Professional Documents

Culture Documents

Partnership Liquidation: Assets Liabilities & Equity

Partnership Liquidation: Assets Liabilities & Equity

Uploaded by

Ivy BautistaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Partnership Liquidation: Assets Liabilities & Equity

Partnership Liquidation: Assets Liabilities & Equity

Uploaded by

Ivy BautistaCopyright:

Available Formats

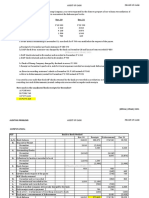

PARTNERSHIP LIQUIDATION

The partners of the M&N Partnership started liquidating their business on July 1, 20x5,

at which time the partners were sharing profits and losses 40% to M and 60% to N.

The balance sheet of the partnership appeared as follows:

Assets Liabilities & Equity

Cash P 8,800 Accounts Payable P 32,400

Receivable 22,400 M, capital P 31,000

Inventory 39,400 M, drawing ( 5,400) 25,600

Equipment P 65, 200 N, capital P 33,200

Accumulated N, drawing ( 200) 33,000

Depreciation (30,800) 34,400 N, loan 14,000

Total P 105,000 Total P 105,000

During the month of July, the partners collected P600 of the receivables with no loss.

The partners also sold during the month the entire inventory on which they realized a

total of P32,400. How much of the cash was paid to M's capital on July 31, 20x5?

a. P25,600 c. P320

b. 5,400 d. 0

(PhilCPA)

Answer: (c)

M N

Drawing P(5,400) P(200)

Loan - 14,000

Partnership Liquidation | ©jipb162021

Capital 31,000 33,200

Total interest P25,600 P47,000

Loan on realization: 40%: 60% P 600

Receivables – collection

Less: book value 22,400 P21,800

Proceeds – inventory P32,400

Less: book value 39,400 7,000

Unrealized noncash assets 34,400

P63,200 (25,280) (37,920)

P 320 P 9,080

Partnership Liquidation | ©jipb162021

You might also like

- Missions and Evangelism Action Plan 2020Document2 pagesMissions and Evangelism Action Plan 2020Angela Noel100% (1)

- Partnership Liquidation. Alynna Joy P. IbanezDocument32 pagesPartnership Liquidation. Alynna Joy P. IbanezAllynna Joy83% (6)

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- ACCCOB1 Module 3Document19 pagesACCCOB1 Module 3Ayanna CameroNo ratings yet

- AFST-Practice Set-01-Partnership (Part 1)Document3 pagesAFST-Practice Set-01-Partnership (Part 1)Alain Copper100% (1)

- Partnership Liquidation Question#6Document2 pagesPartnership Liquidation Question#6Ivy BautistaNo ratings yet

- AFAR - 07 - New Version No AnswerDocument7 pagesAFAR - 07 - New Version No AnswerjonasNo ratings yet

- 1.4 Partnership Liquidation - 1Document4 pages1.4 Partnership Liquidation - 1Leane Marcoleta100% (2)

- Weather For Yachtmaster Day Skipper CourseDocument47 pagesWeather For Yachtmaster Day Skipper CourseAdrian VirlanNo ratings yet

- Partnership Liquidation: Assets Liabilities & EquityDocument2 pagesPartnership Liquidation: Assets Liabilities & EquityIvy BautistaNo ratings yet

- M & N Partnership Balance Sheet - July 1, 2021Document1 pageM & N Partnership Balance Sheet - July 1, 2021dagohoy kennethNo ratings yet

- PDF Partnership Liquidation Alynna Joy P Ibanezdocx DLDocument32 pagesPDF Partnership Liquidation Alynna Joy P Ibanezdocx DLKrizia Mae Uzielle PeneroNo ratings yet

- Illustrative Problem - Financial Ratios: (Including Depreciation P5,000 For 2020 and P 3,000 For 2019)Document5 pagesIllustrative Problem - Financial Ratios: (Including Depreciation P5,000 For 2020 and P 3,000 For 2019)Angelita Dela cruzNo ratings yet

- 3 - Cash Flow Statement - Indirect Method - QuestionsDocument3 pages3 - Cash Flow Statement - Indirect Method - Questionsmikheal beyber100% (1)

- Second Quiz On FS Analysis PDFDocument2 pagesSecond Quiz On FS Analysis PDFRandy ManzanoNo ratings yet

- AFAR 1st PB PDFDocument11 pagesAFAR 1st PB PDFrav dano100% (1)

- Business Com ActivityDocument2 pagesBusiness Com ActivityAlyssa AnnNo ratings yet

- Assignment No. 2 - Cash Flow Statement AnalysisDocument3 pagesAssignment No. 2 - Cash Flow Statement AnalysisNCF- Student Assistants' OrganizationNo ratings yet

- Assignment No. 2 - Cash Flow Statement AnalysisDocument3 pagesAssignment No. 2 - Cash Flow Statement AnalysisNCF- Student Assistants' OrganizationNo ratings yet

