Professional Documents

Culture Documents

Assignment 3: Name

Assignment 3: Name

Uploaded by

Baburam AdOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 3: Name

Assignment 3: Name

Uploaded by

Baburam AdCopyright:

Available Formats

Name:

ASSIGNMENT 3

IAS 37 & IAS 10

1. On 1 October 2013, Xplorer commenced drilling for oil from an undersea oilfield. The extraction of oil

causes damage to the seabed which has a restorative cost (ignore discounting) of $10,000 per million

barrels of oil extracted. Xplorer extracted 250 million barrels of oil in the year ended 30 September 2014.

Xplorer is also required to dismantle the drilling equipment at the end of its five-year licence. This has an

estimated cost of $30 million on 30 September 2018. Xplorer’s cost of capital is 8% per annum and $1 has

a present value of 68 cents in five years’ time.

What is the total provision (extraction plus dismantling) which Xplorer would report in its

statement of financial position as at 30 September 2014 in respect of its oil operations?

A $34,900,000

B $24,532,000

C $22,900,000

D $4,132,000

(Dec 14)

2. Tynan’s year end is 30 September 2014 and the following potential liabilities have been identified:

(i) The signing of a non-cancellable contract in September 2014 to supply goods in the following year on

which, due to a pricing error, a loss will be made

(ii) The cost of a reorganisation which was approved by the board in August 2014 but has not yet been

implemented, communicated to interested parties or announced publicly

(iii) The balance on the warranty provision which relates to products for which there are no outstanding

claims and whose warranties had expired by 30 September 2014

Which of the above should Tynan recognise as liabilities as at 30 September 2014?

(Dec 14)

3. Each of the following events occurred after the reporting date of 31 March 2015, but before the financial

statements were authorised for issue.

Classify the following events as per IAS 10 Events After the Reporting Period.

A A public announcement in April 2015 of a formal plan to discontinue an operation which had been

approved by the board in February 2015

B The settlement of an insurance claim for a loss sustained in December 2014

C Evidence that $20,000 of goods which were listed as part of the inventory in the statement of financial

position as at 31 March 2015 had been stolen

D A sale of goods in April 2015 which had been held in inventory at 31 March 2015. The sale was made at

a price below its carrying amount at 31 March 2015

(June 15)

4. In a review of its provisions for the year ended 31 March 2015, Cumla’s assistant accountant has

suggested the following accounting treatments:

(i) Making a provision for a constructive obligation of $400,000; this being the sales value of goods

expected to be returned by retail customers after the year end under the company’s advertised 30-day

returns policy

(ii) Based on past experience, a $200,000 provision for unforeseen liabilities arising after the year end

(iii) The partial reversal (as a credit to the statement of profit or loss) of the accumulated depreciation

provision on an item of plant because the estimate of its remaining useful life has been increased by three

years

Which of the above suggested treatments of provisions is/are permitted by IFRS?

(June 15)

5. The following two issues relate to Spiko Co’s mining activities:

Issue 1: Spiko Co began operating a new mine in January 20X3 under a five-year government licence

which required Spiko Co to landscape the area after mining ceased at an estimated cost of $100,000.

Issue 2: During 20X4, Spiko Co’s mining activities caused environmental pollution on an adjoining piece of

government land. There is no legislation which requires Spiko Co to rectify this damage, however, Spiko

Co does have a published environmental policy which includes assurances that it will do so. The estimated

cost of the rectification is $1,000,000.

Suggest the appropriate treatment in accordance with IAS 37 Provisions, Contingent Liabilities and

Contingent Assets for the year ended 31 December 20X4?

(Sep 16)

6. Hopewell sells a line of goods under a six-month warranty. Any defect arising during that period is

repaired free of charge. Hopewell has calculated that if all the goods sold in the last six months of the year

required repairs the cost would be $2 million. If all of these goods had more serious faults and had to be

replaced the cost would be $6 million.

The normal pattern is that 80% of goods sold will be fault-free, 15% will require repairs and 5% will have

to be replaced.

What is the amount of the provision required?

