

‘The directors did not pay out any dividends dung the year ended $1 December 2016

(On 1 November 2015, the 8 directors ofthe company were issued 22 600 Class A shares

‘each ata cost of R13.50 a share,

(On 30 June 2016 one of the directors decided to resign and move o a competitor. Due to

‘a cause inhi contract with Nymera ta, he had 0 eal alof the Class A shares that he

hald in Nymeria Lis, back to Nymeria Li at an agreed price of R13.00 per share

Upon resignation, he held 90 000 shares.

Roaited earings amounte to Ré £48 000 at 1 January 20%6.

Profit forthe year ended 31 December 2016 was R2 670 000 (2018: R2 484 000}.

Preferance dividends of Rt 800 000 were pad out in fll on 31 December 2018.

(On 1S March 2017 the company declared a Class A dvidend of RO.80 per share.

none

REQUIRED:

44. Present and disclose the Earnings per Sharo (EPS) of Nymora Li forthe year ended

‘31 December 2016 n terms of JAS 33 Earnings per share. (5)

Please note:

+ Comparative figures are required.

* Show calculations clearly as marks ar awarded for them,

1.2. Present the Statement of Changes in Equity of Nymeria Lid for the year ended

31 December 2016 n accordance with IAS 1 Preeontation of Financial Statements. (10)

Please note

+ Comparative figures are not requred forthe Statement of Changes in Equly.

‘Show calculations clearly a8 marks are awarded for them, =

or

‘MopULE: ACCOUNTING 200

2

‘QUESTION 2 (95 MARKS)

ZAWALA (PTY) LTD

Summarised statement of financial position as at 31 December 2016

2018 2015

R z

ASSETS

Propery, plant and equipment 2.430 850

Cost 3.880 Toto

‘ezumulated depreciation (1460) 060)

Firancilinstzuments 2s79 3316

Invent 41500 41950

Tredbreceivabes 2100 1200

Bank 738 635

TOTAL ASSETS oar 795

EquiTy

(Csss A share capital 2-409 1250

Maric market reserve 138 575

Retared earings 3380 1380

LIABILITIES:

40% debentures 1879 1996

‘Trade payables 580 390

‘Taxation payable 400 41000

‘TOTAL EQUITY AND LIABILITIES 9387 795%

ADDITIONAL INFORMATION:

1, The following amounts wore Inchided In the statement of profit and loss and other

comprehensive income forthe year ended 81 December 2016:

R

Sales 30 465

Cost of elas (28.000)

Interest Income 200

Civeond income 260

Pro on disposal of plant and equipment 40

Daprociation (450)

Interest expense (223)

Taation (00)

Garon fer value adlustments (OCH) 483.

2. Advidend of R1 000 was declared and paid during the year ended 31 Docernber 2016.

3. Accounts receivable included R00 inlorest receivable at 31 December 2015. (NI at

‘51 December 2016).

4. The fwe-yoar, 103%, R2 000 debentures wore Issued on 31 Decomiber 2015, with interest

payable annually in arars on 31 December. The effective inforst rats 12%

5, Plant and equipment acquired during the year ended 31 December 2016 cast R260. RAED of

ths emount was to replace equipment while the belance was to expend operations. The

opreciation on the plant and equipment for the year was correctly calculated and accounted

‘or

&

QUESTION? (CONTINUED)

6. On 1 August 2016, Zawala (Pty) Lid sole one of ts equity investments for Rt 229. The

investment had a carying amount of Rt 085 at 31 Decemioer 2015 and tad criginaly cost

2000, This investment was held 28 pat of the company's eqully Investments with adjustments

recognised in ather comprehensive Income (OCI). It isthe company poley f transfer any fair

Yelue gains and losses to rolained earrings as investments are sold. There were no

‘equistions of equly investments during the curentreportng period,

REQUIRED:

Presant.a statement of eash flows, using the drsct method, forthe year ended 31 December 2016,

in accordance Wil IAS 7 Statement of Cash flows for Zawala (Pi) Lid. Management slaced to

‘shaw dividend cash flows as cash flows fom operating acivites. (25)

MODULE: ACCOUNTING 200

‘QUESTION 3 (40 MARKS)

“The following extract from the francal statements of P Lid and S Lid are presented to you for the

reportng period ended 30 June 2017:

| EXTRACTS FROM STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME |

FOR THE YEAR ENDED 30 JUNE 2017

(te :

Revenue 730 | — ae 00

Sree aes Geno, | Gave

ont seo en0 "Soro

Che fone ed

her estes gins) | sooo,

Probert Sano —"Sso ano

ee ones ezcon | (eo

Par FOR HE YEAR Seteo fiero

Ste orpaete income

TOTAL COMPREHENSIVE INCOME FOR THE YEAR 216.000 —| 748 000

[EXTRACTS FROW STATEMENTS OF CHANGES IN EQUITY FOR THE YEAR ENDED 30 JUNE 2017 |

Retained earnings

Plus SL

R R

Balance att July 2016 508 000 ‘340,000

Changes in equity for 2017

Total comprehensive income forthe year 216.000 144000

Dividend {24 00) (14 000)