- Joint ArrangementDocument3 pagesJoint ArrangementAlliah Mae AcostaNo ratings yet

- BUSCOM2019 (Testbank)Document6 pagesBUSCOM2019 (Testbank)Richel Lidron100% (1)

- Afar-1st-Pb-October-2022 - No AnsDocument15 pagesAfar-1st-Pb-October-2022 - No AnsRhea Mae CarantoNo ratings yet

- Joint Arrangement Answer KeyDocument8 pagesJoint Arrangement Answer KeyMonica DespiNo ratings yet

- 2021 CH 5 AnswersDocument6 pages2021 CH 5 AnswersAlona PrecillasNo ratings yet

- Prelimexamacct1103withanswerandsolutiondocx PDF FreeDocument14 pagesPrelimexamacct1103withanswerandsolutiondocx PDF FreeBaby OREO0% (1)

- ABUSCOM Lecture 15Document2 pagesABUSCOM Lecture 15Mark Lyndon YmataNo ratings yet

- Calvo, Jhoanne C.-BSA 2-1-Chapter 4-Problem 11-20Document12 pagesCalvo, Jhoanne C.-BSA 2-1-Chapter 4-Problem 11-20Jhoanne CalvoNo ratings yet

- FinMan Planning Master-BudgetDocument3 pagesFinMan Planning Master-Budgetjim malajatNo ratings yet

- CMPC 131 SolutionsDocument3 pagesCMPC 131 SolutionsNhel AlvaroNo ratings yet

- Activity 1 Acc311Document3 pagesActivity 1 Acc311Aidreil LeeNo ratings yet

- Advacc 1 Answer Key Set BDocument3 pagesAdvacc 1 Answer Key Set BA BNo ratings yet

- Partnership LiquidationDocument3 pagesPartnership LiquidationBryaneNo ratings yet

- Joint ArrangementsDocument3 pagesJoint ArrangementsCha EsguerraNo ratings yet

- Activity 7Document16 pagesActivity 7JEWELL ANN PENARANDANo ratings yet

- Mysanflower HVA Prob (QUIZ 8 - 26)Document2 pagesMysanflower HVA Prob (QUIZ 8 - 26)NicoleNo ratings yet

- Financial Statement Analysis, Ratio AnalysisDocument5 pagesFinancial Statement Analysis, Ratio AnalysisAngelica CondenoNo ratings yet

- Week 6 7 ULOb Lets Analyze SolutionDocument2 pagesWeek 6 7 ULOb Lets Analyze Solutionemem resuentoNo ratings yet

- Afar Short Quiz Business Combination 01Document3 pagesAfar Short Quiz Business Combination 01Sharmaine Clemencio0No ratings yet

- Problem 17-1, ContinuedDocument6 pagesProblem 17-1, ContinuedJohn Carlo D MedallaNo ratings yet

- Toaz - Info Joint Venture Quizzers PRDocument4 pagesToaz - Info Joint Venture Quizzers PRMark Anthony BabaoNo ratings yet

- Horizontal Analysis-AssignmentDocument1 pageHorizontal Analysis-AssignmentvalNo ratings yet

- Financial Statement Consolidation1 4Document4 pagesFinancial Statement Consolidation1 4crookshanksNo ratings yet

- Parco RSPDocument5 pagesParco RSPElli Francis Tomenio0% (2)

- Final Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Document7 pagesFinal Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisPines MacapagalNo ratings yet

- Installment Liquidation 2Document3 pagesInstallment Liquidation 2Jamie RamosNo ratings yet

- Debit Balances Increase (Decrease) Credit Balances Increase (Decrease)Document7 pagesDebit Balances Increase (Decrease) Credit Balances Increase (Decrease)Shane TabunggaoNo ratings yet

- Partnership Accounting Practical Accounting 2Document13 pagesPartnership Accounting Practical Accounting 2random17341No ratings yet

- Chapter 8Document27 pagesChapter 8Francesz VirayNo ratings yet

- Final Answers (Group 1)Document3 pagesFinal Answers (Group 1)Carl Roger AnimaNo ratings yet

- Q1. ProblemsDocument9 pagesQ1. ProblemsAldrin ZolinaNo ratings yet

- Minglana, Mitch T. (Quiz 1)Document6 pagesMinglana, Mitch T. (Quiz 1)Mitch Tokong MinglanaNo ratings yet

- Abm LecDocument8 pagesAbm LecSheanne GuerreroNo ratings yet

- Chapter 3 Partnership Dissolution ChangeDocument21 pagesChapter 3 Partnership Dissolution ChangeKianJohnCentenoTuricoNo ratings yet

- ACC 110 RemedialDocument11 pagesACC 110 RemedialGiner Mabale StevenNo ratings yet

- Blue and Rubi Are Partners Who Share Profits and Losses in The Ratio of 6Document7 pagesBlue and Rubi Are Partners Who Share Profits and Losses in The Ratio of 6Mark Edgar De Guzman100% (1)