You might also like

- Solutions Tutorial Questions 02 BUSN7050Document5 pagesSolutions Tutorial Questions 02 BUSN7050peter kong100% (1)

- FR15. Provision, Contingent Liab & Assets (Practice)Document4 pagesFR15. Provision, Contingent Liab & Assets (Practice)duong duongNo ratings yet

- Ifrs December 2020 EnglishDocument10 pagesIfrs December 2020 Englishjad NasserNo ratings yet

- IKKA ACCA Classes F7 Test - 1Document10 pagesIKKA ACCA Classes F7 Test - 1ishika bihaniNo ratings yet

- IAS-37 Provisions, Contingent Liabilities and Contingent AssetsDocument3 pagesIAS-37 Provisions, Contingent Liabilities and Contingent AssetsAbdul SamiNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS February Exam 2020 - Extra SessionDocument8 pagesLebanese Association of Certified Public Accountants - IFRS February Exam 2020 - Extra Sessionjad NasserNo ratings yet

- s16 f7 QDocument17 pagess16 f7 QJean LeongNo ratings yet

- CA Final FR Q MTP 2 May 2024 Castudynotes ComDocument12 pagesCA Final FR Q MTP 2 May 2024 Castudynotes ComAudit UserNo ratings yet

- Chapter 13Document8 pagesChapter 13ks1043210No ratings yet

- MN20018 Seminar Questions - Provisions, Contingencies and Post Balance Sheet EventsDocument4 pagesMN20018 Seminar Questions - Provisions, Contingencies and Post Balance Sheet EventsLidia PetroviciNo ratings yet

- Maynard2e Mcqs ACCA F72015junDocument7 pagesMaynard2e Mcqs ACCA F72015junDesmanto HermanNo ratings yet

- Events After The Reporting Period (IAS 10)Document16 pagesEvents After The Reporting Period (IAS 10)AbdulhafizNo ratings yet

- IFA II AssignmentDocument6 pagesIFA II Assignmentaserbeyene29No ratings yet

- Public AccountingDocument3 pagesPublic Accountingjoliejolie28No ratings yet

- Ias 10 Events After The Reporting PeriodDocument9 pagesIas 10 Events After The Reporting PeriodTawanda Tatenda HerbertNo ratings yet

- KTQT Eng 1Document9 pagesKTQT Eng 1Huỳnh Như PhạmNo ratings yet

- Far PDFDocument13 pagesFar PDFp9hnbpt5hpNo ratings yet

- Ias 10 Events After Reporting PeriodDocument13 pagesIas 10 Events After Reporting Periodesulawyer2001No ratings yet

- 2.2. PPE IAS16 - Practice - EnglishDocument12 pages2.2. PPE IAS16 - Practice - EnglishBích TrâmNo ratings yet

- Assignment 2Document5 pagesAssignment 2Baburam AdNo ratings yet

- Revenue (BPP)Document6 pagesRevenue (BPP)ram ramNo ratings yet

- Fca Aa Ican November 2023 Mock QuestionsDocument7 pagesFca Aa Ican November 2023 Mock QuestionsArogundade kamaldeenNo ratings yet

- Assignment 1Document8 pagesAssignment 1Ivan SsebugwawoNo ratings yet

- ADocument7 pagesAAyad Abdelkarim NasirNo ratings yet

- Irmaya Safitra - FR Session 1 Practice Assignment - Questions (8th July 2023)Document5 pagesIrmaya Safitra - FR Session 1 Practice Assignment - Questions (8th July 2023)irmaya.safitraNo ratings yet

- Events After The Reporting Period Final 6 KiloDocument13 pagesEvents After The Reporting Period Final 6 Kilonati100% (1)

- Quick Quiz Lecture 11Document5 pagesQuick Quiz Lecture 11Kong KeaNo ratings yet

- Paper F7. Financial ReportingDocument6 pagesPaper F7. Financial ReportingNub ChetNo ratings yet

- Paper F7. Financial ReportingDocument5 pagesPaper F7. Financial ReportingNub ChetNo ratings yet

- Tutorial Questions 1 - CHP 1 4Document2 pagesTutorial Questions 1 - CHP 1 4Samantha NarayanNo ratings yet

- Revenue From Contract With Customers (IFRS 15) & Accounting For Government Grants and Disclosure of Government Assistance (IAS 20)Document5 pagesRevenue From Contract With Customers (IFRS 15) & Accounting For Government Grants and Disclosure of Government Assistance (IAS 20)Kristen0% (1)