Balance at 30 June 2017 700 000 470 000

EXTRACTS FROM STATEMENTS OF FINANCIAL POSITION AT 30 JUNE 2017

Pie St

R R

‘ASSETS

Land 600.000 | 400000

Equipment 235.000 | 365000

Investment in S Lid 700 000 :

“Trade receivables 109000 | 160000

Inventories 245000 | 275000

Bank 60.000 |

Total assets 000 000 | 4200 000

EQUITY AND LIABILITIES.

‘Share capital (P Lid:100 O00VS (14:60 000 shares) 900000 | 500 000

Retalnad earings |__700 000 _| 470 000,

700 009 —|~970 000.

‘Trade and other payables '300 000} ~180 000

Bank oversea - 0,000

Total equity and labios 2000 000 | 1200 000

nseo.os2017

QUESTION 3 (CONTINUED)

ADDITIONAL INFORMATION:

(1 1 ly 2076 P Lid obtained a contig intrest in $ Ld by buyrg 75% ofthe shares of S Ld

[A thet date the equiy of § Lid consisted ofthe folowing:

R

Share capital 500 ¢00

Retained earnings 260 (00

“The excess that P Ld paid forthe investment in S Lid was party ctibuted to land ownod by S Ltd. The

fair valu ofthe land was R100 000 higher than the carrying anount presented in the statement of

financisl poston of 5 Lid at the acquision date. The fai value of the non-controling interests at the

‘acquisiton date was determined to be R240 000.

‘At 1 July 2015 P Lid sold equipment with a carrying amount of R200 000 to Lid for R27S 000.

Equipments Gepreciated on the steighi-line method, The remabing usefu if of the equipment was.

regarded 28 6 years at that date, S Lid corinued fo use the equpment as part of property, plant and

‘equipment in their operations

'S Ltd has been seling inventories lo P Lid sine the acguslon date. During the current reporting period

fendes 30 June 2017 foal ntragroup sales amounted to R160 000. The folowing Inventories thal wore

‘purchased from § Ltd were inclided n ivortores inthe statomentof franca postion of P Li

R

Ozening inventories s0c00

Giosing inventories 0000

{SLtd maintained a 50% markup on coston all alas to Pic.

‘The flowing secountng polices apply

+ > Lid recognised the equty investment in Lid at costinits separate financial records

+ Pid elected to measure any non-contling interests in the acquire far value

+ A aouiston the identifiable assots acquired and labilies assumed were valued at thelr

‘oquietion date far values, as determined In terme of IFRS 3Business combinations.

Asse052047

QUESTION 3 (CONTINUED)

REQUIRED:

3.1 Calculate the prchage dtferance atthe acquisition date. @

‘32 Prepare al the proforma journals relating to revaluatons at acquison and intragroup transactions

aa

ofthe PLid group forthe reporting period ended 30 June 2017.

+ Indicate cleaty where in the financial statements the account is presented i. statement of

‘nancial postion (SFPI: profit o loss (PL) cher comprehensive income (OG) or statement of

‘changes In equity (SCE)

+ Indicate which entity is affacted bythe journal ents

+ Journal narrations are not required.

+ Ignore al tax implications.

parent (P) and eubsidiay (S)

(13)

Prepare the consolidatd financial staterenis ofthe P Ltd group forthe year ended 30 June 2017

+The conscldated statement of cash lows isnot required.

+ Comparative figures are aiso not required oe

@

‘COURSE: ACCOUNTANCY 200

sssoouzoer

QUESTION « (60 MARKS)

Mandi Properties Lid (horeafter MP} is a property development company focused on affordable

housing development. In partnership with Nedbank, they are fwolved in a project to develop simiir-

looking residentel unis In Riverview, north of Steyn City. The fellowing Information provised to you

regarding the curent reporting period ended $1 Osoember 2016:

Inventories

MP correctly cless‘ies and accounts forthe residential units as Inventory. MP uses the frstn-rst.out

{FIFO} method to measure the cost of inventory on a periodic bass. It also classes its inventory

Between raw materials, work-in-progress and finshed goods snd at 1 January 2016, there wore no

‘opaning balances for raw matarias, work-in-progress or fished goods.