- Corporate Liquidation & Joint Venture2Document5 pagesCorporate Liquidation & Joint Venture2jjjjjjjjjjjjjjjNo ratings yet

- Module 9 and 10Document9 pagesModule 9 and 10French Jame RianoNo ratings yet

- Midterm HahaDocument33 pagesMidterm HahaCarl Elmo Bernardo MurosNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Audit Cash - Aud ProblemsDocument36 pagesAudit Cash - Aud ProblemsIvy BautistaNo ratings yet

- Partnership Liquidation: Answer: (D)Document2 pagesPartnership Liquidation: Answer: (D)Ivy BautistaNo ratings yet

- Audit Prob Q6 Proof of Cash 2021Document9 pagesAudit Prob Q6 Proof of Cash 2021Ivy BautistaNo ratings yet

- Auditing Problems: Jipbautista16 - Cpar - 2021Document2 pagesAuditing Problems: Jipbautista16 - Cpar - 2021Ivy BautistaNo ratings yet

- CBS Tender Document 01.02 2019Document9 pagesCBS Tender Document 01.02 2019Yamraj YamrajNo ratings yet

- Types of ESPDocument17 pagesTypes of ESPWinter Bacalso100% (2)

- Subcont - PT Tigenco Graha PersadaDocument9 pagesSubcont - PT Tigenco Graha PersadaxoxxNo ratings yet

- WHO Tobacco Global Report 2000-2025Document150 pagesWHO Tobacco Global Report 2000-2025ANo ratings yet

- Parental DivorceDocument6 pagesParental DivorceCorina IoanaNo ratings yet

- People v. AbendanDocument13 pagesPeople v. AbendanRe doNo ratings yet

- Cambridge Ordinary Level: Cambridge Assessment International EducationDocument12 pagesCambridge Ordinary Level: Cambridge Assessment International EducationMuhammad BilalNo ratings yet

- Phil. Press Institute vs. ComelecDocument2 pagesPhil. Press Institute vs. ComelecAnge DinoNo ratings yet

- Accenture Consulting Shared Services ReportDocument32 pagesAccenture Consulting Shared Services Reportmmandel1983No ratings yet

- EXPLAINER: Issues The SC Will Decide in Grace Poe Case: Emil Marañon IIIDocument8 pagesEXPLAINER: Issues The SC Will Decide in Grace Poe Case: Emil Marañon IIItink echivereNo ratings yet

- Health Economics - Lecture Ch12Document61 pagesHealth Economics - Lecture Ch12Katherine SauerNo ratings yet

- Signs Symbols JudaismDocument8 pagesSigns Symbols JudaismgrgNo ratings yet

- Graduation Moving Up Attachment BDocument3 pagesGraduation Moving Up Attachment BArjay MarcianoNo ratings yet

- Test Bank For Environmental Science 14th Edition William Cunningham Mary CunninghamDocument18 pagesTest Bank For Environmental Science 14th Edition William Cunningham Mary CunninghamAndi AnnaNo ratings yet

- CONSUMER PERCEPTION UTI-Mutual-FundDocument70 pagesCONSUMER PERCEPTION UTI-Mutual-FundMD PRINTING PRESS PRINTING PRESSNo ratings yet

- Grammar - BE GOING TO - Future PlansDocument2 pagesGrammar - BE GOING TO - Future PlanskssanchezNo ratings yet

- LCPC QueriesDocument11 pagesLCPC QueriesjomarNo ratings yet

- Final Manual For Specification StandardsDocument192 pagesFinal Manual For Specification Standardsbhargavraparti100% (1)

- Sameer Nadeem Electricity BillDocument2 pagesSameer Nadeem Electricity Bill2262literaryNo ratings yet

- Historia SurfinguDocument4 pagesHistoria Surfinguluxuriantcloset18No ratings yet

- Operations Research PracticeDocument3 pagesOperations Research PracticeScribdTranslationsNo ratings yet

- An Arabic-To-English Translation of The Religious Debate Between The Nestorian Patriarch Timothy ... (PDFDrive)Document157 pagesAn Arabic-To-English Translation of The Religious Debate Between The Nestorian Patriarch Timothy ... (PDFDrive)SimeonNo ratings yet

- William Charles Berwick Sayers - Samuel Taylor, Musician - His Life and Letters (1915)Document366 pagesWilliam Charles Berwick Sayers - Samuel Taylor, Musician - His Life and Letters (1915)chyoungNo ratings yet

- 05.0 Mta-Approval Sheet FormatDocument1 page05.0 Mta-Approval Sheet FormatAswin KurupNo ratings yet

- March 29, 2021: Department of EducationDocument3 pagesMarch 29, 2021: Department of EducationJesusa Franco DizonNo ratings yet

- Industrial Relations and PolicyDocument3 pagesIndustrial Relations and Policyshikher027598No ratings yet

- Features of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)Document3 pagesFeatures of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)shashank pathakNo ratings yet

- Assignment: OF Information SystemDocument8 pagesAssignment: OF Information SystemNitin JamwalNo ratings yet