- Lebanese Association of Certified Public Accountants - IFRS December Exam 2019Document11 pagesLebanese Association of Certified Public Accountants - IFRS December Exam 2019jad NasserNo ratings yet

- Eos CupFinal RoundDocument7 pagesEos CupFinal RoundMJ YaconNo ratings yet

- RTP PDFDocument45 pagesRTP PDFsumanmehtaNo ratings yet

- 2021 Revision QuestionsDocument10 pages2021 Revision QuestionsTawanda Tatenda HerbertNo ratings yet

- Suspense QuestionsDocument15 pagesSuspense QuestionsChaiz MineNo ratings yet

- FA Sample PaperDocument10 pagesFA Sample PaperThe ShiningNo ratings yet

- ACCA F7 MockDocument17 pagesACCA F7 MockayeshaghufranNo ratings yet

- Multiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019Document8 pagesMultiple Choice Questions (40%) : Lebanese Association of Certified Public Accountants - IFRS July Exam 2019jad NasserNo ratings yet

- Provision and Contingent LiabilityDocument14 pagesProvision and Contingent LiabilityMiraflor Bia�asNo ratings yet

- Financial Accounting Question SetDocument24 pagesFinancial Accounting Question SetAlireza KafaeiNo ratings yet

- Financial & Corporate Reporting Time Allowed - 3 Hours Total Marks - 100Document5 pagesFinancial & Corporate Reporting Time Allowed - 3 Hours Total Marks - 100Laskar REAZNo ratings yet

- 3 RdyrDocument6 pages3 RdyrErikaNo ratings yet

- F7 - QuestionsDocument10 pagesF7 - QuestionspavishneNo ratings yet

- B Com 2023 Examination PaperDocument9 pagesB Com 2023 Examination PaperAkshitaNo ratings yet

- Events After The Reporting Period TOA ValixDocument4 pagesEvents After The Reporting Period TOA Valixcherry blossomNo ratings yet

- GRP 1 Series 1 MTP CompiledDocument72 pagesGRP 1 Series 1 MTP CompiledSairamNo ratings yet

- RISE All CAF Subj Mocks QP With Solutions Autumn 2022Document130 pagesRISE All CAF Subj Mocks QP With Solutions Autumn 2022Hadeed HafeezNo ratings yet

- FR MTP-1 May-24Document11 pagesFR MTP-1 May-24chandrakantchainani606No ratings yet

- f7 Mock1Document8 pagesf7 Mock1Wajih UddinNo ratings yet

- Test 2 - Chap 8,10,11 & 12Document9 pagesTest 2 - Chap 8,10,11 & 12Bhushan SawantNo ratings yet

- F7uk 2010 Jun QDocument9 pagesF7uk 2010 Jun QKathleen HenryNo ratings yet

- CA Final FR Q MTP 1 May 2024 Castudynotes ComDocument11 pagesCA Final FR Q MTP 1 May 2024 Castudynotes Compabitrarijal1227No ratings yet

- ACP323 Audit of Iib and Ppe ReviewerDocument4 pagesACP323 Audit of Iib and Ppe ReviewerFRAULIEN GLINKA FANUGAONo ratings yet

- Quiz 1 With Correct AnswersDocument10 pagesQuiz 1 With Correct AnswersmarietorianoNo ratings yet

- Far Drill2Document4 pagesFar Drill2Jung Hwan SoNo ratings yet

- IAS 36 Impairment Out of Class Practice EN PrintDocument11 pagesIAS 36 Impairment Out of Class Practice EN PrintDAN NGUYEN THENo ratings yet

- 2021 COAF 4201 GroupsDocument16 pages2021 COAF 4201 GroupsTawanda Tatenda HerbertNo ratings yet

- IAs 10-Events After Reporting DateDocument4 pagesIAs 10-Events After Reporting DateSujan ShresthaNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- DIN73378 & DIN74324-1 - Tube PA CatalogueDocument1 pageDIN73378 & DIN74324-1 - Tube PA CatalogueAyesha RubianaNo ratings yet

- Globalization Liberalization and PrivatizationDocument7 pagesGlobalization Liberalization and PrivatizationChandra Shekhar PantNo ratings yet