(On § Jenuary 2016, MP purchased RAS milion of raw materials tobe used in the construction ofthe total

150 residential units in Riverview. Inthe current reporting period, constructon started on 135 othe units,

LMP ircutted the flowing ooets direct related fo the construction of the esidental units during the

current reporting period:

Site preparaton costs 1500 000

Architects fees R200 000

Lanour costs R6 500 000

LMP als incurred the following costs not directly related tothe construction of the residential unt during

the curent repotrg period

Administrative expences R75 000

Finance costs R4 500 000

(Other expenses R15 500

IMP uses equipment sith 2 cost price of RS 400 000 In the constructon process. The equipment was

criginaly purchases on 1 July 2014 and had an estimated Useful Ife of 8 years, At 31 December 2016,

‘the drectorsre-estmated the remaining useful le as 3 years.

‘At 31 December 2016, 60 unis were sil under constuction while 50 completed units were sold at cost

le 59%.

‘The folowing transactions have not yet been recorded and wore not included in tte abovementioned

experses:

Investments

MP eared R450 C00 dividend income on an investment in shares. MP classifies the investment as @

finaneal asset at fair value through other comprehensive income (OC!) . The jain on fair value

‘agustwent (excluding tne dividend income received) amounted to R350 000.

LMP also invested in an 8% bond, wih a face value of R80 000, hol! at amorised cost. The balance of

the bord at 1 January 2016 was R80 000. Objective evidence existed at the reporting date that

indicated that this bond Is impaired with R2 000, The balance of this bond, ater takg into account the

Impairment loss recogrised at 31 December 2016, is R78 800,

‘COURSE: ACCOUNTANCY 200,

‘QUESTION 4 (CONTINUED)

Contract containing a lease

IMP entered into a contract to obtain the rghto-use ofa large printer from Designjet (Py) Ltd for user

the administrative offces. The printer has a useful life of § years and ownership wil not be obtained at

the ene ofthe contract term. Professional atorey fees of 7 600 were incur to set up the contract.

IMP identified that this contract i a lease according to IFRS 16 Leases. The following amortisation table

is provided to you

Coniract pmt —| Capital Interest Balance

soi01

Hee 2074 4400 7548 wast 31 852

‘31 Dec 2015 "14400. ‘Bare 5528 22680

'34Dec 2016 114400. 10428 3.74 12254] +

34 Dec 2017 14400 T2254 218 =

Event

During the debtor circulation done by the auditors during February 2017 the foling information came

twlight

Suffolk Development (Ply) Lid (SD), @ company who purchased many ints in MP's previous

development mado a series of bed investment decisions. it coors ineviable that the debtor wal be

liquideted and unbkely that any payment wil be received from SD. SD owed the company R1 525 000 at

the end of December 2016, No provision has as yel been made regarding this event.

(ther information

Incoms tax forthe reporting period ended is correctly calculated as Rt 218 000,

REQUIRE!

4.1 Disclose the ventory te to the statement of financial postion of Mandl Properties Ltd at

31 December 2016 based on the information provided. Your answer must Include the

necessary calculations.

‘+ Comparative information Ie not required (16)

4.2 ldentiy the Suffolk Development (Pry) Ld case correctly In terms of IAS 10 Events ater the

eporting period.

+ Discuss the accounting treatment and disclosure inthe financial statements of Man

Properties Li and

‘+ Supply the relevant journal

December 2016,

nities (i applicable) for the reporting >eried ended 31 (6)

43. Present the statement of profi end loss and other comprehensive income (by funetion) of,

Handi Properties L1d forte reporting period ended 31 December 2016.

‘+ Comparative amounts are not required. (20)

4.4. Disclose the change in accounting estimate note to the statement of profi and los and other

comprehensive income of Mnanci Propartios LIC for the reporing Fariod ended 31

December 2016 Cy

Please note

‘= Round amounts to the nearest Rang,

* Show al calculations clearly as marks are awarded for these.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 12 Commerce - 2nd Unit TestDocument3 pages12 Commerce - 2nd Unit Testsushilprajapati10_77No ratings yet

- Bharati Vidyapeeth Prashala & Jr. College: Second Unit Test 2020 - 2021Document3 pagesBharati Vidyapeeth Prashala & Jr. College: Second Unit Test 2020 - 2021sushilprajapati10_77No ratings yet

- 12 Commerce - 2nd Unit Test-05.02.2021Document3 pages12 Commerce - 2nd Unit Test-05.02.2021sushilprajapati10_77No ratings yet

- 9886-Article Text-36748-1-10-20161227Document12 pages9886-Article Text-36748-1-10-20161227sushilprajapati10_77No ratings yet

- Bharati Vidyapeeth Prashala & Jr. College: Second Unit Test 2020 - 2021Document3 pagesBharati Vidyapeeth Prashala & Jr. College: Second Unit Test 2020 - 2021sushilprajapati10_77No ratings yet

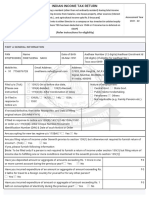

- Indian Income Tax Return: Part A General InformationDocument8 pagesIndian Income Tax Return: Part A General Informationsushilprajapati10_77No ratings yet