- Talino: To Know That We Know What We Know, and To Know That We Do Not Know What We Do Not Know, That Is True KnowledgeDocument2 pagesTalino: To Know That We Know What We Know, and To Know That We Do Not Know What We Do Not Know, That Is True KnowledgeEllen BuenafeNo ratings yet

- Ielts WritingDocument6 pagesIelts WritingESC18 NBKNo ratings yet

- Kanlungan TabsDocument3 pagesKanlungan TabsAlfredNo ratings yet

- Lecture Chapter 5Document32 pagesLecture Chapter 5Mai HiếuNo ratings yet

- MWM 7B270Document80 pagesMWM 7B270brunaspectrum3No ratings yet

- G.B. Perfins: Other NationsDocument24 pagesG.B. Perfins: Other NationsThomas BlackberryNo ratings yet

- Description of Albanian Pyramid SchemeDocument3 pagesDescription of Albanian Pyramid SchemeMaria Kathreena Andrea AdevaNo ratings yet

- BK - July Board 2023Document11 pagesBK - July Board 2023akshaydevendra09No ratings yet

- Botswana Manufacturers DirectoryDocument43 pagesBotswana Manufacturers Directoryindienkhan0% (1)

- PDPFP Aug19Document83 pagesPDPFP Aug19Justine RazonNo ratings yet

- Business Loan ApplicationDocument6 pagesBusiness Loan Applicationcatipop450No ratings yet

- SIFMA Capital Markets Fact Book - 2020 DataDocument186 pagesSIFMA Capital Markets Fact Book - 2020 DataÂn TrầnNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Sanjay SanNo ratings yet

- Time Value of MoneyDocument15 pagesTime Value of MoneytamtradeNo ratings yet

- Autoss: Product Manufacturer Description Quantity SubtotalDocument1 pageAutoss: Product Manufacturer Description Quantity SubtotalKien Nguyen TrungNo ratings yet

- International Arbitrage and Interest Rate ParityDocument28 pagesInternational Arbitrage and Interest Rate ParityFahimHossainNitolNo ratings yet

- Finmar-Midterms ReviewerDocument15 pagesFinmar-Midterms ReviewerANNA BIEN DELA CRUZNo ratings yet

- Abc Ved Analysis-Inventory ManagementDocument28 pagesAbc Ved Analysis-Inventory ManagementarunNo ratings yet

- International Marketing StrategyDocument10 pagesInternational Marketing StrategyMarina IvannikovaNo ratings yet

- Ethiopia, 6.625% 11dec2024, USDDocument1 pageEthiopia, 6.625% 11dec2024, USDLloyd Ki'sNo ratings yet

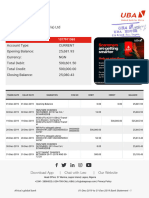

- Bank Statement For Ebesun Company (Nigeria) LTD, UBA GroupDocument2 pagesBank Statement For Ebesun Company (Nigeria) LTD, UBA GroupChidinma NnoliNo ratings yet

- Systematically Trading FX Mean Reversion in The Long Run 1680234492Document32 pagesSystematically Trading FX Mean Reversion in The Long Run 1680234492Jaehyun KimNo ratings yet

- Global Interstate SystemDocument4 pagesGlobal Interstate SystemJohn Carlo Balucio Llave100% (4)

- Tgasp - Meeseva.gov - in APSDCPortal UserInterface Citizen RDocument1 pageTgasp - Meeseva.gov - in APSDCPortal UserInterface Citizen RChitanya KondapallyNo ratings yet

- HW 15-2 Task Budget Prep MCQ StudDocument5 pagesHW 15-2 Task Budget Prep MCQ StudКсения НиколоваNo ratings yet

- Proposed Tax Changes Under The Finance Bill 2022 ALN Kenya Legal Alert April 2022Document24 pagesProposed Tax Changes Under The Finance Bill 2022 ALN Kenya Legal Alert April 2022yomak94018No ratings yet

- Mahasiswa - MG 3 - Bab 2 - Strategi Operasi Dalam Lingkungan GlobalDocument17 pagesMahasiswa - MG 3 - Bab 2 - Strategi Operasi Dalam Lingkungan GlobalMuhammad FaisalNo ratings yet

- GDP, GNP, NDP & NNPDocument2 pagesGDP, GNP, NDP & NNPfdfjhhdddNo ratings yet